|

시장보고서

상품코드

1683946

독일의 야외 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Germany Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

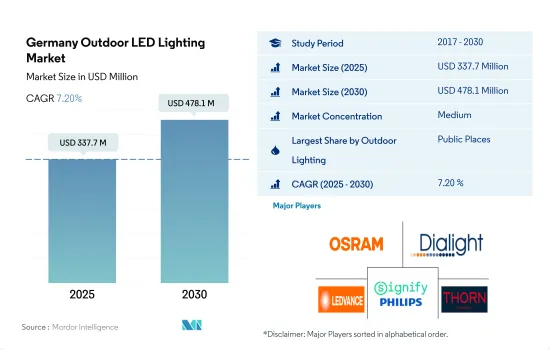

독일의 야외 LED 조명 시장 규모는 2025년에 3억 3,770만 달러에 달할 것으로 추정됩니다. 2030년에는 4억 7,810만 달러에 이를 것으로 예상되며, 예측 기간(2025-2030년)의 CAGR은 7.20%를 나타낼 것으로 전망됩니다.

스마트 시티 프로젝트가 LED 조명 시장 성장을 견인

- 2023년까지 공공 공간이 수량과 금액으로 최대의 점유율을 차지했습니다. COVID-19 팬데믹에 대항하기 위해 독일 전역의 정부는 다른 여행 제한 외에도 엔터테인먼트 센터와 공원의 추가 및 일시적 폐쇄를 부과했습니다. COVID-19의 영향으로 각국은 이 감염 대책에 모든 자원을 투입하게 되었고 정부 기관이 이러한 프로젝트를 승인하기 위한 공공 지출에 영향을 주었습니다. 2021년에는 봉쇄규제가 서서히 완화되고 공공공간이 개방되어 철도역, 쇼핑몰, 공항 부근의 주차장 수요가 높아졌습니다. 정부는 또한 COVID-19 대책을 완화하고 에너지 효율과 지속가능성을 발전시키기 위한 다른 이니셔티브의 창설에 참여했습니다. 그 중 하나는 할로겐 램프의 사용을 줄이고 LED 조명으로 대체하는 것이 었습니다.

- 현재 진행 중인 변혁 프로젝트와 인프라 확장 프로젝트로 국내에서는 LED 야외 조명 수요가 증가하여 시장 성장으로 이어질 것으로 기대되고 있습니다. 스마트 시티와 같은 이니셔티브는 옥외 LED 조명 분야의 개발을 지원할 것으로 기대됩니다. 예를 들어, 2023년 시그니파이는 지능형 가로등의 이용을 통해 독일 지자체 아이헨첼이 지속가능한 스마트 시티가 되도록 지원했습니다. 이 회사의 BrightSites 솔루션은 고속 무선 광대역 연결을 커뮤니티에 제공하여 아이헨첼이 향후 차세대 IoT 용도 및 5G의 고밀도화를 지원할 수 있도록 했습니다. 이 회사는 Interact City 시스템이 관리하는 LED 조명을 설치했습니다. 따라서 LED 조명의 사용을 포함한 이러한 개발은 이 나라에서 이러한 조명 시장 가치를 높이고 있습니다.

독일의 야외 LED 조명 시장 동향

경기장 업그레이드와 신설이 LED 조명 성장을 가속할 것으로 예상

- 경기장 수는 2022년 123기에서 2029년 130기로 증가할 것으로 예상되며, CAGR은 0.8%를 나타낼 것으로 예측됩니다. 경기장 업그레이드에 대한 엄청난 요구가 시장을 견인하는 주요 요인입니다. 예를 들어, 2014년에는 뮌헨의 알리안츠 아레나가 30만개 이상의 LED로 조명되었습니다. 쾰른의 RheinEnergieStadion 경기장은 2016년에 LED 조명을 설치했습니다. 2016년에는 독일 볼프스부르크에 위치한 폭스바겐 아레나에 전 LED 네트워크를 사용한 필드 조명용 Philips ArenaVision 시스템이 설치되었습니다. 보르시아 도르트문트(BVB)의 홈 스타디움인 SIGNAL IDUNA PARK는 2019년에 투무트벨 그룹으로부터 LED 일루미네이션 시스템을 도입했습니다. 도르트문트 스타디움이 10곳 중 1곳으로 선정된 다음 UEFA EURO 2024에서는 이 그룹의 손 브랜드의 새로운 조명 시스템이 채택됩니다. 이것이 이 지역의 LED 시장 확대를 뒷받침하고 있습니다.

- 국가는 경기장 건설을 지원하고 다양한 스포츠에 투자 기회를 제공합니다. 예를 들어, 예나의 경기장 프로젝트는 2021년에 착공해 2023년까지 완성되었습니다. 보훔 로하이드 스타디움은 2025년까지 개조될 예정입니다. 게다가 유행에 대응하여 도입된 'Coronahilfen Profisport' 이니셔티브는 유행에 의해 심각한 영향을 받은 프로스포츠 업계의 부흥을 지원하는 것을 목적으로 하고 있으며, 2021년 총 예산은 2억 유로(1억 8,000만 파운드/2억 3,900만 달러)였습니다. 또한 독일 스포츠 시설 개발을 지원하는 프로그램은 2021년 2월에 시작된 자금 조달 라운드에서 총 6억 유로(5억 3,900만 파운드/7억 1,800만 달러)의 자금을 받았습니다. 이러한 요인은 이 나라의 LED 시장을 견인하고 있습니다.

가구수 증가와 정부 보조금에 의한 EV 판매 증가가 LED 시장 성장을 견인

- 2021년 독일에 사는 인구는 8,324만명이었습니다. 전년에 비해 0.08명 증가했습니다. 독일의 조출생률은 인구 1,000명당 0.3명 증가했습니다(전년 대비 3.23% 증가). 그 결과, 출생률은 관측기간 동안 피크에 도달하여 인구 1,000명당 9.6명이 되었습니다. 독일에서는 출생 1,000명당 유아 사망수가 전년보다 0.1명 감소했습니다(-3.23%). 그 결과 2021년 독일의 유아 사망률은 출생 1,000명당 3명이라는 과거 최저를 기록했습니다. 출생률 상승과 사망률 감소는 더 많은 주택 판매를 촉진하고 LED 조명의 필요성을 높이고 있습니다.

- 2021년 독일 가구 수는 4,160만 가구가 되었습니다. 2021년 독일 가구 수는 연률 0.2% 증가했습니다. 2010년과 2021년 사이에 가구 수는 3.2% 증가했습니다. 10년 전보다 1인 가구가 늘어났습니다. 2021년에는 독일의 16,619호가 1인 가구가 되었습니다. 그 결과 독일의 LED 조명 수요는 가구 수 증가로 도움이 될 것입니다.

- 2022년에는 독일 자동차는 거의 340만대 생산되었습니다. 이는 전년 310만대에서 증가했습니다. 독일 경제의 기초 중 하나는 자동차 부문입니다. 독일 정부는 또한 더 많은 전기자동차가 달리도록 전환을 가속화하고자 합니다. 독일은 구매 보조금을 9,000유로(9872.41달러) 증액하여 전기차 판매를 늘릴 예정입니다. 정부는 2030년까지 1,500만대의 전기자동차를 보급할 예정입니다. 시장 확대는 앞으로 수년간 더 많은 자동차를 판매할 계획에 의해 촉진될 것으로 보입니다.

독일의 야외 LED 조명 산업 개요

독일의 야외 LED 조명 시장은 적당히 통합되어 상위 5개사에서 59.88%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. ams-OSRAM AG, Dialight PLC, LEDVANCE GmbH(MLS), Signify Holding(Philips) and Thorn Lighting Ltd.(Zumtobel Group)(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 소득

- LED 총 수입량

- 조명 전력 소비량

- 가구수

- LED 보급률

- 경기장 수

- 규제 프레임워크

- 독일

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 야외 조명

- 공공시설

- 거리 및 도로

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ALS Architektonische Lichtsysteme GmbH

- ams-OSRAM AG

- Dialight PLC

- LEDVANCE GmbH(MLS Co Ltd)

- Liper Elektro GmbH

- ROBERS-LEUCHTEN GmbH & Co. KG

- Signify Holding(Philips)

- Thorlux Lighting(FW Thorpe Plc)

- Thorn Lighting Ltd.(Zumtobel Group)

- TRILUX GmbH & Co. KG

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Germany Outdoor LED Lighting Market size is estimated at 337.7 million USD in 2025, and is expected to reach 478.1 million USD by 2030, growing at a CAGR of 7.20% during the forecast period (2025-2030).

Smart city projects to drive the growth of LED lighting market

- By 2023, public spaces accounted for the largest share in terms of volume and value. To combat the COVID-19 pandemic, governments across Germany imposed additional and temporary closures of entertainment centers and parks, in addition to other travel restrictions. The impact of the novel coronavirus disease (COVID-19) caused countries to invest all their resources in combating the disease, which impacted public spending for government agencies to approve such projects. Lockdown restrictions were gradually eased in 2021, opening up public spaces, which boosted demand for parking near railway stations, shopping malls, and airports. The government also eased COVID-19 measures and participated in the creation of other initiatives to develop energy efficiency and sustainability. One of them was to reduce the use of halogen lamps and replace them with LED lighting.

- The ongoing transformation and infrastructure expansion projects are expected to increase the demand for LED outdoor lighting in the country, leading to the market's growth. Initiatives such as smart cities are expected to support the development of the outdoor LED lighting segment. For instance, in 2023, Signify helped the German municipality of Eichenzell become a sustainable smart city through the use of intelligent street lighting. The company's BrightSites solution brought high-speed wireless broadband connectivity to the community, enabling Eichenzell to address next-gen IoT applications and 5G densification in the future. The company installed LED lighting, which is managed by the Interact City system. Thus, such developments that include the use of LED lighting are increasing the market value of these lights in the country.

Germany Outdoor LED Lighting Market Trends

Upgradation and construction of new stadiums are expected to drive the growth of LED lights

- The number of stadiums is expected to witness a growth from 123 units in 2022 to 130 units in 2029, recording a CAGR of 0.8%. The enormous need for stadium upgrades is the main factor driving the market. For instance, in 2014, the Allianz Arena in Munich was lit with over 300,000 LEDs. The stadium at RheinEnergieStadion in Cologne installed LED lighting in 2016. The year 2016 saw the installation of the Philips ArenaVision system for field illumination using an all-LED network at the Volkswagen Arena in Wolfsburg, Germany. The SIGNAL IDUNA PARK, the home stadium of Borussia Dortmund (BVB), received an LED illumination system in 2019 from The Zumtobel Group. The next UEFA EURO 2024, which has chosen the Dortmund stadium as one of 10 locations, will employ the new lighting system from the Group's Thorn brand. These factors support the expansion of the LED market in the region.

- The nation supports the building of stadiums and provides investment opportunities for different sports. For instance, work on the Jena stadium project began in 2021 and was expected to be finished by 2023. The Bochum Lohrheide Stadium is expected to be renovated by 2025. Additionally, the "Coronahilfen Profisport" initiative, which was introduced in response to the pandemic and intended to aid in the professional sports industry's rehabilitation after being severely impacted by the pandemic, had a total budget of EUR 200 million (GBP 180 million/USD 239 million) for 2021. Additionally, a program to aid in the development of sporting facilities in Germany received funding with a total of EUR 600 million (GBP 539 million/USD 718 million) in the funding round that started in February 2021. These factors drive the LED market in the country.

Increase in the number of household and government subsidies to increase EV sales and drive the growth of LED market

- In 2021, there were 83.24 million people living in Germany. When compared to the previous year, it went up by 0.08. The crude birth rate in Germany grew over the previous year by 0.3 live births per 1,000 people (+3.23%). The rate thus reached its peak during the observed period at 9.6 live births per 1,000 people. In Germany, there were 0.1 fewer infant deaths per 1,000 live births (-3.23%) than the year before. As a result, in 2021, Germany's infant mortality rate reached its all-time low of three fatalities per 1,000 live births. The rise in birth rates and decline in death rates encourage selling more homes, increasing the need for LED lighting.

- In 2021, Germany had 41.6 million households. In Germany, the number of households increased by 0.2% on an annual basis in 2021. The number of households increased by 3.2% between 2010 and 2021. There are now more one-person families than there were ten years ago. 16,619 German houses only had one person in 2021. As a result, Germany's demand for LED lighting will be aided by an increase in the number of households.

- In 2022, almost 3.4 million German automobiles were produced. This was an increase from the 3.1 million cars sold the year before. One of the foundations of the German economy is the auto sector. The German government also wants to speed up the transition to more electric vehicles on the road. Germany will increase electric vehicle sales by increasing the help-to-buy subsidy by EUR 9,000 (USD 9872.41). By 2030, the government wants 15 million all-electric vehicles on the road. The market's expansion will be facilitated by the plan to sell more cars in the upcoming years.

Germany Outdoor LED Lighting Industry Overview

The Germany Outdoor LED Lighting Market is moderately consolidated, with the top five companies occupying 59.88%. The major players in this market are ams-OSRAM AG, Dialight PLC, LEDVANCE GmbH (MLS Co Ltd), Signify Holding (Philips) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 Germany

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ALS Architektonische Lichtsysteme GmbH

- 6.4.2 ams-OSRAM AG

- 6.4.3 Dialight PLC

- 6.4.4 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.5 Liper Elektro GmbH

- 6.4.6 ROBERS-LEUCHTEN GmbH & Co. KG

- 6.4.7 Signify Holding (Philips)

- 6.4.8 Thorlux Lighting (FW Thorpe Plc)

- 6.4.9 Thorn Lighting Ltd. (Zumtobel Group)

- 6.4.10 TRILUX GmbH & Co. KG

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms