|

시장보고서

상품코드

1640339

북미의 무선 헬스케어 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)North America Wireless Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

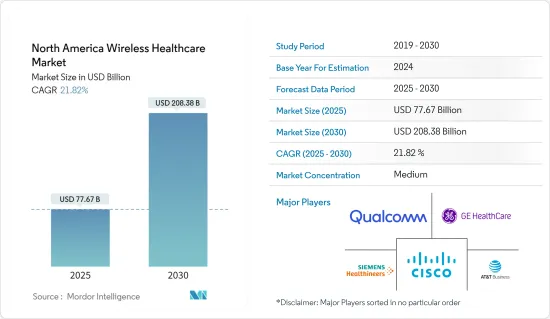

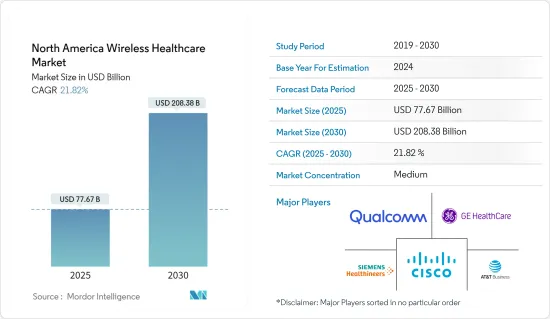

북미 무선 건강 관리 시장 규모는 2025년에 776억 7,000만 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 21.82%로, 2030년에는 2,083억 8,000만 달러에 달할 것으로 예측됩니다.

주요 하이라이트

- 만성 질환 증가, 노화 및 건강 관리 비용 절감의 필요성으로 인해 원격 환자 모니터링(RPM) 솔루션에 대한 수요가 증가할 것으로 예상됩니다. 환자의 필수 징후와 건강 지표를 원격 감시하는 무선 기기와 웨어러블은 건강 문제의 조기 발견으로 이어져 환자의 치료 결과를 향상시킵니다.

- 무선 자동 식별(RFID) 기술을 통해 병원은 주요 장비 위치와 장비 상태를 실시간으로 추적할 수도 있습니다. 플로리다 주 샹즈 병원에서는 무선 기술을 채택하여 분실물을 찾는 데 걸리는 시간을 98.8% 줄였습니다.

- 다양한 최종 사용자 산업 분야에서 사물 인터넷(IoT)과 관련된 서비스 및 애플리케이션이 증가하고 있습니다. IoT는 RFID 및 무선 센서 네트워크(WSN) 기술에서 클라우드 컴퓨팅, 인터넷 서비스, 가상 물리 시스템, 하드웨어 및 소프트웨어 장치 간의 상호 연결을 통합하는 첨단 기술로 진화하고 있습니다. 머신러닝(ML)과 인공지능의 역량은 특히 현재 헬스케어 업계의 기술을 다음 수준으로 끌어올리고 있습니다.

- 세계적인 의료 종사자 부족 현상도 시장 역학에 영향을 미치는 매개 변수 중 하나입니다. 예를 들어 미국에서도 2025년까지 12만 4,000명의 의사 부족에 직면할 것으로 예상되지만, 이는 아시아나 아프리카에서 예상되는 의사 부족보다 훨씬 적습니다. 이러한 요인은 의료 시설 업그레이드와 건강 관리 분야 개선에 대한 필요성을 보여주므로, 고도로 연결된 의료기기 수요가 증가하고 시장을 견인할 것으로 기대됩니다.

- 무선 헬스케어 산업의 개발은 5G, 사물 인터넷, 엣지 컴퓨팅, 인공지능(AI)과 같은 무선 통신 기술의 지속적인 개발에 의해 크게 지원되었습니다. 이러한 기술은 보다 빠르고 신뢰할 수 있는 데이터 전송, 실시간 모니터링 및 고급 분석을 가능하게 하여 의료 서비스 제공과 환자 치료 결과를 향상시킵니다.

- 그러나 무선 의료 기술을 통해 민감한 환자 데이터를 수집, 전송 및 저장하면 데이터 보안 및 환자 개인 정보 보호에 심각한 우려가 발생할 수 있습니다. 환자 정보의 유출 및 무단 액세스는 신뢰를 약화시키고 무선 의료 솔루션의 채택을 방해할 수 있습니다.

북미 무선 헬스케어 시장 동향

디지털 헬스 신흥기업의 존재와 헬스케어 기술에 대한 투자 증가가 시장 성장을 견인

- 무선 헬스케어 영역의 신흥기업 대두는 특정 병리, 환자층, 헬스케어 시나리오에 대응하는 특화형 솔루션의 창출로 이어집니다. 이러한 맞춤형 제품을 통해 무선 헬스케어 기술은 북미 환자의 다양하고 진화하는 요구를 충족하도록 설계되었습니다.

- 예를 들어, 2023년 7월, 65세 이상의 여성에게 1차 진료를 제공하는 Herself Health는 2,600만 달러의 시리즈 A 라운드를 확보했다고 발표했습니다. 또한 2023년 8월에는 미국에 본사를 둔 Healthcare Startup의 Daybreak가 유니언 스퀘어 벤처스가 주도하는 1,300만 달러의 시리즈 B 자금 확보를 발표했습니다. 현재 전략은 전국적으로 서비스를 다양한 학군으로 확대하는 것입니다.

- 많은 신흥 기업들은 무선 통신을 이용한 원격 의료 플랫폼과 원격 모니터링 솔루션에 주력하고 있습니다. 이러한 기술은 가상 진단, 원격 진단 및 지속적인 건강 추적을 가능하게 하여 환자가 집에 있는 동안 적시에 돌봄과 모니터링을 받을 수 있도록 합니다.

- 헬스케어 기술, 특히 무선 헬스케어 분야에 대한 투자 급증은 신흥기업에 자본을 주입하고 있습니다. 이러한 자금 지원은 무선 헬스케어 혁신 연구 개발, 상업화를 가속화하고 시장의 성장을 가속합니다.

- StartUp Health에 따르면 디지털 건강 분야에서 가장 중요한 투자 10건 중 8건은 2022년 미국에서 이루어졌습니다. 미국 기업인 울티마 제노믹스는 6억 달러의 투자를 받아 최대 거래가를 기록하였습니다. 이러한 사례는 미국이 건강 분야 신흥 기업에 대한 투자에 힘을 쏟게 되었음을 보여주며 이는 시장 성장에 기여하고 있습니다.

미국이 큰 시장 점유율을 차지

- 미국은 견고한 헬스케어 인프라, 기술 전문 지식, 전략적 투자를 통해 이 지역의 무선 헬스케어 혁명을 주도하고 환자 관리, 헬스케어 제공 및 웰니스 관리 전반의 변화를 추진하는 위치에 있습니다.

- 또한 미국에는 헬스케어 제공업체, 기술 기업, 규제 당국, 보험 회사, 환자 지원 단체 등 다양한 이해 관계자를 포괄하는 활기찬 디지털 건강 생태계가 존재합니다. 이러한 협력적인 환경은 무선 헬스케어 솔루션의 채택과 통합을 가속화하고 있습니다.

- 또한 미국에서는 원격 의료 서비스의 필요성으로 인해 원격 의료 및 가상 케어 분야가 크게 성장하고 있습니다. 무선 기술은 원활한 원격 의료 상담, 원격 모니터링, 디지털 건강 플랫폼을 가능하게 하고, 미국을 무선 헬스케어 도입에 적합한 국가로 만듭니다.

- 게다가 미국 의사회(AMA)에 따르면 2022년에는 미국 내 효율적이고 개선된 환자 관리의 중요성이 높아짐에 따라 원격 방문 또는 가상 방문이 더 많이 채용될 것으로 예측했으며 이는 응답자의 약 80%를 차지합니다.

- 또한 미국은 무선 의료 기술의 혁신 허브로서 환자 관리, 진단, 치료 및 예방 조치를 제공하는 혁신적인 솔루션의 창출을 촉진하고 있습니다.

북미 무선 헬스케어 산업 개요

북미의 무선 헬스케어 시장은 중간 정도의 집중도를 나타낼 것으로 예상되는데 이는 큰 시장 점유율을 가진 기존 세계 기업의 존재와 신규 진출기업의 출현 때문입니다. 많은 주요 기업들이 이 지역 시장 존재를 확대하기 위해 제휴, 협력, 혁신적인 노력에 적극적으로 참여하고 있습니다. 이 시장에서 사업을 전개하고 있는 유명한 기업으로는 GE HealthCare Technologies Inc., Siemens Healthcare GmbH, AT&T Inc., Cisco Systems, Inc., Qualcomm Technologies, Inc. 등이 있습니다.

2023년 7월, Siemens Healthyners는 미국에서 수술 교육을 추진하기 위해 Atrium Health와 전략적 제휴를 발표하여 유명한 비영리 의료 조직 Atrium Health의 자회사 인 IRCAD North America와의 전략적 파트너 지위를 확립했습니다. 새롭게 설립된 의료 학습 센터 오브 엑설런스는 지멘스 헬시니어스의 최첨단 의료 영상 기술을 활용하여 커리큘럼 개발에 참여하여 외과의사 팀의 전반적인 교육 경험을 향상시킵니다.

2023년 2월 신시내티에 본사를 둔 통합 의료 제공 시스템 개발업체 트라이헬스는 의료기술의 세계 리더인 로얄 Philips와 장기적인 전략적 제휴를 체결했습니다. 이 파트너십은 베세스다 노스 병원 캠퍼스 내에 있는 트라이헬스 심장 혈관 연구소와 해롤드 앤 유지니아 토마스 종합 케어 센터를 지원하기 위한 것입니다. Philips의 종합적인 심장병 솔루션을 활용함으로써 트라이헬스는 양질의 서비스를 제공하고, 다른 의료 제공자와 연계하여 연계 케어를 확보하면서 심장 케어의 제공을 확대하는 것을 목표로 하고 있습니다. 게다가 이 파트너십은 차세대 의료 전문가를 육성하는데 있어서 매우 중요한 역할을 할 것입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자 및 소비자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 시장에 대한 COVID-19의 영향 평가

제5장 시장 역학

- 촉진요인

- 헬스케어 분야 커넥티드 디바이스의 채용 확대

- 높아지는 기술 진보

- 디지털 헬스 신흥기업의 존재감 증가와 헬스케어 기술 투자 증가

- 억제요인

- 데이터 보안 및 디바이스 인증의 과제

- 네트워크 인프라 부족

- 기술 스냅샷

- 무선 개인 영역 네트워크(WPAN)

- Wi-Fi

- WiMAX(마이크로파 액세스를 위한 세계적 상호운용성)

제6장 시장 세분화

- 컴포넌트별

- 하드웨어

- 소프트웨어

- 서비스

- 용도별

- 병원 및 요양 시설

- 홈케어

- 의약품

- 지역별

- 미국

- 캐나다

제7장 경쟁 구도

- 기업 프로파일

- GE HealthCare Technologies Inc.

- Siemens Healthcare GmbH

- AT&T Inc.

- Cisco Systems, Inc.

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd

- Verizon Communication Inc.

- Apple Inc.

- athenahealth, Inc.

- Motorola Solutions Inc.

제8장 투자 분석

제9장 시장의 미래

CSM 25.02.17The North America Wireless Healthcare Market size is estimated at USD 77.67 billion in 2025, and is expected to reach USD 208.38 billion by 2030, at a CAGR of 21.82% during the forecast period (2025-2030).

Key Highlights

- The demand for remote patient monitoring (RPM) solutions is anticipated to rise due to the increased prevalence of chronic diseases, the aging population, and the need to reduce healthcare costs. Wireless devices and wearables that monitor patients' essential signs and health metrics remotely can lead to the early detection of health issues and enhance patient outcomes.

- Wireless radio frequency identification (RFID) technology also allows hospitals to track the real-time location of critical equipment and the condition of the equipment. The Shands Hospital in Florida experienced a 98.8% reduction in the hours spent searching for missing items by adopting wireless technology.

- There is an increased number of services and applications associated with the Internet of Things (IoT) across different end-user industry disciplines. IoT has evolved from RFID and wireless sensor network (WSN) technologies to more advanced technology, with the integration of cloud computing, Internet services, cyber-physical systems, and interconnections between hardware and software devices. Machine learning (ML) and AI capabilities are taking their skills to the next level, especially in the current healthcare industry.

- A worldwide shortage of healthcare workers is another parameter influencing the market dynamics. For instance, the United States alone is projected to face a shortage of 124,000 physicians by 2025, which is much less than the anticipated shortages in Asian and African regions. These factors indicate the need for upgraded medical facilities and improvement in the healthcare sector, which, in turn, is expected to drive the market, as advanced and connected medical equipment is likely to experience more demand.

- The development of the wireless healthcare industry has been significantly supported by ongoing developments in wireless communication technologies, such as 5G, the Internet of Things, edge computing, and artificial intelligence (AI). These technologies can enable faster and more reliable data transmission, real-time monitoring, and advanced analytics, enhancing healthcare delivery and patient outcomes.

- However, collecting, transmitting, and storing sensitive patient data through wireless healthcare technologies might raise significant concerns about data security and patient privacy. Breaches or unauthorized access to patient information can weaken trust and hinder the adoption of wireless healthcare solutions.

North America Wireless Healthcare Market Trends

Presence of Digital Health Startups and Increased Investments in Healthcare Technology to Drive the Market Growth

- The rise of startups in the wireless healthcare domain leads to the creation of specialized solutions catering to specific medical conditions, patient demographics, and healthcare scenarios. These tailored offerings ensure that wireless healthcare technologies are designed to meet North American patients' diverse and evolving needs.

- For instance, in July 2023, Herself Health, a business that provides primary care for women over the age of 65, said that it had secured a USD 26 million Series A fundraising round. Further, in August 2023, Daybreak, a United States-based healthcare startup, announced a USD 13 million Series B funding, which Union Square Ventures is leading. The current strategy is to expand its service footprint across additional school districts nationally.

- Many startups focus on telehealth platforms and remote monitoring solutions that utilize wireless communication. These technologies enable virtual consultations, remote diagnostics, and continuous health tracking, ensuring patients receive timely care and monitoring from the comfort of their homes.

- The surge in investments in healthcare technology, particularly in the wireless healthcare sector, injects capital into startups and emerging companies. This financial support accelerates wireless healthcare innovations' research, development, and commercialization, fostering market growth.

- Moreover, as per StartUp Health, eight of the ten most significant investments in the field of digital health were made in the United States in 2022. Ultima Genomics, a US business, received USD 600 million in investment, making it the biggest deal. Such instances indicate the country's increased focus on investments in health startups, thereby contributing to the market growth.

United States to Hold a Significant Market Share

- The United States is positioned to guide the region's wireless healthcare revolution with its robust healthcare infrastructure, technological expertise, and strategic investments, driving transformative changes in patient care, healthcare delivery, and overall wellness management.

- Further, the country hosts a vibrant digital health ecosystem encompassing a wide spectrum of stakeholders, including healthcare providers, technology companies, regulators, insurers, and patient advocacy groups. This collaborative environment accelerates the adoption and integration of wireless healthcare solutions.

- In addition, the United States has witnessed significant growth in telehealth and virtual care, driven by the need for remote healthcare services. Wireless technologies enable seamless telehealth consultations, remote monitoring, and digital health platforms, making the country favorable for wireless healthcare adoption.

- Moreover, according to the American Medical Association (AMA), in 2022, tele-visits or virtual visits account for a more significant adoption rate, accounting for about 80% of the respondents, owing to the increased significance of efficient and improved patient care in the country.

- Further, the United States serves as an innovation hub for wireless healthcare technologies, promoting the creation of innovative solutions that can transform patient care, diagnostics, treatment, and preventive measures.

North America Wireless Healthcare Industry Overview

The North American wireless healthcare market is expected to exhibit a moderate level of concentration, attributed to the presence of established global players with substantial market shares and the emergence of new entrants. Many key players are actively engaging in partnerships, collaborations, and innovative initiatives to expand their market presence within the region. Prominent companies operating in this market include GE HealthCare Technologies Inc., Siemens Healthcare GmbH, AT&T Inc., Cisco Systems, Inc., and Qualcomm Technologies, Inc., among others.

In July 2023, Siemens Healthineers announced a strategic partnership with Atrium Health to advance surgical training in the United States, marking their position as the inaugural strategic partner with IRCAD North America, a subsidiary of the renowned nonprofit healthcare organization Atrium Health. The newly established Center of Excellence for Medical Learning will leverage Siemens Healthineers' cutting-edge medical imaging technologies, participate in curriculum development, and enhance the overall educational experience for surgeons and their teams.

In February 2023, TriHealth, an integrated healthcare delivery system headquartered in Cincinnati, entered into a long-term strategic collaboration with Royal Philips, a global leader in health technology. This partnership is designed to support the TriHealth Heart & Vascular Institute situated on the Bethesda North Hospital campus and the Harold and Eugenia Thomas Comprehensive Care Center. By leveraging Philips' comprehensive cardiology solutions, TriHealth aims to expand its cardiac care offerings while delivering high-quality services and collaborating with other healthcare providers to ensure coordinated care. Additionally, this partnership will play a pivotal role in training the next generation of medical professionals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Connected Devices in Healthcare

- 5.1.2 Growing Technological Advancements

- 5.1.3 Growing Presence of Digital Health Startups and Increased Investments in Healthcare Technology

- 5.2 Market Restraints

- 5.2.1 Data Security and Device Certification Challenges

- 5.2.2 Lack of Networking Infrastructure

- 5.3 Technology Snapshot

- 5.3.1 Wireless Personal Area Network (WPAN)

- 5.3.2 Wi-Fi

- 5.3.3 Worldwide Interoperability for Microwave Access (WiMAX)

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Hardware

- 6.1.2 Software

- 6.1.3 Services

- 6.2 Application

- 6.2.1 Hospitals and Nursing Homes

- 6.2.2 Home Care

- 6.2.3 Pharmaceuticals

- 6.3 Geography

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 GE HealthCare Technologies Inc.

- 7.1.2 Siemens Healthcare GmbH

- 7.1.3 AT&T Inc.

- 7.1.4 Cisco Systems, Inc.

- 7.1.5 Qualcomm Technologies, Inc.

- 7.1.6 Samsung Electronics Co., Ltd

- 7.1.7 Verizon Communication Inc.

- 7.1.8 Apple Inc.

- 7.1.9 athenahealth, Inc.

- 7.1.10 Motorola Solutions Inc.