|

시장보고서

상품코드

1693622

인도의 전기 버스 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)India Electric Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

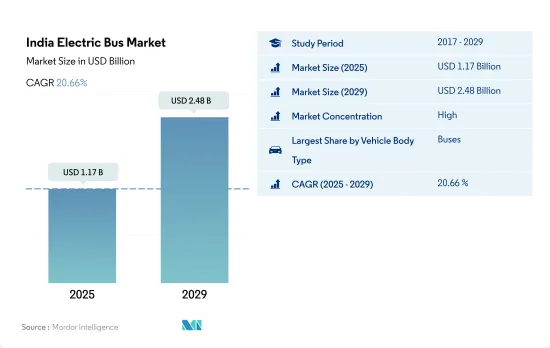

인도의 전기 버스 시장 규모는 2025년 11억 7,000만 달러로 예측되며, 2029년에는 24억 8,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2029년) CAGR 20.66%로 성장할 것으로 예측됩니다.

인도 전기 버스 시장 동향

정부의 이니셔티브와 엄격한 규범이 인도 전기자동차 시장의 급성장을 견인

- 인도의 전기자동차(EV) 시장은 성장 단계에 있으며 정부가 공해 대책 전략을 적극적으로 책정하고 있습니다. 2015년 시작된 Fame India 스킴은 자동차의 전동화를 추진하는데 있어 매우 중요한 역할을 했습니다.

- 인도 전역의 주정부는 내연기관(ICE) 버스에서의 이행을 목표로 하여 전기버스를 도입하는 경우가 늘고 있습니다. 주목할 활동으로, 델리 정부는 2021년 3월에 300대의 신형 저상 전기(AC) 버스의 조달을 허가해, 그 중 100대는 2022년 1월에 도로에 투입되었습니다.

- 전기차 수요는 정부의 엄격한 기준 도입에 힘입어 최근에 급증하고 있습니다. 2021년 8월 인도 정부는 차량 스크랩 정책을 발표하고 연식에 관계없이 오염 및 부적합 차량을 단계적으로 폐지하는 것을 목표로 했습니다. 이 정책은 2024년까지 시행되고 있으며 소비자를 전기자동차로 유도하고 있습니다. 또한 정부는 2030년까지 인도 전차의 30%를 전동화하겠다는 야심찬 목표를 내걸고 있습니다. 이러한 노력으로 인도에서는 2024-2030년간 전기차 판매가 촉진될 전망입니다.

인도 전기 버스 산업 개요

인도의 전기 버스 시장은 상당히 통합되어 있으며 상위 5개 기업에서 79.05%를 차지합니다. 이 시장 주요 기업은 JBM Auto Limited, Olectra Greentech Ltd., PMI Electro Mobility Solutions Pvt. Ltd., Switch Mobility(Ashok Leyland Limited) and Tata Motors Limited입니다(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 GDP

- 자동차 구매를 위한 소비자 지출(cvp)

- 인플레이션율

- 자동차 대출 금리

- 공유 라이드

- 전동화의 영향

- EV 충전소

- 배터리 팩 가격

- Xev 신모델 발표

- 연료 가격

- OEM 생산 통계

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 연료 카테고리

- BEV

- FCEV

- HEV

- PHEV

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Eicher Motors Ltd.

- JBM Auto Limited

- Olectra Greentech Ltd.

- PMI Electro Mobility Solutions Pvt. Ltd.

- Solaris Bus & Coach SA

- Switch Mobility(Ashok Leyland Limited)

- Tata Motors Limited

- VE Commercial Vehicles Limited

- Volvo Buses India Private Limited

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Porter's Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The India Electric Bus Market size is estimated at 1.17 billion USD in 2025, and is expected to reach 2.48 billion USD by 2029, growing at a CAGR of 20.66% during the forecast period (2025-2029).

India Electric Bus Market Trends

Government initiatives and stringent norms drive rapid growth in the electric vehicle market in India

- India's electric vehicle (EV) market is in a growth phase, with the government actively formulating strategies to combat pollution. The Fame India scheme, launched in 2015, has played a pivotal role in driving vehicle electrification. Building on its success, Fame Phase 2, active till April 2022, further bolstered EV sales, especially in 2021, with the government offering subsidies like INR 10,000 grants for electric cars with battery capacities up to 15 kWh.

- State governments across India are increasingly incorporating electric buses into their fleets, aiming to transition from internal combustion engine (ICE) buses. This move not only cuts operational costs but also curbs carbon emissions and improves air quality. In a notable move, the Delhi government greenlit the procurement of 300 new low-floor electric (AC) buses in March 2021, with 100 of them hitting the roads in January 2022. These initiatives contributed to a significant 62.58% surge in demand for electric commercial vehicles in India in 2022 over 2021.

- The demand for electric cars has surged in recent times, driven by the government's introduction of stringent norms. In August 2021, the Indian government unveiled the Vehicle Scrappage Policy, targeting the phasing out of polluting and unfit vehicles, irrespective of their age. This policy, set to be implemented by 2024, is steering consumers toward electric cars. Additionally, the government has set an ambitious target of having 30% of all cars in India electrified by 2030. These initiatives are poised to propel electric car sales during the 2024-2030 period in India.

India Electric Bus Industry Overview

The India Electric Bus Market is fairly consolidated, with the top five companies occupying 79.05%. The major players in this market are JBM Auto Limited, Olectra Greentech Ltd., PMI Electro Mobility Solutions Pvt. Ltd., Switch Mobility (Ashok Leyland Limited) and Tata Motors Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Fuel Category

- 5.1.1 BEV

- 5.1.2 FCEV

- 5.1.3 HEV

- 5.1.4 PHEV

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Eicher Motors Ltd.

- 6.4.2 JBM Auto Limited

- 6.4.3 Olectra Greentech Ltd.

- 6.4.4 PMI Electro Mobility Solutions Pvt. Ltd.

- 6.4.5 Solaris Bus & Coach S.A.

- 6.4.6 Switch Mobility (Ashok Leyland Limited)

- 6.4.7 Tata Motors Limited

- 6.4.8 VE Commercial Vehicles Limited

- 6.4.9 Volvo Buses India Private Limited

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms