|

시장보고서

상품코드

1640610

무선 헬스케어 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Wireless Healthcare - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

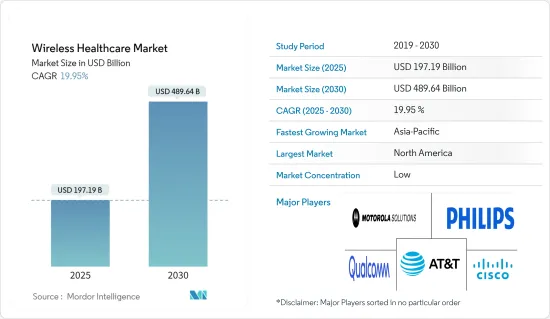

무선 헬스케어 시장 규모는 2025년에 1,971억 9,000만 달러로 추정되고, 예측 기간(2025-2030년)의 CAGR은 19.95%로 전망되며, 2030년에는 4,896억 4,000만 달러에 달할 것으로 예측됩니다.

무선 헬스케어 시장은 디지털화의 진전, 커넥티드 디바이스의 이용 확대, 무선 기술의 진보, 질 높은 헬스 케어에 대한 수요 증가와 함께 헬스 케어 기관이 환자 중심의 어프로치를 채용하게 된 것 등이 주요 요인입니다.

주요 하이라이트

- 세계의 헬스케어 부문은 최근 몇 년동안 디지털화가 급속히 진행되고 있습니다. 인터넷과 무선 통신 기술의 침투가 시장 연구를 뒷받침하고 있습니다. 커넥티드 병원에서 간병인은 시간이 많이 걸리는 관리 업무를 쫓지 않고 무선 헬스케어 장비를 사용하여 환자에게 양질의 케어를 제공합니다. 의사와 간호사는 최신 환자 정보에 쉽게 액세스할 수 있으므로 실시간 헬스케어 정보를 뒷받침하는 치료 결정이 가능하므로 환자 결과가 개선됩니다.

- 지속적인 모니터링을 위한 웨어러블 디바이스가 시장을 견인하고 있습니다. 스마트폰의 보급과 웨어러블 디바이스의 수용에 의해 헬스케어 기기와 진단센터는 바이탈 사인을 모니터해, 원격 액세스 가능한 온라인 플랫폼에 실시간으로 송신할 수 있는 신체 장착형 센서의 실험을 진행하고 있습니다.

- 게다가, 이 부문에서 웨어러블 디바이스를 채택하는 것은 최근 몇 년간 견인력을 증가시키고 있으며, 이는 무선 의료 시장에 영향을 미치는 중요한 요소 중 하나가 되었습니다. 웨어러블 연결 장치의 주요 동향은 통증 관리 웨어러블 장치 수요 증가, 심혈관 질환 관리를 위한 웨어러블 사용 증가 등을 포함합니다.

- 또한 인구 고령화와 장기간의 만성 질환 상태로 인한 원격 환자 모니터링 솔루션에 대한 수요 증가는 시장 성장에 영향을 미치는 주요 요인입니다. 병원 관리자는 항상 환자 관리 수준을 지속적으로 향상시키면서 비용을 절감하기 위해 압력을 받고 있습니다. 이러한 환경에서 병원은 보다 효율적으로 운영하고, 환자 관리를 지원하고, 환자 경험을 향상시키기 위해 무선 기술을 이용합니다.

- 예를 들어, 간호 직원의 워크플로우를 더 잘 이해하고 개선하기 위해 병원은 간호사의 ID 배지에 병원의 Wi-Fi 네트워크와 연동하는 RFID 태그를 장착합니다. 이 태그는 교대를 통해 간호사의 움직임을 추적합니다. 데이터는 수집, 분석 및 프로세스를 개선하기 위해 인사이트를 병원에 설명합니다. 무선 RFID 기술을 통해 병원은 중요한 장비의 위치와 장비 상태를 실시간으로 추적할 수 있습니다.

- 그러나 사이버 보안과 개인 정보 보호 문제는 시장 성장을 억제하고 있습니다. 병원이나 클리닉 등의 헬스 케어 센터에서는 치료중에 방대한 양의 헬스 케어 데이터가 생성되어 이러한 데이터가 도난당하면 환자의 프라이버시가 손상될 가능성이 있기 때문입니다.

- COVID-19의 발생은 조사 대상 시장의 성장을 가능하게 했습니다. 사회적 거리의 필요성은 의료 산업에서 무선 기술의 사용을 지원했습니다. 이를 통해 원격 모니터링 및 원격 모니터링 시스템을 배포할 수 있어 무선 인프라 배포가 필요했습니다. 또한 정부 보건기구는 의료 시설에 원격 모니터링 스펙트럼의 확대를 허용했습니다. 예를 들어, 2020년 3월, FDA는 비침습적 생명 신호 측정 장치를 허가하여 의료 서비스 제공업체가 환자를 원격 모니터링할 수 있도록 사용을 확대했습니다. 이러한 이니셔티브가 유행 중 무선 헬스케어 시장을 견인했습니다.

무선 헬스케어 시장 동향

헬스케어에서 사물인터넷(IoT)과 웨어러블 디바이스 채용 증가가 무선 헬스케어 시장을 견인

- 헬스케어 IT의 진화는 사물인터넷(IoT)과 웨어러블 디바이스의 헬스케어 산업에 대한 개입에 의해 강화되어 병원 환경의 접속이 요구되게 되었습니다. 무선 네트워크 솔루션은 헬스케어 직원이 원격지에서 파일에 액세스하여 사용할 수 없는 경우 직접 진단할 수 있도록 하여 헬스케어 산업에 기여합니다.

- 또한 의료 인프라가 크게 강화됨에 따라 사물인터넷(IoT) 지원 원격 모니터링 및 통신 기술이 지난 몇 년동안 큰 지지를 받고 있습니다. 그 결과, 병원이나 간병 시설에서 무선 헬스케어 솔루션이 널리 채용되어, 신체에 장착한 센서를 통해 헬스케어 정보를 축적해, 질 높은 치료나 케어를 제공하게 되었습니다.

- 또한 IoT의 영향은 의사와 병원 조직이 환자를 돌보는 방식을 바꾸어 헬스케어를 단순화하고 비용을 절감하고 중요한 헬스케어 정보에 대한 액세스를 개선하는 데 기여합니다. 또한, 심장 질환의 비율이 빠르게 증가하고 있기 때문에 IoT 시스템은 병원에서 환자의 심전도를 지속적으로 모니터링하는 알고리즘을 활용합니다. 심전도(ECG) 모니터링은 심장의 전기적 활동을 기록하여 심박수와 기본 리듬을 추적합니다. ECG 모니터는 무선 송신기와 수신기로 구성됩니다. 자동화된 애플리케이션은 비정상적인 심장 활동을 식별하고 데이터는 네트워크를 통해 실시간으로 휴대폰 및 의사 클리닉으로 전송됩니다.

- 의료 조직 및 전문가들은 IoT 및 웨어러블 장치의 보급으로 환자의 건강 상태와 생체 신호를 모니터링하기 위해 많은 유형의 데이터 수집 및 건강 경고 시스템에 의존합니다. 예를 들어, ETNO의 데이터에 따르면 유럽 연합(EU)의 헬스케어에서 사물 인터넷(IoT) 활성 연결 수는 2025년까지 1,034만 연결에 도달할 것으로 예상됩니다. 이를 통해 효율적인 무선 연결에 대한 수요가 더욱 높아지고 시장의 성장을 뒷받침할 수 있습니다.

북미가 큰 시장 점유율을 차지할 전망

- 북미는 풍부한 경제, 고령화된 인구층, 첨단 헬스케어 제공 시스템 등 기술적으로 진보된 헬스케어 시스템으로 인해 큰 시장 점유율을 차지할 것으로 예상됩니다. 또한 헬스케어 비용 증가와 의료 부문의 디지털화를 위한 정부의 이니셔티브가 활발해지고 있으며 예측 기간 동안 무선 의료 시장을 견인할 것으로 기대되고 있습니다.

- 게다가 첨단 1차 의료 커뮤니티, 광범위한 의료 생명 과학 연구 활동, 높은 헬스케어 지출 강도, 대규모 제약, 헬스케어 용품 및 의료기기 산업을 보유한 미국은 의료 서비스의 세계 최대 시장 중 하나입니다.

- 북미에는 무선 헬스케어 부문에서 사업을 전개하는 선도적인 공급업체가 있으며 시장을 빠르게 견인하고 있습니다. 또한, 의료의 디지털 변환은 환자, 간병인 및 병원의 연결을 실현하기 위해 최근 급속히 진행되고 있습니다.

- 또한 WIFI 6 및 WIFI 6E와 같은 무선 기술의 지속적인 발전은 이 지역의 의료기관으로부터 큰 지지를 얻고 있으며 시장 성장에 긍정적인 영향을 미치고 있습니다. 예를 들어, 노스캐롤라이나 주에 본사를 두고 있는 Novant Health는 3개 주에 걸쳐 있는 의사 클리닉, 외래 환자 센터, 병원의 통합 네트워크로 최근 익스트림 네트웍스의 엔터프라이즈급 Wi-Fi 6E 솔루션 도입을 발표했습니다. 익스트림 AP4,000 액세스 포인트(AP)를 도입함으로써, 이 병원은 시설 전체에 고속 Wi-Fi를 제공하여 미션 크리티컬한 헬스케어 앱과 헬스케어 기기에 전용의 안전한 접속을 가능하게 합니다.

무선 헬스케어 산업 개요

무선 헬스케어 시장은 기존의 솔루션과 소프트웨어 플랫폼의 개량, 신흥국 시장의 개척, 다른 시장 진출기업과의 전략적 제휴 등의 전략을 통해 시장 점유율을 확대하려고 하는 진출기업에 의해 세분화되고 있습니다. 따라서 이 시장에서는 여러 진출 기업이 각각 큰 점유율을 차지하고 있습니다. 주요 진출기업은 AT&T Inc., Cisco Systems Inc., Motorola Solutions Inc. 등이 있습니다.

2023년 12월-AT&T는 스마트 헬스케어 진출을 발표했습니다. 견고한 연결성과 첨단 기술을 활용하여 5G를 의료 인프라에 통합하면 대용량 이미지 파일을 전송하는 속도와 신뢰성이 크게 향상되었습니다. 이러한 진보는 환자 관리의 질과 접근성 향상에 중요한 역할을 합니다.

2023년 10월-Cisco와 Bang & Olufsen은 오늘 외출중인 전문가를 위한 맞춤형 엔터프라이즈급 기능을 갖춘 새로운 트루 무선 이어폰을 발표했습니다. 이 제품 릴리즈는 Cisco와 Bang & Olufsen의 파트너십의 연장선에 있으며, 비즈니스 내외부의 라이프 스타일에 맞는 다기능 장치에 대한 고객의 기대감을 높일 수 있습니다.

2022년 10월-Xenter는 헬스케어 부문에서 신기술의 채택을 촉진하기 위해 회사의 무선 'Technology in Medicine' 생태계의 최초 제품인 XenFI를 출시했습니다. XenFI는 XMD(HIPAA 호환 세계 헬스케어 클라우드)와 XenFI-Hub로 구성되며, Xenter 무선 통신 장치는 다양한 헬스케어 환경을 위해 설계되었습니다. 이러한 최초의 Xenter 제품은 스마트 무선 장치 구현, 임상 워크플로우 자동화, 환자 결과 개선, 헬스케어 비용 절감을 위해 설계되었습니다.

2022년 6월-GE Healthcare는 환자 체류를 지속적으로 모니터링하는 무선 환자 모니터링 시스템 Portrait Mobile을 출시했습니다. 이 무선 환자 모니터링 시스템은 임상의가 환자의 악화를 감지하는 데 도움이 됩니다. Portrait Mobile에는 모바일 모니터와 통신하는 환자 장착형 무선 센서가 포함되어 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건 및 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력-Porter's Five Forces 분석

- 신규 진입업자의 위협

- 구매자 및 소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 산업 밸류체인 분석

- COVID-19가 시장에 미치는 영향의 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 인터넷과 무선 통신 기술의 보급

- 헬스케어에서 사물인터넷(IoT)과 웨어러블 디바이스의 채용 증가가 무선 헬스 케어 시장 견인

- 시장 성장 억제요인

- 사이버보안 및 프라이버시 문제

제6장 시장 세분화

- 기술 부문별

- 무선 개인 영역 네트워크(WPAN)

- Wi-Fi

- 세계 마이크로파 액세스 상호 운용성(WiMAX)

- 무선 광역 네트워크(WWAN)

- 컴포넌트별

- 하드웨어

- 소프트웨어

- 서비스

- 용도별

- 병원 및 간병 시설

- 재택 헬스케어

- 의약품

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

제7장 경쟁 구도

- 기업 프로파일

- AT&T Inc.

- Cisco Systems Inc.

- Motorola Solutions Inc.

- Philips Healthcare(Koninklijke Philips NV)

- Qualcomm Technologies, Inc.

- Samsung Group

- Verizon Communication Inc.

- Apple Inc.

- Aerohive Networks Inc.

- Allscripts Healthcare Solutions Inc.

제8장 투자 분석

제9장 시장 기회 및 향후 동향

AJY 25.02.14The Wireless Healthcare Market size is estimated at USD 197.19 billion in 2025, and is expected to reach USD 489.64 billion by 2030, at a CAGR of 19.95% during the forecast period (2025-2030).

The wireless healthcare market is major driven by increasing digitization, growth in the use of connected devices, advancements in wireless technology, and rising adoption of patient-centric approaches by healthcare organizations coupled with growing demand for quality healthcare.

Key Highlights

- The healthcare sector worldwide has rapidly undergone a significant digital transformation over the past few years. The penetration of the internet and wireless communication technology is driving the market studied. In a connected hospital, caregivers use wireless medical equipment to provide patients with quality care rather than being preoccupied with time-consuming administrative tasks. Doctors and nurses can easily access up-to-date patient information, enabling treatment decisions supported by real-time medical information, thus, resulting in improved outcomes for patients.

- Wearable devices for continuous monitoring are driving the market. Owing to the proliferation of smartphones and the acceptance of wearable devices, medical devices and diagnostic centres are experimenting with body-worn sensors that can monitor vital signs and transmit them in real time to an online platform that can be remotely accessed.

- Further, the adoption of wearable devices in this sector has been gaining traction in recent times, which, in turn, has been one of the significant factors influencing the wireless healthcare market. The major trends in wearable connected devices include increasing demand for pain management wearable devices, increasing use of wearables for cardiovascular disease management, and others.

- Moreover, the growing demand for remote patient monitoring solutions due to the aging population and long-term chronic disease conditions is the major factor impacting the market's growth. There is constant pressure on hospital administrators to lower costs while continuing to improve the level of patient care. In this environment, hospitals use wireless technologies to operate more efficiently, support patient care, and improve their experience.

- For instance, to better understand and improve the workflow of nursing staff, hospitals are equipping nurse ID badges with an RFID tag that works with the hospital's Wi-Fi network. These tags track the movement of the nurses throughout their shifts. The data is captured and analyzed, providing insights to the hospital to improve the processes. Wireless RFID technology also allows hospitals to track the real-time location of critical equipment and the condition of the equipment.

- However, issues about cybersecurity and privacy are restraining the market growth, as vast amounts of healthcare data are generated during treatment in medical centers, such as hospitals and clinics, and the theft of such data can damage patients' privacy.

- The outbreak of COVID-19 enabled the growth of the market studied. The need for social distancing supported the use of wireless technology in the healthcare industry. This enabled the deployment of remote monitoring and telemonitoring systems, which demanded wireless infrastructure deployment. Also, government health bodies were allowing healthcare facilities to expand their remote monitoring spectrum. For example, in March 2020, FDA cleared non-invasive vital sign measuring devices to expand their use to help healthcare providers to monitor patients remotely. Such initiatives had driven the market for wireless healthcare during the pandemic.

Wireless Healthcare Market Trends

Increasing Adoption of Internet of Things (IoT) and Wearble Devices in Healthcare to Drive the Wireless Healthcare Market

- The evolution of healthcare IT has been augmented by the intervention of the Internet of Things (IoT) and wearable devices in the industry, which called for a connected hospital environment. Wireless network solutions are helping the healthcare industry by allowing practitioners to access files remotely to direct diagnosis in case of unavailability.

- Moreover, with the substantial enhancements in the healthcare infrastructure, Internet of Things (IoT)-enabled remote monitoring and communication technologies are gaining significant traction over the past few years. This, in turn, has fostered the widespread adoption of wireless healthcare solutions in hospitals and nursing homes to provide quality treatment and care by accumulating medical information via body-worn sensors.

- Further, IoT's impact is changing how doctors and hospital organizations care for their patients and helping simplify healthcare, lower costs, and improve access to critical medical information. Moreover, as the heart disease rate is increasing rapidly, the IoT system utilizes algorithms for continuous ECG monitoring in patients at the hospital. In electrocardiogram (ECG) monitoring, the system keeps track of the heart rate and basic rhythm by recording the heart's electrical activities. The ECG monitor consists of a wireless transmitter and a receiver. An automated application can identify abnormal heart activity, and the data is transferred in real-time to mobile phones and the doctor's clinic via the network.

- Healthcare organizations and professionals rely on many types of data gathering or health alert systems to monitor a patient's health and vital signs owing to the proliferation of IoT and wearable devices. For instance, according to the data from ETNO, the number of Internet of Things (IoT) active connections in healthcare in the European Union (EU) is expected to reach 10.34 million connections by 2025. This further boost the demand for efficient wireless connectivity, thus, in turn, boosting the market growth.

North America is Expected to Hold a Significant Market Share

- The North America region is expected to hold a significant market share owing to the technically advanced healthcare system, with prosperous economies, aging population segments, and advanced medical delivery systems. In addition, the growing healthcare expenditure coupled with increasing government initiatives to digitize the healthcare sector in the region are expected to drive the wireless healthcare market over the forecast period.

- Further, with an advanced primary medical community, extensive medical and life science research activities, high healthcare spending intensity, and large pharmaceutical and medical supply and device industries, the United States account for one of the world's largest markets for healthcare services.

- The North America region is home to some major market vendors operating in the wireless healthcare sector, thus driving the market rapidly. Further, digital transformation in healthcare had a rapid pace in recent years for offering connected patients, caregivers, and hospitals, primarily due to the focus on offering enhanced quality of care.

- Moreover, continuous advancements in wireless technology, such as WIFI 6 and WIFI 6E, are gaining significant traction from healthcare organizations in the region, thus positively impacting the market growth. For instance, North Carolina-headquartered Novant Health, a three-state integrated network of physician clinics, outpatient centers, and hospitals, recently announced the deployment of Extreme Networks' enterprise-grade Wi-Fi 6E solution. The Extreme AP4000 access point (AP) investment will enable the hospital to provide high-speed Wi-Fi throughout its facilities and allow dedicated, secure connectivity for mission-critical healthcare apps and medical devices.

Wireless Healthcare Industry Overview

The wireless healthcare market is fragmented as the players strive to increase their market shares through strategies, such as improvements in the existing solutions and software platforms, the development of new platforms, and strategic alliances with other market players. Therefore, several players account for significant individual shares in the market. Key players include AT&T Inc., Cisco Systems Inc., and Motorola Solutions Inc.

In December 2023, AT&T's has announced joining into smart healthcare is marked by its commitment to expanding high-speed internet and collaborating with the healthcare industry. By harnessing robust connectivity and advanced technology, Incorporating 5G into healthcare infrastructures markedly improves the speed and reliability with which these large imaging files are transmitted. This advancement plays a key role in enhancing the quality and accessibility of patient care.

In October 2023, Cisco and Bang & Olufsen today unveiled new true wireless earbuds built with enterprise-grade features customized for professionals on-the-go. This product release is an extension of the Cisco and Bang & Olufsen partnership, which addresses increased customer expectation for multifunctional devices that fit their lifestyles in and out of work.

In October 2022, Xenter announced the launch of XenFI, the first product in the company's wireless "Technology in Medicine" ecosystem, to improve the adoption of new technology in the healthcare sector. The newly launched product comprises XMD (a HIPAA-compliant, global healthcare cloud) and its XenFI-Hub, Xenter's wireless communications device designed for various healthcare settings. These first Xenter products are designed to enable smart/wireless devices, automate clinical workflow, improve patient outcomes, and lower healthcare costs.

In June 2022, GE Healthcare launched Portrait Mobile, a wireless patient monitoring system that continuously monitors a patient's stay. The wireless patient monitoring system helps clinicians detect patient deterioration. Portrait Mobile includes patient-worn wireless sensors which communicate with a mobile monitor.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Penetration of Internet and Wireless Communication Technology

- 5.1.2 Increasing Adoption of Internet of Things (IoT) and Wearable Devices in Healthcare to Drive the Wireless Healthcare Market

- 5.2 Market Restraints

- 5.2.1 Cyber security and Privacy Issues

6 MARKET SEGMENTATION

- 6.1 Technology

- 6.1.1 Wireless Personal Area Network (WPAN)

- 6.1.2 Wi-Fi

- 6.1.3 Worldwide Interoperability for Microwave Access (WiMAX)

- 6.1.4 Wireless Wide Area Network (WWAN)

- 6.2 Component

- 6.2.1 Hardware

- 6.2.2 Software

- 6.2.3 Services

- 6.3 Application

- 6.3.1 Hospitals and Nursing Homes

- 6.3.2 Home Care

- 6.3.3 Pharmaceuticals

- 6.3.4 Other Applications

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AT&T Inc.

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Motorola Solutions Inc.

- 7.1.4 Philips Healthcare (Koninklijke Philips N.V.)

- 7.1.5 Qualcomm Technologies, Inc.

- 7.1.6 Samsung Group

- 7.1.7 Verizon Communication Inc.

- 7.1.8 Apple Inc.

- 7.1.9 Aerohive Networks Inc.

- 7.1.10 Allscripts Healthcare Solutions Inc.