|

시장보고서

상품코드

1686670

독일의 엔지니어링 플라스틱 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2024-2029년)Germany Engineering Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

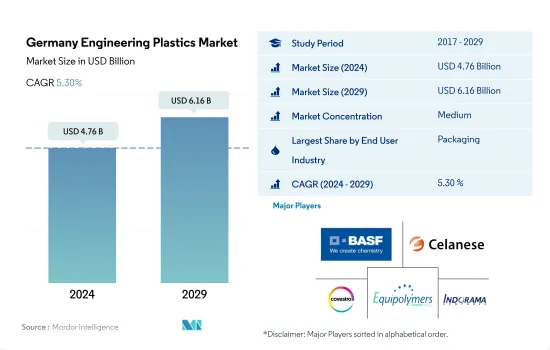

독일의 엔지니어링 플라스틱 시장 규모는 2024년에 47억 6,000만 달러로 평가되었습니다. 2029년에는 61억 6,000만 달러에 이를 것으로 추정되고, 예측 기간 중(2024-2029년)의 CAGR은 5.30%를 나타낼 것으로 예측됩니다.

첨단 재료의 채용 증가가 엔지니어링 플라스틱 수요를 견인

- 독일의 엔지니어링 플라스틱 시장은 2022년 유럽 엔지니어링 플라스틱 시장의 약 21.5%(금액 기준)를 차지했습니다. 엔지니어링 플라스틱의 소비량 증가의 주된 이유 중 하나는 포장 산업 및 전기 및 전자 산업에서의 용도 확대입니다.

- 포장 산업은 시장 최대의 산업이며, 2022년의 성장률은 전년대비 5.9%(금액 기준)입니다. 즉석식품에 대한 수요가 증가함에 따라 편의점 수요 증가하고 외출이 많은 라이프스타일의 상승으로 포장자재의 소비량이 증가하여 엔지니어링 플라스틱의 판매를 뒷받침하고 있습니다. 전자상거래 사이트의 온라인 쇼핑 동향도 포장 업계의 견인 역할을 하고 있습니다.

- 전기 및 전자산업은 2위로, 2023년에는 2022년 대비 12%의 소비량이 기록되었습니다. 첨단 재료의 사용, 유기 전자, 소형화, 인공지능(AI) 및 사물 인터넷(IoT)과 같은 파괴적인 기술과 같은 동향은 스마트 제조 관행을 가능하게 하고 업계의 촉진요인으로 작용하고 있습니다.

- 시장은 예측기간(2023-2029년)에 CAGR 5.53%를 나타낼 것으로 예측되며, 항공우주산업은 항공우주부품 생산 증가로 금액 기준으로 CAGR 7.55%로 가장 높은 CAGR을 나타낼 것으로 보고되고 있습니다. 예를 들어 항공우주 부품 생산 수입은 2022년 423억 달러에 비해 2029년 662억 달러에 이를 것으로 예상됩니다.

독일의 엔지니어링 플라스틱 시장 동향

기술 혁신으로 전기 및 전자기기 생산이 증가할 가능성이 높습니다.

- 가처분 소득 증가, 기술의 진보, 생활 수준의 향상, 스마트 홈이나 오피스에의 기호의 변화가 전기 및 전자 산업의 성장을 가속하고 있습니다. 2017년 독일은 최대 전기 및 전자기기 생산국으로 유럽 시장의 약 24.3%를 차지했습니다.

- 2020년, 이 나라에서의 전기 및 전자기기 생산은 국가 전체의 락다운이나 제조 시설의 일시적인 조업 정지에 의해 전년 대비 3.7% 줄어들어, 공급 체인의 혼란 등 몇 가지 문제를 일으켰습니다. 2020년 독일 전기산업 수출은 2,240억 달러로 전년 대비 6.6% 감소했습니다. 2021년 독일의 전기 및 전자산업 수출액은 2,246억 유로에 달했는데 2020년에 비해 10.1% 증가했습니다. 그 결과 2021년 동국의 전기 및 전자기기 생산은 매출액에서 7.5%의 성장률로 증가했습니다.

- 기술 혁신의 급속한 페이스가 보다 새롭고 보다 빠른 전기 및 전자 제품에 대한 일관된 수요를 견인하고 있습니다. 가상현실, IoT 솔루션, 5G 커넥티비티, 로봇공학 등 첨단기술에 대한 수요는 예측기간 동안 확대될 것으로 예상됩니다. 기술 진보의 결과, 소비자 전자 기기 수요는 예측 기간 동안 상승할 것으로 예상됩니다. 2027년까지 이 나라의 소비자 일렉트로닉스는 8.7% 성장하여 약 188억 달러 시장 규모를 창출할 것으로 예측됩니다. 그 결과 전기 및 전자기기 생산 수요가 증가할 것으로 예측됩니다. 2027년까지 독일은 유럽 시장의 약 22.2%를 차지하며 최대의 전기 및 전자기기 생산국이 될 것으로 예측되고 있습니다.

독일의 엔지니어링 플라스틱 산업 개요

독일의 엔지니어링 플라스틱 시장은 적당히 통합되어 있으며 상위 5개 기업에서 59.43%를 차지하고 있습니다. 이 시장 주요 기업은 다음과 같습니다. BASF SE, Celanese Corporation, Covestro AG, Equipolymers and Indorama Ventures Public Company Limited(알파벳순 정렬).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 전기 및 전자

- 포장

- 수출입 동향

- 가격 동향

- 재활용 동향

- 폴리아미드(PA) 재활용 동향

- 폴리카보네이트(PC) 재활용 동향

- 폴리에틸렌 테레프탈레이트(PET) 재활용 동향

- 스티렌 공중합체(ABS 및 SAN) 재활용 동향

- 규제 프레임워크

- 독일

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 항공우주

- 자동차

- 건축 및 건설

- 전기 및 전자

- 산업 및 기계

- 포장

- 기타 최종 사용자 산업

- 수지 유형

- 플루오로폴리머

- 하위 수지 유형별

- 에틸렌테트라플루오로에틸렌(ETFE)

- 불소화 에틸렌-프로필렌(FEP)

- 폴리테트라플루오로에틸렌(PTFE)

- 폴리비닐플루오라이드(PVF)

- 폴리비닐리덴 플루오라이드(PVDF)

- 기타 하위 수지 유형

- 액정 폴리머(LCP)

- 폴리아미드(PA)

- 하위 수지 유형별

- 아라미드

- 폴리아미드(PA) 6

- 폴리아미드(PA) 66

- 폴리프탈아미드

- 폴리부틸렌 테레프탈레이트(PBT)

- 폴리카보네이트(PC)

- 폴리에테르 에테르 케톤(PEEK)

- 폴리에틸렌 테레프탈레이트(PET)

- 폴리이미드(PI)

- 폴리메틸 메타크릴레이트(PMMA)

- 폴리옥시메틸렌(POM)

- 스티렌 공중합체(ABS와 SAN)

- 플루오로폴리머

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- 3M

- BARLOG Plastics GmbH

- BASF SE

- Celanese Corporation

- Covestro AG

- Domo Chemicals

- DuBay Polymer GmbH

- Equipolymers

- Evonik Industries AG

- Grupa Azoty SA

- Indorama Ventures Public Company Limited

- INEOS

- LANXESS

- Rohm GmbH

- Trinseo

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Germany Engineering Plastics Market size is estimated at 4.76 billion USD in 2024, and is expected to reach 6.16 billion USD by 2029, growing at a CAGR of 5.30% during the forecast period (2024-2029).

Rising adoption of advanced materials to drive the demand for engineering plastics

- The German engineering plastics market accounted for around 21.5%, by value, of the European engineering plastics market in 2022. One of the major reasons behind the rise in the consumption of engineering plastics is their increasing application in the packaging and electrical and electronics industries.

- The packaging industry comprises the largest industry in the market, with a growth rate of 5.9%, by value, in 2022 compared to the previous year. With the increased demand for ready-to-eat convenience food and the emerging trend of on-the-go lifestyles, the consumption of packaging materials increased, bolstering the sales of engineering plastics. The emerging trend of online shopping from e-commerce websites also serves as a driving factor in the packaging industry.

- The electrical and electronics industry is the second-largest, which is expected to witness a consumption of 12%, by volume, in 2023 compared to 2022. Trends like the use of advanced materials, organic electronics, miniaturization, and disruptive technologies like artificial intelligence (AI) and the Internet of Things (IoT) have enabled smart manufacturing practices and worked as growth drivers for the industry.

- The market is expected to register a CAGR of 5.53% during the forecast period (2023-2029), with the aerospace industry reporting the highest CAGR of 7.55%, by value, due to an increase in the production of aerospace components. For instance, aerospace component production revenue is expected to reach USD 66.2 billion by 2029 compared to USD 42.3 billion in 2022.

Germany Engineering Plastics Market Trends

Technological innovations are likely to increase electrical and electronics production

- Rising disposable incomes, technological advancements, improvement in living standards, and shifting preferences toward smart homes and offices are driving the growth of the electrical and electronics industry. In 2017, Germany was the largest electrical and electronics producer, accounting for around 24.3% of the European market.

- In 2020, the electrical and electronic production in the country decreased by 3.7% by revenue compared to the previous year, owing to country-wide lockdowns and the temporary shutdown of manufacturing facilities, causing several issues, including supply chain disruptions. In 2020, the exports of Germany's electrical industry were USD 224 billion, 6.6% lower than the previous year. In 2021, German export of the electrical and electronics industry reached a value of EUR 224.6 billion, 10.1% higher compared to 2020. As a result, electrical and electronics production in the country increased by a growth rate of 7.5% by revenue in 2021.

- The rapid pace of technological innovation is driving consistent demand for newer and faster electrical and electronic products. The demand for advanced technologies such as virtual reality, IoT solutions, 5G connectivity, and robotics is expected to grow during the forecast period. As a result of technological advancements, demand for consumer electronics is expected to rise during the forecast period. By 2027, consumer electronics in the country are projected to grow by 8.7% and generate a market volume of around USD 18.8 billion. As a result, it is projected to increase the demand for electrical and electronics production. By 2027, Germany is projected to hold the largest electrical and electronics production, accounting for around 22.2% of the European market.

Germany Engineering Plastics Industry Overview

The Germany Engineering Plastics Market is moderately consolidated, with the top five companies occupying 59.43%. The major players in this market are BASF SE, Celanese Corporation, Covestro AG, Equipolymers and Indorama Ventures Public Company Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.4.2 Polycarbonate (PC) Recycling Trends

- 4.4.3 Polyethylene Terephthalate (PET) Recycling Trends

- 4.4.4 Styrene Copolymers (ABS and SAN) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 Germany

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Resin Type

- 5.2.1 Fluoropolymer

- 5.2.1.1 By Sub Resin Type

- 5.2.1.1.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3 Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4 Polyvinylfluoride (PVF)

- 5.2.1.1.5 Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6 Other Sub Resin Types

- 5.2.2 Liquid Crystal Polymer (LCP)

- 5.2.3 Polyamide (PA)

- 5.2.3.1 By Sub Resin Type

- 5.2.3.1.1 Aramid

- 5.2.3.1.2 Polyamide (PA) 6

- 5.2.3.1.3 Polyamide (PA) 66

- 5.2.3.1.4 Polyphthalamide

- 5.2.4 Polybutylene Terephthalate (PBT)

- 5.2.5 Polycarbonate (PC)

- 5.2.6 Polyether Ether Ketone (PEEK)

- 5.2.7 Polyethylene Terephthalate (PET)

- 5.2.8 Polyimide (PI)

- 5.2.9 Polymethyl Methacrylate (PMMA)

- 5.2.10 Polyoxymethylene (POM)

- 5.2.11 Styrene Copolymers (ABS and SAN)

- 5.2.1 Fluoropolymer

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 BARLOG Plastics GmbH

- 6.4.3 BASF SE

- 6.4.4 Celanese Corporation

- 6.4.5 Covestro AG

- 6.4.6 Domo Chemicals

- 6.4.7 DuBay Polymer GmbH

- 6.4.8 Equipolymers

- 6.4.9 Evonik Industries AG

- 6.4.10 Grupa Azoty S.A.

- 6.4.11 Indorama Ventures Public Company Limited

- 6.4.12 INEOS

- 6.4.13 LANXESS

- 6.4.14 Rohm GmbH

- 6.4.15 Trinseo

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms