|

시장보고서

상품코드

1632065

영국의 실시간 결제 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)United Kingdom Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

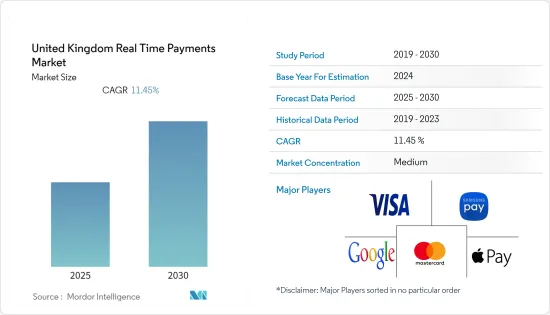

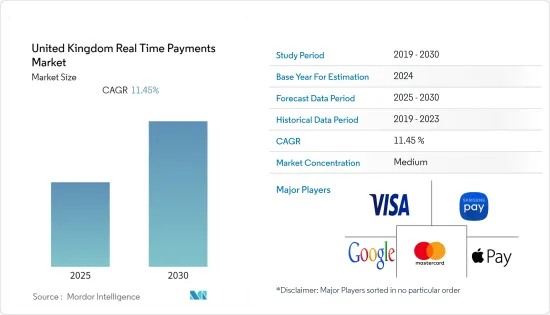

영국의 실시간 결제 시장은 예측 기간 동안 CAGR 11.45%를 기록할 것으로 예상됩니다.

영국에서는 2021년 34억 건의 실시간 거래가 기록될 것으로 예상되며, 그 결과 기업과 소비자는 9억 5,000만 달러의 비용 절감 효과를 거둔 것으로 추정됩니다. 이는 영국 GDP의 0.10%에 해당하는 32억 달러의 추가 경제 생산액을 창출한 것으로 추정됩니다.

2026년에는 실시간 거래가 58억 건으로 증가하고, 소비자와 기업의 순 절감액은 18억 달러에 달할 것으로 예상됩니다. 이는 국가 예상 GDP의 0.11%에 해당하며, 38억 달러의 추가 경제 생산량을 창출하는 데 도움이 될 것입니다. 즉, 실시간 결제가 가져올 수 있는 잠재적 경제 효과는 아직 미개척 상태인 셈입니다.

Cebr에 따르면, 모든 결제가 실시간화될 경우 이론적으로 2026년까지 공식 GDP에 2.7%를 추가할 수 있다고 합니다. 소비자가 실시간 결제에 접근하는 것이 쉽고 저렴함에도 불구하고 영국의 결제는 여전히 전통적인 도구, 특히 카드에 강하게 얽매여 있습니다.

COVID-19가 유행하는 동안 실시간 결제의 점유율은 상대적으로 높았지만(전체 거래의 9.2%), 2021년 영국에서 실시간 결제를 통한 소비자와 기업의 순이익은 9억 5,000만 달러에 달했습니다.

이 중 가장 큰 것은 결제 시스템 내 거래 비용 절감으로 인한 순 비용 절감으로, 거래당 평균 결제 비용은 현재 영국의 실시간 결제는 모든 비실시간 가격의 가중 평균 믹스보다 14.1% 낮습니다.

영국의 실시간 결제 시장 동향

편리한 결제 옵션에 대한 니즈 증가

영국에서는 봉쇄령으로 인해 2020년부터 2021년까지 경제의 상당 부분이 멈춰 섰습니다. 기업들도 재택근무로 전환하면서 출장비 및 도심에서의 지출이 감소했습니다. 경기 침체와 소비자 신뢰도 하락으로 소비자는 재량 지출을 줄였고, 기업 투자 감소로 인해 2020-21년 GDP는 9.8% 감소했습니다.

위와 같은 요인이 총 결제액 감소에 기여한 것 외에도 2020년 영국에서는 사람과 기업의 결제 방식에도 변화가 있었습니다. 사람들이 비접촉식, 온라인, 모바일 지갑 채널을 더 많이 사용하게 되었고, 주로 현금 결제가 희생되었습니다. COVID-19는 영국의 실시간 결제 시장에도 영향을 미쳤습니다.

2020년, 코로나 바이러스 전염병이 전 세계를 강타하여 우리의 생활과 업무 방식에 큰 영향을 미쳤습니다. 당연히 영국의 결제액에도 영향을 미쳐 2020년에는 11% 감소한 356억 원을 기록했습니다.

또한 2020년 전체 카드 결제는 감소하고, 카드 결제의 점유율은 증가하여 2020년 전체 결제의 절반 이상(52%)이 카드 결제였습니다. 이는 많은 소매업체들이 카드와 비접촉식 사용을 장려하고, 봉쇄로 인해 많은 사람들이 온라인 쇼핑을 선택했기 때문입니다. 동시에 오프라인 매장과 접촉이 많은 서비스는 문을 닫았습니다.

현금 의존도 감소

- 영국에서 2020년에도 현금 결제는 장기적인 감소세를 이어갔으며, 전염병의 영향으로 현금 사용은 전년 대비 35% 감소했으며, 2017년 이후 매년 약 15%씩 감소해 왔으며, 2020년에는 이 감소세가 더욱 가속화되었습니다. 이는 전염병이 현금 사용에 미치는 영향이 주요 원인이며, 현금 결제는 다른 많은 결제보다 더 큰 영향을 받았습니다.

- 그 결과, 현금이 COVID-19 전파의 매개체가 될 것을 우려한 소매업체들은 비접촉식 결제를 추진했고, 현금을 많이 사용하는 많은 업체들이 문을 닫았습니다.

- 그러나 현금은 2020년에도 영국에서 두 번째로 많이 사용되는 결제 수단으로, 전체 결제 건수의 5분의 1 미만을 차지하며 여전히 두 번째로 많이 사용되는 결제 수단입니다. 전체 결제 건수는 감소했지만, 기업과 소비자가 온라인 뱅킹과 모바일 뱅킹을 통해 결제와 송금을 하는 경우가 증가함에 따라 패스트 페이먼트(Faster Payments)의 성장세가 두드러졌습니다.

- 특히 모바일 뱅킹의 성장세가 두드러지고 있으며, 이용자들은 잔액 확인에 그치지 않고 단발성 결제 및 기타 재무 관리까지 모바일 뱅킹을 통한 업무의 폭을 지속적으로 넓혀가고 있습니다.

- 영국에서 356억 건의 결제 중 거의 9건 중 9건(10건 중 9건)이 소비자에 의해 이루어졌습니다. 소비자 결제의 81%는 자발적인 쇼핑에 대한 지불이었고, 나머지 19%는 정기적인 청구서나 약속에 대한 지불이었습니다.

영국의 실시간 결제 산업 개요

소비자의 취향이 빠르게 변화하는 가운데, 영국의 실시간 결제 시장은 유리한 선택지가 되어 막대한 투자를 유치하고 있습니다. 거대한 성장 잠재력을 배경으로 신규 진입자들이 시장을 세분화하고 있습니다. 서비스 제공업체들은 제품 혁신을 촉진하기 위해 파트너십을 맺고 있습니다.

2021년 UK Finance의 시장 조사에 따르면, 젊은 층은 노년층보다 애플페이, 구글페이, 삼성페이를 사용할 가능성이 더 높으며, 2020년 모바일 결제에 등록한 사람은 성인 인구의 3분의 1(32%, 1,730만 명)에 달해 2019년 대비 740만 명(75%) 증가했습니다. 740만 명(75%) 증가했습니다. 모바일 결제에 주목한 사람들 중 84%가 결제를 기록했습니다. 이들 중 절반(50%)은 2주 또는 그 이상의 주기로 결제를 하고 있습니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 소개

- 조사 가정과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자/소비자의 협상력

- 신규 참여업체의 위협

- 대체품의 위협

- 경쟁 기업 간의 경쟁 관계

- 영국의 결제 환경의 진화

- 영국의 캐시리스 거래 확대 관련 주요 시장 동향

- COVID-19가 영국의 결제 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 인터넷 보급률 증가

- 전통적 뱅킹 동향 저하

- 편리성 높은 결제 수단에 대한 요구 상승

- 시장 과제

- 온라인 결제 사기 증가 위협

- 정부 규제의 결여

- 시장 기회

- 디지털 결제 성장을 장려하는 정부 정책에 의해 서민 사이에서의 실시간 결제의 성장이 기대됩니다.

- 디지털 결제 업계의 주요 규제와 기준

- 영국 전체의 규제 상황

- 규제상 장애가 될 수 있는 비즈니스 모델

- 비즈니스 상황 변화에 따른 개발 여지

- 주요 사례와 사용 사례 분석

제6장 시장 세분화

- 결제 유형별

- P2P

- P2B

제7장 경쟁 구도

- 기업 개요

- ACI Worldwide Inc.

- Fiserv Inc.

- Paypal Holdings Inc.

- Mastercard Inc.

- Google LLC(Google Pay)

- VISA Inc.

- Apple Inc.(Apple Pay)

- Samsung Electronics(UK) Limited(Samsung Pay)

- Diners Club International

- Finastra Limited

제8장 투자 분석

제9장 시장 향후 전망

ksm 25.02.06The United Kingdom Real Time Payments Market is expected to register a CAGR of 11.45% during the forecast period.

The UK recorded 3.4 billion real-time transactions in 2021, which resulted in an estimated cost savings of USD 950 million for businesses and consumers. This helped unlock USD 3.2 billion of additional economic output, representing 0.10% of the country's GDP.

With real-time transactions rising to 5.8 billion in 2026, net savings for consumers and businesses are forecast to climb to USD 1.8 billion. That would help to generate an additional USD 3.8 billion of economic output, equivalent to 0.11% of the country's forecasted GDP. That means the potential economic benefits of real-time payments remain untapped.

According to the Cebr, the theoretical impact of all charges being real-time could add 2.7% to formal GDP by 2026. Payments in the UK are still very much tied to traditional tools - especially cards - despite being easy and cheap for consumers to access real-time payments.

During the COVID-19 pandemic, a relatively strong real-time payments mix share (9.2% of all transactions), in 2021, net benefits for consumers and businesses of real-time payments hit USD 950 million in the United Kingdom.

The largest component of this was net savings through the transaction costs within the payments system. On a per-transaction basis, real-time payments in the UK currently have a 14.1% lower average payments cost than the weighted average mix of all non-real-time prices.

UK Real Time Payments Market Trends

Growing Requirement of Convenient Payment Options

In the United Kingdom, lockdowns resulted in large parts of the economy shutting down for details 2020-2021. Businesses also switched to working from home, reducing expenditure on travel and spending in city centers. The fall in business and consumer confidence saw consumers reduce discretionary spending while lower levels of business investment resulted in GDP falling by 9.8% in 2020-21.

Keeping above mentioned factors contributing to the fall in total payment volumes, 2020 in the UK also saw changes in how people and businesses paid. This included people making greater use of contactless, online, and mobile wallet channels, largely at the expense of cash payments. This is a permanent change to people's behavior, as in many other parts of people's lives; the pandemic has also affected UK real-time payment markets.

In 2020, the coronavirus pandemic hit the world, significantly impacting how most of us live and work. Unsurprisingly this also affected payment volumes in the UK, which declined by 11% to 35.6 billion in 2020.

Moreover, overall card payments in 2020 declined, and their share of payments increased, with over half (52%) of all payments made by cards in 2020. This was due to many retailers encouraging card and contactless use, along with lockdowns resulting in many people opting to shop online. At the same time, physical stores and contact-intensive services were shut down.

Declining Cash Dependency

- In the United Kingdom, cash payments continued their long-term decline in 2020, with the pandemic resulting in cash use falling by 35% compared to the previous year. Since 2017 cash use had been declining by around 15% each year, so 2020 represented an acceleration of this decline. This is largely attributed to the impact of the pandemic on cash use, with cash payments being affected to a greater degree than many other payments.

- They resulted in retailers pushing contactless payment options amid fears about cash being a vector for COVID-19 transmission, while many businesses with high levels of cash spend were closed.

- However, cash remained the second most frequently used payment method in the UK in 2020, being used for just under a fifth of the total number of payments made. Despite overall payment volumes falling, strong growth was seen in Faster Payments as businesses and consumers increasingly used online and mobile banking to make payments and transfer money.

- Mobile banking, in particular, continued to grow strongly, with users continually widening the range of tasks they perform using such services, exploring beyond checking their balances to make one-off payments and manage other aspects of their finances.

- Consumers made the large majority of the 35.6 billion payments in the UK, accounting for nearly nine out of ten costs. Spontaneous purchases accounted for 81% of payments made by consumers, with the other 19% of payments being made for regular bills and commitments

UK Real Time Payments Industry Overview

With consumer preferences changing rapidly, the United Kingdom real-time payments market has become a lucrative option and thus, has attracted a huge amount of investments. Due to the huge growth potential, the market is moving towards fragmentation due to the new entrants. The service providers are engaging in partnerships to promote product innovation.

In 2021, according to UK Finance market research, younger people were more likely than older people to use either Apple Pay, Google Pay, or Samsung Pay. Nearly a third (32%, 17.3 million people) of the adult population had registered for mobile payments in 2020, an increase of 7.4 million people (75%) compared with 2019. Of those noted for mobile payments, 84% of these people recorded a payment. Half (50%) of these registered users made payments fortnightly or more frequently.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in the United Kingdom

- 4.4 Key market trends pertaining to the growth of cashless transaction in the United Kingdom

- 4.5 Impact of COVID-19 on the payments market in the United Kingdom

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Internet Penetration

- 5.1.2 Decreasing Traditional Banking trend

- 5.1.3 Growing Requirement of Convenient Payment Options

- 5.2 Market Challenges

- 5.2.1 Threat of Growing Online Payment Fraud

- 5.2.2 Lack of Government Regulation

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the United Kingdom

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

6 Market Segmentation

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 ACI Worldwide Inc.

- 7.1.2 Fiserv Inc.

- 7.1.3 Paypal Holdings Inc.

- 7.1.4 Mastercard Inc.

- 7.1.5 Google LLC (Google Pay)

- 7.1.6 VISA Inc.

- 7.1.7 Apple Inc. (Apple Pay)

- 7.1.8 Samsung Electronics (UK) Limited (Samsung Pay)

- 7.1.9 Diners Club International

- 7.1.10 Finastra Limited