|

시장보고서

상품코드

1850190

차세대 메모리 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Next Generation Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

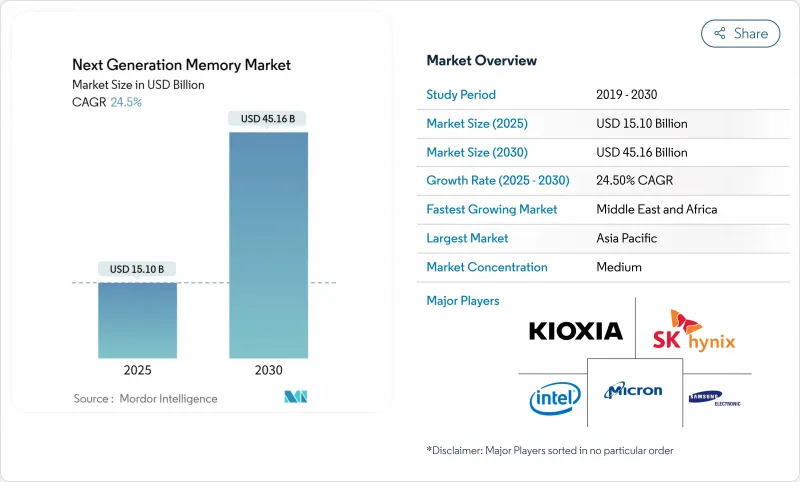

차세대 메모리 시장 규모는 2025년에 151억 달러로 평가되었고, 2030년에는 451억 6,000만 달러에 이를 것으로 예측되며, CAGR은 24.5%를 나타낼 전망입니다.

AI 훈련 클러스터, 엣지 서버, 자율주행 차량이 모두 기존 DRAM-NAND 계층 구조의 지연 시간 한계에 부딪히면서 수요가 가속화되었습니다. 공급업체들은 확대되는 컴퓨팅-메모리 간 격차를 해소하기 위해 고대역폭 아키텍처, 지속적 스토리지 클래스 디바이스, 고급 패키징을 우선시했습니다. 아시아태평양 지역은 생산 중심지로 자리매김한 반면, 북미 지역의 팹 인센티브는 병행 생산 능력 확장을 촉진했습니다. 컴퓨트 익스프레스 링크(CXL) 및 유니버설 칩릿 인터커넥트 익스프레스(UCIe)와 같은 인터페이스 혁신은 시스템 설계 철학을 재편하기 시작했으며, 가속기 수에 거의 선형적으로 확장되는 분산형 메모리 풀을 장려하고 있습니다. 그러나 프리미엄 노드 및 웨이퍼에 대한 공급 제약은 차세대 메모리 시장 전반에 걸쳐 가격 및 할당 전략을 계속해서 좌우하고 있습니다.

세계의 차세대 메모리 시장 동향 및 인사이트

하이퍼스케일 데이터센터의 AI 주도 HBM 수요

급증하는 트랜스포머 모델 규모로 인해 클라우드 운영사들은 서버급 DRAM 및 솔리드 스테이트 예산을 두 배로 늘려야 했으며, 이로 인해 용량보다 대역폭이 주요 병목 현상이 되었습니다. 고대역폭 메모리(HBM)는 링크 처리량을 1.5TB/s 이상으로 증대시키고 전송된 비트당 에너지 소비를 획기적으로 절감했습니다. SK하이닉스가 2025년 HBM 전체 생산량을 사전 완판했다고 발표하면서 글로벌 공급이 더욱 타이트해졌고, 이는 2026년 물량에 대한 장기 예약으로 이어졌습니다. 마이크론은 AI 서버가 기존 x86 노드 대비 거의 두 배에 달하는 DRAM을 탑재한다고 분석했습니다. 이에 차세대 메모리 시장은 비트당 비용 경쟁에서 대역폭 경쟁으로 전환되며 프리미엄 가격 계층화와 마진 확대 기회를 창출했습니다.

차량용 L4 ADAS에는 인스턴트 온 지속성 메모리가 필요

레벨 4 자율주행은 전원 차단 후 결정론적 복구와 150°C를 초과하는 가혹한 작동 온도를 요구합니다. 강유전성 RAM(FRAM) 장치는 대기 전원이 없어도 데이터를 유지하며 1014회 사이클을 견뎌내, 최대 100GB/s를 생성하는 센서 융합 스택의 콜드 스타트 가용성을 보장합니다. 자동차 제조사들은 현재 FRAM과 LPDDR5X 스크래치 패드를 결합한 비대칭적 비휘발성-휘발성 하이브리드 기술을 평가 중입니다. 이러한 아키텍처는 임무 로그를 보호하고, 무선 업데이트를 용이하게 하며, ISO 26262 기준의 기능 안전 목표를 지원하여 모빌리티 가치 사슬 전반에 걸친 차세대 메모리 시장 성장을 강화합니다.

차량용 PCM의 열 안정성 결함

상변화 합금은 150°C 이상에서 데이터 유지에 어려움을 겪어 사막 및 엔진룸 배치 시 이벤트 레코더 무결성을 위협했습니다. 재료 공학은 내구성 범위를 153°C까지 확장하는 게르마늄 풍부 GeSbTe 및 직렬 PCM 셀 쌍을 탐구했으나, 이는 리소그래피 공정 단계와 비용을 추가했습니다. 따라서 OEM 인증 주기가 PCM 채택을 지연시켜, 신뢰성 목표가 달성될 때까지 단기 설계 승리는 FRAM과 ReRAM으로 이동했습니다. 이 제약은 전체 성장을 압박했으며, 특히 차세대 메모리 시장의 자동차 하위 부문에서 두드러졌습니다.

부문 분석

휘발성 디바이스는 HBM의 높은 용량 프리미엄에 힘입어 2024년 매출의 85.6%를 차지했습니다. AI 가속기가 1TB/s 미만 성능을 포화시키면서 HBM 구매 계약이 여러 회계 연도에 걸쳐 지속됨에 따라 이러한 우위는 유지되고 있습니다. 휘발성 솔루션의 차세대 메모리 시장 규모는 점유율이 하락하더라도 절대적 기준으로는 계속 확대될 전망입니다. 이는 ReRAM, PCM, MRAM이 엣지 및 계측 워크로드에서 신뢰성을 확보함에 따른 결과입니다. ReRAM은 비휘발성 메모리 성장세를 주도하며, 추가 마스크 없이 28nm 노드에서 공동 제조 가능한 단순 금속 산화물 적층 구조 덕분에 연평균 38.3% 성장률을 기록할 것입니다. PCM의 점진적인 열 안정성 향상은 10년간 150°C 유지 성능 기준이 인증되면 자동차 시장 진입을 가능케 할 전망입니다. MRAM 발전은 향후 EUV(극자외선) 공정 능력과 NAND 대비 비트당 프리미엄을 축소하는 공정 단순화에 여전히 의존합니다.

구조적으로 휘발성 메모리 제조사들은 현재 스택형 칩릿 토폴로지를 탐색하며 다이 면적을 줄이고 수율 리스크를 분산시키고 있습니다. 비휘발성 메모리 경쟁사들은 면적을 차지하는 트랜지스터를 제거하는 크로스포인트 어레이 및 셀렉터 없는 설계로 대응합니다. 전망 기간 동안 ReRAM과 PCM의 공급 가속화로 휘발성 메모리 시장 점유율이 약 10% 포인트 감소할 것으로 예상되나, AI 서버 총 시장 규모(TAM)가 두 배로 증가함에 따라 휘발성 메모리의 절대적 매출은 여전히 증가할 전망입니다. 설계자들은 휘발성과 비휘발성 다이를 공동 패키징하여 내구성과 지속성을 교환하는 하이브리드 스택을 계속 개발할 것입니다. 이러한 역학은 다중 노드 로드맵을 보장하며 차세대 메모리 시장 내 솔루션 다양성을 확대합니다.

대역폭 집약적 가속기에 맞춰진 인터페이스는 단일 실리콘이 따라잡기 훨씬 전부터 존재했습니다. 2024년 DDR 및 LPDDR 채널은 38.3% 점유율을 유지했으나 소켓당 4채널에서 채택 한계가 나타났습니다. CXL의 PCIe 5.0 기반 캐시 일관성 연결은 이 한계를 완화하여 공유 스위치 뒤에 테라바이트급 메모리를 풀링하고 유휴 용량을 대폭 줄였습니다. 2024년 8월 UCIe 2.0 사양의 등장으로 기존 다이 간 대역폭의 75배에 달하는 3D 적층 칩릿이 구현되어 하이퍼스케일러가 단일 HBM 스택에 수십 개의 컴퓨팅 다이를 배치할 수 있게 되었습니다.

앞으로 2025년 신규 HPC 테이프아웃의 50%는 2.5D 또는 3D 다이 간 링크를 내장하여 CXL 또는 UCIe를 선택적 요소에서 필수 설계 요소로 격상시킬 것입니다. 리타이밍 허브와 리타이머는 부수적 수익원으로 부상합니다. 이러한 변화와 동시대에 PCIe/NVMe는 점진적 세대 이동을 지속하지만, SATA는 아카이브 틈새 시장으로 퇴조합니다. 종합적으로, 새로운 인터페이스는 용량 계획과 CPU 업그레이드 주기를 분리하는 모듈식 배포를 촉진하여 차세대 메모리 시장 내 다각화 옵션을 확대합니다.

차세대 메모리 시장은 기술별(휘발성, 비휘발성), 메모리 인터페이스별(DDR/LPDDR, PCIe/NVMe, SATA, 기타(CXL, Ucie)), 최종 용도 디바이스별(소비자 가전, 기업용 스토리지 및 데이터 센터, 자동차 전자 및 ADAS 등), 웨이퍼 크기별(200mm 미만, 300mm, 450mm), 지역별(북미, 남미, 유럽, 아시아태평양, 중동 및 아프리카)으로 분류됩니다.

지역별 분석

아시아태평양 지역은 2024년 매출의 47.3%를 차지하며 선두를 유지했습니다. 삼성, SK하이닉스, TSMC가 차세대 노드에 대한 총 자본 계획을 850억 달러 이상으로 유지한 덕분입니다. 중국은 국가 보조금과 우대 대출 조건을 바탕으로 자체 DRAM 생산 능력을 전 세계 점유율 5%로 끌어올렸으며, 2025년까지 10%를 목표로 하고 있습니다. 일본의 재개된 보조금은 현지 NAND 생산량과 특수 장비 클러스터를 유지시켰습니다. 인도는 조립, 테스트, 궁극적으로 3D NAND 슬라이싱을 목표로 한 합작 투자를 유치하는 제조 인센티브 프로그램을 시작했습니다. 이러한 지역적 깊이는 차세대 메모리 시장의 공급 안정성을 확보하고 양적 레버리지를 촉진했습니다.

북미의 CHIPS 인센티브는 마이크론의 아이다호 HBM 공장 및 텍사스 메모리 조립 센터를 촉진하여 국방 및 하이퍼스케일 조달을 위한 국내 생산 능력을 보장했습니다. 멕시코는 후공정 조립 흐름을 확보하여 미국의 전공정 웨이퍼 생산을 보완했습니다. 캐나다 연구기관들은 초저전력 비휘발성 메모리를 목표로 한 재료과학 혁신을 기여하며 대륙의 연구개발 영향력을 확대했습니다.

유럽은 반도체 법안 하에 전략적 자율성을 추구하며 2030년까지 글로벌 점유율 20%를 목표로 했습니다. 독일은 자동차 등급 메모리 컨소시엄에 보조금을 집중 투자한 반면, 프랑스는 ReRAM 파일럿 라인에 투자했습니다. 영국은 파운드리 중립적 IP를 통해 칩릿 다이-투-다이 구조를 우선시했습니다. 유럽 연합은 자동차 OEM과 지역 메모리 업체 간 긴밀한 협력을 모색하며 차세대 메모리 시장의 지역 수요를 강화했습니다.

중동 및 아프리카는 사우디아라비아와 UAE의 국부펀드 지원 팹을 기반으로 31.2%의 연평균 성장률 전망을 보이며 가장 빠른 성장세를 기록했습니다. 터키는 유라시아 패키징 허브로 자국을 마케팅했으며, 남아프리카 공화국은 통신망 고밀도화를 활용해 소비자 메모리 수요를 촉진했습니다. 기반은 소규모이지만, 적극적인 자본 배분과 노동력 역량 강화는 차세대 메모리 시장에서 해당 지역의 점유율이 지속적으로 상승할 가능성을 시사합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 하이퍼스케일 데이터센터에서의 HBM의 AI 주도 수요

- 자동차 L4 ADAS의 즉시 가동 지속 메모리 필요성

- 스마트폰의 LPDDR5X 및 임베디드 ReRAM으로의 전환

- 국가 메모리 현지화 프로그램

- 초저전력 FRAM이 필요한 산업용 엣지-IoT

- 3D XPoint를 활용한 데이터 프라이버시 중심의 지속적 인메모리 데이터베이스

- 시장 성장 억제요인

- ReRAM 규모 확대를 제약하는 450mm 웨이퍼 지연

- NAND 대비 높은 비트당 MRAM 비용

- 자동차 등급 PCM의 열적 안정성 결함

- 28nm 미만 STT-MRAM의 파운드리 집중화

- 밸류체인 분석

- 규제와 기술의 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

- 신흥 메모리 기술 로드맵 분석

- 거시 경제 요인이 시장에 미치는 영향

제5장 시장 규모와 성장 예측

- 기술별

- 비휘발성

- 상변화 메모리(PCM)

- 스핀 트랜스퍼 MRAM(STT-MRAM)

- 토글 MRAM

- 저항 변화형 RAM(ReRAM)

- 3D XPoint/옵탄

- 강유전체 RAM(FeRAM)

- 나노RAM

- 휘발성

- 고대역폭 메모리(HBM)

- 하이브리드 메모리 큐브(HMC)

- 저전력 DDR5/LPDDR5X

- 비휘발성

- 메모리 인터페이스별

- DDR/LPDDR

- PCIe/NVMe

- SATA

- 기타(CXL, UCIe)

- 최종 용도 디바이스별

- 소비자 가전

- 기업용 스토리지 및 데이터 센터

- 자동차 전자 및 ADAS

- 산업 IoT 및 제조 자동화

- 항공우주 및 방위

- 헬스케어 및 의료기기

- 기타(스마트 카드, 웨어러블)

- 웨이퍼 사이즈별

- 200mm 이하

- 300mm

- 450mm

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- Micron Technology, Inc.

- Kioxia Holdings Corporation

- Intel Corporation

- Western Digital Corporation

- Everspin Technologies, Inc.

- Crossbar Inc.

- Avalanche Technology Inc.

- Spin Memory, Inc.

- Nantero Inc.

- Weebit Nano Ltd.

- Renesas Electronics Corporation

- Infineon Technologies AG

- NXP Semiconductors NV

- Changxin Memory Technologies(CXMT)

- Taiwan Semiconductor Manufacturing Co. Ltd.

- GlobalFoundries Inc.

- Winbond Electronics Corporation

- Macronix International Co., Ltd.

- Nanya Technology Corporation

- Advanced Semiconductor Engineering(ASE) Inc.

- Powerchip Semiconductor Manufacturing Corp.

- Yangtze Memory Technologies Co.(YMTC)

- Microchip Technology Inc.

제7장 시장 기회와 장래의 전망

HBR 25.11.19The Next Generation Memory market size was valued at USD 15.10 billion in 2025 and is forecast to reach USD 45.16 billion by 2030, reflecting a vigorous 24.5% CAGR.

Demand accelerated as AI training clusters, edge servers, and autonomous vehicles all confronted the latency wall of conventional DRAM-NAND hierarchies. Vendors prioritized high-bandwidth architectures, persistent storage class devices, and advanced packaging to close the widening compute-to-memory gap. Asia-Pacific remained the production powerhouse, while North American fab incentives fostered parallel capacity. Interface innovations such as Compute Express Link (CXL) and Universal Chiplet Interconnect Express (UCIe) have begun to redraw system design philosophies, encouraging disaggregated memory pools that scale almost linearly with accelerator count. Supply constraints for premium nodes and wafers, however, continued to shape pricing and allocation strategies across the Next Generation Memory market.

Global Next Generation Memory Market Trends and Insights

AI-driven demand for HBM in hyperscale data centres

Surging transformer model sizes forced cloud operators to double server-level DRAM and solid-state budgets, making bandwidth rather than capacity the primary bottleneck. High Bandwidth Memory multiplied link throughput beyond 1.5 TB/s and delivered dramatic energy savings per bit moved. Global allocation tightened when SK Hynix reported its entire 2025 HBM output sold in advance, which prompted long-term volume reservations for 2026. Micron observed that an AI server deploys nearly twice the DRAM of a classic x86 node. The Next Generation Memory market, therefore, pivoted from bit-cost leadership toward bandwidth leadership, creating premium pricing tiers and margin expansion opportunities.

Automotive L4 ADAS needs instant-on persistent memory

Level 4 autonomy demands deterministic recovery after power events and harsh operating temperatures beyond 150 °C. Ferroelectric RAM devices withstand 1014 cycles while retaining data without standby power, ensuring cold-start availability for sensor fusion stacks that generate up to 100 GB/s. Automakers now evaluate asymmetric persistent-volatile hybrids combining FRAM with LPDDR5X scratch pads. These architectures protect mission logs, facilitate over-the-air updates, and support functional safety goals under ISO 26262, reinforcing growth in the Next Generation Memory market across the mobility value chain.

Thermal stability failures of automotive-grade PCM

Phase-change alloys struggled to retain data above 150 °C, jeopardizing event recorder integrity in desert and under-hood deployments. Material engineering explored Ge-rich GeSbTe and serial PCM cell pairs that push endurance windows to 153 °C but add lithography steps and cost. OEM qualification cycles, therefore, slowed PCM adoption, shifting near-term design wins to FRAM and ReRAM until reliability goals are met. The constraint compressed overall growth, particularly within the automotive subset of the Next Generation Memory market.

Other drivers and restraints analyzed in the detailed report include:

- Smartphone migration to LPDDR5X and embedded ReRAM

- National memory localization programs

- Foundry concentration for sub-28 nm STT-MRAM

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Volatile devices delivered 85.6% of 2024 revenue, anchored by HBM's steep capacity premiums. That dominance has persisted because AI accelerators saturate anything below 1 TB/s, ensuring HBM purchase commitments stretch multiple fiscal years. The Next Generation Memory market size for volatile solutions is projected to keep expanding in absolute terms even while share slips, as ReRAM, PCM, and MRAM gain credibility in edge and instrumentation workloads. ReRAM leads non-volatile momentum, growing at 38.3% CAGR thanks to simple metal-oxide stacks that co-fabricate on 28 nm nodes without extra masks. PCM's gradual thermal-stability gains are expected to unlock automotive attach once the 10-year, 150 °C retention benchmark is certified. MRAM advances remain tied to future EUV capacity and to process simplification that narrows the per-bit premium versus NAND.

Structurally, volatile makers now explore stacked chiplet topologies, trimming die area, and spreading yield risk. Non-volatile challengers respond with cross-point arrays and selector-less designs that eliminate area-consuming transistors. Over the outlook period, supply acceleration for ReRAM and PCM is expected to erode volatile share by roughly 10 percentage points, although absolute volatile revenue still rises because the AI server TAM doubles. Designers will continue to co-package volatile and non-volatile dies, cultivating hybrid stacks that trade endurance for persistence. Those dynamics ensure a multi-node roadmap, widening solution diversity within the Next Generation Memory market.

Interfaces adapted to bandwidth-hungry accelerators long before monolithic silicon could keep pace. In 2024, DDR and LPDDR channels retained a 38.3% share, but adoption ceilings emerged at four channels per socket. CXL's cache-coherent attach over PCIe 5.0 eased that limit, pooling terabytes of memory behind shared switches and slashing stranded capacity. The arrival of the UCIe 2.0 spec in August 2024 delivered 3D-stacked chiplets with 75 X the prior inter-die bandwidth, empowering hyperscalers to tile dozens of compute dies against a single HBM stack.

Looking ahead, 50% of new HPC tape-outs in 2025 will embed 2.5D or 3D die-to-die links, elevating CXL or UCIe from optional to mandatory design elements. Retiming hubs and retimers emerge as ancillary profit pools. Synchronous to these shifts, PCIe/NVMe continues incremental generational moves, but SATA fades toward archival niches. Collectively, novel interfaces propel modular deployments that decouple capacity planning from CPU upgrade cycles, enlarging diversification options within the Next Generation Memory market.

Next Generation Memory Market is Segmented by Technology (Volatile, and Non-Volatile), by Memory Interface (DDR/LPDDR, PCIe/NVMe, SATA, and Others (CXL, Ucie)), by End-Use Device (Consumer Electronics, Enterprise Storage and Data Centers, Automotive Electronics and ADAS, and More), by Wafer Size (<= 200 Mm, 300 Mm, and 450 Mm), and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific maintained its leadership with 47.3% revenue in 2024, sustained by Samsung, SK Hynix, and TSMC, whose combined capital plans exceeded USD 85 billion for next-generation nodes. China advanced its indigenous DRAM capacity to a 5% global share and targeted 10% by 2025, guided by state grants and preferential loan terms. Japan's renewed subsidies preserved local NAND output and specialty equipment clusters. India launched fabrication incentive programs that attracted joint ventures geared toward assembly, test, and eventually 3D NAND slicing. This regional depth anchored supply security and fostered volume leverage for the Next Generation Memory market.

North America's CHIPS incentive catalysed Micron's Idaho HBM fab and Texas memory assembly centres, ensuring domestic capacity for defense and hyperscale procurement. Mexico captured backend assembly flows, complementing the United States front-end wafer starts. Canadian institutes contributed materials science breakthroughs aimed at ultra-low-power non-volatiles, expanding the research and development halo of the continent.

Europe pursued strategic autonomy under its semiconductor act, targeting a 20% global share by 2030. Germany funnelled grants toward automotive-grade memory consortia, while France invested in ReRAM pilot lines. The United Kingdom prioritized foundry-agnostic IP for chiplet die-to-die fabrics. Collectively, the bloc sought tighter integration between automotive OEMs and local memory houses, reinforcing regional demand in the Next Generation Memory market.

The Middle East and Africa exhibited the fastest trajectory, with a 31.2% CAGR outlook underpinned by sovereign wealth-fund backed fabs in Saudi Arabia and the UAE. Turkey marketed itself as a Eurasian packaging hub, and South Africa leveraged telecom densification to spur consumer memory uptake. While the base is modest, aggressive capital allocations and labour-force upskilling suggest durable upside for the region's share of the Next Generation Memory market.

- Samsung Electronics Co., Ltd.

- SK Hynix Inc.

- Micron Technology, Inc.

- Kioxia Holdings Corporation

- Intel Corporation

- Western Digital Corporation

- Everspin Technologies, Inc.

- Crossbar Inc.

- Avalanche Technology Inc.

- Spin Memory, Inc.

- Nantero Inc.

- Weebit Nano Ltd.

- Renesas Electronics Corporation

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Changxin Memory Technologies (CXMT)

- Taiwan Semiconductor Manufacturing Co. Ltd.

- GlobalFoundries Inc.

- Winbond Electronics Corporation

- Macronix International Co., Ltd.

- Nanya Technology Corporation

- Advanced Semiconductor Engineering (ASE) Inc.

- Powerchip Semiconductor Manufacturing Corp.

- Yangtze Memory Technologies Co. (YMTC)

- Microchip Technology Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-Driven Demand for HBM in Hyperscale Data Centers

- 4.2.2 Automotive L4 ADAS Need for Instant-On Persistent Memory

- 4.2.3 Smartphone Migration to LPDDR5X and Embedded ReRAM

- 4.2.4 National Memory Localization Programs

- 4.2.5 Industrial Edge-IoT Requiring Ultra-Low-Power FRAM

- 4.2.6 Data-Privacy-Driven Persistent In-Memory Databases Using 3D XPoint

- 4.3 Market Restraints

- 4.3.1 450 mm Wafer Delay Constraining ReRAM Scale-up

- 4.3.2 High Per-Bit MRAM Cost versus NAND

- 4.3.3 Thermal Stability Failures of Automotive-Grade PCM

- 4.3.4 Foundry Concentration for Sub-28 nm STT-MRAM

- 4.4 Value Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Emerging Memory Technology Roadmap Analysis

- 4.8 Impact of Macroeconomic factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Non-Volatile

- 5.1.1.1 Phase-Change Memory (PCM)

- 5.1.1.2 Spin-Transfer MRAM (STT-MRAM)

- 5.1.1.3 Toggle MRAM

- 5.1.1.4 Resistive RAM (ReRAM)

- 5.1.1.5 3D XPoint / Optane

- 5.1.1.6 Ferroelectric RAM (FeRAM)

- 5.1.1.7 NanoRAM

- 5.1.2 Volatile

- 5.1.2.1 High-Bandwidth Memory (HBM)

- 5.1.2.2 Hybrid Memory Cube (HMC)

- 5.1.2.3 Low-Power DDR5 / LPDDR5X

- 5.1.1 Non-Volatile

- 5.2 By Memory Interface

- 5.2.1 DDR / LPDDR

- 5.2.2 PCIe / NVMe

- 5.2.3 SATA

- 5.2.4 Others (CXL, UCIe)

- 5.3 By End-Use Device

- 5.3.1 Consumer Electronics

- 5.3.2 Enterprise Storage and Data Centers

- 5.3.3 Automotive Electronics and ADAS

- 5.3.4 Industrial IoT and Manufacturing Automation

- 5.3.5 Aerospace and Defense

- 5.3.6 Healthcare and Medical Devices

- 5.3.7 Others (Smart Cards, Wearables)

- 5.4 By Wafer Size

- 5.4.1 <= 200 mm

- 5.4.2 300 mm

- 5.4.3 450 mm

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Samsung Electronics Co., Ltd.

- 6.4.2 SK Hynix Inc.

- 6.4.3 Micron Technology, Inc.

- 6.4.4 Kioxia Holdings Corporation

- 6.4.5 Intel Corporation

- 6.4.6 Western Digital Corporation

- 6.4.7 Everspin Technologies, Inc.

- 6.4.8 Crossbar Inc.

- 6.4.9 Avalanche Technology Inc.

- 6.4.10 Spin Memory, Inc.

- 6.4.11 Nantero Inc.

- 6.4.12 Weebit Nano Ltd.

- 6.4.13 Renesas Electronics Corporation

- 6.4.14 Infineon Technologies AG

- 6.4.15 NXP Semiconductors N.V.

- 6.4.16 Changxin Memory Technologies (CXMT)

- 6.4.17 Taiwan Semiconductor Manufacturing Co. Ltd.

- 6.4.18 GlobalFoundries Inc.

- 6.4.19 Winbond Electronics Corporation

- 6.4.20 Macronix International Co., Ltd.

- 6.4.21 Nanya Technology Corporation

- 6.4.22 Advanced Semiconductor Engineering (ASE) Inc.

- 6.4.23 Powerchip Semiconductor Manufacturing Corp.

- 6.4.24 Yangtze Memory Technologies Co. (YMTC)

- 6.4.25 Microchip Technology Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment