|

시장보고서

상품코드

1683867

전기 상용차 배터리 팩 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2029년)Electric Commercial Vehicle Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

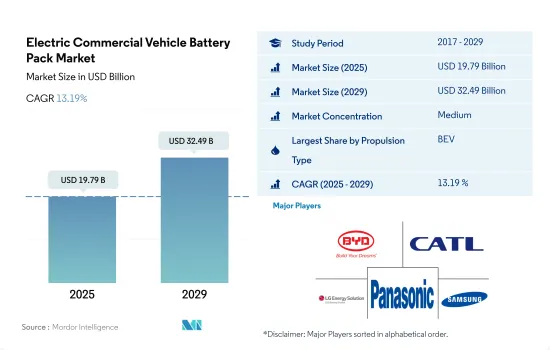

전기 상용차 배터리 팩 시장 규모는 2025년에 197억 9,000만 달러로 추정되고, 예측 기간(2025-2029년) 동안 13.19%의 CAGR로 성장하여 2029년에는 324억 9,900만 달러에 달할 것으로 예상됩니다.

소형 전기 트럭에 대한 관심 증가로 배터리 용량 확장 추진

- 상용차는 최근 몇 년 동안 인기가 높아졌지만 공해와 기후 변화에도 크게 기여하고 있습니다. 따라서 최근 몇 년 동안 전 세계 여러 지역에서 전기 상용차와 이를 구동하는 배터리에 대한 수요가 증가하고 있습니다. 중국은 배터리의 주요 생산국일 뿐만 아니라 2021년 판매된 전기 트럭의 90.24%를 차지할 정도로 전 세계적인 전기자동차 수요의 붐을 주도하는 원동력이기도 합니다. 전기 CV에 대한 수요 증가로 배터리 부문이 활기를 띠면서 2017년 대비 2021년에 LFP 및 NMC를 포함한 다양한 종류의 전기 CV 배터리 팩에 대한 전 세계 수요가 34.38% 증가했습니다.

- 전 세계적으로 전기 트럭에 대한 수요가 증가하면서 전 세계 여러 지역의 다양한 배터리 유형 시장에 영향을 미쳤습니다. NMC, NCM, LFP 배터리는 여러 지역에서 빠르게 확장되고 있습니다. 여러 유형의 전기 CV 배터리 시장의 90% 이상이 전기 CV 및 배터리 생산의 글로벌 리더인 중국에서 생산됩니다. 그 결과, 모든 종류의 상용차 배터리에 대한 전 세계 수요는 2021년에 비해 2022년에 32.11% 증가했습니다.

- 전자상거래, 물류, 인프라 사용자 등 다양한 산업의 증가로 인한 전기자동차 수요 증가를 고려할 때 전 세계 여러 국가에서 예측 기간 동안 BEV, PHEV 등 전기 상용차에 대한 수요가 크게 성장할 것으로 예상됩니다.

아시아태평양 지역은 중국, 일본, 한국의 도입에 힘입어 전기 CV 배터리 팩 시장을 주도

- 전기 CV 배터리 팩 시장은 여러 지역에서 역동적인 성장을 경험하고 있습니다. 아시아태평양 지역은 배터리 팩 시장에서 괄목할 만한 성장을 경험했습니다. 중국, 일본, 한국과 같은 국가에서 전기자동차 채택이 증가하면서 배터리 팩에 대한 수요를 촉진했습니다. 중국의 전기자동차 시장이 크게 성장하면서 아시아 지역은 전 세계 전기 CV 배터리 팩 시장의 선두로 부상했습니다.

- 유럽은 시장이 크게 급성장했습니다. 이는 차량의 전기화에 대한 강력한 추진, 엄격한 배기가스 규제, 정부의 지원 정책 등에 기인합니다. 이 지역은 전기자동차 생산의 중심지로 부상하면서 배터리 팩에 대한 수요가 증가했습니다. 충전 인프라 구축과 함께 배터리 연구 개발에 대한 투자가 시장의 성장을 더욱 촉진하고 있습니다. 북미의 배터리 팩 시장은 수년 동안 꾸준히 성장하고 있습니다. 이러한 성장을 이끄는 요인으로는 전기자동차에 대한 소비자 수요 증가, 청정 에너지를 장려하는 정부 인센티브 및 규제, 배터리 기술의 발전 등이 있습니다. 배터리 팩 제조에 대한 용량 증가와 투자는 지속 가능한 운송 및 에너지 저장 솔루션에 대한 이 지역의 노력을 반영합니다.

- 배터리 팩 시장의 성장은 전기자동차에 대한 수요 증가, 정부 정책 지원, 기술 발전, 지속 가능한 에너지 저장 솔루션의 필요성 등 여러 가지 요인에 기인합니다. 전 세계 각국이 더 깨끗한 운송 및 에너지 시스템을 위해 노력함에 따라 이 시장은 지속적인 성장과 혁신을 이룰 것입니다.

전기 상용차 배터리 팩 시장 동향

전기자동차 시장을 선도하며 미래를 만들어가는 BYD와 테슬라

- 2022년 BYD는 전기자동차 판매량에서 13.3%의 점유율을 차지하며 시장을 선도했습니다. BYD가 선두 자리를 차지한 데에는 몇 가지 요인이 있습니다. 전기자동차 및 관련 기술 생산에 중점을 두고 전기자동차 업계에서 일찍부터 두각을 나타내고 있는 기업입니다. 초기 시장 진입을 통해 탄탄한 기반을 구축하고 소비자들 사이에서 인정을 받을 수 있었습니다. 또한 BYD는 전 세계적으로 적극적으로 사업을 확장하고 파트너십을 구축하며 연구 개발에 투자하는 등 선도적인 입지를 다지는 데 기여하고 있습니다.

- 테슬라는 전기자동차 혁신의 선두에 서 있으며 전 세계적으로 전기자동차를 대중화하는 데 중요한 역할을 해왔습니다. 테슬라는 2022년 전기자동차 업계에서 12.2%의 시장 점유율을 기록하며 중요한 역할을 담당했습니다. 테슬라의 강력한 브랜드 이미지, 최첨단 기술, 광범위한 슈퍼차저 네트워크가 성공에 기여했습니다.

- 전기자동차 시장의 다른 기업들 중에서도 상당한 시장 점유율을 차지하고 있는 몇몇 주목할 만한 기업들이 있습니다. BMW는 자동차 업계에서 쌓은 명성과 'BMW i' 서브 브랜드를 통한 전기 모빌리티에 대한 헌신으로 시장 입지를 다지고 있습니다. 마찬가지로 2022년 3.9%의 시장 점유율을 차지한 폭스바겐은 '폭스바겐 그룹' 산하에 전기 모빌리티에 적극적으로 투자하고 있습니다. 이 기업들은 메르세데스-벤츠, 기아, 현대와 같은 다른 기업들과 함께 기존의 브랜드 인지도를 활용하고, 매력적인 전기자동차 모델을 출시하며, 전기 제품의 주행 거리와 성능을 향상시키기 위해 기술에 투자함으로써 전기자동차 산업을 재편하고 있습니다.

2022년 베스트셀링 전기자동차 모델을 장악한 테슬라와 BYD

- 2022년 베스트셀링 전기자동차 모델은 테슬라와 BYD 두 개의 주요 OEM이 주도했습니다. 테슬라는 Model Y와 Model 3 두 모델이 각각 1위와 3위를 차지하며 강력한 시장 지위를 유지했습니다. 테슬라의 Model Y는 가장 인기 있는 플러그인 전기자동차로 2022년 세계 판매량은 약 77만 1,300대였습니다. 같은 해 테슬라의 Model 3와 Model Y의 인도 대수는 120만 대를 돌파하여 전년 대비 36.77% 증가한 테슬라의 베스트셀링 모델입니다. 베스트셀러 플러그인 전기자동차(PEV) 모델 5개 중 2개가 테슬라 브랜드였지만, 이 배터리 전기자동차 제조업체는 2022년에 아시아 브랜드와의 경쟁에 직면했습니다. 중국에 본사를 둔 BYD는 다양한 플러그인 하이브리드 전기 모델에 힘입어 2022년 테슬라를 제치고 가장 많이 팔린 PEV 브랜드로 등극했습니다. 테슬라 Model Y의 뒤를 이어 BYD Song Plus(BEV + PHEV)는 판매 대수 47만 7,090대에 달하고, 2위 자리를 확보했습니다. BYD는 중국 시장에서 확고한 지위를 확립하고 있으며, 신뢰성이 높고 기술적으로 선진적인 전기자동차를 생산하고 있다는 평판이 Song Plus 모델의 호조로운 판매 실적에 기여한 것으로 보입니다.

- 폭스바겐 ID.4는 베스트셀링 전기자동차 모델 중 유일하게 유럽산 플러그인 전기자동차(PEV)로서 상위 10위 안에 들며 두각을 나타냈습니다. 2022년 판매량은 17만 4,090대로, ID.4는 폭스바겐의 전동 이동성에 대한 헌신과 EV 시장에서의 프레즌스의 고조를 실증했습니다.

- 전반적으로 테슬라와 BYD의 이러한 최상급 EV 모델과 Wuling Hong Guang MINI EV 및 Volkswagen ID.4와 같은 다른 주목할 만한 경쟁 모델은 전기자동차에 대한 소비자 수요가 증가하고 있음을 보여줍니다.

전기 상용차 배터리 팩 산업 개요

전기 상용차 배터리 팩 시장은 적당히 통합되어 상위 5개사에서 59.48%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. BYD Company Ltd., Contemporary Amperex Technology(CATL), LG Energy Solution Ltd., Panasonic Holdings Corporation and Samsung SDI(sorted alphabetically).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 전기 상용차 판매

- OEM별 전기 상용차 판매

- 베스트셀러 전기 상용차 모델

- 선호되는 배터리 화학을 가진 OEM

- 배터리 팩 가격

- 배터리 재료 비용

- 다양한 배터리 화학의 가격 차트

- 누가 누구에게 공급하는지

- V 배터리 용량 및 효율성

- 출시 된 EV 모델 수

- 규제 프레임워크

- 벨기에

- 브라질

- 캐나다

- 중국

- 콜롬비아

- 프랑스

- 독일

- 헝가리

- 인도

- 인도네시아

- 일본

- 멕시코

- 폴란드

- 태국

- 영국

- 미국

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 차체 유형

- 버스

- LCV

- M & HDT

- 추진 유형

- BEV

- PHEV

- 배터리 화학

- LFP

- NCA

- NCM

- NMC

- 기타

- 용량

- 15-40 kWh

- 40-80 kWh

- 80kWh 이상

- 15kWh 미만

- 배터리 형태

- 원통형

- 파우치형

- 프리즘형

- 방식

- 레이저

- 와이어

- 구성요소

- 양극

- 음극

- 전해질

- 분리기

- 재료 유형

- 코발트

- 리튬

- 망간

- 천연 흑연

- 니켈

- 기타 재료

- 지역

- 아시아태평양

- 국가별

- 중국

- 인도

- 일본

- 한국

- 태국

- 기타 아시아태평양

- 유럽

- 국가별

- 프랑스

- 독일

- 헝가리

- 이탈리아

- 폴란드

- 스웨덴

- 영국

- 기타 유럽

- 중동 & 아프리카

- 북미

- 국가별

- 캐나다

- 미국

- 남미

- 아시아태평양

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- A123 Systems LLC

- BYD Company Ltd.

- China Aviation Battery Co. Ltd.(CALB)

- Contemporary Amperex Technology Co. Ltd.(CATL)

- EVE Energy Co. Ltd.

- Farasis Energy(Ganzhou) Co. Ltd.

- Guoxuan High-tech Co. Ltd.

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- Sunwoda Electric Vehicle Battery Co. Ltd.(Sunwoda)

- Tata Autocomp Systems Ltd.

- Tianjin Lishen Battery Joint-Stock Co., Ltd.(Lishen Battery)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 출처 및 참고문헌

- 도표 목록

- 주요 인사이트

- 데이터 팩

- 용어집

The Electric Commercial Vehicle Battery Pack Market size is estimated at 19.79 billion USD in 2025, and is expected to reach 32.49 billion USD by 2029, growing at a CAGR of 13.19% during the forecast period (2025-2029).

The growing interest in light electric delivery vans is driving battery capacity expansion

- Commercial vehicles have been more popular in recent years but have also greatly contributed to pollution and climate change. Therefore, in recent years, there has been a rise in demand for electric commercial vehicles and the batteries that power them in numerous regions worldwide. China is not just a major producer of batteries but also a driving force behind the global boom in demand for electric vehicles, with 90.24% of all-electric trucks sold in 2021. The increasing demand for electric CVs has boosted the battery sector, resulting in a 34.38% increase in the global demand for electric CV battery packs of different kinds, including LFP and NMC, in 2021 compared to 2017.

- Demand for electric trucks has increased worldwide, impacting the market for various battery types in different parts of the world. NMC, NCM, and LFP batteries are rapidly expanding in several regions. Over 90% of the market for several types of electric CV batteries comes from China, a global leader in producing electric CVs and batteries. As a result, worldwide demand for commercial vehicle batteries of all varieties expanded by 32.11% in 2022 compared to 2021.

- Considering the growing demand for electric vehicles due to the rise in various industries, such as e-commerce, logistics, and infrastructure users, the demand for electric commercial vehicles, such as BEV and PHEV, is expected to show significant growth during the forecast period in various countries globally.

The APAC region takes the lead in the electric CV battery pack market, driven by adoption in China, Japan, and South Korea

- The electric CV battery pack market is experiencing dynamic growth across different regions. The APAC region has experienced remarkable growth in the battery pack market. The rising adoption of electric vehicles in countries like China, Japan, and South Korea has fueled the demand for battery packs. China's massive growth in the EV market has propelled the Asian region to the forefront of the global electric CV battery pack market.

- Europe witnessed a significant surge in the market. This can be attributed to the strong push toward the electrification of vehicles, stringent emission regulations, and supportive government policies. The region has become a hub for electric vehicle production, leading to increased demand for battery packs. Investments in battery research and development, coupled with the establishment of charging infrastructure, further drive the growth of the market. The battery pack market in North America has been steadily growing over the years. Factors driving this growth include rising consumer demand for electric vehicles, government incentives and regulations promoting clean energy, and advancements in battery technology. The increasing capacity and investments in battery pack manufacturing reflect the region's commitment to sustainable transportation and energy storage solutions.

- The growth of the battery pack market can be attributed to several factors, including the growing demand for electric vehicles, supportive government policies, technological advancements, and the need for sustainable energy storage solutions. As countries worldwide strive for cleaner transportation and energy systems, the market is poised for continued growth and innovation.

Electric Commercial Vehicle Battery Pack Market Trends

BYD AND TESLA ARE LEADING THE CHARGE IN THE EV MARKET AND SHAPING THE FUTURE

- In 2022, BYD was the market leader in electric vehicle sales and held a share of 13.3%. BYD's leading position can be attributed to several factors. It has been an early and prominent player in the EV industry, with a strong focus on producing electric vehicles and related technologies. The company's early entry into the market allowed it to establish a solid foundation and gain recognition among consumers. BYD has also been actively expanding its operations globally, forging partnerships, and investing in research and development, all of which contribute to its leading position.

- Tesla has been at the forefront of electric vehicle innovation and has played a crucial role in popularizing EVs worldwide. Tesla was a significant player in the EV industry in 2022, with a market share of 12.2%. Tesla's strong brand image, cutting-edge technology, and extensive Supercharger network have contributed to its success.

- Among the other players in the EV market, there are several notable companies that hold significant market shares. BMW's established reputation in the automotive industry, coupled with its commitment to electric mobility through its "BMW i" sub-brand, has contributed to its market presence. Similarly, Volkswagen, which held a market share of 3.9% in 2022, has been actively investing in electric mobility under its "Volkswagen Group" umbrella. These companies, along with others like Mercedes-Benz, Kia, and Hyundai, are recolonizing the EV industry by leveraging their existing brand recognition, introducing compelling electric vehicle models, and investing in technology to enhance the range and performance of their electric offerings.

TESLA AND BYD DOMINATED THE BEST-SELLING EV MODELS OF 2022

- The best-selling EV models in 2022 were dominated by two key OEMs: Tesla and BYD. Tesla held a strong market position with two of its models, the Model Y and Model 3, capturing the first and third spots, respectively. The Tesla Model Y was the most popular plug-in electric vehicle, with global unit sales of roughly 771,300 in 2022. That year, deliveries of Tesla's Model 3 and Model Y surpassed 1.2 million, a Y-o-Y increase of 36.77% for Tesla's best-selling models. While two of the five best-selling plug-in electric vehicle (PEV) models were Tesla-branded, the battery electric vehicle manufacturer faced competition from Asian brands in 2022. China-based BYD overtook Tesla as the best-selling PEV brand in 2022, relying on a large offering of plug-in hybrid electric models. Following closely behind the Tesla Model Y, the BYD Song Plus (BEV + PHEV) secured the second spot, with sales reaching 477,090 units. BYD's established presence in the Chinese market, along with its reputation for producing reliable and technologically advanced electric vehicles, likely contributed to the strong sales performance of the Song Plus models.

- The Volkswagen ID.4 stood out among the best-selling EV models as the only European PEV (Plug-in Electric Vehicle) in the top ten. With a sales volume of 174,090 units in 2022, the ID.4 demonstrated Volkswagen's commitment to electric mobility and its growing presence in the EV market.

- Overall, these top-performing EV models from Tesla and BYD, along with other notable contenders like the Wuling Hong Guang MINI EV and Volkswagen ID.4, demonstrate the increasing consumer demand for electric vehicles.

Electric Commercial Vehicle Battery Pack Industry Overview

The Electric Commercial Vehicle Battery Pack Market is moderately consolidated, with the top five companies occupying 59.48%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), LG Energy Solution Ltd., Panasonic Holdings Corporation and Samsung SDI Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Commercial Vehicle Sales

- 4.2 Electric Commercial Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 Belgium

- 4.11.2 Brazil

- 4.11.3 Canada

- 4.11.4 China

- 4.11.5 Colombia

- 4.11.6 France

- 4.11.7 Germany

- 4.11.8 Hungary

- 4.11.9 India

- 4.11.10 Indonesia

- 4.11.11 Japan

- 4.11.12 Mexico

- 4.11.13 Poland

- 4.11.14 Thailand

- 4.11.15 UK

- 4.11.16 US

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCA

- 5.3.3 NCM

- 5.3.4 NMC

- 5.3.5 Others

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

- 5.9 Region

- 5.9.1 Asia-Pacific

- 5.9.1.1 By Country

- 5.9.1.1.1 China

- 5.9.1.1.2 India

- 5.9.1.1.3 Japan

- 5.9.1.1.4 South Korea

- 5.9.1.1.5 Thailand

- 5.9.1.1.6 Rest-of-Asia-Pacific

- 5.9.2 Europe

- 5.9.2.1 By Country

- 5.9.2.1.1 France

- 5.9.2.1.2 Germany

- 5.9.2.1.3 Hungary

- 5.9.2.1.4 Italy

- 5.9.2.1.5 Poland

- 5.9.2.1.6 Sweden

- 5.9.2.1.7 UK

- 5.9.2.1.8 Rest-of-Europe

- 5.9.3 Middle East & Africa

- 5.9.4 North America

- 5.9.4.1 By Country

- 5.9.4.1.1 Canada

- 5.9.4.1.2 US

- 5.9.5 South America

- 5.9.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A123 Systems LLC

- 6.4.2 BYD Company Ltd.

- 6.4.3 China Aviation Battery Co. Ltd. (CALB)

- 6.4.4 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.5 EVE Energy Co. Ltd.

- 6.4.6 Farasis Energy (Ganzhou) Co. Ltd.

- 6.4.7 Guoxuan High-tech Co. Ltd.

- 6.4.8 LG Energy Solution Ltd.

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Samsung SDI Co. Ltd.

- 6.4.11 SK Innovation Co. Ltd.

- 6.4.12 Sunwoda Electric Vehicle Battery Co. Ltd. (Sunwoda)

- 6.4.13 Tata Autocomp Systems Ltd.

- 6.4.14 Tianjin Lishen Battery Joint-Stock Co., Ltd. (Lishen Battery)

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms