|

시장보고서

상품코드

1641866

강화 플라스틱 : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Reinforced Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

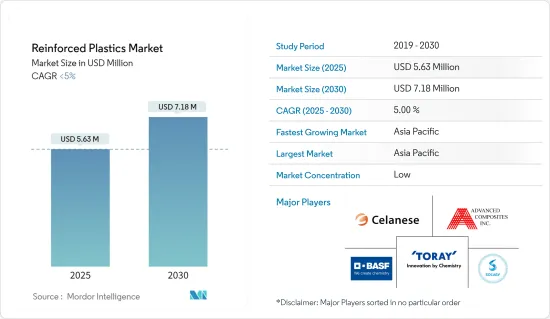

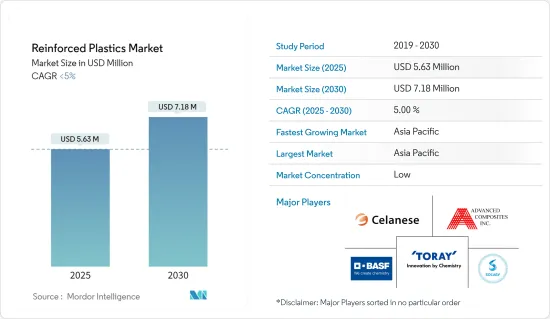

강화 플라스틱 시장 규모는 2025년에 563만 달러로 추정됩니다. 예측 기간(2025-2030년)의 CAGR은 5% 이하로, 2030년에는 718만 달러에 달할 것으로 예상되고 있습니다.

COVID-19의 유행은 강화 플라스틱 시장에 부정적인 영향을 미쳤습니다. 여러 국가에서 전국적인 운영 중단과 사회적 격리 조치로 인한 노동력 부족은 자동차 제조 시설의 폐쇄를 초래하여 강화 플라스틱 시장에 악영향을 미쳤습니다. 그러나 COVID 유행 이후 자동차, 항공우주, 방위, 건설 산업 수요가 증가하여 시장이 순조롭게 회복되었습니다.

주요 하이라이트

- 항공우주산업 수요 증가와 저연비로 경량 자동차에 대한 수요 증가가 강화 플라스틱 시장을 견인할 것으로 예상됩니다.

- 강화 플라스틱의 분해하기 어려운 성질이 시장 성장의 방해가 되고 있습니다.

- 풍력에너지 수요 증가는 예측 기간 동안 시장에 기회를 가져올 것으로 예상됩니다.

- 아시아태평양은 건설, 방위 및 운송 산업에서 강화 플라스틱 수요가 증가함에 따라 시장을 독점할 것으로 예상됩니다.

강화 플라스틱 시장 동향

자동차 부문이 시장을 독점

- 자동차 산업은 세계적으로 강화 플라스틱의 중요한 소비자입니다. 강화 플라스틱은 자동차 및 트럭과 같은 금속 대체품으로 널리 사용됩니다.

- 또한 경량 재료와 기존 재료보다 높은 파괴 지점에 대한 수요가 증가함에 따라 자동차 제조업체를 강화 플라스틱으로 끌고 있습니다. 용도는 매니폴드, 가속기, 클러치 페달 등의 엔진 부품을 포함합니다.

- 자동차 생산량 증가가 강화 플라스틱 시장을 견인할 것으로 예상됩니다. OICA(The Organisation Internationale des Constructeurs d'Automobiles)에 따르면 세계 자동차 생산 대수는 2021년의 8,020만대에 비해 2022년에는 8,502만대에 달하고, 성장률은 6%입니다. 중국, 미국, 인도는 세계에서 가장 눈에 띄는 자동차 시장입니다.

- 미국은 중국에 이어 세계 2위의 자동차 시장으로 세계 자동차 시장에서 큰 점유율을 차지하고 있습니다. 미국은 캐나다, 멕시코, 한국 등 국가에 자동차를 수출하는 여러 세계 자동차 제조업체의 본사입니다. OICA에 따르면 미국의 자동차 생산 대수는 2021년 915만대에 비해 2022년 1,006만대에 이르며 성장률은 9%입니다. 이와 같이 자동차 생산량 증가는 현재의 조사 대상 시장을 견인하는 것으로 예상됩니다.

- 게다가 독일의 자동차 제조업은 유럽의 자동차 생산 전체의 유력한 주주입니다. 이 나라는 Volkswagen, Mercedes-Benz, Audi, BMW, Porsche 등 주요 자동차 제조 브랜드를 보유하고 있습니다. OICA에 따르면 자동차와 소형 상용차의 총 생산 대수는 2021년 330만대에 비해 2022년 367만대에 달하고, 성장률은 11%입니다.

- 게다가 세계 전기자동차 시장은 크게 확대되고 있으며, 이는 조사 대상 시장에 이익을 줍니다. 예를 들어 2022년에는 배터리 전기자동차(BEV)와 플러그인 하이브리드 전기자동차(PHEV)가 전 세계에서 약 1,050만대 판매되었으며, 전년 677만대에 비해 55%의 성장률을 기록했습니다.

- 따라서 위의 요인으로 인해 예측 기간 동안 자동차 최종 사용자 산업이 강화 플라스틱 시장을 독점할 것으로 예상됩니다.

아시아태평양이 시장을 독점

- 아시아태평양은 시장을 독점하고 있으며 예측 기간 동안에도 크게 증가할 것으로 예상됩니다. 중국, 인도, 일본, 한국 등의 국가에서 자동차, 건설, 에너지, 항공 부문이 성장하고 있기 때문에 철근 콘크리트 소비가 증가하고 있습니다.

- 중국은 이 지역에서 가장 큰 자동차 제조업체입니다. OICA에 따르면 중국의 자동차 생산 대수는 2022년에 합계 2,702만대에 달하고, 동시기의 전년 대비 3% 증가했습니다.

- 게다가 중국은 세계 최대 건설 시장으로 전 세계 건설 투자의 20%를 차지하고 있습니다. 중국은 2030년까지 건물 및 건설에 13조 달러 가까이 던질 것으로 예상됩니다. 이것은 나라의 강화 플라스틱에 밝은 전망을 가져올 것으로 예상됩니다.

- 인도 정부는 약 13억 명의 사람들에게 주택을 공급하기 때문에 주택 건설을 적극적으로 추진하고 있습니다. 이 나라에서는 향후 7년간에 약 1조 3,000억 달러의 주택 투자가 행해져, 새롭게 6,000만호의 주택이 건설될 전망입니다. 이 나라의 저렴한 주택 공급은 2024년까지 약 70% 증가할 것으로 예상됩니다.

- 또한 중국, 동남아시아 및 남아시아를 포함한 아시아태평양에서는 항공우주시장의 대폭적인 상승이 예상되고 있으며 조사 대상 시장 수요를 더욱 뒷받침하고 있습니다. Boeing Commercial Outlook 2023-2042에 따르면 중국에서는 2042년까지 약 8,560기가 새로 납품되어 총보유기수는 9,590기가 됩니다.

- 또한 Boeing과 Airbus는 중국에서 가장 유명한 민간 항공기 제조업체입니다. 이들 기업의 우위를 낮추기 위해 중국 상용항공총공사(COMAC)가 국내에서 민간항공기 제조를 시작했습니다. 2022년 9월, 이 회사는 중국 최초의 국산 여객기를 납품했습니다. 게다가 중국 상용항공총공사(COMAC)의 연간 생산능력은 5년간 약 150대의 국산 C919입니다. 그러므로 항공기 생산 능력 증가는 이 나라에서 강화 플라스틱 수요를 높일 가능성이 높습니다.

- 게다가 인도 항공산업은 향후 4년간 3,500억 루피(약 49억 9,000만 달러)의 투자가 예상됩니다. 인도의 거대 항공사인 Air India는 2023년 2월 최근 역사상 최대 규모의 신형 항공기를 주문했습니다. 인도에서 가장 오래된 항공사로 현재는 Tata Group의 산하에 있지만 항공사 Airbus와 Boeing에서 470대의 항공기를 구입한다고 발표했습니다. 이 거래의 총액은 약 800억 달러로 추정됩니다.

- 이러한 모든 요인들로부터 이 지역의 강화 플라스틱 시장은 예측 기간 동안 성장할 것으로 예상됩니다.

강화 플라스틱 산업 개요

강화 플라스틱 시장은 세분화되어 있습니다. 이 시장의 주요 기업에는 BASF SE, Celanese Corporation, Present Advanced Composites Inc., Solvay, Toray Industries Inc. 등이 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 항공우주산업에서의 수요 증가

- 저연비 경차에 대한 수요 증가

- 기타 촉진요인

- 성장 억제요인

- 강화 플라스틱의 비분해성

- 기타 억제요인

- 밸류체인 분석

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 진입업자의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화(금액 베이스 시장 규모)

- 유형

- 유리 섬유 강화 플라스틱

- 탄소섬유 강화 플라스틱

- 아라미드 섬유 강화 플라스틱

- 기타 유형(목질 섬유 강화 플라스틱, 석면 섬유 강화 플라스틱)

- 최종 사용자 산업

- 자동차

- 해양

- 항공우주 및 방위

- 에너지 전력

- 건축 및 건설

- 기타 최종 사용자 산업(전기, 화학 등)

- 지역

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 이탈리아

- 프랑스

- 기타 유럽

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- 사우디아라비아

- 남아프리카

- 기타 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 인수합병, 합작사업, 제휴, 협정

- 시장 점유율(%)**/랭킹 분석

- 주요 기업의 전략

- 기업 프로파일

- Ahlstrom

- BASF SE

- Cabot Corporation

- Celanese Corporation

- Dow

- Formosa Plastics Corporation

- Gulf Reinforced Plastics

- Hexcel Corporation

- Jiangsu QIYI Technology Co., Ltd.

- Nikkiso Co., Ltd.

- PPG Industries Inc

- Present Advanced Composites Inc.

- RBJ Reinforced Plastics Ltd

- Relaince Industries Ltd.

- Solvay

- Teijin Limited

- Toray Industries, Inc

제7장 시장 기회와 앞으로의 동향

- 풍력에너지 수요 증가

- 기타 기회

The Reinforced Plastics Market size is estimated at USD 5.63 million in 2025, and is expected to reach USD 7.18 million by 2030, at a CAGR of less than 5% during the forecast period (2025-2030).

The COVID-19 pandemic negatively affected the market for reinforced plastics. The nationwide lockdowns in several countries and the labour shortage due to social distancing measures had negatively resulted in the closure of manufacturing facilities of automotive vehicles, thereby affecting the market for reinforced plastics. However, post-COVID pandemic, the market recovered well due to increasing demand from the automotive, aerospace, defense, and construction industries.

Key Highlights

- The growing demand from the aerospace industry and the rising demand for fuel-efficient and lightweight vehicles are expected to drive the market for reinforced plastics.

- The non-degradable nature of reinforced plastic is hindering market growth.

- The increasing demand for wind energy is expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market due to the rising demand for reinforced plastics from the construction, defense, and transportation industries.

Reinforced Plastics Market Trends

Automotive Segment Dominated the Market

- The automotive industry is a critical consumer of reinforced plastics globally. Reinforced plastics are widely used as metal substitutes in automobiles, trucks, etc.

- Additionally, increasing demand for lightweight materials and higher fracture points than traditional materials attracts automotive manufacturers toward reinforced plastics. Some of the areas of the application include engine components such as manifold, gas, clutch pedals, etc.

- The increase in the production volume of automotive vehicles is expected to drive the market for reinforced plastics. According to OICA (The Organisation Internationale des Constructeurs d'Automobiles), global automotive vehicle production reached 85.02 million in 2022, compared to 80.2 million manufactured in 2021, at a growth rate of 6%. China, the United States, and India are the most prominent automotive vehicle markets globally.

- The United States is the second-largest automotive market in the world after China, which occupies a significant share of the global automotive vehicles market. The United States is the headquarters for some global automotive vehicle manufacturers, exporting vehicles to countries such as Canada, Mexico, and South Korea. According to OICA, in 2022, the United States automotive vehicle production reached 10.06 million compared to 9.15 million units manufactured in 2021, at a growth rate of 9%. Thus, the rise in vehicle production will drive the current studied market.

- Furthermore, the automobile manufacturing industry in Germany is a prominent shareholder of the overall automotive production in the European region. The country hosts major car-making brands, including Volkswagen, Mercedes-Benz, Audi, BMW, Porsche, etc. According to OICA, the total production volume of cars and light commercial vehicles reached 3.67 million units in 2022, compared to 3.30 million units manufactured in 2021, at a growth rate of 11%.

- Additionally, the global electric vehicle market is expanding signifiantly, which is benefitting the market studied. For instance, in 2022, around 10.5 million units of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) were sold across the globe, witnessing a growth rate of 55% compared to 6.77 million units sold in the previous year.

- Hence, owing to the factors mentioned above, the automotive end-user industry is expected to dominate the market for reinforced plastics during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the market and is expected to significantly increase over the forecast period. With the growing automotive, construction, energy, and aviation sectors in countries like China, India, Japan, and South Korea, the consumption of reinforced concrete is increasing.

- China is the largest automotive vehicle manufacturer in the region. According to OICA, automotive vehicle production in China reached a total of 27.02 million units in 2022, an increase of 3% over the previous year for the same period.

- Furthermore, China is the largest construction market in the world, encompassing 20% of all construction investments globally. China is expected to spend nearly USD 13 trillion on buildings and construction by 2030. This is anticipated to create a positive outlook for reinforced plastics in the country.

- The Indian government has been actively boosting housing construction to provide houses to about 1.3 billion people. The country is likely to witness around USD 1.3 trillion of investment in housing over the next seven years, to witness the construction of 60 million new houses in the country. The availability of affordable housing in the country is expected to increase by around 70% by 2024.

- Furthermore, in the Asia-Pacific region, including China, Southeast Asia, and South Asia, the aerospace market is expected to rise significantly, further supporting the demand for the market studied. According to the Boeing Commercial Outlook 2023-2042, around 8,560 new deliveries in China will be made by 2042, taking the total fleet to 9,590.

- Additionally, Boeing and Airbus are the most prominent civil aircraft manufacturers in China. To decrease the dominance of these companies, the Commercial Aviation Corp of China (COMAC) started to manufacture civil aircraft in the country. In September 2022, the company delivered its first homemade passenger jet in China. Furthermore, the annual production capacity of Commercial Aviation Corp of China (COMAC) is around 150 domestically produced C919 planes in five years. Thus, the increased aircraft production capacity will likely drive the demand for reinforced plastics in the country.

- Moreover, India's aviation industry is expected to witness INR 35,000 crore (~USD 4.99 billion) investment in the next four years. India's airline giant, Air India, in February 2023, placed one of the biggest orders for new aircraft in recent history. India's oldest airline, now firmly under the ownership of the Tata Group, announced that it is purchasing 470 aircraft from airline manufacturers Airbus and Boeing. The combined value of the deals is estimated at some USD 80 billion.

- Due to all such factors, the market for reinforced plastics in the region is expected to grow during the forecast period.

Reinforced Plastics Industry Overview

The reinforced plastics market is fragmented in nature. Some of the major players in the market (not in any particular order) include BASF SE, Celanese Corporation., Present Advanced Composites Inc., Solvay, and Toray Industries, Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Aerospace Industry

- 4.1.2 Rising Demand for Fuel Efficient and Light-weight Vehicles

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Non-Degradable Nature of Reinforced Plastic

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Glass Fiber Reinforced Plastics

- 5.1.2 Carbon Fiber Reinforced Plastics

- 5.1.3 Aramid Fiber Reinforced Plastics

- 5.1.4 Other Types (Wood Fiber Reinforced Plastics, Asbestos Fiber Reinforced Plastics)

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Marine

- 5.2.3 Aerospace and Defence

- 5.2.4 Energy and Power

- 5.2.5 Building and Construction

- 5.2.6 Other End-user Industries (Electrical, Chemicals, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Ahlstrom

- 6.4.2 BASF SE

- 6.4.3 Cabot Corporation

- 6.4.4 Celanese Corporation

- 6.4.5 Dow

- 6.4.6 Formosa Plastics Corporation

- 6.4.7 Gulf Reinforced Plastics

- 6.4.8 Hexcel Corporation

- 6.4.9 Jiangsu QIYI Technology Co., Ltd.

- 6.4.10 Nikkiso Co., Ltd.

- 6.4.11 PPG Industries Inc

- 6.4.12 Present Advanced Composites Inc.

- 6.4.13 RBJ Reinforced Plastics Ltd

- 6.4.14 Relaince Industries Ltd.

- 6.4.15 Solvay

- 6.4.16 Teijin Limited

- 6.4.17 Toray Industries, Inc

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand from Wind Energy

- 7.2 Other Opportunities