|

시장보고서

상품코드

1636172

미국의 상업용 비닐 바닥재 시장 전망 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)United States Commercial Vinyl Floor Covering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

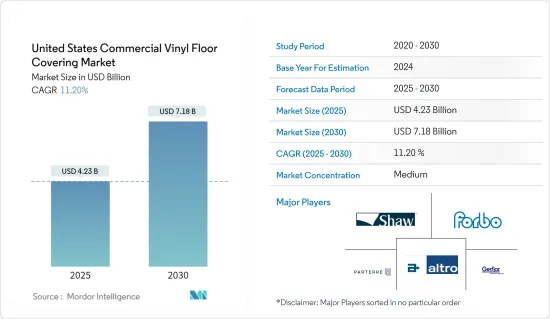

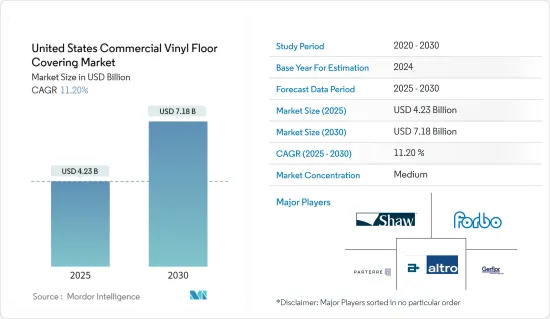

미국의 상업용 비닐 바닥재 시장 규모는 2025년에 42억 3,000만 달러로 예측되어 예측 기간 중(2025-2030년)의 연평귱 성장율(CAGR)은 11.2%로, 2030년에는 71억 8,000만 달러에 달할 것으로 예측됩니다.

내구성과 다용도로 사랑받는 비닐 바닥재는 합성 소재로 제작됩니다. 이러한 바닥재는 다양한 색상과 패턴으로 제공되며 종종 목재, 자연석 또는 타일의 모양을 재현합니다. 탄력성과 손쉬운 유지 관리로 인해 비닐 바닥재는 상업용 영역에서 많은 사람들에게 최고의 선택으로 자리 잡았습니다.

미국 상업 부문에서는 비닐 바닥재의 내구성과 미적 매력으로 인해 비닐 바닥재 채택이 눈에 띄게 증가했습니다. 병원, 소매점, 체육관, 교통 중심지 등 상업 시설의 수가 증가함에 따라 그 수요는 더욱 촉진되고 있습니다.

편안함과 미적 감각이 가장 중요한 접객업에서는 올바른 바닥재를 선택하는 것이 무엇보다 중요합니다. 비닐 바닥재가 최고의 선택으로 떠오르고 있습니다. 비닐 바닥재는 많은 유동인구와 가구 이동을 처리할 수 있으며 수명이 길어 잦은 교체가 필요하지 않습니다. 미국 내 숙박업소의 수가 증가함에 따라 비닐 바닥재에 대한 수요도 증가하고 있습니다.

비닐 바닥재는 오랫동안 숙박업에서 선호되어 왔지만 이제는 자동차, 항공, 해양을 포함한 운송 분야에서도 그 인기가 급증하고 있습니다. 내구성이 뛰어나고 유지보수가 용이하여 전기 자동차에서 선호되고 있습니다. 미국의 전기 자동차 생산 및 판매가 증가할 것으로 예상됨에 따라 자동차 부문의 비닐 바닥재 수요는 크게 증가할 것입니다.

미국의 상업용 비닐 바닥재 시장 동향

탄성 바닥재

상업용 프로젝트의 설계자는 탄성 바닥재의 영역에서 압도적으로 비닐 컴포지션 타일(VCT), 고급 비닐 타일(LVT), 리놀륨, 고무를 선택합니다. 이러한 선택은 다양한 색상과 질감 옵션, 환경 친화적 인 기능 및 낮은 유지 보수의 필요성에 의해 선호됩니다. 일반적으로 예산 친화적인 선택인 VCT는 기존의 12x12인치 형식을 넘어 다양한 크기와 패턴으로 확장되었습니다. 반면 리놀륨은 재생 가능하고 자연스러운 특성을 강조하여 공간에 따뜻하고 질감 있는 느낌을 더합니다. 특히 유동인구가 많은 상업 환경에서 탄력 있는 바닥재에 대한 수요가 급증하면서 고무, 리놀륨, 비닐과 같은 소재가 주목받고 있습니다. 이러한 타일은 내구성, 미끄럼 방지 및 많은 유동인구를 견딜 수 있는 용량으로 인해 인기가 높습니다. 따라서 안전과 수명이 중요한 공항, 병원, 학교와 같이 유동인구가 많은 환경에 이상적입니다.

고급 비닐 타일과 판자 채택 확대

고급 비닐 타일(LVT)과 고급 비닐 판자(LVP)는 고급 비닐 바닥재의 두 가지 다른 형태를 대표합니다. LVT는 타일의 모양을 닮은 반면, LVP는 전통적인 원목 판자를 모방합니다. LVT는 이러한 소재를 모방하면서도 경제성, 우수한 긁힘 방지 및 방수 기능을 자랑합니다. 사실적인 비주얼을 위한 사진 인쇄 레이어와 내구성을 위한 마모 레이어로 구성된 LVT는 판자 및 타일 형식으로 제공됩니다. 세련된 미적 감각과 뛰어난 내구성, 손쉬운 유지보수가 결합된 이상적인 상업용 바닥재 솔루션을 구현합니다.

탄력성이 뛰어나다는 평가를 받는 비닐 바닥재는 상업 환경에서 인기 있는 선택입니다. 콘크리트, 세라믹, 대리석, 목재와 같은 천연 소재를 비용 효율적으로 대체할 수 있으며, 내구성과 높은 수준의 유동인구를 견딜 수 있는 성능을 자랑합니다.

미국의 상업용 비닐 바닥재 산업 개요

고급 비닐 바닥재 시장 특징은 미국에서는 시장 기업이 많다는 것입니다. 따라서 시장은 적당히 통합되어 있습니다.

비닐 바닥재 분야의 주요 기업은 치열한 경쟁을 벌이고 있으며, 각각 시장의 주도권을 잡으려고 노력하고 있습니다. 각 회사의 전략은 생산 능력 향상, R&D 투자 강화, 밸류체인 전반에 걸친 운영 최적화에 중점을 둡니다. 이러한 노력은 시장 수요에 직접 대응하고, 혁신을 촉진하며 고객의 범위를 넓히는 것입니다.

Shaw Industries Group Inc., Forbo, Parterre, Gerflor Group, Altro 등이 시장의 주요 기업입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

- 조사 프레임워크

- 2차 조사

- 1차 조사

- 데이터의 삼각측량과 통찰의 생성

제3장 주요 요약

제4장 시장 역학과 인사이트

- 시장 개요

- 시장 성장 촉진요인

- 상업건설 프로젝트의 성장

- 피트니스 시설로부터 수요 증가

- 시장 성장 억제요인

- 시공 후의 VOCS(휘발성 유기 화합물)의 배출

- 매끄러운 바닥 기초에만 설치 가능

- 시장 기회

- 미국의 바닥재 시장의 기업은 선수를 치기 위해서 혁신적 기술을 도입

- 비닐 바닥재 인쇄의 혁신

- 업계의 밸류체인 분석

- 업계의 매력 Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 업계의 최신 동향과 혁신에 관한 통찰

- 시장의 최근 동향에 대한 통찰

- 미국의 자동차 제조 및 공장의 주요 지역과 주요 주, 도시에 대한 통찰

- 시장에 대한 COVID-19의 영향

제5장 시장 세분화

- 제품 유형별

- 고급 비닐 타일과 판

- 비닐 시트

- 비닐 복합 타일

- 용도별

- 수송

- 자동차용 바닥재

- 항공용 바닥재

- 선박용 바닥재

- 기타 수송

- 접객

- 체육관 및 피트니스

- 병원

- 소매

- 기업

- 교육

- 기타 상업용도

- 수송

- 유통 채널별

- 제조업체 직접 판매

- 판매점, 소매점

제6장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- Shaw Industries Group Inc.

- Forbo

- Parterre

- Gerflor Group

- Altro

- Karndean Designflooring

- Tarkett SA

- Mohawk Industries Inc.

- Armstrong Flooring

- Mannington Commercial

- Flexco Floors

- Interface Inc.

- Milliken

제7장 시장의 미래

제8장 면책사항 및 회사 소개

HBR 25.02.10The United States Commercial Vinyl Floor Covering Market size is estimated at USD 4.23 billion in 2025, and is expected to reach USD 7.18 billion by 2030, at a CAGR of 11.2% during the forecast period (2025-2030).

Vinyl floor coverings, prized for their durability and versatility, are crafted from synthetic materials. These coverings come in many colors and patterns, often replicating the look of wood, natural stone, or tiles. Their resilience and easy maintenance have cemented vinyl flooring as a top choice for many in the commercial realm.

The US commercial sector has seen a notable uptick in adopting vinyl floor coverings, largely due to their durability and aesthetic charm. The demand is further fueled by a growing number of commercial establishments, spanning hospitals, retail outlets, gyms, and transportation hubs.

In the hospitality industry, where comfort and aesthetics reign supreme, choosing the right flooring is paramount. Vinyl floor coverings have emerged as the go-to choice. They can handle heavy foot traffic and furniture movement, boasting a longer lifespan that reduces the need for frequent replacements. As the number of hospitality establishments in the United States grows, so does the demand for vinyl floor coverings.

While vinyl floor coverings have long been favored in hospitality, their popularity is now surging in transportation sectors, including automotive, aviation, and marine. Their durability and easy maintenance have made them a preferred choice in electric vehicles. With the projected rise in electric vehicle production and sales in the US, the demand for vinyl floor coverings in the automotive sector will significantly increase.

United States Commercial Vinyl Floor Covering Market Trends

Resilient Flooring

Commercial project designers overwhelmingly opt for vinyl composition tile (VCT), luxury vinyl tile (LVT), linoleum, and rubber in the realm of resilient flooring. These choices are favored for their diverse color and texture options, eco-friendly features, and low maintenance needs. VCT, typically the budget-friendly choice, has expanded beyond its traditional 12x12-inch format, now offering a range of sizes and patterns. On the other hand, linoleum highlights its renewable and natural qualities, adding a warm, textured feel to spaces. As the demand for resilient flooring surges, especially in high-traffic commercial settings, materials like rubber, linoleum, and vinyl are gaining traction. These tiles are popular due to their durability, slip resistance, and capacity to withstand heavy foot traffic. This makes them ideal for high-traffic settings such as airports, hospitals, and schools, where safety and longevity are crucial.

Growth in Luxury Vinyl Tiles and Planks Adoption

Luxury vinyl tile (LVT) and luxury vinyl plank (LVP) represent two distinct forms of luxury vinyl flooring. LVT mirrors the appearance of tiles, while LVP emulates traditional hardwood planks. LVT, while mimicking these materials, boasts affordability, superior scratch resistance, and waterproof features. Comprising a photographic print layer for realistic visuals and a wear layer for durability, LVT is available in both plank and tile formats. It embodies the ideal commercial flooring solution, blending sophisticated aesthetics with exceptional durability and easy maintenance.

Vinyl flooring, prized for its resilience, is a popular choice in commercial settings. It presents a cost-effective substitute for natural materials such as concrete, ceramic, marble, and wood, boasting durability and the capacity to endure high levels of foot traffic.

United States Commercial Vinyl Floor Covering Industry Overview

The luxury vinyl floor covering market is characterized by a large number of market players in the United States. Therefore, the market is moderately consolidated.

Key players in the vinyl flooring sector are engaged in intense competition, each striving for market leadership. Their strategies focus on increasing manufacturing capacity, bolstering R&D investments, and optimizing operations throughout the value chain. These initiatives directly address market demands, fostering innovation, and broadening their customer reach.

Shaw Industries Group Inc., Forbo, Parterre, Gerflor Group, and Altro are among the market's major players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Research Framework

- 2.2 Secondary Research

- 2.3 Primary Research

- 2.4 Data Triangulation and Insight Generation

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in Commercial Construction Projects

- 4.2.2 Increasing Demand from Fitness Facilities

- 4.3 Market Restraints

- 4.3.1 Emission of VOCS (Volatile Organic Compounds) Post Installation

- 4.3.2 Can only be Installed on Smooth Subfloor

- 4.4 Market Opportunities

- 4.4.1 US Flooring Market Players Embracing Innovative Technologies to Stay Ahead

- 4.4.2 Innovations in Vinyl Floor Covering Printing

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness: Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insight into the Latest Trends and Innovations in the Industry

- 4.8 Insights on Recent Developments in the Market

- 4.9 Insights on Major Regions and Key States/Cities in the United States with Automotive Manufacturing and Plants

- 4.10 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Luxury Vinyl Tiles and Planks

- 5.1.2 Vinyl Sheets

- 5.1.3 Vinyl Composite Tiles

- 5.2 By Application

- 5.2.1 Transport

- 5.2.1.1 Automotive Flooring

- 5.2.1.2 Aviation Flooring

- 5.2.1.3 Marine Flooring

- 5.2.1.4 Other Transport

- 5.2.2 Hospitality

- 5.2.3 Gym and Fitness

- 5.2.4 Hospitals

- 5.2.5 Retail

- 5.2.6 Corporate

- 5.2.7 Education

- 5.2.8 Other Commercial Applications

- 5.2.1 Transport

- 5.3 By Distribution Channel

- 5.3.1 Directly From the Manufacturers

- 5.3.2 Dealers/Retailers

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.3 Shaw Industries Group Inc.

- 6.4 Forbo

- 6.5 Parterre

- 6.6 Gerflor Group

- 6.7 Altro

- 6.8 Karndean Designflooring

- 6.9 Tarkett SA

- 6.10 Mohawk Industries Inc.

- 6.11 Armstrong Flooring

- 6.12 Mannington Commercial

- 6.13 Flexco Floors

- 6.14 Interface Inc.

- 6.15 Milliken