|

시장보고서

상품코드

1692438

유럽의 정밀 농업 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Precision Farming - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

■ 보고서에 따라 최신 정보로 업데이트하여 보내드립니다. 배송일정은 문의해 주시기 바랍니다.

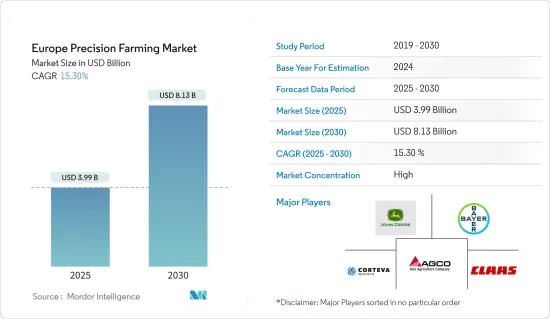

유럽의 정밀 농업 시장 규모는 2025년 39억 9,000만 달러로 추정되며 예측 기간 중(2025-2030년) CAGR 15.3%로 확대되어, 2030년에는 81억 3,000만 달러에 이를 것으로 예측됩니다.

주요 하이라이트

- 유럽의 정밀농업시장은 기술의 진보와 지속가능한 농법에 대한 관심이 높아져 급성장을 이루고 있습니다.

- 시장의 확대에는 정부의 지원이 중요한 역할을 하고 있습니다. 유럽연합(EU)의 호라이즌 유럽계획(2021-2027년)은 약 1,040억 달러의 예산으로 정밀농업의 도입을 촉진하고 있습니다.

- 이 시장의 주요 기술은 지침 시스템, 원격 감지 및 가변 속도 기술을 포함합니다. 이 도구는 농작물 모니터링, 토양 건전성 평가, 농장 생산성을 향상시킵니다. 결정을 할 수 있습니다. 유럽 연합(EU)의 정밀 농업 정책 및 도입 전망 2023에 의하면, 이 지역에서의 정밀 농업의 도입은 영국이 리드하고 있어 영국에서는 스코틀랜드가 85%의 도입률을 보였고, 이어서 아일랜드의 농가가 43%가 였습니다.

- 지속 가능한 식량 생산에 대한 소비자의 관심 증가는 자원의 효율적인 사용으로 환경에 미치는 영향을 줄이는 정밀 농업 실천과 일치합니다. 환경 친화적인 시장에서 농가에게 기회를 가져옵니다.

유럽 정밀 농업 시장 동향

노동력 부족으로 유럽 농업에서 정밀 농업 도입을 촉진

- 유럽 연합(EU)의 청과 부문은 EU 회원국과 비가맹국의 노동력에 크게 의존하고 있습니다. 은 이민정책의 엄격화와 계절노동자의 감소로 인하여 노동력 부족의 심각화에 직면하고 있습니다.

- EU에서는 특히 농업이 중요한 경제적 역할을 담당하는 농촌 지역에서 노동력 인구 감소가 일어나고 있습니다. 이 인구 동태상의 과제에 의해 작부, 수확, 가공 등의 작업에 충분한 노동력을 확보하는 것이 점점 어려워지고 있습니다.

- 2023년 유럽 정부는 농업과 농촌 지역의 디지털화 프로그램을 시작하여 농업에서의 디지털 기술과 데이터 주도형 접근의 통합을 추진하였습니다. 이 프로그램은 GPS, 센서, 데이터 분석 등 정밀 기술의 채용을 장려함으로써 유럽의 정밀 농업 시장의 성장을 직접 지원하고 있습니다.

독일에서 정밀 농업 채택 확대

- 독일의 생산자에 의한 현대 농업 기술의 이용 증가는 정밀 농업으로의 큰 변화를 부각시키고 있습니다. 또한 많은 농가가 GPS를 이용한 면적 측정이나 토양 샘플링 등, 데이터 주도의 수법을 채용하고 있지만, 토지에 따른 파종이나 시비 등, 보다 고도의 기술은 아직 일반적이지 않습니다.

- 독일에서는 특히 500헥타르 이상의 농장에서 정밀 농업이 농업 계약 서비스의 중요한 부분이 되고 있습니다. 특정 농지용 드론 용도에 대한 관심 증가는 모듈식 정밀 농업 툴의 채용을 더욱 촉진하고 시장 성장에 기여할 것으로 예측됩니다. 독일의 JKI(Julius Kuhn-Institut)는 전문적인 노즐 테스트에서 엄격한 기준으로 유명하며, 이 나라에서는 농업용 드론에 필수인 인증을 받고 있습니다.

- 식량 안보와 더 나은 양분 관리에 대한 관심이 높아지면서 전국적으로 정밀 농업 기술의 보급을 뒷받침하고 있습니다. 이러한 진보는 노동력 부족이나 환경의 지속가능성이라고 하는 과제에 대처하기 위해 불가결한 것과 동시에, 토양 센서나 드론 등 기술의 이용을 통해, 작물의 수율을 향상시켜, 투입 코스트를 삭감합니다.

유럽 정밀 농업 산업 개요

유럽의 정밀 농업 시장은 매우 집중되어 있습니다. Deere & Company, Bayer Crop Science, Agco corporation, CLAAS KGaA mbH and Corteva.가 시장의 주요 기업입니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 시장 성장 촉진요인

- 정부의 지원과 보조금

- 기술의 진보

- 지속 가능한 농업에 대한 수요 증가

- 시장 성장 억제요인

- 규제와 표준화의 과제

- 높은 초기 비용

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁도

제5장 시장 세분화

- 기술

- 유도 시스템

- GPS 및 전 지구 위성 항법 시스템(GNSS)

- 전 지구 정보 시스템(GIS)

- 리모트 센싱

- 가변 레이트 기술

- 가변 레이트 비료

- 가변 레이트 파종

- 가변 레이트 농약

- 드론과 UAV

- 기타 기술

- 유도 시스템

- 컴포넌트

- 하드웨어

- 소프트웨어

- 서비스

- 신청

- 수율 모니터링

- 가변 레이트 용도

- 필드 매핑

- 토양 모니터링

- 작물 스카우팅

- 기타 용도

- 지역

- 독일

- 프랑스

- 영국

- 이탈리아

- 기타 유럽

제6장 경쟁 구도

- 가장 채용된 전략

- 시장 점유율 분석

- 기업 프로파일

- AGCO Corporation

- TopCon Corporation

- Corteva(Granular Inc.)

- CNH Industrial NV(Raven)

- Deere & Company

- Teejet Technologies

- CLAAS KGaA mbH(365FarmNet)

- AG Leader Technology Inc.

- Pottinger Landtechnik Gmbh group(MaterMacc)

- Bayer Cropscience AG

제7장 시장 기회와 앞으로의 동향

JHS 25.05.07The Europe Precision Farming Market size is estimated at USD 3.99 billion in 2025, and is expected to reach USD 8.13 billion by 2030, at a CAGR of 15.3% during the forecast period (2025-2030).

Key Highlights

- The precision farming market in Europe is experiencing rapid growth, propelled by technological advancements and an increased focus on sustainable agricultural practices. Farmers are utilizing tools such as GPS, drones, and IoT devices to improve crop yields and manage resources more efficiently.

- Government support plays a crucial role in the market's expansion. The European Union's Horizon Europe Programme (2021-2027), with a budget of about USD 104 billion, promotes the adoption of precision farming. This initiative encourages innovation and collaboration, facilitating the development and implementation of precision farming technologies across the region.

- Key technologies in the market include guidance systems, remote sensing, and variable rate technology. These tools enhance crop monitoring, soil health assessments, and farm productivity. Integrating real-time data and advanced analytics enables farmers to make more informed decisions tailored to their specific crop requirements. According to the European Union Precision Agriculture Policy & Adoption Outlook 2023, the United Kingdom leads in precision agriculture adoption in the region, with Scotland at 85% adoption within the UK, followed by 43% of Irish farmers. Germany and Denmark are also major adopters of these technologies.

- The growing consumer interest in sustainable food production aligns with precision farming practices, which reduce environmental impact through efficient resource use. This trend addresses market demands and presents opportunities for farmers in premium, eco-friendly markets. With ongoing technological progress and strong policy support for sustainable agriculture, the future of precision farming in Europe appears promising.

Europe Precision Farming Market Trends

Labor Shortages Drive Precision Farming Adoption in European Agriculture

- The European Union's fruit and vegetable sector relies heavily on non-national labor from both EU and non-EU countries. Germany, Italy, Spain, France, and Poland employ significant numbers of seasonal migrant workers. With about 9.1 million farms across 157 million hectares of agricultural land, the EU faces increasing labor shortages due to stricter immigration policies and declining availability of seasonal workers. This situation has accelerated the adoption of precision farming technologies, which offer automated solutions to reduce labor dependency while improving efficiency, productivity, and sustainability in the agricultural sector.

- The EU is experiencing a declining labor force, particularly in rural areas where agriculture plays a key economic role. The EU agricultural labor force index decreased by about 15.8%, indicating an overall downward trend in the number of available workers. This demographic challenge has made it increasingly difficult to find sufficient labor for tasks such as planting, harvesting, and processing. Consequently, farmers are increasingly adopting precision farming technologies to address these labor shortages.

- In 2023, the European government initiated a digitalization program for agriculture and rural areas, promoting the integration of digital technologies and data-driven approaches in farming. This initiative benefits over 274,000 farms, aiming to enhance efficiency and productivity through advanced digital tools. The program directly supports the growth of the Europe Precision Farming Market by encouraging the adoption of precision technologies such as GPS, sensors, and data analytics. This shift towards automation not only helps alleviate the labor shortage but also improves efficiency and sustainability in agriculture.

Growing adoption of precision farming in Germany

- The increasing use of modern farming techniques by German growers highlights a significant shift towards precision farming. Germany boasts about 11.6 million hectares of agricultural land as of 2022, positioning it as one of Europe's largest farming regions. This extensive agricultural landscape offers a significant opportunity for the adoption of precision farming technologies. Moreover, many farmers are adopting data-driven methods, such as GPS-based area measurements and soil sampling, although more advanced techniques like site-specific sowing and fertilizing are still less common.

- In Germany, precision farming is increasingly becoming a crucial part of agricultural contractor services, particularly on farms exceeding 500 hectares. This technology plays a significant role in monitoring soil conditions and plant health, leading to improved growth management. The rising interest in drone applications for specific farm areas is projected to further promote the adoption of modular precision farming tools, contributing to market growth. The German Julius Kuhn-Institut (JKI) is renowned for its stringent standards in professional nozzle testing, a certification that is mandatory for agricultural drones in the country. For instance, DJI T30 drones received approval in 2022 for mountain vineyard operations in Germany.

- The growing focus on food security and better nutrient management is driving the widespread adoption of precision farming technologies across the nation. Germany's commitment to sustainable agriculture, reinforced by initiatives such as the "Digital Farming 2025" program, is accelerating the use of digital tools in farming practices. These advancements are critical for addressing challenges like labor shortages and environmental sustainability, while also enhancing crop yields and reducing input costs through the use of technologies such as soil sensors and drones.

Europe Precision Farming Industry Overview

The European precision farming market is highly concentrated. Deere & Company, Bayer Crop Science, Agco corporation, CLAAS KGaA mbH and Corteva. are the key players in the market. The companies operating in Europe are focusing on R&D and product launches, along with innovations and partnerships.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Support and Subsidies

- 4.2.2 Technological Advancements

- 4.2.3 Increasing Demand for Sustainable Agriculture

- 4.3 Market Restraints

- 4.3.1 Regulatory and Standardization Challenges

- 4.3.2 High Initial Cost

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power Of Suppliers

- 4.4.2 Bargaining Power Of Buyers

- 4.4.3 Threat Of New Entrants

- 4.4.4 Threat Of Substitute Products And Services

- 4.4.5 Degree Of Competition

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Guidance System

- 5.1.1.1 Global Positioning System (GPS)/ Global Satellite Navigation System (GNSS)

- 5.1.1.2 Global Information System (GIS)

- 5.1.2 Remote Sensing

- 5.1.3 Variable Rate Technology

- 5.1.3.1 Variable Rate Fertilizer

- 5.1.3.2 Variable Rate Seeding

- 5.1.3.3 Variable Rate Pesticide

- 5.1.4 Drones and UAVs

- 5.1.5 Other Technologies

- 5.1.1 Guidance System

- 5.2 Components

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 Application

- 5.3.1 Yield Monitoring

- 5.3.2 Variable Rate Application

- 5.3.3 Field Mapping

- 5.3.4 Soil Monitoring

- 5.3.5 Crop Scouting

- 5.3.6 Other Application

- 5.4 Geography

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Italy

- 5.4.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 AGCO Corporation

- 6.3.2 TopCon Corporation

- 6.3.3 Corteva (Granular Inc.)

- 6.3.4 CNH Industrial N.V. (Raven)

- 6.3.5 Deere & Company

- 6.3.6 Teejet Technologies

- 6.3.7 CLAAS KGaA mbH (365FarmNet)

- 6.3.8 AG Leader Technology Inc.

- 6.3.9 Pottinger Landtechnik Gmbh group (MaterMacc)

- 6.3.10 Bayer Cropscience AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

샘플 요청 목록