|

시장보고서

상품코드

1683808

북미의 2차 포장 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)North America Secondary Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

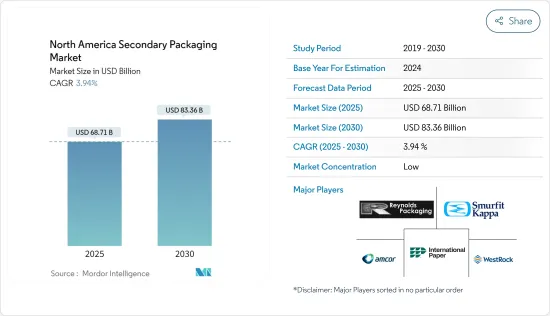

북미의 2차 포장 시장 규모는 2025년 687억 1,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 3.94%로, 2030년에는 833억 6,000만 달러에 달할 것으로 예측되고 있습니다.

미국과 캐나다는 거대한 소비자 시장이며 인구 구매력이 크기 때문에 모든 패키지 공급업체에게 유리한 시장이되었습니다. 그 결과, 북미의 2차 포장 시장은 식품 포장 수요 증가, 전자상거래 거래의 잇따라 성공, 포장 운송의 안전성에 대한 요구로부터 향후 1년간 성장할 것으로 예측됩니다.

주요 하이라이트

- 포장에서 환경 친화적 인 재료의 사용 증가는 북미의 2 차 포장 시장을 견인하고 있습니다. 재활용 가능, 생분해성, 재사용 가능, 비독성 및 환경에 미치는 영향이 적은 포장은 환경 친화적인 것으로 간주됩니다. 환경 친화적인 포장 재료의 필요성은 음식 및 음료 산업 및 가정용 케어 용품 제조업체를 포함한 최종 사용자에게 점점 더 분명해지고 있습니다. 접이식 상자와 골판지 상자와 같은 포장 형태는 판지와 같은 재활용과 생분해가 가능한 소재로 구성되어 있기 때문에 환경에 악영향을 미치지 않습니다.

- 사람들의 바쁜 라이프 스타일로 인해 편의점 수요가 증가하는 경향이 있습니다. 골판지 포장은 제품으로부터의 습기를 방지하고 장시간의 운송에도 견디기 때문에 특히 2차 포장이나 3차 포장에 있어서, 보다 좋은 결과를 고객에게 제공하기 위해 골판지 포장을 채용하는 기업이 늘고 있습니다. 빵, 고기 제품 및 기타 신선품과 같은 가공 식품은 이러한 포장 재료를 한 번 사용해야하므로 수요가 증가하고 있습니다.

- 골판지는 재활용이 쉽고, 펄프·제지업계는 이미 신세대 골판지로의 전환에 뛰어나기 때문에 지속가능성에 대한 관심이 밸류체인 전체에서 높아짐에 따라, 골판지는 포장재로서 점점 보편화되고 있습니다. 이러한 이점으로부터, 골판지 보호 폼은 발포 폴리스티렌(EPS)과 같은 폴리머 기반 대체품보다 인기를 얻고 있습니다.

- 또한, 택배 및 메신저 수익이 증가하고 있다는 것은 제품을 한 곳에서 다른 곳으로 옮길 때 골판지나 종이 포장 등의 2차 포장이 사용되고 있음을 나타냅니다. 미국 상무부에 따르면 2021년 미국 택배·메신저의 영업 수입은 거의 1,379억 1,000만 달러였습니다. UPS는 미국 최대의 택배·배달 서비스 업체로 택배 시장의 약 40%를 차지하고 있습니다.

- 2차 포장은 여전히 환경 문제를 일으키고 있지만 해결해야 할 과제는 그 밖에도 있습니다. 온라인 구매는 부족한 2차 포장이나 부적절한 2차 포장으로 인해 결함이 있거나 불완전하거나 부정확한 제품을 받는 번거로움과 실망에 모두를 접합니다. 그러나 2차 포장은 1차 포장 후에 이루어지므로 정지로 인한 문제는 다른 생산 라인에 영향을 미칩니다. 생산 및 납품 계획은 가동 중지 시간에 의해 중단되며 제품 폐기를 증가시키고 인건비를 경비란으로 되돌립니다. 생산 계획은 사전 계획에 따라 정지를 예측하고 줄이는 것이 이상적입니다.

북미의 2차 포장 시장 동향

소비자 일렉트로닉스가 현저한 성장을 이룹니다.

- 가전 제조업체는 소비자 주도의 지속가능한 포장 외에도 정부와 법률에도 힘쓰고 있습니다. 이것은 특히 미국에서 두드러지며 생산자 책임 프로그램의 확대, 일회용 포장의 제한 및 기타 문제의 법제화가 검토되고 있습니다.

- 접이식 판지 및 골판지 상자와 같은 2차 포장은 중량물 및 소형 전기 부품의 포장에 사용됩니다. 골판지 상자는 가전제품, 냉장고, HVAC 장치 등 소비자용 제품을 포장합니다. 이 외에도 회로 차단기, 테이프 및 전구와 같은 소형 전기 부품 및 액세서리도 2차 포장에 종이 기반 재료를 사용합니다.

- 소비자 기술 협회에 따르면 미국 시장에서 소비자 전자 제품(CE)의 소매 매출은 2015년에서 2022년까지 꾸준히 증가했습니다. 예측에 따르면 2023년 미국의 가전 소매 매출은 4,850억 달러의 성장이 예상됩니다. OLED TV 매출은 2023년 23억 달러에 달했습니다.

- 전자기기 포장의 위조 방지에 대한 강한 요구가 북미 시장을 견인하고 있습니다. 포장에는 바코드, 홀로그램, 씰링 테이프, 고주파 식별 장치 등 앞면과 뒷면 기술이 사용되어 제품의 무결성을 보호합니다. 신흥경제국에서 전자상거래의 급성장은 세계의 위조방지 전자기기 포장업계에 이익을 주고 있습니다.

- 또한, 환경 친화적인 포장이 전기 장비에 보급되고 있습니다. 정부 및 규제 당국은 녹색 포장 채택을 강력하게 추진하고 있습니다. 브랜드와 고객 모두 환경 친화적 인 포장과 생분해성이 없는 포장 쓰레기로부터 환경을 보호하는 중요성을 인식합니다.

현저한 성장이 기대되는 캐나다

- 캐나다의 2차 포장 시장은 전년에 67억 9,000만 달러로 평가되었습니다. 골판지 포장은 다양한 상품을 보호하고 운송하는 경제적인 방법입니다. 골판지의 경량성, 생분해성, 재활용성 등의 특성으로 인해 골판지는 패키징 비즈니스에 필수적인 요소가 되었습니다. Sealed Air는 2025년까지 100% 재활용 또는 재사용 가능한 패키징을 만드는 데 주력합니다. 이 회사의 솔루션의 약 50%는 이미 재활용 소재로 만들어졌습니다.

- 시장에서의 존재감과 지위를 향상시키기 위해 캐나다 벤더는 성장, 파트너십, 협업 노력에 주력하고 있습니다. 마찬가지로 2022년 12월 Titan Corrugated와 그 계열사 All Boxed Up은 미국에 본사를 둔 지주회사 UFP Industries의 일부인 UFP 패키징에 인수되었습니다. 인수된 회사는 All Boxed Up을 통해 미국 전역에 유통되는 표준 사이즈를 제조하고 있습니다.

- 신흥국의 전자상거래 시장은 특히 운송 및 물류 분야의 기업로부터 골판지나 종이제품에 대한 수요를 창출하고 있습니다. 적응성이 있고 합리적인 가격인 종이 기반 패키지는 많은 품목을 운반, 보호 및 저장하는 데 사용되어 왔습니다.

- Worldpay에 따르면 모바일 전자상거래는 2021년 캐나다에서 280억 달러를 초과하는 수익을 올렸고, 이에 대한 데스크톱 전자상거래는 530억 달러였습니다. 또한 이 금액은 2025년까지 모바일에서 570억 달러, 데스크톱에서 810억 달러로 증가할 것으로 예측됩니다. 이 성장은 지정된 기간 내에 골판지 포장 상자에 대한 국가 수요가 비례하여 증가할 것으로 예상됩니다.

- 캐나다의 전자상거래 인프라는 고도로 발전하고 있으며 미국과 밀접하게 통합되어 있습니다. 캐나다의 주요 온라인 소매업체로는 Amazon, Wal-Mart, Canadian Tire, Costco, Best Buy, Hudson's Bay, Etsy 등이 있습니다.

- 캐나다 소비자는 인터넷에서 주문에 의존합니다. 인터넷 소비자 매출은 전통적인 소매 매출보다 지난 10년간 증가하고 있습니다. 캐나다 소매 기업의 대부분은 무선 기술과 인터넷 기반 시스템을 채택하여 기업 간 및 기업 대 소비자 간의 관계를 개선하고 있습니다.

- 캐나다는 인터넷을 가장 많이 사용하는 국가 중 하나이며 소매 채널이 크게 혼란스럽고 소비자는 전자상거래를 받아들입니다. Ascential의 Edge에 따르면 캐나다의 소매 체인의 전자상거래 총 매출은 2022년 473억 달러에 달할 전망입니다. 소매 전자상거래 매출은 2027년까지 739억 달러에 달할 것으로 추정됩니다.

북미의 2차 포장 산업 개요

북미의 2차 포장 시장은 단편화되어 있으며, Amcor PLC, International Paper Company, Reynolds Packaging, Westrock Company, Smurfit Kappa Group과 같은 대기업이 존재합니다. 시장의 기존 기업은 인수, 파트너십 활동, R&D의 중시, 혁신적 활동 등을 특징으로 하는 강력한 경쟁 전략을 채택하고 있습니다.

- 2023년 3월 Amcor와 Nfinite Nanotechnology Inc.는 Nfinite의 나노 코팅 기술을 재활용 가능하고 생분해성 패키징에 적용하기 위한 공동 연구 이니셔티브를 시작했습니다.

- 2022년 6월: Mondi는 Nitto Denko Corporation의 퍼스널케어 컴포넌트 사업(PCC)을 기업 가치 6억 1,500만 유로(6억 8,117만 달러)로 매각했습니다. 이 매각을 통해 몬디는 보유주식을 합리화하고 지속가능한 패키징 확대라는 전략목표에 집중할 수 있게 되었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 산업 밸류체인 분석

- 업계의 매력도 - Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- COVID-19의 업계에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- FMCG 산업 수요 증가

- 보안 및 추적 솔루션 수요 증가

- 시장의 과제

- 유비쿼터스 규격의 부족, 안전성에 대한 우려, 가혹한 기후 조건에 대한 내성의 부족

제6장 시장 세분화

- 제품 유형별

- 골판지 상자

- 접이식 판지

- 플라스틱 상자

- 랩과 필름

- 기타 제품 유형

- 최종 사용자 산업별

- 식품

- 음료

- 헬스케어

- 가전제품

- 퍼스널케어와 가정용품

- 기타 최종 사용자 산업

- 국가별

- 미국

- 캐나다

제7장 경쟁 구도

- 기업 프로파일

- Amcor PLC

- International Paper Company

- Reynolds Packaging

- WestRock Company

- Smurfit Kappa Group

- Berry Global Group Inc.

- Packaging Corporation of America

- Deufol SE

- Mondi PLC

- Tranpak Inc.

제8장 투자 분석

제9장 시장의 미래

JHS 25.03.28The North America Secondary Packaging Market size is estimated at USD 68.71 billion in 2025, and is expected to reach USD 83.36 billion by 2030, at a CAGR of 3.94% during the forecast period (2025-2030).

The United States and Canada are massive consumer markets, and the population's considerable buying power makes it a lucrative market for all package suppliers. As a result, the North American secondary packaging market is anticipated to grow over the upcoming year due to the growing demand for food packaging, a string of successful e-commerce transactions, and the demand for safety in packaging transportation.

Key Highlights

- The rising use of environment-friendly materials in packaging is driving the secondary packaging market in North America. Packaging that is recyclable, biodegradable, reusable, non-toxic, and has a minimal environmental impact is considered eco-friendly. The need for environment-friendly packaging materials is becoming increasingly apparent to end users, including the food and beverage industry and manufacturers of household care products. Packaging formats like folding cartons and corrugated boxes have no adverse effects on the environment because they are constructed of recyclable and biodegradable materials, such as paperboard.

- The demand for convenience foods is on the rise due to the busy lifestyle of people. As corrugated board packaging keeps moisture from the products and withstands long shipping times, companies are increasingly adopting it to offer customers better outcomes, especially secondary or tertiary packaging. Processed foods, such as bread, meat products, and other perishable items, need these packaging materials to be used once, thereby driving the demand.

- Since the corrugated board is easy to recycle and the pulp and paper industry is already skilled at converting it into new generations of containerboard, it is becoming increasingly common in packaging as sustainability concerns become more relevant across the value chain. Due to these benefits, corrugated protective forms have gained popularity over polymer-based substitutes, such as expanded polystyrene (EPS) foams.

- Additionally, increasing courier and messengers' revenue indicates the use of secondary packagings, such as corrugated boards and folding cartons packaging, in transiting the products from one place to another. According to the US Department of Commerce, in 2021, the US couriers and messengers generated almost USD 137.91 billion in operating revenue. UPS is the largest courier and delivery service provider in the United States, with around 40% of the courier market.

- Secondary packaging still raises environmental questions, but there are also other challenges to solve. In online purchasing, all have encountered the bother and disappointment of receiving a flawed, incomplete, or inaccurate product due to subpar or insufficient secondary packaging. However, since secondary packaging comes after primary packaging, any issues resulting from a stoppage impact the rest of the production line. Production and delivery plans are disrupted by downtime, which also increases product waste and brings labor expenses back into the expense column. Production planning should ideally include anticipating and reducing stoppages through advanced planning.

North America Secondary Packaging Market Trends

Consumer Electronics to Witness Significant Growth

- Consumer electronics firms are being pushed by government and legislation in addition to consumer-driven sustainable packaging. This is notably true in the United States, where legislation for expanded producer responsibility programs, single-use packaging limitations, and other issues is being examined.

- Secondary packaging, such as folding cartons and corrugate boxes, is used for heavy and small electrical component packaging. Corrugated boxes pack consumer products, such as home appliances, refrigerators, HVAC units, etc. Apart from these, smaller electrical components and accessories, such as circuit breakers, tapes, light bulbs, etc., also use paper-based materials for secondary packaging.

- According to Consumer Technology Association, the retail sales of consumer electronics (CE) in the US market increased steadily from 2015 to 2022. According to forecasts, retail sales of consumer electronics are expected to grow by USD 485 billion in the United States in 2023. Revenue from OLED Televisions is expected to reach USD 2.3 billion in 2023.

- A strong need for anti-counterfeiting in electronics packaging drives the North American market. The packaging uses overt and covert technology, such as barcodes, holograms, sealing tapes, and radiofrequency identifying devices, to protect the integrity of items. The rapid growth of e-commerce in emerging economies has benefited the worldwide anti-counterfeit electronics packaging industry.

- Furthermore, environmental-friendly packaging is becoming popular for electrical devices. Government authorities and regulators have made a strong push for the adoption of green packaging. Both brands and customers are becoming more aware of environmentally friendly packaging and the importance of safeguarding the environment from non-biodegradable packaging trash.

Canada Expected to Witness Significant Growth

- The Canadian secondary packaging market was valued at USD 6.79 billion the year before. Corrugated board packaging is an economical way to safeguard and transport various goods. The corrugated board's qualities, such as light weightiness, biodegradability, and recyclability, have made it a vital component in the packaging business. Sealed Air will focus on creating 100% recyclable or reused packaging by 2025. Around 50% of its solutions have already been made with recycled material.

- To improve their presence and position in the market, vendors in Canada have focused on growth, partnership, and collaboration initiatives. Similarly, in December 2022, Titan Corrugated and its associate All Boxed Up were acquired by UFP Packaging, a branch of UFP Industries, a US-based holding firm. The acquired company manufacture standard-sized distributed across the United States via All Boxed Up.

- The country's developing e-commerce market generates demand for corrugated and paper goods, notably from players in the transportation and logistics sectors. Paper-based packaging, which is adaptable and affordable, has been used to carry, protect, and preserve many items.

- According to Worldpay, mobile e-commerce earned over USD 28 billion in Canada in 2021, compared to USD 53 billion from desktop e-commerce. Additionally, it predicts that these amounts will rise to USD 57 billion and USD 81 billion in mobile and desktop sales by 2025. This growth is anticipated to show a proportionate rise in the nation's demand for corrugated packing boxes within the specified time frame.

- Canada's e-commerce infrastructure is highly developed and closely integrated with the United States. The major online retailers in Canada include Amazon, Wal-Mart, Canadian Tire, Costco, Best Buy, Hudson's Bay, and Etsy.

- Canadian consumers rely upon the internet to place orders. Internet consumer sales have risen more in the past decade than traditional retail sales. Most Canadian retail firms have adopted wireless technologies and internet-based systems to improve business-to-business and business-to-consumer relations.

- As Canada is one of the heaviest internet users, consumers have embraced electronic commerce amid a significant disruption in retail channels. According to Edge by Ascential, retail chain e-commerce gross sales in Canada accounted for USD 47.3 billion in 2022. Retail e-commerce sales are estimated to total USD 73.9 billion by 2027.

North America Secondary Packaging Industry Overview

The North American secondary packaging market is fragmented, with the presence of major players like Amcor PLC, International Paper Company, Reynolds Packaging, Westrock Company, and Smurfit Kappa Group. The market incumbents are adopting powerful competitive strategies characterized by acquisitions, partnerships activities, a strong emphasis on R&D, and innovative activities.

- March 2023: Amcor and Nfinite Nanotechnology Inc. launched a collaborative research initiative to test the application of Nfinite's nanocoating technology to improve recyclable and biodegradable packaging.

- June 2022: Mondi sold Nitto Denko Corporation its Personal Care Components business (PCC) for an enterprise value of EUR 615 million (USD 681.17 million). The sale allowed Mondi to streamline its holdings and concentrate on its strategic goal of expanding in sustainable packaging.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defnition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand in FMCG Industries

- 5.1.2 Increased Demand for Security and Tracking Solutions

- 5.2 Market Challenges

- 5.2.1 Lack of Ubiquitous Standards, Safety Concerns, and Inability to Withstand Harsh Climatic Conditions

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Corrugated Boxes

- 6.1.2 Folding Cartons

- 6.1.3 Plastic Crates

- 6.1.4 Wraps and Films

- 6.1.5 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Consumer Electronics

- 6.2.5 Personal Care and Household Care

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 International Paper Company

- 7.1.3 Reynolds Packaging

- 7.1.4 WestRock Company

- 7.1.5 Smurfit Kappa Group

- 7.1.6 Berry Global Group Inc.

- 7.1.7 Packaging Corporation of America

- 7.1.8 Deufol SE

- 7.1.9 Mondi PLC

- 7.1.10 Tranpak Inc.