|

시장보고서

상품코드

1692554

영국의 도로 화물운송 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)United Kingdom Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

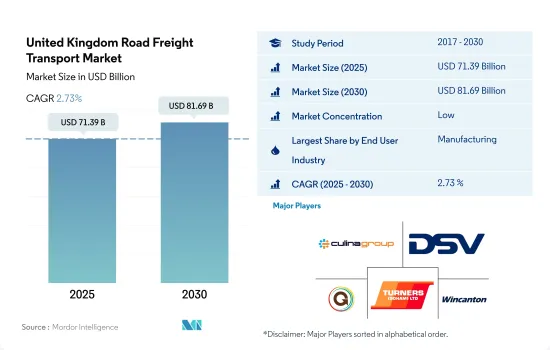

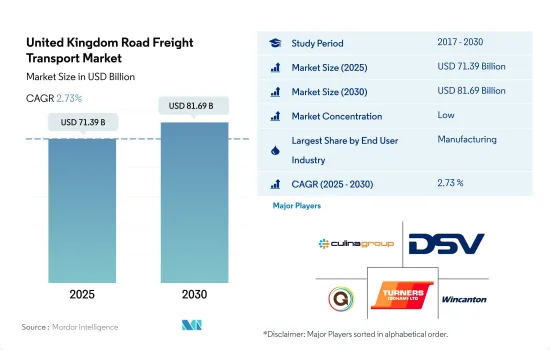

영국의 도로 화물운송 시장 규모는 2025년에 713억 9,000만 달러로 추정되고, 2030년에는 816억 9,000만 달러에 이를것으로 예측되며, 예측 기간(2025-2030년)의 CAGR은 2.73%를 나타낼 것으로 예측됩니다.

영국의 스마트 제조 데이터 허브(SMDH)는 중소기업 생산성을 높이고 도로 화물 시장을 활성화하는 것을 목표로 합니다.

- 2022년 제조업 부문은 영국 경제에서 중요한 역할을 담당하며 GDP의 8% 이상을 차지했고, 이는 약 2,700억 달러에 해당합니다. 제조업에서 가장 큰 비중을 차지하는 분야는 소비재로, 시장 매출의 72%를 차지했습니다. 도로 운송 분야의 주요 기업으로는 Deutsche Post DHL Group, FedEx, Turners (Soham) Limited, United Parcel Service(UPS), Wincanton PLC 등이 있습니다.

- 2022년 영국의 소매 및 도매업은 국내총생산(GDP)의 6% 이상을 차지했습니다. 오프라인 소매업에는 상점, 백화점, 슈퍼마켓, 시장 가판대, 심지어 방문 판매까지 포함됩니다. 영국에서 오프라인 소매 판매는 전체 소매 시장의 68% 이상을 차지합니다. 오프라인 소매업의 이러한 높은 비중은 다양한 소매점으로 상품을 효율적으로 운송해야 하기 때문에 도로 화물 서비스에 대한 수요를 증가시킵니다. Tesco는 영국 최대 식료품 소매업체로, 전국에 4,169개의 매장을 보유하고 있습니다.

영국의 도로 화물운송 시장 동향

소비자 주문 처리 센터에 대한 수요 증가로 인해 영국의 창고 수는 2027년까지 21만 4,000개에 달할 전망

- 2024년 5월 DP월드는 고객 경쟁 강화를 위한 5,000만 파운드(6,092만 달러) 투자의 일환으로 코벤트리에 지금까지 가장 큰 창고, 59만 8,000평방피트의 시설을 개설 2023년 9월에 비스터에 개설한 27만 평방 피트 규모의 음악 및 비디오 유통 창고를 오픈한 데 이은 것으로, 영국 실물 음악의 70%와 홈 엔터테인먼트 제품의 35%를 취급합니다. 앞서 DP World는 버턴 어폰 토렌트에 7만 5,000평방피트의 창고를, 런던 게이트웨이의 물류 허브에 23만평방피트의 멀티 유저 창고를 개설하고 있습니다. 게이트웨이의 허브와 함께 78개국에서 사업을 전개하는 DP월드는 세계무역의 10%를 관리하고 있습니다.

- 영국 내 대형 창고의 수는 빠르게 증가하고 있습니다. 2027년까지 전체 창고의 약 18%가 소비자 주문 처리용 창고가 될 것입니다.

영국 정부는 연료 가격에 큰 영향을 미치며, 휘발유와 경유 가격의 대부분을 유류세와 부가가치세(표준 20% 세율)가 차지합니다.

- 2022년 8월, 유가는 100달러 아래로 하락하여 배럴당 90.63달러로 한 달을 마감했습니다. 2023년에는 가격이 더 하락하여 5월에는 배럴당 72.50달러까지 떨어졌습니다. 2024년 3월 영국의 휘발유 가격은 리터당 평균 150.1p로 2023년 11월 이후 가장 높았습니다. 이는 중동 긴장으로 인한 유가 상승과 달러 대비 파운드화 약세 때문입니다.

- 2024년 6월, 영국 정부는 2030년까지 제트 연료에 최소 10%의 지속 가능한 항공 연료(SAF)를 의무화할 계획이라고 밝혔습니다. 현재 SAF는 기존 연료보다 희소성이 낮고 가격이 비싸서 항공 분야에서 사용을 늘리는 데 어려움이 있습니다. SAF는 전 세계적으로 제트 연료의 0.1% 미만을 차지합니다. 입법 승인을 기다리고 있는 정부의 SAF 의무화는 2025년 1월에 시작될 예정입니다.

영국의 도로 화물운송 산업 개요

영국의 도로 화물운송 시장은 세분화되어 있으며, 이 시장의 주요 5개 업체는 Culina Group, DSV A/S(De Sammensluttede Vognmaend af Air and Sea), Gregory Distribution Ltd, Turners (Soham) Ltd, Wincanton PLC(알파벳 순으로 정렬)입니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 경제 활동별 GDP 분포

- 경제활동별 GDP 성장률

- 경제성과 및 프로파일

- 전자상거래 산업의 동향

- 제조업의 동향

- 운송 및 창고업의 GDP

- 물류 실적

- 도로 길이

- 수출 동향

- 수입 동향

- 연료 가격 동향

- 트럭 운송 비용

- 유형별 트럭 보유 대수

- 주요 트럭 공급업체

- 도로화물 톤수 동향

- 도로화물 가격 동향

- 모달 점유율

- 인플레이션율

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 농업, 어업, 임업

- 건설업

- 제조업

- 석유 및 가스, 광업, 채석업

- 도매 및 소매업

- 기타

- 수출처

- 국내

- 국제

- 트럭 적재량

- FTL(Full-Truck-Load)

- LTL (Less-Than-Truckload)

- 컨테이너 운송

- 컨테이너 운송

- 비컨테이너 운송

- 운송 거리

- 장거리 운송

- 단거리 운송

- 상품 구성

- 유체 상품

- 고체 상품

- 온도 제어

- 비온도 제어

- 온도 제어

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- AP Moller-Maersk

- Culina Group

- DACHSER

- Deutsche Bahn AG(DB Schenker 포함)

- DHL Group

- DSV A/S(De Sammensluttede Vognmaend af Air and Sea)

- Gist Ltd.

- Gregory Distribution Ltd.

- Howard Tenens

- Hoyer GmbH

- Kinaxia Logistics Limited

- Turners(소햄) Ltd.

- United Parcel Service of America, Inc.(UPS)

- WH Malcolm Ltd.

- Wincanton PLC

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 물류 시장 개요

- 개요

- Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(시장 성장 촉진요인, 억제요인, 기회)

- 출처 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

- 환율

The United Kingdom Road Freight Transport Market size is estimated at 71.39 billion USD in 2025, and is expected to reach 81.69 billion USD by 2030, growing at a CAGR of 2.73% during the forecast period (2025-2030).

UK's Smart Manufacturing Data Hub (SMDH) initiative aims to boost SME productivity, fueling the road freight market

- In 2022, the manufacturing sector played a significant role in the United Kingdom's economy, contributing over 8% to the GDP, equivalent to around USD 270 billion. The dominant subset within manufacturing was consumer goods, commanding a substantial 72% share of market revenue. Some of the major players in road transportation are Deutsche Post DHL Group, FedEx, Turners (Soham) Limited, United Parcel Service (UPS), and Wincanton PLC.

- In 2022, the retail and wholesale trade in the UK accounted for over 6% of the nation's GDP. Offline retail encompasses shops, department stores, supermarkets, market stalls, and even door-to-door sales. In the UK, offline retail sales make up more than 68% of the total retail market. This significant share of offline retail drives the demand for road freight services, as goods need to be transported efficiently to various retail outlets. Tesco stands as the UK's largest grocery retailer, boasting 4,169 stores nationwide. Another major player, Sainsbury PLC, operates as a multi-channel retailer, offering groceries, household goods, and clothing, with a footprint of 1,400 stores across the UK.

United Kingdom Road Freight Transport Market Trends

The UK's warehouse count is expected to reach 214,000 by 2027 due to a rise in demand for consumer fulfillment centers

- In May 2024, DP World opened its largest warehouse yet, a 598,000 sq ft facility in Coventry, as part of a GBP 50 million (USD 60.92 million) investment to boost customer competitiveness. This follows the September 2023 opening of a 270,000 sq ft music and video distribution warehouse in Bicester, handling 70% of the UK's physical music and 35% of home entertainment products. Previously, DP World opened a 75,000 sq ft site in Burton upon Trent and a 230,000 sq ft multi-user warehouse at London Gateway's logistics hub. Alongside its hubs at Southampton and London Gateway, operating in 78 countries, DP World manages 10% of global trade. Such initiaves are expected to boost the GDP contribution from the sector.

- The number of large warehouses in the United Kingdom is rapidly increasing. By 2027, there are expected to be around 214,000 warehouses larger than 50,000 square feet globally. Many of these warehouses are to serve as e-commerce fulfillment centers, and approximately 18% of all warehouses will be for consumer fulfillment by 2027. This increase suggests the global expansion of e-commerce as the proportion of warehouses operating as trade distribution hubs begins to shift in favor of consumer fulfillment centers.

UK government has a major influence on fuel prices, and both fuel duty and VAT (standard 20% rate) make up majority of the petrol and diesel prices

- In August 2022, the oil price dropped under USD 100 and finished the month at USD 90.63 a barrel. Prices dropped further in 2023, and by May, a barrel of oil was down to USD 72.50. In March 2024, petrol prices in the UK averaged 150.1p per litre, the highest since November 2023. This is due to rising oil prices due to Middle East tensions and a weaker pound against the dollar. Although overall inflation has eased, petrol and diesel prices increased in March. Oil prices have since dropped after spiking following Israel's retaliatory attack on Iran in April 2024.

- In June 2024, the UK government confirmed it plans to require at least 10% sustainable aviation fuel (SAF) in jet fuel by 2030. Currently, SAF is scarce and more expensive than traditional fuels, making it challenging to increase its use in aviation. SAF represents less than 0.1% of jet fuel globally. The government's SAF mandate, pending legislative approval, is set to start in January 2025. This follows the 2022 "Jet Zero" strategy aiming for net-zero emissions in aviation by 2050.

United Kingdom Road Freight Transport Industry Overview

The United Kingdom Road Freight Transport Market is fragmented, with the major five players in this market being Culina Group, DSV A/S (De Sammensluttede Vognmaend af Air and Sea), Gregory Distribution Ltd., Turners (Soham) Ltd. and Wincanton PLC (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 Culina Group

- 6.4.3 DACHSER

- 6.4.4 Deutsche Bahn AG (including DB Schenker)

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.7 Gist Ltd.

- 6.4.8 Gregory Distribution Ltd.

- 6.4.9 Howard Tenens

- 6.4.10 Hoyer GmbH

- 6.4.11 Kinaxia Logistics Limited

- 6.4.12 Turners (Soham) Ltd.

- 6.4.13 United Parcel Service of America, Inc. (UPS)

- 6.4.14 W H Malcolm Ltd.

- 6.4.15 Wincanton PLC

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate