|

시장보고서

상품코드

1692564

ASEAN의 도로화물 운송 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)ASEAN Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

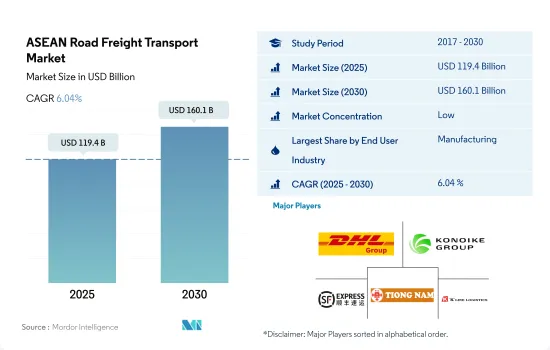

ASEAN의 도로화물 운송 시장 규모는 2025년 1,194억 달러로 추정되며, 2030년에는 1,601억 달러에 이르고, 예측 기간 중(2025-2030년) CAGR 6.04%로 성장할 것으로 예측됩니다.

태국은 전기자동차 정책에 따라 2030년까지 자동차 생산량의 30%를 전기자동차로 만드는 것을 목표로 하고 있습니다.

- 인도네시아의 제조업은 2022년에 5.01% 성장했습니다. 이 나라의 전기자동차 정책은 2030년까지 자동차 생산 대수의 30%를 전기자동차로 하는 것을 목표로 하고 있습니다.

- 2023년부터 2027년까지 ASEAN의 전자상거래 시장은 CAGR 11.11%를 나타낼 것으로 예상됩니다. 전자상거래 시장의 성장은 도소매업의 최종 사용자 부문을 밀어올릴 것으로 예상됩니다. 광업, 채석부문의 성장을 가속할 것으로 예상됩니다.

트럭 운송 서비스의 개발 수요는 전자상거래 매출 증가와 업계 인프라 개발에 의해 지원되고 있습니다.

- 인도네시아는 무역량에서 ASEAN 지역의 리더입니다. 2023년 6월, DHL Express는 인도네시아에서 24대의 전동 운반 밴을 도입하여 전동 차량을 확대했습니다. DHL Express는 인도네시아에서 4대의 전기 밴과 6대의 전기 자전거를 가동시키고 있어 자카르타와 수라바야에서 서비스를 제공합니다.

- 말레이시아의 무역량은 ASEAN 지역에서 3위입니다. 25년까지 세계 컨테이너 항만 보고서의 상위 10위, 세계은행 물류 퍼포먼스 인덱스의 상위 30위에 들어가는 것을 목표로 하고 있습니다.

ASEAN 도로화물 운송 시장 동향

각국 정부의 인프라 건설 프로젝트에 뒷받침된 ASEAN 국가에 대한 직접 투자 증가로 경제 성장 견인

- 2024년 5월 일본 정부는 인도네시아 자카르타에 고속철도를 건설하기 위해 약 1,407억엔(9억 달러)의 대출을 발표했습니다. 이 동서철도 프로젝트는 84.1km를 커버해 2026년부터 2031년까지 2기로 나누어 완성합니다. 이 새로운 철도선은 기차 및 신호 시스템에 일본 기술을 채택합니다. 이와 같은 대처에 의해 운수 및 창고 부문으로부터 GDP 공헌이 기대됩니다.

- 2024년 2월 운수부는 태국 인프라를 강화하기 위해 2025년 말까지 약 150개의 운송 프로젝트에 188억 3,000만 달러를 투자할 계획을 발표했습니다. 2024년에는 64개 프로젝트가 시작되었으며 31개 프로젝트(112억 3,000만 달러 상당)가 진행 중입니다. 2025년에는 57개의 신규 프로젝트가 계획되어 있으며, 그 총액은 75억 9,000만 달러에 이릅니다. 이러한 구상에는 18개의 고속도로 프로젝트, 9개의 철도 프로젝트, 지역 항만 개발 계획이 포함되며, 이들 모두는 미래의 운송 및 저장 부문의 GDP에 대한 기여를 강화하는 것을 목표로 합니다.

이란 이스라엘 분쟁과 우크라이나 러시아 전쟁이 아세안 국가에 미치는 영향은 연료 가격 상승과 공급망 혼란을 초래했습니다.

- 인도네시아는 Shell과 Chevron이 최근 철수한 후 굴착과 탐사를 촉진하기 위해 2024년 석유 및 가스 부문에 대한 투자가 29% 증가할 것으로 예상하고 있습니다. 2024년에 예정된 투자의 40%를 거출할 예정입니다. 또한 2024년 초, 석유 및 가스성은 이란 이스라엘 분쟁에 의해 원유 가격이 1배럴당 100달러까지 상승할 가능성이 있음에도 불구하고, 가솔린 스탠드의 연료 가격은 적어도 2024년 6월까지 안정될 것으로 발표했습니다.

- 말레이시아에서는 앤왈 이브라힘 총리가 오랜 세월에 걸친 연료 보조금 제도의 개혁에 임한 일환으로 2024년 6월에 디젤 가격이 50% 이상 높아졌습니다. 보조금을 가장 필요로 하는 사람들에게 집중시키는 것으로, 국가 재정의 압박을 완화하는 것을 목적으로 하고 있습니다.

ASEAN 도로화물 운송 산업 개요

ASEAN의 도로화물 운송 시장은 단편화되어 있으며 DHL Group, Konoike Group (Konoike Transport Co., Ltd. 포함), SF Express (KEX-SF), Tiong Nam Logistics Holdings Bhd, "K" Line Logistics, Ltd.의 5사(알파벳순)가 주요 기업입니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 경제활동별 GDP 분포

- 경제활동별 GDP 성장률

- 경제성과 및 프로파일

- 전자상거래 산업의 동향

- 제조업의 동향

- 운수 및 창고업의 GDP

- 물류 실적

- 도로의 길이

- 수출 동향

- 수입 동향

- 연료 가격 동향

- 트럭 운송 비용

- 유형별 트럭 보유 대수

- 주요 트럭 공급업체

- 도로화물 톤수의 동향

- 도로화물 가격 동향

- 모달 점유율

- 인플레이션율

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 최종 사용자 산업

- 농업, 어업, 임업

- 건설업

- 제조업

- 석유 및 가스, 광업, 채석업

- 도소매업

- 기타

- 수출처

- 국내화물

- 국제화물

- 트럭 적재량

- Full Truckload(FTL)

- Less-than-truckload(LTL)

- 컨테이너 수송

- 컨테이너 수송

- 컨테이너 없음

- 수송 거리

- 장거리 수송

- 단거리 수송

- 상품 구성

- 유체상품

- 고체상품

- 온도 제어

- 비온도 제어

- 온도 제어

- 국가명

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타 ASEAN 국가

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- DHL Group

- Gemadept

- Konoike Group(including Konoike Transport Co., Ltd.)

- Mitsui OSK Lines, Ltd.

- Profreight Group

- SF Express(KEX-SF)

- Tiong Nam Logistics Holdings Bhd

- Yatfai

- "K" Line Logistics, Ltd.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 물류 시장 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계 밸류체인 분석

- 시장 역학(시장 성장 촉진요인, 억제요인, 기회)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

- 환율

The ASEAN Road Freight Transport Market size is estimated at 119.4 billion USD in 2025, and is expected to reach 160.1 billion USD by 2030, growing at a CAGR of 6.04% during the forecast period (2025-2030).

Thailand aims for 30% of the total vehicle production to account for electric cars by 2030 through the Electric Vehicle Policy

- Indonesia's manufacturing industry grew by 5.01% in 2022. It was the strongest component of the country's economic growth in terms of productivity. Moreover, Thailand is one of the largest automotive manufacturers in Southeast Asia, producing over 2 million vehicles annually for various household brands. The country's Electric Vehicle Policy aims for 30% of the total vehicle production to account for electric cars by 2030. The Thai government successfully attracted major automotive brands, such as Japanese, European, and US manufacturers, to set up production and export bases in Thailand.

- During the period 2023-2027, the ASEAN e-commerce market is projected to register a CAGR of 11.11%. This growth in the e-commerce market is expected to boost the wholesale and retail trade end-user segment. Moreover, the increase in exploration and production activities is expected to drive the growth of the oil and gas, mining, and quarrying segment. For instance, Indonesia aims to increase its crude oil lifting to 1 million bpd by 2030 and boost efforts to attract investment.

Growing demand for trucking services is supported by rising e-commerce sales and infrastructure development in the industry

- Indonesia is the leader in the ASEAN region in terms of trade volumes. In June 2023, DHL Express expanded its electric fleet in Indonesia with 24 electric transporter vans. The new electric delivery vans will be used in the capital, Jakarta and Bandung. The delivery fleet will also be electrified beyond this. The 24 electric transporters will not be the first electric vehicles in the logistics company's Indonesian fleet. So far, DHL Express has four electric vans and six electric bikes in operation in Indonesia, serving areas in Jakarta and Surabaya.

- Malaysia comes third in the ASEAN region in terms of trade volumes. Malaysia's transport infrastructure and logistics services will be further strengthened under the 12th Malaysia Plan (12MP) during 2021-2025. Under the plan, as part of efforts to drive the transport and logistics industry toward competitiveness, the government aims to be in the top 10 rankings of the World Container Port's Report and top 30 ranks in the World Bank Logistics Performance Index by 2025. Putrajaya (a city in Malaysia) is aiming for a 10% increase in cargo volume via rail in the northern, central, and southern regions of the country.

ASEAN Road Freight Transport Market Trends

Rising FDI in ASEAN countries supported by infrastructure construction projects by country governments driving economic growth

- In May 2024, the Japanese government announced a loan of about JPY140.7 billion (USD 900 million) to build a high-speed rail line in Jakarta, Indonesia. The East-West rail project will cover 84.1 km and be completed in two phases, starting in 2026 and finishing by 2031. The new rail line will feature Japanese technology for trains and signaling systems. Such initiatives are expected to boost GDP contribution from transport and storage sector.

- In February 2024, the Transport Ministry announced plans to invest USD 18.83 billion in around 150 transport projects by the end of 2025 to enhance Thailand's infrastructure. In 2024, 64 projects will commence, with an additional 31 projects valued at USD 11.23 billion in the pipeline. For 2025, there are 57 new projects planned, totaling USD 7.59 billion. These initiatives include 18 motorway projects, 9 railway projects, and plans for regional port development, all aimed at bolstering the transport and storage sector's contribution to GDP in the future.

Impact of the Iran-Israel conflict and Ukraine-Russia war on ASEAN countries led to increased fuel prices and supply chain disruptions

- Indonesia expects a 29% increase in oil and gas sector investments in 2024 to boost drilling and exploration after Shell and Chevron's recent exits. This push is vital for Indonesia to counter a long-term decline in output amid rising financing challenges for fossil fuel projects. Foreign companies like Eni, Exxon Mobil, and BP will contribute 40% of 2024's planned investments. Also, in early 2024, the Ministry of Oil and Gas announced that fuel prices at gas stations will stay stable until at least June 2024, despite the Iran-Israel conflict potentially raising oil prices to USD 100 per barrel.

- Diesel prices in Malaysia surged by over 50% in June 2024 as part of Prime Minister Anwar Ibrahim's efforts to reform the country's long-standing fuel subsidy system. The restructuring aimed to alleviate pressure on national finances by eliminating universal energy subsidies and focusing assistance on those most in need. This move also aims to address issues like the smuggling of subsidized diesel to neighboring countries, where it fetches higher prices.

ASEAN Road Freight Transport Industry Overview

The ASEAN Road Freight Transport Market is fragmented, with the major five players in this market being DHL Group, Konoike Group (including Konoike Transport Co., Ltd.), SF Express (KEX-SF), Tiong Nam Logistics Holdings Bhd and "K" Line Logistics, Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

- 5.8 Country

- 5.8.1 Indonesia

- 5.8.2 Malaysia

- 5.8.3 Thailand

- 5.8.4 Vietnam

- 5.8.5 Rest of ASEAN

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 DHL Group

- 6.4.2 Gemadept

- 6.4.3 Konoike Group (including Konoike Transport Co., Ltd.)

- 6.4.4 Mitsui O.S.K. Lines, Ltd.

- 6.4.5 Profreight Group

- 6.4.6 SF Express (KEX-SF)

- 6.4.7 Tiong Nam Logistics Holdings Bhd

- 6.4.8 Yatfai

- 6.4.9 "K" Line Logistics, Ltd.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate