|

시장보고서

상품코드

1636268

프랑스의 SLI 배터리 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)France SLI Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

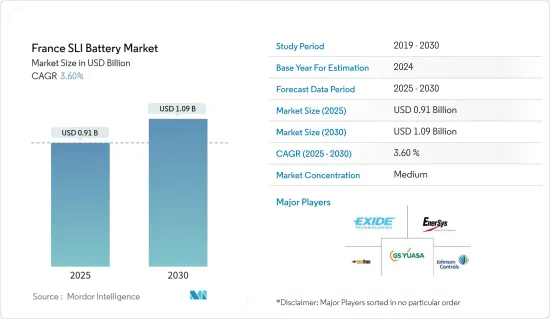

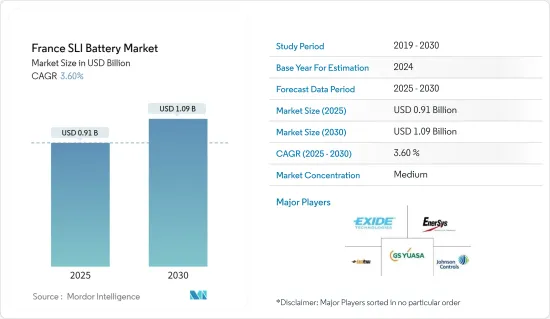

프랑스의 SLI 배터리 시장 규모는 2025년에 9억 1,000만 달러로 추정되며, 예측 기간(2025-2030년) 동안 3.6%의 CAGR로 2030년에는 10억 9,000만 달러에 달할 것으로 예상됩니다.

주요 하이라이트

- 중기적으로는 산업 및 농업용 SLI 배터리 수요 증가와 자동차 보급 확대가 예측 기간 동안 SLI 배터리 수요를 견인할 것으로 예상됩니다.

- 반면, 대체 배터리의 보급이 진행 중이기 때문에 시장 성장은 억제될 것으로 예상됩니다.

- 배터리 재활용에 대한 관심이 높아지고 신흥 시장에서 신차 및 애프터마켓 교체 모두에 대한 관심이 높아짐에 따라 가까운 시일 내에 시장 진입 기업들에게 큰 기회를 제공할 것으로 예상됩니다.

프랑스의 SLI 배터리 시장 동향

자동차 보급이 시장을 주도

- 프랑스에서는 자동차의 보급이 활발히 진행되어 시장 성장을 견인하고 있습니다. 자동차의 보급이 증가함에 따라, 신뢰성 있고 효율적인 자동차 배터리에 대한 수요가 증가하고 있습니다.

- 자동차 생산 및 판매 호조로 유럽 SLI 배터리 수요 증가. 독일과 프랑스는 중요한 자동차 시장이며, SLI 배터리는 신차 및 애프터마켓 교체품에 사용됩니다. 전기자동차 판매는 조사 기간 동안 크게 증가했습니다.

- 국제에너지기구(IEA)에 따르면, 2023년 프랑스에서 판매된 EV는 총 47만대로 2022년에 비해 38.24% 증가했습니다. 수많은 프로젝트가 시작되기 때문에 향후 몇 년 동안 판매량은 비약적으로 증가할 것으로 예상되며, 예측 기간 동안 SLI 배터리에 대한 수요가 높아질 것으로 보입니다.

- 또한, 지속가능한 교통수단을 실현하기 위해 전기자동차(EV)의 사용을 적극적으로 장려하고 있습니다. 전기자동차의 사용을 장려함으로써 세계가 보다 친환경적인 미래로 나아가는 가운데, 중국은 전기 혁명을 받아들이고 있습니다.

- 2024년 5월, 정부는 주요 자동차 제조업체들과 2022년 20만 대에서 2027년까지 80만 대의 전기자동차 판매를 새로운 중기 계획 합의에 따른 중간 목표로 설정하는 것을 포함한 합의에 서명했습니다. 정부는 또한 다양한 프로그램을 통해 전기자동차 생산 및 구매를 위해 15억 유로(16억 달러)를 책정했습니다. 이러한 투자로 인해 예측 기간 동안 지역 전체에서 전기자동차 생산이 증가하여 SLI 배터리에 대한 수요가 증가할 가능성이 높습니다.

- 2023년 현재, 업체들은 VRLA 배터리와 같은 배터리 기술을 발전시키고 있으며, 유지보수가 필요 없고 성능이 향상되어 인기가 높아지고 있습니다. 이러한 배터리는 많은 응용 분야에서 기존의 전해액형 납축배터리를 점차 대체하고 있으며, 예측 기간 동안 이러한 요인으로 인해 자동차 분야에서 더 많은 기회가 창출될 것으로 예상됩니다.

- 이러한 프로젝트와 투자로 인해 예측 기간 동안 지역 전체에서 자동차 생산이 증가하여 SLI 배터리에 대한 수요가 증가할 가능성이 높습니다.

자동차 최종사용자 부문의 성장이 기대됨

- 프랑스의 자동차 부문은 승용차와 상용차 모두 수요가 증가하고 있습니다. 이러한 성장으로 인해 신뢰할 수 있는 SLI 배터리에 대한 수요가 증가하고 있습니다. 자동차 판매량은 지난 몇 년 동안 크게 증가했으며, 자동차 부문이 창출하는 수익은 이 기간 동안 선형적으로 증가했습니다.

- 예를 들어, OICA(Organisation Internationale des Constructeurs d'Automobiles)에 따르면, 2023년 프랑스 국내 자동차 판매량은 221만대로 2022년에 비해 14.5% 증가할 것으로 예상하고 있습니다. 정부가 지역 전체의 자동차 생산량을 늘리기 위해 여러 가지 노력과 프로그램을 발표함에 따라 향후 몇 년 동안 자동차 수익과 판매량이 크게 증가할 것으로 예상됩니다.

- 프랑스 자동차 산업은 성장하고 있으며, 승용차와 상용차 모두에 대한 수요가 증가하고 있습니다. 이러한 성장으로 인해 신뢰할 수 있는 SLI 배터리에 대한 수요가 증가하고 있습니다. 자동차 판매량은 지난 몇 년 동안 크게 증가했으며, 산업이 창출하는 수익도 선형적으로 증가하고 있습니다.

- 예를 들어, OICA(Organisation Internationale des Constructeurs d'Automobiles)에 따르면, 2023년 프랑스 국내 자동차 판매량은 221만대로 2022년 대비 14.5% 증가할 것으로 예상하고 있습니다. 정부가 지역 전체에서 자동차 생산량을 늘리기 위한 다양한 노력과 프로그램을 발표함에 따라 향후 몇 년 동안 자동차 수익과 판매량이 크게 증가할 것으로 예상됩니다.

- 프랑스 정부는 공해 감소, 화석연료 의존도 감소, 지속가능한 개발 촉진을 위한 다양한 노력을 통해 전기자동차(EV)의 보급에 적극적입니다. 주요 기업들은 향후 몇 년 동안 이 지역 전체에서 자동차 생산을 확대하기 위해 수많은 프로젝트를 시작할 것으로 예상됩니다.

- 예를 들어, 2024년 6월 중국 전기자동차 업체 BYD는 프랑스에 전기자동차 생산 공장을 설립하고 향후 몇 년 동안 프랑스 전역에 플러그인 하이브리드 차량(PHEV)을 보급할 것이라고 발표했습니다. 이 시설은 내년 말까지 가동될 예정입니다. 이러한 프로젝트는 전기자동차 생산량을 증가시켜 SLI 배터리에 대한 수요를 증가시킬 것입니다.

- 2023년, ACC(Automotive Cells Company)는 프랑스 오드프랑스 지방의 빌리 벨크로/뒤블랑에 배터리 공장을 설립했으며, 2024년 말까지 연간 13GWh의 생산능력을 갖춘 이 시설은 2030년까지 연간 40GWh의 생산량을 달성할 계획입니다. 2030년까지 연간 40GWh를 생산하겠다는 ACC의 계획의 일환입니다. 이 공장은 연간 20만-30만 대의 전기자동차에 필요한 배터리를 생산할 수 있게 됩니다.

- 오드프랑스 지역에는 여러 프로젝트가 진행 중으로 급성장하는 '배터리 밸리'가 되고 있습니다. 특히 Envision AESC는 Renault에 공급할 새로운 배터리 공장을 Douai에 건설 중이며, 2024년까지 9GWh, 2030년까지 24GWh의 초기 생산능력을 목표로 하고 있으며, Verkor와 ProLogium도 각각 Dunkirk와 Dunkirk의 해안 도시에 시설 를 건설 중이며, 2025-2026년까지 생산을 시작할 예정입니다.

- 이러한 노력과 개발은 자동차 최종사용자 부문의 성장을 촉진할 것으로 보입니다.

프랑스의 SLI 배터리 산업 개요

프랑스 SLI 배터리 시장은 반분할되어 있습니다. 주요 기업으로는 Exide Technologies, EnerSys, East Penn Manufacturing Co., GS Yuasa International Ltd., Johnson Controls International PLC 등이 있습니다.

기타 혜택

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간 애널리스트 지원

목차

제1장 소개

- 조사 범위

- 시장 정의

- 조사 가정

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모와 수요 예측(단위 : 10억 달러)

- 최근 동향과 개발

- 정부 정책 및 규정

- 시장 역학

- 성장 촉진요인

- 자동차 보급 확대

- 산업·농업 용도에서의 SLI 배터리 수요 확대

- 성장 억제요인

- 대체 배터리 보급 확대

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

제5장 시장 세분화

- 유형

- 침수형 배터리

- VRLA 배터리

- EBF 배터리

- 최종사용자

- 자동차용

- 기타

제6장 경쟁 구도

- M&A, 합작투자, 제휴, 협정

- 주요 기업의 전략과 SWOT 분석

- 기업 개요

- GS Yuasa International Ltd.

- Exide Technologies

- Johnson Controls International PLC

- EnerSys

- HBL Power Systems Ltd

- East Penn Manufacturing Company

- FIAMM Energy Technology

- Clarios

- SAFT Groupe SA

- Varta AG

- 기타 저명한 기업 리스트(회사명, 본사 소재지, 관련 제품과 서비스, 연락처 등)

- 시장 순위 분석

제7장 시장 기회와 향후 동향

- 배터리 재활용에 대한 주목 상승

- 신차 및 애프터마켓용 모두 신흥 시장에서의 확장

The France SLI Battery Market size is estimated at USD 0.91 billion in 2025, and is expected to reach USD 1.09 billion by 2030, at a CAGR of 3.6% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, growing demand for SLI batteries from industrial and agricultural applications and increasing adoption of motor vehicles are expected to drive the demand for SLI batteries during the forecast period.

- On the other hand, the increasing penetration of alternative battery chemistries is expected to restrain the growth of the market.

- Nevertheless, increased focus on battery recycling and expansion in emerging markets for both new vehicles and after-market replacements are expected to create significant opportunities for market players in the near future.

France SLI Battery Market Trends

Increasing Adoption of Motor Vehicles Drives the Market

- The increasing adoption of motor vehicles in France drives the growth of the market. The increasing adoption of motor vehicles is leading to increased demand for reliable and efficient automotive batteries.

- Robust automotive production and sales bolster the demand for SLI batteries in Europe. Germany and France are significant automotive markets, and SLI batteries are used in new vehicles and after-market replacements. The sales of electric vehicles rose significantly over the study period.

- According to the International Energy Agency, in 2023, the total number of EVs sold in France was 0.47 million, an increase of 38.24% compared to 2022. As numerous projects are initiated, sales are expected to rise exponentially in the coming years, which will raise the demand for SLI batteries during the forecast period.

- Furthermore, to achieve sustainable transportation, the country is actively promoting the use of electric vehicles (EVs). The country is embracing the electric revolution as the world transitions toward a greener future by encouraging the use of electric vehicles.

- In May 2024, the government signed an agreement with the leading car manufacturers involving an interim goal of 800,000 electric vehicle sales by 2027 under a new medium-term planning agreement with the government, up from 200,000 in 2022. The government also earmarked EUR 1.5 billion (USD 1.6 billion) for the production and purchase of electric vehicles through various programs. uch investments are likely to increase the production of EVs across the region and raise the demand for SLI batteries during the forecast period.

- As of 2023, companies were making advancements in battery technology, such as VRLA batteries, which became more popular due to their maintenance-free nature and improved performance. These batteries are gradually replacing traditional flooded lead-acid batteries in many applications; this factor is expected to create more opportunities for motor vehicles during the forecast period.

- Such projects and investments are likely to increase vehicle production across the region and raise the demand for SLI batteries during the forecast period.

The Automotive End-user Segment is Expected to Grow

- The automotive sector in France is expanding, with increasing demand for both passenger and commercial vehicles. This growth drives the need for reliable SLI batteries. The sales of automobiles have risen significantly over the last few years, and the revenue generated by the automotive sector has risen linearly over the period.

- For instance, according to the OICA (Organisation Internationale des Constructeurs d'Automobiles), in 2023, the domestic motor vehicle sales in France were 2.21 million units, an increase of 14.5% compared to 2022. Automobile revenue and sales are expected to rise significantly in the coming years as the government announces numerous initiatives and programs to raise vehicle production across the region.

- The automotive industry in France is expanding, with increasing demand for both passenger and commercial vehicles. This growth drives the need for reliable SLI batteries. The sales of automobiles have risen significantly over the last few years, and the revenue generated by the industry has linearly increased.

- For instance, according to the OICA (Organisation Internationale des Constructeurs d'Automobiles), in 2023, domestic motor vehicle sales in France amounted to 2.21 million units, an increase of 14.5% compared to 2022. Automobile revenue and sales are expected to rise significantly in the coming years as the government announces numerous initiatives and programs to increase vehicle production across the region.

- The French government has been proactive in promoting electric vehicles (EVs) through various initiatives aimed at reducing pollution, decreasing dependence on fossil fuels, and fostering sustainable development. The leading companies are expected to launch numerous projects to increase automobile production across the region in the coming years.

- For instance, in June 2024, BYD Company, a Chinese electric vehicle giant, announced it would open an EV production factory in France and roll out plug-in hybrid vehicles (PHEV) across the country in the coming years. The facility is expected to be operational by the end of next year. These types of projects boost EV production and, in turn, the demand for SLI batteries.

- Battery production in France is expanding significantly. In 2023, the Automotive Cells Company (ACC) inaugurated a battery plant in Billy-Berclau/Douvrin in the Hauts-de-France region. This facility, expected to reach an annual capacity of 13 GWh by the end of 2024, is part of ACC's plan to eventually produce 40 GWh per year at this site by 2030. The plant will be able to produce enough batteries for 200,000 to 300,000 electric vehicles annually.

- Several other projects are underway in the Hauts-de-France region, turning it into a burgeoning "Battery Valley." Notably, Envision AESC is constructing a new battery plant in Douai to supply Renault, targeting an initial capacity of 9 GWh by 2024 and 24 GWh by 2030. Verkor and ProLogium are also building facilities in Dunkirk and in another coastal city, respectively; these are set to start production between 2025 and 2026.

- Such initiatives and developments are likely to boost the growth of the automotive end-user segment.

France SLI Battery Industry Overview

The France SLI battery market is semi-fragmented. Some key players (not in particular order) include Exide Technologies, EnerSys, East Penn Manufacturing Co., GS Yuasa International Ltd, and Johnson Controls International PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption of Motor Vehicles

- 4.5.1.2 Growing Demand for SLI Batteries from Industrial and Agricultural Applications

- 4.5.2 Restraints

- 4.5.2.1 Increasing Penetration of Alternative Battery Chemistries

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Pestle Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Flooded Battery

- 5.1.2 VRLA Battery

- 5.1.3 EBF Battery

- 5.2 End User

- 5.2.1 Automotive

- 5.2.2 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted & SWOT Analysis for Leading Players

- 6.3 Company Profiles

- 6.3.1 GS Yuasa International Ltd.

- 6.3.2 Exide Technologies

- 6.3.3 Johnson Controls International PLC

- 6.3.4 EnerSys

- 6.3.5 HBL Power Systems Ltd

- 6.3.6 East Penn Manufacturing Company

- 6.3.7 FIAMM Energy Technology

- 6.3.8 Clarios

- 6.3.9 SAFT Groupe SA

- 6.3.10 Varta AG

- 6.4 List of Other Prominent Companies (Company Name, Headquarter, Relevant Products & Services, Contact Details, etc.)

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increased Focus on Battery Recycling

- 7.2 Expansion in Emerging Markets for Both New Vehicles and After-Market Replacements

샘플 요청 목록