|

시장보고서

상품코드

1631626

미국의 경질 PET 포장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)United States Rigid PET Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

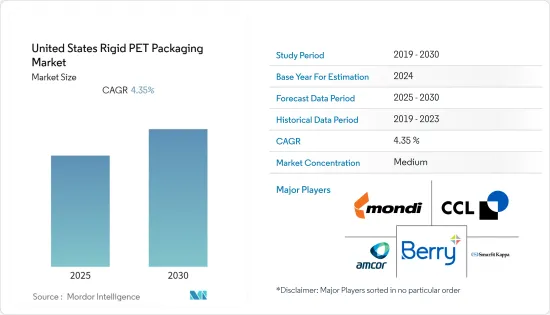

미국의 경질 PET 포장 시장은 예측 기간 동안 CAGR 4.35%를 기록할 것으로 예상됩니다.

국제 생수 협회의 보고서에 따르면, 2021년 미국인이 소비한 생수는 156억 갤런으로 2020년 대비 4.5% 증가(전년 대비 4.2% 증가)했습니다. 즉, 2020년 미국인 1인당 평균 46.9갤런(전년 대비 3.8% 증가)의 생수를 소비한 셈입니다. 또한, 생수 소매 매출은 2021년에 4.4% 증가하여 379억 달러에 달할 것으로 예상됩니다. 이러한 증가 추세는 앞으로도 지속될 것으로 보이며, 생수 포장에 대한 경질 PET의 수요는 더욱 증가할 것으로 보입니다.

클램쉘 포장은 제품이 양면에서 볼 수 있기 때문에 경질 플라스틱 포장 중에서도 소매업자들에게 인기가 있습니다. 매달아 놓을 수도 있고 독립적으로 세울 수도 있으며, 포장이 내부 제품보다 커서 도둑질을 당하기 쉽지 않습니다. 골판지나 다른 대체품보다 훨씬 가볍고, 운송 시 에너지를 절약할 수 있으며, 제조비용이 저렴하고 내구성이 뛰어납니다.

제조 공정에서 원료 손실을 최소화할 수 있기 때문에 제조업체들은 다른 플라스틱 포장재보다 PET를 선호합니다. 재활용이 가능하고 다양한 색상과 디자인으로 맞춤 제작이 가능하기 때문에 인기 있는 선택이 되고 있습니다. 리필 가능한 제품은 환경 문제에 대한 소비자의 지식이 높아짐에 따라 인기가 높아지고 수요가 증가하고 있습니다. 예를 들어, 2022년 2월 에버그린은 2억 달러의 투자와 여러 차례의 인수를 통해 북미에서 식품용 rPET의 유명 제조업체 중 하나가 되었습니다.

수십 년 동안 의약품 포장은 산업의 주요 설계 및 제조 재료인 플라스틱에서 벗어나고 있습니다. 그러나 폴리에틸렌 테레프탈레이트(PET)는 분자 수준에서 PET로 분해될 수 있기 때문에 산업계는 앞으로도 PET를 계속 사용할 것으로 보입니다.

2022년 4월, 재생 소재 제품 및 고배리어 보호 포장재 제조업체인 Klockner Pentaplast는 웨스트버지니아주 비버에 위치한 수백만 달러 규모의 생산 시설을 확장하여 북미의 소비자 사용 후 재활용 소재(PCR) PET 생산능력을 추가하기로 결정했습니다. 추가하기로 했습니다. 압출 라인과 보온병 성형기 2대를 설치함으로써 소비자 건강, 제약 및 식품 포장 시장에서 지속가능한 혁신을 확대하여 15,000톤의 새로운 rPET/PET 생산능력을 창출할 예정입니다. 현재 Klockner Pentaplast 생산량의 20% 이상이 PCR 소재로 만들어지고 있습니다.

미국의 경질 PET 포장 시장 동향

경질 PET 뚜껑 및 마개가 크게 성장했습니다.

Silicon Valley Bank에 따르면 2020년 현재 미국 프리미엄 와이너리의 매출 총이익률은 56.8%이며, 병의 평균 가격은 28달러입니다. 따라서 경질 PET 마개를 사용하면 비용 절감, 코르크보다 강하고 오염에 덜 민감하다는 장점이 있어 PET 캡과 마개가 이 지역의 매출 성장을 더욱 촉진하는 이유입니다.

미국 국립의학도서관에 따르면 2021년 미국 전체 의약품 지출은 2020년 대비 7.7% 증가한 5,769억 달러로, 2022년까지 전체 처방약 지출은 4.0%에서 6.0% 증가할 것으로 예상되며, 클리닉과 병원은 2021년 대비 각각 7.0%에서 9.0%, 3.0%에서 5.0% 증가할 것으로 예상됩니다. 3%에서 5.0% 증가할 것으로 예상됩니다. 의약품 소비량이 많기 때문에 더 많은 병에 대한 수요가 상당히 증가하여 뚜껑 및 마개 시장의 성장을 주도하고 있습니다.

또한, 편의식품 제조에 있어서 나노기술은 보존 절차, 포장 방법, 완제품 가공 등 중요한 기능을 개선하는 데 중요한 역할을 하고 있습니다. 따라서 이러한 추세는 포장 식품 용기의 사용량을 증가시키는 데 중요한 역할을 할 것으로 예상되며, 다양한 종류의 마개에 대한 수요를 증가시킬 것으로 예상됩니다.

대부분의 제조업체는 밀봉 방지 포장 및 제품 보호를 위해 뚜껑 및 마개를 고려하고 있으며, 이는 시장 성장을 주도하고 있습니다. 미국 농무부 대외 농업 서비스 2020 보고서에 따르면, 신선 과일 수출 품목은 사과, 포도, 오렌지, 딸기, 체리 등이며, 총 31억 달러를 차지하며, 주요 시장은 캐나다와 멕시코 등입니다. 캡은 주스에 많이 사용되기 때문에 캡에 대한 수요가 증가할 가능성이 있습니다.

또한, 환경 문제와 브랜드 매력 강화와 관련하여 다양한 제조업체는 외부 포장 제품을 재활용 플라스틱으로 만든 경질 PET 캡과 마개로 대체하여 브랜드 디자인과 높은 매력에 집중하고 있습니다. 미국화학공업협회(American Chemistry Council)에 따르면, 미국에서는 2017년부터 2020년까지 52개의 새로운 플라스틱 재활용 프로젝트가 발표되었으며, 총 48억 달러에 달하는 프로젝트가 발표되었습니다. 미국의 첨단 재활용 기술에 대한 투자 확대로 더 많은 종류의 플라스틱을 재사용할 수 있는 가능성이 높아지고 있습니다.

식품은 시장 성장의 중요한 요소 중 하나입니다.

잼, 마요네즈, 피클과 같은 포장 식품은 일반적으로 다양한 종류의 단단한 PET 마개로 보호되는 병에 보관됩니다. 노동 인구가 증가함에 따라 조리하기 쉬운 포장 식품에 대한 수요가 크게 증가하고 있으며, Global Organic Trade Guide에 따르면 이 지역의 유기농 포장 식품 소비는 2026년까지 213억 9,000만 달러에 달할 것으로 예상됩니다. 이는 경질 PET 포장의 성장을 촉진할 것으로 예상됩니다.

식품 안전 절차 및 환경 문제와 관련하여 정부 및 관련 규제 기관에서 다양한 노력을 기울이고 있으며, 이는 기존 식품 포장 절차에 대한 재검토로 이어지고 있습니다. 이는 포장 산업의 포장재에 대한 더 나은 선택지를 찾기 위한 것으로, 환경 규제를 준수하고 환경적으로 지속가능한 포장을 제공하는 것이 시장 진입 기업들을 견인할 것으로 예상됩니다.

예를 들어, Fabri-Kal 제품은 최소 20-50%의 소비자 재사용(PCR) PET 소재로 만들어집니다. 재활용 가능한 제품은 미국에서 제조되며, PET 컵 뚜껑은 이동 중에도 차가운 음료를 마실 수 있도록 만들어져 빨대 사용을 방지하고 튀지 않고 안전하게 휴대할 수 있습니다. 이 회사의 그린웨어 제품은 식물 유래 PLA 수지로 만들어졌습니다.

또한 많은 정부가 의약품 및 식품의 표시 및 포장에 대한 엄격한 법률 및 규제를 요구하고 있으며, 이는 경질 PET 포장 시장의 범위를 더욱 확장하고 있습니다. 예를 들어, 미국에서는 식품 산업에서 경질 포장에 대한 수요가 증가하고 있는데, 이는 이 지역의 일부 기업이 자체 포장 설비를 갖추지 못했기 때문입니다.

2021년에는 식품 포장의 투명화 추세가 두드러졌습니다. 소비자들은 라벨에 기재된 성분뿐만 아니라 구매 전에 실물을 확인하기를 원합니다. 폴리에틸렌 테레프탈레이트(PET) 병은 1회용 케첩, 조미료, 바비큐 소스 시장에서 유리를 대체하고 있습니다. 많은 기업들이 폴리에틸렌 테레프탈레이트(PET) 병을 선택하고 있는데, 이는 PET가 유리만큼 투명하고 깨지기 쉽지 않기 때문입니다.

미국의 경질 PET 포장 산업 개요

미국의 경질 페트병 포장 시장은 몇몇 대기업에 의해 적당히 통합되어 있습니다. 각 업체들은 시장 점유율 확대를 위해 전략적 제휴 및 제품 개발에 지속적으로 투자하고 있습니다. 최근 시장 개척 동향은 다음과 같습니다.

2021년 4월, 베리 세계 그룹(Berry Global Group, Inc.)은 E-Commerce 및 식음료용 소비자 포장용 필름의 지속적인 성장을 지원하기 위해 7,000만 달러 이상을 투자한다고 발표했습니다. 이번 투자는 2021년과 2022년에 북미의 여러 제조 시스템에서 가동될 새로운 다층 블로우 필름 라인, 인프라 업그레이드 및 기타 장비를 지원하기 위한 것입니다. 기존 인프라 업그레이드와 더불어, 이 필름 라인은 향후 예상되는 재활용 컨텐츠에 대한 고객 수요 증가를 지원할 것입니다.

2021년 2월, 베리세계은 E-Commerce 사업자를 위해 폴리에틸렌 테레프탈레이트(PET) 소재의 주류 병을 출시했습니다. 이 50ml PET 병은 진을 중심으로 한 주류의 온라인 판매 수요 증가에 대응하기 위한 것입니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 산업 공급망 분석

- 시장 성장 촉진요인

- 의약품 부문에서의 PET 보틀·용기 사용 확대

- 최근의 재료 관련의 진보와 재생 PET 사용

- 시장 과제

- 환경에 대한 우려와 원료 가격 변동

- 시장 기회

- PET를 대체하는 주요 재료 - PO, PS 등

- 주요 규격과 규제

- 충전 기술의 주요 유형 - 핫 필, 콜드 필, 아셉틱 필 등

제5장 COVID-19의 미국 플라스틱 포장 산업에 대한 영향 평가

제6장 시장 세분화

- 제품 유형별

- 보틀 및 자

- 뚜껑 및 마개

- 트레이

- 기타

- 최종 이용 산업별

- 식품

- 음료

- 의약품

- 화장품

- 기타 최종사용자별(산업·농업)

제7장 경쟁 구도

- 기업 개요

- CCL Industries, Inc.

- Amcor Limited

- Mondi Group

- Smurfit Kappa Group PLC

- Berry Plastics Group

- Graham Packaging Company

- Dunmore Group

제8장 투자 분석

제9장 시장 전망

ksm 25.02.04The United States Rigid PET Packaging Market is expected to register a CAGR of 4.35% during the forecast period.

The International Bottled Water Association reports that Americans consumed 15.6 billion gallons of bottled water in 2021, up 4.5% from 2020 (compared to a 4.2% increase the previous year). That means that each American consumed 46.9 gallons of bottled water on average in 2020, up 3.8% from the prior year. Furthermore, retail dollar sales of bottled water increased by 4.4% in 2021, reaching USD 37.9 billion. With this rising trend likely to continue, it is set to propel the demand for Rigid PET in bottled water packaging.

Clamshell packaging remains popular with retailers among rigid plastic packaging because the product is visible on both sides. It can be hung or freestanding, and it's harder to shoplift since the package is bigger than the product inside. It's much lighter than cardboard or other alternatives, saving energy during transport, cheaper to make, and more durable.

Manufacturers prefer PET over other plastic packaging goods because it minimizes the loss of raw material throughout the manufacturing process. Its recyclability and ability to customize it with numerous colors and designs make it a popular choice. Refillable items have risen in popularity as consumer knowledge of environmental issues has grown, increasing demand for the product. For instance, in February 2022, Evergreen is one of the prominent producers of food-grade rPET in North America, having its USD 200 million investment and multiple acquisitions.

For decades, pharma packaging has likely migrated away from plastic, the industry's main design and manufacturing material. However, the industry will continue to use polyethylene terephthalate (PET) because of its capacity to break down to PET at the molecular level.

In April 2022, Klockner Pentaplast, a manufacturer of recycled content products and high-barrier protective packaging, decided to expand its multi-million dollar production facility in Beaver, West Virginia, to add post-consumer recycled content (PCR) PET capacity in North America. Installing an extrusion line and two thermos formers will increase the company's sustainable innovation in the consumer health, pharmaceutical, and food packaging markets, producing 15,000 metric tonnes of new rPET/PET capacity. Over 20% of Klockner Pentaplast volumes are currently made with PCR material.

US Rigid PET Packaging Market Trends

Rigid PET Caps and Closures will Observe a Significant Growth

According to Silicon Valley Bank, premium wineries in the United States had a gross margin of 56.8 % as of 2020, with the average bottle price being USD 28. Hence, the usage of Rigid PET closures can be an advantage in reducing cost, being stronger than cork, and not susceptible to taint, which is why PET caps and closures are further fueling the growth of sales in the region.

According to the National Library of Medicine, in 2021, overall pharmaceutical expenditures in the US grew 7.7% compared to 2020, for a total of USD 576.9 billion. By 2022, overall prescription drug spending is expected to rise by 4.0% to 6.0%, whereas in clinics and hospitals it is anticipated to increase from 7.0% to 9.0% and 3.0% to 5.0%, respectively, compared to 2021. Due to the high consumption of drugs, there is a considerable rise in demand for more bottles, driving the growth of the caps and closures market.

Furthermore, nanotechnology in convenience food manufacturing has played a crucial role in improving critical functions, including preservation procedures, packaging methods, and finished goods processing. Thus, this trend is anticipated to play a significant role in increasing the usage of containers for packaged food products, which is expected to increase the demand for various kinds of closures.

Most manufacturers are considering caps and closures to provide seal-proof packaging and product protection, driving the market's growth. According to the USDA Foreign Agricultural Service 2020 report, fresh fruit export commodities included apples, grapes, oranges, strawberries, and cherries, which accounted for a combined USD 3.1 billion, with top markets including Canada and Mexico. The requirement for caps can be increased since they are most often used in juices.

Moreover, concerning the environmental issue and enhancing brand appeal, various manufacturers are replacing outer box products with rigid PET caps and closures made from recycled plastic and are concentrating more on design and high appeal for their brands. According to American Chemistry Council, 52 new plastics recycling projects have been announced in the United States between 2017 and 2020, with the combined value of projects being USD 4.8 Billion. The growing investments in the US advanced recycling technologies are making it probable to reuse more plastic types than was possible.

Food is One of the Significant Factor for Market Growth

Packaged food products, such as jams, mayonnaise, pickles, etc., are usually stored in bottles protected using various kinds of airtight Rigid PET closures. With an increase in the working population, there has been a substantial increase in the demand for easy-to-cook and packaged food. According to Global Organic Trade Guide, organic packaged food consumption in the region is expected to reach USD 21.39 Billion by 2026. It is expected to fuel the growth of rigid PET packaging.

Various initiatives were taken by the governments and the related regulatory bodies regarding food safety procedures and environmental issues that have led to the revision of the existing food packaging procedures. It has been done to promote the packaging industry to look for better options in terms of packaging materials, which is expected to drive the market players to comply with environmental regulations and provide environmentally sustainable packaging.

For instance, Fabri-Kal products are made with a minimum of 20-50% post-consumer recycled (PCR) PET material. Recyclable products are made in the United States. The PET Sip Lids are created for on-the-go consumption of cold drinks and transport safely without splashing, preventing the use of straws. The company's greenware products are made from PLA resin derived from plants.

Also, many governments are mandating stringent laws and regulations on the labeling and packaging of drugs and food products, further expanding the scope of the Rigid PET packaging market. For instance, the United States witnessed an increase in the demand for rigid packaging in the food industries, owing to the inability of an in-house packaging facility for a few companies in this region.

In 2021, transparency in food packaging had been trending. Beyond just the listed ingredients on the label, consumers also want to see the physical product before purchasing. Polyethylene terephthalate (PET) bottles are taking over for glass in the single-serve ketchup, condiments, and barbecue sauce markets. Many companies are choosing polyethylene terephthalate (PET) bottles, as PET is as clear as glass and less likely to break.

US Rigid PET Packaging Industry Overview

US rigid pet packaging market is moderately consolidated, with a few major companies. The companies continuously invest in strategic partnerships and product developments to gain more market share. Some of the recent developments in the market are

April 2021: Berry Global Group, Inc. announced an investment of more than USD 70 million to support continued growth in consumer packaging films, primarily for e-commerce, food, and beverage applications. The investment supports new multi-layer blown film lines, infrastructure upgrades, and other equipment that will come online in 2021 and 2022 across multiple sites in the North American manufacturing system. Beyond the traditional infrastructure upgrade, the film lines will support the anticipated increased customer demand for recycled content.

February 2021: Berry Global launched a polyethylene terephthalate (PET) spirit bottle for e-commerce businesses. The 50ml PET bottle addressed the increasing demand for online spirit sales, especially gin.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Supply Chain Anlaysis

- 4.3 Market Drivers

- 4.3.1 Growing use of PET bottles & containers in the Pharmaceutical sector

- 4.3.2 Recent material-related advancements and use of recycled PET

- 4.4 Market Challenges

- 4.4.1 Environmental concerns & fluctuations in raw material pricing

- 4.5 Market Opportunities

- 4.6 Key alternatives to the use of PET - PO, PS, etc.

- 4.7 Key Standards & Regulations

- 4.8 Maior types of filling technology - Hot Fill, Cold Fill, Aseptic Fill, etc.

5 ASSESSMENT OF COVID-19 IMPACT ON THE US PLASTIC PACKAGING INDUSTRY

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Bottles & Jars

- 6.1.2 Caps & Closures

- 6.1.3 Trays

- 6.1.4 Others

- 6.2 By End-User Industry

- 6.2.1 Food

- 6.2.2 Beverages

- 6.2.3 Pharmaceuticals

- 6.2.4 Cosmetics

- 6.2.5 Other End-user verticals (Industrial & Agriculture)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CCL Industries, Inc.

- 7.1.2 Amcor Limited

- 7.1.3 Mondi Group

- 7.1.4 Smurfit Kappa Group PLC

- 7.1.5 Berry Plastics Group

- 7.1.6 Graham Packaging Company

- 7.1.7 Dunmore Group