|

시장보고서

상품코드

1683433

수동 전자부품 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Passive Electronic Components - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

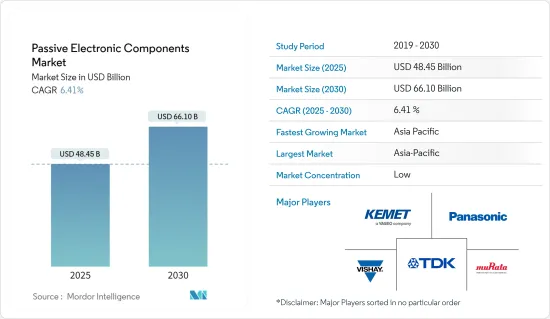

세계의 수동 전자부품 시장 규모는 2025년 484억 5,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 6.41%, 2030년에는 661억 달러에 달할 것으로 예측되고 있습니다.

수동 전자 부품은 물리적 설계 및 회로 모델 언어에서 모든 전자 제품의 기초이며 복잡한 시스템에서 전기적 거동을 나타냅니다. 집적 회로에는 이러한 부품이 포함되고 회로 보드에는 이산 수동 부품이 포함됩니다. 전자기기에 대한 수요 증가는 수동 전자부품 시장의 성장을 뒷받침할 것으로 예상됩니다.

주요 하이라이트

- 인덕터의 성장은 제품 출시 증가, 소비자용 전자기기 부문의 개발, 자동차용 전자기기에서의 인덕터 사용 증가, 스마트 그리드의 채용 등에 의해 현재 견조하게 추이하고 있습니다. 세계적으로는 태블릿, 스마트폰, 노트북, 셋톱박스, 휴대용 게임기 등의 소비자용 전자기기에 대한 수요 증가가 인덕터의 요구를 높이는 주요 요인이 되고 있습니다.

- 기술이 발전함에 따라 전자기기와 전자 장치는 더욱 복잡해지고 있으며, 그 주요 이유는 소형 또는 슬림한 장치에 대한 소비자 수요가 증가하고 있기 때문입니다. 고객은 현재 이러한 장비에 대해 화면이 가장자리에서 끝까지 세련되고 얇은 디자인과 같은 특정 기준을 가지고 있습니다.

- 또한 스마트폰은 저비용, 소형화, 경량화로 MEMS 자이로스코프의 큰 성공을 목격하고 있습니다. 음성 대응 스마트 디바이스 등의 기능도, 최근 몇 년간 채용이 증가하고 있습니다. Amazon Echo, Google Home, Sonos와 같은 스마트 디바이스의 채택은 2023년 말까지 긍정적인 것으로 추정됩니다. 젊은 세대는 이러한 장치를 더 똑똑하고, 빠르고, 쉽게 일상 활동을 수행하는 방법으로 간주합니다.

- 의료 부문에서 웨어러블을 채택하는 것은 최근 몇 년간 견인력을 증가시키고 있으며, 이로 인해 조사된 시장에 영향을 미치는 중요한 요소 중 하나가 되었습니다. 웨어러블 연결 장치의 주요 동향으로는 통증 관리 웨어러블 장치 수요 증가와 심혈관 질환 관리에 대한 웨어러블 사용 증가 등이 있습니다.

- 니켈은 철강 산업에 필수적인 요소이기 때문에 산업 국가에 매우 중요합니다. 가장 큰 채굴국이자 니켈 수출국인 인도네시아는 중국으로 공급이 제한됨에 따라 가격 상승을 기대하여 금속 수출을 금지했습니다.

- COVID-19의 대유행은 세계 산업공급망에 엄청난 혼란을 가져왔습니다. 바이러스의 확산을 막기 위해 전 세계적으로 많은 기업들이 운영을 중단하거나 축소했습니다. 유행은 수동 전자 부품 시장에 영향을 미치며 원료 및 부품 생산 수준공급 체인 전반에 걸쳐 운영 수준이 낮아졌습니다. 이로 인해 다양한 지역과 국가에서 매출이 감소했습니다.

- 유행 이후 소비자용 전자기기 산업 수요가 증가하고 수동 전자부품 시장 수요를 높일 것으로 예상됩니다. 예를 들어 산업단체인 India Cellular and Electronics Association(ICEA)에 따르면 2022년 4월부터 2023년 2월까지 스마트폰 수출은 45억 달러 전후로, 추이했던 전년보다 두 배로 늘었습니다. 또한 인도 휴대전화 수출은 주로 Apple과 Samsung이 견인해 2023년 첫 2개월 만에 20억 달러를 넘어 제조업체가 생산과 외부 출하를 강화했기 때문에 2022년 4월 이후 전체 수출액은 90억 달러를 넘어섰습니다.

수동 전자 부품 시장 동향

인덕터 부문이 컨슈머 일렉트로닉스와 컴퓨팅 산업에서 큰 시장 점유율을 차지할 전망

- 인덕터는 전기 회로의 전압 조정, 노이즈 여과 및 전류 제어에 중요한 기능을 가지고 있습니다. 직류전력에 대한 의존도가 높기 때문에 소비자용 전자기기에 널리 사용되고 있습니다. 다양한 소비자 제품의 스위칭 모드 파워 디바이스에서 인덕터는 DC 전류를 생성하기 위한 에너지 저장 부품으로서의 역할을 합니다. 소비자용 전자기기 부문 확대와 산업 투자 증가로 시장 수요 증가가 예상됩니다.

- 인덕터는 여러 응용 분야에 사용되기 때문에 소비자용 전자 기기 부문에서 가장 중요합니다. 전력 관리, 신호 필터링, 전자기 간섭의 억제 등에 이용되고 있습니다. TV, 디지털 셋톱박스, 스마트 워치, 프린터, 오디오 기기 등의 소비자용 전자 기기에서 인덕터는 중요한 부품으로 작용합니다. 주요 기능은 안정적인 전원 공급을 보장하고 노이즈를 제거하여 신뢰할 수 있는 신호 전송을 실현하는 것입니다. 인덕터를 신중하게 선택 및 설계함으로써 소비자용 전자기기 제품의 성능이 최적화되어 최종적으로 사용자 체험 전체가 향상됩니다. 이러한 장비에 인덕터를 통합하면 효율성, 안정성 및 신뢰성이 향상됩니다.

- 수많은 기술적 진보로 최근 소비자용 전자기기의 이용이 대폭 급증하고 있습니다. 다양한 기술 강화의 통합이 고객을 매료시켜 인덕터 수요 증가로 이어지고 있습니다. 소비자용 전자기기에 터치스크린 및 기타 고급 기능이 도입됨에 따라 산업 내 인덕터에 대한 요구가 더욱 커지고 있습니다. 소비자 전자 부문에서 제품 출시가 증가함에 따라 인덕터에 대한 수요도 증가하고 있습니다.

- 스마트폰은 인덕터를 이용하는데 있어서 필수적인 부품이 되고 있습니다. 일반적으로 고주파 인덕터는 휴대폰에 사용되고 있으며, 지금은 일상 생활에 필수적입니다. 고주파 인덕터를 통합함으로써 보다 빠르고 안정적인 인터넷 열람이 가능해져 언제 어디서나 최신의 사회적 사건을 알 수 있어 통화 품질이 향상되어 휴대전화의 사용자 체험 전체가 향상됩니다

- 스마트폰 기술은 소비자 수요에 강하게 의존하기 때문에 다른 기술에 비해 빠르게 성장하고 있습니다. 휴대폰 인덕터의 양은 모바일 통신 네트워크의 세대가 진행될 때마다 크게 증가하고 있습니다. 스마트폰이 진화를 계속하고, 특히 개발도상국에서의 보급률이 확대됨에 따라, 더욱 확대의 길이 태어납니다. 5G 스마트폰의 급증과 5G 휴대폰 제조에 대한 투자 확대는 인덕터의 필요성을 증폭시킬 것으로 예측됩니다.

- Ericsson의 최신 보고서에 따르면 스마트폰의 모바일 네트워크 계약 수는 2022년 세계에서 거의 64억에 달했으며 2028년에는 77억을 넘을 것으로 예측되고 있습니다. 주목할 점은 중국, 인도, 미국이 스마트폰 및 모바일 네트워크의 계약 수로 최고를 자랑한다는 것입니다. 판매 대수는 2022년에 두드러졌지만, 스마트폰의 평균 판매 가격은 상승하고 있어 향후 수년간은 시장을 견인할 것으로 예상됩니다.

아시아태평양이 인덕터 부문에서 현저한 성장을 이룰 전망

- 일본, 중국, 한국, 대만과 같은 많은 국가들이 수동 전자기기 대기업의 거대 기업과 주조소를 보유하고 있습니다. 아시아태평양의 컨슈머 일렉트로닉스 시장은 스마트 소비자용 전자기기, 혁신적인 하이엔드 제품, 신형 스마트폰의 인기에 견인되어 일관된 성장이 전망되고 있습니다. 그 결과, 이 지역에서의 판매 확대에 추진되어 인덕터 수요도 증가할 것으로 예상됩니다.

- 특히 중국은 혁신과 브랜드 구축에 뛰어나며 산업정보화성이 언급한 바와 같이 소비자용 전자기기 제품의 생산과 판매에 있어서 세계적 리더로서의 지위를 확보하고 있습니다. 생산 능력을 강화하기 위한 투자가 이 지역에서 증가하고 있으며, 소비자 일렉트로닉스 시장은 성장 태세를 정돈하고 있습니다.

- 인도의 전자정보기술부(MeitY)는 2026년까지 인도의 전자기기 제조 부문이 3,000억 달러의 가치를 달성해, 휴대전화 판매가 시장을 선도할 것으로 예측했습니다. ICEA에 따르면 휴대폰 판매액은 2022년 400억 달러로 추정됐고 2026년 800억 달러로 증가할 것으로 예상됩니다. 이 지역의 휴대폰 생산 능력을 강화하기 위한 이러한 정부의 이니셔티브는 결과적으로 인덕터 수요를 창출할 것으로 예상됩니다.

- GSMA 보고서에 따르면 인도는 2030년까지 아시아태평양의 주요 국가로 부상하며 13억대의 스마트폰 연결을 획득할 것으로 예상됩니다. 이 지역은 가장 빠르게 성장하는 5G 시장을 자랑하고 있으며, Ericsson은 2028년까지 5G가 인도 모바일 계약의 57%를 차지하고 총 6억 9,980만 계약에 이를 것으로 예측했습니다. 그 결과, 이 시장은 광범위한 인터넷의 보급과 혁신적인 영상 기술에 의해 촉진되는 휴대폰 수요에 의해 추진될 것으로 예상됩니다.

- Ericsson은 2028년 말까지 동남아시아와 오세아니아의 5G 계약 수가 약 6억 2천만에 달할 것으로 예측했습니다. 이것은 5G가 다른 기술을 능가하고 가입자의 압도적인 선택이 되는 것을 보여주고, 보급률은 48%에 이를 것입니다. 게다가 이 지역에서는 2022년까지 3,000만건 가까운 5G 가입이 전망될 것으로 예측됐습니다. 이러한 5G 도입 이니셔티브 증가는 시장 기회를 높일 것으로 예상됩니다.

수동 전자 부품 시장 개요

패시브 전자 부품 시장은 Delta Electronics Inc., Panasonic Corporation, TDK Corporation, Vishay Intertechnology Inc., Murata Manufacturing 등 주요 기업이 존재하고 부문화되어 있습니다. 이 시장의 진출기업은 제품 제공을 강화하고 지속 가능한 경쟁 우위를 얻기 위해 제휴 및 인수와 같은 전략을 채택하고 있습니다.

- 2023년 10월, TDK Corporation은 배터리 구동 웨어러블 기기 및 기타 기기용으로 개발된 고효율 파워 인덕터의 새로운 시리즈 PLEA85의 출시를 발표하여 작동 시간을 개선했습니다. 신시리즈는 TDK가 새로 개발한 저손실 자성재료의 채용과 박막 가공 기술로 산업 최소의 두께를 실현했습니다.

- 2023년 10월, Vishay Intertechnology Inc.는 유리 및 금속 밀폐 씰을 갖춘 습식 탄탈 커패시터의 새로운 시리즈를 출시했습니다. 항공전자공학과 항공우주를 위해 STH 전해 커패시터는 Vishay의 SuperTan 확장 시리즈 디바이스의 모든 장점을 제공하는 반면, 군용 H 레벨의 충격과 진동 능력의 향상과 300사이클까지의 열충격 증가를 위한 고신뢰성 설계를 기재하고 있습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업의 매력 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

- 산업 밸류체인 분석

- COVID-19 및 기타 거시 경제 요인이 시장에 미치는 영향

- 2022년까지의 팔라듐과 루테늄 수요 및 공급, 2023년의 예측

제5장 시장 역학

- 시장 성장 촉진요인

- 일렉트로닉스의 복잡화

- 설계의 소형화 지향의 고조

- 시장의 과제

- 부품 제조 비용에 영향을 미치는 금속 가격 상승

제6장 시장 세분화

- 커패시터

- 유형별

- 세라믹 커패시터

- 탄탈 커패시터

- 알루미늄 전해 커패시터

- 종이 및 플라스틱 필름 커패시터

- 슈퍼커패시터

- 최종 사용자 산업별

- 자동차

- 산업용

- 항공우주 및 방위

- 에너지

- 통신/서버/데이터 스토리지

- 컨슈머 일렉트로닉스

- 의료

- 지역별

- 아메리카

- 유럽, 중동 및 아프리카

- 아시아태평양(일본과 한국 제외)

- 일본과 한국

- 유형별

- 인덕터

- 유형별

- 전력

- 주파수별

- 최종 사용자 산업별

- 자동차

- 항공우주 및 방위

- 통신

- 소비자용 전자기기와 컴퓨팅

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 기타

- 유형별

- 저항기

- 유형별

- 표면 실장 칩

- 네트워크

- 권선

- 필름, 산화막, 박

- 카본

- 최종 사용자 산업별

- 자동차

- 항공우주 및 방위

- 통신

- 소비자용 전자기기와 컴퓨팅

- 기타

- 지역별

- 북미

- 유럽

- 아시아태평양

- 기타

- 유형별

제7장 경쟁 구도

- 기업 프로파일

- Delta Electronics Inc.

- Panasonic Corporation

- TDK Corporation

- Vishay Intertechnology Inc.

- Murata Manufacturing Co. Ltd

- AVX Corporation(Kyocera Corporation)

- Taiyo Yuden Co. Ltd

- Sagami Elec Co. Ltd

- WIMA GmbH & Co. KG

- Cornell Dubilier Electronics Inc.

- Yageo Corporation

- Lelon Electronics Corp.

- United Chemi-Con(일본 Chemi-con Corporation)

- Bourns Inc.

- Wurth Elektronik Group

- API Delevan(Fortive Corporation)

- Eaton Corporation

- Coilcraft Inc.

- TT Electronics PLC

- KOA Speer Electronics Inc.

- TE Connectivity Ltd

- Ohmite Manufacturing Company

- Susumu Co. Ltd

- Viking Tech Corporation

- Honeywell International Inc.

제8장 중국 제조업체 일람

제9장 투자 분석

제10장 투자 분석 시장의 미래

JHS 25.04.01The Passive Electronic Components Market size is estimated at USD 48.45 billion in 2025, and is expected to reach USD 66.10 billion by 2030, at a CAGR of 6.41% during the forecast period (2025-2030).

Passive electronic components are the cornerstone of all electronics, in physical design and circuit models' language, representing electrical behavior in complicated systems. Integrated circuits include these components, and circuit boards contain discrete passive components. The increasing demand for electronic devices is anticipated to boost the passive electronic components market's growth.

Key Highlights

- The growth of inductors is presently steady, owing to the increasing number of product launches, the developments in the consumer electronics sector, the rising use of inductors in automotive electronics, and the adoption of smart grids. Globally, the rising demand for consumer electronics, such as tablets, smartphones, laptops, set-top boxes, and portable gaming consoles, is the major factor boosting the need for inductors.

- With the advent of technological advancements, electronics, and electronic devices are getting more complex, primarily due to the increasing consumer demand for small or slim devices. Customers have a specific standard for these devices nowadays, such as a sleek, thin design, with the screen going from edge to edge.

- Moreover, smartphones have witnessed the great success of MEMS gyroscopes owing to their low cost, miniature size, and lightweight nature. Features like voice-enabled smart devices have also been witnessing increased adoption over the past few years. The adoption of smart devices, such as the Amazon Echo, Google Home, and Sonos, was estimated to be aggressive by the end of 2023. The younger generation views these devices as the smarter, faster, and easier way to perform everyday activities.

- The adoption of wearables in the healthcare sector has been gaining traction in recent times, which, in turn, has been one of the significant factors influencing the market studied. The major trends in wearable connected devices include the increasing demand for pain management wearable devices and the increasing use of wearables for cardiovascular disease management.

- As nickel is an essential element for steel industries and, therefore, crucial to industrial countries, in recent times, the price of the element has been most affected by continuing lockdowns in some parts of the world, coupled with supply-side restraints. Indonesia, the largest miner and nickel exporter, banned metal exports in the hopes of a price rise in the wake of limited supplies to China.

- The COVID-19 pandemic led to immense disruptions in supply chains across industries globally. Many businesses globally halted or reduced operations to help combat the spread of the virus. The pandemic impacted the passive electronic components market, leading to decreased operation levels across the supply chain on the raw material and component production levels. This denoted a fall in sales in a range of regions and countries.

- The demand from consumer electronics industries has increased post-pandemic and is anticipated to boost the demand in the passive electronic components market. For instance, according to the industry body India Cellular and Electronics Association (ICEA), smartphone exports in the April 2022-February 2023 years doubled from a year ago when exports hovered around USD 4.5 billion. In addition, India's mobile phone exports crossed USD 2 billion in the first two months of 2023, driven mainly by Apple and Samsung, taking the entire export value to over USD 9 billion since April 2022, as manufacturers stepped up production and external shipments.

Passive Electronic Components Market Trends

The Consumer Electronics and Computing Industry in the Inductors Segment is Expected to Hold a Significant Market Share

- Inductors have a significant function in the regulation of voltage, noise filtration, and current control within electrical circuits. Their usage is widespread in consumer electronics due to their strong reliance on DC power. In switched-mode power devices in various consumer products, inductors serve as energy storage components to generate DC current. The market is anticipated to experience increased demand due to the expanding consumer electronics sector and growing investments in the industry.

- Inductors are of utmost importance in the consumer electronics sector as they serve multiple purposes. They are utilized for power management, signal filtering, and suppressing electromagnetic interference. In consumer electronic devices like televisions, digital set-top boxes, smartwatches, printers, and audio equipment, inductors act as crucial components. Their primary function is to ensure a steady power supply and eliminate noise, thereby ensuring reliable signal transmission. By carefully selecting and designing inductors, the performance of consumer electronics is optimized, ultimately enhancing the overall user experience. The incorporation of inductors in these devices leads to improved efficiency, stability, and reliability.

- Due to numerous technological advancements, there has been a significant surge in the utilization of consumer electronic devices in recent years. The incorporation of various technological enhancements has captivated customers, leading to a higher demand for inductors. The introduction of touch screens and other advanced functionalities in consumer electronics has further fueled the need for inductors within the industry. With the increasing number of product launches in the consumer electronics sector, there is a growing demand for inductors in the industry.

- Smartphones have become integral components for the utilization of inductors. Typically, high-frequency inductors find their application in mobile phones, which have now become indispensable in day-to-day lives. The incorporation of high-frequency inductors enables faster and more stable internet browsing, facilitates staying updated with the latest social events at any time and place, enhances call quality, and elevates the overall mobile phone user experience.

- Smartphone technology is experiencing rapid growth in comparison to other technologies due to its strong reliance on consumer demand. The quantity of inductors in mobile phones experiences a substantial rise with every successive generation of the mobile communication network. As smartphones continue to evolve and their adoption rate expands, particularly in developing nations, additional avenues for expansion arise. The surge in 5G smartphones and the escalating investments in the manufacturing of 5G mobile phones are projected to amplify the need for inductors.

- Ericsson's most recent report disclosed that the global count of smartphone mobile network subscriptions nearly reached 6.4 billion in 2022, and it is projected to surpass 7.7 billion by 2028. It is noteworthy that China, India, and the United States are at the forefront, boasting the highest number of smartphone mobile network subscriptions. Although sales plateaued in 2022, the rising average selling price of smartphones is anticipated to propel the market in the forthcoming years.

Asia-Pacific is Expected to Witness Significant Growth in the Inductors Segment

- The demand for inductors is primarily felt in Asia-Pacific, with many countries, like Japan, China, South Korea, and Taiwan, hosting massive companies and foundries for several major passive electronic powerhouses. The consumer electronics market in Asia-Pacific is expected to witness consistent growth, driven by the popularity of smart appliances, innovative high-end products, and new smartphones. As a result, the demand for inductors is also expected to increase, fueled by the expanding sales in the region.

- China, in particular, has excelled in innovation and brand building, securing its position as the global leader in the production and sales of consumer electronics, as stated by the Ministry of Industry and Information Technology. With increasing investments in the region to enhance production capabilities, the consumer electronics market is poised for growth.

- The Ministry of Electronics and Information Technology (MeitY) in India has forecasted that the electronics manufacturing sector in the country will achieve a worth of USD 300 billion by 2026, with mobile phone sales taking the lead in the market. As per ICEA, mobile phone sales were estimated at USD 40 billion in 2022 and are anticipated to rise to USD 80 billion by 2026. These governmental efforts to enhance the mobile phone production capabilities in the region are expected to consequently generate demand for inductors.

- As per the GSMA report, India is anticipated to emerge as the leading country in Asia-Pacific by 2030, with 1.3 billion smartphone connections. The region boasts some of the most rapidly expanding 5G markets, and by 2028, Ericsson predicts that 5G will constitute 57% of mobile subscriptions in India, totaling 699.8 million subscriptions. Consequently, the market is anticipated to be propelled by the demand for mobile phones, facilitated by extensive internet penetration and innovative imaging technology.

- Ericsson predicts that by the end of 2028, the number of 5G subscriptions in Southeast Asia and Oceania will reach approximately 620 million. This indicates that 5G will surpass other technologies and become the dominant choice for subscribers, with a penetration rate of 48%. Furthermore, it is projected that the region will have nearly 30 million 5G subscriptions by 2022. Such increasing 5G deployment initiatives are expected to enhance the market opportunities.

Passive Electronic Components Market Overview

The passive electronic components market is fragmented with the presence of major players like Delta Electronics Inc., Panasonic Corporation, TDK Corporation, Vishay Intertechnology Inc., and Murata Manufacturing Co. Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In October 2023, TDK Corporation announced the launch of its new PLEA85 series of high-efficiency power inductors developed for battery-powered wearables and other devices, improving operating times. The new series has the lowest profile in the industry, owing to the use of TDK's newly developed low-loss magnetic material and its thin-film processing techniques.

- In October 2023, Vishay Intertechnology Inc. launched a new series of wet tantalum capacitors with hermetic glass-to-metal seals. For avionics and aerospace applications, the STH electrolytic capacitors provide all the advantages of Vishay's SuperTan extended series devices while offering a higher reliability design for improved military H-level shock and vibration capabilities and increased thermal shock up to 300 cycles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 and Other Macroeconomic Factors on the Market

- 4.5 Demand and Supply of Palladium and Ruthenium Till 2022 and Forecast for 2023

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Complexity of Electronics

- 5.1.2 Increasing Miniaturized Design Preferences

- 5.2 Market Challenges

- 5.2.1 Rising Metal Prices Impacting Component Production Costs

6 MARKET SEGMENTATION

- 6.1 Capacitors

- 6.1.1 By Type

- 6.1.1.1 Ceramic Capacitors

- 6.1.1.2 Tantalum Capacitors

- 6.1.1.3 Aluminum Electrolytic Capacitors

- 6.1.1.4 Paper and Plastic Film Capacitors

- 6.1.1.5 Supercapacitors

- 6.1.2 By End-user Industry

- 6.1.2.1 Automotive

- 6.1.2.2 Industrial

- 6.1.2.3 Aerospace and Defense

- 6.1.2.4 Energy

- 6.1.2.5 Communications/Servers/Data Storage

- 6.1.2.6 Consumer Electronics

- 6.1.2.7 Medical

- 6.1.3 By Geography

- 6.1.3.1 Americas

- 6.1.3.2 Europe, Middle East and Africa

- 6.1.3.3 Asia-Pacific (Excl. Japan and Korea)

- 6.1.3.4 Japan and South Korea

- 6.1.1 By Type

- 6.2 Inductors

- 6.2.1 By Type

- 6.2.1.1 Power

- 6.2.1.2 Frequency

- 6.2.2 By End-user Industry

- 6.2.2.1 Automotive

- 6.2.2.2 Aerospace and Defense

- 6.2.2.3 Communications

- 6.2.2.4 Consumer Electronics and Computing

- 6.2.2.5 Other End-user Industries

- 6.2.3 By Geography

- 6.2.3.1 North America

- 6.2.3.2 Europe

- 6.2.3.3 Asia-Pacific

- 6.2.3.4 Rest of the World

- 6.2.1 By Type

- 6.3 Resistors

- 6.3.1 By Type

- 6.3.1.1 Surface-mounted Chips

- 6.3.1.2 Network

- 6.3.1.3 Wirewound

- 6.3.1.4 Film/Oxide/Foil

- 6.3.1.5 Carbon

- 6.3.2 By End-user Industry

- 6.3.2.1 Automotive

- 6.3.2.2 Aerospace and Defense

- 6.3.2.3 Communications

- 6.3.2.4 Consumer Electronics and Computing

- 6.3.2.5 Other End-user Industries

- 6.3.3 By Geography

- 6.3.3.1 North America

- 6.3.3.2 Europe

- 6.3.3.3 Asia-Pacific

- 6.3.3.4 Rest of the World

- 6.3.1 By Type

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Delta Electronics Inc.

- 7.1.2 Panasonic Corporation

- 7.1.3 TDK Corporation

- 7.1.4 Vishay Intertechnology Inc.

- 7.1.5 Murata Manufacturing Co. Ltd

- 7.1.6 AVX Corporation (Kyocera Corporation)

- 7.1.7 Taiyo Yuden Co. Ltd

- 7.1.8 Sagami Elec Co. Ltd

- 7.1.9 WIMA GmbH & Co. KG

- 7.1.10 Cornell Dubilier Electronics Inc.

- 7.1.11 Yageo Corporation

- 7.1.12 Lelon Electronics Corp.

- 7.1.13 United Chemi-Con (Nippon Chemi-con Corporation)

- 7.1.14 Bourns Inc.

- 7.1.15 Wurth Elektronik Group

- 7.1.16 API Delevan (Fortive Corporation)

- 7.1.17 Eaton Corporation

- 7.1.18 Coilcraft Inc.

- 7.1.19 TT Electronics PLC

- 7.1.20 KOA Speer Electronics Inc.

- 7.1.21 TE Connectivity Ltd

- 7.1.22 Ohmite Manufacturing Company

- 7.1.23 Susumu Co. Ltd

- 7.1.24 Viking Tech Corporation

- 7.1.25 Honeywell International Inc.