|

시장보고서

상품코드

1683215

야외 LED 조명 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

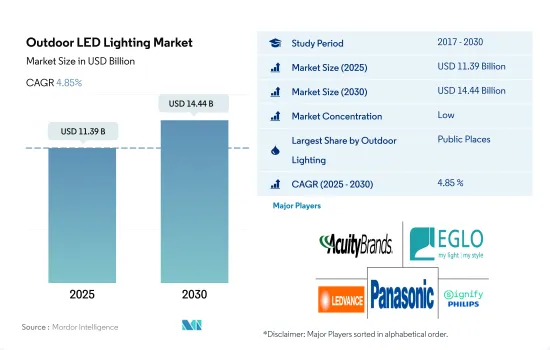

야외 LED 조명 시장 규모는 2025년에 113억 9,000만 달러로 추정되고, 2030년에는 144억 4,000만 달러에 이를 것으로 예측되며, 예측 기간 중 2025년부터 2030년까지 CAGR은 4.85%로 성장할 전망입니다.

도시화, 관광화, 무역망 확대로 인한 공공장소 및 도로 성장이 LED 조명 시장을 뒷받침

- 2023년 금액 점유율에서는 공공장소에서 LED 라이트 이용이 시장 점유율의 대부분을 차지한 다음 가로와 도로, 기타 부문이 되었습니다. 세계 인구의 약 55%가 도시에 살고 있으며, 이 비율은 2050년까지 68%로 상승할 것으로 예상됩니다. 가장 도시화가 진행되고 있는 지역은 북미(2018년에는 인구의 82%가 도시에 거주), 라틴아메리카와 카리브해 국가(81%), 유럽(74%), 오세아니아(68%) 등입니다. 아시아의 도시화율은 약 50%입니다. 대조적으로, 아프리카는 여전히 대부분이 시골 지역이고 인구의 43%가 도시 지역에 살고 있습니다. 도시 지역이 해마다 발전함에 따라 유원지와 주차장과 같은 공공 장소도 증가하고 있습니다. 관광업 및 각종 교통 서비스 증가도 공공 공간의 확대에 크게 기여하고 있습니다. 따라서 이 부문에서 LED의 보급률은 높고 앞으로도 주류가 될 것으로 예상됩니다.

- 2023년의 수량 점유율에서는 공공 공간에서 LED 조명의 이용이 시장 점유율의 대부분을 차지한 다음 가로, 도로 및 기타 부문이 되었습니다. 세계 무역이 계속 성장하고 있는 가운데, 신흥 시장은 경쟁을 유지하고 관련성을 유지하면서 상품을 운송하기 위한 실행 가능한 대안을 필요로 합니다. 세계 각 대륙의 해안과 지역을 따라 기존의 해상 운송에는 도로 운송 및 경우에 따라 철도와 같은 다른 옵션이 필요합니다. 자동차 산업은 철도 뿐만 아니라 수송 부문을 변화시키는 획기적인 개발의 최전선에 있습니다. 장기적으로, 도로 운송은 국내 경제에서 무역을 촉진하는 중요한 수단이며 관련성을 유지하는 것으로 간주됩니다. 그러므로 세계 도로망의 확대도 이 부문에서 LED 조명의 보급을 촉진하는 것으로 예상됩니다.

세계 각 주요 지역에서 LED 조명 채용이 증가하고 있으며 LED 조명 매출을 끌어올릴 것으로 예상됩니다.

- 2022년 금액 점유율에서는 아시아태평양 LED 시장이 대부분을 차지하였고, 북미, 유럽, 남미, 중동, 아프리카가 이어집니다. 마찬가지로 2022년 수량 점유율에서는 아시아태평양 LED 시장이 점유율의 대부분을 차지하였고, 북미, 유럽, 중동, 아프리카, 남미가 계속됩니다.

- 아시아는 2025년까지 세계 최대의 에너지 소비국이 될 전망입니다. LED 조명 칩 제조업체 증가, 신흥 기업, 도시화, 공공시설 증가, 기타 지역 경제에 공헌하는 부문이 LED 조명 시장에 영향을 미치고 있습니다.

- LED 기술의 발전과 지속적인 혁신은 북미의 LED 조명 판매 증가에 기여하고 있습니다. 원예에서 LED 기술의 사용은 식물의 성장 단계에 따라 다른 광 스펙트럼을 제어함으로써 에너지 낭비를 줄입니다. 지능형 광충전 기술의 출현도 시장에 잠재적인 기회를 가져올 것으로 보입니다. 예를 들어 2017년 Signify는 효율적인 작물 개발을 위해 GreenPower LED Interlighting Gen 3 기술을 발표했습니다. 이러한 개발은 이 지역의 새로운 성장 기회에 대한 길을 열 것으로 기대됩니다.

- 중동, 아프리카, 남미 등의 지역도 지역 주요 국가가 LED 조명을 채택하고 있기 때문에 LED 조명 채용이 증가하고 있습니다. 예를 들어 아르헨티나에서는 2020년 11월에 가로등용 최신형 LED 램프가 처음으로 납품되어 고비를 맞이했습니다. 9개 지자체의 자금 지원으로 이 도시들은 12만 1,000달러의 임시 기금을 설립하고 652개의 고급 LED 조명을 구입했습니다.

- 이처럼 세계에서 LED 조명의 급속한 기술 변화와 채용 확대가 LED 조명의 이용을 뒷받침할 것으로 보입니다.

세계의 야외 LED 조명 시장 동향

스포츠 경기장의 업그레이드 및 리노베이션, 스포츠 부문의 정부의 자금 지원이 시장 성장을 가속할 것으로 예상됩니다.

- 경기장의 수는 2022년 3,957기에서 2030년에는 4,205기로 증가해 CAGR 0.9%를 나타낼 것으로 예측되고 있습니다. 북미에서는 소비자 수요를 높이기 위해 새로운 경기장 개수와 기존 경기장 개수가 장려되고 있습니다. 2022년의 축구 시즌을 향해 미국에서는 55억 달러를 들여 건설된 SoFi 경기장이 LED 조명을 통합한 새로운 일루미네이션으로 업그레이드 되었습니다. 또한 존스 AT&T 경기장은 두 프로젝트에 초점을 맞추고 새로운 LED 조명과 잔디를 설치할 계획을 발표했습니다. 존스 AT&T 경기장은 2억 달러를 들여 수리 중이며, 공과대학 육상 경기는 이 추가 개선 프로젝트에 총 220만 달러를 기부하고 있습니다. 이러한 요소는 LED 시장의 확대를 지원합니다.

- 또한 건설 러시는 유럽 시장 수요 증가에도 기여합니다. 예를 들어 독일에서는 2023년 스페셜 올림픽을 위해 베를린에 가장 종합적인 경기장이 건설되었습니다. 이 새로운 육상 경기장은 노후화된 프리드리히 루트비히 얀스포트 파크를 대신하여 당국으로부터 1억 6,000만 유로(1억 7,544만 달러)가 지급되었습니다.

- 아시아태평양 시장에서의 상품과 서비스에 대한 수요도 스포츠 부문에 대한 정부 보조금 증가와 각종 행사의 개최로 인해 긍정적인 영향을 받을 수 있습니다. 예를 들어, 중국 정부는 경기장의 유지 보수 및 인프라 정비에 자금을 제공할 계획을 발표했습니다. 예를 들어 상하이는 2025년까지 '스포츠 도시'를 건설할 것을 제안했습니다. 2023년에는 AFC 아시아컵, 2023년에는 제12회 전국소수민족 전통체육대회, 제3회 전국청소년대회 등의 대회를 개최하고, 그 실현을 목표로 하고 있습니다. 이러한 개발로 LED 시장은 향후 수년간 성장할 것으로 예상됩니다.

에너지 효율적인 건축물 증가와 EV의 세계 판매량 증가가 시장 성장을 가속할 것으로 예상

- 세계 인구는 2021년에 78억 9,000만 명에 달했습니다. 세계 고용자 수는 2015년 31억 6,000만 명에서 2022년에는 33억 2,000만 명에 이르며 거의 1억 3,000만 명 증가했습니다. 고용자 수가 증가함에 따라 더 많은 지식이 국민에게 넘어가기 때문에 LED의 사용이 증가할 것으로 예상됩니다.

- COVID-19의 대유행에도 불구하고 에너지 효율적인 건설에 대한 세계 지출은 2019년 1,650억 달러에서 2020년에는 1,840억 달러 이상으로 이례적인 11.4% 증가했습니다. 에너지 효율에 대한 투자의 연간 성장률은 2015년 이후 처음으로 3%를 초과했습니다. 에너지 효율적인 건물의 개발이 진행되고, 확대되는 인구의 주택 요구에 대응하기 위해, 주택의 방수를 늘려야 하기 때문에 LED 수요가 증가할 것으로 예상됩니다.

- 2022년에는 전 세계적으로 1억 4,396만 대의 자동차가 생산되었습니다. 2023년에는 1억 5,092만대로 증가할 것으로 예측됩니다. 전기차의 세계 판매량은 2022년 1,000만 대를 돌파했으며, 2023년에는 35% 증가한 1,400만 대가 된 것으로 평가됐습니다. 이러한 급속한 확대로 인해 전기차 시장 점유율은 2020년 4%에서 2022년 14%로 상승했습니다. 전기자동차는 기존 자동차보다 1대당 더 많은 프로세서를 필요로 하기 때문에 사용량이 증가함에 따라 차량용 반도체 칩의 요구도 증가하고 있습니다. 자동차 산업의 반도체 수요 증가는 LED 조명 시장을 뒷받침할 것으로 보입니다.

야외 LED 조명 산업 개요

야외 LED 조명 시장은 세분화되어 상위 5개사에서 34.47%를 차지하고 있습니다. 이 시장의 주요 기업은 ACUITY BRANDS, INC., EGLO Leuchten GmbH, LEDVANCE GmbH(MLS), Panasonic Holdings Corporation, Signify Holding(Philips)입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 소득

- Leds의 총 수입량

- 조명의 전력 소비량

- #가구수

- LED 보급률

- #경기장수

- 규제 프레임워크

- 아르헨티나

- 브라질

- 중국

- 프랑스

- 독일

- 걸프 협력 회의

- 인도

- 일본

- 남아프리카

- 영국

- 미국

- 밸류체인 및 유통채널 분석

제5장 시장 세분화

- 야외 조명별

- 공공 장소

- 도로 조명

- 기타

- 지역별

- 아시아태평양

- 유럽

- 중동 및 아프리카

- 북미

- 남미

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ACUITY BRANDS, INC.

- ams-OSRAM AG

- Current Lighting Solutions, LLC.

- EGLO Leuchten GmbH

- Guangdong PAK Corporation Co.,Ltd.

- LEDVANCE GmbH(MLS Co Ltd)

- OPPLE Lighting Co., Ltd

- Panasonic Holdings Corporation

- Signify Holding(Philips)

- Thorn Lighting Ltd.(Zumtobel Group)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Outdoor LED Lighting Market size is estimated at 11.39 billion USD in 2025, and is expected to reach 14.44 billion USD by 2030, growing at a CAGR of 4.85% during the forecast period (2025-2030).

The growth in public places and roadways due to increased urbanization, tourism, and trade networks would boost the LED lights market

- In terms of value share in 2023, the utilization of LED lights in public places accounted for the majority of the market share, followed by the street and roadways and others segments. Around 55% of the world's population lives in urban areas, and this proportion is expected to rise to 68% by 2050. The most urbanized regions include North America (82% of the population lived in urban areas in 2018), Latin America and the Caribbean (81%), Europe (74%), and Oceania (68%). The degree of urbanization in Asia is around 50%. In contrast, Africa is still largely rural, with 43% of the population living in urban areas. As urban areas have grown over the years, so have public places such as amusement parks and parking lots. The rise in tourism and various transportation services has also contributed significantly to the growth of public spaces. Hence, the penetration of LEDs in this sector is high and will continue to be mainstream.

- In terms of volume share in 2023, the utilization of LED lights in public places accounted for the majority of the market share, followed by the street and roadways and others segments. As global trade continues to grow, emerging markets need viable alternatives to transport goods while remaining competitive and relevant. Conventional maritime reach along the coasts and geographies of the world's continents requires other options: road transport and possibly rail. The automotive industry, like railroads, has been at the forefront of groundbreaking developments transforming the transportation sector. In the long term, road transport will remain relevant and an important tool for promoting trade in the domestic economy. Therefore, the growing road network around the world will also promote the penetration of LED lighting in this sector.

The rising adoption of LED lights in every major region across the world is expected to boost LED lighting sales

- In terms of value share in 2022, the Asia-Pacific LED market accounted for the majority of the share, followed by North America, Europe, South America, and the Middle East and Africa. Similarly, in terms of volume share in 2022, the Asia-Pacific LED market accounted for the majority of the share, followed by North America, Europe, the Middle East and Africa, and South America.

- Asia is set to become the world's largest energy consumer by 2025. The growing number of LED lighting chip manufacturers, startups, urbanization, growth in public places, and other sectors contributing to the local economy are impacting the LED lighting market.

- Advancements and continued innovation in LED technology are contributing to the increased sales of LED lighting in North America. The use of LED technology in horticulture has reduced energy waste by controlling different light spectrums according to plant growth stages. The emergence of intelligent light-filling technology is also expected to bring potential opportunities to the market. For instance, in 2017, Signify introduced its GreenPower LED Interlighting Gen 3 technology for efficient crop development. Such developments are expected to pave the way for new growth opportunities in the region.

- Regions such as the Middle East, Africa, and South America are also seeing increased adoption of LED lighting as major countries in the regions are adopting LED lighting. For example, in Argentina, November 2020 marked a milestone with the first delivery of modern LED lamps for street lighting. With funding from nine municipalities, these cities established a USD 121,000 temporary fund to purchase 652 advanced LED lights.

- Thus, rapid technological changes and increased adoption of LED lights across the world are expected to boost their use.

Global Outdoor LED Lighting Market Trends

Upgradation and renovation of sports stadiums and government funding in the sports sector are expected to drive the growth of the market

- The number of stadiums is expected to witness a growth from 3,957 units in 2022 to 4,205 units in 2030, registering a CAGR of 0.9%. Upgrading new venues as well as the rehabilitation of existing stadiums are encouraged in North America in an effort to increase consumer demand. For the 2022 football season, the new USD 5.5 billion SoFi Stadium in the United States received an upgrade with new illumination that incorporated LED lights. In addition, Jones AT&T Stadium announced plans to focus on two projects and install new LED lights and turf. Jones AT&T Stadium is undergoing a USD 200 million restoration, and Tech Athletics is contributing a total of USD 2.2 million to the project for the additional improvements. These elements support the expansion of the LED market.

- In addition, increasing construction will help fuel the demand in the European market. For instance, Germany constructed its most inclusive stadium in Berlin for the Special Olympics in 2023. The new athletics stadium, which replaced the venerable Friedrich-Ludwig-Jahn-Sportpark, was given EUR 160 million (USD 175.44 million) by the authorities.

- The demand for goods and services in the Asia-Pacific market will also be positively influenced by the increasing government funding for the sports sector and the staging of various events. For instance, the Chinese government announced plans to fund stadium maintenance and infrastructural improvements. For instance, Shanghai suggested that a "sports city" will be built by 2025. The nation hosted competitions like the AFC Asian Cup 2023, the 12th National Traditional Minority Sports in 2023, and the third National Youth Games in order to achieve that. Due to these developments, the LED market is expected to grow in the coming years.

Increasing energy-efficient construction and the rise in global sales of EVs are expected to drive the growth of the market

- The world's population reached 7.89 billion people in 2021. Global employment figures reached 3.32 billion in 2022 from 3.16 billion in 2015, an increase of almost 0.13 billion. The use of LEDs is expected to increase as more knowledge is spread throughout the population as a result of the rise in the number of employed individuals.

- Despite the COVID-19 pandemic, worldwide spending on energy-efficient construction increased by an exceptional 11.4% in 2020 to over USD 184 billion, up from USD 165 billion in 2019. The yearly growth rate for investments in energy efficiency surpassed 3% for the first time since 2015. The requirement for additional rooms in a house is anticipated to result in increased demand for LEDs due to the rise in the development of energy-efficient buildings and to meet the residential needs of the expanding population.

- In 2022, there were 143.96 million automobiles produced worldwide. In 2023, that number was projected to rise to 150.92 million. Global sales of electric vehicles exceeded 10 million in 2022, and it was predicted that sales in 2023 would rise by another 35% to a total of 14 million. The market share of electric cars rose from 4% in 2020 to 14% in 2022 as a result of this quick expansion. Due to the fact that electric cars need more processors per vehicle than conventional automobiles, there has also been an increase in the need for automotive semiconductor chips as more of them are used. The rise in semiconductor demand in the automotive industry is likely to help the market for LED lighting.

Outdoor LED Lighting Industry Overview

The Outdoor LED Lighting Market is fragmented, with the top five companies occupying 34.47%. The major players in this market are ACUITY BRANDS, INC., EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), Panasonic Holdings Corporation and Signify Holding (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 Argentina

- 4.8.2 Brazil

- 4.8.3 China

- 4.8.4 France

- 4.8.5 Germany

- 4.8.6 Gulf Cooperation Council

- 4.8.7 India

- 4.8.8 Japan

- 4.8.9 South Africa

- 4.8.10 United Kingdom

- 4.8.11 United States

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

- 5.2 Region

- 5.2.1 Asia-Pacific

- 5.2.2 Europe

- 5.2.3 Middle East and Africa

- 5.2.4 North America

- 5.2.5 South America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 ams-OSRAM AG

- 6.4.3 Current Lighting Solutions, LLC.

- 6.4.4 EGLO Leuchten GmbH

- 6.4.5 Guangdong PAK Corporation Co.,Ltd.

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 OPPLE Lighting Co., Ltd

- 6.4.8 Panasonic Holdings Corporation

- 6.4.9 Signify Holding (Philips)

- 6.4.10 Thorn Lighting Ltd. (Zumtobel Group)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms