|

시장보고서

상품코드

1632095

인도의 실시간 결제 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)India Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

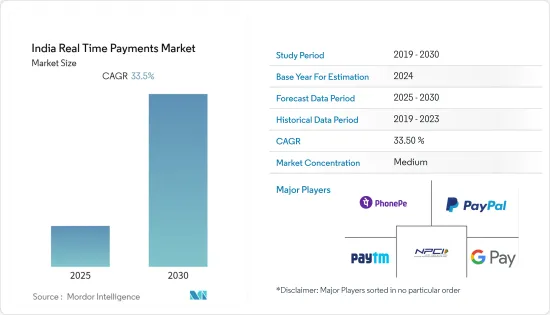

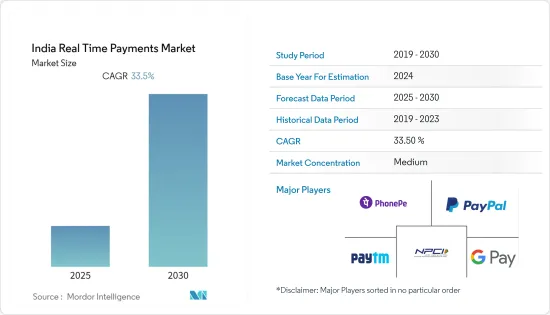

인도의 실시간 결제 시장은 예측 기간 중 CAGR 33.5%를 기록할 전망

주요 하이라이트

- 인도에서는 인터넷 지원 기기에 대한 접근성이 비약적으로 증가하고 있습니다. 예를 들어 BharatNet 프로그램에 따라 2025년까지 모든 마을을 광섬유로 연결하려는 정부의 계획은 인도 은행 부문에 혜택을 가져다 주었고, 휴대폰을 통해 금융 서비스에 액세스하는 디지털 수단을 도입함으로써 은행의 구조에 결정적인 변화를 가져왔습니다. 즉시 결제 시스템. 즉각적인 결제 시스템을 통해 인도 최고의 은행들은 직관적일 뿐만 아니라 고객 만족에 중점을 둔 혁신적이고 인터랙티브한 모바일 뱅킹 용도를 출시했습니다.

- 2010-2020년의 10년은 인도 결제 진화의 10년이라고 할 수 있습니다. 인도는 지난 30년간 결제 시스템을 변화시켜왔습니다. 물물교환 시스템에서 통합 결제 인터페이스(UPI) 결제 시스템까지 인도는 긴 여정을 걸어왔으며, 그 주요 이유는 전통적인 은행의 회복력 저하와 디지털 혁신으로 인한 실시간 결제 시스템의 부상입니다.

- 인도 중앙은행(RBI)은 이러한 모든 변화를 감독하는 중요한 역할을 담당하고 있습니다. 예를 들어 2022년 3월 RBI는 2022-23년 디지털 중심 계획을 발표했습니다. 중앙은행은 디지털 플랫폼에 대한 대출 기준을 발표하고, 중앙은행 디지털 화폐를 출시하고, 75개의 디지털 은행 설립을 촉진하고, POS 단말기의 지오태깅 프레임워크를 시행했습니다. 중앙은행은 디지털 결제 및 핀테크 부문에 구조 개혁을 초래하는 몇 가지 조치를 제안했으며, 이는 국내 실시간 결제 성장에 긍정적인 영향을 미치고 있습니다.

- IMPS, UPI 등 소비자가 24시간 언제든지 자금이체를 할 수 있는 고속 결제 시스템 도입, Bharat bill pay system(BBPS), 청구서 결제 및 상품 서비스 구매를 용이하게 하는 PPI, 통행료의 전자 결제를 용이하게 하는 전국 전자 통행료 징수(NETC) 등 모바일 기반 결제 시스템 도입으로 인도는 수혜자에게 즉각적인 신용을 제공하는 혁신적인 결제 시스템을 도입하기 위해 노력해 왔습니다.

- 이러한 결제 시스템의 편리성은 소비자에게 현금과 종이 결제의 대안을 제공했으므로 빠르게 받아들여졌고, PPI 발행사, BBPOU, UPI 플랫폼의 제3자 용도 프로바이더로서 결제 생태계에서 비은행 핀테크 기업의 핀테크 기업의 이용이 촉진되면서 국내 디지털 결제 도입이 더욱 가속화되었습니다.

- COVID-19는 인도의 실시간 결제 시스템에 다양한 영향을 미쳤으며, 봉쇄로 인해 전자지갑은 청구서 결제, P2P 송금, 필수 서비스를 위한 P2P 결제에 대한 사용량이 증가했습니다. 결제 게이트웨이는 거래가 온라인으로 전환되고 현재 온라인 입지를 구축하려는 생필품을 판매하는 소규모 상점과 제휴하여 거래량이 증가했습니다.

- 데이터베이스 악용, 신원 도용, 피싱 공격, 카드 결제 관련 사기와 같은 온라인 사기는 인도에서 흔한 일이며, 그 수는 대유행 기간 중 증가했으며, Microsoft의 세계 기술 지원 사기 조사 2021 보고서에 따르면 인도 소비자는 상당히 높은 온라인 사기를 경험했습니다. 인도인의 31%가 사기로 인해 돈을 잃었고, 지난 1년간 사기 발생률은 69%로 세계 최고 수준이었습니다. 낮은 인터넷 대역폭 E-Commerce는 거래가 완료되기까지 복잡한 절차를 거쳐야 하므로 작은 결함도 작업을 중단시킬 수 있습니다.

인도 실시간 결제 시장 동향

P2B 부문이 큰 시장 점유율을 차지

- 인도내 P2P 거래의 실시간 결제 솔루션은 주로 인도 국가결제공사(NPCI)가 관리하고 있습니다. 소매 결제 부문은 NPCI가 운영 및 도입한 다양한 시스템을 통해 발전과 성숙을 거듭해 왔습니다. NPCI는 인도인 개개인의 생활에 밀착하기 위해 RuPay 카드 제도, IMPS, UPI, NACH(National Automated Clearing House), Aadhaar-enabled Payments System(AePS), Aadhaar Payments Bridge System(APBS), National Electronic Toll Collection(NETC), Bharat bill pay system(BBPS) 등 다양한 혁신적인 소매 결제 상품을 개발했습니다. 또한 NPCI는 국제 네트워크 파트너(Japan Credit Bureau, Discover Financial Services, China Union Pay)와의 제휴를 통해 인도의 실시간 결제 시스템에 세계 솔루션 프로바이더로서의 길을 열었습니다. 길을 열었습니다.

- Aadhaar는 2009년 인도에서 시작된 이래 127,000,000명 이상의 개인에게 발급된 인도 고유 ID 번호로, Aadhaar를 지원하는 e-KYC(전자 고객 정보)는 인도에서 실시간 결제의 비약적인 성장을 가져왔습니다. 또한 Aadhaar는 가맹점 결제(P2P) 및 비즈니스 콜레스(BC)를 통한 거래(B2B)의 인증 및 처리에도 활용되고 있습니다.

- 인도의 UPI 결제 시스템은 인도에서 가장 종합적인 결제 수단으로 자리 잡았으며, RBI 데이터에 따르면 260만 명 이상의 고유 사용자와 5,000만 개의 가맹점이 UPI 플랫폼에 등록되어 있으며, 2022년 5월에는 약 594.63억 루피(1억 4,000만 루피)의 거래가 UPI를 통해 처리되었습니다. UPI는 사용자의 직불카드를 통해 저축계좌와 당좌예금 계좌를 연결하여 거래를 용이하게 함으로써 인도에서 실시간 결제 솔루션을 발전시키는 중요한 요소 중 하나입니다. 중요한 요소 중 하나가 되고 있습니다.

- 또한 인도 중앙은행은 2021년 1월 mPoS(모바일 POS), 물리적 POS, QR코드와 같은 결제 인프라를 북동부 지방 및 Tier-3에서 Tier-6 중심지에 배치하는 데 인센티브를 제공하기 위해 결제 인프라 개발 기금(PIDF) 제도를 운영했습니다. 이 제도는 이 제도는 P2P 거래 증가에 대응하기 위해 3년간(2023년 말까지) 9만 대의 POS(Point of Sale, 판매 시점 관리) 단말기와 QR(Quick Response, 빠른 응답) 코드를 배치하는 것을 목표로 하고 있으며, 가맹점의 결제 수단을 용이하게 하는 것을 목표로 하고 있습니다.

- ACI 월드와이드가 발표한 보고서에 따르면 2021년 인도는 실시간 결제 거래에서 세계 선두를 달리고 있으며, 486억 건의 거래가 전 세계 상거래의 40% 이상을 차지할 것으로 예상됩니다. 인도의 실시간 결제 거래 건수는 중국의 약 2.6배, 미국, 프랑스, 영국, 캐나다, 독일의 실시간 결제 거래 건수의 약 7배에 달할 전망입니다.

기술의 발전은 실시간 결제를 더욱 촉진할 것입니다.

- 스마트폰 사용자 증가와 5G 기술 도입으로 인도는 실시간 모바일 결제 시장을 주도하고 있습니다. 예를 들어 인도 국가결제공사(NPCI)는 오프라인 결제를 가능하게 하기 위해 UPI Lite 서비스의 온디바이스 지갑을 출시했으며, 2022년 2월 UPI는 852만 6,843루피의 온라인 거래 45억 2,749만 건을 처리했습니다. 오프라인 서비스를 제공하는 UPI Lite는 인도의 즉시 결제 시장을 더욱 활성화시킬 것으로 보입니다.

- 인도의 결제 시스템을 업그레이드하기 위해 RBI는 VSAT 기술을 이용한 위성 기반 인도 금융 네트워크(INFINITE)라는 통신 백본을 금융 및 은행 부문에 제공했으며, IDRBT는 이 통신 네트워크의 설계 및 개발을 맡았습니다. 폐쇄형 사용자 그룹(CUG) 네트워크는 VSAT 기술을 사용합니다. 시분할 다중접속(TDMA)/시분할 다중접속(TDM) 네트워크로, 데이터는 STAR 토폴로지를, 비디오 및 음성 트래픽은 메시 토폴로지에 DAMASCPC(Demand Assigned Multiple Access-Single Channel Per Carrier) Per Carrier)를 메시 토폴로지에 오버레이하고 있습니다.

- 인도 금융 시스템은 비접촉식 기술을 사용하고 있습니다. 비접촉식 기술은 카드 소지자가 "탭 앤 고"를 가능하게 하는 카드 결제 생태계의 혁신 중 하나입니다. 이러한 카드는 점점 더 널리 보급되고 있습니다. 이러한 카드 사용의 편의성을 제공하기 위해 RBI는 근거리무선통신(NFC) 지원 EMV 칩 및 PIN 카드를 사용한 카드 선물(CP) 거래의 경우 소액(2,000 루피)의 추가 인증 요소(AFA)를 완화할 수 있도록 허용했습니다. 이 한도는 2021년 1월 1일부터 5,000루피로 상향 조정되었습니다.

- IMPS는 2010년에 도입된 24시간 365일 '고속 결제' 시스템으로 P2P 모드 간 결제 수단으로 널리 받아들여지고 있습니다. 인도는 영국, 한국, 남아프리카공화국에 이어 네 번째로 이러한 결제 시스템을 도입한 국가입니다. 이 시스템은 수취인과 송금인 간의 실시간 자금 이동을 제공하며, 은행 간 인터넷 결제는 연기됩니다. 이 시스템은 1회 거래 한도를 2,000루피로 설정하여 푸시 거래를 촉진하고 있습니다.

- UPI(Unified Payments Interface)는 푸시 및 풀을 통한 즉시 송금, 공과금 결제, QR코드(Scan & Pay) 기반 결제, 가맹점 결제 등을 용이하게 합니다. 거래 중 UPI PIN은 공개키 기반(PKI) 기술을 사용하여 암호화되며, UPI의 프레임워크는 구글페이, 왓츠앱 등의 TPAP와는 별도로 네트워크 및 결제 서비스 프로바이더인 NPCI, 결제 시스템 프로바이더(PSP)인 은행, 발행 은행과 매출자 은행으로 구성되어 있습니다. 인도 시장에서는 은행 이외의 PPI 발행사들도 이 기능을 제공합니다.

인도 실시간 결제 산업 개요

소비자 취향이 빠르게 변화하는 가운데, 이 시장은 유리한 선택이 되어 막대한 투자를 유치하고 있습니다. 성장 잠재력이 큰 이 시장은 신규 진입으로 인해 세분화되는 추세입니다. 서비스 프로바이더들은 제품 혁신을 촉진하기 위해 파트너십을 맺고 있습니다.

- 2022년 6월 - WhatsApp은 인도 사용자에게 1.35달러의 캐시백을 제공하고 NPCI로부터 사용자 기반을 1억 명으로 확대할 수 있는 권한을 부여받았습니다.

- 2022년 6월 - 인도의 유니콘 파인랩스 핀테크(Unicorn Pine Labs Fintech)가 API 인프라 프로바이더 세투(Setu)를 7,000만-7,500만 달러에 인수했습니다. 인수 완료 후에도 Setu의 브랜드 ID 확인, 팀, 비즈니스 및 고객은 유지되며, Setu는 용도 프로그래밍 인터페이스(API) 인프라 제공 업체로 청구서 결제, 저축, 신용, 결제 등의 서비스를 제공합니다.

- 2022년 3월 - PhonePe는 기업용 서비스를 강화하기 위해 GigIndia를 인수했습니다. 이번 인수를 통해 GigIndia의 프리랜서 소규모 기업이 네트워크를 활용하여 기업 및 법인이 더 많은 고객을 확보하고 유통 채널을 확장 할 수 있습니다. PhonePe는 기술 및 금융 플랫폼 사업을 강화하기 위해 올해 2-3건의 추가 인수를 계획하고 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급 기업의 교섭력

- 구매자/소비자의 교섭력

- 신규 진출업체의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 국내에서 결제 환경의 진화

- 국내에서 캐시리스 거래의 확대에 관련된 주요 시장 동향

- COVID-19가 인도의 결제 시장에 미치는 영향

제5장 시장 역학

- 시장 성장 촉진요인

- 스마트폰의 보급

- 기존형 뱅킹에 대한 의존도 하락

- 편리성의 향상

- 시장이 해결해야 할 과제

- 결제 사기

- 현금에 대한 의존

- 시장 기회

- 디지털 결제의 성장을 장려하는 정부의 시책에 의해 서민 사이에서 실시간 결제의 성장이 기대

- 디지털 결제 산업에서 주요 규제와 기준

- 세계 각국의 규제 상황

- 규제상 장애가 될 수 있는 비즈니스 모델

- 비즈니스 상황의 변화에 수반하는 개발 여지

- 주요 사례와 사용 사례 분석

- 전거래에서 차지하는 리얼 결제 거래의 점유율과 주요 국가의 거래량·거래액의 지역별 분석

- 비현금거래에서 차지하는 리얼 결제 거래의 비율과 주요 국가의 지역별 거래량 분석

제6장 시장 세분화

- 결제 유형별

- P2P

- P2B

제7장 경쟁 구도

- 기업 개요

- Temenos AG

- ACI Worldwide

- Google LLC(Alphabet Inc.)

- Paypal Holdings Inc.

- Mastercard Inc.

- Paytm

- NPCI

- VISA Inc.

- Razorpay Technologies Private Limited

- Volante Technologies Inc.

- PhonePe Private Limited

제8장 투자 분석

제9장 시장 전망

KSA 25.01.31The India Real Time Payments Market is expected to register a CAGR of 33.5% during the forecast period.

Key Highlights

- India has made tremendous growth when it comes to access to Internet-enabled devices in the country. For instance, the government's plan to fiberize all villages by 2025 under the BharatNet program has benefitted the banking sector in India, which has been able to make crucial changes in banking mechanisms by introducing digital means of accessing financial services through mobile phones. With instant payment systems, top banks in India have launched not just intuitive but also innovative and interactive mobile banking applications with features revolving around customer satisfaction.

- The decade of 2010-2020 can be termed as the decade of payment evolution in India. India has been transforming its payment systems over the past three decades. From barter systems to Unified Payments Interface (UPI) payment systems, India has come a long way primarily because of the failing resilience of traditional banking and the rise of Real-time Payment systems through digital transformation.

- India's central bank (RBI) plays a key role and has been supervising all these transformations. For Instance, in March 2022, RBI rolled out a digital-heavy plan for 2022-23. The central bank announced lending norms for digital platforms, rolled out a central bank digital currency, facilitated the setting up of 75 digital banks, and implemented a geo-tagging framework for POS terminals. It has proposed several measures to bring about structural reforms in the digital payments and fintech space, which has positively influenced the real time payments growth in the country.

- India has worked around its policies towards the introduction of innovative payment systems that provide instant credit to the beneficiary, with the launch of fast payment systems such as IMPS and UPI that are available to consumers round the clock for undertaking fund transfers and the introduction of mobile-based payment systems such as Bharat Bill Payment System (BBPS), PPIs to facilitate payment of bills and purchase of goods and services and National Electronic Toll Collection (NETC) to facilitate electronic toll payments.

- The convenience of these payment systems ensured rapid acceptance as they provided consumers with an alternative to using cash and paper for making payments. The facilitation of non-bank FinTech firms in the payment ecosystem as PPI issuers, BBPOUs, and third-party application providers in the UPI platform has furthered the adoption of digital payments in the country.

- The Covid-19 pandemic has had a mixed impact on the real-time payment system in India. The e-wallets saw increased traction for bill payments, P2P transfers, and P2B payments for essential services owing to the lockdown. Payment gateways saw an increase in volumes as transactions went online, tieing up with small stores selling essentials that are currently seeking to establish an online presence.

- Online frauds, including database exploits, ID thefts, phishing attacks, and card payment-related scams, are common in India, and the number has only increased during the pandemic. As per Microsoft's Global Tech Support Scam Research 2021 Report, consumers in India experienced a fairly high online fraud. 31% of Indians lost money through a scam making it the highest global encounter rate of 69% in the past year. Low internet bandwidth E-commerce entails a set of complex steps while completing a transaction, and even a minor glitch can terminate the task.

India Real-Time Payments Market Trends

P2B Segment Will Hold Significant Market Share

- The real-time payment solutions for P2B transactions in India are majorly governed by the National Payments Corporation of India (NPCI). The retail payments space developed and matured with various systems operated and introduced by NPCI. To touch the lives of every Indian, NPCI has rolled out a variety of innovative retail payment products such as RuPay card scheme, IMPS, UPI, National Automated Clearing House (NACH), Aadhaar-enabled Payments System (AePS), Aadhaar Payments Bridge System (APBS), National Electronic Toll Collection(NETC), and Bharat bill pay system(BBPS). In addition, NPCI's alliance with international network partners (Japan Credit Bureau, Discover Financial Services, and China Union Pay) has paved the way for a global solution provider for the Indian real-time payment system.

- Aadhaar, a unique identification number in India issued to over 127 crore individuals Since its launch in 2009 in the country. Aadhaar-enabled e-KYC (electronic-Know Your Customer) has resulted in exponential growth of real-time payments in India. The use of Aadhaar also has leveraged authentication and processing of payments to merchants (P2B) and transactions made through Business Correspondents (BCs) (B2B) segments.

- India's UPI payment system has become the most inclusive mode of payment in India. As per the RBI data, over 26 crore unique users and five crore merchants are onboarded on the UPI platform. In May 2022, approximately 594.63 crores of transactions (INR 10.40 lakh crore) were processed through UPI, which includes (P2B) and (P2C) transactions. UPI facilitates transactions by linking Savings / Current Accounts through Debit Cards of users and is one of the key factors for developing real-time payment solutions in India.

- Further, the Reserve Bank of India operationalized the Payments Infrastructure Development Fund (PIDF) Scheme in January 2021 to incentivize the deployment of payment acceptance infrastructures such as mPoS (mobile PoS), physical Point of Sale (PoS), Quick Response (QR) codes in the North Eastern States and Tier-3 to 6 centers. The Scheme had targeted 90 lakh Points of Sale (PoS) terminals and Quick Response (QR) codes to be deployed over three years (till end-2023) in response to the rise in number of P2B transactions, aiming to ease the payment mode for merchants.

- According to the report published by ACI Worldwide, India is leading the world in real-time payment transactions in the year 2021, with 48.6 billion transactions representing more than 40% of the global commerce emerging from the country. The number of real-time transactions in India was almost 2.6 times higher than that of China and approximately seven times higher than the combined real-time payments volume of the US, France, the UK, Canada, and Germany.

Technological advancement will Further Drive the Real Time Payment Transfer

- With the rise in smartphone users and much-awaited 5G technology, India has been driving the real-time mobile payment market. For instance, The National Payments Corporation of India (NPCI) launched the UPI Lite service on-device wallet to enable people to conduct offline payments. In February 2022, UPI processed 4,527.49 million online transactions worth Rs 8,26,843. UPI Lite providing offline services will further boost the instant payment market in India.

- To upgrade the country's payment systems, RBI provided a communication backbone in the form of the satellite-based Indian Financial Network( INFINITE) using VSAT technology to the financial and banking sectors. IDRBT was entrusted with the task of designing and developing the communication network. The Closed User Group (CUG) Network uses VSAT technology. It is Time-division multiple access (TDMA)/Time-division multiplexing (TDM) network with STAR topology for Data and with Demand Assigned Multiple Access-Single Channel Per Carrier (DAMASCPC) overlaying with mesh topology for video and voice traffic.

- Indian Financial system uses contactless technology, one of the innovations in the card payments ecosystem which allows cardholders to "Tap and Go." These cards are becoming increasingly popular. To provide convenience in the use of such cards, RBI permitted relaxation in Additional Factor of Authentication (AFA) in case of Card Present (CP) transactions using Near Field Communication (NFC)-enabled EMV Chip and PIN cards for small values(INR 2,000). The limit was revised to INR 5,000, effective from January 01, 2021.

- IMPS is a 24*7 'fast payments' system introduced in 2010 and has become a widely accepted payment method between P2P modes. India was the fourth country after the UK, South Korea, and South Africa to introduce such a payment system. The system provides real-time funds transfer between the beneficiary and remitter with a deferred net settlement between banks. The system facilitates push transactions with a per-transaction limit of INR 2 lakhs.

- Unified Payments Interface (UPI) facilitates immediate money transfer through push and pull payments, utility bill payments, QR code (scan and pay) based payments, merchant payments, etc. While transacting, the UPI PIN is encrypted using Public Key Infrastructure (PKI) technology. UPI's framework comprises NPCI as network and settlement service provider, banks as Payment System Providers (PSPs), and issuer banks and beneficiary banks, apart from TPAPs such as Google Pay and WhatsApp. Non-bank PPI issuers have also provided this facility in the Indian market.

India Real-Time Payments Industry Overview

With consumer preferences changing rapidly, the market has become a lucrative option and thus, has attracted a huge amount of investments. Due to the huge growth potential, the market is moving towards fragmentation due to the new entrants. The service providers are engaging in partnerships to promote product innovation.

- June 2022 - WhatsApp has been offering Indian users USD 1.35 cashback and was allowed by the NPCI to expand its user base to 100 million, an incentive for the users to leverage WhatsApp Payments for sending money to family members, friends, and more.

- June 2022 - Unicorn Pine Labs Fintech from India Acquires API infrastructure provider Setu in a USD 70-75 Mn deal. After the deal completion, Setu will keep its brand identity, teams, business, and customers. Setu is an application programming interface (API) infrastructure provider that offers services across bill payments, savings, credit, and payments.

- March 2022 - PhonePe acquires GigIndia, to strengthen enterprise offerings. The acquisition will allow it to leverage GigIndia's network of freelance microentrepreneurs to help enterprises and corporates reach more customers and scale their distribution channels PhonePe is eyeing 2-3 more acquisitions this year to boost its tech and financial platform play. Individuals who are aware of the company's internal plans told ET on condition of anonymity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in the country

- 4.4 Key market trends pertaining to the growth of cashless transaction in the country

- 4.5 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Falling Reliance on Traditional Banking

- 5.1.3 Ease of Convenience

- 5.2 Market Challenges

- 5.2.1 Payment Fraud

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Payments is expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions with a regional breakdown of key countries by volume and transacted value

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions with a regional breakdown of key countries by volumes

6 MARKET SEGMENTATION

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Temenos AG

- 7.1.2 ACI Worldwide

- 7.1.3 Google LLC (Alphabet Inc.)

- 7.1.4 Paypal Holdings Inc.

- 7.1.5 Mastercard Inc.

- 7.1.6 Paytm

- 7.1.7 NPCI

- 7.1.8 VISA Inc.

- 7.1.9 Razorpay Technologies Private Limited

- 7.1.10 Volante Technologies Inc.

- 7.1.11 PhonePe Private Limited

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

샘플 요청 목록