|

시장보고서

상품코드

1906868

필리핀의 재생에너지 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Philippines Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

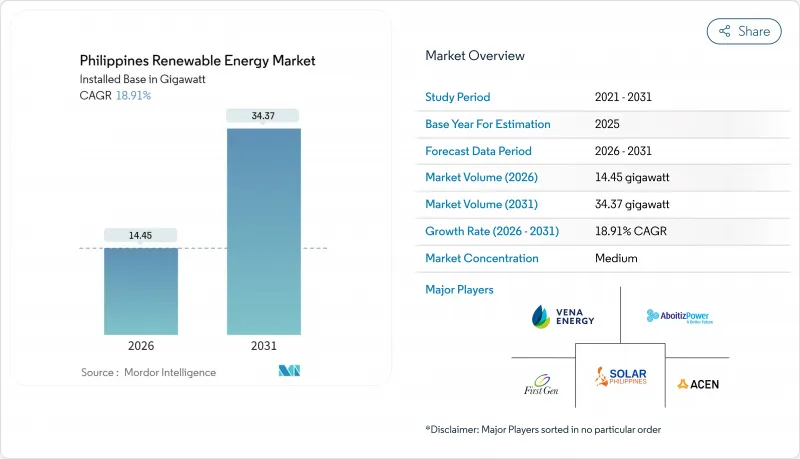

필리핀의 재생에너지 시장은 2025년에 12.15 기가와트로 평가되었고, 2026년 14.45 기가와트에서 2031년까지 34.37 기가와트에 이를 것으로 보입니다. 예측기간(2026-2031년)의 CAGR은 18.91%를 나타낼 것으로 예상됩니다.

정책에 따른 포트폴리오 기준, 태양광 및 풍력 설비 비용 하락, 소매 요금 인상, 신규 석탄 발전소 건설 중단 조치가 복합적으로 작용하며 화력 발전에서 벗어나고 있습니다. 2022년 기준 석탄은 여전히 전력 공급의 60%를 차지했으나, 기후투자기금(CIF)의 5억 달러 규모 양허성 자본 지원으로 추진되는 조기 폐쇄 계획이 노후 설비 900MW를 대체함으로써 신규 친환경 프로젝트를 위한 여력을 창출할 전망입니다. ACEN의 600MW 바탄 태양광 발전소와 솔라 필리핀의 3.5GW 테라 솔라 단지를 비롯한 즉시 가동 가능한 자산들은 선점자 규모의 이점을 확보하며 기관 자본을 유치하고 있습니다. 동시에 데이터센터와 연중무휴 비즈니스 프로세스 아웃소싱(BPO) 캠퍼스가 필리핀의 지역 최고 수준 소매 요금에 대비해 장기 전력 구매 계약을 체결하면서 기업 대상 전력 구매 시장이 호황을 누리고 있습니다.

필리핀의 재생에너지 시장 동향 및 인사이트

재생에너지 의무할당제(RPS) 및 공급가격보장제도(FIT)

재생에너지 의무할당제(RPS)는 2024년 11%로 재설정되었으며, 2030년까지 35%로 증가할 것으로 예상되어 배전 사업자들이 공급량의 3분의 1을 청정 발전업체로부터 계약하도록 강제하고 있습니다. 고정가격매입제도는 초기 프로젝트를 촉진했으나, 최근 그린에너지 경매 프로그램이 주요 조달 채널로 자리잡았으며, 2024년 3.4GW가 낙찰되었고 2025년에는 에너지저장연계 입찰이 예정되어 있습니다. 에너지규제위원회의 2024년 6월 공문은 대부분의 외국인 지분 제한을 해제하여 파트너십 구조를 단순화했습니다. CREATE법에 따른 7년간 소득세 면제 후 10% 세율 적용으로 재정적 경쟁력이 강화되어, 필리핀은 동남아시아에서 그린필드 재생에너지에 가장 유리한 관할 구역 중 하나로 자리매김했습니다.

태양광 및 풍력발전설비 투자 감소

2010년 이후 세계의 모듈 가격이 89% 하락하면서, 일로코스노르테와 팡가시난 지역의 유틸리티 규모 태양광 균등화 발전 비용이 kWh당 2.50페소 미만으로 떨어졌습니다. ACEN의 바탄 발전소는 2024년 4분기에 와트당 0.60달러 미만으로 가동되어 기존 국내 기준보다 25% 낮았으며, NREL은 부유식 플랫폼 학습 곡선이 성숙함에 따라 2050년까지 해상풍력 비용이 MWh당 34달러로 하락할 것으로 전망합니다. 제조사 트리나솔라(Trina Solar)와 베스타스(Vestas)는 양면 모듈과 5MW 초과 터빈을 필리핀 공급망에 통합하며 효율성 향상을 가속화하고 있습니다.

전력망 혼잡 및 제한된 송전 용량

2024년까지 계획된 258개 송전 프로젝트 중 단 75개만 완료되었으며, 58개 사업은 최대 9년 지연되었습니다. TransCo는 혼잡으로 인해 최종 사용자 요금이 kWh당 0.80페소가 추가되어 재생에너지의 비용 우위 대부분이 상쇄된다고 추정합니다. ERC의 그룹 3 자본 지출 유예로 2GW 규모의 태양광 및 풍력 계약에 대한 계통 연계가 동결되었으며, 2024년 일로코스노르테 회랑의 비수기 시간대 발전량 제한률은 12%에 달했습니다.

부문 분석

2025년 설치 용량의 41.20%를 차지한 수력 발전은 산악 지역의 전력 생산 핵심으로 남아 있습니다. 수력 발전의 경우 기존 댐 개조로 인해 필리핀 재생에너지 시장 규모가 확대될 전망이지만, 태양광 및 풍력 발전 증가에 비해 성장세는 완만할 것으로 예상됩니다. 해양 에너지는 미미한 수준에서 시작하지만, 산 베르나르디노와 동부 비사야스 지역의 조력 및 파력 시범 발전소 덕분에 2031년까지 연평균 114.2%의 복합 성장률을 보일 것으로 전망됩니다. 부유식 플랫폼의 상업적 타당성이 입증된다면 이 틈새 시장이 해안 전력 공급을 변화시킬 수 있습니다. 국립 재생에너지 연구소(NREL)는 42.86GW 규모의 해상 풍력 기술 잠재력을 분석했으며, 이 중 93%가 부유식 터빈에 적합해 비용이 육상 기준과 수렴되면 장기적으로 해상 풍력이 우위를 점할 것으로 전망됩니다.

필리핀에서의 태양광 발전의 확대는 꾸준히 진행되고 있습니다. ACEN사의 '솔라 필리핀' 테라 솔라 프로젝트만 해도 루손 전력망이 강화되면 4GW를 넘어설 전망으로, 루손의 우위를 공고히 할 것입니다. 풍력 발전 단지는 몬순 풍속이 평균 7.5m/s인 일로코스 및 파나이 회랑을 따라 밀집해 있습니다. 지열 발전량은 기존 유정을 활용한 바크만 지역의 이중 사이클 업그레이드로 약 1.5GW 수준을 유지 중입니다. 바이오에너지는 소규모 역할을 수행하며, 360MW 칼라얀 발전소가 대표하는 양수식 발전은 중요한 균형 공급원입니다. 다만 2010년 이후 신규 사업은 금융 마감을 달성하지 못했습니다. 전반적으로 다양한 신규 설비 증설은 에너지 공급 변동성과 연료 가격 변동성에 대한 신재생 에너지 산업의 회복탄력성을 뒷받침합니다.

필리핀의 재생에너지 시장 보고서는 기술별(태양광 에너지, 풍력 에너지, 수력 발전, 바이오에너지, 지열, 해양 에너지) 및 최종 사용자별(유틸리티, 상업 및 산업, 주택)으로 분류됩니다. 시장 규모와 예측은 설치 용량(GW) 단위로 제공됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트의 3개월간 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 재생에너지 의무할당제(RPS) 및 고정가격매입제도(FIT)

- 태양광 발전 및 풍력 터빈의 설비 투자(Capex) 감소 경향

- 증가하는 전력 수요 및 높은 소매 전기 요금

- BPO/IT 허브로부터의 기업간 전력 구입 계약(PPA)

- JICA 자금의 송전망 강화 프로젝트

- 재해 복원력 강화 섬 및 마이크로그리드 프로그램

- 시장 성장 억제요인

- 전력망 혼잡 및 제한된 송전 용량

- CREZ 경매에 관한 규제의 불확실성

- 태풍으로 인한 보험 비용 상승

- 농지 개혁 토지와의 토지 이용 갈등

- 공급망 분석

- 규제 상황

- 기술 전망(하이브리드, 부체식, 저장)

- Porter's Five Forces

- 신규 참가업체의 위협

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- PESTEL 분석

제5장 시장 규모와 성장 예측

- 기술별

- 태양광 에너지(PV 및 CSP)

- 풍력 에너지(육상 및 해상)

- 수력 발전(소규모, 대규모, PSH)

- 바이오 에너지

- 지열

- 해양 에너지(조력 및 파력)

- 최종 사용자별

- 유틸리티

- 상업 및 산업

- 주택

제6장 경쟁 구도

- 시장 집중도

- 전략적 움직임(M&A, 합작사업, 자금조달, 전력구매계약)

- 시장 점유율 분석(주요 기업의 시장 순위 및 점유율)

- 기업 프로파일

- Aboitiz Power Corporation

- ACEN Corporation

- Solar Philippines Power Project Holdings Inc.

- Vena Energy

- First Gen Corporation

- Energy Development Corporation(EDC)

- SN Aboitiz Power Group

- Alternergy Holdings Corp.

- Trina Solar Co. Ltd.

- Vestas Wind Systems A/S

- Solenergy Systems Inc.

- Solaric Corp.

- National Power Corporation(NPC-PSALM)

- Philippine Geothermal Production Company Inc.

- Meralco PowerGen Corp.

- Siemens Gamesa Renewable Energy

- Nexif Energy

- Kepco Philippines Holdings

- Enfinity Global Inc.

- Sharp Energy Solutions

제7장 시장 기회와 장래의 전망

HBR 26.01.26The Philippines Renewable Energy Market was valued at 12.15 gigawatt in 2025 and estimated to grow from 14.45 gigawatt in 2026 to reach 34.37 gigawatt by 2031, at a CAGR of 18.91% during the forecast period (2026-2031).

Policy-mandated portfolio standards, falling solar and wind equipment costs, rising retail tariffs, and a moratorium on new coal plants are collectively accelerating the shift away from thermal generation. Coal still supplied 60% of electricity in 2022; yet, imminent retirements backed by USD 500 million of concessional capital from the Climate Investment Funds will displace 900 MW of aging capacity, creating headroom for new green projects. Grid-ready assets, notably ACEN's 600 MW Bataan solar farm and Solar Philippines' 3.5 GW Terra Solar complex, are capturing first-mover scale advantages and attracting institutional capital. At the same time, the corporate power-purchase market is booming as data centers and 24/7 business-process outsourcing campuses sign long-term offtake contracts to hedge against the country's region-leading retail tariffs.

Philippines Renewable Energy Market Trends and Insights

Renewable Portfolio Standards & Feed-in Tariffs

The Renewable Portfolio Standard was reset to 11% in 2024 and is expected to increase to 35% by 2030, forcing distribution utilities to contract a third of their supply from clean generators. Feed-in tariffs helped seed initial projects; however, the latest Green Energy Auction Program rounds are now the principal procurement channel, with 3.4 GW awarded in 2024, and storage-linked bids are scheduled for 2025. The Energy Regulatory Commission's June 2024 circular removed most foreign-ownership caps, simplifying partnership structures. Seven-year income-tax holidays followed by a 10% rate under the CREATE Act sharpen fiscal competitiveness, placing the Philippines among Southeast Asia's most favorable jurisdictions for greenfield renewables.

Declining Solar-PV & Wind Turbine Capex

Global module prices have fallen by 89% since 2010, pushing utility-scale solar levelized costs below PHP 2.50/kWh in Ilocos Norte and Pangasinan. ACEN's Bataan plant commissioned in 4Q 2024 at under USD 0.60 per watt, 25% under the prior domestic benchmark, while NREL projects offshore-wind costs sliding to USD 34 /MWh by 2050 as floating-platform learning curves mature. Manufacturers Trina Solar and Vestas are integrating bifacial modules and turbines exceeding 5 MW into the Philippine supply chain, accelerating efficiency gains.

Grid congestion & limited transmission capacity

Only 75 of 258 planned transmission projects were completed by 2024, leaving 58 schemes delayed up to nine years. TransCo estimates that congestion adds PHP 0.80/kWh to end-user bills, nullifying much of the cost advantage of renewables. ERC's deferral of Group 3 capex frozen interconnection for 2 GW of solar and wind contracts, and curtailment in the Ilocos Norte corridor reached 12% during off-peak hours in 2024.

Other drivers and restraints analyzed in the detailed report include:

- Rising Electricity Demand & High Retail Tariffs

- Corporate PPAs from BPO/IT Hubs

- Regulatory Uncertainty around CREZ Auctions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hydropower accounted for 41.20% of the installed capacity in 2025 and remains the cornerstone of electricity generation in mountainous regions. The Philippines' renewable energy market size for hydropower is expected to expand as retrofits upgrade existing dams, although growth is moderate compared to solar and wind additions. Ocean energy, while starting from a negligible baseline, is projected to compound at a rate of 114.2% per year through 2031, thanks to tidal and wave pilot plants in San Bernardino and Eastern Visayas. This niche could transform coastal supply if floating platforms prove commercially viable. The National Renewable Energy Laboratory maps 42.86 GW of offshore wind technical potential, 93% of which is suited for floating turbines, indicating long-term marine dominance once costs converge with onshore benchmarks.

The expansion of solar energy in the Philippines is relentless; ACEN's Solar Philippines' Terra Solar projects alone will surpass 4 GW when Luzon's power grid is reinforced, thereby solidifying Luzon's dominance. Wind farms cluster along the Ilocos and Panay corridors where monsoon speeds average 7.5 m/s. Geothermal output remains steady at about 1.5 GW, with binary-cycle upgrades at Bacman leveraging existing wells. Bioenergy plays a modest role, and pumped storage, exemplified by the 360 MW Kalayaan plant, supplies vital balancing; however, no new schemes have reached financial close since 2010. Overall, diversified additions underpin the new renewable industry's resilience against fluctuations in energy supply and fluctuations in fuel prices.

The Philippines Renewable Energy Market Report is Segmented by Technology (Solar Energy, Wind Energy, Hydropower, Bioenergy, Geothermal, and Ocean Energy) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Aboitiz Power Corporation

- ACEN Corporation

- Solar Philippines Power Project Holdings Inc.

- Vena Energy

- First Gen Corporation

- Energy Development Corporation (EDC)

- SN Aboitiz Power Group

- Alternergy Holdings Corp.

- Trina Solar Co. Ltd.

- Vestas Wind Systems A/S

- Solenergy Systems Inc.

- Solaric Corp.

- National Power Corporation (NPC-PSALM)

- Philippine Geothermal Production Company Inc.

- Meralco PowerGen Corp.

- Siemens Gamesa Renewable Energy

- Nexif Energy

- Kepco Philippines Holdings

- Enfinity Global Inc.

- Sharp Energy Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Renewable Portfolio Standards & Feed-in Tariffs

- 4.2.2 Declining Solar-PV & Wind Turbine Capex

- 4.2.3 Rising Electricity Demand & High Retail Tariffs

- 4.2.4 Corporate PPAs from BPO/IT Hubs

- 4.2.5 Grid Upgrades via JICA-funded Projects

- 4.2.6 Disaster-resilient Island & Micro-grid Programs

- 4.3 Market Restraints

- 4.3.1 Grid Congestion & Limited Transmission Capacity

- 4.3.2 Regulatory Uncertainty around CREZ Auctions

- 4.3.3 Typhoon-driven Insurance Cost Escalation

- 4.3.4 Land-use Conflicts with Agrarian Reform Lands

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Hybrid, Floating, Storage)

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Energy (PV and CSP)

- 5.1.2 Wind Energy (Onshore and Offshore)

- 5.1.3 Hydropower (Small, Large, PSH)

- 5.1.4 Bioenergy

- 5.1.5 Geothermal

- 5.1.6 Ocean Energy (Tidal and Wave)

- 5.2 By End-User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, JVs, Funding, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Aboitiz Power Corporation

- 6.4.2 ACEN Corporation

- 6.4.3 Solar Philippines Power Project Holdings Inc.

- 6.4.4 Vena Energy

- 6.4.5 First Gen Corporation

- 6.4.6 Energy Development Corporation (EDC)

- 6.4.7 SN Aboitiz Power Group

- 6.4.8 Alternergy Holdings Corp.

- 6.4.9 Trina Solar Co. Ltd.

- 6.4.10 Vestas Wind Systems A/S

- 6.4.11 Solenergy Systems Inc.

- 6.4.12 Solaric Corp.

- 6.4.13 National Power Corporation (NPC-PSALM)

- 6.4.14 Philippine Geothermal Production Company Inc.

- 6.4.15 Meralco PowerGen Corp.

- 6.4.16 Siemens Gamesa Renewable Energy

- 6.4.17 Nexif Energy

- 6.4.18 Kepco Philippines Holdings

- 6.4.19 Enfinity Global Inc.

- 6.4.20 Sharp Energy Solutions

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment

- 7.2 Developing Floating PV Parks in Calm Backwaters