|

시장보고서

상품코드

1683942

프랑스의 야외 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)France Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

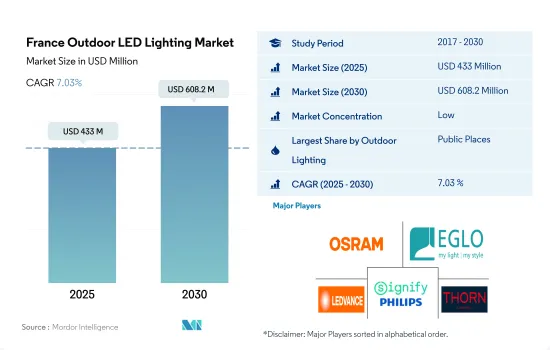

프랑스의 야외 LED 조명 시장 규모는 2025년에 4억 3,300만 달러에 달할 것으로 추정됩니다. 2030년에는 6억 820만 달러에 이를 것으로 예상되며, 예측 기간(2025-2030년)의 CAGR은 7.03%를 나타낼 것으로 전망됩니다.

스마트 시티 프로젝트가 LED 조명 시장 성장을 견인

- 공공 공간은 2023년 금액과 수량에서 가장 큰 점유율을 차지했습니다. 유행 기간 동안 프랑스 정부는 COVID-19 유행의 확산을 억제하기 위해 엔터테인먼트 센터, 쇼핑몰, 공원, 여행, 행사 등에 일시적인 폐쇄 및 제한을 부과했습니다. 정부 기관의 이러한 조치는 공공 지출에 영향을 미쳤습니다. 2021년 봉쇄 규정이 완화되면서 개방적인 공공 공간이 기차역, 쇼핑몰, 공항 근처의 주차장 수요를 가속화했습니다. 정부는 또한 COVID-19 대책을 완화하고 에너지 효율과 지속가능성 이니셔티브를 개발하기 위한 이니셔티브를 도입했습니다. 그 중 하나는 할로겐 램프의 사용을 줄이고 LED 조명으로 대체하는 것이 었습니다.

- 스마트시티 개발을 촉진하기 위해 이 나라는 조명 제조업체와 프로젝트 협정을 맺었습니다. 그러한 협정의 하나가 건축 사무소 AWP에 의한 도시 재생 프로젝트, Jardins de l'Arche 조명 프로젝트입니다. 이 지역의 면적은 15헥타르이며 문화와 오락의 중심지가 되기 위한 것입니다. 이 프로젝트는 라 그랜드 알슈에서 난테르 테라스, 40,000명의 관객을 수용할 수 있는 스포츠 경기장, 상업시설, 행정 시설, 학교, 접객 시설로 이어지는 600m 보행자 전용 프롬나드를 정비합니다. 프랑스 조명 디자인 스튜디오 8'18 ''는이 새로운 공공 공간과 보행자 프롬나드의 조명을 담당했습니다. 이러한 개발과 프로젝트에는 LED 조명이 사용되고 있으며, 이 나라에서 LED 조명 수요와 시장 가치가 높아지고 있습니다.

프랑스의 야외 LED 조명 시장 동향

스포츠 및 관련 인프라 투자가 LED 조명 성장을 가속

- 프랑스 경기장 수는 2023년 139에서 2030년 152로 증가할 것으로 예상되며 CAGR은 1.2%가 될 것으로 예측됩니다. 스포츠 업계에서는 최근 몇 년 동안 다양한 변화가 일어나고 있습니다. 2015년에는 릴의 피에르 모로와 스타디움 개보수 공사의 일환으로 투광기가 설치되었습니다. 마르세유의 오렌지 벨로드롬은 2019년 시그니파이가 LED 조명을 설치하여 프랑스 최대 100% LED 경기장이 되었습니다. 2020년에는 스터드 루이Ⅱ에서 LED 기술의 토탈 라이트 매니지먼트가 도입되었습니다. 이 요소는 프랑스의 야외 LED 조명 시장의 확대를 지원합니다.

- 국가는 경기장 건설을 지원하고 다양한 스포츠에 투자 기회를 제공합니다. 예를 들어, 파리 2024 올림픽·패럴림픽 경기 대회 준비로 프랑스 정부의 스포츠 투자는 2020년에 크게 증가할 것으로 예상되었습니다. 정부의 스포츠 지원에 대한 의욕을 보여주는 계획의 일환으로 스포츠부 예산은 2020년에 증가하여 7억 1,040만 유로(6억 1,380만 파운드/7억 9,350만 달러)에 이르렀습니다. 향후 수년간 1억 2,900만 유로(1억 1,150만 파운드/1억 4,410만 달러) 이상이 스포츠 시설에 투자될 것으로 예상되고 있습니다.

- 2022년 님 올림픽을 위한 새로운 경기장 건설은 최근 완성 프로젝트에 포함되었으며, 제2 경기장은 2026년까지 완성될 예정입니다. 수용 인원 26,280명의 프로 축구 경기장인 스타드 드 라 마이노는 2021년에 착공되어 전면적으로 개조되었습니다. 조사 기간 동안 프랑스에서 열린 중요한 대회로는 2023년 럭비 월드컵 프랑스 대회, FIVB 배구 남자 네이션스 리그, FIBA 3x3 여자 시리즈, 2024년 올림픽이 있었습니다. 이러한 개발로 야외 LED 조명 시장은 향후 수년간 성장할 것으로 예상됩니다.

승용차와 배터리식 전기차 등록 증가가 LED 시장 성장을 견인

- 프랑스의 총 인구는 해마다 증가하고 있으며, 2021년에는 6,764만 명에 달했습니다. 프랑스 출생률은 여성 1명당 1.83명입니다. 프랑스의 평균 수명은 2021년 82.32세가 될 것으로 예상되었습니다. 지난 몇 년 동안 프랑스의 평균 수명은 안정적입니다. 프랑스 사망률은 2020년에 비해 2021년 인구 1,000명당 0.2명 감소했습니다(-2.02%). 전체적으로 사망률은 감소했고, 2021년에는 인구 1,000명당 9.7명이 되었습니다. 이 데이터에 따르면 국내에는 더 많은 거주 공간을 필요로 하는 사람들이 증가하고 있으며, 이는 시장 확대에 기여할 수 있습니다.

- 프랑스에서는 2021년 가구 수가 약 3,100만 가구이며, 2018년 시점의 평균 가구 수는 2.19명이었습니다. 프랑스에서는 2021년 4분기 시점에서 판매 또는 판매 예약된 신축 주택이 29,712호 이상이었습니다. 2020년 4분기에는 약 2만 7,918호의 주택 판매가 완료되거나 예정되어 있었습니다. 주택 판매 호수 증가는 국내 LED 사용량을 증가시킬 것으로 예상됩니다.

- 2022년 1월 기준 프랑스 승용차 보유 대수는 3,870만대 이상이며, 2011년 3,580만대 이상에서 증가했습니다. 2022년까지 승용차의 보유 대수는 계속 증가했습니다. 게다가 프랑스 자동차 시장에 전기차 등록이 등장한 이래로 그 수는 급격히 증가하고 있습니다. 2022년 프랑스에서 새로 등록된 배터리 구동 전기 자가용차 및 전기 유틸리티 차량는 21만 9,800대 가까이 올라 전년 대비 26.1% 가까이 증가했습니다. 프랑스에서의 LED 판매는 자동차 판매량 증가로 혜택을 누릴 수 있습니다.

프랑스의 야외 LED 조명 산업 개요

프랑스의 야외 LED 조명 시장은 단편화되어 있어 상위 5개사에서 30.14%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. ams-OSRAM AG, EGLO Leuchten GmbH, LEDVANCE GmbH(MLS), Signify Holding(Philips) and Thorn Lighting Ltd.(Zumtobel Group)(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 소득

- LED 총 수입량

- 조명 전력 소비량

- 가구수

- LED 보급률

- 경기장 수

- 규제 프레임워크

- 프랑스

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 야외 조명

- 공공시설

- 거리 및 도로

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ams-OSRAM AG

- BEGA Lighting

- EGLO Leuchten GmbH

- Fagerhult(Fagerhult Group)

- Feilo Sylvania(Shanghai Feilo Acoustics Co., Ltd)

- LEDVANCE GmbH(MLS Co Ltd)

- Signify Holding(Philips)

- Thorlux Lighting(FW Thorpe Plc)

- Thorn Lighting Ltd.(Zumtobel Group)

- TRILUX GmbH & Co. KG

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The France Outdoor LED Lighting Market size is estimated at 433 million USD in 2025, and is expected to reach 608.2 million USD by 2030, growing at a CAGR of 7.03% during the forecast period (2025-2030).

Smart city projects drive the growth of the LED lighting market

- Public spaces held the largest share by value and volume in 2023. During the pandemic, the French government imposed temporary closures and restrictions on entertainment centers, shopping malls, parks, travel, events, etc., to control the spread of the COVID-19 pandemic. These measures by government agencies impacted public spending. When lockdown restrictions eased in 2021, the open public spaces accelerated demand for parking near railway stations, shopping malls, and airports. The government also introduced initiatives to ease COVID-19 measures and develop energy efficiency and sustainability initiatives. One of them was to reduce the use of halogen lamps and replace them with LED lighting.

- To facilitate smart city development, the country signed project agreements with lighting manufacturers. One such agreement is the Jardins de l'Arche lighting project, an urban renewal project by AWP, an architectural firm. The district covers an area of 15 hectares and is intended as a center of culture and entertainment. The project encloses a 600 m pedestrian promenade that leads from La Grande Arche to the terraces of Nanterre, a sports arena that can accommodate up to 40,000 spectators, and to areas intended for commercial, administrative, school, and hospitality buildings. The French lighting design studio 8'18'' was responsible for lighting this new public space and pedestrian promenade. Such developments and projects involve the use of LED lighting, increasing the demand and market value of these lights in the country.

France Outdoor LED Lighting Market Trends

Investments in sports and related infrastructure to drive the growth of LED lighting

- The number of stadiums in France is expected to grow from 139 in 2023 to 152 in 2030, with a CAGR of 1.2%. The sports industry has undergone a number of changes in recent years. Floodlights were installed in 2015 as part of renovations at the Pierre Mauroy stadium in Lille. The Orange Velodrome in Marseille became France's largest 100% LED stadium in 2019 when Signify installed LED lighting. Total light management for LED technology was featured at Stade Louis II in 2020. These elements support the expansion of the French outdoor LED lighting market.

- The nation supports the building of stadiums and provides investment opportunities for different sports. For instance, as the nation prepared for the Paris 2024 Olympic and Paralympic Games, the French government's investments in sports were expected to increase significantly in 2020. The budget for the Sports Ministry was expected to increase in 2020 and reach EUR 710.4 million (GBP 613.8 million/USD 793.5 million) as part of plans to demonstrate the government's desire to support sports. Over EUR 129 million (GBP 111.5 million/USD 144.1 million) is anticipated to be invested in sporting facilities over the coming years.

- The new stadium building for Nimes Olympique 2022 is expected to be among the most recently completed projects, while the second stadium will be finished by 2026. A professional football stadium with a capacity of 26,280, Stade de la Meinau, will be revamped completely, with construction having started in 2021. Some of the significant tournaments in France during the study period have been the Rugby World Cup France 2023, FIVB Volleyball Men's Nations League, FIBA 3x3 Women's Series, and the 2024 Olympic Games. Due to such developments, the outdoor LED lighting market is expected to grow in the coming years.

Increasing passenger car and battery electric private and utility car registration to drive the growth of LED market.

- France's total population has been growing for years, reaching 67.64 million in 2021. The fertility rate in France looks to be 1.83 children for every woman. The overall life expectancy at birth in France was expected to be 82.32 years in 2021. Over the years, the nation's rate has remained consistent. The death rate in France fell by 0.2 per 1,000 people (-2.02%) in 2021 compared to 2020. Overall, the death rate decreased, falling to 9.7 deaths per 1,000 people in 2021. According to the data, there are more people in the country who will need more space to live in, which may help the market expand.

- In France, there were about 31 million households in 2021, and there were 2.19 individuals in each family on average as of 2018. In France, as of the fourth quarter of 2021, there were over 29,712 new dwelling units that had been sold or reserved for sale. There were around 27,918 completed or scheduled house sales in the fourth quarter of 2020. The rising number of homes sold is expected to increase the usage of LEDs in the country.

- As of January 2022, there were more than 38.7 million passenger vehicles in the French fleet, up from over 35.8 million in 2011. Until 2022, the number of passenger vehicles on the road had continuously increased. Additionally, since electric passenger car registrations first appeared on the French automobile market, they have dramatically increased. Nearly 219,800 new battery-powered electric private and utility cars were registered in France in 2022, which was an increase of almost 26.1% from the previous year. The sale of LEDs in France may benefit from the rise in automotive vehicle sales.

France Outdoor LED Lighting Industry Overview

The France Outdoor LED Lighting Market is fragmented, with the top five companies occupying 30.14%. The major players in this market are ams-OSRAM AG, EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), Signify Holding (Philips) and Thorn Lighting Ltd. (Zumtobel Group) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 France

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ams-OSRAM AG

- 6.4.2 BEGA Lighting

- 6.4.3 EGLO Leuchten GmbH

- 6.4.4 Fagerhult (Fagerhult Group)

- 6.4.5 Feilo Sylvania (Shanghai Feilo Acoustics Co., Ltd)

- 6.4.6 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.7 Signify Holding (Philips)

- 6.4.8 Thorlux Lighting (FW Thorpe Plc)

- 6.4.9 Thorn Lighting Ltd. (Zumtobel Group)

- 6.4.10 TRILUX GmbH & Co. KG

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms