|

시장보고서

상품코드

1910505

낸드 플래시 메모리 시장 : 점유율 분석, 업계 동향, 통계, 성장 예측(2026-2031년)NAND Flash Memory - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

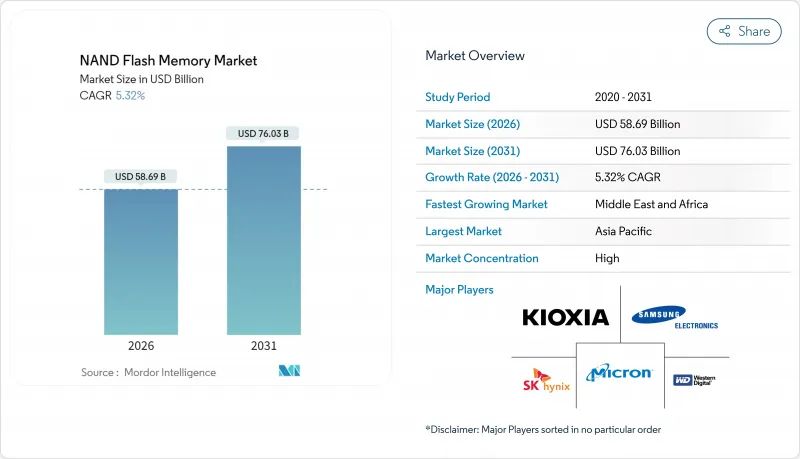

2026년 낸드 플래시 메모리 시장 규모는 586억 9,000만 달러로 추정되며, 2025년 557억 3,000만 달러에서 성장한 수치입니다. 2031년까지 760억 3,000만 달러에 달하고, 2026년부터 2031년에 걸쳐 CAGR은 5.32%를 나타낼 전망입니다.

이러한 꾸준한 확장은 인공지능 교육 클러스터에 대한 하이퍼스케일 데이터센터의 설비 투자, 클라이언트 PC 및 게임기에서 솔리드 스테이트 스토리지로의 전환, 비트 단가의 감소 경향을 유지하는 수직 적층형 3D 아키텍처에 의해 추진되고 있습니다. 동시에, 특히 미국과 사우디아라비아에서 반도체 제조의 현지화를 촉진하는 국가적 인센티브는 지역 공급 탄력성을 강화하고 있습니다. 300개 이상의 계층 수의 기술적 혁신과 PCIe 5.0의 채택으로 기업용 및 소비자용 SSD 교체 사이클이 단축되었습니다. 5G 배포와 엄청난 IoT 엔드포인트의 융합이 대응 가능한 수요를 더욱 확대하고 낸드 플래시 메모리 시장은 지속적인 중간 정도의 단일 자리 성장이 예상되는 상황에 있습니다.

세계 낸드 플래시 메모리 시장 동향과 인사이트

데이터센터의 AI/ML 스토리지 수요 급증

하이퍼스케일 운영자는 NVMe SSD 풀을 GPU 클러스터에 근접하게 배치하는 스토리지 계층 구조를 재설계하고 있으며, 검색 강화된 생성 워크로드에 대해 초당 몇 기가바이트의 처리량을 유지하고 있습니다. 웨스턴 디지털은 2029년까지 5G 지원 엔드포인트에서만 누계 19,000페타바이트의 낸드 수요를 예상하고 있으며 메모리와 콜드 스토리지의 성능 갭을 메우는 플래시의 역할을 강조하고 있습니다. 조달 로드맵은 30TB-100TB의 엔터프라이즈 드라이브가 점점 더 중시되는 경향이 있으며, 이러한 변화는 2024년에 발표된 삼성 128TB BM1743 SSD에도 현저하게 나타났습니다. 이로 인한 풀스루 효과는 층수 혁신과 컨트롤러 수준의 압축 기술을 가속화하고 낸드 플래시 메모리 시장의 기세를 유지하고 있습니다.

5G 및 대규모 IoT 디바이스의 보급

독립형 5G의 도입으로 에지 분석 이용 사례, 스마트 팩토리, 커넥티드카, 스마트 그리드가 실현되고, 실시간 의사결정 엔진을 위한 로컬 비휘발성 스토리지가 필요합니다. 웨스턴 디지털 백서에서는 산업용 모듈에서 용량이 8GB를 초과할 때 NOR에서 NAND로의 전환이 예상됩니다. 반도체 로드맵에서는 현재 확장 온도 대응 QLC 다이와 자동차용 인정 NVMe 설계가 우선되고, 낸드 플래시 메모리 시장의 입지가 수송 및 인프라 분야로 확대하고 있습니다.

고밀도 셀의 내구성 한계

QLC의 1,000-3,000회 프로그램/소거 임계값은 로그 처리량이 많은 데이터베이스에는 여전히 불충분하며, 비용 이점을 손상시키는 과잉 프로비저닝을 강요하고 있습니다. Hackaday 잡지는 300층 스택에서 전자 트랩의 열화 가속과 함께 물리적 한계가 다가오고 있다고 지적합니다. 고도의 에러 정정이나 웨어 레벨링 알고리즘이 열화를 상쇄하는 것, PLC나 크로스 포인트 등의 대체 메모리 기술은 여전히 개발 단계에 있으며, 그 내구성이 입증될 때까지는 낸드 플래시 메모리 시장의 일부를 억제하는 요인이 될 것입니다.

부문 분석

TLC 디바이스의 낸드 플래시 메모리 시장 규모는 내구성과 비용의 균형이 뛰어난 강점으로부터 63.58%의 점유율을 차지했습니다. 한편 QLC는 하이퍼스케일러가 AI 데이터 레이크용 8-16배의 밀도 우위성을 실증한 것으로 6.35%의 연평균 복합 성장률(CAGR)로 성장을 가속화하고 있으며, 2031년까지 QLC가 차지하는 낸드 플래시 메모리 시장 전체의 점유율을 끌어올릴 전망입니다. 삼성의 280층 QLC 프로토타입은 16TB 단면 M.2 드라이브로의 로드맵을 보여주며 랙 점유 면적을 줄이면서 추론 클러스터의 처리량 요구 사항을 충족합니다. 컨트롤러 수준의 SLC 캐시 기술과 온다이 ECC는 TLC와의 대기 시간 차이를 줄이고 VOD 라이브러리 및 백업 리포지토리와 같은 광범위한 워크로드 마이그레이션을 촉진합니다. TLC는 쓰기 집약적 인 ERP 및 OLTP 환경에서 우위를 유지하고 10,000 회 이상의 사이클 정격이 예측 가능한 서비스 품질을 보장합니다.

소비자용 노트북에서는 TLC의 뛰어난 전력 프로파일이 도입 기반을 유지하고 있지만, QLC의 비트 단가 저하로 이미 미드레인지 SKU에 대한 압력이 발생하고 있습니다. 마이크론의 6세대 QLC는 1세대 샘플 비율로 읽기 대기 시간을 34% 줄여 성능 격차 인식을 희미하게 하고 있습니다. 펌웨어 정의의 내구성 대책이 성숙함에 따라 OEM 제조업체는 계층화된 제품 라인을 도입할 전망입니다. 대용량 SKU는 QLC를 채택하고 프리미엄 라인은 고급 TLC 노드를 계속할 것입니다. 이러한 상호작용은 예측 기간 동안 두 기술 모두 낸드 플래시 메모리 시장의 중심적인 존재로 남아 있습니다.

평면 구조에서 수직 적층으로의 전환은 거의 완료되었으며, 2025년에는 3D NAND가 낸드 플래시 메모리 시장의 86.85%를 차지했습니다. SK하이닉스의 상용 321층 TLC와 삼성의 400층 초 V-NAND와 같은 층수에 있어서의 기술적 돌파는 2020년대 말까지 500층이라는 벽을 확실히 넘는 것을 시사하고 있습니다. 경제적 합리성은 분명합니다. 세로 미세화는 셀 크기를 줄이지 않고 용량을 증가시키고 리소그래피 제약을 피합니다. 2D NAND는 초저지연 쓰기가 용량을 웃도는 틈새 항공우주 및 방위 모듈 분야에서 존속합니다.

레이어 수가 증가하면 배선 저항과 셀 간 간섭이 악화됩니다. 이를 극복하기 위해 키옥시아의 CMOS 본딩 어레이 전략은 주변 회로를 분리하여 초적층 구조에서 I/O 효율과 수율을 향상시킵니다. 삼성이 크림 계면 게이트를 위해 탐구하는 하프니아 강유전체도 비슷한 목적을 추구합니다.

낸드 플래시 메모리 보고서는 유형별(SLC(단일 레벨 셀), MLC(다중 레벨 셀), TLC(트리플 레벨 셀), QLC(쿼드 레벨 셀)), 구조별(2D(평면) NAND, 3D NAND), 인터페이스별(SATA, PCIe/NVMe, UFS/eMMC), 용도(스마트폰, SSD(PC 및 콘솔), 엔터프라이즈/데이터센터 SSD 등), 지역별로 분류됩니다. 시장 예측은 금액(달러)으로 제공됩니다.

지역별 분석

아시아태평양은 한국의 수직 통합형 대기업과 중국의 거대한 디바이스 조립 거점에 지지되어 2025년 매출의 55.40%를 차지했습니다. 삼성의 9세대 V-NAND(286층) 양산과 SK하이닉스의 321층 TLC 라인은 이 지역의 기술적 우위성을 뒷받침하고 있습니다. 베이징의 국내 대기업 YMTC는 수출 규제 제약에도 불구하고 232층 QLC 노드를 추진하고 있으며, 아시아태평양이 낸드 플래시 메모리 시장에서 압도적인 영향력을 유지하는 기반이 되는 자국 생산 능력의 확대를 나타내고 있습니다.

북미는 클라우드 분야의 설비 투자 수요에 힘입어 매출 순위에서 2위를 유지하고 있습니다. CHIPS and Science Act는 마이크론사의 1,250억 달러 규모의 국내 메가팹 건설계획을 자금 조달하여 2035년까지 미국의 선진 메모리 자급률이 향상될 전망입니다. 캐나다는 컨트롤러 IP 설계 인력을, 멕시코는 USMCA 협정에 근거한 모듈 레벨 조립 라인의 확대에 공헌해, 지역 전체공급 다양화를 강화하고 있습니다.

유럽은 메모리 웨이퍼 제조 능력의 제약에 의해 한 자리수 중반의 쉐어에 머물고 있습니다. 그러나 독일과 프랑스의 자동차 및 산업용 OEM 제조업체는 자동차 등급 NVMe 모듈에 대한 견고한 수요가 발생했습니다. 유럽 그린딜 등의 지속가능성 지령에 의해 랙 에너지 밀도를 저감하는 절전형 PCIe 5.0 SSD에 대한 수요가 확대되고 있으며, 유럽의 팹은 차세대 3D NAND 노드(읽기 에너지 소비량 3pJ/bit 미만)로 이 틈새 시장을 획득하려고 하고 있습니다.

중동 및 아프리카은 8.21%의 연평균 복합 성장률(CAGR)로 최고 성장률을 보였습니다. 사우디아라비아의 '비전 2030'은 리야드 주변의 웨이퍼에서 백엔드까지의 복합시설을 뒷받침하며, 아부다비의 정부계 투자기관은 컨트롤러 전문 기업과의 합작사업을 통해 지역 공급망 구축을 모색하고 있습니다. 풍부한 신재생에너지 공급원과 매력적인 세제가 패키징 파트너를 끌어들여 GCC 데이터 허브 전역에서 낸드 플래시 메모리 시장의 침투를 촉진하는 현지 생산의 기반을 마련하고 있습니다.

기타 혜택 :

- 엑셀 형식 시장 예측(ME) 시트

- 애널리스트에 의한 3개월간의 지원

자주 묻는 질문

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- 데이터센터 AI/ML 스토리지 수요 급증

- 5G 및 대규모 IoT 디바이스의 보급

- PC/콘솔에 있어서의 HDD에서 SSD로의 전환

- 비용 효율적인 QLC SSD로의 기업 전략 전환

- 국내용 온쇼어 낸드 제조 프로그램

- CXL 대응 컴퓨팅 스토리지의 도입 상황

- 시장 성장 억제요인

- 고밀도 셀의 내구성 한계

- 가격의 주기성과 설비투자 부담

- 수출규제에 의한 설비공급 부족

- 고단화 적층 팹의 지속가능성(ESG) 심사 강화

- 업계 공급망 분석

- 규제 상황

- 기술의 전망

- 거시경제 요인의 영향

- Porter's Five Forces 분석

- 공급기업의 협상력

- 구매자의 협상력

- 신규 참가업체의 위협

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 유형별

- SLC (Single-Level Cell)

- MLC (Multi-Level Cell)

- TLC (Triple-Level Cell)

- QLC (Quad-Level Cell)

- 구조별

- 2D(평면) 낸드

- 3D 낸드

- 인터페이스별

- SATA

- PCIe/NVMe

- UFS/eMMC

- 용도별

- 스마트폰

- SSD(PC 및 콘솔용)

- 기업 / 데이터 센터 SSD

- 메모리 카드 및 USB 메모리

- 산업용 및 자동차용 전자 기기

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 동남아시아

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 중동

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Samsung Electronics Co., Ltd.

- SK hynix Inc.

- KIOXIA Holdings Corporation

- Western Digital Corporation

- Micron Technology, Inc.

- Nanya Technology Corporation

- Powerchip Technology Corporation

- Winbond Electronics Corporation

- Macronix International Co., Ltd.

- Silicon Motion Technology Corp.

- Phison Electronics Corp.

- Kingston Technology Company, Inc.

- ADATA Technology Co., Ltd.

- Transcend Information, Inc.

- GigaDevice Semiconductor Inc.

- SK Group(Solid-State Storage division)

- PNY Technologies, Inc.

- Team Group Inc.

- Longsys Electronics Co., Ltd.

- Smart Modular Technologies, Inc.

제7장 시장 기회와 장래의 전망

SHW 26.01.26NAND flash memory market size in 2026 is estimated at USD 58.69 billion, growing from 2025 value of USD 55.73 billion with 2031 projections showing USD 76.03 billion, growing at 5.32% CAGR over 2026-2031.

This steady expansion is powered by hyperscale data-center capital spending on artificial-intelligence training clusters, the transition of client PCs and game consoles to solid-state storage, and vertically-scaled 3D architectures that keep cost-per-bit on a declining path. At the same time, national incentives to localize semiconductor fabrication, especially in the United States and Saudi Arabia, are strengthening regional supply resilience. Layer-count breakthroughs above 300 layers and PCIe 5.0 adoption are shortening replacement cycles for both enterprise and consumer SSDs. The confluence of 5G rollouts and massive IoT endpoints further widens addressable demand, positioning the NAND flash memory market for durable mid-single-digit growth horizons.

Global NAND Flash Memory Market Trends and Insights

Data-center AI/ML storage surge

Hyperscale operators are redesigning storage hierarchies so that NVMe SSD pools sit closer to GPU clusters, sustaining multi-gigabyte-per-second throughput for retrieval-augmented generation workloads. Western Digital estimates cumulative demand of 19,000 petabytes of NAND by 2029 for 5G-enabled endpoints alone, underscoring flash's role in bridging memory and cold-storage performance gaps. Procurement roadmaps increasingly favor 30 TB to 100 TB enterprise drives, a shift visible in Samsung's 128 TB BM1743 SSD showcased in 2024. The resulting pull-through effect accelerates layer-count innovation and controller-level compression techniques that sustain the NAND flash memory market momentum.

5G and massive-IoT device proliferation

Standalone 5G deployments unlock edge analytics use cases, smart factories, connected cars, and smart grids that mandate local non-volatile storage for real-time decision engines. Western Digital's white paper anticipates a NOR-to-NAND crossover within industrial modules as capacities climb above 8 GB. Semiconductor roadmaps now prioritize extended-temperature QLC die and automotive-qualified NVMe designs, broadening the NAND flash memory market footprint across transportation and infrastructure domains.

Endurance limits of high-density cells

QLC's 1,000-3,000 program/erase thresholds remain insufficient for log-heavy databases, forcing over-provisioning that erodes cost benefits. Hackaday notes the physics ceiling approaching as electron-trap wear accelerates in 300-layer stacks. Although advanced error-correction and wear-leveling algorithms offset degradation, alternate memories such as PLC or cross-point remain on the horizon, tempering portions of the NAND flash memory market until longevity is proven.

Other drivers and restraints analyzed in the detailed report include:

- PC/Console transition from HDD to SSD

- Enterprise pivot to cost-efficient QLC SSDs

- Pricing cyclicality and cap-ex burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The NAND flash memory market size for TLC devices held a 63.58% market share with the strength of balanced endurance and cost. QLC, however, is accelerating at 6.35% CAGR as hyperscalers validate its 8-16X density advantage for AI data-lakes, which lifts the overall NAND flash memory market share allocated to QLC by 2031. Samsung's 280-layer QLC prototype signals a roadmap to 16 TB single-sided M.2 drives, shrinking rack footprints while meeting throughput rules for inference clusters. Controller-level SLC-cache techniques and on-die ECC are narrowing the latency gap with TLC, encouraging broader workloads such as VOD libraries and backup repositories to migrate. TLC will retain primacy in write-intensive ERP and OLTP environments where its 10,000-plus cycle rating secures predictable quality-of-service.

In consumer notebooks, TLC's favorable power profile sustains its install base, but falling QLC cost-per-bit is already pressuring mid-range SKUs. Micron's sixth-gen QLC exhibits 34% lower read latency than first-gen samples, eroding the perceived performance divide. As firmware-defined endurance mitigation matures, OEMs will likely introduce tiered offerings where high-capacity SKUs employ QLC, while premium lines continue on advanced TLC nodes. This interplay keeps both technologies central to the NAND flash memory market over the forecast horizon.

The shift from planar to vertical stacking is virtually complete: 3D NAND commanded 86.85% of the NAND flash memory market share in 2025. Layer-count breakthroughs, SK Hynix's commercial 321-layer TLC and Samsung's 400-plus-layer V-NAND, signal confident scaling beyond the 500-layer watermark before decade-end. The economic logic is clear; vertical scaling adds capacity without shrinking cell size, sidestepping lithography constraints. 2D NAND survives in niche aerospace and defense modules where ultra-low-latency writes outweigh capacity.

Layer additions do stress interconnect resistance and cell-to-cell interference. To overcome this, Kioxia's CMOS-bonded-array strategy decouples peripheral circuits, boosting I/O efficiency and improving yield in ultra-tall stacks. Samsung's exploration of hafnia ferroelectrics for creamy-interface gates pursues a similar aim: maintain threshold-voltage margins even as stack height extends.

The NAND Flash Memory Report is Segmented by Type (SLC (Single-Level Cell), MLC (Multi-Level Cell), TLC (Triple-Level Cell), and QLC (Quad-Level Cell)), Structure (2D (Planar) NAND, and 3D NAND), Interface (SATA, Pcie / NVMe, and UFS / EMMC), Application (Smartphones, Solid-State Drives (PC and Console), Enterprise / Data-Center SSD, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 55.40% of sales in 2025, anchored by South Korea's vertically-integrated champions and China's colossal device assembly base. Samsung's mass production of 9th-generation V-NAND (286 layers) and SK Hynix's 321-layer TLC line affirm the region's technology lead. Beijing's domestic champion YMTC pushes 232-layer QLC nodes despite export-control constraints, illustrating indigenous capacity expansion that preserves Asia-Pacific's outsized influence on the NAND flash memory market.

North America sits second on revenue league tables, propelled by cloud capital-expenditure intensity. The CHIPS and Science Act bankrolls Micron's USD 125 billion state-side megafab roadmap, lifting U.S. advanced-memory self-sufficiency by 2035. Canada contributes controller-IP design talent, while Mexico scales module-level assembly lines under USMCA provisions, together reinforcing regional supply diversification.

Europe registers mid-single-digit share, constrained by limited memory wafer fabrication. Nonetheless, automotive and industrial OEMs in Germany and France generate robust demand for auto-grade NVMe modules. Sustainability directives such as the European Green Deal pivot buyers toward power-efficient PCIe 5.0 SSDs that lower rack energy density, a niche European fabs aim to capture through next-generation 3D NAND nodes with under-3 pJ/bit read energy footprints.

The Middle East and Africa present the highest growth rate at 8.21% CAGR. Saudi Arabia's Vision 2030 underwrites wafer-to-back-end complexes around Riyadh, while Abu Dhabi's sovereign investors explore joint-ventures with controller specialists to bootstrap a regional supply chain. Ample renewable-energy pipelines and attractive tax regimes draw packaging partners, setting the stage for localized production that boosts the NAND flash memory market penetration across GCC data hubs.

- Samsung Electronics Co., Ltd.

- SK hynix Inc.

- KIOXIA Holdings Corporation

- Western Digital Corporation

- Micron Technology, Inc.

- Nanya Technology Corporation

- Powerchip Technology Corporation

- Winbond Electronics Corporation

- Macronix International Co., Ltd.

- Silicon Motion Technology Corp.

- Phison Electronics Corp.

- Kingston Technology Company, Inc.

- ADATA Technology Co., Ltd.

- Transcend Information, Inc.

- GigaDevice Semiconductor Inc.

- SK Group (Solid-State Storage division)

- PNY Technologies, Inc.

- Team Group Inc.

- Longsys Electronics Co., Ltd.

- Smart Modular Technologies, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Data-center AI/ML storage surge

- 4.2.2 5G and massive-IoT device proliferation

- 4.2.3 PC/Console transition from HDD to SSD

- 4.2.4 Enterprise pivot to cost-efficient QLC SSDs

- 4.2.5 National on-shore NAND fab programs

- 4.2.6 CXL-enabled computational storage adoption

- 4.3 Market Restraints

- 4.3.1 Endurance limits of high-density cells

- 4.3.2 Pricing cyclicality and cap-ex burden

- 4.3.3 Export-control induced equipment bottlenecks

- 4.3.4 Sustainability scrutiny on high-layer fabs

- 4.4 Industry Supply Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 SLC (Single-Level Cell)

- 5.1.2 MLC (Multi-Level Cell)

- 5.1.3 TLC (Triple-Level Cell)

- 5.1.4 QLC (Quad-Level Cell)

- 5.2 By Structure

- 5.2.1 2D (Planar) NAND

- 5.2.2 3D NAND

- 5.3 By Interface

- 5.3.1 SATA

- 5.3.2 PCIe / NVMe

- 5.3.3 UFS / eMMC

- 5.4 By Application

- 5.4.1 Smartphones

- 5.4.2 Solid-State Drives (PC and Console)

- 5.4.3 Enterprise / Data-center SSD

- 5.4.4 Memory Cards and USB Drives

- 5.4.5 Industrial and Automotive Electronics

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 South-East Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Electronics Co., Ltd.

- 6.4.2 SK hynix Inc.

- 6.4.3 KIOXIA Holdings Corporation

- 6.4.4 Western Digital Corporation

- 6.4.5 Micron Technology, Inc.

- 6.4.6 Nanya Technology Corporation

- 6.4.7 Powerchip Technology Corporation

- 6.4.8 Winbond Electronics Corporation

- 6.4.9 Macronix International Co., Ltd.

- 6.4.10 Silicon Motion Technology Corp.

- 6.4.11 Phison Electronics Corp.

- 6.4.12 Kingston Technology Company, Inc.

- 6.4.13 ADATA Technology Co., Ltd.

- 6.4.14 Transcend Information, Inc.

- 6.4.15 GigaDevice Semiconductor Inc.

- 6.4.16 SK Group (Solid-State Storage division)

- 6.4.17 PNY Technologies, Inc.

- 6.4.18 Team Group Inc.

- 6.4.19 Longsys Electronics Co., Ltd.

- 6.4.20 Smart Modular Technologies, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment