|

시장보고서

상품코드

1630455

프랑스의 원자로 해체 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)France Nuclear Power Reactor Decommissioning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

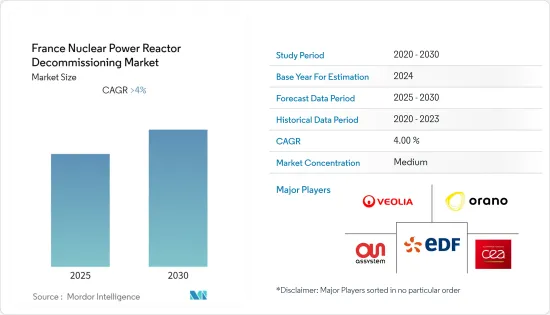

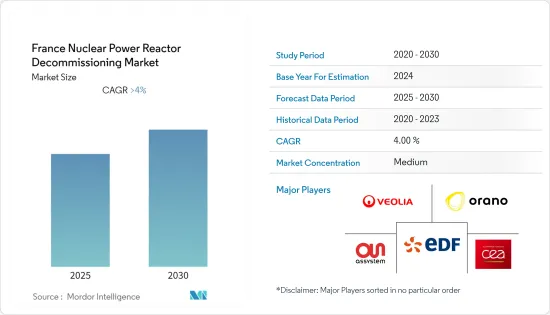

프랑스의 원자로 해체 시장, 예측 기간 동안 CAGR 4% 이상 기록할 것으로 예상됩니다.

COVID-19는 2020년 시장에 부정적인 영향을 미쳤습니다. 현재 시장은 전염병이 발생하기 전의 수준에 도달했습니다.

주요 하이라이트

- 중기적으로는 국내 기존 원자력발전소의 노후화가 진행되고 많은 발전소가 정년퇴직을 앞두고 있다는 점이 예측 기간 동안 시장을 견인할 것으로 보입니다.

- 한편, 높은 폐로 비용은 예측 기간 동안 시장 성장의 걸림돌이 될 것으로 예상됩니다.

- 원자력발전으로 인한 에너지를 줄이고 재생에너지 비중을 늘리겠다는 프랑스 정부의 전략은 프랑스의 원자로 해체 시장에 큰 기회를 가져올 것으로 예상됩니다.

프랑스의 원자로 해체 시장 동향

상업용 원자로가 시장을 독점할 전망

- 상업용 원자력발전소는 발전을 위해 지역에 배치된 발전소이며, 생산된 전력이 국가의 에너지 그리드에서 국가의 다양한 부문에 송전 및 배전되는 발전소입니다. 프랑스에서는 대부분의 원자력발전소가 상업용 원자로 범주에 속합니다.

- 세계원자력협회에 따르면, 프랑스에는 56기의 상업용 원자로가 18곳에 분산되어 운영되고 있으며, 총 발전 용량은 6만 1,370MWe(2019년 6만 3,130MWe)에 달합니다. 동시에 1기의 원자로가 건설 중입니다. 또한 2022년 12월까지 프랑스는 총 5,549MWe의 발전 용량을 가진 14기의 원자로를 가동 중단했습니다.

- 2021년 프랑스에서 원자력으로 생산된 총 전력은 554.8테라와트시(TWh)에 달했습니다. 최근 몇 년 동안 원자력이 전체 에너지 생산량에서 차지하는 비중이 감소하고 있지만, 원자력발전소는 여전히 프랑스 전체 발전량의 약 70%를 차지하고 있습니다.

- Electricite de France SA(EDF)는 2021년 현재 9기의 원자로가 정지 및 폐로될 것이라고 발표했습니다. 브레느리, 뷔지1, 시농 A1, A2, A3, 초즈 A, 끌레 마르빌, 생 로랑 A1, A2입니다. 연료 인출은 2023년 여름까지 완료되며, 완전한 폐로는 빠르면 2040년까지 완료될 것으로 예상됩니다.

- 따라서, 위의 관점에서 볼 때, 예측 기간 동안 상업용 전력 부문이 프랑스의 원자로 해체 시장을 독점할 가능성이 높습니다.

신재생에너지의 증가가 시장을 주도

- 프랑스의 재생에너지 발전 부문은 가까운 장래에 더욱 성장할 가능성이 높습니다. 이는 주로 청정 발전원으로의 에너지 전환을 목표로 하는 정부 프로그램과 재생 가능 기술의 지속적인 개선에 기인합니다. 프랑스는 최근 탄소 중립을 달성하기 위해 많은 기후 변화 목표를 설정했습니다.

- 2020년 프랑스는 2030년 국가 에너지 및 기후 계획(NECP)을 유럽연합 집행위원회에 제출했습니다. 프랑스는 2030년 에너지 믹스에서 재생에너지 비중을 33%까지 끌어올리는 것을 목표로 하고 있습니다. 이는 전력 부문에서 40%의 재생에너지에 해당하며, 풍력에너지는 그 절반을 공급할 수 있습니다. 이 계획은 에너지 전환을 위한 야심차고 현실적인 목표를 제시합니다.

- 프랑스의 발전 산업은 화석연료에서 재생에너지로의 전환이라는 큰 전환기를 맞이하고 있습니다. 국제재생에너지기구에 따르면, 프랑스의 재생에너지 도입량은 2017년 4,279만kW에서 2021년 5,900만kW 이상으로 증가하여 큰 폭의 성장세를 기록할 것으로 예상됩니다.

- 지난 12월, 네오엔은 프랑스에서 180MW 규모의 태양광 및 풍력발전 프로젝트를 수주했다고 발표했습니다. 이 프로젝트는 프랑스 정부가 에너지규제위원회(CRE)의 다년간 에너지 계획(PPE2)의 일환으로 실시한 기술 중립 입찰에서 낙찰되었습니다. 이 프로젝트는 프랑스 정부가 에너지규제위원회(CRE)의 다년간 에너지 계획(PPE2)의 일환으로 실시한 최신 기술 중립적 입찰에서 낙찰되었습니다.

- 따라서, 위의 관점에서 볼 때, 재생에너지의 증가는 예측 기간 동안 프랑스의 원자로 해체 시장을 견인할 것으로 예상됩니다.

프랑스의 원자로 해체 산업 개요

프랑스의 원자로 해체 시장은 비교적 통합된 시장입니다. 이 시장의 주요 기업으로는 Veolia Environnement SA, Orano Group, Electricite de France SA(EDF), Assystem SA, French Alternative Energies and Atomic Energy Commission(CEA) 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2028년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부 규제와 시책

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 원자로 유형

- 가압수형 원자로

- 가압수형 중수로

- 비등수형 원자로

- 고온가스로

- 액체 금속 고속증식로

- 기타

- 용도

- 상업용 동력로

- 원형로

- 연구로

- 원자로 용량

- 100MW 이하

- 100-1,000MW

- 1,000MW 이상

제6장 경쟁 구도

- 합병, 인수, 제휴, 합작투자

- 주요 기업의 전략

- 기업 개요

- Veolia Environnement SA

- Leniko bvba

- Orano SA

- Electricite de France SA(EDF)

- Assystem SA

- French Alternative Energies and Atomic Energy Commission(CEA)

제7장 시장 기회와 향후 동향

ksm 25.01.23The France Nuclear Power Reactor Decommissioning Market is expected to register a CAGR of greater than 4% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing age of existing nuclear power plants and many power plants reaching retirement age in the country is expected to drive the market during the forecasted period.

- On the other hand, the high cost of decommissioning plants is the major restraint expected to hinder the market's growth during the forecasted period.

- Nevertheless, the French government's strategy of reducing the energy generated through nuclear energy and increasing the share of renewable energy is expected to create significant opportunities for the France Nuclear Power Reactor Decommissioning Market.

France Nuclear Power Reactor Decommissioning Market Trends

Commercial Power Reactor Expected to Dominate the Market

- Commercial nuclear power plants are the power plants deployed in the region to generate electricity and utilized in the national energy grid through which the generated electricity is transmitted and distributed to various sectors of the country. In France, the majority of nuclear power plants fall under the commercial reactor category.

- According to World Nuclear Association, 56 commercial nuclear reactors are functioning in France, distributed in 18 sites with a total generating capacity of 61370, MWe compared to 63130 MWe in 2019. At the same time, one reactor is under construction. Moreover, till December 2022, France has shut down 14 reactors with a total capacity of 5549 MWe.

- The total power produced by nuclear energy in France in 2021 was 554.8 Terawatt-hours (TWh); even though the share of nuclear energy in total energy production has been decreasing in recent years, nuclear power plants still account for around 70 percent of the entire power generation in the country.

- As of 2021, Electricite de France SA (EDF) has announced that nine reactors have been shut down and are being decommissioned: Brennilis, Bugey 1, Chinon A1, A2 and A3, Chooz A, Creys-Malville, Saint-Laurent A1 and A2. The fuel removal is expected to be completed by the summer of 2023, and the complete decommissioning is expected to be completed by 2040 at the earliest.

- Hence, owing to the above points, the commercial power rector segment will likely dominate the France nuclear power reactor decommissioning market during the forecast period.

Increasing Renewable Energy Expected to Drive the Market

- France's renewable power sector is likely to thrive more in the near future, mainly due to the government programs for an energy transition to cleaner power generation sources and the continuous improvement in renewable technology. The country has set many climate goals in the recent picture to achieve carbon neutrality.

- In 2020, France presented its 2030 National Energy and Climate Plan (NECP) to the European Commission. The country aims for 33% renewable energy in its energy mix in 2030. This translates into 40% renewables in the power sector - wind energy could deliver half of this. The Plan outlines ambitious yet realistic targets for the energy transition.

- The power generation industry in the country is undergoing a significant transition, shifting from fossil fuels to renewable energy sources. According to the International Renewable Energy Agency, renewable power installed in France increased from 42.79 GW in 2017 to more than 59 GW in 2021, recording massive growth.

- In December 2022, Neoen announced that they had been allocated contracts worth 180 MW in solar and wind projects in France. The projects were awarded in the technology-neutral call for tenders held by the French government as part of the energy regulation commission's (CRE) multi-year energy plan (PPE2). The projects were awarded in the latest technology-neutral call for tenders held by the French government as part of the energy regulation commission's (CRE) multi-year energy plan (PPE2).

- Hence, owing to the above points, increasing renewable energy is expected to drive the France nuclear power reactor decommissioning market during the forecast period.

France Nuclear Power Reactor Decommissioning Industry Overview

The France Nuclear Power Reactor Decommissioning Market is moderately consolidated. Some of the key players in this market (not in a particular order) include Veolia Environnement SA, Orano Group, Electricite de France SA (EDF), Assystem SA, and French Alternative Energies and Atomic Energy Commission (CEA).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Reactor Type

- 5.1.1 Pressurized Water Reactor

- 5.1.2 Pressurized Heavy Water Reactor

- 5.1.3 Boiling Water Reactor

- 5.1.4 High-temperature Gas-cooled Reactor

- 5.1.5 Liquid Metal Fast Breeder Reactor

- 5.1.6 Other Reactor Types

- 5.2 Application

- 5.2.1 Commercial Power Reactor

- 5.2.2 Prototype Power Reactor

- 5.2.3 Research Reactor

- 5.3 Capacity

- 5.3.1 Below 100 MW

- 5.3.2 100-1000 MW

- 5.3.3 Above 1000 MW

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Veolia Environnement SA

- 6.3.2 Leniko bvba

- 6.3.3 Orano SA

- 6.3.4 Electricite de France SA (EDF)

- 6.3.5 Assystem SA

- 6.3.6 French Alternative Energies and Atomic Energy Commission (CEA)