|

시장보고서

상품코드

1635344

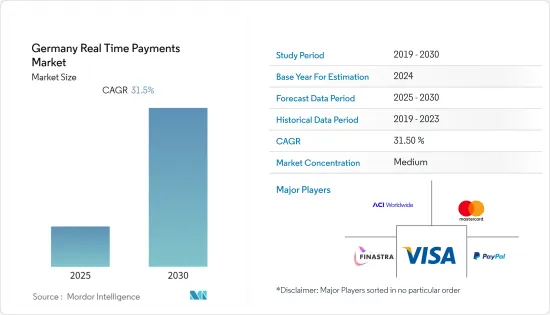

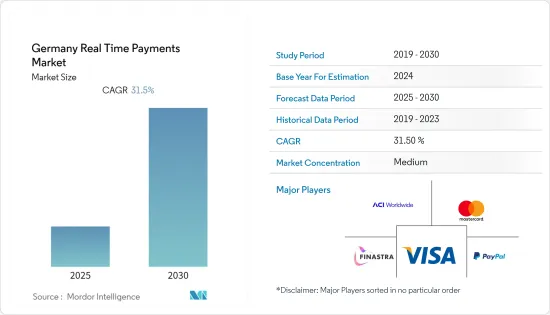

독일의 실시간 결제 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Germany Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

독일의 실시간 결제 시장은 예측 기간 중 CAGR 31.5%를 기록할 전망

주요 하이라이트

- 비은행 결제 서비스 프로바이더(PSP)와 은행이 개발한 새로운 결제 기술의 등장으로 기업과 소비자는 다양한 결제 수단을 이용할 수 있게 되었습니다. 기술의 발전과 함께 이러한 시설들은 첨단 API, AI, 모바일 뱅킹 솔루션의 힘을 활용하여 핀테크의 세계를 재구성하고 있습니다.

- 실시간 결제는 현금을 좋아하는 독일인들을 디지털 결제로 전환시키는 게임 체인저로 주목받고 있으며, SCT Inst는 신용 카드와 관련된 문화적 부정적인 이미지를 제거합니다. 모드의 거래 서비스 및 솔루션을 소비자에게 제공하기 위해 기술 서비스 프로바이더를 통한 결제를 선택하고 있습니다. 독일에서 실시간 결제는 2027년까지 전체 소매 결제 거래의 37%를 차지할 것으로 예상됩니다.

- 독일에서는 최근 유로존의 규제 개혁과 함께 큰 변화가 일어나고 있습니다. 많은 대기업이 비즈니스 및 핀테크 솔루션 프로바이더로서 입지를 구축할 수 있는 기회를 활용하고 있습니다. 예를 들어 유로 단일 결제권(SEPA), 결제 서비스 지침(PSD2), 유로 소매 결제 위원회(ERPB)의 설립 등이 시장 성장을 가속하고 있습니다.

- COVID-19는 디지털 혁신의 기폭제가 되어 경제의 '혁신 촉진제'가 되었습니다. 시장 진출기업이 E-Commerce에 집중하고 온라인 쇼핑을 늘리면서 시장은 이미 큰 변화를 겪고 있습니다. 팬데믹(세계적 대유행)의 격화와 봉쇄 및 비접촉식 결제와 같은 규제 변화도 업계에 도움이 되었습니다. 이와 함께 부가 서비스로서 보험, 특히 PayPal 및 신용카드 프로바이더가 제공하는 구매자 보호와 같은 기능도 등장했습니다. 혜택과 특별 혜택에 대한 캐시백 포인트는 일부 참가자들에게 어필하고 있습니다.

- 실시간 결제 솔루션은 소비자와 기업에게 즉각적인 자금 접근과 버튼 하나로 자금 이동이 가능한 편리함을 쉽게 제공했으나, 새로운 결제 인프라 도입 비용, 결제 관련 금융 범죄, 기술 장애, 사이버 공격 등의 문제로 인해 업계는 설립 초기부터 직면하고 있습니다.

독일 실시간 결제 시장 동향

P2B 부문이 시장의 주요 점유율을 차지

- ACI Worldwide가 발표한 보고서에 따르면 결제 플로트란 아직 정산되지 않은 은행 계좌에 입금된 금액입니다. 현재 실시간 결제가 널리 보급된 독일의 기업과 소비자는 2021년에 결제 플로트 감소로 인해 3억 1,300만 달러의 효율성을 달성할 것으로 예상됩니다. 인스턴트 결제의 도입으로 독일에서는 유동 시간이 단축되며, 2021년에는 하루 48억 2,300만 달러의 거래 총액이 감소합니다. 이 운전자금은 같은 해에 약 1억 1,400만 달러의 확정된 생산량을 촉진할 것으로 예상됩니다.

- 최근 EPC(유럽결제협의회)는 2022년 6월 P2P 거래 관련 QR코드(모바일 주도형(SEPA) 결제) 표준화 최종 버전을 발표하여 즉시 신용송금(SCT) 결제 및 송금 규제기관의 필요성을 해결했습니다.

- 독일연방은행의 조사에 따르면 2021년 말 기준 독일 직불카드 결제 4건 중 3건(73%)이 NFC 기술을 이용한 비접촉식 결제였다고 합니다. 독일에는 1억 장 이상의 카드가 유통되고 있습니다. 이 시스템은 독일 은행 부문이 운영하고 있으며, 비자나 마스터카드와 같은 국제 신용카드 회사로부터 독립적이기 때문에 가까운 미래에 독일이 실시간 결제에서 우위를 점할 것으로 예상됩니다.

- 실시간 결제 시장은 독일 인스턴트 결제 시장을 주도하는 중요한 요인이 되고 있는 새로운 진입자들의 채택으로 인해 큰 변화를 겪고 있습니다. N26 은행은 이 지역에서 실시간 결제 솔루션을 제공하는 최초의 조직 중 하나이며, 이러한 시스템의 핵심은 새로운 디지털 뱅킹 용도 프로그래밍 인터페이스(API)에 있습니다.

- 최근 독일의 한 저축은행은 고객이 즉시 결제로 거래할 수 있는 새로운 기능을 도입했습니다. 그러나 이 새로운 기능은 수취인 은행도 즉시 결제를 지원하는 경우에만 작동합니다. 기술 발전과 이 지역의 실시간 결제 모드의 적응 속도에 따라 독일에서는 이미 더 많은 금융 기관이 이 기술의 초기 도입 그룹에 합류하고 있으며, 이는 독일 실시간 결제 시장을 주도하는 중요한 요인이 되고 있습니다.

E-Commerce가 시장을 주도하는 열쇠가 될 것입니다.

- 코로나 사태 이후 독일의 E-Commerce 비즈니스는 빠르게 성장하고 있으며, 코로나 사태에도 불구하고 지역 전체에서 매출이 증가하고 있습니다. 예를 들어 Postnord가 발표한 2021년 E-Commerce 비즈니스 보고서에 따르면 인구의 약 94%가 온라인 쇼핑을 이용하고 있으며, 이는 6,210만 명의 소비자에 해당합니다. 이 보고서는 또한 독일에서 대부분의 B2C 기업이 Paypal, Apple Pay, Google Pay와 같은 공급업체와의 실시간 결제를 선호한다고 밝혔습니다.

- Postnord의 최근 조사에서도 독일은 유럽인들이 온라인 쇼핑을 하는 국가 중 4위(각국(중국, 미국, 영국)에서 쇼핑을 한 수백만 명)를 차지합니다. 이는 유럽 전체 소비자의 약 26%에 해당합니다. 이 조사에 따르면 이 지역에서 선호하는 결제 게이트웨이는 PayPal 또는 이와 유사한 옵션이 50%, 청구서가 21%, 직불카드 또는 신용카드가 17%로 뒤를 이었습니다.

- 발표된 보고서(2021 European E-commerce Report)에 따르면 독일에서는 전체 인구의 96%가 인터넷에 접속하고 있으며, 그 중 88%가 온라인으로 상품과 서비스를 구매하고 있습니다.

- 세계 팬데믹으로 인해 비즈니스의 전체 시나리오가 바뀌었습니다. 즉각적인 거래에 대한 필요성이 높아지면서 산업 전반에 걸쳐 디지털 결제 솔루션의 강화가 요구되고 있습니다. 컨텍스트 커머스(contextual commerce)가 부상하면서 근로자, 상인, 고객, 공급업체가 24시간 365일 라이프스타일에 맞는 빠른 거래 방식을 도입할 수 있게 되었습니다.

- 독일의 새로운 기술 개혁과 규제의 발전으로 인해 실시간 결제 시스템 시장은 이질적인 시장으로 변모하고 있습니다. 그 주요 이유는 디지털화의 진전, 고객 행동의 변화, NFC 및 QR코드와 같은 기술을 도입한 PSD2 규제의 등장입니다.

독일 실시간 결제 산업 개요

소비자의 취향이 빠르게 변화하는 가운데, 이 시장은 유리한 선택이 되고 있으며, 이에 따라 막대한 투자가 이루어지고 있습니다. 거대한 성장 잠재력을 가진 이 시장은 신규 진입으로 인해 세분화되는 추세입니다. 서비스 프로바이더들은 제품 혁신을 촉진하기 위해 파트너십을 맺고 있습니다.

- 2022년 6월 - 독일에 본사를 둔 디지털 결제 처리 회사인 ePay와 유로넷 월드와이드(Euronet Worldwide)가 비즈니스 인센티브, 기프트 카드, 옴니채널 상거래를 위한 E-Commerce, 카드 결제, 모바일 등 다양한 결제 솔루션 포트폴리오를 제공한다고 발표했습니다. 결제 솔루션 포트폴리오를 제공합니다. 이러한 서비스에는 POS, 엔드투엔드 ATM, 카드 아웃소싱 솔루션, 카드 발급, 가맹점 획득 서비스 등이 포함됩니다.

- 2022년 5월 - 국제 송금 업계의 선도기업인 Euronet Worldwide, Inc.의 사업부인 Ria Money Transfer는 스웨덴에 본사를 둔 국제 전화 서비스 프로바이더인 Rebtel과 새로운 제휴를 체결했다고 발표했습니다. 이번 제휴를 통해 Ria의 국제 송금 서비스가 Rebtel의 디지털 플랫폼에 직접 통합되어 Rebtel의 고객들이 세계의 소중한 사람들에게 쉽고 편리하게 송금할 수 있게 되었습니다. 세계 최대 규모의 실시간 국제 결제 네트워크인 Euronet의 Dandelion 서비스를 이용하고 있습니다. 송금 기능을 통합하는 것은 핀테크 분야에 진출하고자 하는 통신 사업자에게는 독특한 성장 기회가 될 수 있습니다.

- 2021년 6월 - Deutsche Bank와 Fiserv는 가맹점을 위한 결제 솔루션을 제공하는 합작회사를 설립합니다. 이 합작회사는 클로버의 결제 수용 솔루션과 도이치뱅크의 통합 뱅킹 서비스를 결합한 것입니다. 이 합작회사는 중소-중견기업(SME)을 대상으로 서비스를 제공하며, 규제 당국의 승인을 거쳐 프랑크푸르트 암 마인에 본사를 두고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자/소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 강도

- 국내에서 결제 환경의 진화

- 국내에서 캐시리스 거래의 확대에 관련된 주요 시장 동향

- COVID-19가 독일의 결제 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 스마트폰의 보급

- 기존형 뱅킹에 대한 의존도 하락

- 편리성의 향상

- 시장이 해결해야 할 과제

- 결제 사기

- 현금에 대한 의존

- 시장 기회

- 디지털 결제의 성장을 장려하는 정부 시책에 의해 서민 사이에서 실시간 결제의 성장이 기대

- 디지털 결제 산업에서 주요 규제와 기준

- 세계 각국의 규제 상황

- 규제상 장애가 될 수 있는 비즈니스 모델

- 비즈니스 상황의 변화에 수반하는 개발 여지

- 주요 사례와 사용 사례 분석

- 전거래에서 차지하는 리얼 결제 거래의 점유율과 주요 국가의 거래량·거래액의 지역별 분석

- 비현금거래에서 차지하는 리얼 결제 거래의 비율과 주요 국가의 지역별 거래량 분석

제6장 시장 세분화

- 결제 유형별

- P2P

- P2B

제7장 경쟁 구도

- 기업 개요

- ACI Worldwide, Inc.

- Mastercard Inc.

- Finastra International GmbH

- PayPal Holdings, Inc.

- Fiserv, Inc.

- Fidelity National Information Services, Inc.(FIS Inc.)

- Wirecard AG

- Worldpay, Inc.

- Temenos AG

- Visa Inc.

제8장 투자 분석

제9장 시장 전망

KSA 25.01.31The Germany Real Time Payments Market is expected to register a CAGR of 31.5% during the forecast period.

Key Highlights

- With the rise of new payment technologies developed by non-bank payment service providers (PSPs) and banks, businesses and consumers now have a wide range of payment instruments. With the rise of technological advancement, these facilities are reshaping the fintech world, leveraging the power of advanced API, AI, and mobile banking solutions.

- Real-time payments are being touted as a game-changer for moving cash-loving Germans into digital payments. SCT Inst solves the negative cultural association of credit cards. As per the data by FSI Many smaller banks have opted to use payments via a technical service provider to deliver real-time payment mode transactional services and solutions for consumers. Real-time payments in Germany are expected to make up 37 percent of all retail payment transactions by 2027.

- Germany has been experiencing a major transformation with the recent regulatory reforms in the Euro region. Many major players are trying to take advantage of the opportunity to establish themselves as a business and Fintech solution provider. For instance, the establishment of the Single Euro Payments Area (SEPA), Payment Services Directive (PSD2), and the establishment of the Euro Retail Payments Board (ERPB) have aided the growth of the market.

- The COVID-19 pandemic has turned out to be a catalyst for digital transformation and thus an 'innovation accelerator' for the economy. The market has already been going through a major transformation, with participants shifting focus toward e-commerce to do more shopping online. Pandemic intensification and changes in regulation like lockdown and touchless payments benefitted the industry. Along came features like Insurance as an added service, particularly in buyer protection (e.g., as provided by PayPal and credit card providers). Cashback points for rewards and special offers appeal to some participants.

- The real-time payment solution has easily given consumers and businesses the luxury of ready access to funds and the convenience of transferring them with a single button; however, there are also challenges related to the cost of adopting a new payment infrastructure, financial crimes related to payments, technological failure, and cyberattacks, which the industry has faced since its inception.

Germany Real Time Payments Market Trends

P2B Segment Will hold The Major Share of the Market

- According to a report published by ACI Worldwide, a payment float is a deposit into a bank account that has not yet been cleared. With its current share of real-time adoption, German businesses and consumers will gain an estimated net efficiency saving of USD 313 million in 2021, driven by a reduction in the payment float. Instant payments unlocked a total transaction value of USD 4,823 million daily in 2021 through a reduced float time in Germany. This working capital facilitated an estimated USD 114 million of firm output in the same year.

- Recently in June 2022 EPC (European payment council) publishes the final version of the standardization of QR codes ( mobile-initiated ( SEPA) payment) involving the P2B mode of transaction addressing the need for a regulatory body for Instant credit transfer (SCT) payment and transfers, which seems to make real-time payment more secured in upcoming future. looking forward to these regulatory reforms Germany is expected to double its real-time payments volume by 2026.

- As per the study by Deutsche Bundesbank at the end of 2021, three out of four (73%)payments of the debit card in Germany were contactless using NFC Technology. In Germany, there are more than 100 million cards in circulation. The system is operated by the German banking sector and is independent of international credit card companies like Visa and Mastercard which is expected to favor Germany in real-time payment settlement in the near future.

- Real-time payment market has been experiencing tremendous changes with the introduction of new players which has been a key factor to drive the market for instant germany N26 bank one of the first organizations to provide real-time payment solutions in the region key to these sytems lies in the new digital banking application programming interfaces - APIs.

- Recently, Germany's savings banks introduced a new feature allowing customers to make a transaction as an instant payment. But it only works if the receiving bank also supports instant payments. With technological advancement and the adaptation rate of the real-time payment mode in the region, an increasing number of lenders in Germany have already joined the group of early adopters of the technology, which has been a key factor in driving the real-time payment market in Germany.

Ecommerce will be the Key to Drive The Market

- Germany's e-commerce business has proliferated since the pandemic, and sales have increased across the region during the coronavirus pandemic. For Instance, the report posted on eCommerce business 2021 by Postnord reflects approximately 94 % of the population is shopping online, which is 62.1 million consumers. The report also suggested that most B2C companies prefer real-time payment settlement with vendors like Paypal, Apple Pay, and Google pay in Germany.

- The recent survey from Postnord also reflects that Germany is at 4th position in countries where Europeans shop online (number of millions who shopped from each country (China, USA, and the UK). It's approximately 26 % of the total consumers in the European region. The study also suggested that the preferred payment gateway in the area be PayPal or a similar option at 50%, followed by invoices at 21%, debit or credit card at 17 %.

- As per the report (2021 European E-commerce Report) published, 96 % of the total population in Germany have access to the internet estimated growth rate of 1 %, and 88% of that internet user that bought goods or services online growth rate expected to be 2%from the previous year 2020.

- The global pandemic has changed the entire scenario of doing business; an increased need for immediate transactions and enhanced digital payment solutions across industries have become necessary. Contextual commerce is on the rise - allowing workers, merchants, customers, and suppliers to implement a quicker way to do business that fits into their 24/7/365 lifestyle.

- With the country's new technological reforms and regulations advancement, Germany has a heterogeneous market for real-time payment systems. The key reasons are the growing digitalization level, changes in customer behavior, and the advent of the PSD2 regulation by deploying technologies such as NFC or QR codes.

Germany Real Time Payments Industry Overview

With consumer preferences changing rapidly, the market has become a lucrative option and thus, has attracted a huge amount of investments. Due to the huge growth potential, the market is moving towards fragmentation due to the new entrants. The service providers are engaging in partnerships to promote product innovation.

- June 2022 - Germany-based digital payments processing company ePay and Euronet Worldwide announced additional product launches. ePay offers a portfolio of business incentives, gift cards, and payment solutions, such as eCommerce, card acceptance, and mobile for omnichannel commerce. These services include point-of-sale (POS), end-to-end ATM, card outsourcing solutions, card issuance, and merchant acquisition services.

- May 2022 - Ria Money Transfer, a business segment of Euronet Worldwide, Inc., a key player in the cross-border money transfer industry, announced a new partnership with Rebtel, an international calling service provider based in Sweden. The partnership embeds Ria's international money transfer service directly into Rebtel's digital platform, making it easy and convenient for Rebtel's customers to send money to loved ones worldwide. Ria offers payments to bank accounts, mobile wallets, and cash across 170 countries and territories and is powered by Euronet's Dandelion service, the world's largest real-time international payments network. Embedding a money transfer feature presents a unique growth opportunity for Telcos wanting to enter the fintech space.

- June 2021 - Deutsche Bank and Fiserv are entering into a Joint venture to provide a payment solution for merchants. The joint venture is to combine Clover's payment acceptance solution with Deutsche Bank's integrated banking services. The joint venture will serve small, medium-sized, and small, medium-sized enterprises (SMEs) and will be based in Frankfurt am Main, pending regulatory approval.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in the country

- 4.4 Key market trends pertaining to the growth of cashless transaction in the country

- 4.5 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Falling Reliance on Traditional Banking

- 5.1.3 Ease of Convenience

- 5.2 Market Challenges

- 5.2.1 Payment Fraud

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions with a regional breakdown of key countries by volume and transacted value

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions with a regional breakdown of key countries by volumes

6 MARKET SEGMENTATION

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ACI Worldwide, Inc.

- 7.1.2 Mastercard Inc.

- 7.1.3 Finastra International GmbH

- 7.1.4 PayPal Holdings, Inc.

- 7.1.5 Fiserv, Inc.

- 7.1.6 Fidelity National Information Services, Inc. (FIS Inc.)

- 7.1.7 Wirecard AG

- 7.1.8 Worldpay, Inc.

- 7.1.9 Temenos AG

- 7.1.10 Visa Inc.

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

샘플 요청 목록