|

시장보고서

상품코드

1690076

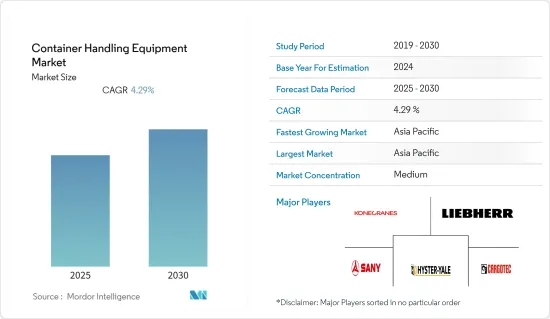

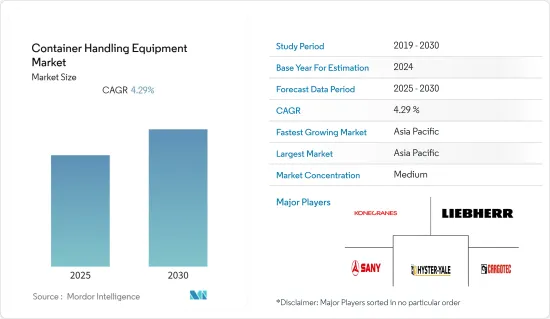

컨테이너 핸들링 장비 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Container Handling Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

컨테이너 핸들링 장비 시장은 예측 기간 동안 4.29%의 연평균 복합 성장률(CAGR)을 나타낼 것으로 예상됩니다.

중기적으로는 국제 상업의 확대와 화물 수송 요구 증가가 최근 수십 년간의 세계 경제 개발을 결정했습니다. 대규모 수출입과 관련된 대규모 제조 시설이 있기 때문에 중국과 인도와 같은 아시아태평양 국가들은 세계화와 산업화의 결과로 가장 높은 성장률을 포함할 것으로 예상됩니다.

항만 터미널의 자동화를 위한 동향 변화, 전자상거래 산업의 상승, 생산 현장에서의 노동에 대한 예방 조치 및 엄격한 배출 규제에 중점을 둔 전기 및 하이브리드 장비에 대한 요구 증가는 컨테이너 핸들링 장비 시장에 혁신적인 비즈니스 기회를 제공합니다.

컨테이너 핸들링 장비 시장은 항만 터미널의 자동화, 전자상거래 산업의 성장, 생산 현장에서 근로자의 안전과 엄격한 배출 기준을 중시하는 전기 및 하이브리드 장비에 대한 요구 증가에 대한 동향 변화로 인해 혁신적인 새로운 비즈니스 기회를 보게될 수 있습니다.

컨테이너 핸들링 장비 시장 동향

컨테이너 핸들링 장비의 전기화에 대한 중요성 증가

세계 경제의 성장과 산업화의 진전은 다양한 분야에서 컨테이너 핸들링 장비 수요를 촉진하고 있습니다. 건설업, 제조업, 항만하역업 등 폭넓은 용도로 사용되고 있는 것이 매출 증가의 요인이 되고 있습니다.

핸들링 장비의 매출을 높이는 또 다른 요인은 특히 인도, 브라질, 싱가포르, 멕시코와 같은 신흥 경제 국가에서 전자상거래, 소매 및 물류 산업의 급속한 확대입니다.

환경 효율성은 카고와 자재관리에 매우 중요해졌습니다. 세계의 항만과 터미널이 에너지 효율 개선과 배출량 감축을 향해 움직이는 가운데 전동화는 업계 전체를 석권하는 최신 동향입니다. 항만 시설의 전기는 배출량을 크게 줄이는 것으로 입증되었습니다. 각국이 배출량을 줄이는 데 주력하고 있기 때문에 전기 컨테이너와 하이브리드 전기 컨테이너의 채용은 향후 수년에 증가할 것으로 예상됩니다.

또한, 일부 전자상거래 회사는 배송 시간을 단축하기 위해 제품 픽업 및 픽업 프로세스를 가속화하기 위한 자율 지게차 및 전기 지게차에 많은 투자를 하는 등 새로운 전략을 개발하고 있습니다. CO2 배출을 규제하기 위해 세계에서 디젤 차량에 대한 엄격한 배출 규제가 실시되고 있기 때문에 제조업체는 보다 환경 친화적인 지게차 모델을 제공하게 되었습니다. 또한 이와 관련한 정부의 이니셔티브는 예측기간에 걸쳐 시장 수요를 끌어올립니다.

보다 엄격한 배출 규제는 컨테이너 핸들링 장비의 제조업체에게 전력 능력을 희생하지 않고 제품의 에너지 효율을 향상시킬 것을 요구할 수 있습니다. 환경보호청(EPA)에 의한 오프로드 차량/기기(건설, 농업 채굴, 자재관리 장비 포함)의 새로운 배출 기준에 따르면, 항만 또는 복합 일관 수송 철도 야드에 반입되는 모든 신규 구매 야드 트럭 및 비 야드 트럭 장비는 Tier 4 최종 오프로드 엔진 또는 모델 이어 2010 이상 탑재 따라서 Tier 4 엔진 기술은 제조업체가 새로운 컨테이너 하역 기계에 점차 채택하고 있습니다.

지게차 기술의 발전은 모든 사람에게 창고 환경을 더욱 안전하게 만듭니다. 예를 들어, 지게차 사고의 가능성을 줄이는 것은 빠른 속도를 보다 쉽게 함으로써 달성될 수 있습니다. 노동자가 부상을 입고 직장을 잃지 않고 생산성이 변하지 않습니다. 또한 사고율이 떨어지면 지게차 수리가 적습니다.

세계에서 위와 같은 개발이 진행되고 있기 때문에 컨테이너 핸들링 장비 수요는 예측 기간 동안 성장할 것으로 보입니다.

아시아태평양이 시장의 리더로 계속

아시아태평양은 중국과 인도와 같은 세계 주요 신흥 경제 국가로 구성되어 있으며 원재료 및 최종 제품에 대한 요구가 높기 때문에 대량의 컨테이너가 수출입되고 있습니다.

중국은 아시아태평양의 주요 국가 중 하나이며 경제 성장에 뒷받침되는 산업 활동이 가장 활발합니다. 중국에는 34개의 컨테이너 항구와 2,000개의 작은 항구가 있습니다. 상해는 4,330만 TEU의 수송 능력을 가진 세계 최대의 항구입니다.

이 나라의 성장률은 높지만 점차 완만한 방향으로 향하고 있다(인구가 고령화되고 경제가 투자에서 소비로, 제조업에서 서비스업으로, 외수에서 내수로 리밸런싱하기 때문). 그러나 중국의 인건비와 재료비가 저렴하기 때문에 많은 기업들이 중국에서 제품을 제조하고 그 후 필요한 마을로 수출하고 있습니다. 그 결과 중국은 세계 최고의 수출국이 되었습니다.

중국의 항구 건설은 최근의 동향에서 크게 발전하고 있으며,화물과 컨테이너 처리 능력 모두에서 세계 10 개 항구 중 7 개가 중국에 있습니다. 양산심수항은 상하이항의 주요 항구로서 컨테이너 처리량은 전체의 적어도 40%를 차지하는 큰 규모를 자랑하고 있습니다. 제4기 개항으로 상하이 항의 연간 컨테이너 처리량은 4,000만 TEU를 초과하며, 이는 미국 전항의 연간 컨테이너 처리량의 합과 같습니다.

인도는 아시아태평양의 주요 국가 중 하나이며 경제 성장에 지원되는 수출입 활동이 진행되고 있습니다. 뭄바이 항구는 국내에서 가장 크고 가장 바쁜 항구입니다.

항만·해운·수로성에 따르면 인도에서 가장 바쁜 국영 컨테이너 게이트웨이인 자바할랄 네루 항만공사(JNPA)의 취급량은 417만7,000TEU로 전년 동기의 322만2,000TEU에서 증가했습니다.

일본에는 주요한 하역 기계 제조업체가 다수 존재하고, 항만 하역 기계의 설계·제조는 현지 기업이 독점하고 있었습니다. 디자인, 제조, 품질에 관해서도 독자적인 기준을 가지고 있었습니다. 따라서 기타 국가의 제품이 일본 시장에 진입하기 위해서는 많은 노력이 필요했습니다.

일본이 고령화와 인구 감소 문제에 직면하고 있는 이유는 기업이 생산성과 안전성을 향상시키기 위해 터미널 컨테이너 하역 자동화 등 첨단 기술 개발에 투자하고 있는 이유입니다. 또한 컨테이너 핸들링 장비의 운영 비용을 줄이기 위해 오래된 장비를 최신 기술로 개조하는 움직임도 시작되었습니다. Kone Cranes와 Kalmar는 오래된 장비의 개조 서비스를 제공하는 많은 기업 중 두 개입니다. 여기에는 구형 장비의 자동화도 포함됩니다.

지역 전체에서 위와 같은 개발이 이루어지고 있으며 예측 기간 동안 시장이 크게 성장할 가능성이 높습니다.

컨테이너 핸들링 장비 산업 개요

Cargotec Corp, Liebherr Group, SANY Group, Hyster-Yale Materials Handling Inc., Konecranes 등 여러 주요 기업이 컨테이너 핸들링 장비 시장을 독점하고 있습니다. 각 회사는 신제품 및 첨단 제품 혁신을 위한 연구 개발에 많은 투자를 하고 있습니다. 세계 각지에서의 제조시설의 확장은 향후 수년간 시장을 밀어올릴 것으로 예상되고 있습니다.

- 2023년 9월 Global Ports는 Vostochnaya Stevedoring Company(VSC)의 극동 터미널에 장비를 설치했습니다. 이 회사는 상하이 진화 중공(ZPMC)과 항만 컨테이너 핸들링 장비를 구입하는 각서에 서명했습니다.

- 2022년 10월, 도요타 자재관리은 북미에서 도요타의 3륜 전동 지게차 업데이트 버전을 출시했습니다. 이 새로운 전동 지게차는이 부문에서 상단 판매자 지게차에 새로운 기능과 새로운 기술을 탑재했습니다.

- 2022년 1월, Cargotec의 일부인 Kalmar는 노르웨이에서 세계 최초의 복합 충전 시스템이 장착된 전기 리치 스태커를 공급함으로써 Westport AS와 합의했습니다. 이 수주에는 2022년 1분기 판매 오더로 5년간의 캘머 컴플리트 케어 서비스 계약도 포함되어 있으며, 2022년 4분기 초에 납품되었습니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 성장 촉진요인

- 컨테이너 핸들링 장비의 전기화에 대한 중요성 증가

- 시장 성장 억제요인

- 높은 자본 비용과 컨테이너 핸들링 장비의 복잡성

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자/소비자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제5장 시장 세분화

- 장비 유형별

- 지게차

- 스태킹 크레인

- 이동식 항만 크레인

- 고무 타이어 갠트리 크레인

- 추진 유형별

- 디젤

- 전기

- 하이브리드

- 지역별

- 북미

- 미국

- 캐나다

- 기타 북미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 인도

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 세계 기타 지역

- 남미

- 중동 및 아프리카

- 북미

제6장 경쟁 구도

- 벤더의 시장 점유율

- 기업 프로파일

- Cargotec Corp.

- Liebherr Group

- SANY Group

- Shanghai Zhenhua Heavy Industries Co. Ltd(ZPMC)

- Hyster-Yale Materials Handling Inc.

- Anhui HELI Forklifts Group Co. Ltd

- Hoist Material Handling Inc.

- CVS Ferrari SpA

- Lonking Holdings Limited

- Konecranes

제7장 시장 기회와 앞으로의 동향

KTH 25.04.09The Container Handling Equipment Market is expected to register a CAGR of 4.29% during the forecast period.

Over the medium term, the expansion of international commerce and the rising need for cargo transportation defined global economic development in recent decades. Due to large-scale manufacturing facilities involved in large-scale imports and exports, Asia-Pacific nations such as China and India are predicted to include the highest growth rates as a result of globalization and industrialization.

The shifting trends toward automation of port terminals, the rising e-commerce industry, and growing requirements for electric and hybrid equipment, with emphasis on precaution for labor on the production floor and stringent emission norms, provide innovative business opportunities in the container handling equipment market.

The container handling equipment market may see innovative new opportunities as a result of shifting trends toward port terminal automation, the growing e-commerce industry, and growing demands for electric and hybrid equipment, with an emphasis on worker safety on the production floor and stringent emission standards.

Container Handling Equipment Market Trends

Growing Emphasis on the Electrification of Container Handling Equipment

The growing world economy and rising industrialization are driving the demand for container-handling equipment across different fields. Their use in industries like construction, manufacturing, and port handling, owing to the wide range of applications, are the reasons for their increased sales.

Another factor boosting the handling equipment sales is the rapid expansion of the e-commerce, retail, and logistics industries, especially in developing economies such as India, Brazil, Singapore, and Mexico.

Eco-efficiency became extremely important for cargo and material handling. As ports and terminals around the world move toward improved energy efficiency and reduced emissions, electrification is the latest trend sweeping across the industry. Electrification of port equipment proved to reduce emissions hugely. With countries focusing on reducing their emissions, the adoption of electric and hybrid-electric containers is expected to increase in the years to come.

In addition, some e-commerce companies are developing new strategies, including investing heavily in autonomous and electric forklifts to speed up the loading and picking up processes of products as they reduce the delivery time. Stringent emission norms for diesel vehicles across the globe to regulate CO2 emissions led the manufacturers to offer more environment-friendly forklift truck models. Furthermore, government initiatives in this regard boost demand in the market over the forecast period.

More stringent emission regulations may require manufacturers of container handling equipment to improve the energy efficiency of their products without sacrificing their power capabilities. According to the new emission standards for off-road vehicles/equipment (including construction, agricultural mining, and material handling equipment) by the Environmental Protection Agency (EPA), all newly purchased yard truck and non-yard truck equipment brought onto a port or intermodal rail yard must include either a Tier 4 final off-road engine or a model year (MY) 2010 or newer on-road engine. Thus, Tier 4 engine technology is gradually adopted by manufacturers in their new container handling equipment.

Forklift technology advancements make warehouse environments safer for everyone. For instance, reducing the likelihood of forklift accidents can be achieved by making it simpler to make a fast turn. Workers won't get hurt and lose their jobs, and productivity rates can stay the same. Additionally, fewer forklift repairs are required when accident rates drop.

With the development mentioned above across the globe, the demand for container handling equipment is likely to grow during the forecast period.

Asia-Pacific Remains the Market Leader

The Asia-Pacific region consists of major developing economies of the world, such as China and India, where a large volume of containers is exported and imported due to the high requirement for raw materials and final products.

China is one of the major countries in the Asia-Pacific region, with the highest industrial activities being supported by its growing economy. China includes 34 container ports and 2,000 minor ports. Shanghai is the world's largest port, with a capacity of 43.3 million TEU.

The country's growth rate is high but is gradually moving toward moderate (as the population ages and the economy rebalances from investment to consumption, manufacturing to services, and external to internal demand). However, due to low labor and material costs in China, many companies manufacture their products in China and later export them to required destinations. It helped China position itself as the world's leading exporter.

China's port construction developed so greatly in recent years that seven of the world's top 10 ports, in terms of both cargo and container throughput, are in China. As a major part of Shanghai Port, Yangshan Port boasts of a big container throughput, which accounts for at least 40% of the total. The opening of the fourth phase will help the annual container throughput in Shanghai Port surpass 40 million TEUs, which is equivalent to the sum of all US ports' annual container throughput.

India is one of the major countries in the Asia-Pacific region, with import and export activities being supported by its growing economy. Mumbai Port is the country's largest and busiest port.

According to the Ministry of Ports, Shipping and Waterways, India's busiest state-run container gateway, Jawaharlal Nehru Port Authority (JNPA), handled 4.177 million TEUs, up from 3.222 million TEUs during the same time previous year.

Japan contains many of the leading cargo-handling machinery manufacturers, and the local companies made the monopoly on designing and manufacturing the cargo handling equipment for ports in Japan. They had unique standards for design, manufacturing, and quality. Thus, it took a lot of work for the products of other countries to enter the market of Japan.

Japan is facing the problem of aging and decreasing population, which is the reason why companies are investing in the development of advanced technologies such as terminal container handling automation to improve productivity and safety. They also started to retrofit old equipment with the latest technology to reduce the operational costs of container handling equipment. Kone Cranes and Kalmar are two of many companies that provide retrofitting services for old equipment. It includes old equipment automation as well.

The development mentioned above across the region is likely to witness major growth for the market during the forecast period.

Container Handling Equipment Industry Overview

Several key players, such as Cargotec Corp, Liebherr Group, SANY Group, Hyster-Yale Materials Handling Inc., Konecranes, and others, dominate the container handling equipment market. Companies are investing heavily in research and development for the innovation of new and advanced products. The expansion of manufacturing facilities across the globe is anticipated to boost the market in the coming years. For instance,

- In September 2023, Global Ports equipped the Far Eastern terminal of Vostochnaya Stevedoring Company (VSC). They signed a memorandum of intent with Shanghai Zhenhua Heavy Industry Company (ZPMC) to buy portside container handling equipment.

- In October 2022, Toyota Material Handling launched an updated version of Toyota's 3-Wheel Electric Forklift in North America. The new updated electric forklift equipped with new features and technology to the top-selling forklift in the segment.

- In January 2022, Kalmar, part of Cargotec, agreed with Westport AS to supply the world's first electric reach stacker with a combined charging system in Norway. The order also includes a five-year Kalmar Complete Care service agreement, which was booked in Cargotec's Q1 2022 order intake, with delivery scheduled for early Q4 of 2022.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Emphasis on The Electrification of Container Handling Equipment

- 4.2 Market Restraints

- 4.2.1 High Capital Cost And Increasing Complexity of Container Handling Equipment

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value (USD))

- 5.1 By Equipment Type

- 5.1.1 Forklift Truck

- 5.1.2 Stacking Crane

- 5.1.3 Mobile Harbor Crane

- 5.1.4 Rubber-tired Gantry Crane

- 5.2 By Propulsion Type

- 5.2.1 Diesel

- 5.2.2 Electric

- 5.2.3 Hybrid

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 south America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Cargotec Corp.

- 6.2.2 Liebherr Group

- 6.2.3 SANY Group

- 6.2.4 Shanghai Zhenhua Heavy Industries Co. Ltd (ZPMC)

- 6.2.5 Hyster-Yale Materials Handling Inc.

- 6.2.6 Anhui HELI Forklifts Group Co. Ltd

- 6.2.7 Hoist Material Handling Inc.

- 6.2.8 CVS Ferrari SpA

- 6.2.9 Lonking Holdings Limited

- 6.2.10 Konecranes