|

시장보고서

상품코드

1795410

폴리우레탄 접착제 시장 : 유형별, 기술별, 용도별, 지역별 예측(-2030년)Polyurethane Adhesives Market by Type, Technology, Application, and Region - Global Forecast to 2030 |

||||||

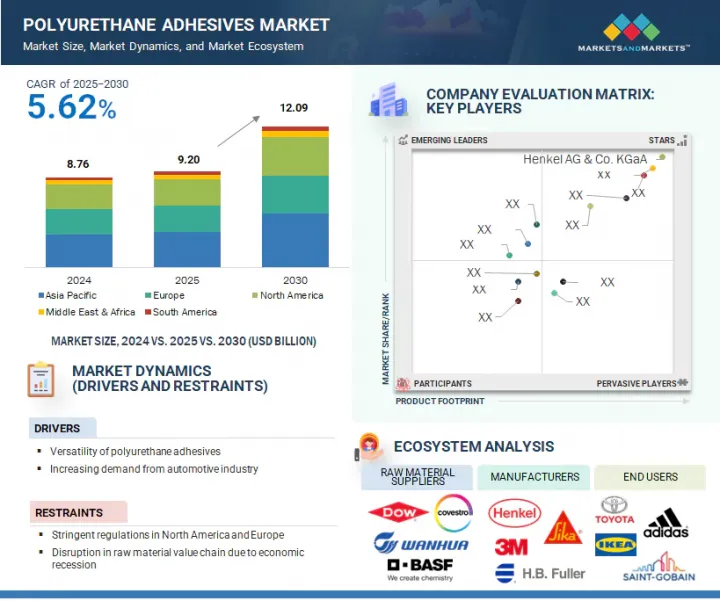

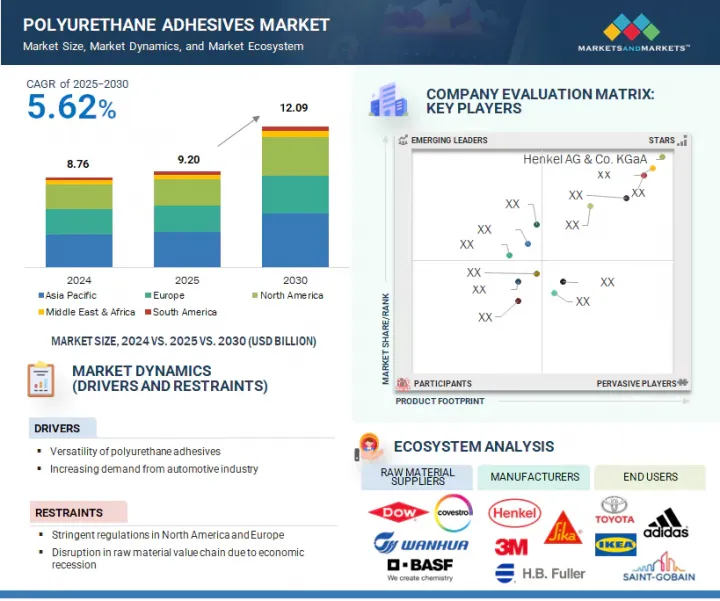

세계의 폴리우레탄 접착제 시장 규모는 2024년 87억 6,000만 달러에서 2030년까지 120억 9,000만 달러에 이를 것으로 예측되며, CAGR 5.62%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 킬로톤 |

| 부문 | 유형, 기술, 용도 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 중동, 아프리카, 남미 |

"열경화성 부문이 2025년 폴리우레탄 접착제 시장을 선도할 것으로 추정됩니다."

유형별로 열경화성 부문은 2024년 폴리우레탄 접착제 시장을 독점했습니다. 이 성장의 주요 요인은 우수한 기계적 강도, 우수한 내구성, 내 환경 열화성입니다. 이러한 유형의 접착제는 높은 응력과 영구적인 접착이 필수적인 자동차, 건설 및 양말 산업에서 널리 적용됩니다. 열경화성 수지는 경화시에 형성되는 비가역적인 가교결합에 의해 구조적 용도로 사용되어 열, 화학물질, 습기에 노출되는 조건 하에서 높은 성능을 발휘하는 것으로 입증되었습니다. 저렴하고 다양한 산업에서 사용할 수 있는 유연성 때문에 대량 생산에 적합한 접착제가 되고 있습니다. 내구성이 뛰어나고 강도가 높은 접착제에 대한 세계 수요가 감소하지 않고 증가하고 있기 때문에 열경화성 PU 접착제는 폴리우레탄 접착제 시장에서 일류 유형이 되는 페이스를 유지할 가능성이 높습니다.

"100% 고형분 부문이 2025년 폴리우레탄 접착제 시장을 선도할 것으로 추정됩니다."

기술별로는 100% 고형분 부문이 2025년에 폴리우레탄 접착제 시장을 금액 기준으로 선도할 것으로 추정됩니다. 이 부문의 성장은 환경 지속가능성, 작업자의 안전성 및 저배출 물질의 세계 동향 증가로 인한 것으로 보입니다. 100% 고형분 접착제는 휘발성 유기 화합물(VOC)의 배출이 적기 때문에 특히 북미와 유럽에서 엄격한 환경 기준에 적합합니다. 낮은 냄새, 불연성, 빠른 경화 접착제의 사용은 가구, 자동차 인테리어, 포장 등의 용도로 꾸준히 증가하고 있습니다. 산업계와 소비자가 환경 친화적인 솔루션을 중시하고 있기 때문에 제조업체는 수성 기술로 전환하고 있으며 다양한 분야에서 수성 기술의 채택이 급속히 진행되고 있습니다.

“중동 및 아프리카가 예측 기간에 폴리우레탄 접착제 시장에서 금액 기준으로 2번째로 급성장하는 지역이 될 전망입니다.”

중동 및 아프리카가 예측 기간에 두 번째로 급성장하는 시장이 될 전망입니다. 2025-2030년에 CAGR로 6.61%의 성장이 예측됩니다. 건설 작업, 산업 확대, 석유 자원을 기반으로 한 경제의 다양화가 이 지역의 성장을 추진하는 주요 요인입니다. 아랍에미리트(UAE), 사우디아라비아, 남아프리카와 같은 국가들은 거대한 인프라와 상업 구조에 투자하기 때문에 고급 접착제에 대한 수요가 높습니다. 또한, 가처분 소득 증가는 가구, 실내 장식, 포장 등의 최종 용도 시장에서 PU 접착제 수요를 촉진하고 있으며, PU 접착제는 강도, 유연성, 환경 안정성이 뛰어난 것으로 입증되었습니다. 시장 성장은 이 지역이 외국인 투자와 신기술의 채택에 적극적으로 노력하고 있기 때문에 뒷받침되고 있습니다.

본 보고서에서는 세계의 폴리우레탄 접착제 시장에 대해 조사 분석하여 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 폴리우레탄 접착제 시장에서의 매력적인 기회

- 폴리우레탄 접착제 시장 : 지역별

- 아시아태평양의 폴리우레탄 접착제 시장 : 유형별, 주요 국가별

- 폴리우레탄 접착제 시장 : 용도별, 지역별

- 폴리우레탄 접착제 시장 : 주요 국가별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 거시경제 전망

- 공급망 분석

- 원재료 공급자

- 폴리우레탄 접착제 제조업체

- 유통 네트워크

- 최종 사용자

- 가격 설정 분석

- 폴리우레탄 접착제의 평균 판매 가격의 동향 : 주요 기업별(2024년)

- 평균 판매 가격의 동향 : 지역별(2022-2030년)

- 고객사업에 영향을 주는 동향 및 혼란

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 사례 연구 분석

- 무역 분석

- 수입 데이터(HS 코드 3506)

- 수출 시나리오(HS 코드 3506)

- 규제 상황

- 세계 : 규제기관, 정부기관, 기타 조직

- 규제 틀

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 투자 및 자금조달 시나리오

- 특허 분석

- 접근

- 문서 유형

- 주요 출원자

- 관할분석

- 미국의 2025년 관세

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 미치는 영향

- 폴리우레탄 접착제 시장에 대한 AI 및 생성형 AI의 영향

제6장 폴리우레탄 접착제 시장 : 용도별

- 소개

- 자동차

- 건축 및 건설

- 포장

- 가죽 및 신발

- 일반 공업

- 가구 및 장식

- 기타

제7장 폴리우레탄 접착제 시장 : 기술별

- 소개

- 100% 고형분

- 용제계

- 디스퍼전

- 기타

제8장 폴리우레탄 접착제 시장 : 유형별

- 소개

- 열경화성

- 열가소성

제9장 폴리우레탄 접착제 시장 : 기재별

- 소개

- 금속

- 플라스틱

- 목재

- 유리

- 종이

제10장 폴리우레탄 접착제 시장 : 지역별

- 소개

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 대만

- 태국

- 말레이시아

- 기타 아시아태평양

- 유럽

- 독일

- 프랑스

- 이탈리아

- 영국

- 기타 유럽

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

제11장 경쟁 구도

- 소개

- 주요 기업이 채용한 전략의 개요

- 시장 점유율 분석

- 수익 분석

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 브랜드 비교

- 기업 평가 및 재무 지표

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 기업

- HENKEL AG & CO. KGAA

- HB FULLER COMPANY

- DOW

- SIKA AG

- 3M COMPANY

- HUNTSMAN INTERNATIONAL LLC

- ARKEMA

- ILLINOIS TOOL WORKS INC.

- JOWAT SE

- PARKER HANNIFIN CORP

- 기타 기업

- DYMAX

- FRANKLIN INTERNATIONAL

- HEXCEL CORPORATION

- SCOTT BADER COMPANY LTD

- MAPEI

- MASTER BOND

- PIDILITE INDUSTRIES LTD

- DELO

- PERMABOND

- PARSON ADHESIVES, INC.

- SOUDAL GROUP

- DAUBERT CHEMICAL COMPANY

- IMAWELL

- AKZO NOBEL NV

- HELMITIN ADHESIVES

제13장 인접 시장과 관련 시장

- 소개

- 제한 사항

- 구조용 접착제 시장

- 시장의 정의

- 시장 개요

- 구조용 접착제 시장 : 지역별

- 아시아태평양

- 북미

- 유럽

- 남미

- 중동 및 아프리카

제14장 부록

JHS 25.08.28The polyurethane adhesives market size is projected to grow from USD 8.76 billion in 2024 to USD 12.09 billion by 2030 at a CAGR of 5.62%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Technology, and Application |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"The thermoset segment is estimated to lead the polyurethane adhesives market in 2025."

By type, the thermoset segment dominated the polyurethane adhesives market in 2024. The main causative factors for this growth are their superb mechanical strength, good durability, and environmental degradation resistance. These kinds of adhesives find extensive applications in the automotive, construction, and footwear industries, where high stress and permanent bonding are essential. Thermosets are used in a structural application due to the irreversible cross-linked bonds formed upon curing, which have been demonstrated to provide high performance in heat, chemical, and moisture exposure conditions. They are cheap and have the flexibility to be used in various industries, which makes them the preferred adhesive in mass production. With the increasing global demand for durable and high-strength adhesives without diminishing, thermoset PU adhesives will likely sustain their pace in becoming the top-notch type in the polyurethane adhesives market.

"The 100% solids segment is estimated to lead the polyurethane adhesives market in 2025."

By technology, the 100% solids segment is estimated to lead the polyurethane adhesives market in 2025, in terms of value. The growth of this segment can be attributed to the increasing trend in the world of environmental sustainability, worker safety, and low-emission materials. 100% solid adhesives have low emissions of volatile organic compounds (VOCs); thus, the adhesives conform to stringent environmental standards, especially in North America and Europe. The use of low odor, non-flammable, and rapid-curing adhesives is steadily rising in furniture, automotive interior, packaging, and other applications. Since industries and consumers focus on green solutions, manufacturers are moving toward water-based technologies, and this has seen a swift adoption of water-based technology in various fields.

"Middle East & Africa is projected to be the second-fastest-growing region in the polyurethane adhesives market, in terms of value, during the forecast period."

The Middle East & Africa is projected to be the second-fastest-growing market during the forecast period. It is projected to grow at a CAGR of 6.61% between 2025 and 2030. Construction works, expansion of industries, and the diversification of economies based on oil resources are the main factors that propel the region's growth. Nations such as the UAE, Saudi Arabia, and South Africa invest in mega infrastructure and commerce structures, so premium quality adhesives are in high demand. Additionally, the increase in disposable income is driving the demand for PU adhesives in the end-use markets, such as furniture, interior decoration, and packaging, where they are proving to be better in strength, flexibility, and environmental stability. Market growth is also boosted by the region's progressive exposure to foreign investments and the adoption of new technologies.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of World - 5%

The key players profiled in the report include Henkel AG & Co. KGaA (Germany), H.B. Fuller (US), Sika AG (Switzerland), Dow Inc. (US), 3M Company (US), Huntsman Corporation (US), Arkema (France), Illinois Tool Works Inc. (US), and Parker-Hannifin Corporation (US), and Jowat SE (Germany).

Research Coverage

The polyurethane adhesives market is segmented by type, technology, application, and region. It provides value estimations (USD Million) for the overall market size across various areas. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies.

Reasons to Buy this Report

This research report is focused on various levels of analysis, industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the polyurethane adhesives market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on polyurethane adhesives offered by top players in the global market

- Analysis of key drivers: (Versatility of polyurethane adhesives, increasing demand from automotive industry), restraints (stringent regulations in North America and Europe, disruption in raw material value chain due to economic recession), opportunities (growing urbanization and construction industry, greater opportunities in Asia Pacific and Middle East), and challenges (application determined by various external factors) influencing the growth of polyurethane adhesives market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the polyurethane adhesives market

- Market Development: Comprehensive information about lucrative emerging markets across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global polyurethane adhesives market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the polyurethane adhesives market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.3.4 MARKET DEFINITION AND INCLUSIONS, BY TECHNOLOGY

- 1.3.5 MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNIT CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY-SIDE ANALYSIS

- 2.4.2 DEMAND-SIDE ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYURETHANE ADHESIVES MARKET

- 4.2 POLYURETHANE ADHESIVES MARKET, BY REGION

- 4.3 ASIA PACIFIC: POLYURETHANE ADHESIVES MARKET, BY TYPE AND KEY COUNTRY

- 4.4 POLYURETHANE ADHESIVES MARKET, BY APPLICATION AND REGION

- 4.5 POLYURETHANE ADHESIVES MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Versatility of polyurethane adhesives

- 5.2.1.2 Increasing demand from automotive industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent regulations in North America and Europe

- 5.2.2.2 Disruption in raw material value chain due to economic recession

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid urbanization and growing construction industry

- 5.2.3.2 Opportunities in Asia Pacific and Middle East

- 5.2.4 CHALLENGES

- 5.2.4.1 External factors influencing applications

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT FROM NEW ENTRANTS

- 5.3.2 THREAT FROM SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC OUTLOOK

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 RAW MATERIAL SUPPLIERS

- 5.6.2 POLYURETHANE ADHESIVE MANUFACTURERS

- 5.6.3 DISTRIBUTION NETWORKS

- 5.6.4 END USERS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF POLYURETHANE ADHESIVES, BY KEY PLAYER, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 One-component, moisture-cured polyurethane adhesives

- 5.10.1.2 Two-component polyurethane adhesives

- 5.10.1.3 Reactive hot melt polyurethane adhesives (RHM/PUR hot melts)

- 5.10.2 COMPLIMENTARY TECHNOLOGIES

- 5.10.2.1 Primer & surface treatment technologies

- 5.10.2.2 Green chemistry & bio-based polyols

- 5.10.1 KEY TECHNOLOGIES

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 MOISTURE-CURE POLYURETHANE ADHESIVES INTRODUCED AS ALTERNATIVE THAT FORMS HIGHLY ELASTIC, DURABLE BONDS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 3506)

- 5.12.2 EXPORT SCENARIO (HS CODE 3506)

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 REGULATORY FRAMEWORK

- 5.13.2.1 REACH Regulation (European Union)

- 5.13.2.2 Circular Economy Action Plan (European Union)

- 5.13.2.3 Clean Air Act (United States)

- 5.13.2.4 TSCA (Toxic Substances Control Act) (United States)

- 5.13.2.5 ISO 9001 and ISO 14001 Standards (Global)

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 PATENT ANALYSIS

- 5.16.1 APPROACH

- 5.16.2 DOCUMENT TYPES

- 5.16.3 TOP APPLICANTS

- 5.16.4 JURISDICTION ANALYSIS

- 5.17 US 2025 TARIFF

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.18 IMPACT OF AI/GEN AI ON POLYURETHANE ADHESIVES MARKET

6 POLYURETHANE ADHESIVES MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- 6.2 AUTOMOTIVE

- 6.2.1 RISING DEMAND FOR LIGHTWEIGHT VEHICLES TO BOOST MARKET

- 6.3 BUILDING & CONSTRUCTION

- 6.3.1 INCREASING DEMAND FOR ADHESIVES FROM RESIDENTIAL HOUSING SEGMENT TO DRIVE MARKET

- 6.4 PACKAGING

- 6.4.1 INCREASING USE OF FLEXIBLE LAMINATES IN FOOD, MEDICAL, AND E-COMMERCE SEGMENTS TO PROPEL MARKET

- 6.5 LEATHER & FOOTWEAR

- 6.5.1 FLEXIBILITY, STRENGTH, AND DURABILITY OF POLYURETHANE ADHESIVES TO SUPPORT MARKET GROWTH

- 6.6 GENERAL INDUSTRIAL

- 6.6.1 NON-TOXICITY AND ECO-FRIENDLINESS OF POLYURETHANE ADHESIVES TO DRIVE MARKET

- 6.7 FURNITURE & DECORATION

- 6.7.1 RAPID GROWTH IN CONSTRUCTION INDUSTRY TO DRIVE MARKET

- 6.8 OTHERS

7 POLYURETHANE ADHESIVES MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 100% SOLIDS

- 7.2.1 NEED FOR LOW VOC EMISSIONS TO BOOST MARKET

- 7.3 SOLVENT-BORNE

- 7.3.1 COMPATIBILITY OF SOLVENT-BORNE ADHESIVES WITH VARIOUS SUBSTRATES TO DRIVE MARKET

- 7.4 DISPERSION

- 7.4.1 INCREASING GOVERNMENT REGULATIONS FOR VOC EMISSIONS TO PROPEL MARKET

- 7.5 OTHERS

8 POLYURETHANE ADHESIVES MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 THERMOSET

- 8.2.1 RISING DEMAND FOR THERMOSET POLYURETHANE ADHESIVES ACROSS INDUSTRIES TO BOOST MARKET

- 8.2.2 POLYESTER RESIN

- 8.2.3 POLYETHER RESIN

- 8.3 THERMOPLASTIC

- 8.3.1 DEMAND FOR ADJUSTABLE SEALING TEMPERATURES AND CUSTOM FORMULATIONS TO DRIVE MARKET

- 8.3.2 ALIPHATIC RESIN

9 POLYURETHANE ADHESIVES MARKET, BY SUBSTRATE

- 9.1 INTRODUCTION

- 9.2 METAL

- 9.2.1 METAL OFFERS STRUCTURAL BONDING AND CORROSION-RESISTANT SUBSTRATES

- 9.3 PLASTIC

- 9.3.1 PLASTIC OFFERS FLEXIBILITY AND COMPATIBILITY WITH LOW-ENERGY SURFACES

- 9.4 WOOD

- 9.4.1 WOOD OFFERS MOISTURE RESISTANCE AND DEEP PENETRATION

- 9.5 GLASS

- 9.5.1 GLASS OFFERS CLARITY, ELASTICITY, AND WEATHER STABILITY ACROSS VARIOUS FORMULATIONS

- 9.6 PAPER

- 9.6.1 PAPER IS USED MAINLY FOR ITS LIGHTWEIGHT, FLEXIBLE BONDING FOR PACKAGING

10 POLYURETHANE ADHESIVES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 Developments in construction industry to drive market

- 10.2.2 JAPAN

- 10.2.2.1 Infrastructural developments to boost demand

- 10.2.3 SOUTH KOREA

- 10.2.3.1 Growth in automotive industry to fuel demand

- 10.2.4 INDIA

- 10.2.4.1 Government initiatives to boost economy and contribute to market growth

- 10.2.5 TAIWAN

- 10.2.5.1 Growth in construction industry to influence market growth

- 10.2.6 THAILAND

- 10.2.6.1 Growing automotive sector to contribute to market growth

- 10.2.7 MALAYSIA

- 10.2.7.1 Favorable business policies to spur market growth

- 10.2.8 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Changing trends in food packaging industry to boost demand

- 10.3.2 FRANCE

- 10.3.2.1 Growth in construction and automotive industries to boost market

- 10.3.3 ITALY

- 10.3.3.1 Aerospace and automotive industries to offer growth potential

- 10.3.4 UK

- 10.3.4.1 Implementation of innovative and energy-efficient technologies in household appliances to drive market

- 10.3.5 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Growth in major end-use industries to boost demand

- 10.4.2 CANADA

- 10.4.2.1 Automotive sector to drive demand for polyurethane adhesives

- 10.4.3 MEXICO

- 10.4.3.1 Growing use of polyurethane adhesives in automotive industry to drive market

- 10.4.1 US

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Rapid growth in automotive industry to boost demand for polyurethane adhesives

- 10.5.2 ARGENTINA

- 10.5.2.1 Rapid growth in economy to propel market

- 10.5.3 REST OF SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

- 10.6.1.1 Saudi Arabia

- 10.6.1.1.1 Increasing car sales to support market

- 10.6.1.2 Rest of GCC Countries

- 10.6.1.1 Saudi Arabia

- 10.6.2 SOUTH AFRICA

- 10.6.2.1 Rising awareness about advantages of polyurethane adhesives among local manufacturers to drive market

- 10.6.3 REST OF MIDDLE EAST & AFRICA

- 10.6.1 GCC COUNTRIES

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Type footprint

- 11.5.5.4 Technology footprint

- 11.5.5.5 Application footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMES

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 BRAND COMPARISON

- 11.8 COMPANY VALUATION AND FINANCIAL METRICS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- 11.9.2 EXPANSION

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 HENKEL AG & CO. KGAA

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Expansion

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 H.B. FULLER COMPANY

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.3.2 Expansion

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 DOW

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 SIKA AG

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 3M COMPANY

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 HUNTSMAN INTERNATIONAL LLC

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.7 ARKEMA

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 ILLINOIS TOOL WORKS INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 JOWAT SE

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 PARKER HANNIFIN CORP

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.1 HENKEL AG & CO. KGAA

- 12.2 OTHER PLAYERS

- 12.2.1 DYMAX

- 12.2.2 FRANKLIN INTERNATIONAL

- 12.2.3 HEXCEL CORPORATION

- 12.2.4 SCOTT BADER COMPANY LTD

- 12.2.5 MAPEI

- 12.2.6 MASTER BOND

- 12.2.7 PIDILITE INDUSTRIES LTD

- 12.2.8 DELO

- 12.2.9 PERMABOND

- 12.2.10 PARSON ADHESIVES, INC.

- 12.2.11 SOUDAL GROUP

- 12.2.12 DAUBERT CHEMICAL COMPANY

- 12.2.13 IMAWELL

- 12.2.14 AKZO NOBEL N.V.

- 12.2.15 HELMITIN ADHESIVES

13 ADJACENT & RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 STRUCTURAL ADHESIVES MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 STRUCTURAL ADHESIVES MARKET, BY REGION

- 13.4.1 ASIA PACIFIC

- 13.4.2 NORTH AMERICA

- 13.4.3 EUROPE

- 13.4.4 SOUTH AMERICA

- 13.4.5 MIDDLE EAST & AFRICA

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS