|

시장보고서

상품코드

1907331

유럽의 작물 보호 화학 물질 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Europe Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

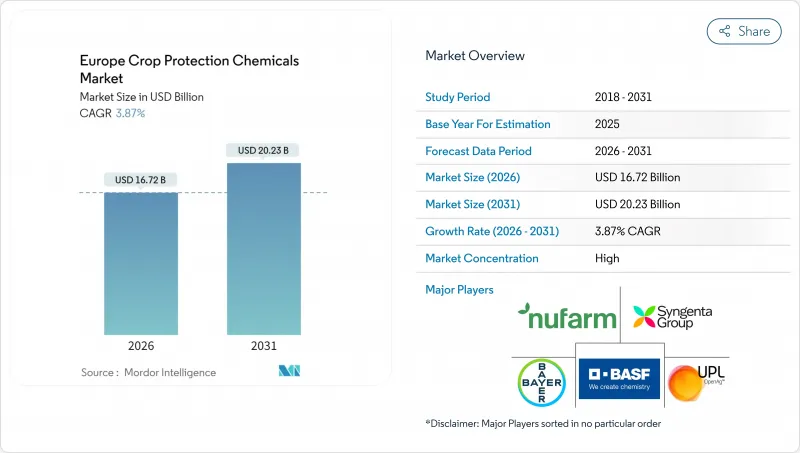

유럽의 작물 보호 화학 물질은 2025년 161억 달러로 평가되었고, 2026년 167억 2,000만 달러에서 2031년까지 202억 3,000만 달러에 이를 것으로 예측됩니다.

예측기간(2026-2031년)의 CAGR은 3.87%를 나타낼 전망입니다.

지속적인 규제 압박, 기후 변화로 인한 해충 발생 증가, 저위험 제형의 프리미엄화 등이 이 꾸준한 성장을 뒷받침하고 있습니다. 해당 지역 농가들은 수익성과 규정 준수를 균형 있게 고려하는 통합 해충 관리(IPM) 도구와 디지털 자문 플랫폼에 지속적으로 투자하고 있습니다. 대형 제조사들은 생장조절제-농약 복합 제형으로 포트폴리오를 재편하는 한편, 유통사들은 서비스 패키지에 인공지능(AI) 의사 결정 지원 시스템을 통합하고 있습니다. 동시에 동유럽의 가격 민감 계층은 비용 효율적인 제네릭 제품을 채택하며 유럽의 작물 보호 화학 물질 시장 내 이중 수요 구조를 공고히 하고 있습니다. REACH(화학물질 등록, 평가, 허가 및 제한) 비용 상승으로 주요 업체들의 규모 경제 효과가 강화되면서 경쟁 강도는 여전히 높지만, RNA 간섭(RNAi) 및 미생물 솔루션을 무기로 삼은 신규 진입자들이 파괴적 가능성을 제시하고 있습니다.

유럽의 작물 보호 화학 물질 시장 동향 및 인사이트

통합 해충 관리(IPM) 도입 확대

통합 해충 관리(IPM) 도입이 증가하면서 농가의 구매 기준이 대량 구매에서 표적 효능 중심으로 전환되고 있습니다. 유럽 식품안전청(EFSA)은 2024년 IPM 시행률이 23% 증가했으며, 네덜란드 상업 재배 농가의 도입률은 89%에 달했다고 기록했습니다. 이러한 변화로 모니터링 장비, 선택적 화학물질, 생물학적 방제제 수요가 증가하며, 해당 제품들은 15-30%의 가격 프리미엄을 형성합니다. 디지털 정찰 및 센서 네트워크는 유효 성분 사용량을 최대 40%까지 절감시켜, 공급업체들이 유럽 작물 보호 화학 물질 시장 내에서 물량 중심에서 서비스 중심 수익 모델로 전환할 수 있게 합니다.

보전형 경작 방식 급증

유럽연합 집행위원회 산하 공동연구센터에 따르면, 무경운 및 줄경운을 포함한 보전형 경작 방식이 현재 유럽연합 경작지의 19%를 차지하며, 이는 2023년 14%에서 증가한 수치입니다. 농가들은 토양 침식 감소, 수분 유지, 디젤 비용 절감을 위해 이러한 방식을 채택하지만, 잡초 압력 증가로 제초제 수요가 상승합니다. 고잔류 디스크 드릴 및 제초제 내성 작물과 같은 장비 업그레이드는 선택적 화학 제품 및 정밀 살포 서비스의 판매를 촉진합니다.

주요 활성 성분(예 : 글리포세이트)의 신속한 금지 조치

2024년 글리포세이트 단계적 폐지 논쟁으로 대표되는 기존 분자들에 대한 가속화된 재검토는 투자 불확실성을 야기합니다. 갑작스러운 네오니코티노이드 종자 처리제 금지 조치는 연간 13억 달러의 매출을 감소시켜 재제형화 주기와 재고 평가 손실을 초래했습니다. 다각화된 포트폴리오는 충격을 완화하지만 단일 활성 성분에 의존하는 중소 기업들은 유럽 작물 보호 화학 물질 시장의 퇴출 위기에 직면합니다. 이러한 규제 변동성은 다각화된 제품 포트폴리오를 보유한 기업에는 유리하지만 특정 활성 성분에 의존하는 기업에는 불리하여, 민첩한 경쟁사들에게 시장 점유율 재분배 기회를 창출합니다.

부문 분석

기존 활성 성분이 규제 제약을 받는 가운데, 진보된 잡초 저항성 관리가 제초제 혁신을 주도합니다. 제초제는 2025년 35.01%의 시장 점유율을 차지하지만, 살충제는 기후 변화로 인한 해충 압력과 정밀 살포 기술 도입으로 2031년까지 연평균 4.45%의 성장률을 보이며 우월한 성장 동력을 보여줍니다. 제초제 부문은 글리포세이트 단계적 폐지 일정과 진화된 잡초 내성이라는 이중 압박에 직면해 있으며, 이로 인해 기존 화학물질이 유럽 농경지의 40%에서 효과를 상실했습니다. 살균제는 기후 변화로 인한 병해 압박에 힘입어 꾸준한 수요를 유지하는 반면, 연체동물살충제와 선충살충제는 성장 잠재력이 제한된 특수 시장 틈새를 공략합니다.

지속가능 사용 규정(SUR) 하의 규제 준수는 새로운 작용 기전을 개발하는 기업들에게 기회를 창출합니다. 유럽의약품청(EMA)의 저위험 물질에 대한 신속 심사 절차는 RNA 간섭 기술 및 미생물 기반 솔루션에 투자하는 기업들에게 경쟁 우위를 제공합니다. 정밀 살포 기술은 제초제 제조업체들이 환경 노출을 줄이면서 잡초 방제 효과를 유지하는 표적 전달 시스템을 통해 효능을 최적화함으로써, 사용량 제한에도 불구하고 시장 점유율을 유지할 수 있게 합니다.

유럽의 작물 보호 화학 물질 시장은 기능별(살균제, 제초제, 살충제 등), 적용 방법별(화학 관개, 엽면 살포, 훈증 등), 작물 유형별(상업 작물, 과수, 야채, 곡류 등), 지역별(프랑스, 독일, 네덜란드, 러시아, 스페인, 우크라이나 등)로 구분됩니다. 시장 예측은 금액(달러) 및 수량(메트릭톤)으로 제공됩니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제2장 보고서 제공

제3장 주요 요약 및 주요 조사 결과

제4장 업계의 주요 동향

- 1헥타르당 농약 소비량

- 유효성분의 가격 분석

- 규제 프레임워크

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 러시아

- 스페인

- 우크라이나

- 영국

- 밸류체인, 유통 채널 분석

- 시장 성장 촉진요인

- 통합 해충 관리(IPM) 도입 확대

- 보전 경작 방식 급증

- 기후 변화에 따른 해충 압력 증가

- 생물자극제 농약 복합 제형의 신속한 출시

- AI를 활용한 처방 살포 플랫폼

- 동유럽의 곡물 제작 면적 확대

- 시장 성장 억제요인

- 주요 활성 성분(예 : 글리포세이트)에 대한 신속 금지 조치

- REACH 규제하에 등록비용 상승

- 회색 수입을 통한 위조 농약 유통

- 비건/유기농 소비자 로비 확대

제5장 시장 규모와 성장 예측(금액 및 수량)

- 기능

- 살균제

- 제초제

- 살충제

- 연체동물 구제제

- 살선충제

- 적용방법

- 화학 관개

- 엽면 살포

- 훈증

- 종자 처리

- 토양 처리

- 작물 유형

- 상업 작물

- 과수 및 야채

- 곡류, 잡곡

- 콩류 및 유지종자

- 잔디 및 관상식물

- 국가

- 프랑스

- 독일

- 이탈리아

- 네덜란드

- 러시아

- 스페인

- 우크라이나

- 영국

- 기타 유럽

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 동향

- 기업 프로파일

- Syngenta Group

- Bayer AG

- BASF SE

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Nufarm

- Sumitomo Chemical Co., Ltd.

- Albaugh LLC

- Rovensa(Bridgepoint Group plc)

- Belchim Crop Protection(Mitsui and Co.)

- Koppert BV

- Sipcam SpA

- Zhejiang Wynca Chemical Group Co., Ltd.

제7장 CEO에 대한 주요 전략적 질문

HBR 26.02.04The Europe crop protection chemicals market was valued at USD 16.1 billion in 2025 and estimated to grow from USD 16.72 billion in 2026 to reach USD 20.23 billion by 2031, at a CAGR of 3.87% during the forecast period (2026-2031).

Sustained regulatory pressure, climate-driven pest incidence, and the premiumization of low-risk formulations together underpin this steady expansion. Farmers across the region continue to invest in integrated pest management (IPM) tools, and digital advisory platforms that balance profitability with compliance. Large manufacturers are reshaping portfolios toward biostimulant-pesticide co-formulations, while distributors integrate artificial-intelligence (AI) decision support into service packages. At the same time, price-sensitive segments in Eastern Europe adopt cost-effective generics, anchoring a two-tiered demand structure within the Europe crop protection chemicals market. Competitive intensity remains high as rising Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) costs elevate scale advantages for the top players, yet novel entrants armed with RNA interference (RNAi) and microbial solutions introduce disruptive possibilities.

Europe Crop Protection Chemicals Market Trends and Insights

Expanding Integrated Pest Management Adoption

Integrated pest management adoption is rising, shifting farmer purchasing criteria from bulk volume toward targeted efficacy. The European Food Safety Authority (EFSA) recorded a 23% increase in IPM implementation during 2024, with Dutch commercial growers achieving 89% adoption. This shift increases demand for monitoring devices, selective chemistries, and biological control agents that command 15-30% price premiums. Digital scouting and sensor networks reduce active ingredient use by up to 40%, allowing suppliers to transition from volume-driven to service-oriented revenue models within the Europe crop protection chemicals market.

Surge in Conservation-Tillage Practices

Conservation tillage, including no-till and strip-till, now covers 19% of the European Union's arable land, up from 14% in 2023, according to the Joint Research Centre of the European Commission. Farmers adopt these practices to reduce soil erosion, retain moisture, and lower diesel costs, though increased weed pressure boosts herbicide demand. Equipment upgrades like high-residue disc drills and herbicide-tolerant crops drive sales of selective chemistries and precision spraying services.

Fast-track Bans on Key Actives (e.g., Glyphosate)

Accelerated reviews of legacy molecules, exemplified by the 2024 glyphosate phase-out debate, inject investment uncertainty. Sudden neonicotinoid seed-treatment bans removed USD 1.3 billion in annual sales, forcing reformulation cycles and inventory write-downs. Diversified portfolios cushion impact yet smaller firms reliant on single actives face market exit in the Europe crop protection chemicals market. This regulatory volatility favors companies with diversified product portfolios but penalizes firms dependent on specific active ingredients, creating market share redistribution opportunities for agile competitors.

Other drivers and restraints analyzed in the detailed report include:

- Climate-Change-Driven Pest Pressure

- Rapid Biostimulant Pesticide Co-formulation Launches

- Escalating Registration Costs Under REACH

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Advanced weed resistance management drives herbicide innovation as traditional active ingredients face regulatory restrictions. Herbicides command 35.01% market share in 2025, yet insecticides demonstrate superior growth dynamics with 4.45% CAGR through 2031, reflecting climate-driven pest pressure and precision application adoption. The herbicide segment confronts dual pressures from glyphosate phase-out timelines and evolved weed resistance that renders established chemistries ineffective across 40% of European agricultural land. Fungicides maintain steady demand driven by climate-induced disease pressure, while molluscicides and nematicides serve specialized market niches with limited growth potential.

Regulatory compliance under the Sustainable Use Regulation creates opportunities for companies developing novel modes of action. The European Medicines Agency's expedited review process for low-risk substances provides competitive advantages for firms investing in RNA interference technologies and microbial-based solutions. Precision application technologies enable herbicide manufacturers to maintain market share despite volume restrictions by optimizing efficacy through targeted delivery systems that reduce environmental exposure while preserving weed control effectiveness.

The Europe Crop Protection Chemicals Market is Segmented by Function (Fungicide, Herbicide, Insecticide, and More), Application Mode (Chemigation, Foliar, Fumigation, and More), Crop Type (Commercial Crops, Fruits and Vegetables, Grains and Cereals, and More), and Geography (France, Germany, Netherlands, Russia, Spain, Ukraine, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Syngenta Group

- Bayer AG

- BASF SE

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Nufarm

- Sumitomo Chemical Co., Ltd.

- Albaugh LLC

- Rovensa (Bridgepoint Group plc)

- Belchim Crop Protection (Mitsui and Co.)

- Koppert B.V.

- Sipcam SpA

- Zhejiang Wynca Chemical Group Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Expanding Integrated Pest Management adoption

- 4.5.2 Surge in conservation-tillage practices

- 4.5.3 Climate-change-driven pest pressure

- 4.5.4 Rapid biostimulant pesticide co-formulation launches

- 4.5.5 AI-based prescription spraying platforms

- 4.5.6 Rising cereal acreage in Eastern Europe

- 4.6 Market Restraints

- 4.6.1 Fast-track bans on key actives (e.g., glyphosate)

- 4.6.2 Escalating registration costs under REACH

- 4.6.3 Counterfeit pesticide penetration via gray imports

- 4.6.4 Growing vegan / organic consumer lobby

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits and Vegetables

- 5.3.3 Grains and Cereals

- 5.3.4 Pulses and Oilseeds

- 5.3.5 Turf and Ornamental

- 5.4 Country

- 5.4.1 France

- 5.4.2 Germany

- 5.4.3 Italy

- 5.4.4 Netherlands

- 5.4.5 Russia

- 5.4.6 Spain

- 5.4.7 Ukraine

- 5.4.8 United Kingdom

- 5.4.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level overview, Core Business Segments, Financials, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Syngenta Group

- 6.4.2 Bayer AG

- 6.4.3 BASF SE

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 UPL Limited

- 6.4.7 Nufarm

- 6.4.8 Sumitomo Chemical Co., Ltd.

- 6.4.9 Albaugh LLC

- 6.4.10 Rovensa (Bridgepoint Group plc)

- 6.4.11 Belchim Crop Protection (Mitsui and Co.)

- 6.4.12 Koppert B.V.

- 6.4.13 Sipcam SpA

- 6.4.14 Zhejiang Wynca Chemical Group Co., Ltd.