|

시장보고서

상품코드

1849883

이탈리아의 상처 관리 기기 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)Italy Wound Care Management Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

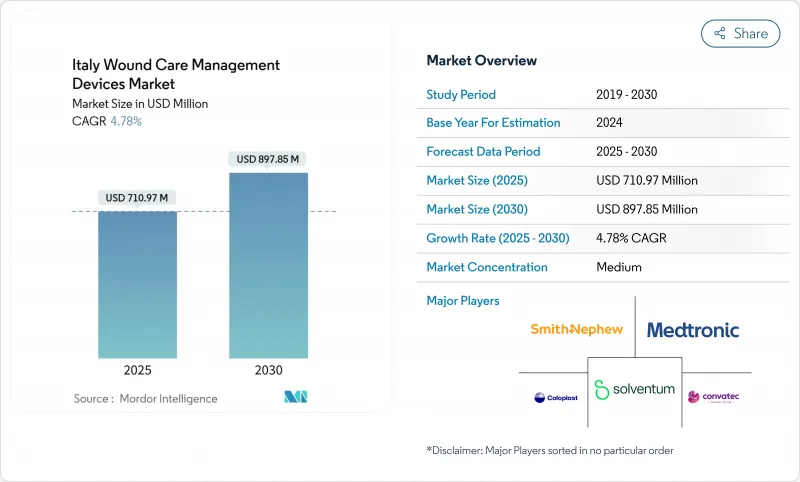

이탈리아의 상처 관리 기기 시장은 2025년 7억 1,097만 달러, 2030년 8억 9,785만 달러에 이르며 CAGR 4.78%를 나타낼 것으로 예측됩니다.

노인 인구 증가, 당뇨병 이환율 증가, 국민 의료 서비스의 지속적인 디지털 업그레이드는 수량 성장을 유지하여 고급 드레싱 재료, 음압상처치료(NPWT), 생물활성 재료의 신속한 채용을 촉진합니다. 병원은 여전히 수요의 기간이지만, 지불자가 입원 비용을 억제하는 것을 목표로 하고 환자가 편리한 회복 옵션을 선호함에 따라, 재택치료의 기세는 강해지고 있습니다. 입찰을 표준화하고 가치 기반 구매에 보상하는 조달 개혁은 세계 브랜드와 지역 전문가의 경쟁을 자극합니다. 한편, EU 의료기기 규제의 기한은 이탈리아의 아웃컴 주도형 의료로의 변화에 매치한 보다 안전하고 데이터 풍부한 제품으로 제조업체를 밀어 올리고 있습니다.

이탈리아의 상처 관리 기기 시장 동향과 인사이트

당뇨병 관련 만성 궤양의 급증

이탈리아 당뇨병 유병률 6%는 당뇨병성 발 궤양 1례당 평균 4,888유로의 입원 비용을 억제하는 고기능 드레싱재와 기성품 NPWT에 대한 지속적인 수요를 창출하고 있습니다. 궤양 위험이 65세를 넘으면 급증하기 때문에 고령화는 이 압력을 증폭시킵니다. 병원에서는 위험이 높은 환자에게 우선순위를 부여하고 조기 개입을 이끌기 위해 80%의 정확도를 가진 머신러닝 알고리즘인 예측 분석을 채용하는 경우가 늘고 있습니다. 통합된 장비 포트폴리오, 원격 모니터링, 증거 기반 프로토콜을 제공하는 공급업체는 예산의 예측 가능성을 요구하는 지역의 의료 당국에 의해 지원됩니다.

이탈리아 공립 병원에서 NPWT 채택 확대

임상경제학적 연구에 따르면 NPWT는 입원 기간을 2.5일 단축하고 재입원을 감소시킵니다. 유럽 전역의 임상 표준화 후, 이탈리아 전역의 간호사는 프로토콜 개발이 더욱 원활해지고 드레싱과 관련된 감염이 감소했다고보고했습니다. 1차 케어의 현장으로의 이동을 위해 설계된 휴대용 배터리 구동 유닛은 현재 재택 케어의 확대에 맞추어 급성장하는 서브라인을 형성하고 있습니다.

차세대 피부대용제에 대한 불리한 보험상환

AIFA의 비용 효율적인 렌즈는 프리미엄 셀 매트릭스의 상장을 지연시킵니다. 첨부 문서에 광범위한 이탈리아 데이터가 없는 경우, 지역 위원회는 보험 적용을 망설이고, 임상의는 전통적인 드레싱 재료에 의존할 수밖에 없습니다. 장기적인 결과 연구와 예산에 미치는 영향 모델을 결합한 기업은 수락 태세를 개선하고 있는 반면, 보험 적용의 확대는 아직 몇년전 전망입니다.

부문 분석

상처 케어 제품은 2024년 이탈리아의 상처 관리 기기 시장에서 65.11%의 압도적인 점유율을 차지했으며, 임상의는 일상적인 궤양 관리를 위해 고급 드레싱 재료, 폼, 하이드로 섬유, NPWT 캐니스터를 사용했습니다. 정기적인 교환주기로 예측 가능한 수익을 확보하고 상시 삼출액 관리를 필요로하는 200 만건의 만성 상처 사례로 수요를 강화하고 있습니다. 항균 드레싱재는 상피화가 빠르고, 감염에 의한 재입원이 적기 때문에 종래의 거즈의 사용량은 감소하고 있습니다. 휴대용 NPWT 장치는 외래 채용을 강화하고 일회용 키트는 간호사의 작업 부담과 교차 오염의 위험을 줄입니다.

상처 폐쇄 제품은 2030년까지 연평균 복합 성장률(CAGR) 5.45%를 나타내 보다 광범위한 이탈리아의 상처 관리 기기 시장을 웃돌았습니다. 주요 대학 센터의 선택적 수술과 낮은 침습 수술 증가는 흡수성 스테이플러, 조직 접착제 및 새로운 실란트의 보급을 촉진합니다. 롬바르디아 주 외과의사는 생체 흡수성 접착제를 사용하면 수술 시간이 단축된다고 보고하고 있으며, 이는 입원 기간 단축에 보상을 주는 병원의 실적 평가 기준에 부합합니다. 60초 이내에 경화하는 합성 폴리머 접착제에 주력하는 신흥 기업이 벤처 자금을 획득하여 경쟁 압력을 높이고 있습니다.

만성 상처는 2024년 이탈리아 상처 관리 기기 시장 규모의 58.76%를 차지하며 당뇨병성 족부 궤양, 욕창, 정맥성 궤양의 존속을 반영했습니다. 당뇨병성 궤양만으로도 환자 1인당 4,888유로의 치료비가 발생하고 있으며, 병원은 치유하지 않는 궤적을 예측하고 조기에 NPWT를 개시하는 알고리즘을 채용하도록 요구되고 있습니다. 52%의 면적 축소를 달성한 단백질 농축 혈소판이 풍부한 혈장 주사는 비용 부담을 입원 침대에서 외래 주입실로 이동시킬 수 있는 치료법의 한 예입니다.

외상 센터가 열상 유닛을 업그레이드하고 폐쇄 절개 NPWT를 채택함에 따라 급성 상처의 성장이 가속화되고 CAGR은 5.53%를 나타낼 전망입니다. 이탈리아 외과 병동의 경제 분석에 따르면 NPWT에서 수술 부위 감염을 예방하면 환자 100명당 EUR 16만 6,944를 절약할 수 있습니다. 에밀리아 로마냐의 열상 치료 연구 기관에서는 이식 간격의 단축과 비후성 흉터의 감소를 약속하는 이종 진피 매트릭스의 시험도 실시했습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 당뇨병과 관련된 만성 궤양의 유병률이 급증

- 이탈리아의 공립 병원에 있어서의 음압 폐쇄 요법(NPWT)의 도입 확대

- 외래 및 재택에서의 고도의 상처 피복재로의 이행

- 국가의 입찰 개혁에 의해 일회용 NPWT의 도입이 가속

- EU MDR 주도의 생체활성 콜라겐-HA 드레싱에 있어서의 혁신

- 병원의 성과 보수 제도는 상처 폐쇄의 신속화에 보답

- 시장 성장 억제요인

- 차세대 피부 대체품에 대한 불리한 상환

- 남부 이탈리아의 지역 조달 지연

- 스마트 상처 모니터링 장치에 관한 임상의의 연수 갭

- 수입 폼 및 알긴산염 원재료에 공급 체인의 의존

- 규제 상황

- 기술 전망

- Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력/소비자

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업 간 경쟁 관계

제5장 시장 규모와 성장 예측

- 제품별

- 상처 관리

- 드레싱

- 전통적 거즈 및 테이프 드레싱

- 고급 드레싱

- 상처 관리 기기

- 음압 상처 치료(NPWT)

- 산소 및 고압 산소 치료 시스템

- 전기 자극 장치

- 기타 상처 관리 기기

- 국소 치료제

- 기타 상처 관리 제품

- 상처 봉합

- 봉합사

- 수술용 스테이플러

- 조직 접착제, 스트립, 실런트 및 접착제

- 상처 관리

- 상처 유형별

- 만성 상처

- 당뇨병성 족부 궤양

- 욕창

- 정맥성 다리 궤양

- 기타 만성 상처

- 급성 상처

- 수술/외상성 상처

- 화상

- 기타 급성 상처

- 만성 상처

- 최종 사용자별

- 병원 및 전문 상처 클리닉

- 장기 요양 시설

- 재택 의료 환경

- 구입 방법별

- 기관 구매

- 소매/일반의약품(OTC) 채널

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Solventum

- Smith Nephew

- Molnlycke Health Care AB

- Coloplast Group

- ConvaTec Plc

- B. Braun SE

- Medtronic plc

- Paul Hartmann AG

- Integra LifeSciences

- Essity(BSN medical)

- Lohmann & Rauscher

- Urgo Medical

- Fidia Farmaceutici SpA

- Medela AG

- DeRoyal Industries

- Cardinal Health

- Baxter International

- Kerecis

- Vivostat A/S

- Kinetic Concepts

제7장 시장 기회와 향후 전망

KTH 25.11.03The Italy wound care management devices market stands at USD 710.97 million in 2025 and is projected to reach USD 897.85 million by 2030, advancing at a 4.78% CAGR.

A larger elderly population, rising diabetes incidence, and continuous digital upgrades within the national health service sustain volume growth and encourage faster adoption of advanced dressings, negative pressure wound therapy (NPWT), and bioactive materials. Hospitals remain the backbone of demand, yet home-healthcare momentum is intensifying as payers look to curb inpatient costs and patients favor convenient recovery options. Procurement reforms that standardize tenders and reward value-based purchasing stimulate competition among global brands and regional specialists . Meanwhile, regulatory deadlines under the EU Medical Device Regulation push manufacturers toward safer, data-rich products that match Italy's shift to outcome-driven care.

Italy Wound Care Management Devices Market Trends and Insights

Surging Prevalence of Diabetes-Linked Chronic Ulcers

Italy's 6% diabetes prevalence feeds continuous demand for sophisticated dressings and off-the-shelf NPWT that curb hospitalization costs averaging EUR 4,888 per diabetic foot ulcer case. Ageing amplifies this pressure because ulcer risk rises sharply after 65 years. Hospitals increasingly employ predictive analytics-machine-learning algorithms with 80% accuracy-to prioritize high-risk patients and guide early intervention. Suppliers offering integrated device portfolios, remote monitoring, and evidence-based protocols gain traction with regional health authorities seeking budget predictability .

Growing Adoption of NPWT in Italian Public Hospitals

Clinical-economic studies show NPWT shortens stays by 2.5 days and lowers readmissions, prompting procurement teams in Lombardy and Emilia-Romagna to accelerate single-use system tenders. After Europe-wide clinical standardization, nurses across Italy report smoother protocol rollouts and fewer dressing-related infections. Portable, battery-powered units designed for transfer to primary care settings now form a fast-growing sub-line that aligns with home-care expansion .

Unfavorable Reimbursement for Next-Gen Skin Substitutes

AIFA's cost-effectiveness lenses slow listing for premium cellular matrices, partly because 23% of health outlays already fall on patients. Where dossiers lack extensive Italian data, regional commissions hesitate to grant coverage, forcing clinicians to rely on conventional dressings. Companies that pair long-term outcome studies with budget impact models are improving acceptance, but widespread coverage remains a multi-year prospect.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Outpatient & Home-Based Advanced Wound Dressings

- EU MDR-Driven Innovation in Bioactive Collagen-HA Dressings

- Regional Procurement Delays in Southern Italy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wound care products held a commanding 65.11% share of the Italy wound care management devices market in 2024 as clinicians relied on advanced dressings, foams, hydrofibers, and NPWT canisters for day-to-day ulcer management. The recurring replacement cycle secures predictable revenue, and demand is reinforced by 2 million chronic wound cases that require constant exudate management. Traditional gauze usage is falling because antimicrobial dressings achieve faster epithelialization and fewer infection-related readmissions. Portable NPWT units strengthen outpatient adoption, while single-use kits lower nurse workload and cross-contamination risk.

Wound closure products expand at a 5.45% CAGR to 2030, outpacing the broader Italy wound care management devices market. Increased elective surgeries and minimally invasive procedures in major university centers stimulate uptake of absorbable staplers, tissue adhesives, and novel sealants. Surgeons in Lombardy report reduced operating time when using bioresorbable adhesives, aligning with hospital pay-for-performance metrics that reward shorter stays. Start-ups focusing on synthetic polymer glues that set in under 60 seconds attract venture funding, adding competitive pressure.

Chronic wounds contributed 58.76% to the Italy wound care management devices market size in 2024, reflecting the persistence of diabetic foot, pressure, and venous ulcers. Diabetic ulcers alone generate treatment outlays of EUR 4,888 per patient and push hospitals to adopt algorithms that predict non-healing trajectories and trigger early NPWT initiation. Protein-enriched platelet-rich plasma injections achieving 52% area reduction exemplify therapies that could shift cost burdens from inpatient beds to outpatient infusion rooms.

Acute wounds grow faster, registering a 5.53% CAGR as trauma centers upgrade burn units and adopt closed-incision NPWT. Economic analyses from Italian surgery wards show EUR 166,944 savings per 100 patients when NPWT prevents surgical site infections. Burn care research institutes in Emilia-Romagna also test xenogenic dermal matrices that promise shorter grafting intervals and less hypertrophic scarring.

The Italy Wound Care Management Devices Market is Segmented by Product (Wound Care [Dressings, Wound-Care Devices, and More] and Wound Closure), Wound Type (Chronic Wounds and Acute Wounds), End User (Hospitals & Specialty Wound Clinics and More), and Mode of Purchase (Institutional Procurement and Retail / OTC Channel). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Solventum

- Smiths Group

- Molnlycke Health Care

- Coloplast

- ConvaTec Plc

- B. Braun

- Medtronic

- Hartmann Group

- Integra LifeSciences

- Essity (BSN medical)

- Lohmann & Rauscher

- Urgo Medical

- Fidia Farmaceutici SpA

- Medela

- DeRoyal Industries

- Cardinal Health

- Baxter

- Kerecis

- Vivostat

- Kinetic Concepts

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging prevalence of diabetes-linked chronic ulcers

- 4.2.2 Growing adoption of Negative-Pressure Wound Therapy (NPWT) in Italian public hospitals

- 4.2.3 Shift to outpatient & home-based advanced wound dressings

- 4.2.4 National tender reforms accelerating uptake of single-use NPWT

- 4.2.5 EU MDR-driven innovation in bioactive collagen-HA dressings

- 4.2.6 Hospital Pay-for-performance rules rewarding faster wound closure

- 4.3 Market Restraints

- 4.3.1 Unfavourable reimbursement for next-gen skin substitutes

- 4.3.2 Regional procurement delays in Southern Italy

- 4.3.3 High clinician training gap for smart wound monitoring devices

- 4.3.4 Supply-chain dependency on imported foam & alginate raw materials

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Wound Care

- 5.1.1.1 Dressings

- 5.1.1.1.1 Traditional Gauze & Tape Dressings

- 5.1.1.1.2 Advanced Dressings

- 5.1.1.2 Wound-Care Devices

- 5.1.1.2.1 Negative Pressure Wound Therapy (NPWT)

- 5.1.1.2.2 Oxygen & Hyperbaric Systems

- 5.1.1.2.3 Electrical Stimulation Devices

- 5.1.1.2.4 Other Wound Care Devices

- 5.1.1.3 Topical Agents

- 5.1.1.4 Other Wound Care Products

- 5.1.2 Wound Closure

- 5.1.2.1 Sutures

- 5.1.2.2 Surgical Staplers

- 5.1.2.3 Tissue Adhesives, Strips, Sealants & Glues

- 5.1.1 Wound Care

- 5.2 By Wound Type

- 5.2.1 Chronic Wounds

- 5.2.1.1 Diabetic Foot Ulcer

- 5.2.1.2 Pressure Ulcer

- 5.2.1.3 Venous Leg Ulcer

- 5.2.1.4 Other Chronic Wounds

- 5.2.2 Acute Wounds

- 5.2.2.1 Surgical/Traumatic Wounds

- 5.2.2.2 Burns

- 5.2.2.3 Other Acute Wounds

- 5.2.1 Chronic Wounds

- 5.3 By End User

- 5.3.1 Hospitals & Specialty Wound Clinics

- 5.3.2 Long-term Care Facilities

- 5.3.3 Home-Healthcare Settings

- 5.4 By Mode of Purchase

- 5.4.1 Institutional Procurement

- 5.4.2 Retail / OTC Channel

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Solventum

- 6.3.2 Smith+Nephew

- 6.3.3 Molnlycke Health Care AB

- 6.3.4 Coloplast Group

- 6.3.5 ConvaTec Plc

- 6.3.6 B. Braun SE

- 6.3.7 Medtronic plc

- 6.3.8 Paul Hartmann AG

- 6.3.9 Integra LifeSciences

- 6.3.10 Essity (BSN medical)

- 6.3.11 Lohmann & Rauscher

- 6.3.12 Urgo Medical

- 6.3.13 Fidia Farmaceutici SpA

- 6.3.14 Medela AG

- 6.3.15 DeRoyal Industries

- 6.3.16 Cardinal Health

- 6.3.17 Baxter International

- 6.3.18 Kerecis

- 6.3.19 Vivostat A/S

- 6.3.20 Kinetic Concepts

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment