|

시장보고서

상품코드

1640511

소매 분야 빅데이터 분석 - 시장 점유율 분석, 산업 동향과 통계, 성장 예측(2025-2030년)Big Data Analytics in Retail - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

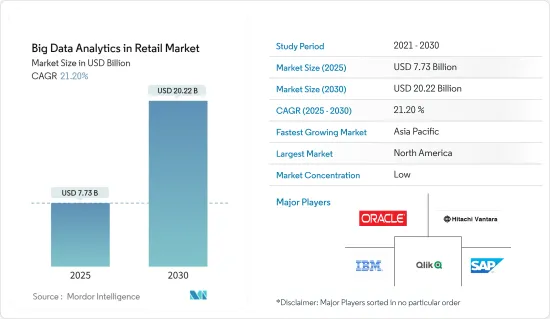

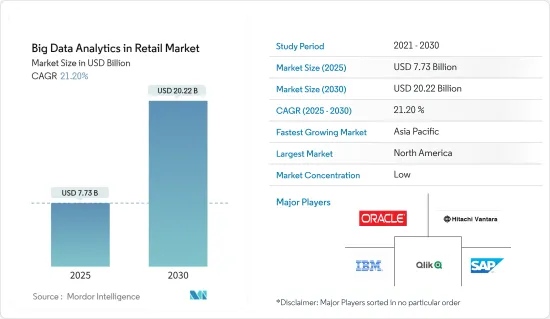

소매업에서의 빅데이터 분석 시장 규모는 2025년에 77억 3,000만 달러로 추정되며, 예측기간(2025-2030년)의 CAGR은 21.2%로, 2030년에는 202억 2,000만 달러에 달할 것으로 예측됩니다.

소매업은 첨단 분석과 빅데이터 기술을 통해 큰 변화를 이루고 있습니다. 전자상거래와 온라인 쇼핑의 성장과 고객 충성도를 둘러싼 경쟁이 치열해지면서 소매업체는 시장 경쟁을 유지하기 위해 빅데이터 분석을 활용하고 있습니다.

주요 하이라이트

- 소매업은 클라우드, AI, 관련 기술의 꾸준한 도입을 목격하고 가장 높은 성장률을 보이는 부문 중 하나입니다. NASSCOM의 조사에 따르면 기업의 70%가 AI를 활용하고 지출을 늘려 수익 확대에 주력하고 있다고 응답하고 있습니다. 예를 들어 세계 최대의 소매업체인 Walmart는 디지털 전환을 진행하고 있습니다. 세계 최대의 프라이빗 클라우드 시스템을 구축 중이며, 매시간 2.5페타바이트의 데이터를 관리할 수 있는 능력을 가질 전망입니다.

- Predictive Analysis(예측 분석)는 소매업체가 소비자의 행동과 시장 동향의 변화로 예상되는 매출 성장을 예측하기 위해 과거 데이터를 활용하는 적극적인 접근 방식입니다. 이를 통해 소매업체는 항상 시대의 첨단을 달리고 효과적인 경쟁을 펼치며 시장 점유율을 대폭 확대할 수 있습니다. 고객과의 지속가능한 관계를 구축하기 위해 판촉 효과의 향상이나 크로스셀링의 추진 등에 도움이 되는 예측 분석을 중시하는 경향이 강해지고 있습니다.

- 소매기업은 소비자 행동에 대한 구조화 또는 비구조화 정보의 양이 계속 증가하고 있는 가운데, 해당 정보에서 인사이트를 이끌어내는 혁신적인 방법을 찾아내려 노력하고 있습니다. 소매업체는 오프라인 온라인에 상관없이 소매 프로세스의 모든 단계에서 빅데이터 분석을 적용하여 고객의 구매 행동을 이해하고, 이를 상품에 매핑하며, 상품을 판매하기 위한 마케팅 전략을 수립하고, 이익을 증대시키는 데이터 우선 전략을 채택하고 있습니다. IPS 시스템의 도입, 셀프 계산에 의한 점포 자동화, 로봇, 소매업 자동화 등의 혁신적인 방법이 소매 시장에서의 빅데이터 분석의 필요성을 높이고 있습니다.

- 데이터 통합의 과제는 데이터 거버넌스, 확장성, 여러 소스에서 데이터를 검색하는 데 따른 데이터 중복 및 변환 규칙 문제 등으로 이는 시장을 억제할 수 있으나 적절하고 체계적인 규칙을 설정함으로써 완화될 수 있습니다.

- COVID-19 팬데믹은 공장과 제조 플랜트 폐쇄, 가격 상승, 엄격한 봉쇄조치, 사람들의 재택 활동으로 인해 발생하는 공급사슬의 혼란 등에 의해 지역이나 국가 레벨의 소매 시장에 큰 영향을 주었습니다. 하지만 팬데믹 이후 인간의 본질적인 요구를 고려하면 빅데이터는 소매업체가 타겟팅한 광고, 제품 추천, 가격 설정을 통해 보다 개인화된 방식으로 고객을 수용하는 데 도움이 됩니다.

소매 분야 빅데이터 분석 시장 동향

머천다이징 및 공급사슬 분석 부문이 큰 점유율을 차지할 전망

- 전자상거래는 전통적인 실제 매장형 소매업에 영향을 미쳐 그 중요성을 낮추고 소매업에서 데이터 중심의 혁명을 가져왔습니다. 효율적인 공급사슬, 즉 공급업체에서 창고, 상점, 고객으로 상품을 최적으로 이동시키는 것은 모든 비즈니스에 필수적입니다. 따라서 빅데이터 분석이 소매업 공급사슬에 혁명을 일으키는 핵심이 되고 있습니다. 빅데이터 분석을 통해 기업은 상품의 흐름이나 재고량을 실시간으로 추적해 고객 데이터를 활용하여 구매 패턴을 예측하고, 나아가서는 로봇을 사용해 광대한 자동 창고에 쉴새없이 주문을 가득 채우고 있습니다.

- 머천다이징 분석과 디지털 솔루션의 통합으로 소매업이 진화를 계속하고 있는 가운데 소매업체는 항상 앞을 내다보고 고객의 요구에 신속하게 대응해 나가야 합니다. 영국에서는 제조업과 에너지 부문에 이어 소매업을 위한 공급사슬 빅데이터 분석이 예측 기간 동안 크게 성장할 것으로 예상됩니다. 또한 예측 분석과 머신러닝 AI가 소매 공급사슬에 혁명을 일으킬 것으로 예상됩니다.

- 첨단 머천다이징 분석을 활용하면 소매 기업이 옴니채널 소매 업계에서 성공하기 위한 과제를 극복할 수 있음이 입증되었습니다. MIT Technology Review Insights for Big Data Analytics가 세계 소비재 소매업 사례를 이용해 실시한 조사에 따르면 소비재 소매업 응답자의 48%가 인공지능 도입은 고객 케어 향상에 도움이 된다고 응답하고 있으며, 이어 품질 관리(47%), 재고 관리(47%), 상품 개인화, 가격 책정, 위조품 탐지에 도움이 된다고 밝혔습니다.

- 세계 경제가 서로 연관되고 복잡해짐에 따라 기업은 고객의 기대에 부응하기 어려워지고 있습니다. 기업은 공급사슬의 의사결정을 보다 빠르고 과감하며 보다 정확하게 수행해야 하며, 이러한 의사결정을 빠르고 투명하게 수행할 수 있습니다. 통합 수요 계획은 오늘날 시장에서 경쟁을 유지하는 데 필요합니다. 게다가 OTIF(On-Time-In-Full)를 달성하기 위해서는 기업은 엔드 투 엔드로 공급사슬을 시각화하고 실시간으로 수요 및 공급의 균형을 맞추고 빠르고 효과적으로 적절한 의사 결정을 내릴 수 있어야 합니다. 고객 만족도 향상, 재고 수준 및 유통망 최적화, 판매 극대화를 위한 시장 출시 시간 단축은 이 부문에서 빅데이터 분석의 필요성을 입증합니다.

북미가 가장 큰 점유율을 차지할 전망

- 소매업에서 빅데이터 분석을 통해 기업이 고객의 구매 내역을 기반으로 추천 상품을 생성할 수 있습니다. 결과적으로 맞춤형 쇼핑 경험을 제공하는 능력이 향상되고 고객 서비스가 강화됩니다. 이러한 데이터 세트는 대량으로 사용할 수 있으며 동향을 예측하고 데이터에 기반한 전략적 의사 결정을 내리는 데 도움이 됩니다. 북미 소매업에서의 빅데이터 분석 시장의 성장은 소매 분석 도구에 대한 수요 증가와 소매 프로세스에서 IoT의 이용, 소매업 생산성 및 효율성 향상으로 이어집니다.

- 이 지역의 거대한 소매업에서는 매출이 증가하고 있습니다. 미국의 전미 소매업 협회(NRF)에 따르면 지난해 소매 매출액은 6%에서 8% 증가한 4조 4,400억 달러 이상에 달할 것으로 예상되며 높은 소비자 신뢰감, 낮은 실업률, 임금 상승과 강하고 탄력적인 경제 징후를 그 이유로 꼽고 있습니다.

- 또한 북미는 빅데이터 분석의 도입에 있어 주요 혁신가이자 선구자입니다. 이 지역은 빅데이터 분석 업체의 강력한 기반을 자랑하며 시장 성장에 더욱 기여하고 있습니다. 북미에는 IBM Corporation, SAS Institute Inc., Alteryx Inc., Microstrategy Incorporated 등이 포진하고 있습니다. 빅데이터 분석의 하드웨어, 소프트웨어, 서비스는 데이터 생산과 소매 소비 증가, 이에 상응하는 매출 증가로 인해 더 많은 비용이 필요합니다.

- 소매 부문 전반에 걸쳐 Industry 4.0의 채택이 증가하고 있는 것은 시장 성장을 가속하는 주요 측면 중 하나입니다. 소매 4.0에서는 재고 관리, 고객 서비스, 고객 계정, 공급사슬 관리, 상품 관리 활동 등 소매업의 여러 업무 및 프로세스가 디지털화 및 자동화되었고 이는 예측 기간 동안 북미 소매 빅데이터 분석 시장의 성장을 더욱 촉진할 것으로 기대되고 있습니다.

소매 분야 빅데이터 분석 산업 개요

소매 분야 빅데이터 분석 시장은 중간에서 높은 정도로 세분화되고 있습니다. 전자상거래, 온라인 쇼핑 성장, 고객 충성도를 둘러싼 높은 경쟁은 소매 시장에서 빅 데이터 분석에 유리한 기회를 제공합니다. 전반적으로 기존 경쟁사 간의 경쟁은 치열하지만 앞으로 대기업의 다양한 혁신 전략이 시장 성장을 효과적으로 향상시킬 것입니다.

2022년 8월, Maxis는 말레이시아에 본사를 둔 소매 분석 신흥 기업인 ComeBy에 자본을 투자하고 기술 및 인적 네트워크에 대한 액세스를 확대함으로써 소매업의 혁신과 디지털화를 뒷받침하여 말레이시아에 추가 경제 효과를 창출합니다.

또한 2022년 8월에는 AI를 활용한 브랜드 분석 솔루션 기업인 DataWeave가 Amazon Advertising Partner Network의 검토 파트너가 되었음을 발표하고 실용적인 데이터 인사이트로 브랜드 디지털 광고 캠페인 최적화를 지원하고 있습니다. Amazon Advertising Partner Network와 새로운 Partner Directory는 Amazon Ads 제품을 사용하여 광고주가 비즈니스 목표를 달성할 수 있도록 지원하는 대행사 및 도구 제공업체를 포함하는 세계적인 커뮤니티에 대한 액세스를 브랜드에 제공합니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 지원

목차

제1장 서론

- 조사 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 역학

- 시장 개요

- 촉진요인

- 예측 분석 중시의 고조

- 머천다이징과 공급사슬 분석 부문이 큰 점유율을 차지할 전망

- 억제요인

- 다른 시스템으로부터의 데이터 수집과 조합의 복잡성

- 산업 가치사슬 분석

- 산업의 매력 - Porter's Five Forces

- 신규 진입업자의 위협

- 구매자/소비자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- COVID-19가 시장에 미치는 영향

제5장 시장 세분화

- 용도별

- 머천다이징 및 공급사슬 분석

- 소셜 미디어 분석

- 고객분석

- 오퍼레이션 인텔리전스

- 기타

- 비즈니스 유형별

- 중소기업

- 대규모 조직

- 지역별

- 북미

- 유럽

- 아시아태평양

- 기타

제6장 경쟁 구도

- 기업 프로파일

- SAP SE

- Oracle Corporation

- Qlik Technologies Inc.

- Zoho Corporation

- IBM Corporation

- Retail Next Inc.

- Alteryx Inc.

- Salesforce.com Inc.(Tableau Software Inc.)

- Adobe Systems Incorporated

- Microstrategy Inc.

- Hitachi Vantara Corporation

- Fuzzy Logix LLC

제7장 투자 분석

제8장 시장 기회와 앞으로의 동향

CSM 25.02.13The Big Data Analytics in Retail Market size is estimated at USD 7.73 billion in 2025, and is expected to reach USD 20.22 billion by 2030, at a CAGR of 21.2% during the forecast period (2025-2030).

The retail industry is witnessing a major transformation through advanced analytics and Big Data technologies. With the growth of e-commerce, online shopping, and high competition for customer loyalty, retailers are utilizing Big Data analytics to stay competitive in the market.

Key Highlights

- The retail industry witnessed a steady adoption of cloud, AI, and related technologies and is considered one of the top sectors in terms of growth. According to a survey by NASSCOM, 70 percent of the companies said they focus on revenue growth by leveraging AI and increasing their spending. For Example, Walmart, one of the largest retailers in the world, is undergoing a digital transformation. It is in the process of building the world's largest private cloud system, which is expected to have the capacity to manage 2.5 petabytes of data every hour.

- Predictive analytics is a proactive approach whereby retailers can use data from the past to predict expected sales growth due to changes in consumer behaviors and market trends. It can help retailers stay ahead of the curve, compete effectively, and gain considerable market share. Increased Emphasis on Predictive Analytics which can help increase promotional effectiveness, drive cross-selling, and much more to build sustainable relationships with the customers.

- Retailers attempt to find innovative ways to draw insights from the ever-increasing amount of structured and unstructured information about consumer behavior. Retailers, both offline and online, are adopting the data-first strategy toward understanding their customers' buying behavior, mapping them to products, and planning marketing strategies to sell their products to increase profits by applying Big Data Analytics at every step of the retail process. Innovative ways such as Implementing IPS systems, Store Automation with self check out, Robots, and Automation in retail, etc., drive the need for Big data analytics in the retail market.

- Data integration challenges could restrain the market, including data governance, scalability, and problems associated with getting data from multiple sources to have data duplication and transformation rules. However, these can be reduced with the proper systematic set of rules.

- The COVID-19 pandemic hugely impacted retail markets at the regional and country level due to the shutdown of factories, and manufacturing plants, increase in prices, strict lockdowns, and supply chain disruptions as people's mobility were confirmed to their homes. However, post-pandemic considering the inherent human needs, Big Data is helping retailers to cater to customers in a more personalized way via targeted advertising, product recommendations, and pricing; the retailers increasingly prefer the technology.

Big Data Analytics in Retail Market Trends

Merchandising and Supply Chain Analytics Segment Expected to Hold Significant Share

- E-commerce has impacted traditional brick-and-mortar retailers, reducing their significance and marking the data-driven revolution in the retail sector. An efficient supply chain, the optimized movement of goods from supplier to warehouse to store to the customer, is critical to every business. Therefore, big data analytics is at the core of revolutionizing the retail supply chain, i.e., tracking and tracing product flow and stock levels in real-time, leveraging customer data to predict buying patterns, and even using robots to fulfill orders in vast automated warehouses tirelessly.

- Retailers must stay proactive and quickly fulfill customer needs as the retail industry continues to evolve with the integration of merchandising analytics and digital solutions. In the United Kingdom, the supply chain Big Data analytics for retail is expected to grow significantly over the forecast period, following the manufacturing and energy sector. It is further expected that predictive analytics and machine learning AI will revolutionize the retail supply chain.

- Leveraging advanced merchandising analytics is proven to help retailers overcome the challenges to thrive in an omnichannel retail world. According to the survey conducted by MIT Technology Review Insights for Big Data Analytics using cases in the consumer goods and retail industry worldwide predicts that 48 percent of respondents from the consumer goods and retail industry state that deployment of artificial intelligence can help improve customer care, followed by Quality control (47%), Inventory Management(47%), personalization of products, pricing, and fraud detection.

- As the global economy becomes interconnected and complex, companies find it challenging to meet customer expectations. They must make supply chain decisions faster, more decisive, and more accurate and can implement those decisions rapidly and transparently. Integrated demand planning is necessary to remain competitive in today's marketplace. Further, to achieve OTIF (On-Time-In-Full), a company must have end-to-end supply chain visibility and be able to balance demand and supply in real-time to make the right decisions quickly and effectively. Improving customer satisfaction, optimizing inventory levels and distribution networks, and achieving a faster time to market for sales maximization prove the need for big data Analytics in this sector.

North America Region Expected to Hold the Largest Share

- Big data analytics in retail helps companies to generate customer recommendations based on their purchase history. It results in an improved ability to offer customized shopping experiences and enhanced customer service. These data sets are available in massive volumes and aid in forecasting trends and making strategic decisions guided by data. The growth of North America's big data analytics in the retail market is driven by the rising demand for retail analytics tools and the usage of the IoT in retail processes, enhancing the productivity and efficiency of the retail industry.

- The region's massive retail industry is experiencing growth in sales. In the United States, according to the National Retail Federation (NRF), retail sales are expected in between 6% to 8% to more than USD 4.44 trillion in the last year, citing high consumer confidence, low unemployment, and rising wages and clear signs of a strong and resilient economy.

- Besides, North America is among the leading innovators and pioneers, in terms of the adoption, of Big Data analytics. The region boasts a strong foothold of Big Data analytics vendors, which further contributes to the market's growth. Some include IBM Corporation, SAS Institute Inc., Alteryx Inc., and Microstrategy Incorporated. Big data analytics hardware, software, and services need more significant expenditures due to the rise in data production and retail consumption with corresponding sales increases.

- The increasing adoption of industry 4.0 across the retail sector is one of the primary aspects encouraging market growth. In retail 4.0, several operations and processes in the retail industry, like inventory management, customer service, customer accounts, supply chain management, and merchandising management activities, became digitized and automated. It is further expected to bolster the growth of North America's big data analytics in the retail market during the forecast period.

Big Data Analytics in Retail Industry Overview

Big data analytics in the retail market is moderately to highly fragmented. The growth of e-commerce, online shopping, and high competition for customer loyalty provides lucrative opportunities in big data analytics in the retail market. Overall, the competitive rivalry among existing competitors is high. Moving forward, different kinds of innovation strategies of large companies boost market growth effectively.

In August 2022, Maxis took a significant stake in Malaysian-based retail analytics startup, ComeBy, to empower innovation and digitalization in the retail industry with greater access to technology and the human network to create more economic multipliers for the country.

Also, in August 2022, DataWeave, an AI-powered Brand Analytics solution company, announced its status as a vetted partner in the Amazon Advertising Partner Network to support brands in optimizing their digital advertising campaigns with actionable data insights. The Amazon Advertising Partner Network, and new Partner Directory, provide brands access to a global community of agencies and tool providers that can help advertisers achieve their business goals using Amazon Ads products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased Emphasis on Predictive Analytics

- 4.2.2 Merchandising and Supply Chain Analytics Segment Expected to Hold Significant Share

- 4.3 Market Restraints

- 4.3.1 Complexities in Collecting and Collating the Data From Disparate Systems

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Application

- 5.1.1 Merchandising and Supply Chain Analytics

- 5.1.2 Social Media Analytics

- 5.1.3 Customer Analytics

- 5.1.4 Operational Intelligence

- 5.1.5 Other Applications

- 5.2 By Business Type

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large-scale Organizations

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE

- 6.1.2 Oracle Corporation

- 6.1.3 Qlik Technologies Inc.

- 6.1.4 Zoho Corporation

- 6.1.5 IBM Corporation

- 6.1.6 Retail Next Inc.

- 6.1.7 Alteryx Inc.

- 6.1.8 Salesforce.com Inc. (Tableau Software Inc.)

- 6.1.9 Adobe Systems Incorporated

- 6.1.10 Microstrategy Inc.

- 6.1.11 Hitachi Vantara Corporation

- 6.1.12 Fuzzy Logix LLC