|

시장보고서

상품코드

1636461

영국의 전기자동차 배터리 분리막 시장 : 점유율 분석, 산업 동향, 성장 예측(2025-2030년)United Kingdom Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

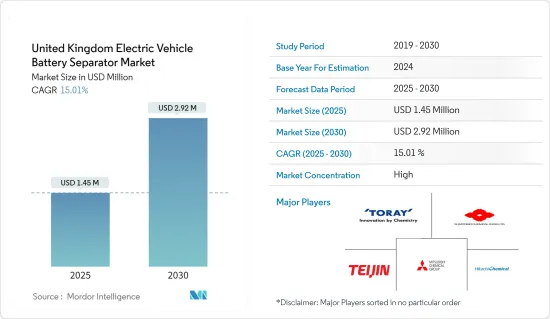

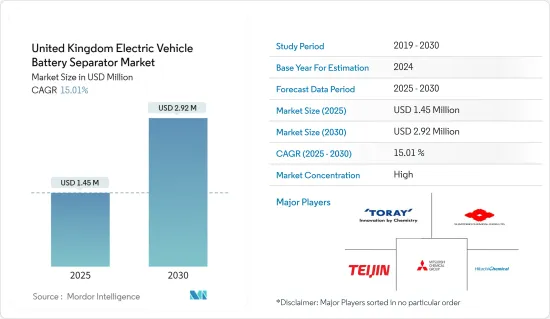

영국의 전기자동차 배터리 분리막 시장 규모는 2025년 145만 달러, 2030년 292만 달러로 추정되며, 예측기간(2025-2030년)의 CAGR은 15.01%에 이를 것으로 예측됩니다.

주요 하이라이트

- 중기적으로는 전기자동차의 보급과 리튬 이온 전지의 저가격화가 예측 기간 시장을 견인할 것으로 보입니다.

- 한편, 일부 국가의 독점으로 인한 배터리 재료공급망 격차(성분 부족 및 유통 병목 현상 등)은 향후 시장 성장을 억제할 것으로 예상됩니다.

- 그럼에도 불구하고 고체 전지, 첨단 리튬 이온 화학, 나트륨 이온 전지 등 다른 전지 화학의 연구 개발이 진행되고 있다는 것은 향후 시장에 기회를 가져올 것으로 예상됩니다.

영국 EV 배터리 분리막 시장 동향

전기자동차의 보급이 시장을 견인

- 영국에서는 전기자동차(EV)에 대한 수요가 급증하고 있어 전기자동차 배터리 분리막 시장의 성장을 뒷받침하고 있습니다. 국가가 청정에너지로 이행하는 가운데 전기차에 이목이 집중되어 기업의 관심이 높아지고 있습니다. 이 소비자의 관심 증가는 환경 의식 증가, EV 소유의 경제적 이점, EV 기술의 비약적 진보에 힘쓰고 있습니다.

- 최근 이 지역에서는 전기자동차(EV) 판매가 현저하게 증가하고 있습니다. 국제에너지기구(IEA)는 2023년 EV 판매량이 45만대에 달하고, 2022년부터 21.62% 증가한다고 발표했습니다. 이러한 소비자 지향의 고조는 EV의 보급을 가속시킬 뿐만 아니라, 이 지역에서의 배터리나 배터리 분리막 수요도 증대시킵니다.

- EV의 보급을 더욱 촉진하기 위해 정부는 일련의 인센티브와 보조금을 도입하고 있습니다. 여기에는 감세, 전기자동차 구매에 대한 보조금, 충전 인프라 투자 강화 등이 포함됩니다. 이러한 이니셔티브는 이산화탄소 배출량을 줄이고 기후 변화 목표를 달성하려는 유럽연합(EU)의 광범위한 노력과 공명하고 있습니다.

- 그 예로 영국은 2023년 제로 방출 차량(ZEV)의 의무화를 내세웠습니다. 이 지령은 2030년까지 신차의 80%, 신차 밴의 70%를 제로 방출 차량으로 하는 것을 규정하고, 2035년까지 100%의 완전 이행을 목표로 하는 것입니다. 또한 정부는 전기 밴과 전기 트럭을 구매하는 기업과 개인에 대한 구매 가격의 35%를 부담하는 지원을 확대하고 있습니다. 이는 소형 밴에서는 최대 2,500 파운드(3,188 USD), 대형 밴에서는 최대 5,000 파운드(6,377 USD)에 해당합니다. 이러한 우대조치는 EV구입에 대한 세제상의 우대조치나 보조금에 이르는 것으로, EV용 배터리, 나아가서는 배터리 분리막 수요를 당분간 크게 밀어 올리게 됩니다.

- 또한 영국 자동차 산업에서는 EV 생산 확대를 목표로 한 투자가 급증하고 있습니다. 영국 기업이 EV 제조에 나서면서 고급 배터리 부품, 특히 분리막 수요가 현저하게 증가하고, 업계의 혁신과 지속가능성에 대한 대처가 부각되고 있습니다.

- 예를 들어 Jaguar Land Rover의 모회사인 Tata Motors는 2023년 5월 수십억 달러 규모의 전기자동차 배터리 공장 건설 계획을 발표했습니다. 이 배터리 공장의 건설지로 선정된 것은 잉글랜드 남서부에 위치한 서머셋입니다. 이러한 시도는 이 지역에서 전기자동차 라인업의 확대와 함께 EV 배터리 분리막 시장을 강화하는 데 매우 중요합니다.

- 이러한 개발로 인해 EV 배터리 분리막 수요가 예측 기간 동안 크게 증가할 것으로 예상됩니다.

시장을 독점하는 리튬 이온 배터리 유형

- 리튬 이온 배터리는 전기자동차 배터리 분리막 시장의 성장에 매우 중요한 역할을 하고 있으며, 전기자동차(EV) 산업의 궤도를 형성하고 있습니다. 에너지 밀도가 높고 사이클 수명이 길고 자기 방전율이 최소이기 때문에 리튬 이온 배터리는 전기자동차의 가장 중요한 선택이 되고 있습니다. EV 분야에서의 리튬 이온 전지의 보급은 이러한 전지에 맞춘 특수한 분리막 수요를 증대시키고 있습니다.

- 주요 시장 기업은 R&D 투자와 생산 활동을 활발히 하고 경쟁을 격화시켜 가격을 인하하고 있습니다. Bloomberg NEF에 따르면 EV와 배터리 에너지 저장 시스템(BESS)의 배터리 팩 평균 가격은 전반적으로 상승했지만 2023년에는 13% 하락해 139달러/kWh에 침착했습니다. 이 동향은 앞으로도 계속될 것으로 2025년에는 113달러/kWh까지 하락하고, 2030년에는 80달러/kWh까지 더욱 하락할 것으로 예측되고 있습니다.

- 게다가 지속가능성이 중요시되는 가운데, 리튬이온 배터리의 재활용에 대한 국가의 노력이 분리막 시장을 재구성하고 있습니다. 지속 가능한 소재를 사용하여 보다 쉽게 재활용할 수 있도록 설계된 분리막의 인기가 높아지고 있습니다. 이 동향은 폐기물 삭감과 순환형 경제 강화라는 유럽의 광범위한 목표에 부합하고 있으며, 분리막 기술의 혁신을 뒷받침하고 있습니다.

- 예를 들어, 2024년 2월, Volkswagen Group United Kingdom Ltd.은 전기자동차(EV) 배터리에서 리튬 이온 재료를 재생하기 위해 유명한 배터리 재활용 기업인 Ecoba와 파트너십을 맺었습니다. 이 제휴는 VWG UK의 순환 에너지 모델로의 길을 앞당길 뿐만 아니라 영국의 지속가능성 강화에 대한 자동차 업계의 거인의 헌신을 강조하기 위한 것입니다.

- 또한 영국의 급성장 기가팩토리는 유럽 배터리 산업을 지배하려는 야심을 뒷받침하고 있습니다. 주로 리튬 이온 배터리의 생산을 중심으로 이러한 대규모 시설은 특수 분리막 수요를 증가하고 있습니다.

- 2023년 11월, 영국 정부는 이 나라의 미래 EV 생산 목표를 강화하기 위해 리튬 이온 배터리를 중심으로 배터리 공급망을 강화하기 위해 5,000만 파운드(6,300만 달러) 투자를 발표했습니다. 배터리 전략은 2030년까지 새로운 자본 및 R&D 자금을 포함한 제로 배출 차량, 배터리 및 공급망에 대한 적극적인 지원을 약속합니다. 이러한 전략적 투자는 영국에서의 리튬 이온 배터리 생산을 촉진하고 앞으로 수년간 배터리 분리막에 대한 수요가 높아질 것으로 예상됩니다.

- 결과적으로 이러한 노력은 리튬 이온 배터리의 생산을 강화하고 예측 기간 동안 전기자동차 배터리 분리막의 생산 능력을 크게 증가시킵니다.

영국 EV 배터리 분리막 산업 개요

영국 EV 배터리 분리막 시장은 반고착화되고 있습니다. 주요 기업(순부동)는 Mitsubishi Chemical Group Corporation, Hitachi Chemical Company Ltd, Toray Industries Inc., Sumitomo Chemical Co. Ltd, Teijin Ltd 등입니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사 범위

- 시장의 정의

- 조사의 전제

제2장 주요 요약

제3장 조사 방법

제4장 시장 개요

- 소개

- 2029년까지 시장 규모 및 수요 예측(단위: 달러)

- 최근 동향과 개발

- 정부의 규제와 정책

- 시장 역학

- 성장 촉진요인

- 전기자동차의 보급 확대

- 전지 원재료 비용의 저하

- 억제요인

- 공급 체인의 갭

- 성장 촉진요인

- 공급망 분석

- PESTLE 분석

- 투자분석

제5장 시장 세분화

- 배터리별

- 리튬 이온

- 납축

- 기타

- 재료 유형별

- 폴리프로필렌

- 폴리에틸렌

- 기타 재료 유형

제6장 경쟁 구도

- M&A, 합작사업, 제휴, 협정

- 주요 기업의 전략

- 기업 프로파일

- Mitsubishi Chemical Group Corporation

- Hitachi Chemical Company Ltd

- Toray Industries Inc.

- Sumitomo Chemical Co. Ltd

- Teijin Ltd

- Entek International

- EniChem

- SK Innovation Co. Ltd

- 기타 유명 기업 일람

- 시장 랭킹 분석

제7장 시장 기회와 앞으로의 동향

- 다른 전지화학의 연구개발 증가

The United Kingdom Electric Vehicle Battery Separator Market size is estimated at USD 1.45 million in 2025, and is expected to reach USD 2.92 million by 2030, at a CAGR of 15.01% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the supply chain gap in battery materials created by the monopolies of some countries, such as ingredient shortages or distribution bottlenecks, is expected to restrain market growth in the future.

- Nevertheless, the increasing research and development of other battery chemistries like solid-state batteries, advanced lithium-ion chemistry, Sodium-ion batteries, etc, are expected to create an opportunity for the market in the future.

United Kingdom Electric Vehicle Battery Separator Market Trends

Growing Adoption of Electric Vehicles Drives the Market

- In the United Kingdom, the surging demand for electric vehicles (EVs) is propelling the growth of the EV battery separator market. As the nation pivots towards clean energy, the spotlight is firmly on electric vehicles, a segment garnering heightened attention from companies. This burgeoning interest among consumers is fueled by heightened environmental consciousness, the economic benefits of owning an EV, and strides in EV technology.

- Recently, the region has seen a notable uptick in electric vehicle (EV) sales. The International Energy Agency (IEA) highlighted that in 2023, EV sales reached 450,000 units, marking a 21.62% rise from 2022. This escalating consumer inclination not only accelerates EV adoption but also amplifies the demand for batteries and battery separators in the region.

- To further bolster EV adoption, the government has introduced a suite of incentives and subsidies. These encompass tax breaks, grants for electric car purchases, and bolstered investments in charging infrastructure. Such initiatives resonate with broader European Union endeavors to mitigate carbon emissions and achieve climate goals.

- As a case in point, in 2023, the UK rolled out a Zero-Emission Vehicle (ZEV) mandate. This directive stipulates that by 2030, 80% of new cars and 70% of new vans should be zero-emission, aiming for a complete 100% transition by 2035. Additionally, the government extends support to businesses and individuals acquiring electric vans and trucks, covering 35% of the purchase price. This translates to a maximum of GBP 2,500 (USD 3,188) for small vans and GBP 5,000 (USD 6,377) for larger ones. Such incentives, spanning tax rebates and subsidies for EV purchases, are poised to significantly elevate the demand for EV batteries and, consequently, battery separators in the foreseeable future.

- Furthermore, the UK's automotive landscape is witnessing a surge in investments, all aimed at amplifying EV production. As UK firms delve into EV manufacturing, there's a pronounced uptick in the demand for premium battery components, especially separators, underscoring the industry's commitment to innovation and sustainability.

- For instance, in May 2023, Tata Motors, the parent company of Jaguar Land Rover, announced plans for a multi-billion dollar electric car battery plant, set to commence in the following year. The chosen site for this battery facility is Somerset, nestled in southwest England. Such endeavors, alongside the expansion of electric vehicle lineups in the region, are pivotal in bolstering the EV battery separator market.

- Given these developments, it's anticipated that the demand for EV battery separators will see a significant uptick during the forecast period.

Lithium-Ion Battery Type to Dominate the Market

- Li-ion batteries play a pivotal role in the growth of the EV battery separator market, shaping the trajectory of the electric vehicle (EV) industry. Celebrated for their high energy density, extended cycle life, and minimal self-discharge rate, Li-ion batteries have become the top choice for electric vehicles. This prevalent adoption of Li-ion batteries in the EV sector amplifies the demand for specialized separators tailored for these batteries.

- Key market players are ramping up their R&D investments and production activities, intensifying competition and driving prices down. Bloomberg NEF reports that while average battery pack prices for EVs and battery energy storage systems (BESS) saw a general rise, 2023 stood out with a notable 13% drop, settling at USD 139/kWh. The trend appears set to continue, with forecasts predicting a dip to USD 113/kWh by 2025 and a further slide to USD 80/kWh by 2030, all thanks to relentless technological and manufacturing advancements.

- Additionally, as sustainability takes center stage, the nation's commitment to recycling lithium-ion batteries is reshaping the separator market. Separators made from sustainable materials and designed for easier recycling are becoming increasingly popular. This trend aligns with Europe's broader goals of waste reduction and strengthening the circular economy, propelling innovations in separator technology.

- For example, in February 2024, Volkswagen Group United Kingdom Ltd. forged a partnership with Ecoba, a prominent battery recycling firm, to reclaim lithium-ion materials from electric vehicle (EV) batteries. This collaboration not only advances VWG UK's journey towards a circular energy model but also underscores the automotive titan's commitment to bolstering sustainability in the UK.

- Furthermore, the nation's burgeoning gigafactories underscore its ambition to dominate Europe's battery landscape. These expansive facilities, predominantly centered on Li-ion battery production, are amplifying the demand for specialized separators.

- In November 2023, the United Kingdon (UK) government unveiled a GBP 50 million (USD 63 million) investment aimed at fortifying the battery supply chain, with a focus on lithium-ion batteries, to bolster the country's future EV production goals. The Battery Strategy promises targeted backing for zero-emission vehicles, batteries, and their supply chains, including fresh capital and R&D funding extending to 2030. Such strategic investments are poised to boost lithium-ion battery production in the UK and elevate the demand for battery separators in the years ahead.

- Consequently, these initiatives are set to bolster lithium-ion battery output and substantially amplify the capacity for EV battery separators during the forecast period.

United Kingdom Electric Vehicle Battery Separator Industry Overview

The United Kingdom's electric vehicle battery separator market is semi-consolidated. Some key players (not in particular order) are Mitsubishi Chemical Group Corporation, Hitachi Chemical Company Ltd, Toray Industries Inc., Sumitomo Chemical Co. Ltd, Teijin Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Decline in cost of battery raw materials

- 4.5.2 Restraints

- 4.5.2.1 The Supply Chain Gap

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery

- 5.1.1 Lithium-ion

- 5.1.2 Lead-Acid

- 5.1.3 Others

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Mitsubishi Chemical Group Corporation

- 6.3.2 Hitachi Chemical Company Ltd

- 6.3.3 Toray Industries Inc.

- 6.3.4 Sumitomo Chemical Co. Ltd

- 6.3.5 Teijin Ltd

- 6.3.6 Entek International

- 6.3.7 EniChem

- 6.3.8 SK Innovation Co. Ltd

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Research and Development of Other Battery Chemistries