|

시장보고서

상품코드

1689869

커넥티드카 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Connected Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

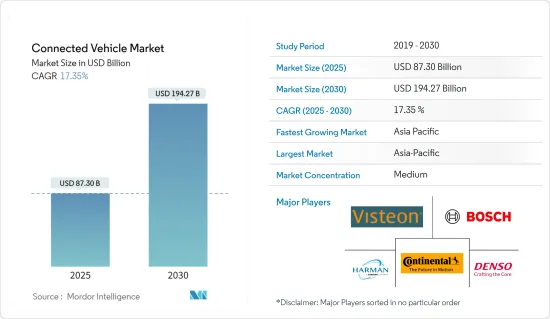

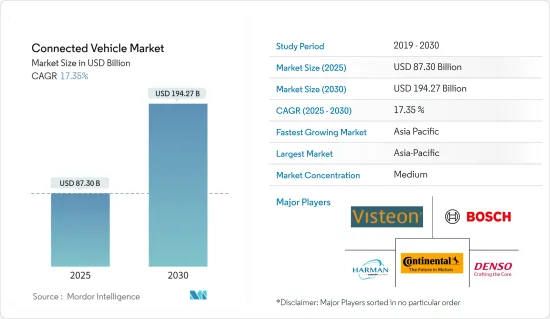

커넥티드카 시장 규모는 2025년에 873억 달러로 추정되며, 예측 기간(2025-2030년)의 CAGR은 17.35%로, 2030년에는 1,942억 7,000만 달러에 달할 것으로 예측됩니다.

COVID-19 팬데믹은 봉쇄와 무역 제한으로 인해 공급망에 혼란을 초래하고 전 세계 자동차 생산이 중단되면서 조사 대상 시장에 큰 영향을 미쳤습니다. 그러나 규제가 완화됨에 따라 기업은 예측 기간 중 시장에 모멘텀을 창출하기 위해 이러한 위험과 개발을 완화하는 데 집중하기 시작했습니다.

첨단운전자보조시스템(ADAS), 차량 인포테인먼트 등 첨단 안전 및 편의 기능의 차량 통합이 진행되면서 시장이 크게 성장하고 있습니다. 탑승자의 편안함과 안전에 대한 인식이 높아지고 안전 기능을 의무화하는 정부 규제를 배경으로 ADAS 기능을 통합한 자동차의 생산이 증가하고 있으며, 시장 수요를 견인할 것으로 예측됩니다. 또한 자율주행차 및 자율주행 자동차의 수용이 증가하고 있는 것도 시장 성장 촉진에 기여하고 있습니다.

세계 정부는 사용자를 모니터링하기 위해 여러 입법 정책 및 규제 설계에 초점을 맞추고 있으며, 일부 국가에서는 증가하는 교통사고를 줄이기 위해 소비자에게 ADAS 구성 요소를 차량에 장착하도록 의무화하고 장려하는 정책을 제안하고 있습니다. 예를 들어 인도 정부는 자동차의 안전성 향상에 중점을 두고 이미 이륜차에 ABS 장착을 의무화하고 있습니다. 현재 인도는 2022-2023년까지 자동차에 ESC(미끄럼방지장비)와 AEB(자동긴급제동장치)를 의무화하는 방향으로 움직이고 있습니다.

커넥티드카 시장 동향

자동차의 ADAS 기능에 대한 수요 증가

자율주행차와 커넥티드카는 소비자의 관심을 끌고 있으며, 예측 기간 중 널리 수용될 것으로 예상되며, 첨단운전자보조시스템(ADAS)는 기존 자동차와 미래형 자동차의 보급 격차를 줄일 것으로 예측됩니다. 또한 자동차 산업의 기술 발전이 가속화됨에 따라 최종사용자는 운전 경험을 개선하고 운전자와 라이더의 안전을 향상시키는 최신 기술에 더 많은 비용을 지출할 준비가 되어 있습니다. 충돌 경고, 차선 지원, 사각지대 감지 등의 ADAS 기능은 소비자의 행동에 큰 영향을 미치고, 차량 고장을 소유주에게 경고하여 차량 다운타임을 줄이고 차량 성능을 향상시킬 것으로 기대됩니다.

ADAS는 상당히 발전했으나, 커넥티드 차량 기술은 아직 갈 길이 멉니다. V2V 통신은 차량 간 직접 통신하여 상대 속도, 위치, 진행 방향, 급제동, 급가속, 방향 전환 등의 제어 입력에 대한 정보를 공유할 수 있으므로 더욱 업그레이드될 가능성이 있습니다. 가능성이 있습니다. 이 데이터와 차량의 센서 입력을 사용하여 주변을 보다 상세하게 파악하여 보다 정확한 경고와 충돌을 피하기 위한 수정 조치를 제공할 수 있습니다.

그러나 과거에는 고급형 차량에 탑재되었던 이러한 시스템이 보급형 차량에도 적용되기 시작하면서 ADAS 구성 요소의 수는 계속 증가할 것으로 보입니다. 이러한 시스템은 일상적인 운전에 더 많은 안전과 안심을 가져다 줍니다. 이러한 시스템 중 상당수는 차량이 상황에 따라 운전을 조정할 수 있도록 합니다. 스티어링 조작, 브레이크 조작, 엑셀 조작 등을 상황에 따라 차량이 스스로 조절할 수 있는 것입니다. 예를 들어

Canalys의 조사에 따르면 차선 유지 보조 기능은 작동시 차량이 차선을 유지할 수 있도록 조향을 지원하는 기능으로, 2021년 상반기 유럽에서 판매된 신차의 56%, 일본에서 52%, 중국 본토에서 30%, 미국에서 63%가 장착되었습니다.

시장에서 많은 기술 기업이 팀을 구성하여 ADAS(첨단운전자지원시스템) 개발의 복잡성을 해결하려고 노력하고 있습니다. 예를 들어

- 2022년 6월, PATEO Corporation과 Qualcomm Technologies, Inc.(Qualcomm Technologies, Inc.)는 차량 인텔리전스, 스마트카 커넥티비티, 서비스 지향 아키텍처(SOA), 중앙 제어 장비 기반의 지능형 콕핏과 멀티 도메인 융합을 지원하는 솔루션 개발을 위해 관계를 확대했습니다.

- 2021년 7월, 마그나 인터내셔널은 안전 기술 대기업인 Veoneer Inc.를 인수할 계획을 발표했습니다. 마그나 인터내셔널은 Veoneer Inc.와 최종 합병 계약을 체결하고 자동차 안전 기술 선도 기업인 Veoneer Inc.를 인수할 계획입니다. 이번 인수를 통해 마그나는 ADAS 포트폴리오를 강화하고 업계내 입지를 확대하고자 합니다.

아시아태평양이 커넥티드카 시장을 주도할 가능성이 높습니다.

아시아태평양은 최신 자동차 모델의 커넥티비티 기능 증가로 인해 예측 기간 중 커넥티드 차량 시장을 주도할 가능성이 높습니다. 특히 중국과 인도와 같은 신흥 국가에서 자동차의 디지털 기능에 대한 수요가 증가함에 따라 이 지역의 커넥티드 차량 시장을 촉진할 것으로 예측됩니다.

중국은 세계 최대 규모의 자동차 시장으로 2021년에는 2,148만 대 이상의 승용차가 중국에서 판매되며, 2020년 대비 6%의 판매 증가를 기록할 것으로 예측됩니다. 팬데믹에도 불구하고 중국은 여전히 자동차 판매 대국 중 하나이며, 예측 기술이 중국 자동차 시장에서 활약할 수 있는 절호의 기회가 되고 있습니다.

중국 정부는 전기 모빌리티와 함께 ADAS 기능 등 여러 첨단 자동차 기술에 집중하고 있습니다. 이에 따라 중국의 주요 자동차 제조업체들은 새로운 레벨 2 및 레벨 3 ADAS 기능을 도입하여 포트폴리오를 업데이트하고 있습니다. 예를 들어

- 2021년 5월, 만리장성자동차의 HAVAL 브랜드는 1.5L 터보 엔진(최고출력 135kW, 최대토크 275Nm)과 7단 습식 듀얼 클러치 변속기를 조합한 신형 소형 SUV '치투'를 출시했습니다. 또한 버전에 따라 기능이 다른 레벨 2 ADAS 시스템도 탑재되어 있습니다.

인도에서는 많은 신제품이 출시되는 동시에 자율주행과 인공지능을 중심으로 한 자동차 산업에 점차 발을 들여놓고 있으므로 커넥티드카 시장에는 잠재적인 가능성과 기회가 있습니다. 예를 들어

- 2021년 Morris Garage는 자동 긴급 제동, 자동 주차 보조, 사각지대 감지, 전방 충돌 경고, 차선이탈 경고 등 예측 기술 기반의 최신 ADAS 기능을 탑재한 신형 SUV Gloster를 출시했으며, MG는 2021년에도 어댑티브 크루즈 컨트롤, 자동 긴급 제동, 사각지대 감지, 전방 충돌 경고, 차선이탈 경고 등 ADAS 기능을 갖춘 자동 긴급제동, 사각지대 감지, 차선유지 보조, 차선이탈 경보 등 레벨 2 ADAS 기능을 탑재한 합리적인 가격대의 소형 SUV 아스토르(Astor)를 출시할 예정입니다.

그 다음으로 아시아태평양, 북미, 유럽이 매출 측면에서 큰 시장 점유율을 차지하고 있으며, 예측 기간 중 성장할 것으로 예측됩니다. 자동차에 ADAS 기능 구현 등 예측 기술 분야에 대한 노력이 시장을 촉진할 것으로 예측됩니다.

커넥티드카 산업 개요

커넥티드카 시장은 Continental AG, Robert Bosch GmbH, Harman International Industries, Inc., DENSO Corporation, Airbiquity Inc., Visteon Corporation에 의해 지배되고 있습니다. 커넥티드카 기능은 OEM들이 새로운 모델에 커넥티드카 기능을 제공하기 시작하면서 예측 기간 중 중국, 인도와 같은 신흥 시장에서 일반적인 현상이 될 것으로 예측됩니다. 예를 들어

- 2022년 5월, LEVC(London Electric Vehicle Company)는 IoT 및 커넥티드 운송 분야의 세계 리더인 지오탭(Geotab)과의 새로운 제휴를 통해 동급 최고의 전기 택시 TX와 VN5 밴에 최첨단 차량 관리 시스템을 제공한다고 발표했습니다.

- 2021년 8월, Robert Bosch GmbH는 마힌드라 & 마힌드라와 커넥티드 차량 플랫폼 개발을 위해 파트너십을 체결했습니다. 이 파트너십은 자동차의 커넥티드 플랫폼의 성장과 촉진에 기여할 것입니다.

- 2021년 2월, 포드자동차와 구글은 커넥티드카 서비스 애플리케이션 개발을 위한 전략적 파트너십을 체결했습니다. 이 제휴는 포드자동차의 커넥티드 차량 사업을 강화하는 데 도움이 될 것입니다.

기타 특전:

- 엑셀 형식의 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 개요

제4장 시장 역학

- 시장 성장 촉진요인

- 시장 성장 억제요인

- Porter's Five Forces 분석

- 신규 진출업체의 위협

- 구매자·소비자의 교섭력

- 공급 기업의 교섭력

- 대체품의 위협

- 경쟁 기업 간 경쟁 강도

제5장 시장 세분화

- 기술 유형별

- 4G/LTE

- 3G

- 2G

- 용도별

- 드라이버 지원

- 텔레매틱스

- 인포테인먼트

- 기타

- 커넥티비티별

- 통합형

- 임베디드형

- 테더링

- 차량 접속성별

- 차량간(V2V)

- 차량 대 인프라(V2I)

- 차량 대 보행자(V2P)

- 차량별

- 승용차

- 상용차

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 세계의 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더 시장 점유율

- 기업 개요

- Robert Bosch GmbH

- Continental AG

- Denso Corporation

- Visteon Corporation

- Harman International

- AT&T Inc.

- TomTom N.V.

- Airbiquity Inc.

- Qualcomm Technologies Inc.

- Sierra Wireless

- Infineon Technologies

- Magna International

- ZF Friedrichshafen AG

제7장 시장 기회와 향후 동향

KSA 25.05.14The Connected Vehicle Market size is estimated at USD 87.30 billion in 2025, and is expected to reach USD 194.27 billion by 2030, at a CAGR of 17.35% during the forecast period (2025-2030).

The COVID-19 pandemic had a massive impact on the market studied as lockdowns and trade restrictions have led to supply chain disruptions and a halt of vehicle production across the globe. However, as restrictions eased, players started focusing on mitigating such risks and developments to create momentum in the market during the forecast period.

The rising integration of advanced safety and comfort features in the vehicle, such as advanced driver assistance systems, vehicle infotainment, and many others witnessing major growth in the market. Growing production of vehicles with integrated ADAS features in the wake of rising awareness toward comfort and safety of passengers and government regulations mandating safety features are expected to drive demand in the market. Moreover, the rising acceptance of self-driving or automated vehicles further contributes to the enhanced growth of the market.

Governments across the globe are focusing on designing several legislative policies and regulations to monitor the users and are proposing policies mandating and encouraging consumers to install ADAS components in vehicles to mitigate rising road accidents across several countries. For instance, the Indian government has already mandated a requirement for ABS on motorcycles with a focus on improving vehicle safety. Currently, India is working to make Electronic Stability Control (ESC) and Autonomous Emergency Braking (AEB) mandatory in cars by 2022-2023.

Connected Vehicle Market Trends

Growing demand for ADAS features in vehicle

Autonomous cars and connected vehicles are gaining consumers' interest and are anticipated to gain wider acceptance over the forecast period. The advanced driver assistance systems (ADAS) featured are expected to diminish the penetration gap between traditional cars and tomorrow's cars. Moreover, With the rising technological advancements in the automotive industry, end users are ready to spend more on the latest technologies, which enhance the driving experience and increase the safety of drivers and riders. ADAS features, such as collision warning, lane assistance, blind spot detection, etc., have a significant impact on consumer behavior and are expected to enhance vehicles' performance by reducing vehicle downtime by alerting the owner of any faults in the vehicle.

ADAS has advanced considerably, but there is still a long way to go with connected vehicle technology. V2V communication has the potential to upgrade it further, as vehicles may communicate with each other directly and share information on relative speeds, positions, directions of travel, and even control inputs, such as sudden braking, accelerations, or changes in direction. By using this data with the vehicle's sensor inputs, it is possible to create a more detailed picture of the surrounding area and provide more accurate warnings or even corrective actions to avoid collisions.

However, the number of ADAS components may keep growing, as these previously available systems in high-end models are now being used in entry-level vehicles. These systems bring added safety and security to daily driving. Many of these systems allow the vehicle to make driving adjustments according to the condition. Functions, such as steering, braking, and accelerating, can be performed by the vehicle in certain situations. For instance,

Research conducted by Canalys shows that the lane-keep assist feature, which when activated provides steering assistance to keep a vehicle in its lane, was installed in 56% of new cars sold in Europe in the first half of 2021, 52% in Japan, 30% in Mainland China, and 63% in the United States.

Many technology companies in the market are teaming up to solve the complexities of developing advanced driver-assistance systems (ADAS). For instance,

- In June 2022, PATEO Corporation and Qualcomm Technologies, Inc. (Qualcomm) expanded their relationship to develop solutions to support vehicle intelligence, smart car connectivity, Service-Oriented Architecture (SOA), and intelligent cockpits and multi-domain fusion based on central controllers.

- In July 2021, Magna International Inc. announced its plans to acquire safety tech major Veoneer Inc. Magna International Inc. entered a definitive merger agreement with Veoneer Inc., under which the company plans to acquire Veoneer Inc., a leading player in automotive safety technology. With this acquisition, Magna's aimed to strengthen and broaden its ADAS portfolio and industry position.

Asia-Pacific is Likely to Lead the Connected Vehicle Market

Asia-Pacific is likely to lead the connected vehicle market over the forecast owing to the increase in the connectivity features in the latest car models. The rise in demand for digital features in vehicles, especially in developing countries like China and India, is anticipated to drive the connected vehicle market in the region.

China is one of the largest automotive markets in the world, and more than 21.48 million passenger cars were sold in the country in 2021 and recorded a 6% surge in sales compared to 2020. Despite the pandemic, China is still one of the largest sellers of automobiles, which is a great opportunity for predictive technology to make its place in the Chinese automobile market.

The Chinese government is focusing on several advanced vehicles technology, like ADAS features, along with electric mobility. With that, major automakers in the country are updating their portfolio with the introduction of the new level 2 and level 3 ADAS features. For instance,

- In May 2021, the HAVAL brand of Great Wall Motor Co. Ltd launched the new Chitu compact SUV, and it is equipped with a 1.5L turbocharged engine (maximum power output of 135kW, peak torque of 275Nm) in combination with a 7-speed wet dual-clutch transmission. In addition, the vehicle includes a Level 2 ADAS system, with varying functions depending on the version.

India has a potential and opportunity for a connected vehicle market as India is stepping gradually into the autonomous and artificial intelligence-oriented automotive industry along with many new product launches. For instance,

- In 2021, Morris Garage launched its new SUV Gloster, which is equipped with the latest ADAS features based on predictive technology such as automatic emergency brake, automatic parking assist, blind spot detection, forward collision warning, and lane departure warning. MG, in 2021, has launched another SUV, the Astor, an affordable compact SUV with level-2 ADAS features such as Adaptive Cruise Control, Automatic Emergency Braking, Blind Spot Detection, Lane-keeping Assist, and Lane Departure Warning.

Followed by Asia-Pacific, North America, and Europe, also witnessing significant market share in terms of revenue and are projected to grow during the forecast period. Initiatives toward the predictive technology sector, such as implementing ADAS features in cars, are going to boost the market.

Connected Vehicle Industry Overview

The connected vehicle market is dominated by Continental AG, Robert Bosch GmbH, Harman International Industries, Inc., DENSO Corporation, Airbiquity Inc, and Visteon Corporation. Connected vehicles' features are poised to become a common phenomenon in developing nations such as China, India, etc., market over the forecast period, as OEMs have started offering connected car features in their new respective models. For instance,

- In May 2022, LEVC (London Electric Vehicle Company) announced a new partnership with the global leader in IoT and connected transportation, Geotab, providing state-of-the-art fleet management systems on its class-leading electric TX taxi and VN5 van.

- In August 2021, Robert Bosch GmbH joined with Mahindra & Mahindra for the development of a connected vehicle platform. This partnership helps to grow and boost the connected platform in vehicles.

- In February 2021, Ford Motors and Google signed a strategic partnership for the development of connected car service applications. This partnership helps to enhance the ford motors connected vehicle business.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology Type

- 5.1.1 4G/LTE

- 5.1.2 3G

- 5.1.3 2G

- 5.2 By Application

- 5.2.1 Driver Assistance

- 5.2.2 Telematics

- 5.2.3 Infotainment

- 5.2.4 Others

- 5.3 By Connectivity

- 5.3.1 Integrated

- 5.3.2 Embedded

- 5.3.3 Tethered

- 5.4 By Vehicle Connectivity

- 5.4.1 Vehicle to Vehicle (V2V)

- 5.4.2 Vehicle to Infrastructure (V2I)

- 5.4.3 Vehicle to Pedestrian (V2P)

- 5.5 By Vehicle

- 5.5.1 Passenger cars

- 5.5.2 Commercial Vehicle

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 India

- 5.6.3.2 China

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Rest of the World

- 5.6.4.1 South America

- 5.6.4.2 Middle-East and Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Robert Bosch GmbH

- 6.2.2 Continental AG

- 6.2.3 Denso Corporation

- 6.2.4 Visteon Corporation

- 6.2.5 Harman International

- 6.2.6 AT&T Inc.

- 6.2.7 TomTom N.V.

- 6.2.8 Airbiquity Inc.

- 6.2.9 Qualcomm Technologies Inc.

- 6.2.10 Sierra Wireless

- 6.2.11 Infineon Technologies

- 6.2.12 Magna International

- 6.2.13 ZF Friedrichshafen AG