|

시장보고서

상품코드

1630428

설탕 포장 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Sugar Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

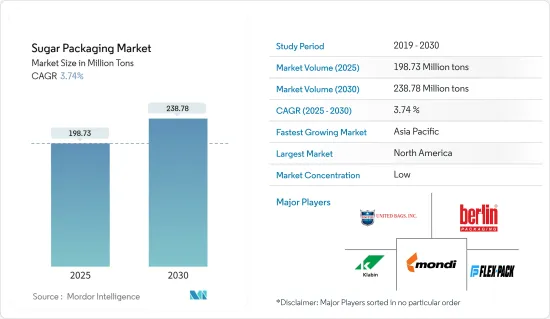

설탕 포장 시장 규모는 2025년에 1억 9,873만 톤으로 추정되며, 예측 기간(2025-2030년)의 CAGR은 3.74%로, 2030년에는 2억 3,878만 톤에 이를 것으로 예상됩니다.

주요 하이라이트

- 설탕은 벌크와 소매 목적으로 다양한 형태로 포장되기 때문에 시장은 특히 연포장으로의 현저한 변화를 목격하고 있습니다. 액티브 포장이나 스마트 포장 등의 포장 기술의 혁신 덕분에, 설탕의 연포장은 실현 가능할 뿐만 아니라, 유통 기한을 연장할 수도 있습니다.

- 유기 설탕과 특수 설탕에 대한 수요가 증가함에 따라 특수 포장의 필요성이 커지고 있습니다. 이렇게 하면 운송 및 보관 중에 이러한 고가치 제품의 보호가 보장됩니다. 또한 무역이 세계화됨에 따라 다양한 국가와 지역의 다양한 요구 사항을 충족하는 표준화된 포장 솔루션이 시급해지고 있습니다.

- USDA에 따르면 호주 설탕 생산량은 천천히 증가하고 2022년과 2023년에는 440만 톤에 달할 전망입니다. 2022/23년 사탕수수 생산량은 3,300만 톤으로 추정됩니다. 이 생산량 증가는 수확 면적의 확대와 관련이 있었고, 수확 면적은 5,000 헥타르 증가하여 35만 헥타르에 달했습니다.

- 건강 지향이 높아지는 시장에서 설탕 마케팅은 큰 장애물을 극복하고 있습니다. 소비자는 무의식적으로 설탕 함량이 높은 제품을 선택할 수 있지만, 가공되지 않은 설탕을 구매할 때는 여러 가지 요소를 고려합니다. 그 결과 설탕 시장은 설탕의 매력을 높이고 사용 편의성을 보장하기 위해 혁신적인 포장 솔루션에 많은 투자를 하고 있습니다.

- 종이 봉투의 주요 소재인 종이는 저렴한 가격으로 구하기 쉽습니다. 그러나 종이 봉지에 들어간 설탕은 손상을 입기 쉽습니다. 그럼에도 불구하고 쉽고 빠르고 편리한 운송을 가능하게 합니다. 그 방수성과 방습성은 큰 장점으로 두드러집니다. 또한 종이 봉투는 판매, 보관 및 소비를 단순화합니다. 또한 종이 봉투는 분해성이 높으므로 생태 발자국을 최소화 할 수 있습니다.

- 착색된 주석 철은 철 상자 포장 재료로 선호됩니다. 원통형, 직사각형, 타원형, 오각형 등의 형태가 있는 이 상자는 내구성, 확실한 밀봉성, 내파손성으로 유명합니다. 철 상자 포장의 밝은 외관과 선명한 색상은 설탕의 매력을 향상시킬뿐만 아니라 견고함을 강조합니다. 설탕뿐만 아니라 철제 상자는 과자 포장에도 자주 사용되며 많은 주요 포장, 선물 및 과자 제조업체가 제품의 품질을 보여주기 위해 활용합니다.

- 비닐 봉투는 설탕 포장에 가장 일반적으로 사용되는 옵션입니다. 방습성, 방수성이 뛰어나 비용 효율도 높기 때문에 인기가 있습니다. 설탕 생산자는 종종 투명하거나 컬러 옵션 두 가지 모두 가능한 비닐 봉투를 선택합니다. 특히 다채로운 랩은 설탕의 시각적 매력을 높일 수 있으며 전통 제과업체와 신생 제과업체도 이 전략을 채용하고 있습니다. 하지만 큰 우려가 있습니다. 이 비닐 봉투는 심각한 플라스틱 오염의 원인이 되었습니다. 설탕 포장 기계는 비닐 봉투와 종이 봉투를 모두 능숙하게 처리할 수 있으며 최신 기술을 통해 일관된 성능을 약속하기 때문에 다용도성이 빛을 발합니다.

설탕 포장 시장 동향

플라스틱 소재가 큰 시장 점유율을 차지

- Nichrome Packaging Solutions에 따르면, 플라스틱 포장은 탁월한 기능성으로 더 큰 시장 점유율을 차지합니다. 플라스틱 솔루션 중에서도 연질 플라스틱 포장은 경질 플라스틱 포장에 비해 원재료 사용량이 70% 적은 것이 특징입니다.

- 2023년 4월에 Feedback Organization이 보고한 것처럼 슈퍼마켓은 주요 설탕 판매업체로 영국 시장을 독점하고 있습니다. 이 소매업체는 한때 소비자 수요에 부응하기만 한다고 주장했지만 그 이후로 이 자세를 포기하고 있습니다. 조사는 일관되게 슈퍼마켓의 '소매업체 파워'에 초점을 맞추었습니다. 슈퍼마켓은 식품 생산자와 소비자를 연결하는 중개자입니다. 그 지배력은 공급자와 고객 모두를 제한하고 식품 매매의 선택을 좁히고 있습니다. 이 영향력은 단지 5개의 슈퍼마켓이 소매 시장 점유율의 75% 이상을 지배한다는 점에서 분명합니다. 슈퍼마켓은 '바이어 파워'를 활용하고 공급업체에게 조건을 지시하며 재고 선택, 품질, 양, 포장 및 가격 결정에 영향을 미칩니다. 이 역동성은 Procter & Gamble, Nestle, Unilever와 같은 업계 선두에도 적용됩니다. 슈퍼마켓이 설탕 매출을 늘리면서 설탕 포장, 특히 파우치와 파우치와 같은 유연한 형태의 포장에 대한 수요도 증가하고 있습니다. 퀵 서비스 레스토랑과 커피숍의 성장은 설탕 파우치 수요를 더욱 증가시키고 있습니다.

- 내습성, 비용 효과, 색상 및 투명성에 의한 브랜딩의 가능성으로 인해 설탕 제조업체에 지지되어 연질 플라스틱 가방으로 설탕을 포장하는 경향이 강해지고 있습니다.

- 그럼에도 불구하고 시장 관계자는 플라스틱 포장의 대체품에 관심을 갖고 있습니다. 바이오플라스틱의 채용이 증가하고 있어, 종래의 플라스틱 포장에 대한 큰 과제가 되고 있습니다. 예측 기간 동안 재활용 가능하고 재생 가능한 소재가 플라스틱 포장을 대체할 수 있습니다.

- Logistex Ltd.는 컨테이너에 의한 브라질의 설탕 수출이 '컨테이너 에르게돈'운동의 영향을 받고 2년간의 고강 상태를 거쳐 2023년에 회복할 것을 강조하고 있습니다. 이 출하량 증가는 브라질의 설탕 생산량 증가와 해상 운임 하락과 일치합니다. 또한 세계의 다른 주요 설탕 생산국이 직면한 과제로 인해 브라질 시장 리더십은 더욱 견고해졌습니다.

- 반대로 인도는 수확 과제에 직면했으며, 특히 에탄올 생산으로의 전환과 함께 설탕 수출 시장으로의 재진입을 주저했습니다. 이 때문에 브라질이 우위성을 주장하는 길이 열렸습니다. 국내 생산자들은 벌크 운송을 선호했지만 컨테이너 운송은 여전히 수출에 필수적이며, 종종 복잡한 협상과 고부가가치를 수반합니다.

- 2023년 브라질 설탕 컨테이너 수출량은 294만 톤에 달했다고 해양 기관 Williams는 지적했습니다. 이는 브라질 총 수출량의 9.4%를 차지했으며 전년 대비 90.1% 증가한 현저한 성장률을 보였습니다. 이 수치는 총 출하량의 10.7%를 차지한 2017년 피크 298만t에 늘어선 기세였습니다. 컨테이너에 적재하기 전에 이러한 설탕은 일반적으로 황마와 같은 천연 소재와 플라스틱으로 짜여진 유연한 가방에 포장되어 플라스틱 인테리어가 자주 사용됩니다.

가장 높은 성장을 이루는 아시아태평양

- 아시아태평양은 식품 포장 및 브랜드화에 있어 탁월한 기술 혁신으로 성장을 이끌고 있습니다. 또한, 이 지역의 소비자는 설탕의 호화로운 경험에 높은 가치를 두고 있습니다.

- 인구 증가, 소득 수준 향상, 라이프 스타일 진화, 미디어 영향력 증가, 견조한 경제가 포장 수요를 부추기고 있습니다. 이 분야는 이 지역에서 가장 중요하고 빠르게 확장되는 분야 중 하나입니다. 특히 인도의 주요 등급 회사인 Care Ratings는 인도 종이 생산량의 49% 이상이 포장 전용임을 강조합니다.

- 아시아태평양, 특히 음식 및 음료 분야에서 몇 가지 규정이 포장 산업을 감독합니다. 주요 규제로는 1956년 식품 혼입 방지법, 2011년 플라스틱 폐기물(관리 및 취급) 규칙, 2011년 식품 안전 기준(포장 및 표시) 규칙 등이 있습니다.

- 식품 분야에서의 종이 및 펄프 사용에 관한 규제가 예상되어 시장을 밀어 올리는 자세입니다. 예를 들어, 인도의 식품 안전 기준국은 식품 포장에서 종이의 역할을 강화하기 위한 새로운 포장 규정을 개발했습니다. 또한, BIS 표준 IS 4664:1986은 식품 포장에 재생 펄프를 사용하는 것을 인정하고 있으며, 인도의 설탕 포장에서 종이의 존재감을 높일 것입니다.

- 미국 농무부 대외 농업 서비스에 따르면 2023/2024년 주기 인도의 설탕 생산량은 약 3,400만 톤입니다. 인도의 설탕 생산량은 수년에 걸쳐 기복을 보였지만, 브라질에 이어 세계에서 두 번째로 큰 설탕 생산국이라는 자부심을 가지고 있습니다. 2023-2024년 주기로 인도의 내각경제위원회(CCEA)는 황마 포장을 중시하는 새로운 기준을 승인했습니다. 특히 2023-24년 황마의 해 규범에 따라 식품 곡물은 100%, 설탕 포장재는 20%에 황마 봉투를 사용해야 합니다.

설탕 포장 산업 개요

본 조사에서는 설탕의 생산량을 소재 유형과 제품 유형에 근거하여 세계적으로 고찰했습니다. 설탕은 벌크와 소매 모두에서 다양한 형태로 포장되기 때문에 연포장으로의 이동이 두드러집니다. 활성 포장과 같은 신기술은 이러한 추세를 촉진할 뿐만 아니라 설탕의 저장 수명을 연장시킵니다. 플라스틱은 탁월한 기능성으로 포장 시장을 독점하고 있습니다. 연질 플라스틱 포장은 플라스틱 솔루션 중에서도 두드러지며 강성 포장에 비해 원재료 사용량이 70% 적습니다.

설탕 포장 시장은 적당하게 단편화됩니다. 시장 선수는 점유율을 확대하고 수익을 증가시키기 위해 광범위한 제품 사용자 정의를 제공합니다. 주요 기업은 Mondi Group, United Bags Inc, FlexPack, Klabin SA, Berlin Packaging 등을 포함합니다. 각 회사는 요구 증가에 따라 이 시장의 혁신을 통해 지속 가능한 경쟁 우위를 확보하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 경쟁 기업 간 경쟁 관계

- 대체품의 위협

- 산업 밸류체인 분석

제5장 시장 역학

- 시장 성장 촉진요인

- 인도, 중국, 유럽연합 지역 등 주요 국가에서 설탕 소비량의 꾸준한 증가

- 맞춤형 포장 형태와 지속 가능한 소재에 대한 수요 증가

- 시장 성장 억제요인

- 제조업체가 직면하는 운용면 및 규제면의 우려

제6장 시장 세분화

- 제품 유형별

- 연포장

- 가방 및 파우치

- 봉지

- 자루

- 기타 연포장

- 경질 포장

- 병과 용기

- 연포장

- 재료별

- 플라스틱

- 종이

- 기타 재료

- 지역별

- 북미

- 미국

- 캐나다

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 아시아

- 인도

- 중국

- 일본

- 태국

- 라틴아메리카

- 중동 및 아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Mondi Group

- United Bags Inc.

- FLexPack

- Berlin Packaging

- Grupo Bio Pappel

- Swiss Pack Limited

- Packman Industries

- TedPack Company Limited

- Klabin SA

- Shri Salasar Plastics

제8장 투자 분석

제9장 시장의 미래

KTH 25.02.05The Sugar Packaging Market size is estimated at 198.73 million tons in 2025, and is expected to reach 238.78 million tons by 2030, at a CAGR of 3.74% during the forecast period (2025-2030).

Key Highlights

- The market is witnessing a notable shift towards flexible packaging, especially as sugar is being packaged in various formats for both bulk and retail purposes. Thanks to innovations in packaging technologies, such as active and smart packaging, flexible packaging for sugar is not only feasible but also extends its shelf life.

- With the rising demand for organic and specialty sugars, there's an increasing need for specialized packaging. This ensures the protection of these high-value products during transportation and storage. Moreover, as trade becomes more globalized, there's a pressing need for standardized packaging solutions that meet the varied requirements of different countries and regions.

- According to USDA, Australia's sugar production is set to see a modest rise, reaching 4.4 million tons for the years 2022 and 2023. In the 2022/23 cycle, sugarcane production is estimated at 33.0 million tons. This increase in output is linked to an expansion in the harvested area, which has grown by 5,000 hectares to reach 350,000 hectares.

- In a market increasingly focused on health, sugar marketing is navigating significant hurdles. While consumers might unknowingly choose products high in sugar, they consider multiple factors when purchasing unprocessed sugar. As a result, the sugar bag market is heavily investing in innovative packaging solutions to boost sugar's appeal and ensure user-friendliness.

- Paper, the go-to material for paper bags, is both affordable and easily sourced. Yet, sugar in paper bags is more prone to damage. Despite this vulnerability, paper bags enable quick and convenient transportation. Their waterproof and moisture-proof qualities stand out as significant advantages. Moreover, paper bags simplify selling, storage, and consumption. An added environmental perk of using paper for bags is its degradability, leading to a minimal ecological footprint.

- Tinted tin iron is the favored material for packaging in iron boxes. These boxes, available in shapes like cylinders, rectangles, ovals, and pentagons, are celebrated for their durability, secure sealing, and damage resistance. The bright appearance and vibrant colors of iron box packaging not only enhance sugar's appeal but also underscore its robustness. Beyond sugar, these iron boxes are a go-to for candy packaging, with many leading packaging, gift, and candy producers leveraging them to signify product quality.

- Plastic bags reign supreme in sugar packaging, being the most commonly used option. Their moisture-proof and waterproof nature, combined with cost-effectiveness, makes them a favorite. Sugar producers often opt for these bags, available in both transparent and colored variants. Colorful wraps, especially, can elevate sugar's visual allure, a strategy embraced by both established and budding confectionery makers. Yet, a major concern looms: these plastic bags contribute to the growing issue of plastic pollution. Versatility shines through as sugar packing machines adeptly handle both plastic and paper bags, and with modern technology, they promise consistent performance.

Sugar Packaging Market Trends

Plastic Material to Hold Significant Market Share

- According to Nichrome Packaging Solutions, plastic packaging holds a significant market share due to its unparalleled functionality. Among plastic solutions, flexible plastic packaging is notable for using 70% less raw material than its rigid counterpart.

- As reported by Feedback Organization in April 2023, supermarkets dominate the UK market as primary sugar sellers. While these retailers once claimed to merely respond to consumer demand, they've since abandoned this stance. Research has consistently spotlighted the 'retailer power' of supermarkets. Acting as intermediaries, they bridge food producers and consumers. Their dominance restricts both suppliers and customers, curtailing choices in buying and selling food. This influence is evident as just five supermarkets control over 75% of the retail market share. Leveraging their 'buyer power', supermarkets dictate terms to suppliers, influencing stock selection, quality, quantity, packaging, and pricing decisions. This dynamic holds even for industry giants like Procter & Gamble, Nestle, and Unilever. With supermarkets bolstering sugar sales, they're simultaneously driving up demand for sugar packaging, especially in flexible formats like pouches and sachets. The growth of quick-service restaurants and coffee shops has further amplified the demand for sugar sachets.

- There's a growing trend of packaging sugar in flexible plastic bags, favored by sugar manufacturers for their moisture resistance, cost-effectiveness, and branding potential through color or transparency.

- Despite this, market players are gravitating towards alternatives to plastic packaging. The rising adoption of bioplastics poses a significant challenge to traditional plastic packaging in the industry. Over the forecast period, recyclable and renewable materials are poised to potentially replace plastic packaging.

- Logistex Ltd. highlights a rebound in Brazilian sugar exports via containers in 2023, after a two-year lull, influenced by the "containergeddon" movement. This increase in shipments coincided with a rise in Brazil's sugar production and a decline in seafreight rates. Additionally, challenges faced by other major global sugar producers further cemented Brazil's market leadership.

- Conversely, India faced harvest challenges and was hesitant to re-enter the sugar export market, especially with its shift towards ethanol production. This opened the door for Brazil to assert its dominance. While national producers favored bulk shipping, container shipments remained vital for exports, often involving intricate negotiations and higher value additions.

- In 2023, Brazil's containerized sugar exports reached 2.94 million tons, as noted by maritime agency Williams. This constituted 9.4% of Brazil's total exports and marked a remarkable 90.1% increase from previous years. The figure was on the verge of matching the 2017 peak of 2.98 million tons, which represented 10.7% of total shipments. Before container loading, these sugars are typically packaged in flexible bags or sacks made from woven natural materials like jute or woven plastic, frequently featuring a plastic inner lining.

Asia-Pacific to Witness Highest Growth

- The Asia-Pacific region leads in growth, driven by notable innovations in food packaging and branding. Additionally, consumers in this region place a high value on the indulgent experience of sugar confectionery.

- Rising population, increasing income levels, evolving lifestyles, heightened media influence, and a robust economy are fueling the demand for packaging. This sector stands out as one of the most vital and rapidly expanding in the region. Notably, Care Ratings, a leading credit rating agency in India, highlights that over 49% of the country's paper production is dedicated to packaging.

- Several regulations oversee the packaging industry in the Asia-Pacific, particularly in the food and beverage sectors. Key regulations include the Prevention of Food Adulteration Act of 1956, the Plastic Waste (Management and Handling) Rules of 2011, and the Food Safety and Standards (Packaging and Labelling) Regulations of 2011.

- Anticipated regulations on paper and pulp usage in the food sector are poised to boost the market. For example, India's Food Safety and Standards Authority has rolled out new packaging regulations, aiming to bolster paper's role in food packaging. Furthermore, the BIS standard IS 4664: 1986, which allows recycled pulp in food packaging, is set to enhance paper's prominence in India's sugar packaging.

- As per the USDA Foreign Agricultural Service, India produced around 34 million metric tons of sugar in the 2023/2024 cycle. While sugar production in India has seen its ups and downs over the years, the nation proudly stands as the world's second-largest sugar producer, trailing only Brazil. In the 2023-2024 cycle, India's Cabinet Committee on Economic Affairs (CCEA) approved new norms emphasizing jute packaging. Specifically, the 2023-24 Jute Year norms mandate that jute bags must be used for 100% of food grains and 20% of sugar packaging.

Sugar Packaging Industry Overview

The study considers sugar production globally based on material type and product type. As sugar is packaged in various formats for both bulk and retail, there's been a notable shift towards flexible packaging. New technologies, like active packaging, not only facilitate this trend but also extend the shelf life of sugar. Plastic dominates the packaging market due to its unmatched functionality. Flexible plastic packaging stands out among plastic solutions, utilizing 70% less raw material than its rigid counterpart.

The sugar packaging market is moderately fragmented. Players in the market are offering extensive product customization to increase their share and augment their revenue. Some of the key players are Mondi Group, United Bags Inc, FlexPack, Klabin S.A., Berlin Packaging and more. The companies have a sustainable competitive advantage through innovations in this market, owing to the growing need.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Increase in the Consumption of Sugar in Major Countries such as India, China and EU Regions

- 5.1.2 Rising Demand for Customized Packaging Formats and Sustainable Materials

- 5.2 Market Restraints

- 5.2.1 Operational and Regulatory Concerns Faced by the Manufacturers

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Flexible Packaging

- 6.1.1.1 Bags and Pouches

- 6.1.1.2 Sachets

- 6.1.1.3 Sacks

- 6.1.1.4 Other Flexible Packaging Types

- 6.1.2 Rigid Packaging

- 6.1.2.1 Jars and Containers

- 6.1.1 Flexible Packaging

- 6.2 By Material Type

- 6.2.1 Platsic

- 6.2.2 Paper

- 6.2.3 Other Material Type

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 India

- 6.3.3.2 China

- 6.3.3.3 Japan

- 6.3.3.4 Thailand

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mondi Group

- 7.1.2 United Bags Inc.

- 7.1.3 FLexPack

- 7.1.4 Berlin Packaging

- 7.1.5 Grupo Bio Pappel

- 7.1.6 Swiss Pack Limited

- 7.1.7 Packman Industries

- 7.1.8 TedPack Company Limited

- 7.1.9 Klabin S.A.

- 7.1.10 Shri Salasar Plastics