|

시장보고서

상품코드

1683958

중동 및 아프리카의 야외 LED 조명 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Middle East and Africa Outdoor LED Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

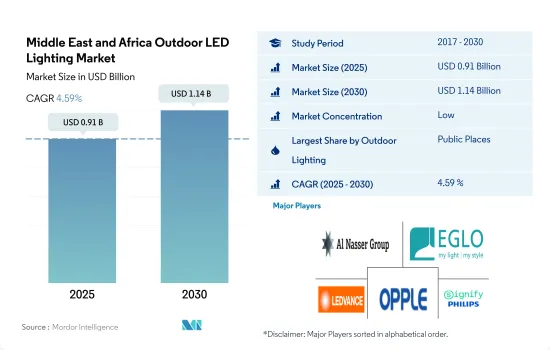

중동 및 아프리카의 야외 LED 조명 시장 규모는 2025년에 9억 1,000만 달러에 달할 것으로 추정됩니다. 2030년에는 11억 4,000만 달러에 이를 것으로 예상되며, 예측 기간 중(2025-2030년) CAGR은 4.59%를 나타낼 것으로 전망됩니다.

도로망 증가와 경기장 업그레이드가 시장 성장을 견인

- 금액 점유율에서는 2023년에는 공공장소가 대부분(55.1%)을 차지한 다음, 도로·가로(44.9%)가 뒤를 이었습니다. 향후 몇 년간은 공공 장소에서의 점유율이 낮고 가로·도로에서의 점유율이 높아질 것으로 예상됩니다. 2020년에는 COVID-19의 확산을 억제하기 위해 경기장, 해변, 요새와 같은 공공 장소가 지역 전체에서 폐쇄되었습니다. 공원과 경기장 시설의 건설도 중단되었습니다. 2021년 중동 및 아프리카는 COVID 규칙을 완화했습니다. 미랄 종이는 2023년 씨월드 아부다비가 열릴 예정임을 밝혔습니다. 야스 섬의 새로운 차세대 해양 생물 공원은 90% 완성되어 있으며 건축 공사는 2022년 말까지 종료되었습니다.

- 도로 인프라로의 개발은 이 지역의 성장의 큰 원동력이 되고 있으며, 정부는 사회·경제 발전을 위해 중요한 투자를 계속하고 있습니다. 지역의 주요 프로젝트로는 두바이가 150억 AED(48억 달러)를 할당, 도로와 고가교 업그레이드 등 2020년 만박을 향한 주요 프로젝트를 완료한 것을 들 수 있습니다. 사우디아라비아의 도로 프로젝트에는 1조 1,400억 달러 이상이 투자되고 있습니다.

- 최근 몇 년 동안 스포츠 분야에서 많은 변화가있었습니다. 예를 들어, 2015년에는 사우디아라비아의 축구 경기장을 클레이 파키가 LED로 라이트 업했습니다. 2022년에는 칼리파 국제경기장에 Philips 조명 LED 조명이 도입되었습니다. 이러한 개선은 카타르의 2022년 FIFA 월드컵 준준결승에서 경기를 개최하는 데 필요했습니다. 2022년에는 라스 아브 아부드의 경기장 내에 비상등과 퇴장 표지를 포함한 4,000개 이상의 조명 장치가 설치되었습니다. 이상과 같은 사례가 이 지역의 야외 조명 분야를 밀어 올릴 것으로 기대되고 있습니다.

중동 및 아프리카의 야외 LED 조명 시장 동향

LED 조명의 성장을 가속하는 스포츠 스타디움 개보수 및 신설

- 경기장 수는 2022년 227개에서 2030년에는 255개로 증가할 것으로 추정되고 CAGR 1.4%를 나타낼 것으로 예상됩니다. 스포츠 분야는 최근 몇 가지 변화를 겪고 있습니다. 예를 들어 사우디아라비아의 킹 파하드 국제 경기장에서는 2015년 Clay Paky가 LED를 사용한 라이트업을 실시했습니다. 칼리파 국제 경기장은 2022년 Philips 조명의 LED 조명을 사용했습니다. 2022년 카타르 월드컵의 준준결승까지 경기를 개최하기 위해서는 업그레이드가 필요했습니다. 라스 아부 아부드 스타디움 내에서는 2022년에 비상 조명기구와 퇴장 표지를 포함한 4,000종 이상의 조명기구가 설치되었습니다. 이러한 요소는 이 지역에서 LED 시장의 확대를 지원합니다.

- 사우디아라비아의 스포츠부는 스포츠 인프라의 정비로 눈부신 성과를 올리고 있습니다. 이 나라는 2023년까지 널리 알려진 스포츠 행사인 FIFA를 개최하기 위한 선진 경기장 건설에 101억 SAR(27억 달러)을 투자할 계획이었습니다. 리야드의 새로운 경기장 프로젝트는 경기장 조명에 LED를 사용하는 등 지속가능성 대책으로 두드러집니다.

- 사우디아라비아의 스포츠부는 2023년에 새로운 스포츠 시설을 건설하고 이미 있는 시설을 개수하기 위해 101억 SAR(27억 달러)의 프로그램을 시작했습니다. 사우디아라비아 스포츠부에 따르면 이 구상은 2030년 FIFA 월드컵 개최를 향해 사우디아라비아가 이집트, 그리스와 공동으로 입후보하기 위한 일환이 되었습니다. 사우디아라비아 축구 연맹(SAFF)은 2023년 사우디아라비아가 2027년 아시아 컵에 맞추어 리야드, 알 코발, 담맘에 3개의 새로운 경기장을 건설할 것이라고 발표했습니다. 이와 같이 새로운 경기장 건설과 경기 행사 증가로 LED 조명 매출은 전국적으로 증가할 것으로 예상됩니다.

가구 수가 증가하면 이 지역에서 LED 사용의 성장을 가속

- 중동 및 아프리카의 2018년 시점의 인구는 4억 8,400만명으로, 2030년에는 약 5억명으로 증가할 것으로 예측되고 있습니다. 2020년에는 아부다비 에미리트 국가에서 9만 2,800호 이상의 주택이 건설되고, 그 다음에 샤르자 에미리트 국가에서 4만 1,000호, 두바이 에미리트 국가에서 3만 5,000호가 건설되었습니다. 향후 몇 년간 아랍에미리트(UAE) 전체에서 23만 1,200호의 주택이 건설될 전망입니다. 새로운 방의 건설은 결과적으로 LED 매출을 밀어 올릴 것으로 보입니다.

- 중동 및 아프리카에서는 일반 가구 인원이 5명을 초과합니다. 사우디아라비아에서는 인구의 약 절반이 집을 소유하고 있으며 546만 가구가 기록되었습니다. 이스라엘에서는 2020년 시점에 5명 이상의 가구가 68만 1,500가구가 있었습니다. 5명이 살기 위해서는 집안에 2실 이상이어야 합니다. 이스라엘에서는 대부분의 사람들이 원룸 아파트에 살고 있습니다. 가구 인원수가 증가함에 따라 LED 판매도 증가하고 있습니다.

- 중동 및 아프리카에서는 2022년에 총 233만대의 자동차가 생산되고 2023년에는 245만대가 생산되었습니다. 아직 초기 단계이지만 중동 및 아프리카 국가의 전기자동차(EV) 시장은 이미 희망이 가득한 성장의 조짐을 보이고 있습니다. 지방자치단체가 이산화탄소 배출량을 줄일 필요성을 보다 강하게 인식하게 됨에 따라 EV의 사용을 촉진하기 위한 법률이 통과되고 있습니다. 예를 들어, 아랍에미리트(UAE), 사우디아라비아, 바레인, 오만은 그물 제로 목표를 발표했습니다. 또한 이 지역의 일부 국가에서는 전기자동차 구매를 촉진하기 위한 세금 혜택 및 보조금을 제공합니다. 이 지역에서는 전기자동차가 큰 잠재력을 갖고 있기 때문에 LED 조명 수요가 높아질 것으로 예측됩니다.

중동 및 아프리카의 야외 LED 조명 산업 개요

중동 및 아프리카의 야외 LED 조명 시장은 단편화되어 상위 5개사에서 20.13%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Al Nasser Group, EGLO Leuchten GmbH, LEDVANCE GmbH(MLS), OPPLE Lighting and Signify Holding(Philips)(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 소득

- LED 총 수입량

- 조명 전력 소비량

- 가구수

- LED 보급률

- 경기장 수

- 규제 프레임워크

- 걸프 협력 회의

- 남아프리카

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 야외 조명

- 공공시설

- 거리 및 도로

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일(세계 수준 개요, 시장 수준 개요, 주요 사업 부문, 재무, 직원 수, 주요 정보, 시장 순위, 시장 점유율, 제품 및 서비스, 최근 동향 분석 포함)

- ACUITY BRANDS, INC.

- Al Nasser Group

- ams-OSRAM AG

- Current Lighting Solutions, LLC.

- Dialight PLC

- EGLO Leuchten GmbH

- LEDVANCE GmbH(MLS Co Ltd)

- Nardeen Lighting Company Limited

- OPPLE Lighting Co., Ltd

- Signify Holding(Philips)

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Middle East and Africa Outdoor LED Lighting Market size is estimated at 0.91 billion USD in 2025, and is expected to reach 1.14 billion USD by 2030, growing at a CAGR of 4.59% during the forecast period (2025-2030).

The increasing road network and the upgradation of stadiums drive the market's growth

- In terms of value share, in 2023, public places accounted for the majority of the share (55.1%), followed by streets and roads (44.9%). The market share is expected to be low in public places and high in streets and roads in the coming years. In 2020, public places such as stadiums, beaches, and forts were shut down throughout the region to limit the spread of COVID-19. There was a halt in the construction of parks and stadium facilities. In 2021, the Middle East & Africa relaxed COVID rules. The Miral revealed that in 2023, SeaWorld Abu Dhabi is expected to open. The new next-generation marine life park on Yas Island was 90% complete, with building work set to finish by the end of 2022.

- Spending on road infrastructure has been a major driver of growth in the region, and the government continues to make critical investments for social and economic development. Major regional projects included Dubai's allocation of AED 15 billion (USD 4.8 billion) to complete key projects for the Expo 2020, including road and viaduct upgrades. More than USD 1.14 trillion has been invested in Saudi Arabia's road projects.

- Over the last few years, there have been many changes in the sports sector. For example, in 2015, Clay Paky lit up Saudi Arabia's soccer stadium with LEDs. In 2022, Khalifa International Stadium was equipped with LED lights of Philips lighting. These improvements were needed to host games in the quarter-finals of Qatar's 2022 FIFA World Cup. In 2022, more than 4,000 lighting devices, including emergency lights and exit signs, were put in place within the stadium of Ras Abu Aboud. The above instances are expected to boost the outdoor lighting segment in the region.

Middle East and Africa Outdoor LED Lighting Market Trends

Renovation and construction of new sports stadiums to facilitate the growth of LED lights

- The number of stadiums witnessed a growth from 227 units in 2022 to 255 units in 2030, registering a CAGR of 1.4%. The sports sector has undergone several changes in recent years. For instance, Clay Paky lit up the King Fahd International Stadium in Saudi Arabia using LEDs in 2015. The Khalifa International Stadium used LED lighting by Philips Lighting in 2022. To host games up to the quarterfinals of the Qatar 2022 FIFA World Cup, the upgrades were necessary. Within Ras Abu Aboud Stadium, more than 4,000 different luminaires, including emergency luminaires and exit signs, were erected in 2022. These elements support the expansion of the LED market in the area.

- The Sports Ministry of Saudi Arabia is making impressive progress in building sports infrastructure. The country planned to invest SAR 10.1 billion (USD 2.7 billion) in constructing advanced stadiums to host FIFA, a widely recognized sporting event, by 2023. The new stadium project in Riyadh stands out for its sustainability measures, which include using LED lights in the stadiums.

- The Saudi Arabian Sports Ministry started a SAR 10.1 billion (USD 2.7 billion) program in 2023 to construct new sporting facilities and renovate those that already exist. According to the Saudi Arabian Ministry of Sports, the initiatives will be a part of Saudi Arabia's joint candidature with Egypt and Greece to host the FIFA World Cup in 2030. The Saudi Arabian Football Federation (SAFF) announced in 2023 that Saudi Arabia would construct three new stadiums in Riyadh, Al-Khobar, and Dammam in time for the 2027 Asian Cup. Thus, LED light sales are anticipated to increase nationwide as a result of the building of new stadiums and an increase in athletic events.

Increase in household size to bolster the growth of LED usage in the region

- The Middle East & Africa had a population of 484 million people as of 2018, with that number predicted to climb to around 500 million by 2030. In 2020, over 92.8 thousand homes were built in the emirate of Abu Dhabi, followed by 41 thousand in the emirate of Sharjah and 35 thousand in the emirate of Dubai. There are expected to be 231.2 thousand residences in the entire United Arab Emirates over the coming years. The building of new rooms will consequently boost sales of LEDs.

- In the Middle East and Africa, the typical household size exceeds five people. In Saudi Arabia, about half of the population owns a home, with 5.46 million households counted in the country. In Israel, there were 681.5 thousand homes with five or more people as of 2020. There must be more than two rooms in a house to accommodate five people. The majority of people in Israel live in studio apartments. Sales of LEDs have increased as a result of the growth in household sizes.

- In the Middle East and Africa, 2.33 million automobiles were produced in total in 2022, and 2.45 million were anticipated to be produced in 2023. Although it is still in its early stages, the electric vehicle (EV) market across the Middle East and African countries is already showing hopeful signs of growth. As local governments become more aware of the need to reduce their carbon footprint, they are passing legislation to promote the use of EVs. The United Arab Emirates, Saudi Arabia, Bahrain, and Oman, for instance, have announced their net-zero targets. Several countries in the region are also offering tax incentives and subsidies to promote the purchase of electric vehicles. Due to the enormous potential that EVs present in this region, it is projected that demand for LED lighting will rise.

Middle East and Africa Outdoor LED Lighting Industry Overview

The Middle East and Africa Outdoor LED Lighting Market is fragmented, with the top five companies occupying 20.13%. The major players in this market are Al Nasser Group, EGLO Leuchten GmbH, LEDVANCE GmbH (MLS Co Ltd), OPPLE Lighting Co., Ltd and Signify Holding (Philips) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 Per Capita Income

- 4.3 Total Import Of Leds

- 4.4 Lighting Electricity Consumption

- 4.5 # Of Households

- 4.6 Led Penetration

- 4.7 # Of Stadiums

- 4.8 Regulatory Framework

- 4.8.1 Gulf Cooperation Council

- 4.8.2 South Africa

- 4.9 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Outdoor Lighting

- 5.1.1 Public Places

- 5.1.2 Streets and Roadways

- 5.1.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ACUITY BRANDS, INC.

- 6.4.2 Al Nasser Group

- 6.4.3 ams-OSRAM AG

- 6.4.4 Current Lighting Solutions, LLC.

- 6.4.5 Dialight PLC

- 6.4.6 EGLO Leuchten GmbH

- 6.4.7 LEDVANCE GmbH (MLS Co Ltd)

- 6.4.8 Nardeen Lighting Company Limited

- 6.4.9 OPPLE Lighting Co., Ltd

- 6.4.10 Signify Holding (Philips)

7 KEY STRATEGIC QUESTIONS FOR LED CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms