|

시장보고서

상품코드

1911423

유럽의 중고차 시장 : 시장 점유율 분석, 업계 동향과 통계, 성장 예측(2026-2031년)Europe Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

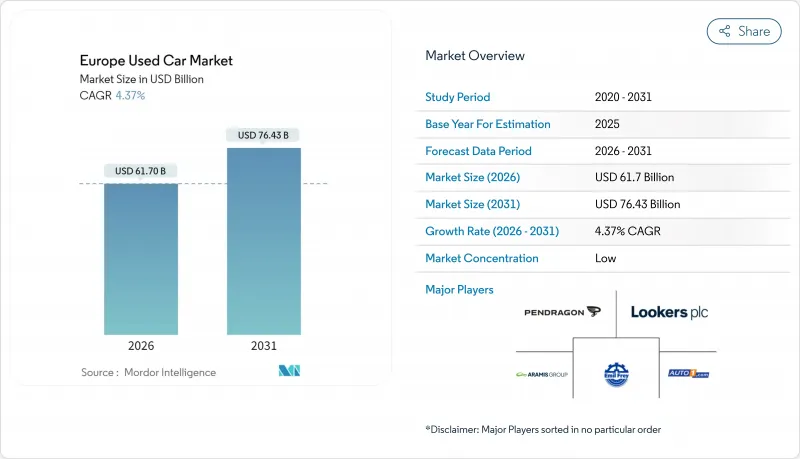

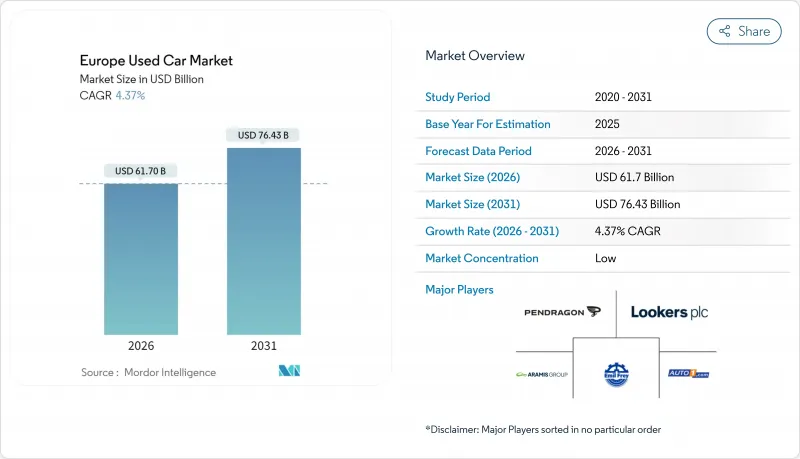

유럽의 중고차 시장은 2025년 591억 2,000만 달러에서 2026년에는 617억 달러에 달할 것으로 보입니다. 2026-2031년에 걸쳐 CAGR 4.37%로 성장을 지속하여 2031년까지 764억 3,000만 달러에 달할 전망입니다.

디지털 마켓플레이스, OEM 지원 인증 중고차(CPO) 프로그램, 내장형 금융 솔루션은 가격 투명성, 신뢰도, 경제성을 개선하여 수요를 가속화합니다. 서유럽의 디젤차 퇴출 정책으로 차량이 중부 및 동유럽으로 재배치되면서 국경을 넘는 재고 흐름이 추가 판매량을 창출합니다. 3-5년 된 중고 리스 차량의 공급 물결이 신차 부족 현상을 상쇄하는 가운데, 배터리 전기차(BEV)는 가치 평가 불확실성에도 불구하고 급성장하는 프리미엄 시장을 형성합니다. 전통적 딜러, 디지털 혁신 기업, OEM 직영 채널이 온라인 검색과 전시장 또는 인도 절차를 결합한 옴니채널 모델을 추구하며 경쟁이 격화되면서 마진 구조와 고객 소유 주기가 재편되고 있습니다.

유럽의 중고차 시장 동향 및 인사이트

OEM 지원형 인증 중고차(CPO) 프로그램 급증

OEM CPO 제도는 제조업체 보증, 리퍼비시 기준, 디지털 예약 도구를 재판매 과정에 도입하여 신차에 근접한 중고차를 신뢰할 수 있는 신차 대체재로 포지셔닝합니다. 높은 잔존가치와 단위당 수익성 증대는 브랜드들이 핵심 계획에 CPO를 주류화하도록 유도합니다. 그러나 소비자 인식은 여전히 낮은 수준입니다. 독일과 영국의 딜러 협의회는 기술적 내용을 명확한 가치 메시지로 전환하기 위한 지속적인 교육 프로그램을 진행 중입니다. 효과적인 프로그램은 소유자를 공식 서비스 채널로 재유입시켜 소유 주기 전반에 걸친 액세서리 및 정비 수익 흐름을 강화합니다.

차량군 전기화 의무화로 인한 리스 만기 차량(3-5년 차) 공급 증가

특히 3-5년 구간의 리스 만기 차량 유입은 유럽의 전역의 재고 역학을 재편하며 시장 참여자들에게 도전과 기회를 동시에 창출하고 있습니다. 차량군 전기화 의무화 정책이 이 추세를 가속화하고 있는데, 기업 차량군은 지속가능성 목표 달성과 진화하는 기술 활용을 위해 차량 교체 주기를 단축하고 있습니다. 이러한 공급 급증은 독일과 네덜란드 등 리스 침투율이 높은 시장에서 특히 두드러지며, 해당 지역에서는 리스가 배터리 전기차(BEV)의 주요 구매 수단으로 남아있습니다. (BEVs).

지속되는 주행거리 조작, 구매자 신뢰 훼손

주행거리 조작은 유럽의 중고차 시장을 계속해서 괴롭히며 소비자 신뢰를 약화시키고 영향을 받는 부문 전반의 가치를 떨어뜨리고 있습니다. 차량 주행거리를 인위적으로 줄여 판매 가격을 올리는 이 관행은 유럽 소비자에게 매년 수십억 유로의 손실을 초래하며, 검증하기 더 어려운 국경 간 거래에 불균형적으로 영향을 미칩니다. 이 문제는 규제 집행이 크게 다른 동유럽, 이탈리아, 스페인에서 특히 심각합니다. 블록체인 기반 차량 이력 기록과 같은 디지털 솔루션이 유망함을 보이지만, 대륙 전반에 걸쳐 도입은 여전히 파편화되어 있습니다.

부문 분석

SUV/MUV 모델은 2025년 시점에서 유럽의 중고차 시장의 33.78%를 차지하고 연료비 상승이 피크를 넘은 후에도 소비자가 범용성과 높은 승차 위치를 요구하는 경향을 반영하고 있습니다. BEV 대응 SUV의 리스 종료 대수가 증가 경향에 있어 CAGR9.67%의 전망을 지지하고 있습니다. 세단은 도시의 정체 요금이 긴 몸을 불리하게 하기 때문에 계속 감소하는 경향이 있습니다. 해치백은 가격에 민감한 최초의 구매자층에서 밀집한 도시 중심부에서의 지지를 유지하고 있습니다.

역동적인 잔존가치로 인해 프랑스와 스페인의 프랜차이즈 딜러들은 중간 사양 크로스오버에 지붕 공간을 할당하는 반면, 서비스 중심 중소기업에서는 LCV(경상용차) 채택이 꾸준히 유지되고 있습니다. 유로 6 규격 밴은 저공해 구역 내에서 12% 프리미엄에 거래되며, 규격 준수 차량과 미준수 작업용 차량 간의 격차를 부각시킵니다. 남유럽은 SUV 선호도가 더욱 강해지며, 포르투갈의 푸조 2008과 같은 소형 크로스오버 수요는 두 자릿수 성장률을 기록합니다.

2025년 유럽의 중고차 시장에서 디젤 차량 점유율은 41.52%로, 청정 공기 정책 강화로 과거 최고치 대비 하락했습니다. 배터리 전기차(BEV)는 초기 도입 업체들이 실증 차량을 출시하며 기술적 우려를 해소함에 따라 소규모 시작에도 불구하고 연평균 17.95% 성장률을 보이고 있습니다. 충전 인프라가 미비한 국가에서는 가솔린 차량이 여전히 경쟁력을 유지하는 한편, 하이브리드(HEV)와 플러그인 하이브리드(PHEV)는 배출 기준과 주행 거리 문제를 동시에 해결합니다.

국경을 넘는 차익 거래로 프랑스와 독일산 디젤 차량이 불가리아와 루마니아로 유입되며 수명 주기 수익이 연장되고 있습니다. 한편 네덜란드에서는 재판매 보조금 축소로 BEV 할인 거래가 나타나고 있습니다. 배터리 상태(SOH) 투명성은 여전히 진입 장벽이지만, 검증 키트 시장 성장은 유로 7 시행 후 추가 유동성 확보로 이어질 전망입니다.

개인간 거래, 개인 광고, 소규모 딜러는 여전히 거래량의 54.60%를 차지하지만 데이터 풍부한 마켓플레이스에 대한 투자자 지원을 받고 조직된 기업은 CAGR 6.18%로 급속히 규모를 확대하고 있습니다. 상위 5곳의 소매업체가 B2C 거래의 불과 6%를 차지할 뿐, 통합의 여지가 충분히 있음을 보여주고 있습니다. 제조업체 지원의 CPO(인정 중고차) 판매점은 재고 관리의 엄격화, 서비스 플랜의 세트 판매, 리스크 회피 지향의 소비자층에 영향을 미치는 파이낸스를 제공합니다.

유럽의 중고차 시장에서는 재고의 공동 관리, 정비의 자동화, 소유권 보증을 실현할 수 있는 플랫폼이 우위입니다. 폴란드에서는 운송 및 세무 서비스를 조합함으로써 조직화된 판매업자가 국경을 넘은 거래에 분산된 경쟁사보다 낮은 가격 설정이 가능해져 신뢰성과 반복구매를 촉진하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

자주 묻는 질문

목차

제1장 서론

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 성장 촉진요인

- OEM 지원 인증 중고차(CPO) 프로그램 급증

- 차량군 전기화 의무화로 인한 리스 만기 차량(3-5년 차) 공급 증가

- 순수 온라인 마켓플레이스 성장과 디지털 침투율 향상

- WLTP/유로7 규제 대응에 의한 신차 가격 상승/중고차와의 가격차 확대

- 디젤차 단계적 퇴출 정책 가속화로 촉진된 국경 간 거래 흐름

- 내장형 금융/BNPL 솔루션으로 인한 초보 구매자 구매력 향상

- 시장 성장 억제요인

- 지속되는 주행거리 조작 사기로 인한 구매자 신뢰 훼손

- 단절된 세금 및 등록 규정으로 인한 원활한 중고차 거래 저해

- 전기차 배터리 상태 표준화 지연으로 인한 중고 BEV 잔존 가치 하락

- 노후 차량의 품질 및 신뢰성 문제

- 가치/가치 체인 분석

- 규제 전망

- 유로-7 EU 배터리 규정 부가가치세 마진 제도 개정

- 기술의 전망

- AI를 활용한 차량 평가* 재판매용 디지털 트윈*OTA 보증 분석

- Porter's Five Forces

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측(금액(달러) 및 수량(대수))

- 차량 유형별

- 세단

- SUV/MUV

- 해치백

- 연료 유형별

- 가솔린차

- 디젤차

- 배터리식 전기자동차(BEV)

- 하이브리드 자동차 및 플러그인 하이브리드 자동차(HEV/PHEV)

- 기타(LPG, CNG, 바이오연료)

- 벤더 유형별

- 조직화

- 비조직화

- 판매 채널별

- 오프라인

- 온라인

- 차량 연식별

- 0-2년

- 3-5년

- 6-8년

- 9년 이상

- 소유자 수별

- 단일 소유자 차량

- 복수 소유자 차량

- 가격대별(달러)

- 1만 달러 미만

- 1만-2만 달러

- 2만-3만 달러

- 3만 달러 초과

- 대출 방법별

- 대출 구매

- 현금 구입

- 국가별

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 네덜란드

- 스웨덴

- 폴란드

- 기타 유럽

제6장 경쟁 구도

- 전략적 움직임(M&A, 자금 조달, 차량군 제휴)

- 시장 점유율 분석

- 기업 프로파일

- Auto1 Group SE

- Emil Frey AG

- BCA Marketplace(Constellation Automotive)

- Pendragon PLC

- Aramis Group SA

- Lookers PLC

- Autorola A/S

- Arnold Clark Automobiles Ltd

- Sytner Group Ltd

- Cazoo Group Ltd

- CarNext BV

- Inchcape PLC

- Hedin Mobility Group

- Heycar(Mobility Trader GmbH)

- Penske Automotive Group/CarShop

- ALD Automotive and LeasePlan

- Groupe Renault Retail Group

- Bilia AB

- Motorpoint Group PLC

- Vertu Motors PLC

제7장 시장 기회와 장래의 전망

HBR 26.01.29The Europe used car market is expected to grow from USD 59.12 billion in 2025 to USD 61.7 billion in 2026 and is forecast to reach USD 76.43 billion by 2031 at 4.37% CAGR over 2026-2031.

Digital marketplaces, OEM-backed certified pre-owned (CPO) programs, and embedded finance solutions together accelerate demand by improving price transparency, trust, and affordability. Cross-border inventory flows unlock incremental volume as diesel phase-out policies in Western Europe redirect vehicles to Central and Eastern Europe. The mid-age supply wave of 3 to 5-year-old ex-lease cars balances out persistent shortages of younger stock, while battery-electric vehicles (BEVs) add a fast-growing premium layer despite valuation uncertainty. Competitive intensity is rising as traditional dealers, digital disruptors, and OEM captive channels pursue omnichannel models that blend online research with showroom or delivery hand-offs, reshaping margins and customer ownership cycles.

Europe Used Car Market Trends and Insights

Surge in OEM-Backed Certified Pre-Owned (CPO) Programs

OEM CPO schemes inject manufacturer warranties, refurbishment standards, and digital booking tools into the resale journey, positioning near-new cars as credible substitutes for new models. Strong residuals and higher per-unit profitability motivate brands to mainstream CPO in core planning. Consumer awareness, however, remains muted; ongoing education initiatives by dealer councils in Germany and the UK aim to translate technical coverage into clearer value messaging. Effective programs also loop owners back into authorized service lanes, reinforcing accessory and maintenance revenue streams across the ownership lifecycle.

Rising Supply of Ex-Lease Vehicles (3-5-Year Bracket) Driven by Fleet Electrification Mandates

The influx of off-lease vehicles, particularly in the 3-5 year bracket, is reshaping inventory dynamics across Europe, creating both challenges and opportunities for market participants. Fleet electrification mandates are accelerating this trend, with corporate fleets cycling through vehicles more rapidly to meet sustainability targets and take advantage of evolving technology. This supply surge is particularly pronounced in markets with strong leasing penetration, such as Germany and the Netherlands, where leasing remains a key acquisition method for battery electric vehicles (BEVs).

Persisting Odometer Fraud Undermining Buyer Trust

Odometer fraud continues to plague the European used car market, eroding consumer confidence and depressing values across affected segments. This practice, where vehicle mileage is artificially reduced to increase selling prices, costs European consumers billions annually and disproportionately impacts cross-border transactions where verification is more challenging.The problem is particularly acute in Eastern Europe, Italy, and Spain, where regulatory enforcement varies significantly. While digital solutions like blockchain-based vehicle history records show promise, implementation remains fragmented across the continent.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Pure-Play Online Marketplaces Increasing Digital Penetration

- Elevated New-Car Prices from WLTP/Euro-7 Compliance Widening Price Gap to Used

- Slow EV Battery-Health Standardisation Depressing Residual Values of Used BEVs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUV/MUV models commanded 33.78% of the Europe used car market size in 2025, reflecting consumer appetite for versatility and higher seating positions even after fuel-cost pressures peaked. BEV-compatible SUVs now exit lease pools in greater numbers, which underpins a 9.67% CAGR outlook. Sedans continue to slide as urban congestion charges penalise longer body formats. Hatchbacks retain loyalty inside dense city cores among price-sensitive first-time buyers.

Dynamic residuals encourage franchised dealers in France and Spain to dedicate rooftop space to mid-spec crossovers, while LCV uptake remains steady in service-oriented SMEs. Euro 6-compliant vans trade at 12% premiums inside low-emission zones, highlighting a bifurcation between compliant and non-compliant workhorses. Southern Europe leans even harder into SUVs; Portugal's demand for sub-compact crossovers such as the Peugeot 2008 grows by double digits.

Diesel vehicles captured 41.52% of the Europe used car market share in 2025, down from previous highs as clean-air measures rise. Though starting small, battery electric vehicles are advancing at 17.95% CAGR as early adopter fleets de-risk technology fears by releasing documented vehicles. Petrol maintains relevance in countries with nascent charging grids, while HEV and PHEV bridge compliance and range concerns.

Cross-border arbitrage channels diesel cars from France and Germany into Bulgaria and Romania, prolonging lifecycle yields. Meanwhile, BEV bargains appear in the Netherlands, where resale subsidies tighten. Transparency around battery state of health remains a gating factor, yet growth in verification kits is expected to unlock further liquidity after Euro 7 implementation.

Independent traders, private classifieds, and micro-dealerships still account for 54.60% of the volume, but organized players scale quicker at 6.18% CAGR as investors back data-rich marketplaces. The top five retailers account for only 6% of B2C transactions, signalling ample consolidation headroom. OEM-sponsored CPO outlets add inventory discipline, bundled service plans, and financing that resonate with risk-averse shoppers.

The Europe used car market rewards platforms able to syndicate stock, automate reconditioning, and guarantee title. In Poland, bundled transport and taxation services enable organised sellers to undercut fragmented rivals on cross-border purchases, boosting trust and repeat business.

The Europe Used Car Market Report is Segmented by Vehicle Type (Hatchback, Sedan, and More), Fuel Type (Gasoline, Diesel, and More), Vendor Type (Organized and Unorganized), Sales Channel (Offline and Online), Vehicle Age (0 To 2 Years, 3 To 5 Years, and More), Ownership Count (Single-Owner Vehicles and More), Price Band, Financing Type, and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Auto1 Group SE

- Emil Frey AG

- BCA Marketplace (Constellation Automotive)

- Pendragon PLC

- Aramis Group SA

- Lookers PLC

- Autorola A/S

- Arnold Clark Automobiles Ltd

- Sytner Group Ltd

- Cazoo Group Ltd

- CarNext B.V.

- Inchcape PLC

- Hedin Mobility Group

- Heycar (Mobility Trader GmbH)

- Penske Automotive Group/CarShop

- ALD Automotive and LeasePlan

- Groupe Renault Retail Group

- Bilia AB

- Motorpoint Group PLC

- Vertu Motors PLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Surge in OEM-Backed Certified Pre-Owned (CPO) Programs

- 4.1.2 Rising Supply of Ex-Lease Vehicles (3-5-Year Bracket) Driven by Fleet Electrification Mandates

- 4.1.3 Growth of Pure-Play Online Marketplaces Increasing Digital Penetration

- 4.1.4 Elevated New-Car Prices from WLTP/Euro-7 Compliance Widening Price Gap to Used

- 4.1.5 Accelerated Diesel Phase-Out Policies Boosting Cross-Border Trade Flows

- 4.1.6 Embedded Finance/BNPL Solutions Improving Affordability for First-Time Buyers

- 4.2 Market Restraints

- 4.2.1 Persisting Odometer Fraud Undermining Buyer Trust

- 4.2.2 Fragmented Tax and Registration Rules Hampering Seamless Secondary Trade

- 4.2.3 Slow EV Battery-Health Standardisation Depressing Residual Values of Used BEVs

- 4.2.4 Quality and Reliability Concerns in Older-Age Vehicles

- 4.3 Value/Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.4.1 Euro-7 EU Battery Regulation VAT margin scheme revisions

- 4.5 Technological Outlook

- 4.5.1 AI-driven vehicle grading * Digital twins for re-marketing * OTA warranty analytics

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Sedan

- 5.1.2 SUV/MUV

- 5.1.3 Hatchback

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Battery Electric Vehicle (BEV)

- 5.2.4 Hybrid and Plug-in Hybrid (HEV/PHEV)

- 5.2.5 Others (LPG, CNG, Bio-fuel)

- 5.3 By Vendor Type

- 5.3.1 Organized

- 5.3.2 Unorganized

- 5.4 By Sales Channel

- 5.4.1 Offline

- 5.4.2 Online

- 5.5 By Vehicle Age

- 5.5.1 0 to 2 Years

- 5.5.2 3 to 5 Years

- 5.5.3 6 to 8 Years

- 5.5.4 More Than 9 Years

- 5.6 By Ownership Count

- 5.6.1 Single-Owner Vehicles

- 5.6.2 Multi-Owner Vehicles

- 5.7 By Price Band (USD)

- 5.7.1 Less than 10k

- 5.7.2 10k to 20k

- 5.7.3 20k to 30k

- 5.7.4 More than 30k

- 5.8 By Financing Type

- 5.8.1 Financed Purchase

- 5.8.2 Outright Purchase

- 5.9 By Country

- 5.9.1 Germany

- 5.9.2 United Kingdom

- 5.9.3 France

- 5.9.4 Italy

- 5.9.5 Spain

- 5.9.6 Russia

- 5.9.7 Netherlands

- 5.9.8 Sweden

- 5.9.9 Poland

- 5.9.10 Rest of Europe

6 Competitive Landscape

- 6.1 Strategic Moves (M&A, Fund-Raises, Fleet Partnerships)

- 6.2 Market Share Analysis

- 6.3 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.3.1 Auto1 Group SE

- 6.3.2 Emil Frey AG

- 6.3.3 BCA Marketplace (Constellation Automotive)

- 6.3.4 Pendragon PLC

- 6.3.5 Aramis Group SA

- 6.3.6 Lookers PLC

- 6.3.7 Autorola A/S

- 6.3.8 Arnold Clark Automobiles Ltd

- 6.3.9 Sytner Group Ltd

- 6.3.10 Cazoo Group Ltd

- 6.3.11 CarNext B.V.

- 6.3.12 Inchcape PLC

- 6.3.13 Hedin Mobility Group

- 6.3.14 Heycar (Mobility Trader GmbH)

- 6.3.15 Penske Automotive Group/CarShop

- 6.3.16 ALD Automotive and LeasePlan

- 6.3.17 Groupe Renault Retail Group

- 6.3.18 Bilia AB

- 6.3.19 Motorpoint Group PLC

- 6.3.20 Vertu Motors PLC