|

시장보고서

상품코드

1683147

남미의 종자 처리 시장 : 시장 점유율 분석, 산업 동향, 성장 예측(2025-2030년)South America Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

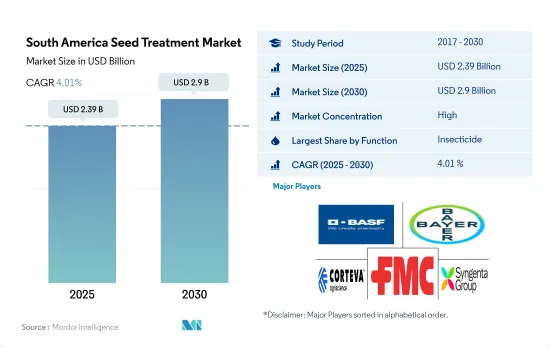

남미의 종자 처리 시장 규모는 2025년에 23억 9,000만 달러로 추정되고, 2030년에는 29억 달러에 이를 전망이며, 예측 기간 2025년부터 2030년까지 CAGR은 4.01%를 나타낼 것으로 예측됩니다.

생산성 향상과 건강한 묘목 확립의 필요성이 시장 성장을 뒷받침하고 있습니다.

- 남미의 종자 처리 산업은 현저한 성장을 이루고 있습니다. 시장액은 2017년에 비해 2022년에는 51.7% 증가했습니다. 이 성장의 원동력이 된 것은 건전한 모종의 보호와 정착에 있어서 종자 적용 기술의 이점에 대한 인식 향상 및 전체적인 생산성 향상의 필요성입니다.

- 브라질과 아르헨티나는 다양한 곰팡이 질병으로부터 작물을 보호하기 위해 종자 처리를 많이 사용하는 유명한 농업 국가입니다. 브라질과 아르헨티나 종자 처리의 총 시장 점유율은 크며, 지역 시장의 77.9%를 브라질이, 약 3.1%를 아르헨티나가 차지하고 있습니다.

- 살충제 종자 처리가 주요 점유율을 차지하고 있으며, 그 시장액은 2023년부터 2029년까지 35.3%의 대폭적인 증가가 전망되고 있습니다.

- 남미의 살균제 종자 처리는 대두, 옥수수, 밀, 과일 등의 주요 작물에 영향을 미치는 진균병이 만연하고 있기 때문에 최근 중요성이 증가하고 있습니다. 콩 녹, 우동병, 후자리움 두고병을 포함한 이러한 질병은 작물의 수율과 품질에 심각한 위험을 초래합니다. 그 결과 남미의 농업 종사자들은 작물을 보호하고 수율 손실을 줄이기 위해 살균제 종자 처리에 대한 의존도를 높이고 있습니다. 이러한 요인으로 인해 살균제 부문 시장 규모는 예측 기간 동안 33.6% 증가할 것으로 예상됩니다.

- 작물의 보호와 수율을 향상시키기 위해 종자 처리가 받아들여지고 있으며, 그 이점에 대한 농업 종사자의 의식 증가가 예측 기간 동안 시장 성장을 가속할 것으로 예상됩니다.

생육 초기의 병해충으로부터 종자나 모종을 보호할 필요성에 의해 종자 처리의 채용율이 높아집니다.

- 남미의 종자 처리 시장은 작물의 초기 병해충으로부터 종자와 모종을 보호할 필요성에 대한 농업 종사자의 의식이 높아짐에 따라 큰 성장을 이루고 있습니다. 이 지역의 주요 작물인 콩, 옥수수, 밀, 과일, 야채는 종자 처리 용도를 받아들입니다. 주목할 만한 것으로, 종자 처리 시장은 2017년부터 2022년까지의 역사적 기간에 51.7%라는 눈부신 성장을 보였습니다.

- 2022년에는 브라질이 남미 최대 시장으로서 압도적인 지위를 차지했으며, 이 지역 시장 점유율의 77.9%를 차지했습니다. 이 나라의 눈부신 확대는 식량 안보에 대한 요구가 증가하고, 콩 등 주요 작물에서 종자 처리 제품의 이용 확대 등 여러 요인에 기인하고 있습니다.

- 남미의 종자 처리 산업 2위 시장인 아르헨티나는 가뭄이나 고온 등 어려운 환경조건에 휩싸이고 있습니다. 이러한 요인은 농업 종사자가 작물의 성장 초기에 종자 처리 기술을 채택하는 원동력이 되었습니다. 종자 처리법을 채택함으로써, 농업 종사자는 더 빠른 발아를 촉진하고 토양 전염성 병해를 효과적으로 방제할 수 있습니다. 이 접근법은 국가의 가혹한 기후로 인한 악영향을 완화하는 데 매우 중요하며 농업 종사자는 작물 수율을 높이고 농업 생산성을 지속적으로 유지할 수 있습니다.

- 남미의 종자 처리 시장은 예측 기간 동안 CAGR 4.3%를 나타낼 것으로 예측됩니다. 이 성장은 농작물을 보호하고 수율을 향상시키고 병해충에 의해 초래되는 작물의 초기 성장 과제를 다루는 데 종자 처리가 제공하는 엄청난 가치에 대해 농업 종사자들 사이에서 인식이 높아지고 있기 때문입니다.

남미의 종자 처리 시장 동향

내병성 재배자와 같은 대체 접근법에 따른 이 지역의 헥타르 당 종자 처리 소비량 감소

- 과거 기간 동안 헥타르 당 종자 처리 소비량이 현저히 감소했으며, 2017년 데이터와 비교할 때 2022년에는 헥타르당 1,000g의 상당한 감소가 나타났습니다. 이 감소는 주로 다양한 요인에 기인하고 있으며, 종자 처리 사용량의 감소에 기여하는 매우 중요한 이유 중 하나는 제초제 내성 재배자의 채용이 증가하고 있다는 것입니다. 이 재배자는 제초제의 살포를 견디도록 유전적으로 조작되어 농업 종사자는 추가 종자 처리 없이 잡초를 방제할 수 있습니다. 그 결과, 종래의 종자 처리 수요는 감소하고 있습니다. 브라질, 아르헨티나, 파라과이와 같은 주요 농업 국가들은 콩, 밀, 옥수수와 같은 주요 작물에 이러한 제초제 내성 재배자를 채택합니다.

- 제초제 내성 이외에, 유전자 변형 작물의 재배가 퍼진 것도 종자 처리의 소비에 큰 영향을 주고 있습니다. 유전자 재조합 작물은 다양한 병해충에 대한 저항성을 갖는 형질이 통합되도록 조작되어 있기 때문에 이들 작물에는 종자 처리가 필요하지 않을 수도 있습니다. 그 결과, 유전자 변형 작물을 재배하는 농업 종사자는 종래의 종자 처리에 대한 의존도를 감소시키고 있습니다.

- 헥타르 당 종자 처리 소비량 감소에 기여하는 또 다른 중요한 요인은 내병성 재배자의 채용입니다. 이러한 재배 품종은 일반적인 식물 병해에 저항하도록 품종 개량 또는 유전적으로 조작되어 병해에 특화된 종자 처리의 필요성이 감소하고 있습니다. 더 많은 농업 종사자가 내병성 재배자를 채택함에 따라, 헥타르 당 특정 종자 처리 사용량에 대한 전반적인 수요가 크게 감소하고 있습니다.

아조시스트로빈의 침투 전이성은 처리된 식물에 흡수되어 장기간의 방제 효과를 제공합니다.

- 시페르메트린, 메탈락실, 말라티온, 아바멕틴, 아조시스트로빈은 남미에서 일반적으로 사용되는 종자 처리의 활성 성분입니다. 종자 처리는 종자와 모종을 병해충으로부터 조기에 보호합니다. 토양에 파종하는 동시에 종자 주위에 보호 장벽을 만들어 잠재적 위협으로부터 보호합니다.

- 시펠 메트린은 접촉 살충제로서 주로 처리된 종자 및 식물의 표면에 남아 보호 장벽을 형성하여 다양한 해충에 신속한 녹다운 효과를 발휘합니다. 2022년 가격은 톤당 2만 1,100달러였습니다. 시펠 메트린의 작용기전은 곤충의 신경계를 혼란시키고 마비를 일으키고 결국 죽음을 초래합니다.

- 말라티온의 전신작용에 의해 진딧물, 대양벌레, 엉겅퀴벌레, 비늘벌레, 특정 벌레 등 다양한 해충을 효과적으로 제거할 수 있어 2022년 가격은 1톤당 12만 4,000달러였습니다. 말라티온의 작용기전에는 곤충의 적절한 신경 기능에 필수적인 효소인 아세틸콜린 에스테라아제의 억제가 포함됩니다.

- 2022년 가격이 톤당 4,400달러인 Metalaxyl은 Pythium, Phytophthora, 특정 베토병과 같은 토양 전염성 병원체로부터 종자와 모종을 조기에 보호합니다. Metalaxyl은 진균 세포의 RNA 형성을 억제함으로써 효과를 발휘합니다. 이 억제는 필수 단백질의 합성을 방해하고 곰팡이의 성장과 번식을 억제합니다.

- 2022년 가격은 1톤당 4,500달러로, 아조시스트로빈의 전신활성에 의해 처리한 식물에 흡수되어, 진균세포의 미토콘드리아 호흡을 저해하는 것으로, 새싹이나 잎을 포함한 다양한 식물 부위에 장기간에 걸친 보호를 기재하고 있습니다.

남미의 종자 처리 산업 개요

남미의 종자 처리 시장은 상당히 통합되어 있으며 상위 5곳에서 65.66%를 차지하고 있습니다. 이 시장의 주요 기업은 BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation, Syngenta Group입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 1헥타르당 농약 소비량

- 유효성분의 가격 분석

- 규제 프레임워크

- 아르헨티나

- 브라질

- 칠레

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 기능별

- 살균제

- 살충제

- 살선충제

- 작물 유형별

- 상업 작물

- 과일 및 야채

- 곡물

- 콩류 및 지방종자

- 잔디 및 관상용

- 국가별

- 아르헨티나

- 브라질

- 칠레

- 기타 남미

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The South America Seed Treatment Market size is estimated at 2.39 billion USD in 2025, and is expected to reach 2.9 billion USD by 2030, growing at a CAGR of 4.01% during the forecast period (2025-2030).

The need to improve productivity and establish healthy seedlings is fueling the growth of the market

- The South American seed treatment industry is experiencing significant growth. The market value increased by 51.7% in 2022 compared to 2017. This growth was driven by growing awareness of the benefits of seed-applied technologies in protecting and establishing healthy seedlings and the need to improve overall productivity.

- Brazil and Argentina are prominent agricultural nations that heavily utilize seed treatments to protect their crops from a range of fungal diseases. The combined market share of seed treatments in Brazil and Argentina is significant, with Brazil accounting for 77.9% and Argentina accounting for around 3.1% of the regional market.

- The insecticide seed treatments held the major share, and their market value is expected to increase significantly by 35.3% between 2023 and 2029 because of the growing recognition of the effectiveness of seed treatments in combatting insect vectors and safeguarding crop productivity.

- Fungicide seed treatment in South America has gained significant importance in recent years due to the prevalence of fungal diseases that affect key crops like soybeans, corn, wheat, and fruits. These diseases, including soybean rust, powdery mildew, and Fusarium head blight, pose a significant risk to crop yields and quality. Consequently, farmers in South America are increasingly relying on fungicide seed treatments to safeguard their crops and reduce yield losses. These factors are expected to increase the market value of the fungicide segment by 33.6% during the forecast period.

- The growing acceptance of seed treatment to enhance crop protection and yield, coupled with the increasing awareness among farmers regarding its advantages, is anticipated to drive the market's growth in the forecast period.

The need to protect seeds and seedlings from early-growth pests and diseases will increase the adoption rate of seed treatment

- The seed treatment market in South America is experiencing significant growth, driven by the increasing awareness among farmers regarding the need to protect seeds and seedlings from early crop diseases and insect pests. The region's major crops, including soybean, maize, wheat, fruits, and vegetables, have embraced seed treatment applications. Notably, the market for seed treatment exhibited impressive growth of 51.7% over the historical period spanning from 2017 to 2022.

- In 2022, Brazil held the dominant position as the largest market in South America, representing 77.9% of the region's market share. The country's remarkable expansion can be attributed to several factors, including the growing need for food security and the escalating utilization of seed treatment products in key crops like soybeans.

- Argentina, the second-largest market in the South American seed treatment industry, experiences challenging environmental conditions such as drought and hot temperatures. These factors drove farmers to adopt seed treatment techniques during the early stages of crop growth. By employing seed treatment methods, farmers can promote faster germination and effectively control soil-borne diseases. This approach proves crucial in mitigating the adverse effects of the country's harsh climate, enabling farmers to enhance crop yields and sustainably maintain agricultural productivity.

- The South American seed treatment market is projected to register a CAGR of 4.3% during the forecast period. This growth can be attributed to the increasing recognition among farmers regarding the immense value offered by seed treatments in safeguarding their crops, enhancing yields, and countering early crop growth challenges posed by infestations.

South America Seed Treatment Market Trends

Alternative approaches like disease-resistant cultivators reduce the seed treatment consumption per hectare in the region

- Over the historical period, there was a remarkable decrease in the consumption of seed treatments per hectare, with a significant reduction of 1,000 g per ha noted in 2022 when compared to the data from 2017. This decline was primarily attributed to various factors, including one of the pivotal reasons contributing to the decline in seed treatment usage is the increasing adoption of herbicide-resistant cultivators. These cultivators are genetically engineered to withstand the application of herbicides, allowing farmers to control weeds without the need for additional seed treatments. As a result, the demand for conventional seed treatments has reduced. Major agricultural countries like Brazil, Argentina, and Paraguay adopt these herbicide resistance cultivators in their major crops like soybeans, wheat, and maize.

- In addition to herbicide resistance, the widespread cultivation of genetically modified crops has significantly impacted seed treatment consumption. Genetically modified crops are engineered to possess built-in traits that offer resistance to various pests and diseases, rendering some seed treatments unnecessary for these crops. Consequently, farmers planting genetically modified crops have reduced their reliance on traditional seed treatments.

- Another crucial factor contributing to the decline in seed treatment consumption per hectare is the adoption of disease-resistant cultivators. These cultivators have been bred or engineered to resist common plant diseases, thereby reducing the need for disease-specific seed treatments. As more farmers adopt disease-resistant cultivators, the overall demand for certain types of seed treatment usage per hectare has decreased significantly.

Azoxystrobin's systemic activity allows it to be absorbed by treated plants, providing extended protection

- Cypermethrin, metalaxyl, malathion, abamectin, and azoxystrobin are commonly used active ingredients in seed treatment chemicals in South America. Seed treatment provides early protection to seeds and seedlings against pests and diseases. It creates a protective barrier around the seed, shielding it from potential threats as soon as it is sown in the soil.

- Cypermethrin, as a contact insecticide, remained primarily on the surface of treated seeds or plants, forming a protective barrier for quick knockdown action against a wide range of insect pests. It was priced at USD 21.1 thousand per metric ton in 2022. The mode of action of cypermethrin involves disrupting the nervous systems of insects, leading to paralysis and, ultimately, their death.

- Malathion's systemic action enabled effective control of diverse insect pests, including aphids, leafhoppers, thrips, scales, and certain caterpillar species, with a price of USD 124 thousand per metric ton in 2022. Malathion's mode of action involves inhibiting acetylcholinesterase, an enzyme essential for proper nerve function in insects.

- Metalaxyl, priced at USD 4.4 thousand per metric ton in 2022, provided early protection to seeds and seedlings from soil-borne pathogens such as Pythium, Phytophthora, and certain downy mildews. Metalaxyl works by inhibiting the formation of RNA in fungal cells. This disruption prevents the synthesis of essential proteins, leading to the inhibition of fungal growth and reproduction

- With a price of USD 4.5 thousand per metric ton in 2022, azoxystrobin's systemic activity allowed it to be absorbed by treated plants, providing extended protection to different plant parts, including new growth and foliage, by inhibiting the mitochondrial respiration in fungal cells.

South America Seed Treatment Industry Overview

The South America Seed Treatment Market is fairly consolidated, with the top five companies occupying 65.66%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Brazil

- 4.3.3 Chile

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Insecticide

- 5.1.3 Nematicide

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Country

- 5.3.1 Argentina

- 5.3.2 Brazil

- 5.3.3 Chile

- 5.3.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 BASF SE

- 6.4.2 Bayer AG

- 6.4.3 Corteva Agriscience

- 6.4.4 FMC Corporation

- 6.4.5 Sumitomo Chemical Co. Ltd

- 6.4.6 Syngenta Group

- 6.4.7 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록