|

시장보고서

상품코드

1683869

프랑스의 EV 배터리 팩 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2029년)France EV Battery Pack - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2029) |

||||||

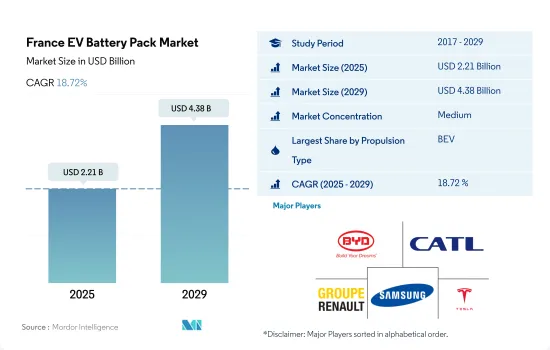

프랑스의 EV 배터리 팩 시장 규모는 2025년 22억 1,000만 달러로 추정·예측되고, 2029년에는 43억 8,000만 달러에 이르고, 예측 기간(2025-2029년)의 CAGR은 18.72%로 성장할 것으로 예측됩니다.

프랑스 EV 배터리 팩 시장, 2025년까지 EV 보급 목표 140만대에서 급증 가능성

- 프랑스 전기자동차(EV)용 배터리 팩 시장은 최근 몇 년동안 크게 성장하고 있습니다. 2020년 현재 프랑스 도로를 달리는 EV는 약 25만대로, 2025년에는 140만대 이상으로 늘어날 것으로 예측되고 있습니다. 프랑스 정부는 2040년까지 가솔린차와 디젤차의 신차 판매를 단계적으로 폐지하겠다는 목표를 내걸고 있어 이 나라에서 EV의 보급을 촉진할 것으로 기대되고 있습니다. 정부는 EV 구매를 장려하기 위해 보조금과 세액공제 등 다양한 우대조치를 강구하고 있습니다.

- 프랑스에서 EV의 평균 배터리용량은 2020년에는 약 50kWh, 항속 거리는 약 240km이었습니다. 배터리 비용은 꾸준히 떨어지고 있으며, 1kWh당 비용은 2010년 1,100달러에서 2020년에는 약 137달러까지 떨어졌습니다. 이 동향은 앞으로도 계속될 것으로 예측되고, 2030년에는 전지 비용이 1킬로와트시당 58달러까지 저하할 것으로 예측도 있습니다. 에너지 밀도가 높은 배터리를 요구하는 동향도 있어, 300Wh/kg을 넘는 밀도의 배터리 팩을 개발하고 있는 제조업체도 있습니다.

- 프랑스 전기자동차 배터리 팩 시장은 기술 발전과 제조 공정 개선으로 향후 수년간 급성장할 것으로 예상됩니다. 예측 기간 동안 프랑스 EV 배터리 팩의 평균 용량은 약 75kWh로 증가하고 항속 거리는 최대 405km가 될 것으로 예측됩니다. 배터리 비용은 계속 하락하는 경향이 있으며, 2025년에는 1kWh당 약 100달러까지 감소할 것으로 예상됩니다. 에너지 밀도가 높은 배터리로의 동향도 계속될 것으로 예측되고, 400Wh/kg을 넘는 밀도의 배터리 팩의 개발을 목표로 하고 있는 제조업체도 있습니다.

프랑스 EV 배터리 팩 시장 동향

Renault, Toyota Group, Peugeot, Hyundai, and Kia, Kia가 프랑스 전기자동차 시장의 주요 기업

- 프랑스의 전기자동차 배터리 팩 시장은 경쟁이 치열하지만, 2022년 시점에서 5개사가 시장의 50% 이상을 차지하고 있습니다. 이러한 기업은 Renault, Toyota Group, Peugeot, Hyundai, Kia입니다. 르노는 프랑스 전기자동차 배터리 팩 시장에서 23.12%의 점유율을 자랑하며 최대의 전기자동차 판매 대수를 기록하고 있습니다. 국내 기업으로서 프랑스의 소비자들 사이에서 확고한 평판을 얻고 있으며, 전국에 500개 이상의 딜러를 전개하고 있습니다.

- Toyota Group은 프랑스의 EV 배터리 팩 시장에서 15.94%의 점유율을 갖고 있으며, 전기차 판매 대수로 2위를 차지하고 있습니다. 광범위한 서비스 네트워크, 다양한 제품 라인업, 신뢰할 수 있는 브랜드 이미지가 회사의 성장에 기여하고 있습니다. 마찬가지로 프랑스 브랜드인 Peugeot는 프랑스 EV 배터리팩 시장에서 8.67%의 점유율로 3위를 차지하고 있습니다. 다양한 고객의 요구에 부응하는 회사는 신뢰할 수 있는 공급 및 유통 체인에서 번창하고 있습니다.

- Hyundai는 시장 점유율의 6.28%를 차지하며 프랑스 EV 배터리 팩 시장에서 4위를 차지하고 있습니다. 그 다양한 제품은 중급차와 고급차 고객 모두에게 호소하고 있습니다. Kia는 시장 점유율의 약 4.90%를 차지하며 프랑스 전기차 배터리 팩 시장의 5위입니다. 프랑스 EV 배터리 팩 시장의 다른 주목할만한 기업으로는 Mercedes-Benz, Dacia, Fiat, BMW, Volkswagen등이 있습니다.

Renault와 Toyota는 프랑스에서 EV의 50% 이상을 판매하며, 가장 많은 배터리 팩을 채용하고 있습니다.

- 유럽에서는 전기자동차 수요가 높아지고 있으며, 프랑스에서는 이러한 경향이 일관되게 강해지고 있습니다. 소비자의 선호도가 더 스포티하고 모험적인 운전 체험으로 이동하고 세단에 필적하는 가격의 장점을 수반하기 때문에 전동 컴팩트 SUV 수요가 증가하고 있습니다.

- 이 급성장하는 시장에서 Renault Arkana의 판매량은 크게 증가하고 있습니다. 이 모델은 효율적인 주행 거리와 저렴한 가격을 결합한 전동 컴팩트 SUV를 원하는 사람들에게 호소합니다. 소형 SUV에 대한 호의적인 반응은 프랑스 전기자동차 배터리 팩 시장에서도 분명합니다. 그 결과 르노 캡처도 2022년 베스트셀러로 떠올랐습니다. 풀 하이브리드와 다소 비싼 플러그인 하이브리드 제공, 뛰어난 연비 효율, 편안한 좌석, 경쟁력있는 가격 설정은 판매 성공을 뒷받침합니다.

- 프랑스 EV 시장에서는 여러 국제 브랜드가 다양한 전기 SUV와 세단으로 포트폴리오를 다양화하고 있습니다. Toyota Yaris의 하이브리드는 2022년에 눈부신 매출을 기록해 인기가 높은 선택이 되고 있습니다. 광범위한 서비스 네트워크, 경쟁력 있는 가격 설정, 신뢰할 수 있는 브랜드 이미지 등 요인이 Toyota 자동차의 성장을 견인하고 있으며, 2022년 Toyota Yaris Cross의 판매 대수 2만 3,576대가 그 예입니다. Renault Clio, Peugeot 208, Tesla Model 3, (Dacia Spring Electric), 르노 메가느(Renault Megane) 등이 경쟁해 프랑스의 EV 사정을 개선하고 있습니다.

프랑스 EV 배터리 팩 산업 개요

프랑스 EV 배터리 팩 시장은 상위 5개사에서 63.42%를 차지하며 적당히 통합되어 있습니다. 이 시장 주요 기업은 다음과 같습니다. BYD Company Ltd., Contemporary Amperex Technology(CATL), Groupe Renault, Samsung SDI and Tesla Inc.(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 전기자동차 판매 대수

- OEM별 전기자동차 판매 대수

- 판매 LINE EV 모델

- 선호되는 배터리 화학을 가진 OEM

- 배터리 팩 가격

- 배터리 재료 비용

- 각 전지 화학의 가격표

- 누가 누구에게 공급하는지

- EV 배터리의 용량과 효율

- EV의 발매 모델수

- 규제 프레임워크

- 프랑스

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 바디 유형

- 버스

- LCV

- M&HDT

- 승용차

- 추진 유형

- BEV

- PHEV

- 배터리 케미스트리

- LFP

- NCA

- NCM

- NMC

- 기타

- 용량

- 15-40 kWh

- 40-80 kWh

- 80kWh 이상

- 15kWh 미만

- 배터리 형상

- 원통형

- 가방

- 각형

- 방식

- 레이저

- 와이어

- 컴포넌트

- 애노드

- 캐소드

- 전해액

- 세퍼레이터

- 재료 유형

- 코발트

- 리튬

- 망간

- 천연 흑연

- 니켈

- 기타 재료

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Automotive Cells Company(ACC)

- Blue Solutions SA(Bollore Group)

- BYD Company Ltd.

- Contemporary Amperex Technology Co. Ltd.(CATL)

- Elecsys France

- Forsee Power

- Groupe Renault

- LG Energy Solution Ltd.

- Panasonic Holdings Corporation

- Saft Groupe SA

- SAIC Volkswagen Power Battery Co. Ltd.

- Samsung SDI Co. Ltd.

- SK Innovation Co. Ltd.

- Sunwoda Electric Vehicle Battery Co. Ltd.(Sunwoda)

- Tesla Inc.

- Verkor

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The France EV Battery Pack Market size is estimated at 2.21 billion USD in 2025, and is expected to reach 4.38 billion USD by 2029, growing at a CAGR of 18.72% during the forecast period (2025-2029).

France's electric vehicle battery pack market may surge as EV adoption targets 1.4 million vehicles by 2025

- The French electric vehicle (EV) battery pack market has grown significantly in recent years. As of 2020, there were approximately 250,000 EVs on French roads, with the number projected to increase to over 1.4 million by 2025. The French government has set a target of phasing out the sale of new gasoline and diesel cars by 2040, which is expected to drive the adoption of EVs in the country. The government is offering various incentives to encourage the purchase of EVs, including subsidies and tax credits.

- The average battery pack capacity for an EV in France was approximately 50 kWh in 2020, with a range of around 240 km. Battery costs have been decreasing steadily, with the cost per kilowatt-hour dropping from USD 1,100 in 2010 to approximately USD 137 in 2020. This trend is projected to continue, with some estimates suggesting that battery costs could fall to as low as USD 58 per kilowatt-hour by 2030. There has been a trend toward higher energy-density batteries, with some manufacturers developing battery packs with a density of over 300 Wh/kg.

- The French electric vehicle battery pack market is expected to continue its rapid growth in the coming years, driven by technological advancements and improvements in manufacturing processes. During the forecast period, the average battery pack capacity for an EV in France is projected to increase to around 75 kWh, with a range of up to 405 km. Battery costs are expected to continue their downward trend, falling to approximately USD 100 per kWh by 2025. The trend toward higher energy-density batteries is also projected to continue, with some manufacturers aiming to develop battery packs with a density of over 400 Wh/kg.

France EV Battery Pack Market Trends

Renault, Toyota Group, Peugeot, Hyundai, and Kia are the leading players in the French electric vehicle market

- The electric vehicle battery pack market in France is competitive, although five companies accounted for over 50% of the market as of 2022. These companies are, namely, Renault, Toyota Group, Peugeot, Hyundai, and Kia. Renault has witnessed the largest electric car sales, boasting a 23.12% share of the French electric vehicle battery pack market. As a domestic company, it enjoys a robust reputation among French consumers and has over 500 dealerships nationwide.

- The Toyota Group has a 15.94% share in the French electric vehicle battery pack market, ranking it second in terms of electric vehicle sales. The company's expansive service network, diverse product lineup, and trusted brand image contribute to its growth. Peugeot, another French brand, occupies the third place in the French electric vehicle battery pack market, with an 8.67% share. Catering to various client needs, the company thrives on a dependable supply and distribution chain.

- Hyundai, capturing 6.28% of the market share, stands as the fourth largest player in the French electric vehicle battery pack market. Its diverse offerings appeal to both mid-range and premium customers. Kia, holding roughly 4.90% of the market share, is the fifth largest player in the French electric vehicle battery pack market. Other notable companies in the French electric vehicle battery pack market include Mercedes-Benz, Dacia, Fiat, BMW, and Volkswagen.

Renault and Toyota sell more than 50% of EVs in France while employing the most battery packs

- Demand for electric vehicles in Europe is escalating, and France is witnessing a consistent uptick in this trend. The demand for electric compact SUVs is on the rise as consumer preference shifts toward sportier, adventurous driving experiences, accompanied by benefits comparable in price to sedans.

- In this burgeoning market, Renault Arkana sales have seen significant growth. The model appeals to those desiring an electric compact SUV that combines efficient mileage with affordability. The positive response to compact SUVs is evident in the French electric vehicle battery pack market. Consequently, the Renault Captur also emerged as a best-seller in 2022. Its offerings of a full hybrid and a slightly pricier plug-in hybrid, along with superior fuel efficiency, comfortable seating, and competitive pricing, have fueled its sales success.

- Several international brands are diversifying their portfolios in the French EV market with a range of electric SUVs and sedans. The Toyota Yaris hybrid has been a popular choice, registering impressive sales in 2022. Factors such as an extensive service network, competitive pricing, and a trusted brand image have driven the growth of Toyota models, exemplified by the 23,576 units of Toyota Yaris Cross sold in 2022. Competing alongside are models like Renault Clio, Peugeot 208, Tesla Model 3, Dacia Spring Electric, and Renault Megane, improving the EV landscape in France.

France EV Battery Pack Industry Overview

The France EV Battery Pack Market is moderately consolidated, with the top five companies occupying 63.42%. The major players in this market are BYD Company Ltd., Contemporary Amperex Technology Co. Ltd. (CATL), Groupe Renault, Samsung SDI Co. Ltd. and Tesla Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Electric Vehicle Sales

- 4.2 Electric Vehicle Sales By OEMs

- 4.3 Best-selling EV Models

- 4.4 OEMs With Preferable Battery Chemistry

- 4.5 Battery Pack Price

- 4.6 Battery Material Cost

- 4.7 Price Chart Of Different Battery Chemistry

- 4.8 Who Supply Whom

- 4.9 EV Battery Capacity And Efficiency

- 4.10 Number Of EV Models Launched

- 4.11 Regulatory Framework

- 4.11.1 France

- 4.12 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Body Type

- 5.1.1 Bus

- 5.1.2 LCV

- 5.1.3 M&HDT

- 5.1.4 Passenger Car

- 5.2 Propulsion Type

- 5.2.1 BEV

- 5.2.2 PHEV

- 5.3 Battery Chemistry

- 5.3.1 LFP

- 5.3.2 NCA

- 5.3.3 NCM

- 5.3.4 NMC

- 5.3.5 Others

- 5.4 Capacity

- 5.4.1 15 kWh to 40 kWh

- 5.4.2 40 kWh to 80 kWh

- 5.4.3 Above 80 kWh

- 5.4.4 Less than 15 kWh

- 5.5 Battery Form

- 5.5.1 Cylindrical

- 5.5.2 Pouch

- 5.5.3 Prismatic

- 5.6 Method

- 5.6.1 Laser

- 5.6.2 Wire

- 5.7 Component

- 5.7.1 Anode

- 5.7.2 Cathode

- 5.7.3 Electrolyte

- 5.7.4 Separator

- 5.8 Material Type

- 5.8.1 Cobalt

- 5.8.2 Lithium

- 5.8.3 Manganese

- 5.8.4 Natural Graphite

- 5.8.5 Nickel

- 5.8.6 Other Materials

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Automotive Cells Company (ACC)

- 6.4.2 Blue Solutions SA (Bollore Group)

- 6.4.3 BYD Company Ltd.

- 6.4.4 Contemporary Amperex Technology Co. Ltd. (CATL)

- 6.4.5 Elecsys France

- 6.4.6 Forsee Power

- 6.4.7 Groupe Renault

- 6.4.8 LG Energy Solution Ltd.

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Saft Groupe S.A.

- 6.4.11 SAIC Volkswagen Power Battery Co. Ltd.

- 6.4.12 Samsung SDI Co. Ltd.

- 6.4.13 SK Innovation Co. Ltd.

- 6.4.14 Sunwoda Electric Vehicle Battery Co. Ltd. (Sunwoda)

- 6.4.15 Tesla Inc.

- 6.4.16 Verkor

7 KEY STRATEGIC QUESTIONS FOR EV BATTERY PACK CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms