|

시장보고서

상품코드

1693625

중국의 전기 버스 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)China Electric Bus - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

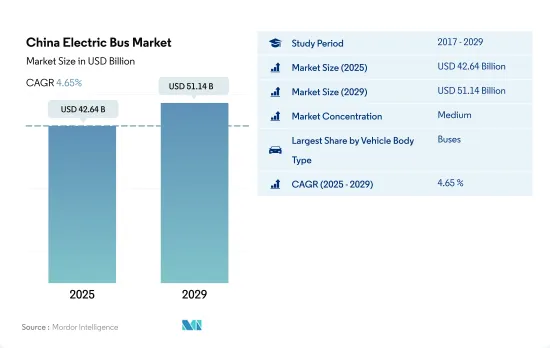

중국의 전기 버스 시장 규모는 2025년 426억 4,000만 달러로 예측되고, 2029년에는 511억 4,000만 달러에 이를 것으로 예측되며, 예측 기간 중(2025-2029년) CAGR 4.65%로 성장할 것으로 예측됩니다.

중국 전기 버스 시장 동향

정부의 이니셔티브와 강력한 OEM 투자가 중국에서 전기자동차 판매의 급성장을 견인

- 자동차 연료로 인한 가스 배출을 줄이기 위해 정부가 시작한 프로그램은 소비자들에게 녹색 자동차로의 전환을 촉구하고 있습니다. 2020년 11월, 중국 정부는 2035년까지 화석연료차를 금지할 것이라고 발표해, 신 에너지 계획 아래, 100% 신에너지차를 판매하는 것을 명언했습니다. 그 결과, 전기차 수요가 증가했습니다.

- 정부는 국내 전기자동차 수요를 촉진하고 강화하기 위해 고객과 제조업체에 다양한 제도와 인센티브를 도입하고 있습니다.

- 전기자동차에 대한 수요가 높아짐에 따라 OEM 각사는 전기자동차 카테고리의 개발과 생산 확대를 계획할 수밖에 없었습니다. 2021년, General Motors는 전기자동차와 자율주행차에 대한 지출을 2025년까지 200억 달러까지 끌어올릴 계획을 발표했습니다. 동사는 2023년까지 20차종의 신형 전기자동차를 발매할 예정으로, 중국에서 연간 100만대 이상의 전기자동차를 판매하는 것을 목표로 하고 있습니다.

중국 전기 버스 산업 개요

중국의 전기버스 시장은 적당히 통합되어 있으며 상위 5개사에서 59.80%를 차지하고 있습니다. 이 시장 주요 기업은 Chery Automobile, Chongqing Changan Automobile Company Limited, King Long United Automotive Industry, Zhejiang Geely Holding Group, Zhengzhou Yutong Bus입니다(알파벳순).

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월의 애널리스트 서포트

목차

제1장 주요 요약과 주요 조사 결과

제2장 보고서 제안

제3장 소개

- 조사의 전제조건과 시장 정의

- 조사 범위

- 조사 방법

제4장 주요 산업 동향

- 인구

- 1인당 GDP

- 자동차 구매를 위한 소비자 지출(cvp)

- 인플레이션율

- 자동차 대출 금리

- 공유 라이드

- 전동화의 영향

- EV 충전소

- 배터리 팩 가격

- Xev 신모델 발표

- 연료 가격

- OEM 생산 통계

- 규제 프레임워크

- 밸류체인과 유통채널 분석

제5장 시장 세분화

- 연료 카테고리

- BEV

- FCEV

- HEV

- PHEV

제6장 경쟁 구도

- 주요 전략적 움직임

- 시장 점유율 분석

- 기업 상황

- 기업 프로파일

- Anhui Ankai Automobile Co. Ltd.

- BYD Auto Co. Ltd.

- Chery Automobile Co. Ltd.

- Chongqing Changan Automobile Company Limited

- CRRC Electric Vehicle Co. Ltd.

- FAW Toyota Motor Co. Ltd.

- Higer Bus Company Ltd.

- King Long United Automotive Industry Co. Ltd.

- Nanjing Golden Dragon Bus Co. Ltd.

- Shanghai Sunwin Bus Corporation.Ltd.

- Zhejiang Geely Holding Group Co. Ltd

- Zhengzhou Yutong Bus Co. Ltd.

- Zhongtong Bus Holding Co. Ltd.

제7장 CEO에 대한 주요 전략적 질문

제8장 부록

- 세계 개요

- 개요

- Five Forces 분석 프레임워크

- 세계의 밸류체인 분석

- 시장 역학(DROs)

- 정보원과 참고문헌

- 도표 일람

- 주요 인사이트

- 데이터 팩

- 용어집

The China Electric Bus Market size is estimated at 42.64 billion USD in 2025, and is expected to reach 51.14 billion USD by 2029, growing at a CAGR of 4.65% during the forecast period (2025-2029).

China Electric Bus Market Trends

Government initiatives and strong OEM investments drive rapid drowth in electric vehicle sales in China

- The programs launched by the government to reduce gas emissions caused by vehicle fuels are encouraging consumers to shift to green vehicles. In November 2020, the government of China announced a ban on fossil fuel vehicles by 2035, clearly stating the selling of 100% new energy vehicles under the new energy program. As a result, the demand for electric cars increased. Adopting such regulations enhanced the sales of electric cars and various types of battery packs used in them in China in recent years.

- The government is introducing various schemes and incentives for customers and manufacturers to promote and enhance the demand for electric vehicles in the country. In May 2022, the government announced the reintroduction of the subsidy program to increase the sales of electric vehicles. Moreover, the government will allocate a subsidy of USD 1500 to customers opting for an electric car. Such factors have encouraged customers to invest in electric mobility, which further has increased the sales of electric cars by 2.90% in 2022 over 2021 in China.

- The growing demand for electric vehicles has forced OEMs to plan to increase development and production in the electric vehicle category. In 2021, General Motors announced its plans to raise its spending on electric and autonomous vehicles to USD 20 billion by 2025. The company is expected to launch 20 new electric models by 2023 and aims to sell more than 1 million electric cars a year in China. As a result, these factors are expected to drive the electric vehicle market in China during the 2024-2030 period.

China Electric Bus Industry Overview

The China Electric Bus Market is moderately consolidated, with the top five companies occupying 59.80%. The major players in this market are Chery Automobile Co. Ltd., Chongqing Changan Automobile Company Limited, King Long United Automotive Industry Co. Ltd., Zhejiang Geely Holding Group Co. Ltd and Zhengzhou Yutong Bus Co. Ltd. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Fuel Price

- 4.12 Oem-wise Production Statistics

- 4.13 Regulatory Framework

- 4.14 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Fuel Category

- 5.1.1 BEV

- 5.1.2 FCEV

- 5.1.3 HEV

- 5.1.4 PHEV

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Anhui Ankai Automobile Co. Ltd.

- 6.4.2 BYD Auto Co. Ltd.

- 6.4.3 Chery Automobile Co. Ltd.

- 6.4.4 Chongqing Changan Automobile Company Limited

- 6.4.5 CRRC Electric Vehicle Co. Ltd.

- 6.4.6 FAW Toyota Motor Co. Ltd.

- 6.4.7 Higer Bus Company Ltd.

- 6.4.8 King Long United Automotive Industry Co. Ltd.

- 6.4.9 Nanjing Golden Dragon Bus Co. Ltd.

- 6.4.10 Shanghai Sunwin Bus Corporation.Ltd.

- 6.4.11 Zhejiang Geely Holding Group Co. Ltd

- 6.4.12 Zhengzhou Yutong Bus Co. Ltd.

- 6.4.13 Zhongtong Bus Holding Co. Ltd.

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms