|

시장보고서

상품코드

1683414

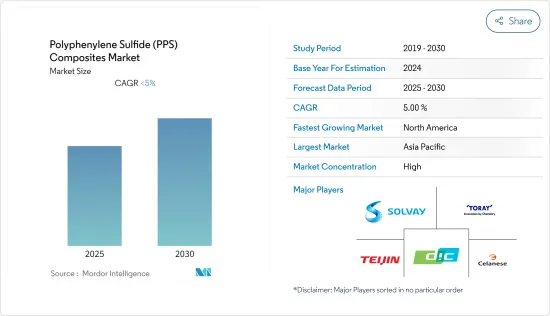

폴리페닐렌 설파이드(PPS) 복합재료 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Polyphenylene Sulfide (PPS) Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

폴리페닐렌설파이드(PPS) 복합재료 시장 예측 기간 동안 CAGR은 5% 미만으로 예상됩니다.

주요 하이라이트

- 섬유 강화에서 복합재 형성의 과제와 코로나19의 영향은 시장 성장의 걸림돌이 될 것으로 예상됩니다.

- 항공우주 및 방위 분야가 시장을 독점하고 있으며, 예측 기간 동안에도 큰 성장이 예상됩니다.

- 예측 기간 동안 아시아태평양이 PPS 시장을 장악했습니다.

폴리페닐렌설파이드(PPS) 복합재료 시장 동향

항공우주 및 국방 분야 수요 증가

- 항공우주 및 방위산업은 PPS 복합소재의 세계 최대 수요처입니다. 이 부문은 전 세계에서 생산된 PPS 복합재료의 약 48%를 소비하고 있습니다.

- PPS 복합재료는 항공우주산업에서 사용되는 폴리에테르에테르케톤(PEEK)이나 폴리이미드(PI)에 비해 가공비용과 원료수지의 가격이 가장 저렴합니다.

- PPS는 고성능 열가소성 플라스틱으로 매우 강하고 단단하며 견고하고 강인합니다. 고유의 난연성과 높은 내열성을 가지고 있으며, 200℃를 훨씬 넘는 온도에서 연속 사용이 가능합니다.

- 또한, 매우 우수한 내산화성과 내화학성, 우수한 전기적 특성, 최소한의 수분 흡수, 낮은 크리프 및 우수한 기계적 특성을 가지고 있습니다.

- 이러한 복합재료는 특히 미군이 정한 다양한 군사 규격에 부합합니다. 또한 여러 기관에서 회로 기판, 소켓, 플러그인, 전자 부품, 방위 항공기에 사용되는 것을 승인했습니다.

- 따라서 앞서 언급한 요인들을 바탕으로 항공우주 및 방위산업에서 PPS 복합재에 대한 수요는 앞으로 더욱 늘어날 것으로 예상됩니다.

아시아태평양이 시장을 장악합니다.

- GDP 최대 경제대국은 중국입니다. 미국과의 무역전쟁으로 인한 무역 장애 이후에도 2019년 GDP 성장률은 약 6.1%를 나타낼 것으로 예상됩니다.

- IMF는 2020년 성장률을 5.8%였고, GDP(구매력평가)로 보면 중국은 25조 2,700억 달러로 세계 최대 경제대국입니다. 게다가 현재 코로나19 사태는 경제에 더 큰 영향을 미치고 있습니다.

- 그러나 예측 기간 동안 이러한 경기 변동성에서 벗어날 수 있을 것으로 예상됩니다.

- 폴리페닐렌설파이드(PPS) 복합재료는 고온 성능, 내크리프성, 우수한 치수 안정성, 내화학성, 난연성을 겸비하고 있어 항공우주 및 방위산업에 널리 사용되고 있습니다.

- 이는 다른 특성과 함께 고온 덕트, 시트 프레임, 인테리어 패널과 같은 인테리어 용도에 적합합니다.

- 랜드 연구소(RAND) 보건 기관(연구 개발)에 따르면, 중국 제조업체는 세계의 많은 주요 시장에서 러시아 방위 산업을 대체 할 가능성이 높을 것으로 예상됩니다. 광범위한 방위 산업 덕분에 PPS 복합재료 시장은 예측 기간 동안 성장할 것으로 예상됩니다.

기타 특전:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 산업 밸류체인 분석

- Porter의 Five Forces 분석

- 신규 진출업체의 위협

- 바이어의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 정도

- 원재료 분석

제5장 시장 세분화

- 유형별

- 탄소섬유 강화 복합재료

- 유리섬유 강화 복합재료

- 기타 유형

- 최종사용자 산업별

- 항공우주 및 방위

- 자동차

- 산업(석유 및 가스 포함)

- 전기 및 전자

- 기타 최종사용자 산업

- 지역별

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 기타 아시아태평양

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 폴란드

- 기타 유럽

- 세계 기타 지역

- 남미

- 중동 및 아프리카

- 아시아태평양

제6장 경쟁 구도

- 인수합병(M&A)/합작투자(JV)/협업/협정

- 시장 순위 분석

- 주요 기업의 전략

- 기업 개요

- Celanese Corporation

- DIC Corporation

- Ensinger

- RTP Company

- SABIC

- Solvay

- Teijin Limited

- Toray Advanced Composites

- Xiamen LFT Composite Plastic Co. Ltd

제7장 시장 기회와 향후 동향

LSH 25.03.28The Polyphenylene Sulfide Composites Market is expected to register a CAGR of less than 5% during the forecast period.

Key Highlights

- Challenges to form composites from fiber reinforcement and the Impact of COVID-19 are expected to hinder the market growth.

- The aerospace and defense segment dominated the market, and is likely to witness significant growth during the forecast period.

- The Asia-Pacific region dominated the PPS market over the forecast period.

Polyphenylene Sulfide Composites Market Trends

Growing Demand from Aerospace and Defense Sector

- The aerospace and defense end-user industry is the largest consumer of PPS composites, globally. The sector consumed about 48% of the total PPS composites produced, globally.

- PPS composites have the lowest processing cost and the price of raw resin compared to polyether ether ketone (PEEK) and polyimide (PI), which are used in the aerospace industry.

- PPS is a high-performance thermoplastic, which is extremely strong, rigid, and tough. It offers inherent flame resistance and high heat resistance with continuous service at temperatures well above 200°C (392°F).

- Moreover, it has very good oxidation and chemical resistance, good electrical properties, minimal water absorption, and low creep and excellent mechanical properties.

- These composites also specifically meet the various military specifications framed by the US military. They are also approved by several agencies to be used in circuit boards, sockets, plug-ins, electronic components, and defense airplanes.

- Thus, based on the aforementioned factors, in the aerospace and defense industry, it can be expected that the demand from for PPS composites may grow further in the future.

Asia-Pacific Region to Dominate the Market

- China is the largest economy, in terms of GDP. The country is expected to have witnessed about 6.1% growth in its GDP during 2019, even after the trade disturbance caused due to its trade war with the United States.

- The IMF projects a growth of 5.8% in 2020. In terms of GDP in PPP, China is the largest economy, with a GDP (PPP) of USD 25.27 trillion. Furthermore, the outbreak of COVID-19 has further affected the economy at present.

- However, the country is expected to rise from such fluctuations in economic performance over the forecast period.

- Polyphenylene sulfide (PPS) composites are widely used in the aerospace and defense industry, as they exhibit a combination of high-temperature performance, creep resistance, excellent dimensional stability, chemical resistance, and flame resistance.

- This, along with other properties, makes it suitable for interior applications, such as high temperature ducting, seat frames, and interior panels.

- According to the RAND's Health Organization (Research And Development), Chinese manufacturers are expected to likely displace Russian defense industries in many key markets around the world. Owing to the wide defense industry, the market for PPS composites is expected to grow during the forecast period.

Polyphenylene Sulfide Composites Industry Overview

The global polyphenylene sulfide (PPS) composites market is consolidated in nature, with the five players accounting for the significant share in the global market. Some of the major companies are DIC Corporation, Toray Advanced Composites, Teijin Limited, Solvay and Celanese Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from Aerospace Sector

- 4.1.2 Increasing Demand from Oil and Gas Sector

- 4.2 Restraints

- 4.2.1 Challenges to Form Composites from Fiber Reinforcement

- 4.2.2 Impact of COVID-19 Pandemic on the Global Economy

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

- 4.5 Raw Material Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Carbon Fiber-reinforced

Composites

- 5.1.2 Glass Fiber-reinforced

Composites

- 5.1.3 Other Types

- 5.2 End-user Industry

- 5.2.1 Aerospace and Defense

- 5.2.2 Automotive

- 5.2.3 Industrial (Includes Oil and Gas)

- 5.2.4 Electrical and Electronics

- 5.2.5 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Poland

- 5.3.3.6 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Celanese Corporation

- 6.4.2 DIC Corporation

- 6.4.3 Ensinger

- 6.4.4 RTP Company

- 6.4.5 SABIC

- 6.4.6 Solvay

- 6.4.7 Teijin Limited

- 6.4.8 Toray Advanced Composites

- 6.4.9 Xiamen LFT Composite Plastic Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Usage in the Asia-Pacific Region

샘플 요청 목록