|

시장보고서

상품코드

1850129

첨단 운전자 보조 시스템(ADAS) 시장 : 점유율 분석, 산업 동향, 통계, 성장 동향 예측(2025-2030년)Advanced Driver Assistance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

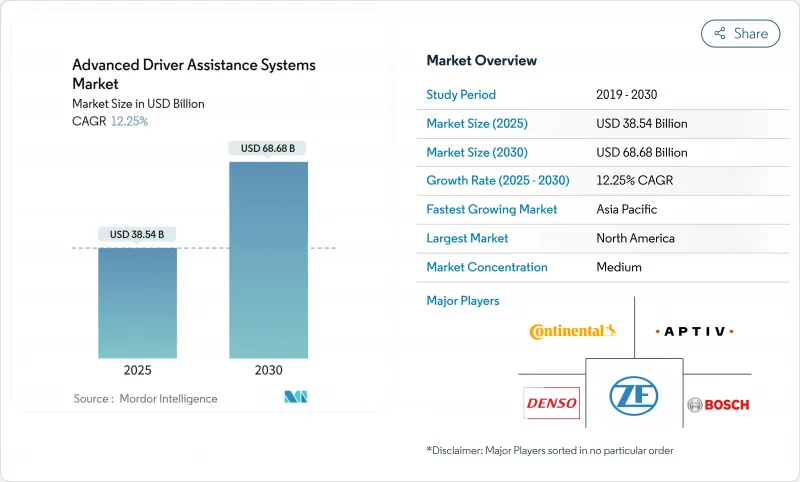

세계 첨단 운전자 보조 시스템(ADAS) 시장의 2025년 매출은 385억 4,000만 달러, 2030년에는 686억 8,000만 달러에 이르고, CAGR 12.25%로 확대될 전망입니다.

미국, 유럽 연합(EU), 중국에서의 강력한 규제 의무화, 레이더, 카메라, LiDAR 센서의 급속한 비용 디플레이션, 자동차 섹터의 소프트웨어 정의 차량(SDV) 플랫폼으로의 전환이 이 성장을 지원하는 주요한 힘이 되고 있습니다. 자동차 제조업체는 미드부문 차량에 레벨 2 기능을 번들링하는 반면, OTA(over-the-air) 업그레이드의 경로는 경상적인 소프트웨어 수익을 창출하게 되었습니다. 동시에 아시아의 반도체 용량 확대와 새로운 4나노미터 자동차 시스템 온칩은 더 높은 센서 퓨전 정밀도를 가능하게 하고 ADAS 시장을 대량 생산 모델로 밀어 올리고 있습니다. 경쟁력은 Tier 1 공급업체, 클라우드 하이퍼스케일러, 팹리스 칩 설계자가 지각 스택, 교육 데이터 및 수익화 가능한 소프트웨어 서비스를 제어하기 위해 협력하는 수직 플랫폼 플레이로 이동합니다.

세계 첨단 운전자 보조 시스템(ADAS) 시장 동향과 통찰

엄격한 안전규제가 시장 성장을 지원

현재 운전 지원은 필수 인프라로 규제로 취급되고 있습니다. NHTSA는 2029년 9월부터 미국의 모든 신형 경차에 자동 긴급 브레이크를 의무화해 연간 약 1,700만대를 기준으로 하고 있습니다. 유럽의 일반 안전 규칙 II는 2024년 7월부터 모든 신형 차량에 지능형 속도 지원, 레인 키핑 지원 및 긴급 브레이크를 의무화하고 있으며, OEM은 표준화된 ADAS 기능을 위해 전기 아키텍처를 재설계해야 합니다. 중국은 ADAS의 성능을 신차 평가 프로그램에 통합하여 5성급 안전 점수를 센서 구성 및 알고리즘 정확도에 연결했습니다. 이러한 규칙은 재량적 구매 결정을 없애고 ADAS 시장을 컴플라이언스 중심의 볼륨 비즈니스로 바꾸고 모든 가격대에서 착용률을 가속화합니다.

AI 기반 센서 퓨전이 피처 번들링을 해제

온칩 신경망의 진보로 저렴한 프로세서로 고급 지각이 가능해졌습니다. 모바일 아이의 EyeQ6 Lite는 8개의 카메라 스트림과 4D 레이더 입력을 하나의 5와트 디바이스에 통합하여 L2 고속도로 파일럿 패키지의 부품 비용을 줄였습니다. 보쉬가 Microsoft의 생성형 AI 서비스를 통합함으로써 운전자의 의도와 교차 교통 작업을 예측하는 예측 진로 계획이 가능합니다. 이러한 개발을 통해 OEM은 적응형 크루즈 컨트롤, 차선 중앙 유지 및 교통 표지 인식을 하나의 구독으로 패키징하여 기능별 하드웨어 중복성을 줄이고 소프트웨어 마진을 늘릴 수 있습니다.

높은 센서 스위트 비용이 여전히 장벽

가격이 급락하더라도 L2 센서 팩 세트는 B-부문 해치백 제조 비용에 2,000-4,000달러를 늘립니다. 보험 업계의 데이터에 따르면 경미한 충돌 사고 후 레이더 교환은 1대당 900달러를 넘고 카메라 재교정은 평균 450달러다. 이러한 비용은 프리미엄 가격대 이외의 소비자의 구매 의욕을 감퇴시켜 수리 인프라가 갖추어지지 않은 신흥 경제 국가에서는 후부 수요를 둔화시킵니다.

부문 분석

시스템 레벨 솔루션의 첨단 운전자 보조 시스템(ADAS) 시장 규모는 기존의 전자브레이크 모듈과의 호환성과 장거리 이동시 소비자의 수용으로 2024년 매출의 22.41%를 창출한 어댑티브 크루즈 컨트롤에 지지되고 있습니다. 자동 긴급 브레이크는 모든 신차에 전방 충돌 완화를 요구하는 규제에 힘입어 CAGR 16.21%로 가속화되고 있습니다. 공급업체는 현재 보행자와 자전거 감지를 동일한 제어 장치에 통합하여 부문을 넘어서는 스케일 이점을 제공합니다. 2030년까지 OEM은 도시형 긴급 브레이크를 이륜차와 소형 상업용 밴으로 확장하여 안전 적용 범위를 넓히고 장착 수를 늘릴 것으로 예측됩니다.

과거 데이터에서 2020년부터 2024년까지의 하위 부문의 복합 성장률은 8.5%였지만, NHTSA와 EU의 의무화에 의해 예측 기간 중에는 이 페이스가 2배가 되었습니다. 차선 이탈이나 전방 충돌 경보와 같은 엔트리 레벨 경고 기능은 저가격 트림으로 존속하고 있지만, 고급 프리미엄 패키지에는 360도 카메라, HD 맵, 교차점 선회시의 AI 대응 예측 브레이크가 통합되어 있습니다. 이러한 단계적 업그레이드 경로는 정기적 인 OTA 수입을 촉진하고 지각 스택을 소유하는 Tier-1 공급업체에게 플랫폼의 끈적 거리기를 향상시킵니다.

레이더의 46.07% 점유율은 비, 안개, 눈에 강하다는 특성을 강조하고 자동 긴급 브레이크의 주요 트리거로서의 지위를 확실히 하고 있습니다. ADAS 시장은 28나노미터 RF CMOS에서 생산되는 77GHz 프론트 코너 레이더 모듈의 상품화로 혜택을 누리고 있습니다. 10나노미터 이하의 화상 신호 프로세서를 탑재한 카메라 센서는 딥러닝에 의한 지각 아키텍처를 비용 효율적으로 실현함으로써 이것에 추종하고 있습니다.

LiDAR 시장 점유율은 아직 미미하지만 CAGR이 21.35%로 예측되는 급성장 요소입니다. 솔리드 스테이트, 무브먼트 부품이 없는 아키텍처, 웨이퍼 레벨 광학 시스템으로 인해 변동 비용은 350달러로 낮아지고 미드 부문 SUV는 다음 목표가 됩니다. ADAS 시장 점유율 확대를 위해 LiDAR 공급업체는 OEM 설계 스튜디오와 제휴하여 미관을 손상시키는 루프탑 돔을 피하고 헤드램프 클러스터에 센서를 내장합니다. 초음파와 적외선은 주차와 암시를위한 틈새 임무를 유지합니다. 중앙 집중식으로 융합된 신호 처리의 크로스 트렌드가 대두되고 있어, 배선량을 삭감하고, OTA 기반의 알고리즘 개량을 가능하게 해 하드웨어 사이클을 연장하고 있습니다.

지역 분석

북미는 연방 정부의 의무화, 보험 우대 조치, SUV 보급률의 높이에 따라 레벨 2 번들에 대한 수용 기반을 형성했기 때문에 2024년 세계 매출의 34.33%를 차지했습니다. 미국은 자배책보험료 인하와 NCAP 채점으로 ADAS 도입 인센티브를 높이고 캐나다는 자동차 안전규제를 미국 기준에 맞추어 국경을 넘은 모델의 무결성을 확보하고 있습니다. 주요 공급업체는 애리조나, 미시간 및 온타리오에서 검증 플릿을 실행하고 눈과 눈부심 조건에 대한 센서 융합 알고리즘을 개선하는 에지 케이스 데이터를 수집합니다.

아시아태평양은 2030년까지 연평균 복합 성장률(CAGR) 14.55%로 가장 급성장하고 있는 지역으로, 2023년 3분기에 30만 이상의 L2 라이선스를 수여한 중국의 적극적인 '스마트 차량' 로드맵이 뒷받침하고 있습니다. HD 맵의 클라우드 소싱에 관한 베이징 가이드라인은 BYD 및 Xpeng와 같은 국내 OEM에 이익을 가져오는 데이터 네트워크 효과를 촉진합니다. 인도의 반도체 공장과 전자 부품에 대한 생산 연동 인센티브는 현지에서 ADAS ECU 제조를 장려하고, 재료비를 삭감하고, 컴팩트 해치백의 장착을 가속화합니다.

유럽에서는 자동차 제조업체가 모든 신형 차량에 9개의 안전 기능을 통합할 것을 의무화하는 일반 안전 규정 II 하에서 꾸준한 성장이 계속되고 있습니다. 독일 연방 참의원은 시속 60km까지 제한된 핸즈오프 하이웨이 주행을 승인하고 레벨 3 데뷔 시기를 앞당겼습니다. 프랑스와 스페인은 Vision Zero의 사고 목표를 달성하기 위해 대형 트럭 차량으로의 개수 조성을 우선. 남미에서는 브라질이 모든 신차에 일렉트로닉 스태빌리티 컨트롤을 의무화하고, 2027년을 향해 차선 일탈 경보의 평가를 실시하는 등, 2030년까지의 가능성을 나타내고 있습니다. 칠레와 콜롬비아는 AEB 장착과 관련된 자동차 세금 리베이트를 개발하고 수입업체가 엔트리 모델에 레이더를 지정하도록 촉구합니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 미국, 유럽연합, 중국의 엄격한 안전규제

- AI 기반 센서 융합에 의해 L2 기능의 번들이 가능

- 판매 후 수익을 창출하는 SDV/OTA 아키텍처

- 급속한 센서 비용 절감 및 모듈 통합

- 신흥 시장에서 SUV와 고급차의 보급률 확대

- 사용 상황에 따른 보험 할인이 OEM 장비를 가속

- 시장 성장 억제요인

- LiDAR/레이더 시스템의 고비용

- 악천후나 조명에 의한 기능 제한

- 사이버 보안 책임과 데이터 프라이버시 리스크

- mmWave 칩셋과 기판 공급의 병목

- 밸류체인/공급망 분석

- 규제 상황

- 기술의 전망

- Porter's Five Forces

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 시스템 유형별

- 주차 지원 시스템

- 어댑티브 프론트 라이팅

- 야간 투시 시스템

- 사각 감지

- 자동 긴급 브레이크

- 전방 충돌 경보

- 드라이버의 졸음 경고

- 교통 표지 인식

- 차선 이탈 경보

- 어댑티브 크루즈 컨트롤

- 센서 유형별

- 레이더

- LiDAR

- 카메라

- 초음파

- 적외선

- 차량 유형별

- 이륜차

- 승용차

- 중형 및 대형 상용차

- 자율성 레벨별

- L1

- L2

- L3

- L4

- L5

- 판매 채널별

- OEM 장착

- 애프터마켓 개조

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 인도네시아

- 기타 아시아태평양

- 중동 및 아프리카

- 튀르키예

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 이집트

- 나이지리아

- 기타 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 시장 점유율 분석

- 기업 프로파일

- Continental AG

- Robert Bosch GmbH

- DENSO Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Magna International

- Valeo SA

- Hyundai Mobis

- Aisin Corporation

- Mobileye(Intel)

- NVIDIA Corporation

- NXP Semiconductors

- Infineon Technologies

- Renesas Electronics

- ON Semiconductor

- STMicroelectronics

- Hitachi Astemo

- Autoliv Inc.

제7장 시장 기회와 장래의 전망

SHW 25.11.17The global ADAS market posted USD 38.54 billion in revenue in 2025 and is on course to reach USD 68.68 billion by 2030, expanding at a 12.25% CAGR.

Robust regulatory mandates in the United States, the European Union, and China, rapid cost deflation in radar, camera, and LiDAR sensors, and the auto sector's migration to software-defined vehicle (SDV) platforms are the prime forces sustaining this growth. Automakers are bundling Level 2+ features on mid-segment vehicles while over-the-air (OTA) upgrade pathways increasingly generate recurring software revenue. Simultaneously, the expansion of semiconductor capacity in Asia and new 4-nanometer automotive system-on-chips enable higher sensor fusion accuracy, pushing the ADAS market deeper into mass-volume models. Competitive dynamics are shifting toward vertical platform plays in which Tier-1 suppliers, cloud hyperscalers, and fabless chip designers collaborate to control perception stacks, training data, and monetisable software services.

Global Advanced Driver Assistance Systems Market Trends and Insights

Stringent Safety Mandates Anchor Market Growth

Regulations now treat driver-assistance as mandatory infrastructure. The NHTSA requires automatic emergency braking on all new US light vehicles from September 2029, setting a baseline of roughly 17 million units per year. Europe's General Safety Regulation II has required intelligent speed assistance, lane-keeping assistance, and emergency braking on every new model since July 2024, forcing OEMs to redesign electrical architectures for standardised ADAS functions. China integrated ADAS performance into its New Car Assessment Programme, linking five-star safety scores to sensor configuration and algorithm accuracy. These rules remove discretionary purchasing decisions and transform the ADAS market into a compliance-driven volume business, accelerating fitment rates across all price points.

AI-Based Sensor Fusion Unlocks Feature Bundling

Advances in on-chip neural networks now permit high-level perception on inexpensive processors. Mobileye's EyeQ6 Lite combines eight camera streams and 4-D radar inputs on a single 5-Watt device, lowering bill-of-materials costs for L2+ highway pilot packages. Bosch's integration of Microsoft's generative AI services enables predictive path planning that anticipates driver intent and cross-traffic manoeuvres. These developments allow OEMs to package adaptive cruise control, lane centering, and traffic sign recognition under one subscription, reducing per-feature hardware redundancy and increasing software margins.

High Sensor Suite Cost Remains a Barrier

Even with steep price declines, a complete L2+ sensor pack adds USD 2,000-4,000 to build cost for a B-segment hatchback. Insurance-sector data show radar replacement after minor collisions exceeding USD 900 per unit, while camera recalibration averages USD 450. These costs dampen consumer uptake outside premium tiers and slow retrofit demand in developing economies lacking repair infrastructure.

Other drivers and restraints analyzed in the detailed report include:

- SDV Architectures Redefine Revenue Models

- Sensor Cost Deflation Broadens Mass-Market Access

- Weather Vulnerabilities Challenge Reliability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The ADAS market size for system-level solutions remains anchored by adaptive cruise control, which generated 22.41% of 2024 revenue thanks to its compatibility with existing electronic braking modules and consumer acceptance during long-distance travel. Automatic emergency braking is accelerating at a 16.21% CAGR, propelled by regulations that demand forward collision mitigation on all new vehicles. Suppliers now integrate pedestrian and cyclist detection in the same control unit, creating cross-segment economies of scale. Over the period to 2030, OEMs are expected to extend urban emergency braking to two-wheelers and light commercial vans, broadening safety coverage and raising fitment volumes.

Historical data underline the regulatory inflection, between 2020-2024 the sub-segment posted 8.5% compound growth, but the NHTSA and EU mandates double that pace in the forecast window. Entry-level warning functions such as lane departure and forward collision alerts persist for low-cost trims, whereas advanced premium packages integrate 360-degree cameras, HD maps and AI-enabled predictive braking during intersection turns. This layered upgrade pathway encourages recurring OTA revenues and deepens platform stickiness for Tier-1 suppliers that own the perception stack.

Radar's 46.07% share underscores its robustness in rain, fog, and snow, attributes that secure its position as the primary trigger for automatic emergency braking. The ADAS market benefits from the commoditisation of 77 GHz front-corner radar modules now produced in 28-nanometer RF CMOS. Camera sensors, powered by sub-10 nm image-signal processors, are followed closely by enabling deep-learning perception architectures cost-effectively.

LiDAR, though still accounts for minimal market share, is the flash-growth element with a projected 21.35% CAGR. Solid-state, no-moving-parts architecture plus wafer-level optics lower variable cost to USD 350, making mid-segment SUVs the next target. For ADAS market share gains, LiDAR suppliers partner with OEM design studios to embed sensors into headlamp clusters, avoiding rooftop domes that hinder aesthetics. Ultrasonic and infrared retain niche duties for parking and night vision. A cross-trend of centrally fused signal processing is emerging, reducing wiring mass and enabling OTA-based algorithm improvements that prolong hardware cycles.

The Advanced Driver Assistance Systems Market Report is Segmented by System Type (Parking Assist Systems, Adaptive Front-Lighting, and More), Sensor Type (Radar, Lidar, and More), Vehicle Type (Two-Wheeler, and More), Level of Anatomy (L1, L2, and More), Sales Channel (OEM-Fitted and Aftermarket Retrofit), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

North America generated 34.33% of global revenue in 2024 as federal mandates, insurance incentives, and high SUV penetration created a receptive base for Level 2+ bundles. The United States incentivises ADAS deployment further through reduced liability premiums and positive NCAP scoring, while Canada aligns its Motor Vehicle Safety Regulations to US norms, ensuring cross-border model harmonisation. Major suppliers run validation fleets across Arizona, Michigan, and Ontario, collecting edge-case data that refines sensor-fusion algorithms for snow and glare conditions.

Asia-Pacific is the fastest-growing region at a 14.55% CAGR to 2030, propelled by China's aggressive "smart-vehicle" roadmap that awarded more than 300,000 L2+ licences in Q3 2023. Beijing's guidelines on HD map crowdsourcing encourage data-network effects that benefit domestic OEMs such as BYD and Xpeng. India's Production-Linked Incentive for semiconductor fabs and electronic components incentivises local ADAS ECU manufacturing, cutting bill-of-materials costs and quickening fitment among compact hatchbacks.

Europe continues at a steady growth rate under General Safety Regulation II, which obliges automakers to integrate nine safety functions on every new model. Germany's Bundesrat approved limited hands-off motorway driving at speeds up to 60 km/h, accelerating Level 3 debut timelines. France and Spain prioritise retrofit subsidies for heavy-duty truck fleets to meet Vision Zero accident targets. South America shows potential through 2030 as Brazil mandates electronic stability control on all new cars and evaluates lane departure alerts for 2027. Chile and Colombia roll out vehicle tax rebates tied to AEB fitment, spurring importers to specify radar on entry models.

- Continental AG

- Robert Bosch GmbH

- DENSO Corporation

- Aptiv PLC

- ZF Friedrichshafen AG

- Magna International

- Valeo SA

- Hyundai Mobis

- Aisin Corporation

- Mobileye (Intel)

- NVIDIA Corporation

- NXP Semiconductors

- Infineon Technologies

- Renesas Electronics

- ON Semiconductor

- STMicroelectronics

- Hitachi Astemo

- Autoliv Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent safety mandates in United States, European Union, China

- 4.2.2 AI-based sensor fusion enabling L2+ feature bundling

- 4.2.3 SDV/OTA architectures unlocking post-sale revenue

- 4.2.4 Rapid sensor-cost deflation & module integration

- 4.2.5 Growing SUV & premium-car penetration in Emerging Markets

- 4.2.6 Usage-based-insurance discounts accelerating OEM fitment

- 4.3 Market Restraints

- 4.3.1 High LiDAR/Radar system cost

- 4.3.2 Functional limitations in poor weather & lighting

- 4.3.3 Cyber-security liability & data-privacy risk

- 4.3.4 mmWave chipset & substrate supply bottlenecks

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By System Type

- 5.1.1 Parking Assist Systems

- 5.1.2 Adaptive Front-Lighting

- 5.1.3 Night Vision Systems

- 5.1.4 Blind-Spot Detection

- 5.1.5 Automatic Emergency Braking

- 5.1.6 Forward Collision Warning

- 5.1.7 Driver Drowsiness Alert

- 5.1.8 Traffic Sign Recognition

- 5.1.9 Lane Departure Warning

- 5.1.10 Adaptive Cruise Control

- 5.2 By Sensor Type

- 5.2.1 Radar

- 5.2.2 LiDAR

- 5.2.3 Camera

- 5.2.4 Ultrasonic

- 5.2.5 Infra-red

- 5.3 By Vehicle Type

- 5.3.1 Two-Wheelers

- 5.3.2 Passenger Cars

- 5.3.3 Medium and Heavy Commercial Vehicles

- 5.4 By Level of Autonomy

- 5.4.1 L1

- 5.4.2 L2

- 5.4.3 L3

- 5.4.4 L4

- 5.4.5 L5

- 5.5 By Sales Channel

- 5.5.1 OEM-Fitted

- 5.5.2 Aftermarket Retrofit

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Indonesia

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Turkey

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 United Arab Emirates

- 5.6.5.4 South Africa

- 5.6.5.5 Egypt

- 5.6.5.6 Nigeria

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.3.1 Continental AG

- 6.3.2 Robert Bosch GmbH

- 6.3.3 DENSO Corporation

- 6.3.4 Aptiv PLC

- 6.3.5 ZF Friedrichshafen AG

- 6.3.6 Magna International

- 6.3.7 Valeo SA

- 6.3.8 Hyundai Mobis

- 6.3.9 Aisin Corporation

- 6.3.10 Mobileye (Intel)

- 6.3.11 NVIDIA Corporation

- 6.3.12 NXP Semiconductors

- 6.3.13 Infineon Technologies

- 6.3.14 Renesas Electronics

- 6.3.15 ON Semiconductor

- 6.3.16 STMicroelectronics

- 6.3.17 Hitachi Astemo

- 6.3.18 Autoliv Inc.