|

시장보고서

상품코드

1636266

독일의 전기자동차 배터리 제조 장비 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Germany Electric Vehicle Battery Manufacturing Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

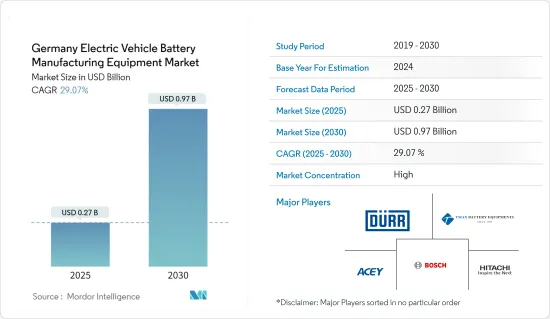

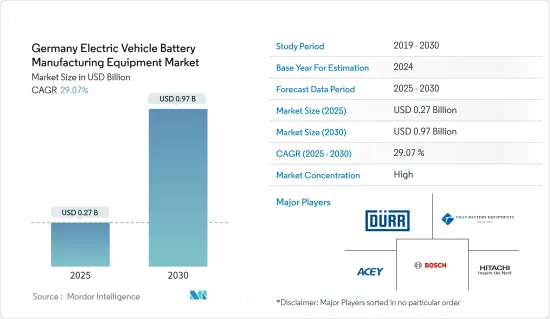

독일의 전기자동차 배터리 제조 장비 시장 규모는 2025년에 2억 7,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 29.07%의 CAGR로 2030년에는 9억 7,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 중기적으로는 전기자동차 보급 확대와 정부의 규제 및 정책적 지원 등의 요인이 시장을 견인할 것으로 예상됩니다.

- 한편, 기존 시장과의 경쟁은 예측 기간 동안 시장 성장을 저해할 것으로 보입니다.

- 공급망의 현지화는 향후 몇 년 동안 시장에 큰 비즈니스 기회를 가져올 것으로 예상됩니다.

독일의 전기자동차 배터리 제조 장비 시장 동향

전기자동차 보급 확대

- 유럽 최대의 자동차 시장이자 자동차 기술 혁신의 선두주자인 독일은 전기 모빌리티 혁명의 최전선에 있습니다. 국제에너지기구(IEA)에 따르면 독일의 전기자동차 판매량은 2019년 10만 8,000대에서 2023년 70만대로 증가하여 540% 이상의 성장세를 보일 것으로 전망하고 있습니다.

- 더 많은 소비자가 EV로 전환함에 따라 배터리, 특히 리튬이온 배터리 생산은 수요 증가에 대응하기 위해 규모를 확대해야 합니다. 예를 들어, 노스볼트는 2024년 3월, 하이데(Heide) 인근의 신공장에 49억 달러를 투자할 계획을 발표했습니다. 생산 시작은 2026년으로 예정되어 있으며, 이 프로젝트를 통해 약 3,000개의 일자리가 창출될 것으로 예상됩니다. 이러한 배터리 생산의 확대는 당연히 이러한 배터리를 효율적이고 대규모로 생산하기 위해 필요한 특수 장비에 대한 수요 증가로 이어질 것입니다.

- 최근 몇 년 동안 독일 전기자동차 시장은 괄목할 만한 성장을 이루었습니다. Kraftfahrt-Bundesamt(KBA)에 따르면, 독일의 전기자동차 등록대수는 2019년 6만 3,281대에서 2023년 52만 4, 219대로 4년간 700% 증가한 것으로 나타났습니다. 219대로 증가하여 4년 만에 700% 이상 증가하게 됩니다. 또한, 2024년 5월까지 등록대수는 14만 700대를 넘어섰으며, 더 많은 독일인들이 전기자동차를 신규로 등록하고 있습니다.

- 독일 정부의 야심찬 목표는 전기자동차 시장의 성장 가능성을 더욱 부각시키고 있습니다. 예를 들어, 독일 정부는 2030년까지 최소 1,500만 대의 전기자동차를 독일 도로에서 운행할 계획이며, 이에 따라 견고한 배터리 제조 인프라의 필요성이 더욱 커지고 있습니다. 따라서 예상되는 수요를 충족시키기 위해 필요한 제조 시설에 대한 투자가 촉진될 것입니다.

- 제조업체들이 시장 수요를 충족시키기 위해 생산 규모를 확장하고 확대되는 EV 시장이 제공하는 기회를 활용함에 따라, 첨단 및 효율적인 제조 장비에 대한 수요는 계속 증가하여 독일 EV 산업의 성장에 중요한 역할을 할 것입니다.

시장을 지배하는 리튬이온 배터리 부문

- 리튬이온 배터리는 고에너지 밀도, 긴 수명, 가벼운 무게로 유명한 이차전지입니다. 리튬 이온을 전극 사이를 이동시켜 에너지를 효율적으로 저장하고 방출합니다.

- 2023년 생산과 수입에서 수출을 뺀 산업 시장 규모는 32% 증가한 232억 유로(248억 4,000만 달러)에 달할 것으로 예상됩니다. 이 성장을 주도한 것은 주로 전기 이동성에 사용되는 리튬이온 배터리입니다.

- 리튬이온 배터리는 높은 에너지 밀도를 제공하고 더 긴 주행거리와 효율적인 성능을 제공하기 때문에 전기자동차(EV)에서 매우 중요합니다. 수명이 길고 급속 충전이 가능하기 때문에 EV의 동력원으로 이상적이며, 자동차 산업에서의 보급을 뒷받침하고 있습니다. 독일에서는 EV의 생산 규모가 지속적으로 확대되고 있으며, 리튬 이온 기술에 대응하는 첨단 배터리 제조 장비에 대한 수요가 증가하고 있습니다.

- 이러한 우위를 강화하는 중요한 요인 중 하나는 리튬이온 배터리의 가격 하락입니다. 지난 10년간 기술 발전, 규모의 경제, 제조 공정의 개선으로 인해 리튬이온 배터리의 비용이 크게 하락했습니다.

- 전 세계적으로 리튬이온 배터리 가격은 지난 10년간 급락하여 2023년 평균 리튬이온 배터리 가격은 1kWh당 약 139달러로 2013년 대비 2023년 82% 이상 하락할 것으로 예상됩니다.

- BloombergNEF는 더 많은 채굴 및 정제 설비가 가동되고 리튬 가격이 완화되기 시작하는 2025년에 배터리 비용이 다시 하락하기 시작할 것으로 예상하고 있으며, BNEF의 2023년 배터리 가격 조사에 따르면 2025년까지 평균 팩당 가격은 113달러/kWh 이하로 떨어질 것으로 예상하고 있습니다. 2030년까지 전 세계적으로 80달러/kWh 이하로 떨어질 것으로 예상됩니다.

- 이러한 비용 절감으로 인해 전기자동차는 더욱 저렴하고 친숙해졌으며, 전국적인 보급이 가속화되고 있습니다. 더 많은 소비자와 기업이 전기자동차로 전환함에 따라 리튬이온 배터리의 생산과 수요가 급증하면서 배터리 제조 장비 시장은 더욱 견고해지고 있습니다.

- 그 결과, 독일의 리튬이온 배터리 제조 장비 시장은 내수 수요와 유럽 전기자동차 공급망에서 중요한 진입자가 되고자 하는 독일의 야심에 힘입어 확대될 것으로 예상됩니다.

독일의 전기자동차 배터리 제조 장비 산업 개요

독일의 전기자동차 배터리 제조 장비 시장은 반통합형입니다. 주요 기업으로는 Duerr AG, Hitachi, ACEY New Energy Technology, Robert Bosch Manufacturing Solutions GmbH, Xiamen Tmax Battery Equipments Limited 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위 : 달러)

- 최근 동향과 개발

- 정부 정책 및 규정

- 시장 역학

- 성장 촉진요인

- 전기자동차 보급 확대

- 지원적인 정부 정책 및 규정

- 성장 억제요인

- 기존 시장과의 경쟁

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자 분석

제5장 시장 세분화

- 프로세스별

- 믹싱

- 코팅

- 캘린더

- 슬릿·전극 가공

- 기타

- 배터리별

- 리튬이온

- 납축배터리

- 니켈수소 배터리

- 기타 전지

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 주요 기업의 전략

- 기업 개요

- Duerr AG

- Schuler AG

- Hitachi Ltd

- Xiamen Tmax Battery Equipments Limited

- ACEY New Energy Technology

- IPG Photonics Corporation

- Wuxi Lead Intelligent Equipment Co. Ltd

- Targray Technology International Inc.

- Xiamen Lith Machine Limited

- Robert Bosch Manufacturing Solutions GmbH

- 시장 순위/점유율(%) 분석

- 기타 저명한 기업 리스트

제7장 시장 기회와 향후 동향

- 공급망 현지화

The Germany Electric Vehicle Battery Manufacturing Equipment Market size is estimated at USD 0.27 billion in 2025, and is expected to reach USD 0.97 billion by 2030, at a CAGR of 29.07% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as the increasing adoption of electric vehicles and supportive government regulations and policies are expected to drive the market.

- On the other hand, competition from established markets are likely to hinder market growth during the forecast period.

- Nevertheless, localization of supply chains are expected to provide significant opportunities for the market in the coming years.

Germany Electric Vehicle Battery Manufacturing Equipment Market Trends

Increasing Adoption of Electric Vehicles

- As Europe's largest automotive market and a leader in automotive innovation, Germany is at the forefront of the electric mobility revolution. According to the International Energy Agency, Germany's electric vehicle sales grew from 108,000 in 2019 to 700,000 in 2023, representing an increase of more than 540%.

- As more consumers shift toward EVs, the production of batteries, particularly lithium-ion batteries, will need to scale up to meet the increasing demand. For instance, in March 2024, Northvolt announced plans to invest USD 4.9 billion in a new plant near Heide. Production is scheduled to begin in 2026, and the project is anticipated to create approximately 3,000 jobs. This expansion in battery production will naturally lead to a higher demand for the specialized equipment required to manufacture these batteries efficiently and at scale.

- In recent years, the German EV market has seen impressive growth. The number of electric vehicle registrations has surged, supported by a growing awareness of environmental issues and the financial benefits of owning an EV. According to the Kraftfahrt-Bundesamt (KBA), electric car registrations in Germany grew from 63,281 in 2019 to 524,219 in 2023, representing an increase of more than 700% within four years. Further, more Germans are registering for new electric cars, with over 140,700 registrations till May 2024.

- The German government's ambitious targets further underscore the growth potential of the EV market. For instance, the German government planned to have at least 15 million electric cars on German roads by 2030, further intensifying the need for a robust battery manufacturing infrastructure. This, in turn, drives investment in the necessary manufacturing equipment to meet the anticipated demand.

- As manufacturers scale up production to meet market demands and capitalize on the opportunities presented by the expanding EV market, the demand for advanced and efficient manufacturing equipment will continue to rise, playing a critical role in the growth of the EV industry in Germany.

Lithium-Ion Batteries Segment to Dominate the Market

- Lithium-ion batteries are rechargeable batteries known for their high energy density, long lifespan, and lightweight. They work by moving lithium ions between electrodes to store and release energy efficiently.

- In 2023, the industry's market volumes, including production plus imports minus exports, rose by 32% to EUR 23.2 billion (USD 24.84 billion). This growth was primarily driven by the dominant segment of lithium-ion batteries used in electric mobility.

- Lithium-ion batteries are crucial in electric vehicles (EVs) because they provide high energy density, allowing for longer driving ranges and efficient performance. Their long cycle life and fast charging capabilities make them ideal for powering EVs, supporting their widespread use in the automotive industry. As Germany continues to scale up its EV production, the demand for advanced battery manufacturing equipment tailored to Li-Ion technology is rising.

- One of the key factors reinforcing this dominance is the declining price of lithium-ion batteries. Over the past decade, the cost of lithium-ion batteries has dropped significantly due to technological advancements, economies of scale, and improved manufacturing processes.

- Globally, the price of lithium-ion batteries declined steeply over the past ten years. In 2023, the price of an average lithium-ion battery was valued at around USD 139 per kWh. It witnessed a decrease in the price of more than 82% in 2023 compared to 2013.

- BloombergNEF anticipates that battery costs will begin to decline again in 2025 as more extraction and refinery capacity become operational and lithium prices begin to ease. By 2025, the average pack price is expected to drop below USD 113/kWh and USD 80/kWh by 2030 globally, according to BNEF's 2023 Battery Price Survey.

- This cost reduction has made electric vehicles more affordable and accessible, accelerating their adoption nationwide. As more consumers and companies transition to EVs, the production and demand for lithium-ion batteries have surged, further solidifying the market for battery manufacturing equipment.

- As a result, the market for lithium-ion battery manufacturing equipment in Germany is expected to expand, driven domestic demand and the country's ambition to become a key player in the European EV supply chain.

Germany Electric Vehicle Battery Manufacturing Equipment Industry Overview

The German electric vehicle battery manufacturing equipment market is semi-consolidated. Some of the major players (not in particular order) include Duerr AG, Hitachi Ltd, ACEY New Energy Technology, Robert Bosch Manufacturing Solutions GmbH, and Xiamen Tmax Battery Equipments Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumption

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Electric Vehicles

- 4.5.1.2 Supportive Government Regulations and Policies

- 4.5.2 Restraints

- 4.5.2.1 Competition From Established Markets

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Process

- 5.1.1 Mixing

- 5.1.2 Coating

- 5.1.3 Calendaring

- 5.1.4 Slitting and Electrode Making

- 5.1.5 Other Processes

- 5.2 By Battery

- 5.2.1 Lithium-ion

- 5.2.2 Lead-acid

- 5.2.3 Nickel Metal Hydride Battery

- 5.2.4 Other Batteries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Duerr AG

- 6.3.2 Schuler AG

- 6.3.3 Hitachi Ltd

- 6.3.4 Xiamen Tmax Battery Equipments Limited

- 6.3.5 ACEY New Energy Technology

- 6.3.6 IPG Photonics Corporation

- 6.3.7 Wuxi Lead Intelligent Equipment Co. Ltd

- 6.3.8 Targray Technology International Inc.

- 6.3.9 Xiamen Lith Machine Limited

- 6.3.10 Robert Bosch Manufacturing Solutions GmbH

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Localization of Supply Chains