|

시장보고서

상품코드

1693417

유럽의 폴리우레탄 접착제 시장 : 시장 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Europe Polyurethane Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

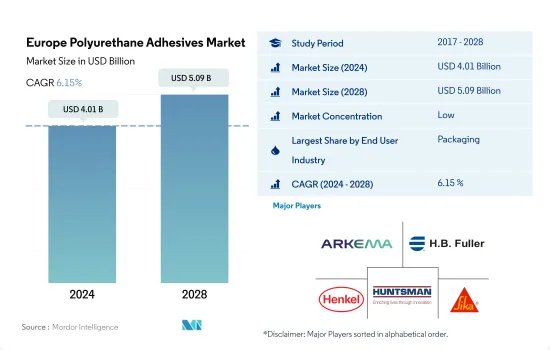

유럽의 폴리우레탄 접착제 시장 규모는 2024년에 40억 1,000만 달러로 평가되었고, 2028년에는 50억 9,000만 달러에 이를 것으로 예측되며, 예측 기간(2024-2028년) 중 CAGR 6.15%로 성장할 것으로 예측됩니다.

신흥 건설 및 포장 최종 용도 부문이 유럽의 폴리우레탄 접착제 소비를 끌어올릴 전망

- 폴리우레탄 접착제는 식음료 포장, 용기 포장, 기능적 장벽 용도의 최종 포장, 금속 포장 등의 포장 업계에서 널리 사용되고 있습니다. 영국은 이 나라 최대의 포장 시장 중 하나입니다. 이 나라의 설계 개선과 기술 혁신은, 포장용 재활용 가능 재료의 사용에 대한 시프트와 맞물려, 시장 성장을 위한 수많은 기회를 제공할 것으로 기대되고 있어, 그 결과, 시장에 신제품을 투입하는 기회를 낳고 있습니다. 영국의 포장 제조업은 110억 영국 파운드의 연간 매출액을 기록하고 있으며, 이것이 이 지역의 포장용 접착제 시장을 견인하고 있는 것으로 보입니다.

- 2020년 COVID-19 팬데믹에 의한 경기 감속 후 유럽 연합 위원회의 부흥 계획, 예를 들면 유럽의 건물을 환경 친화적으로 하고, 자원의 낭비를 줄이기 위해 건설 부문에 자금이 할당된 Next Generation EU 등에 의해 건설 업계에 있어서의 폴리우레탄 접착제 수요는 2021년에 비약적으로 늘어났습니다. 폴리우레탄 건축용 접착제의 전체적인 수요 성장은 덴마크 등 북유럽 국가들이 건설 생산량에서 17.8%의 성장을 보였기 때문에 그 외 유럽의 지역 부문에서 2021년에 가장 높았습니다.

- 유럽에서는 독일이 최대의 헬스케어 산업을 차지하고 있습니다. 이 나라의 건강에 대한 연간 지출은 피트니스와 웰니스를 제외하고 3,750억 유로 이상으로 추정됩니다. 인구 동태 변화와 디지털화 동향으로 헬스케어 지출은 계속 증가하여 예측 기간 동안 이 지역 폴리우레탄 접착제 시장을 견인할 것으로 예상됩니다.

유럽에서는 건설, 포장, 자동차 산업이 증가하고 폴리우레탄 접착제 수요를 향후 촉진할 가능성이 높습니다.

- 2017-2021년 유럽에서 창출된 수요는 전 지역 중 2위에 랭크되었습니다. 이 지역의 자동차, 항공우주, 건축 및 건설 등 최종 사용자 산업의 제조 능력이 높기 때문에 이 지역의 접착제 수요 점유율은 일관되게 세계 수요의 24-25%를 차지하고 있습니다. 이 지역에서는, 핫 멜트나 수용성 기술을 이용한 폴리우레탄 접착제가 수요의 대부분을 낳고 있습니다.

- 2017-2019년 이 지역의 접착제 수요는 CAGR 1.85%로 증가했습니다. 폴리우레탄 접착제 수요의 성장 둔화는 이 지역에서의 건설 활동의 성장 둔화와 자동차 생산의 감소에 기인하고 있습니다. 이러한 최종 사용자 산업으로부터의 수요는, 이 기간에 각각 CAGR 0.44%와 -0.50%로 감소했습니다.

- 2020년에는 운영, 노동력, 원재료, 공급망 및 기타 분야의 제약으로 인해 지역 전체의 모든 최종 사용자 수요가 감소했습니다. 이 지역의 모든 국가의 모든 산업 가운데 독일 신발 산업 및 프랑스 자동차 산업이 가장 큰 타격을 받았으며 전년 같은 기간 대비 수량 기준으로 각각 37.89%와 35.94% 감소했습니다.

- 2021년에는 이 지역의 모든 국가에서 폴리우레탄 접착제 수요가 회복되기 시작했으며 2022년에는 팬데믹 전 수요량을 초과할 것으로 예상됩니다. 이탈리아 수요는 수량 기준으로 전년 대비 8.38% 증가했으며 가장 높은 성장세를 보였습니다. 이 성장 동향은 예측 기간 동안 계속 될 것으로 예상됩니다. 유럽 전체 수요는 예측 기간 동안 CAGR 3.83%로 증가할 것으로 예상됩니다.

유럽의 폴리우레탄 접착제 시장 동향

유럽에서 식품 및 식품 산업의 현저한 성장으로 포장 산업 확대

- 포장은 유럽의 주요 분야 중 하나입니다. 이 지역은 세계 2위의 포장 제품 생산국으로, 아시아태평양에 이어 세계 포장 생산량의 약 24%를 차지하고 있습니다. 독일, 러시아, 스페인, 영국은 유럽에서 포장 제품의 주요 생산 국가입니다. COVID-19 팬데믹의 영향으로 2020년 포장 생산은 2019년에 비해 7.14% 감소한 것으로 보입니다. 이 해 몇 나라에 의해 전국적인 봉쇄가 이루어졌으며, 이 지역의 생산설비는 3-4개월간 정지되었습니다.

- 러시아는 포장 제품의 주요 생산국으로, 2021년에는 2억 1,380만 톤을 생산했으며, 이는 유럽에서 최고입니다. 러시아의 포장 산업은 최근 식음료 산업의 급성장에 의해 크게 견인되었습니다. 러시아는 세계 식품의 주요 수출국이며, 다양한 최종 이용 산업에 걸친 정교한 포장에 대한 요구를 충족시키기 위해 포장 판매에 추가적인 영향을 미치고 있습니다.

- 독일은 유럽의 플라스틱 포장의 주요 생산국입니다. 플라스틱 포장은 2021년에 생산된 포장의 약 79%를 차지했습니다. 플라스틱 포장 산업은 주로 국내 식음료 산업의 급성장에 의해 견인되고 있습니다. 이 지역에서는, 보다 바쁜 라이프 스타일, 보다 큰 소비력 및 관련 요인의 증가에 수반해, 재빠르게 운반할 수 있는 포장 제품의 수요가 증가하고 있습니다. 이러한 동향은 향후 몇 년간 유럽의 포장 제품에서 높아질 것으로 생각됩니다.

신축의 급증과 개축 요구의 고조가 업계를 견인합니다.

- 2020년의 건설업 전체의 수익은 COVID-19에 의한 팬데믹 상황의 영향에 의해 급감했습니다.

- 유럽의 건설 부문 전체 매출은 엄청난 성장을 보였으며, 2021년 전년 대비 성장률은 2020년에 비해 가장 높았습니다. 이것은, '넥스트 제너레이션 EU라고 이름 붙여진 코로나 부흥 계획아래, 전 분야에 7,500억 유로를 투입하는 등의 EU위원회의 대처나 대책이 주효했기 때문입니다. 넥스트 제너레이션 EU 계획에서는 건축물의 그린화와 디지털화라는 유럽의 목표가 기존 건축물과 구조물의 연간 개수율 증가로 이어졌기 때문에 건설 부문이 가장 큰 투자를 받았습니다.

- EUROCONSTRUCT의 보고서에 따르면 EU의 정치적 지역을 기반으로 한 부문 중 중동 유럽의 CAGR은 6.4%, 그 다음 서유럽의 CAGR은 6.1%로 예상됩니다.

- 유럽연합(EU) 및 국가 수준의 정책 입안자는 '건물의 에너지 성능에 관한 지령(Energy Performance of Buildings Directive)'을 비롯한 다양한 정책을 통해 새로운 건물의 건설과 기존 건물의 에너지 효율화를 우선하고 있습니다. 이러한 정책에 의해 예측 기간 동안 건설 전체의 수익이 증가하게 됩니다.

유럽의 폴리우레탄 접착제 산업 개요

유럽의 폴리우레탄 접착제 시장은 세분화되어 있으며 상위 5개 기업에서 25.72%를 차지하고 있습니다. 이 시장의 주요 기업은 다음과 같습니다. Arkema Group, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC and Sika AG(알파벳순 정렬)

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약 및 주요 조사 결과

제2장 보고서 제안

제3장 서문

- 조사의 전제조건 및 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 최종 사용자 동향

- 항공우주

- 자동차

- 건축 및 건설

- 신발 및 가죽

- 포장

- 목공 및 건구

- 규제 프레임워크

- EU

- 러시아

- 밸류체인 및 유통 채널 분석

제5장 시장 세분화

- 최종 사용자 산업별

- 항공우주

- 자동차

- 건축 및 건설

- 신발 및 가죽

- 헬스케어

- 포장

- 목공 및 건구

- 기타 최종 사용자 산업

- 기술별

- 핫멜트

- 반응성

- 용제계

- UV 경화형 접착제

- 수계

- 국가별

- 프랑스

- 독일

- 이탈리아

- 러시아

- 스페인

- 영국

- 기타 유럽

제6장 경쟁 구도

- 주요 전략 동향

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- 3M

- Arkema Group

- Beardow Adams

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Jowat SE

- MAPEI SpA

- Sika AG

- Soudal Holding NV

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계의 접착제 및 실란트 산업의 개요

- 개요

- Porter's Five Forces 분석 프레임워크(산업 매력도 분석)

- 세계의 밸류체인 분석

- 성장 촉진요인, 억제요인 및 기회

- 정보원 및 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The Europe Polyurethane Adhesives Market size is estimated at 4.01 billion USD in 2024, and is expected to reach 5.09 billion USD by 2028, growing at a CAGR of 6.15% during the forecast period (2024-2028).

Emerging construction and packaging end-use sector expected to boost the consumption of polyurethane adhesives in Europe

- Polyurethane adhesives are widely used in the packaging industry for food and beverage packaging, container packaging, end-of-line packaging for functional barrier applications, and metal packaging. The United Kingdom is one of the largest packaging markets in the country. The country's designed improvements and innovation, combined with a shifting focus toward the usage of recyclable materials for packaging, are expected to offer numerous opportunities for market growth, thus, creating opportunities for the launch of new products into the market. The UK packaging manufacturing industry records annual sales of GBP 11 billion, which is likely to drive the market for packaging adhesives in the region.

- The demand for polyurethane adhesives in the construction industry grew tremendously in 2021 because of the European Union's Commission's recovery plan post an economic slowdown due to the COVID-19 pandemic in 2020, such as Next Generation EU in which a fund has been allocated for the construction sector to make European buildings environmentally benign and reduce the wastage of resources. The overall growth in demand for polyurethane construction adhesives was the highest in 2021 for the Rest of Europe regional segment because of the Nordic countries, such as Denmark, which witnessed a 17.8% growth in their construction output.

- In Europe, Germany accounts for the largest healthcare industry. The annual expenditure on health in the country is estimated to be more than EUR 375 billion, excluding fitness and wellness. Owing to its demographic changes and digitalization trends, healthcare expenditure is expected to continue rising and drive the polyurethane adhesives market in the region over the forecast period.

Rising construction, packaging and automotive industries in Europe likely to propel the demand for polyurethane adhesives in the future

- In the period 2017 to 2021, the demand generated from the Europe region ranked 2rd among all regions. The share of adhesive demand from this region has consistently occupied 24-25% of the global demand because of the high manufacturing capacity of end-user industries, like automotive, aerospace, building and construction, and other industries in the region. Polyurethane adhesives with hot melt and water-borne technologies generate most of the demand in the region.

- From 2017 to 2019, the demand for adhesives from this region increased with a CAGR of 1.85%. The slow growth in the demand for polyurethane adhesives has resulted in slow growth in construction activities and a decrease in Automotive production in the region. The demand from these end-user industries declined with a CAGR of 0.44% and -0.50%, respectively, during this period.

- In 2020, due to constraints in operations, labor, raw material, supply chain, and other areas, the demand from all end users across the region declined. Among all Industries from all countries in the region, the footwear industry in Germany and the automotive industry in France took the worst hit, declining by 37.89% and 35.94%, respectively, in Y-o-Y volume terms.

- In 2021, the demand for polyurethane adhesives started to recover from all countries in the region and is expected to outgrow pre-pandemic demand volume by 2022. The demand from Italy has witnessed the highest Y-o-Y growth of 8.38% in volume terms. This growth trend is expected to continue during the forecast period. The overall demand from the Europe region is expected to increase with a CAGR of 3.83% during the forecast period.

Europe Polyurethane Adhesives Market Trends

Significant growth of food & beverage industry in Europe to escalate packaging industry

- Packaging is one of the major sectors of Europe region. The region is the second-largest producer of packaging products in the world, which holds about 24% of global packaging production after the Asia-Pacific region. Germany, Russia, Spain, and the United Kingdom are major producers of packaging products in Europe. It is seen that packaging production reduced by 7.14% in 2020 compared to 2019 due to the impact of the COVID-19 pandemic. During the year, a nationwide lockdown imposed by several countries halted the production facilities for three to four months in the region.

- Russia is a leading producer of packaging products producing 213.8 million tons in 2021, which is the highest in Europe. The Russian packaging industry has majorly been driven by the rapid growth of the food and beverages industry in recent years. Russia is a major exporter of food products worldwide, which further influences packaging sales to meet the need for sophisticated packaging across various-end use industries.

- Germany is the major producer of plastic packaging in Europe. Plastic packaging which nearly accounts for around 79% of the packaging produced in 2021. The plastic packaging industry is majorly driven by the rapid growth of the food and beverages industry in the country. With the rise in busier lifestyles, greater spending power, and related factors in the region, the demand for quick and on-the-go packaged products is increasing. This trend will rise in packaging products in the coming years in Europe.

Rapid growth of new construction along with rising need for renovation activities will drive the industry

- The overall revenue of construction showed a steep decrement in 2020 because of the impact of the pandemic situation due to COVID-19, which led to an overall recovery slowdown and social distancing measures on work sites.

- The overall revenue of the construction sector in Europe grew tremendously, with the highest year-on-year growth in 2021 compared to that of 2020 because of the initiatives and measures taken by the EU Commission, such as the infusion of EUR 750 billion for all sectors under the COVID recovery plan named Next Generation EU. Under the Next Generation EU plan, the construction sector received the maximum investment because of the European objective of green and digital transition in buildings which led to growth in the annual renovation rate of existing buildings and structures.

- As per the EUROCONSTRUCT report, among the segments of the European Union based on political geography, Central and Eastern Europe are expected to register a CAGR of 6.4%, followed by Western Europe at a CAGR of 6.1% in 2022-2024.

- The policymakers at European Union and national level are prioritizing the construction of new buildings and conversion of existing buildings to be energy efficient through various policies including Energy Performance of Buildings Directive and others. These policies will lead to an increase in overall revenue for construction in the forecast period.

Europe Polyurethane Adhesives Industry Overview

The Europe Polyurethane Adhesives Market is fragmented, with the top five companies occupying 25.72%. The major players in this market are Arkema Group, H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman International LLC and Sika AG (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Footwear and Leather

- 4.1.5 Packaging

- 4.1.6 Woodworking and Joinery

- 4.2 Regulatory Framework

- 4.2.1 EU

- 4.2.2 Russia

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2028 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Footwear and Leather

- 5.1.5 Healthcare

- 5.1.6 Packaging

- 5.1.7 Woodworking and Joinery

- 5.1.8 Other End-user Industries

- 5.2 Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured Adhesives

- 5.2.5 Water-borne

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Russia

- 5.3.5 Spain

- 5.3.6 United Kingdom

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 3M

- 6.4.2 Arkema Group

- 6.4.3 Beardow Adams

- 6.4.4 H.B. Fuller Company

- 6.4.5 Henkel AG & Co. KGaA

- 6.4.6 Huntsman International LLC

- 6.4.7 Jowat SE

- 6.4.8 MAPEI S.p.A.

- 6.4.9 Sika AG

- 6.4.10 Soudal Holding N.V.

7 KEY STRATEGIC QUESTIONS FOR ADHESIVES AND SEALANTS CEOS

8 APPENDIX

- 8.1 Global Adhesives and Sealants Industry Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Drivers, Restraints, and Opportunities

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms