|

시장보고서

상품코드

1684035

중국의 MLCC : 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)China MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

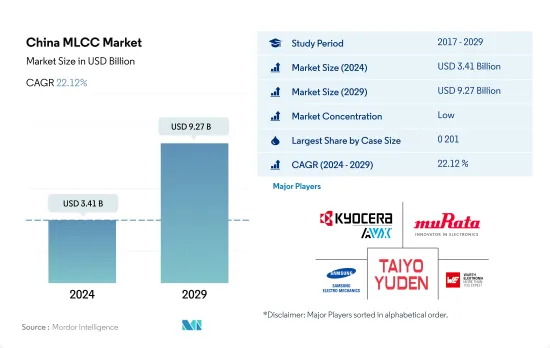

중국의 MLCC 시장 규모는 2024년에 34억 1,000만 달러로 추정되고, 2029년에는 92억 7,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2029년)의 CAGR은 22.12%를 나타낼 전망입니다.

케이스 크기 역학 및 시장 성장 전망을 통한 중국의 번창하는 MLCC 시장

- 역동적인 중국 MLCC 시장에서 0 201 케이스 크기 부문은 2022년에 41.33%의 상당한 시장 점유율을 차지했으며, 2029년에는 35억 1,000만 달러의 수익을 창출할 것으로 전망됩니다. 이러한 소형 MLCC는 웨어러블, 의료 장비, IoT 기기와 같은 소형 전자 기기에서 광범위하게 사용되는 중추적인 부품입니다. 밀집된 PCB 레이아웃 내에서 뛰어난 성능을 발휘하여 효율성 저하 없이 원활한 통합을 보장합니다. 중국이 글로벌 5G 시장을 장악하기 위해 준비함에 따라, 특히 소형 폼팩터가 중요한 5G 지원 스마트폰에서 0 201 MLCC에 대한 수요가 급증할 것으로 예상됩니다.

- 2022년 수량 기준으로 시장 점유율 23.82%를 차지한 0 402 케이스 크기 부문은 2029년까지 20억 6천만 달러의 수익을 올릴 것으로 예상됩니다. 길이 0.040인치, 너비 0.020인치의 이 소형 부품은 스마트폰, 태블릿, 노트북, 게임 콘솔 등 소비자 가전제품에 주로 사용됩니다.

- 중국의 0 603 케이스 크기 부문은 2022년 물량 시장에서 18.78%의 점유율을 차지하며 2029년까지 17억 1,100만 달러의 매출을 올릴 것으로 예상됩니다. 길이 0.06인치, 너비 0.03인치인 이 MLCC는 수작업으로 작업하기 편리하며, 식별이 쉽고 수작업 납땜이 가능하다는 장점이 있습니다.

- 1 210 케이스 크기 부문은 2022년 물량 시장 점유율의 16.07%를 차지하고 2029년에는 9억 5,660만 달러로 예상되며, 회로 기판과 전자 장치의 최적 통합에 필수적인 정밀한 측정을 제공합니다. 중국 전기 자동차 시장의 성장과 첨단 스마트폰 기술로 인해 신뢰할 수 있는 성능을 보장하고 최신 기능을 지원하는 이러한 MLCC에 대한 수요가 증가하고 있습니다.

중국의 MLCC 시장 동향

전자상거래 산업의 발전으로 소형 상용차 수요 증가 전망

- 중국 시장의 소형 경차 부문 픽업은 더 많은 정부가 차량 사용에 대한 규제를 완화함에 따라 견고한 성장세를 보일 것으로 예상됩니다. 2019년 중국 내 소형 상용차의 총 생산량은 200만 대였으며, 판매량은 190만 대에 달해 지속적인 성장을 달성했습니다.

- 소형 트럭 판매량은 지난 2년 동안 꾸준히 성장했습니다. 중국에서 저속 트럭의 제품 카테고리를 취소하고 국내 전자상거래 특송 물류와 콜드체인 운송이 빠르게 발전하면서 소형 트럭에 대한 시장 수요가 계속 증가하여 2020년에는 전년 대비 7.44% 성장했습니다. 중국 소형 트럭 제조업체들은 복잡한 사용 환경에 대응하기 위해 관련 제품을 설계했습니다.

- 2022년 중국은 전체 전기 LCV 판매량에서 선두를 차지하며 1억 3,000만 대 이상이 판매되었고, 판매된 LCV의 약 15%가 전기 차량이었습니다. 최근 몇 년간 배터리 전기 및 연료전지 트럭과 직업용 차량(LCV 포함)에 대한 보조금은 감소했지만, 2020년 이후 무공해 상용 트럭 판매는 차량당 보조금 감소에도 불구하고 증가하고 있어 전기 트럭의 상업적 경쟁력이 높아지고 있음을 알 수 있습니다. 중국 특송 및 물류 산업의 지속적인 발전으로 전체 소형 트럭 판매 수요는 중장기적으로 성장세를 유지할 것으로 예상됩니다.

급속한 도시화와 첨단 차량 기술로 인해 승용차 수요가 증가할 것으로 예상

- 중국은 자동차 산업이 가장 빠르게 성장하는 국가 중 하나이며, 전 세계 OEM(주문자 상표 부착 생산업체)의 주요 진출 국가 중 하나입니다. 승용차는 2019년 2,138만 대를 생산한 중국 자동차 산업의 핵심 부문입니다. 가처분 소득 증가, 급속한 도시화, 지방 도시의 신차 수요, 낮은 차량 비용 등의 요인이 중국 승용차의 성장을 이끌고 있습니다.

- 2021년 중국에서는 2020년 전 세계(300만 대)보다 더 많은 전기차가 판매(330만 대)되었습니다. 중국의 전기차 보유 대수는 2021년 780만 대로 세계 최대 규모를 유지했으며, 이는 코로나19 팬데믹 이전인 2019년의 2배가 넘는 수치입니다. 2021년 중국에서 270만 대 이상의 BEV가 판매되었으며, 이는 신규 전기차 판매의 82%를 차지했습니다.

- 전기차는 2020년 5%에서 2021년 국내 자동차 판매의 16%를 차지했으며, 2021년 12월에는 월별 점유율이 20%에 달해 기존 자동차에 비해 전기차 시장이 훨씬 빠르게 회복되고 있음을 반영했습니다. 이러한 놀라운 성장은 새로운 제14차 5개년 계획(2021-2025년)에서 탈탄소화를 가속화하려는 정부의 노력과 함께 이루어졌으며, 지난 몇 번의 FYP 기간 동안 전기차 시장에 대한 정책 지원을 점진적으로 강화하는 추세를 이어가고 있습니다. 현재 FYP에는 2025년 전기차 판매 연평균 시장 점유율 20% 달성과 같은 운송 분야의 중기 목표가 포함되어 있습니다.

- 엄격한 배기가스 규제, 연료 가격 변동, 친환경 운송 수단에 대한 고객의 수요 증가로 인해 2022년 승용차 생산량은 전년 대비 11.15% 성장했으며 이러한 성장은 앞으로도 계속될 것으로 예상됩니다.

중국의 MLCC 산업 개요

중국의 MLCC 시장은 세분화되어 상위 5개사에서 0%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. Kyocera AVX Components Corporation(Kyocera Corporation), Murata Manufacturing, Samsung Electro-Mechanics, Taiyo Yuden and Wurth Elektronik GmbH & Co. KG(알파벳 순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 가격 동향

- 구리의 가격 동향

- 니켈 가격 동향

- 은 가격 동향

- 가전 판매 대수

- 에어컨 판매

- 데스크톱 PC 판매

- 게임기 판매

- 노트북 판매

- 냉장고 판매

- 스마트폰 판매

- 저장 장치 판매

- 태블릿 판매

- TV 판매

- 자동차 생산

- 버스 생산

- 대형 트럭 생산

- 소형 상용차 생산

- 승용차 생산

- 자동차 생산

- EV 생산

- BEV(배터리 전기자동차)의 생산

- PHEV(플러그인 하이브리드차) 생산

- 산업용 자동화 매출액

- 산업용 로봇 판매

- 서비스 로봇 판매

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 유전체 유형

- 클래스 1

- 클래스 2

- 케이스 사이즈

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 기타

- 전압

- 500-1000V

- 500V 미만

- 1000V 이상

- 정전용량

- 100-1000uF

- 100uF 미만

- 1,000uF 이상

- MLCC 실장 유형

- 금속 캡

- 방사형 리드

- 표면 실장

- 최종 사용자

- 항공우주 및 방어

- 자동차

- 소비자 가전제품

- 산업기기

- 의료기기

- 전력 및 유틸리티

- 통신 기기

- 기타

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co. Ltd

- Murata Manufacturing Co. Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co. Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

제7장 CEO에 대한 주요 전략적 질문 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 출처 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The China MLCC Market size is estimated at 3.41 billion USD in 2024, and is expected to reach 9.27 billion USD by 2029, growing at a CAGR of 22.12% during the forecast period (2024-2029).

China's thriving MLCC market through case size dynamics and market growth projections

- In China's dynamic MLCC market, the 0 201 case size segment held a substantial 41.33% of the volume market share in 2022, and it's poised to generate a revenue of USD 3.51 billion by 2029. These miniature MLCCs are pivotal components, finding extensive use in small electronic devices like wearables, medical equipment, and IoT devices. Their remarkable performance within densely populated PCB layouts ensures seamless integration without compromising efficiency. As China gears up to dominate the global 5G market, the demand for 0 201 MLCCs is expected to soar, especially in 5G-enabled smartphones, where compact form factors are crucial.

- The 0 402 case size segment, representing 23.82% of the market share by volume in 2022, is projected to yield USD 2.06 billion by 2029. These compact components, measuring 0.040 inches in length and 0.020 inches in width, are the go-to for consumer electronics, including smartphones, tablets, laptops, and gaming consoles.

- China's 0 603 case size segment, with a 18.78% share of the volume market in 2022, is expected to generate USD 1.71 billion by 2029. These MLCCs, measuring 0.06 inches in length and 0.03 inches in width, are convenient to work with manually, providing advantages in ease of identification and hand soldering.

- The 1 210 case size segment, accounting for 16.07% of the volume market share in 2022 and projecting USD 956.60 million by 2029, offers precise measurements that are crucial for optimal integration on circuit boards and electronic devices. The growth in China's electric vehicle market and advanced smartphone technologies are driving the need for these MLCCs, ensuring dependable performance and supporting modern functionalities.

China MLCC Market Trends

The development of the e-commerce industry is expected to propel the demand for light commercial vehicles

- Pickups, a small light-vehicle segment in the Chinese market, are poised for robust growth as more governments relax rules over their use. The total production of light commercial vehicles in 2019 was 2 million units, and the sales volume of light trucks in the country reached 1.9 million units, achieving continuous growth.

- The sales of light trucks have grown steadily in the past two years. Due to the country canceling the product category of low-speed trucks and the rapid development of domestic e-commerce express logistics and cold chain transportation, the market demand for light trucks continued to increase, with a Y-o-Y growth of 7.44% in 2020. Chinese light truck manufacturers designed their related products accordingly to cope with the complex usage environment.

- In 2022, China led in terms of overall electric LCV sales, with over 130 million units sold and nearly 15% of LCVs sold being electric. Subsidies for battery electric and fuel cell trucks and vocational vehicles (including LCVs) have decreased in recent years, but zero-emission commercial truck sales have been growing since 2020, even as subsidies per vehicle have declined, indicating the increasing commercial competitiveness of electric trucks. With the continuous development of the country's express delivery and logistics industry, the overall light truck sales demand is expected to maintain a growth trend in the medium and long term.

Rapid urbanization and advanced vehicle technology are expected to increase the demand for passenger vehicles

- China has one of the fastest-growing auto industries and accounts for a major presence of original equipment manufacturers (OEMs) globally. Passenger cars were a key segment of the Chinese automotive industry, producing 21.38 million units in 2019. Factors such as increasing disposable income, rapid urbanization, demand for new cars from lower-tier cities, and low vehicle costs are driving the growth of passenger vehicles in China.

- More electric cars were sold in China in 2021 (3.3 million) than in the world in 2020 (3.0 million). China's fleet of electric cars remained the world's largest at 7.8 million in 2021, which was more than double the stock of 2019 before the COVID-19 pandemic. Over 2.7 million BEVs were sold in China in 2021, accounting for 82% of new electric car sales.

- Electric cars accounted for 16% of domestic car sales in 2021, up from 5% in 2020, and reached a monthly share of 20% in December 2021, reflecting a much quicker recovery of the EV market relative to conventional cars. This impressive growth came alongside government efforts to accelerate decarbonization in the new 14th Five-Year Plan (FYP) (2021-2025), continuing the trend of progressively strengthening policy support for EV markets in the past few FYP periods. The current FYP includes medium-term objectives in transport, such as reaching an annual average of 20% market share for electric car sales in 2025.

- Stringent emission norms, fluctuating fuel prices, and the growing demand from customers for eco-friendly transportation caused the production of passenger vehicles to witness a Y-o-Y growth of 11.15% in 2022, and this growth is expected to continue in the future.

China MLCC Industry Overview

The China MLCC Market is fragmented, with the top five companies occupying 0%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co. Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co. Ltd and Wurth Elektronik GmbH & Co. KG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Copper Price Trend

- 4.1.2 Nickel Price Trend

- 4.1.3 Silver Price Trend

- 4.2 Consumer Electronics Sales

- 4.2.1 Air Conditioner Sales

- 4.2.2 Desktop PC's Sales

- 4.2.3 Gaming Console Sales

- 4.2.4 Laptops Sales

- 4.2.5 Refrigerator Sales

- 4.2.6 Smartphones Sales

- 4.2.7 Storage Unit Sales

- 4.2.8 Tablets Sales

- 4.2.9 Television Sales

- 4.3 Automotive Production

- 4.3.1 Buses and Coaches Production

- 4.3.2 Heavy Trucks Production

- 4.3.3 Light Commercial Vehicles Production

- 4.3.4 Passenger Vehicles Production

- 4.3.5 Total Motor Production

- 4.4 EV Production

- 4.4.1 BEV (Battery Electric Vehicle) Production

- 4.4.2 PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.5 Industrial Automation Sales

- 4.5.1 Industrial Robots Sales

- 4.5.2 Service Robots Sales

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 500V to 1000V

- 5.3.2 Less than 500V

- 5.3.3 More than 1000V

- 5.4 Capacitance

- 5.4.1 100µF to 1000µF

- 5.4.2 Less than 100µF

- 5.4.3 More than 1000µF

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co. Ltd

- 6.4.3 Murata Manufacturing Co. Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co. Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms