|

시장보고서

상품코드

1686644

인도의 종자 처리 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)India Seed Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

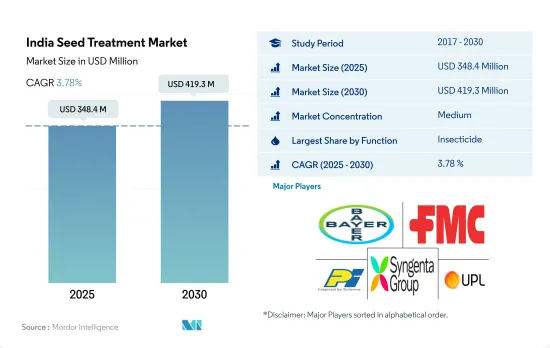

인도의 종자 처리 시장 규모는 2025년에 3억 4,840만 달러에 달할 것으로 추정됩니다. 2030년에는 4억 1,930만 달러에 이를 것으로 예상되며, 예측 기간(2025-2030년)의 CAGR은 3.78%를 나타낼 것으로 전망됩니다.

첨단 종자 기술에 대한 요구 증가와 정부 지원이 시장을 견인

- 인도의 화학 살균제 종자 처리 시장은 작물 보호에서 종자 처리의 중요성에 대한 의식이 높아짐에 따라 과거 기간에 큰 성장을 이루었습니다. 종자 처리는 종자를 균류 병해로부터 보호하고, 발아율을 향상시키고, 건전한 식물 수립을 확보하는데 있어서 매우 중요합니다.

- 살균제는 종자 처리 약품 중에서 두 번째로 중요하며, 2022년에는 9.0%의 점유율을 차지했습니다. 이는 식물의 종자와 묘목의 단계가 토양과 종자를 매개하는 질병에 더 취약하기 때문입니다.

- 종자 처리 시장에서 살충제 부문은 2022년에 2억 8,060만 달러로 평가되었습니다. 화학 살충제에 의한 종자 처리에서는 이미다클로프리드, 크로티아니딘, 티아메톡삼, 피프로닐, 클로르피리포스 등 유효 성분의 중요성이 높습니다.

- 국내 농민들은 고품질 및 파종 후 최대 발아율을 보장하기 위해 이러한 화학 물질로 전처리 된 종자를 구입하는 것을 고려하고 있습니다. 중앙정부와 일부 주정부는 농민들에게 종자 처리의 사용을 인식하고 현대적인 농업 관행에 대한 의지를 높이기 위한 노력을 하고 있습니다. 예를 들어, 매디야 프라데시 주정부는 1,000개의 마을에서 지식이 부족한 농민을 훈련시키고 콩과 같은 작물 재배를 촉진하기 위해 나선형 그레이더와 종자 처리 드럼 프로그램을 시작했습니다.

- 뿌리 벌레 선충은 과일 및 채소 작물에 영향을 미치는 선충 중에서도 가장 위험한 유형로 당근에서는 34.0%, 감자에서는 26.0%, 토마토에서는 23.0%, 전장 가하라에서는 22.0%, 브린잘에서는 21.0%의 수량 손실을 일으키는 것으로 알려져 있습니다. 살선충제 종자 처리는 과채류에서 가장 흔했으며 2022년 점유율은 9.1%였습니다.

인도의 종자 처리 시장 동향

질병과 해충의 조기 방제에 대한 의식 증가와 도입은 종자 처리의 소비를 증가시키고 있습니다.

- 지난 일정 기간 동안 종자 처리 농약의 헥타르 당 소비량은 안정적입니다. 2022년에 기록된 소비량은 헥타르당 125.46g이었습니다. 이 안정성은 종자 처리 기술의 진보, 병해충 관리 방법의 개선, 기존의 농약 제제의 효능 등 다양한 요인 때문입니다.

- 종자 처리는 종자와 토양을 매개하는 병충해의 유해한 영향으로부터 종자와 모종을 보호하는 데 중요한 역할을합니다. 종자 처리제는 사탕수수(뿌리 썩음병, 위음병), 땅콩(줄기 부패병, 종자 부패병, 묘부패병, 백문우병), 벼(뿌리 벌레 선충, 뿌리 쓰레기병) 등 중요한 작물의 해충이나 병해를 구제합니다.

- 작물의 출아와 성장은 종자 처리법을 사용하여 이러한 유해 요인으로부터 효과적으로 차단할 수 있습니다. 종자 처리 제품에는 큰 이점이 있기 때문에 농업 분야에서의 사용이 필수적입니다.

- 종자 수요의 약 70%는 농부가 자가 채종한 종자를 이용하여 채워집니다. 그러나 이러한 종자는 종자 병해와 토양 병해에 약합니다. 따라서 질병이나 해충의 발생으로부터 작물을 보호하기 위해서는 종자 처리를 실시하는 것이 매우 중요합니다. 이러한 필요로 인해 종자 처리 제품의 사용이 증가하고 있습니다.

- 확대하는 농업 활동에는 종자 처리를 포함한 효과적인 작물 보호 대책이 필요합니다. 초기 단계의 병해충으로부터 작물을 보호하는 종자 처리의 이점에 대한 농민의 의식 증가는 종자 처리 제품의 보급과 헥타르 당 살포율 증가에 기여하고 있습니다.

종자 시장성을 높이기 위해 종자 처리제의 사용에 관한 정부 기관의 촉진 활동

- 종자 처리는 작물의 이삭과 생육에 영향을 미치는 종자와 토양을 매개하는 병해충으로부터 종자와 모종을 보호하는 데 중요한 역할을합니다. 종자를 매개로 하는 병충해는 농부가 직면하는 작물 수율을 감소시키는 몇 가지 큰 도전입니다. 시펠메트린, 아바멕틴, 아조시스트로빈, 말라티온, 메탈락실은 인도에서 가장 일반적으로 사용되는 종자 처리제입니다.

- 시펠메트린은 비전신 토양 작용형의 피레스로이드계 살충제로, 인도에서는 가을 뿌리기나 겨울 뿌리기의 밀이나 보리의 구근충이나 침금충의 피해를 경감하기 위한 종자 처리제입니다. 2022년 가격은 톤당 2만 1,000달러였습니다.

- 아바멕틴은 이버멕틴 시스템에 속하며 선충에 대해 높은 고유 활성을 가지고 있습니다. 옥수수, 콩, 면화의 생산에서 뿌리를 공격하는 선충으로부터 유식물을 보호하는 데 사용됩니다. 2022년 가격은 톤당 8,700달러였습니다.

- 아조시스트로빈은 광역 스펙트럼의 예방적 종자 처리 살균제로, 농작물의 수율 저하를 일으키는 자실체균, 진균류, 새끼 곰팡이류, 담자균류의 방제에 추천됩니다. 2022년 아조시스트로빈의 가격은 톤당 4,500달러였습니다.

- 다양한 규제와 정부 기관이 종자 시장성을 높이기 위해 종자 처리의 사용을 장려합니다. 예를 들어 인도 정부는 칼리프 시즌 동안 모든 중요한 작물에서 종자 처리를 100% 확실히 수행하기 위해 전국 캠페인을 시작할 계획을 발표했습니다. 농약 산업 단체, ATMA, CIPMCs, KVK, 농민 클럽, SAU, NGO 등은 종자 처리 100% 캠페인에서 중요한 역할을 할 수 있습니다. 이는 국내 종자 처리제의 가격에 더욱 영향을 미칠 것으로 예상됩니다.

인도의 종자 처리 산업 개요

인도의 종자 처리 시장은 적당히 통합되어 있으며 상위 5개 기업에서 56.48%를 차지합니다. 이 시장 주요 기업은 다음과 같습니다. Bayer AG, FMC Corporation, PI Industries, Syngenta Group and UPL Limited(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 1헥타르당 농약 소비량

- 유효성분의 가격 분석

- 규제 프레임워크

- 인도

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 기능

- 살균제

- 살충제

- 살선충제

- 작물 유형

- 상업 작물

- 과일 및 야채

- 곡물 및 곡류

- 맥류 및 유지종자

- 잔디 및 장식용

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- ADAMA Agricultural Solutions Ltd

- BASF SE

- Bayer AG

- Corteva Agriscience

- Crystal Crop Protection Ltd

- FMC Corporation

- PI Industries

- Rallis India Ltd

- Syngenta Group

- UPL Limited

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The India Seed Treatment Market size is estimated at 348.4 million USD in 2025, and is expected to reach 419.3 million USD by 2030, growing at a CAGR of 3.78% during the forecast period (2025-2030).

The market is driven by the growing need for advanced seed technologies and government support

- The Indian seed treatment market for chemical fungicides has experienced significant growth during the historical period due to the rising awareness about the importance of seed treatment in crop protection. Seed treatment is crucial in safeguarding seeds from fungal diseases, improving germination rates, and ensuring healthy plant establishment.

- Fungicides are the second most important among seed treatment chemicals, and they accounted for a share of 9.0% in 2022. This is because the seeds and seedling stages of plants are more vulnerable to soil and seed-borne diseases.

- The insecticide segment in the seed treatment market was valued at USD 280.6 million in 2022. Active ingredients such as imidacloprid, clothianidin, thiamethoxam, fipronil, and chlorpyrifos are of high importance in chemical insecticide seed treatment.

- Farmers in the country are also looking to buy seeds that are pre-treated with these chemicals to ensure high quality and a maximum percentage of germination after sowing. The central government and several state governments are taking initiatives to make farmers aware of the use of seed treatment and enhance their motivation toward modern agricultural practices. For instance, the Government of Madhya Pradesh launched a spiral grader and seed treatment drum program to train the less-knowledgeable farmers in 1,000 villages and boost the cultivation of crops like soybeans.

- Root-knot nematode is the most dangerous among the nematode species that affect fruits and vegetable crops and is known to cause a yield loss of 34.0% in carrots, 26.0% in potatoes, 23.0% in tomatoes, 22.0% in the battleground, and 21.0% in brinjal. Nematicide seed treatment is most common in fruits and vegetable crops, and it accounted for a share of 9.1% in 2022.

India Seed Treatment Market Trends

Growing awareness and adoption of early control of diseases and pests are raising the seed treatment consumption

- Over the historical period, the per-hectare consumption of seed treatment pesticides has remained consistent. In 2022, the recorded consumption stood at 125.46 grams per hectare. This stability can be attributed to various factors, such as advancements in seed treatment technologies, improved disease and pest management practices, and the efficacy of existing pesticide formulations.

- Seed treatment plays a crucial role in protecting seeds and seedlings against the harmful impact of seed and soil-borne diseases and insect pests. Seed treatment products control pests and diseases in significant crops such as sugarcane (root rot and wilt), groundnut (stem rot, seed rot, seedling rot, and white grubs), and rice (root-knot nematode and root rot disease).

- Crop emergence and growth can be effectively shielded from these detrimental factors by employing seed treatment methods. The significant advantages associated with seed treatment products are driving their indispensable utilization in the agriculture sector.

- Approximately 70% of seed requirements are fulfilled by farmers utilizing their own seed stock. However, these seeds are more vulnerable to seed and soil-borne diseases. Thus, it is crucial to implement seed treatment to safeguard crops from the emergence of diseases and pests. This necessity consequently increased the utilization of seed treatment products.

- Expanding agricultural activities necessitate effective crop protection measures, including seed treatment. Farmers' heightened awareness of the benefits of seed treatment in protecting crops from early-stage diseases and pests has contributed to the increased adoption of these products and their application rates per hectare.

Promotional activities of government agencies to use seed treatments to increase the marketability of seeds

- Seed treatment plays an important role in protecting seeds and seedlings from seed and soil-borne diseases and insect pests affecting crop emergence and growth. Seed-borne diseases and pests are a few major challenges farmers face that decrease crop yield. Cypermethrin, abamectin, azoxystrobin, malathion, and metalaxyl are the most commonly used seed treatment chemicals in India.

- Cypermethrin is a non-systemic soil-acting pyrethroid insecticide seed treatment for reducing wheat bulb fly and wireworm damage to autumn or winter-sown wheat and barley in India. It was valued at a price of USD 21.0 thousand per metric ton in 2022.

- Abamectin belongs to the ivermectin chemical class and has high intrinsic activity against nematodes. It is used to protect young plants from root-attacking nematodes in the production of corn, soybeans, and cotton. It was priced at USD 8.7 thousand per metric ton in 2022.

- Azoxystrobin is a broad-spectrum, preventative seed treatment fungicide with systemic properties recommended for the control of Deuteromycetes, Oomycetes, Ascomycetes, and Basidiomycetes fungi that cause yield losses in crops. In 2022, azoxystrobin was priced at USD 4.5 thousand per metric ton.

- Various regulations and government agencies are encouraging the use of seed treatments to increase the marketability of seeds. For instance, the Government of India announced plans to launch a countrywide campaign for ensuring 100% seed treatment in all important crops during the kharif season. Pesticide industry associations, ATMAs, CIPMCs, KVKs, farmers clubs, SAUs, NGOs, etc., can play an important role in the campaign for 100% seed treatment. This is expected to further affect the price of seed treatment chemicals in the country.

India Seed Treatment Industry Overview

The India Seed Treatment Market is moderately consolidated, with the top five companies occupying 56.48%. The major players in this market are Bayer AG, FMC Corporation, PI Industries, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 India

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Insecticide

- 5.1.3 Nematicide

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 Crystal Crop Protection Ltd

- 6.4.6 FMC Corporation

- 6.4.7 PI Industries

- 6.4.8 Rallis India Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

샘플 요청 목록