|

시장보고서

상품코드

1690722

북미의 자동차 물류 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)North America Automotive Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

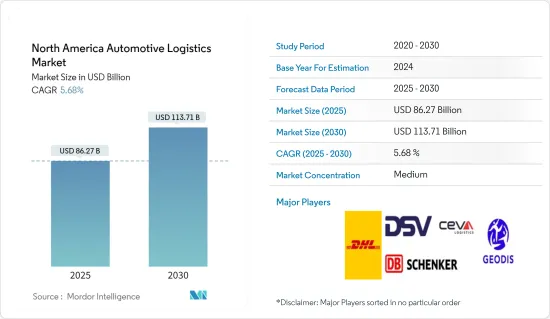

북미의 자동차 물류 시장 규모는 2025년 862억 7,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 5.68%로 확대되어, 2030년에는 1,137억 1,000만 달러에 달할 것으로 예측됩니다.

북미의 자동차 물류가 큰 변화와 기회를 맞이하는 일은 거의 없습니다. 그러나 광범위한 자동차 산업과 마찬가지로 자동차 물류가 직면 한 경제 및 무역 위험, 새로운 규제, 소비자 행동 및 투자 이익률에 대한 불확실성은 거의 없습니다.

전례없는 가시성과 유연성으로 차량 물류 부문은 경쟁을 이겨야 합니다. OEM, 물류 및 기술 공급자는 공급망의 효율적인 흐름을 유지하기 위해 데이터를 공유하고 계획하고 기술을 업그레이드하기 위해 협력해야 합니다.

자동차 공급망의 미래는 자동차 부문의 물류 서비스 제공업체와 거시 수준에서 경제 전체에 매우 중요합니다. 자동차 공급망 구조가 바뀌면 세계 무역의 성격과 국가 경제의 역동성이 영향을 받을 수 있습니다.

세계 자동차 생산 시설 증가는 자동차 물류 시장의 성장을 가속하고 있습니다. 또한 자동차 제조업체가 물류 공급자에게 큰 비즈니스 기회를 제공하기 때문에 시장 성장은 향후 몇 년동안 가속화 될 것으로 예상됩니다. 불황 후 신흥국 경제는 꾸준한 성장을 이루고 있으며 소비자의 가처분소득 증가로 이어지고 있습니다.

북미의 자동차 물류 시장 동향

소형 자동차 생산에 대한 수요

- 북미에서는 소비자의 기호가 스포츠 유틸리티 차량과 트럭으로 이동하고 있으며 자동차 제조업체는 수요 증가에 대응하는 생산 체제를 갖추고 있습니다. 그 예로는 Ford Explorer와 Chevrolet Silverado 같은 모델의 인기를 들 수 있습니다.

- 전기자동차의 증산은 하이브리드차와 EV에 대한 관심 증가로 인한 것입니다. 예를 들어, 2023년 12월 Tesla의 기가팩토리가 텍사스에 건설되었는데, 이는 북미의 전기자동차 수요 증가에 대응하기 위한 것이었습니다.

- 북미 자동차 산업은 엄격한 배기 가스 규제에 대응하기 위해 기술에 적응과 투자를 추진하고 있으며, 소형 자동차의 설계와 생산에 영향을 미치고 있습니다. 2022년 8월, 미국 정부는 역사적인 인플레이션 억제법에 서명했으며, 이는 미국 역사상 가장 중요한 경제 및 기후 관련 법안이 될 수 있습니다. 미국의 제조 능력 부활의 원동력이 된 인플레이션 삭감법은 클린 에너지 기술의 개발과 제조에 폭넓은 인센티브를 제공합니다.

- 소형 자동차 생산 수요가 증가함에 따라 자동차 물류 회사는 수송량이 증가할 것으로 예상됩니다. 더 많은 차량과 부품을 제조 시설에서 배송 센터나 대리점으로 운송해야 합니다.

미국의 EV 부스트

- EV의 보급에는 연방 정부 및 주 수준의 인센티브가 필수적입니다. 연방 정부는 대상 전기자동차 구매에 대한 세액 공제를 제공합니다. 예를 들어, 적격 플러그인 전기자동차 크레딧은 최대 USD 7,500의 크레딧을 제공합니다.

- 대기업 자동차 제조업체도 전기자동차에 적극적으로 노력하고 있습니다. General Motors(GM)와 Ford와 같은 기업들은 전기자동차 개발 및 생산에 투자할 계획을 발표하고 있습니다. 2024년 1월, Ford Motor Co.는 미네소타를 기반으로 하는 기업과 1,000대의 전 전기자동차, 구체적으로 F-150 라이트닝과 머스탱 마하 E를 구입하는 계약을 맺었습니다.

- 2023년 첫 11개월 동안 EV 등록 대수는 100만대를 넘어 시장 전체의 약 7.4%에 달했습니다(2022년 동시기의 5.4%에서 상승). 또한 전문가는 2023년에는 약 110만대의 배터리 전기자동차(BEV)가 판매되었다고 합니다. Tesla는 2023년에 모델 3/Y를 173만 9,707대 판매했습니다.

- 또한 2025년 연비 기준 철회와 대기 정화법에 근거한 주권에 대한 연방 정부와 국정 관계자간의 논의가 계속되고 있기 때문에 시장의 지속적인 성장은 규제 동향에도 좌우됩니다.

북미의 자동차 물류 산업 개요

북미의 자동차 물류 시장은 단편화되고 있습니다. EV 수요 증가, 경량 차량 증가, 기타 몇 가지 요인들이 향후 수년간 시장 성장을 견인할 것으로 보입니다. 경쟁 구도믐 다음과 같은 주요 기업이 특징입니다. DHL Supply Chain, Ryder System, and CH Robinson. 이 기업들은 글로벌 네트워크와 첨단 기술을 활용하여 포괄적인 물류 및 공급망 솔루션을 제공합니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 성과

- 조사의 전제조건

- 조사 범위

제2장 조사 방법

- 분석 방법

- 조사 단계

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 정부의 규제와 대처

- 밸류체인/서플라이체인 분석

- 업계의 기술 동향

- 스포트라이트: 기존 자동차 물류 공급망에 대한 전자상거래의 영향

- 자동차 애프터마켓과 그 물류활동에 관한 통찰

제5장 시장 역학

- 시장 성장 촉진요인

- 환경문제에 대한 우려와 규제

- 자동차 기술의 진보

- 시장 성장 억제요인

- 경제 불확실성

- 시장 기회

- 전기자동차의 보급

- 업계의 매력 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

제6장 시장 세분화

- 서비스별

- 수송

- 창고, 유통, 재고 관리

- 기타 서비스

- 유형별

- 완성차

- 자동차 부품

- 기타

- 국가별

- 미국

- 캐나다

- 멕시코

제7장 경쟁 구도

- 시장 집중도 개요

- 기업 프로파일

- CEVA Logistics AG

- DB Schenker

- DHL

- DSV

- GEODIS

- KUEHNE NAGEL International AG

- Nippon Express Co. Ltd

- Ryder System Inc.

- XPO Logistics Inc.

- United Parcel Service Inc.*

- 기타 기업

제8장 시장 기회와 앞으로의 동향

제9장 부록

- 활동별 GDP 분포

- 자본 흐름의 통찰

- 경제 통계-운수 및 창고 부문, 경제에 대한 공헌

The North America Automotive Logistics Market size is estimated at USD 86.27 billion in 2025, and is expected to reach USD 113.71 billion by 2030, at a CAGR of 5.68% during the forecast period (2025-2030).

North American automotive logistics has rarely been on the verge of much change and opportunity. Yet, as in the broader automotive industry, there are few uncertainties about economic and trade risks, new regulations, consumer behavior, or returns on investment faced by vehicle logistics.

With greater visibility and more flexibility than ever before, the vehicle logistics sector must be able to compete. OEMs, logistics, and technology providers must collaborate to share data, plan, and upgrade technology to keep the supply chain flowing efficiently.

The future of automotive supply chains is vital to logistics service providers in the automotive sector and, at the macro level, whole economies. The nature of global trade and the dynamics of different national economies can be affected by any change in the supply chain structure for vehicles.

An increasing number of vehicle production facilities worldwide compels the growth of the automotive logistics market. In addition, the market growth is expected to accelerate in the coming years due to automobile manufacturers' significant business opportunities for logistics providers. In the post-recession era, emerging economies have seen steady growth, leading to a rise in disposable income for consumers.

North America Automotive Logistics Market Trends

Demand for Light Vehicle Production

- In North America, consumer preferences have shifted to sport utility vehicles and trucks, driving auto manufacturers to adapt their production to meet rising demand. Instances include the popularity of models like Ford Explorer and Chevrolet Silverado.

- Increased production of electric vehicles results from the increasing interest in hybrids and EVs. For example, in December 2023, Tesla's Gigafactory in Texas aimed to meet North America's growing demand for electric vehicles.

- The automotive industry in North America has been adapting to and investing in technologies to meet stringent emission standards, influencing the design and production of light vehicles. In August 2022, the US government signed the historic Inflation Reduction Act into law, which could prove to be the most critical economic and climate legislation in American history. The Act to reduce inflation, which has driven a revival in US manufacturing capacity, offers broad incentives for developing and manufacturing clean energy technologies.

- As the demand for light vehicle production rises, automotive logistics companies experience increased shipping volumes. More vehicles and components must be transported from manufacturing facilities to distribution centers and dealerships.

EV Boost in United States

- Federal and state-level incentives have been crucial in promoting EV adoption. The federal government offers tax credits for the purchase of qualifying electric vehicles. For instance, the Qualified Plug-In Electric Drive Motor Vehicle Credit provides a credit of up to USD 7,500.

- Major automakers have made substantial commitments to electric vehicles. Companies like General Motors (GM), Ford, and others have announced plans to invest in developing and producing electric vehicles. In January 2024, Ford Motor Co. inked a deal with a Minnesota-based company to buy a fleet of 1,000 all-electric vehicles, specifically the F-150 Lightning and Mustang Mach-E.

- During the first 11 months of 2023, EV registrations exceeded 1 million units, which is about 7.4% of the total market (up from 5.4% at this same time in 2022). Experts also stated that around 1.1 million battery-electric vehicles (BEVs) were sold in 2023. Tesla sold 1,739,707 Model 3/Y cars in 2023.

- The market's sustainable growth also depends on regulatory developments, given ongoing discussions among federal and national parties regarding the rollback of 2025 fuel-economy standards and state authority under the Clean Air Act.

North America Automotive Logistics Industry Overview

The North American Automotive Logistics Market is fragmented. The increasing demand for EVs, an increase in lighter vehicles, and several other factors are likely to drive the market's growth over the coming years. The competitive landscape is marked by key players such as DHL Supply Chain, Ryder System, and C.H. Robinson. These companies offer a comprehensive range of logistics and supply chain solutions, leveraging their global networks and advanced technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Government Regulations and Initiatives

- 4.3 Value Chain/Supply Chain Analysis

- 4.4 Technological Trends in the Industry

- 4.5 Spotlight - Effect of E-commerce on Traditional Automotive Logistics Supply Chain

- 4.6 Insights into Automotive Aftermarket and its Logistics Activities

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Environmental Concerns and Regulations

- 5.1.2 Technological Advancements in Automotive Technology

- 5.2 Market Restraints

- 5.2.1 Economic Uncertainty

- 5.3 Market Opportunities

- 5.3.1 Electric Vehicle Adoption

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Threat of New Entrants

- 5.4.2 Bargaining Power of Buyers/Consumers

- 5.4.3 Bargaining Power of Suppliers

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Service

- 6.1.1 Transportation

- 6.1.2 Warehousing, Distribution and Inventory Management

- 6.1.3 Other Services

- 6.2 By Type

- 6.2.1 Finished Vehicle

- 6.2.2 Auto Components

- 6.2.3 Other types

- 6.3 By Country

- 6.3.1 United States

- 6.3.2 Canada

- 6.3.3 Mexico

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 CEVA Logistics AG

- 7.2.2 DB Schenker

- 7.2.3 DHL

- 7.2.4 DSV

- 7.2.5 GEODIS

- 7.2.6 KUEHNE + NAGEL International AG

- 7.2.7 Nippon Express Co. Ltd

- 7.2.8 Ryder System Inc.

- 7.2.9 XPO Logistics Inc.

- 7.2.10 United Parcel Service Inc.*

- 7.3 Other Companies

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

9 APPENDIX

- 9.1 GDP Distribution, by Activity

- 9.2 Insights into Capital Flows

- 9.3 Economic Statistics-Transport and Storage Sector, Contribution to Economy