|

시장보고서

상품코드

1683955

일본의 야외 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Japan Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

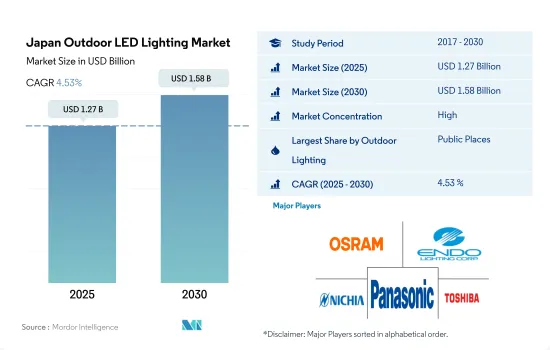

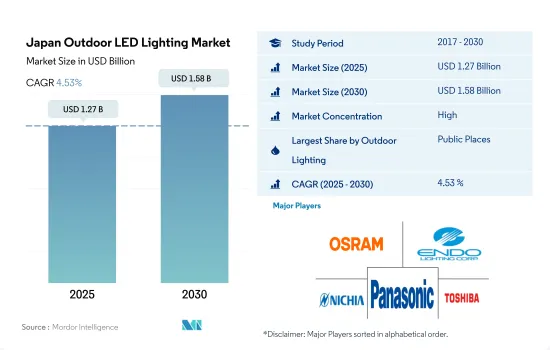

일본의 야외 LED 조명 시장 규모는 2025년에 12억 7,000만 달러에 달할 것으로 추정됩니다. 2030년에는 15억 8,000만 달러에 이를 것으로 예상되며, 예측기간(2025-2030년)의 CAGR은 4.53%를 나타낼 것으로 전망됩니다.

일본에서는 관광객 증가와 공공시설에 있어서의 정부의 대처가 LED 조명 수요를 밀어 올립니다.

- 금액 점유율에서는 2023년에 공공 장소가 점유율의 대부분을 차지한 다음 도로와 차도, 기타가 뒤를 이었습니다. 일본의 공공 장소는 여행 및 관광이 증가함에 따라 해마다 확대되고 있습니다. 일본 정부(GOJ)는 COVID-19의 유행 개시 이후 도항 제한을 서서히 해제해 왔습니다. 국경관리에 있어서의 이러한 긍정적인 진전과 일본의 소비자에게 해외 여행을 장려하는 업계의 노력을 생각하면 미국의 여행 업계에 있어서 지금이야말로 일본 시장 개척을 향해 여행지나 서비스를 선전하는 절호의 기회입니다. 이와 같이 관광업의 성장은 국가가 공공장을 미화하고 전시할 기회를 만들어 냅니다. 유원지나 공항·역의 주차장은 관광객 증가에 의해 다양한 개발이 진행되어 이 분야에서의 LED 조명의 보급이 진행되고 있습니다.

- 수량 점유율에서 2023년에는 공공 장소가 점유율의 대부분을 차지한 다음 도로, 차도 등이 후순위가 되었습니다. LED 조명의 대부분은 관광의 압도적인 반응과 기술 발전의 성장으로 공공 장소 부문에서 사용됩니다. 도쿄도는 가정용 조명의 LED화에 의한 에너지 절약 활동을 추진하는 캠페인을 시작했습니다. 도쿄도는 2016년에 책정한 「2020 실행 계획」에 있어서 항상 진화해 활력이 넘치고 세계에 열린 환경 성능이 뛰어난 「스마트 시티 도쿄」를 목표로 했습니다.

- 일본 정부 주도에 의한 새로운 도로 개발이나 기존의 국도 등의 재개발이 기대되고 있습니다. 이러한 요인도 일본의 야외 부문에서 LED 조명 수요를 뒷받침하고 있습니다.

일본의 야외 LED 조명 시장 동향

새로운 경기장 건설과 LED 조명 설치가 시장 성장을 견인

- 경기장의 수는 2022년의 105기에서 2030년에는 128기로 증가할 것으로 예상되고, CAGR은 2.5%가 될 것으로 전망됩니다. 스포츠 분야는 최근 몇 가지 변화를 겪고 있습니다. 예를 들어, 시그니파이가 2019년에 커넥티드 조명 시스템 인터랙트 스포츠를 설치한 일본 아이치현의 도요타 스타디움이 있습니다. 럭비 월드컵 2019와 2020년에 열린 도쿄 올림픽 축구 경기 전에 일본 요코하마시에 있는 국제 경기장 요코하마(닛산 스타디움)에 LED 기술의 Total Light Control-TLC가 설치되었습니다. 2019년 럭비 월드컵 일본 대회를 앞두고, 시그니파이사는 고베 미사키 경기장에 LED 조명을 설치했습니다. 이러한 요소는 이 지역에서 LED 시장의 확대를 지원합니다.

- 일본에서는 수많은 스포츠를 위한 경기장 건설에 기여하고 있습니다. 예를 들어 나가사키 스타디움 시티는 2022년에 착공했습니다. 이 프로젝트는 이전에 700억엔(4억 2,740만 파운드, 4억 9,360만 유로)의 비용이 소요되었습니다. 그러나 현재는 계획의 변경과 자재비 증가에 의해 총 공비는 800억엔을 넘을 것으로 예상되고 있습니다. 에너지 절약을 위해 경기장에는 LED 조명도 설치됩니다. 일본 스포츠 진흥 센터의 계약에서는 2022년에 치치부궁 럭비장을 대신하는 신 경기장이 도쿄 도심부에 건설되었습니다. 신경기장은 2024년 착공되어 2027년 이후 운영이 시작됩니다. 게다가 가나자와 경기장은 2023년까지 건설되어 2024년 시즌 개막 전에 오픈되었습니다. 이러한 요인이 향후 몇 년간의 LED 시장을 견인해 나갈 것으로 보입니다.

가구수 증가가 LED 조명 시장 성장을 견인

- 2021년 일본의 총 인구는 1억 2,551만 명으로 추정되었습니다. 일본에서는 2021년에는 여성 1명당 1.3명의 어린이가 태어났습니다. 2021년 일본에서는 약 81만 1,600명의 출생이 등록되었습니다. 주택 공간의 공실률 상승으로 시장이 확대됩니다. 2022년에 일본에서 착공된 주택 착공 건수는 약 85만 9,500건이었습니다. 정부 지출 증가, 주택 계획 보조금 및 정부가 주요 인프라 프로젝트에 주력할 것으로 예상되는 것은 모두 일본 주택 시장 확대에 기여하며 결국 LED 판매 증가로 이어질 것입니다. 그 결과, 상업용 부동산 가격의 하락에 의해 보다 많은 상업용지가 구입하게 되어, 향후 수년간은 LED의 사용 확대에 공헌하게 됩니다.

- 2020년 일본 전체의 가구수는 약 5,570만 가구였습니다. 그 중 54.2%가 핵가족 가구이고 38.1%가 단신 가구였습니다. 2022년 가구 인원은 평균 2.2명으로 기록됐습니다. 일본의 가구당 평균 거실 수는 4.4실이었습니다. 2021년 일본의 주택수는 5,560만호였습니다. 같은 해 지표는 전년 대비 0.6% 증가했습니다. 이 지표는 2010년부터 2021년에 걸쳐 8.5% 증가했습니다. 일본에서 LED의 확대는 가구 수 증가에 의해 촉진됩니다.

- 2020년 8월 31일 기준 일본 가구의 46.1% 가까이 적어도 1대의 승용차를 보유하고 있었습니다. 일본의 신차등록 대수는 전년의 약 445만대에서 2022년에는 약 420만대로 감소했습니다. 또한 2022년에는 약 420만대가 새롭게 등록되었습니다. 이러한 등록 대수는 자동차 분야에서 LED 시장이 확대되고 있음을 나타냅니다.

일본의 야외 LED 조명 산업 개요

일본의 야외 LED 조명 시장은 상당히 통합되어 있어 상위 5개사에서 66.76%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. ams-OSRAM AG, Endo Lighting Corporation, Nichia Corporation, Panasonic Holdings Corporation and Toshiba Corporation(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 소득

- LED 총 수입량

- 조명 전력 소비량

- 가구수

- LED 보급률

- 경기장 수

- 규제 프레임워크

- 일본

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 야외 조명

- 공공시설

- 거리 및 도로

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ams-OSRAM AG

- Endo Lighting Corporation

- Japan Street Light Mfg. Co., Ltd.

- Lumileds Holding BV

- Nichia Corporation

- NVC INTERNATIONAL HOLDINGS LIMITED

- Panasonic Holdings Corporation

- Signify Holding(Philips)

- Takasho Digitec Co. Ltd

- Toshiba Corporation

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Japan Outdoor LED Lighting Market size is estimated at 1.27 billion USD in 2025, and is expected to reach 1.58 billion USD by 2030, growing at a CAGR of 4.53% during the forecast period (2025-2030).

Increased tourism and government initiatives in public places in Japan to boost the demand for LED lights in the country

- In terms of value share, in 2023, public places accounted for the majority of the share, followed by streets and roadways and others. Public places in Japan have grown over the years with increasing travel and tourism. The Government of Japan (GOJ) has been gradually lifting travel restrictions since the start of the COVID-19 pandemic. Given these positive developments in border controls and the industry's efforts to encourage Japanese consumers to travel abroad, now is the perfect time for the US travel industry to promote its destinations and services to the Japanese market. Thus, the growth in tourism creates an opportunity for the country to display its public places in a beautified manner. Amusement parks and parking lots in airports and railway stations have gone through various developments due to increased tourism, thus increasing the penetration of LED lights in this segment.

- In terms of volume share, in 2023, public places accounted for the majority of the share, followed by streets and roadways and others. The majority of LED lights are used in the public places segment due to the overwhelming response from tourism and the growth in technological advancement. The Tokyo government launched a campaign to promote energy-saving activities by converting home lighting to LEDs. Under the 2020 Action Plan formulated in 2016, the Tokyo Metropolitan Government aims to become a "Smart City Tokyo" that is constantly evolving, dynamic, open to the world, and has excellent environmental performance.

- Japanese government-led initiatives are expected to develop new roadways and redevelop existing national highways and other roadways. These factors are also propelling the demand for LED lights in the outdoor segment in Japan.

Japan Outdoor LED Lighting Market Trends

Construction of new stadiums and installation of LED lights to drive the growth of the market

- The number of stadiums segment is expected to witness growth from 105 units in 2022 to 128 units in 2030, exhibiting a CAGR of 2.5%. The sports sector has undergone several changes in recent years. For instance, the Toyota Stadium in Aichi, Japan, where Signify installed its connected lighting system Interact Sports in 2019. Before the Rugby World Cup 2019 and the Tokyo Olympic Soccer matches slated for 2020, Total Light Control - TLC for LED technology was installed at the International Stadium Yokohama (Nissan Stadium) in Yokohama City, Japan. Ahead of the 2019 Rugby World Cup Japan, Signify installed LED lights in Kobe Misaki Stadium. These elements support the expansion of the LED market in the area.

- The nation is helping to build stadiums for numerous sports. For instance, work on Nagasaki Stadium City will start in 2022. The project was previously projected to cost JPY 70 billion (GBP 427.4 million or EUR 493.6 million). Still, it is now anticipated that the total cost will exceed JPY 80 billion due to changes in the planning and increased material costs. To save energy, the stadium will also have LED lighting installed. According to a contract awarded by the Japan Sport Council, a new stadium will be built in central Tokyo in 2022 to replace the Chichibunomiya Rugby Stadium. The new stadium is expected to break ground in 2024. After 2027, it will start operating. Additionally, Kanazawa Stadium will be constructed by 2023 and opened before the start of the 2024 season. These factors will drive the LED market in the coming years.

The increasing number of households drives the growth of the LED lighting market

- The overall population of Japan was estimated to be 125.51 million in 2021. In Japan, there are 1.3 children for every woman in 2021. Around 811.6 thousand live births were registered in Japan in 2021. The market will expand due to the rise in residential space availability. Approximately 859.5 thousand home starts were started in Japan in 2022. Increased government spending, housing program subsidies, and the government's anticipated focus on major infrastructure projects will all contribute to Japan's residential market expansion, ultimately resulting in higher LED sales. Consequently, more commercial land will be purchased as a result of the drop in the price of commercial real estate, and thus, will contribute to the greater use of LEDs in coming years.

- Around 55.7 million private households existed in Japan as a whole in 2020. About 54.2% of those were nuclear families, and 38.1% were single-person households. In 2022, there were 2.2 household members on average. Japan had 4.4 rooms per home, on average. In 2021, Japan had 55.6 million homes. In the same year, the indicator showed a 0.6% year-over-year growth. The indicator increased by 8.5% from 2010 to 2021. The expansion of LEDs in Japan will be fueled by an increase in the number of households.

- Nearly 46.1% of households in Japan had at least one passenger car as of August 31, 2020. The number of newly registered motor cars in Japan fell from roughly 4.45 million the year before to about 4.2 million in 2022. Additionally, in 2022, Japan saw the registration of almost 4.2 million new cars. These registrations show that there is a growing market for LEDs in the automobile sector.

Japan Outdoor LED Lighting Industry Overview

The Japan Outdoor LED Lighting Market is fairly consolidated, with the top five companies occupying 66.76%. The major players in this market are ams-OSRAM AG, Endo Lighting Corporation, Nichia Corporation, Panasonic Holdings Corporation and Toshiba Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 Japan

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ams-OSRAM AG

- 6.4.2 Endo Lighting Corporation

- 6.4.3 Japan Street Light Mfg. Co., Ltd.

- 6.4.4 Lumileds Holding B.V.

- 6.4.5 Nichia Corporation

- 6.4.6 NVC INTERNATIONAL HOLDINGS LIMITED

- 6.4.7 Panasonic Holdings Corporation

- 6.4.8 Signify Holding (Philips)

- 6.4.9 Takasho Digitec Co. Ltd

- 6.4.10 Toshiba Corporation

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms