|

시장보고서

상품코드

1639452

아시아태평양의 무선 헬스케어 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)Asia Pacific Wireless Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

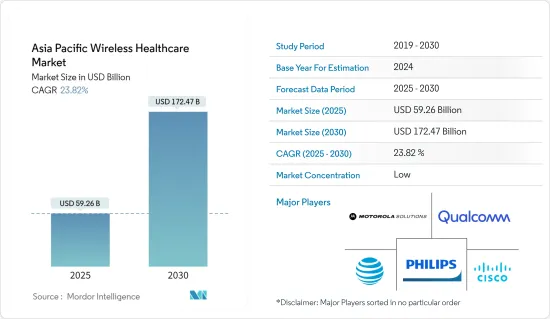

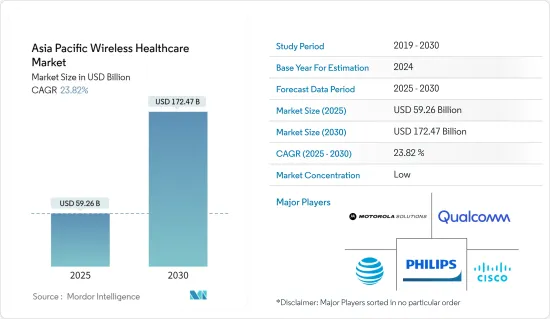

아시아태평양의 무선헬스케어 시장 규모는 2025년 592억 6,000만 달러로 추정됩니다. 예측기간 중(2025-2030년) CAGR은 23.82%로, 2030년에는 1,724억 7,000만 달러에 달할 것으로 예상됩니다.

아시아태평양의 무선 헬스케어 시장은 디지털화의 진전, 연결 장치의 사용 증가, 무선 기술의 진보, 고품질의 헬스케어에 대한 수요 증가와 함께 헬스케어 기관에 의한 환자 중심 접근법의 채용이 증가하는 것이 큰 요인이 되고 있습니다.

주요 하이라이트

- 무선 장비와 센서는 환자의 생체 신호와 건강 상태를 원격으로 모니터링할 수 있습니다. 이를 통해 의료 서비스 제공업체는 실시간으로 환자의 건강 상태를 추적하고 필요에 따라 개입할 수 있습니다. 무선 통신은 원격 의료 서비스를 촉진하고 환자는 비디오, 음성 및 메시징을 통해 의료 전문가와 원격으로 상담할 수 있습니다. 이는 원격지에 있거나 이동하기 어려운 환자에게 특히 가치가 있습니다.

- 웨어러블 디바이스의 출현이 시장을 견인하고 있습니다. 스마트폰의 보급과 웨어러블 디바이스의 수용에 의해 헬스 케어 기기나 진단센터는 바이탈 사인을 모니터해, 원격 액세스 가능한 온라인 플랫폼에 실시간으로 송신할 수 있는 신체 장착형 센서의 실험을 진행하고 있습니다.

- 무선 통신 기술의 발전은 무선 헬스케어 시장의 성장과 진화를 촉진하는 데 매우 중요한 역할을 합니다. 이러한 혁신은 보다 효과적인 새로운 헬스케어 솔루션 개발을 가능하게 하고 헬스케어 제공, 모니터링 및 관리에 변화를 가져왔습니다.

- 무선 헬스케어 시장의 성장을 억제하는 것은 전통적인 의료 서비스 제공업체의 저항입니다. 기존의 의료 서비스 제공업체는 무선 기술을 보다 잘 알고 효과적으로 배포 및 활용하는 데 필요한 교육이 필요할 수 있습니다. 헬스케어 부문은 환자의 안전과 데이터 보안을 강조합니다.

아시아태평양 무선 헬스케어 시장 동향

재택 헬스케어 용도 부문이 큰 시장 점유율을 차지할 전망

- 무선 센서 및 웨어러블 장치를 통해 의료 서비스 제공업체는 환자의 생명 징후, 건강 상태, 복약 어드밴스를 원격으로 모니터링할 수 있습니다. 이 실시간 데이터는 헬스케어가 실제 판단을 내리고 필요한 경우 신속하게 개입하는 데 도움이 됩니다.

- Cisco Systems Inc.에 따르면 아시아태평양에서 사용되는 웨어러블 단말기는 2022년 3억 1,100만 대가 됩니다. 북미와 아시아태평양에서 사용되는 웨어러블 단말기는 2022년에는 세계 웨어러블 5G 연결의 약 70%를 차지할 것으로 예측되고 있습니다.

- 홈 케어 애플리케이션은 화상 통화 및 기타 통신 플랫폼을 통해 환자가 헬스케어 제공업체와 가상 협의를 할 수 있습니다. 이는 경과 관찰 예약, 정기 검진, 긴급성 없는 의료 문제 등에 유용합니다.

- 만성 질환 환자는 개인화된 케어 플랜, 의약품 알림, 지속적인 모니터링을 제공하는 홈 케어 용도의 혜택을 누릴 수 있습니다. 이러한 애플리케이션은 환자가 헬스케어 제공업체와 연결하면서 적극적으로 자신의 건강을 관리할 수 있습니다.

- 아시아태평양 무선 헬스케어 시장에서 재택 헬스케어 애플리케이션의 채택은 원격 헬스케어 서비스의 필요성, 무선 기술의 진보, 헬스케어 제공 모델의 변화, 환자 중심의 치료에 중점을 두는 등 요인으로 인해 앞으로도 확대됩니다. 계속할 가능성이 높습니다.

중국이 큰 시장 점유율을 차지할 전망

- 중국은 의료 개혁의 일환으로 디지털 건강에 대한 노력을 적극적으로 추진하고 있습니다. 중국 정부는 헬스케어의 접근성, 품질, 효율성을 높이는 무선 기술의 잠재력을 인식하고 있습니다.

- 원격 헬스케어는 특히 헬스케어 서비스에 접근하기 어려운 원격지와 농촌 지역에서 중국에서 지지를 받고 있습니다. 무선 통신 기술은 환자와 헬스케어 제공업체를 연결하는 플랫폼을 통해 가상 진단, 진단 및 후속 관리를 가능하게 합니다.

- 무선 장치와 센서는 중국에서도 환자의 원격 모니터링에 사용되고 있습니다. 이러한 장비를 통해 의료 서비스 제공업체는 실시간으로 환자의 건강 상태를 추적하고 필요에 따라 적시에 개입할 수 있습니다.

- 5G 기술의 도입과 5G 기지국의 확대는 중국의 무선 의료 시장에 큰 영향을 미칠 수 있습니다. 5G 기술은 고속화, 저지연화, 연결성 향상을 실현하여 실시간 데이터 전송 및 통신에 의존하는 다양한 헬스케어 용도과 서비스를 가능하게 합니다.

- MIIT에 따르면 2022년 말까지 중국 국내 5G 기지국 수는 약 231만국에 달했습니다. 대규모 인프라 투자와 야심찬 개발 계획으로 중국은 5G의 대폭적인 보급을 달성했습니다. 예측에 따르면 2024년까지 기지국 수는 약 600만에 달할 것으로 예측됩니다.

아시아태평양 무선 헬스케어 산업 개요

아시아태평양 무선 의료 시장은 AT&T Inc., Cisco Systems Inc., Motorola Solutions Inc., Koninklijke Philips NV, Qualcomm Technologies Inc.와 같은 대기업이 존재하기 때문에 매우 세분화되었습니다. 시장 진출기업은 제품 라인업을 강화하고 지속 가능한 경쟁 우위를 얻기 위해 제휴 및 인수와 같은 전략을 채택하고 있습니다.

2022년 9월, Philips 재단과 RAD-AID International은 중저소득 국가의 5,000만 명의 모바일 초음파 서비스에 대한 액세스를 개선하기 위해 대륙을 가로지르는 다년간 협력 관계를 맺었습니다. 이 새로운 파트너십은 아시아 국가를 포함한 10개국에서 집중 프로그램을 시작하고 실시간 원격 교육 및 모의 절차의 시연을 통해 다양한 의료 종사자와 전문가를 육성합니다. 이 공동 프로그램은 수백 대의 초음파 진단 장치를 배포하고 수천 킬로미터 떨어진 원격지에서 헬스케어를 가능하게 함으로써 5,000만 명에 이르는 것을 목표로 하고 있습니다.

2022년 9월, Verizon 비즈니스 및 주요 의료 기술 기업 중 하나 인 Visionable이 제휴를 확대하고 Verizon의 5G 울트라 와이드 밴드 및 5G 에지 네트워크를 사용하는 Visionable 특허 기술을 사용하여 두 회사가 미국에서 다양한 커넥티드 헬스케어 솔루션을 다루겠다고 발표했습니다. Verizon과 Visionable은 아시아, 태평양 및 유럽, 중동 및 아프리카의 의료 전문가가 데이터에 액세스, 협업 및 리소스를 공유할 수 있는 안전한 차세대 디지털 헬스케어 협업 플랫폼에서 협력합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

- 기술 스냅샷

- 무선 개인 영역 네트워크(WPAN)

- Wi-Fi

- 마이크로파 액세스를 위한 전 세계 상호 운용성(WiMAX)

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 무선 통신 기술의 진보

- 웨어러블 디바이스의 출현

- 시장 성장 억제요인

- 기존의 의료 제공자로부터의 저항

제6장 시장 세분화

- 구성 요소별

- 하드웨어

- 소프트웨어

- 서비스별

- 용도별

- 병원 및 요양원

- 홈 케어

- 의약품

- 국가별

- 중국

- 인도

- 일본

- 한국

제7장 경쟁 구도

- 기업 프로파일

- AT&T Inc.

- Cisco Systems Inc.

- Motorola Solutions Inc.

- Koninklijke Philips NV

- Qualcomm Technologies Inc.

- Samsung Electronics Co. Ltd

- Verizon Communications Inc.

- Apple Inc.

- Extreme Networks Inc.

- Allscripts Healthcare Solutions Inc.

제8장 투자 분석

제9장 시장의 미래

KTH 25.02.07The Asia Pacific Wireless Healthcare Market size is estimated at USD 59.26 billion in 2025, and is expected to reach USD 172.47 billion by 2030, at a CAGR of 23.82% during the forecast period (2025-2030).

The Asia Pacific wireless healthcare market is significantly driven by growing digitization, increased use of connected devices, advancements in wireless technology, and rising adoption of patient-centric approaches by healthcare organizations coupled with increasing demand for quality healthcare.

Key Highlights

- Wireless devices and sensors enable remote monitoring of patient's vital signs and health conditions. This allows healthcare providers to track patients' health status in real-time and intervene when necessary. Wireless communication facilitates telemedicine services, allowing patients to consult with healthcare professionals remotely via video, voice, or messaging. This is especially valuable for individuals in remote areas or those with limited mobility.

- The emergence of Wearable Devices is driving the market. Owing to the proliferation of smartphones and the acceptance of wearable devices, medical devices, and diagnostic centers are experimenting with body-worn sensors that can monitor vital signs and transmit them in real time to an online platform that can be remotely accessed.

- Advancements in wireless communication technology have played a pivotal role in driving the growth and evolution of the wireless healthcare market. These technological innovations have enabled the development of new and more effective healthcare solutions, transforming the healthcare is delivered, monitored, and managed.

- Resistance from traditional healthcare providers restrains the growth of the wireless healthcare market. Traditional healthcare providers may need more familiarity with wireless technologies and the necessary training to implement and use them effectively. The healthcare sector places a high emphasis on patient safety and data security.

Asia Pacific Wireless Healthcare Market Trends

Home Care Application Segment is Expected to Hold Significant Market Share

- Wireless sensors and wearable devices enable healthcare providers to remotely monitor patients' vital signs, health conditions, and medication adherence. This real-time data helps healthcare make real decisions and intervene promptly when necessary.

- According to Cisco Systems, The Wearables used in the Asia Pacific region is 311 million devices in 2022. Wearables used in North America and Asia Pacific are forecasted to account for around 70 percent of the wearable 5G connections globally in 2022.

- Home care applications enable patients to have virtual consultations with healthcare providers through video calls or other communication platforms. This is useful for follow-up appointments, routine check-ups, and non-emergency medical concerns.

- Patients with chronic conditions can benefit from home care applications that offer personalized care plans, medication reminders, and continuous monitoring. These applications empower patients to actively manage their health while staying connected to their healthcare providers.

- The adoption of home care applications in the Asia Pacific wireless healthcare market is likely to continue growing, driven by factors such as the need for remote healthcare services, advancements in wireless technology, changing healthcare delivery models, and the emphasis on patient-centered care.

China is Expected to Hold Significant Market Share

- China has actively promoted digital health initiatives as part of its healthcare reform efforts. The Chinese government has recognized the potential of wireless technologies to enhance healthcare accessibility, quality, and efficiency.

- Telemedicine has gained traction in China, specifically in remote and rural areas where access to healthcare services can be challenging. Wireless communication technologies have enabled virtual consultations, diagnostics, and follow-up care through platforms connecting patients and healthcare providers.

- Wireless devices and sensors have been increasingly used for remote patient monitoring in China. These devices allow healthcare providers to track patients' health conditions in real-time and provide timely interventions when necessary.

- The deployment of 5G technology and expansion of 5G base stations have the potential to impact the wireless healthcare market in China significantly. 5G technology offers faster speeds, lower latency, and increased connectivity, enabling various healthcare applications and services that rely on real-time data transmission and communication.

- According to MIIT, By the end of 2022, the number of 5G base stations in China was approximately 2.31 million. With extensive infrastructure investments and ambitious rollout plans, China has achieved significant 5G coverage. According to forecasts, by 2024, the number of base stations was projected to reach about six million.

Asia Pacific Wireless Healthcare Industry Overview

The Asia Pacific wireless healthcare market is highly fragmented due to the presence of major players like AT&T Inc., Cisco Systems Inc., Motorola Solutions Inc., Koninklijke Philips NV, and Qualcomm Technologies Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In September 2022, Philips Foundation and RAD-AID International formed a multi-year cross-continental collaboration to increase access to mobile ultrasound services for 50 million people in low- and middle-income countries. The new partnership sets up the intensive program in 10 countries, including countries in Asia, to train various health workers and specialists through real-time distance education and simulated procedure demonstrations. The co-created program aims to reach 50 million people by deploying hundreds of ultrasound devices, allowing remote healthcare thousands of kilometers away.

In September 2022, Verizon Business and Visionable, one of the leading health technology companies, announced that they are expanding their partnership, allowing both companies to work on various connected healthcare solutions in the United States using Visionable's patented technology powered by Verizon's 5G Ultra Wideband and 5G Edge networks. Verizon and Visionable are collaborating on a secure next-generation digital healthcare collaboration platform that will allow healthcare professionals in the APAC and EMEA regions to access data, collaborate, and share resources.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Technology Snapshot

- 4.4.1 Wireless Personal Area Network (WPAN)

- 4.4.2 Wi-Fi

- 4.4.3 Worldwide Interoperability for Microwave Access (WiMAX)

- 4.5 Assessment of COVID-19 impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Advancements in Wireless Communication Technology

- 5.1.2 Emergence of Wearable Devices

- 5.2 Market Restraints

- 5.2.1 Resistance From Traditional Healthcare Providers

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 By Application

- 6.2.1 Hospitals and Nursing Homes

- 6.2.2 Home Care

- 6.2.3 Pharmaceuticals

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 South Korea

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Inc.

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Motorola Solutions Inc.

- 7.1.4 Koninklijke Philips NV

- 7.1.5 Qualcomm Technologies Inc.

- 7.1.6 Samsung Electronics Co. Ltd

- 7.1.7 Verizon Communications Inc.

- 7.1.8 Apple Inc.

- 7.1.9 Extreme Networks Inc.

- 7.1.10 Allscripts Healthcare Solutions Inc.