|

시장보고서

상품코드

1851092

MEMS 시장 : 시장 점유율 분석, 산업 동향, 통계, 성장 예측(2025-2030년)MEMS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

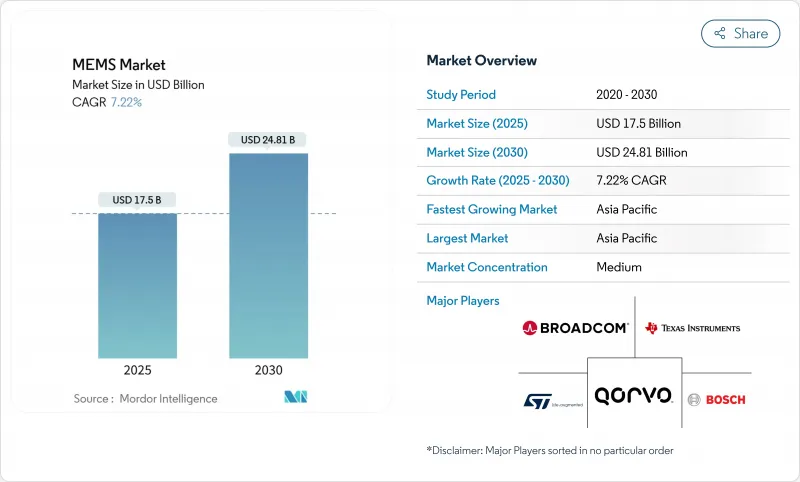

세계의 MEMS 시장의 규모는 2025년에 175억 달러, 2030년에는 248억 1,000만 달러에 이를 것으로 예측되며, CAGR은 7.22%로 안정적일 것으로 예상됩니다.

이 기세는 스마트폰, 전기자동차, 의료용 웨어러블, 산업용 IoT 노드에서 센서의 보급이 진행되고, 내구성이 높고 소비 전력이 적은 소형화된 부품이 요구되고 있기 때문입니다. 자동차의 전동화는 1대당 압력, 온도, 관성 센서의 수를 증가시키고, POC(Point of Care) 진단은 파일럿 라인에서 대량 생산으로 마이크로유체 칩을 끌어올립니다. 5G 인프라의 진전은 확대되는 주파수 대역에서 낮은 삽입 손실을 유지하는 RF 필터 수요를 더욱 증가시킵니다. 미국에서는 300mm 웨이퍼의 파일럿 생산이 개시되어 공급의 회복력이 향상되고 있지만, 경쟁은 여전히 세분화되고 있으며, 틈새 전문가가 엣지 AI 센서 퓨전 등의 새로운 이용 사례로 설계의 우위를 획득하고 있습니다.

세계의 MEMS 시장의 동향과 인사이트

IoT 및 엣지 디바이스 채택 증가

커넥티드 엔드포인트가 증가함에 따라 공장, 건물 및 물류 허브는 자산당 수십 개의 센서를 통합해야 하며, 저전력 가속도계, 자이로스코프 및 환경 모니터가 표준 부품이 되었습니다. 반도체 회사는 MEMS 센서를 마이크로컨트롤러와 패키징하고 백홀 대역폭과 클라우드 대기 시간을 줄이는 현지화된 분석을 제공합니다. 결정 트리와 경량 신경망을 센서 노드에서 직접 실행하는 엣지 AI 칩은 50μW 이하의 전력 예산 설계 규칙을 검토하도록 공급업체를 지원하고 MEMS 시장을 확장하는 지속적인 재설계 사이클을 장려합니다.

EV와 ADAS에서 센서 컨텐츠 확대

전기자동차에는 압력, 관성, 환경 센서가 내연차보다 2-3배 더 탑재되어 있습니다. 무라타 제작소의 차량용 관성 센서의 새로운 국내 라인은 레거시 휴대 단말의 판매 대수가 늘어나고 있는 가운데, 일본공급자가 어떻게 모빌리티 수익으로 전환하고 있는지를 나타내고 있습니다. TDK의 광학 MEMS 미러는 적응형 헤드라이트와 솔리드 스테이트 LiDAR을 가능하게 하고 차량별로 차별화된 소켓을 제공합니다. LiDAR 공급업체인 RoboSense는 2024년 자동차용 LiDAR 세계 매출의 33.5%를 차지했으며, 첨단 운전 지원과 고정밀 감지가 서로 연관되어 성장하고 있음을 밝혔습니다.

복잡하고 자본 집약적인 제조

300mm 웨이퍼로의 전환은 다이 비용을 줄이지만 새로운 리소그래피, 본딩 및 측정 도구를 필요로 하며, 그 취득액은 라인당 5억 달러를 초과합니다. SEMI는 2025년 1분기에 300mm 웨이퍼 출하가 6% 성장한 것으로 발표했지만, 중소 MEMS 공장은 업그레이드를 위한 자금 조달에 고전하고 있습니다. 미국 CHIPS법 우대 조치는 2025년 생산 예정인 Rogue Valley Microdevices의 플로리다 공장을 포함한 소수의 국내 프로젝트에 대한 자금 조달을 완화합니다. 300mm 생산 능력이 없는 공급업체는 마진을 압박하는 비용 격차 확대에 직면하고 있습니다.

부문 분석

센서는 휴대전화 OEM, Tier-1 자동차 공급업체, 산업 자동화 기업이 관성, 압력, 환경 패키지의 표준화를 진행하고 있기 때문에 2024년 매출의 57%를 차지하였습니다. MEMS 시장에서 이 압도적인 점유율은 성숙한 제조 노드가 가혹한 환경에서도 신뢰성을 유지하면서 비용 효율성을 실현하고 있음을 보여줍니다. 이 부문은 최대 6개의 디스크리트 모션 센서와 오디오 센서를 내장한 스마트폰과 에어백, 안정성, ADAS 기능을 위한 3중 중복 가속도계를 내장한 자동차로부터 혜택을 받고 있습니다. 대조적으로, 액추에이터는 광학 이미지 스태빌라이제이션 모터 및 LiDAR 빔 스티어링을 위한 마이크로미러 어레이와 관련되어 성장은 안정적이고 완만합니다. 오실레이터는 자동차 파워트레인의 쿼츠 타이밍을 대체하고, 전동화가 가속됨에 따라 장착율이 상승할 것으로 예측됩니다.

마이크로유체 칩은 CAGR 9.8%로 기술 프론티어입니다. 랩온어칩 카트리지는 모세관 흐름 제어, 전기화학 감지 및 온보드 시약을 결합하여 진단 사이클 시간을 수일에서 수분으로 단축합니다. 병원 조달 담당자는 단순화된 샘플 전처리와 최소한의 작동 훈련을 중시하고 장비 제조업체를 폴리머 기반 MEMS 유로에 의존하는 완전 일회용 유닛으로 향하게 합니다. 제약 회사는 인간의 조직 반응을 모델링하기 위해 장기온칩 플랫폼을 탐구하여 고정밀 미세 유체 제조에 대한 추가 견인력을 창출합니다. 이 새로운 추세는 지속적인 차별화를 지원하고 표면 화학에 익숙한 공급업체를 프리미엄 파트너로 자리 매김하고 MEMS 시장을 기존의 전기 기계식 구체의 범위를 넘어 확장합니다.

관성 센서는 2024년 매출의 24.5%를 차지하였으며 스마트폰 방향 감지, 자동차 횡전 방지, 산업용 추적 모듈을 지원합니다. 진동과 극단적인 온도 환경 하에서의 신뢰성이 입증됨으로써 MEMS 시장에서의 이 카테고리의 중요성이 확고해졌습니다. 바이어스 드리프트를 1°/h 이하로 억제하는 등, 계속적인 성능 향상에 의해 이용 사례가 정밀 농업이나 창고 자동화 로봇에까지 확산되고 있습니다. 한편, RF MEMS 컴포넌트의 CAGR은 10.4%이며, 5G의 배치에서는 고정 세라믹 필터로는 실현할 수 없는 민첩한 스펙트럼 튜닝이 요구되고 있습니다. 주조는 높은 Q 캐비티를 습기 침입으로부터 보호하기 위해 웨이퍼 레벨 하메틱 패키징에 투자하여 수율을 보호하고 평균 판매 가격을 상승시킵니다.

MEMS 마이크, 압력 센서 및 환경 검출기는 꾸준한 수량 성장을 유지합니다. STMicroelectronics가 2024년에 출시한 유한 상태 머신 로직을 통합한 자율적 산업용 IMU는 작은 코드 개요로 전송 전에 이벤트를 필터링하는 엣지 인텔리전스에 대한 전환을 강조하고 있습니다. 광학 MEMS 미러는 최소한의 가동 질량과 기계적 내피로성으로 솔리드 스테이트 LiDAR을 진화시킵니다.

지역 분석

아시아태평양은 2024년에 45%의 매출 점유율을 유지하였고 2030년까지의 CAGR은 10.7%로 예상되며 중국 국내 벤더는 RF 프론트엔드의 특허 출원을 가속화하고 5G와 위성 통신용 공급의 현지화를 목표로 합니다. 일본의 TDK와 무라타 제작소, 세계의 전동화 수요를 받아들이기 위해 차량용 관성 센서의 생산 능력을 증강하고 있습니다. 한국은 첨단 메모리 클린룸을 활용하여 MEMS 타이밍 디바이스로 다각화하고, 싱가포르와 말레이시아는 낮은 인건비 구조를 제공하는 테스트 조립 클러스터를 확대합니다.

북미는 강력한 항공우주 및 방위 프로그램과 의료기기 혁신 파이프라인의 혜택을 받고 있습니다. CHIPS 프로그램 오피스는 MEMS 파일럿 라인을 통합한 팹에 수십억 달러 규모의 조성금 협상을 실시하여 국내 공급망의 단축을 촉구했습니다. 2025년 1분기 실리콘 웨이퍼 출하량은 전년 동기 대비 2.2% 증가하였고 300mm급 수요에 대해 대량 생산이 준비되었음을 시사했습니다. 플로리다의 새로운 MEMS 주조공장이 2025년 양산을 시작하면 지역적인 회복력이 높아집니다.

유럽은 자동차 안전, 산업 자동화 및 의료용 웨어러블에 주력하고 있습니다. 첨단 운전 지원 기능을 의무화하는 규제 프레임워크가 센서의 보급을 가속화하고 MEMS 시장에 이 지역의 공헌을 뒷받침합니다. STMicroelectronics의 자율 산업 IMU는 독일 및 이탈리아 장비 제조업체의 수명주기에 대한 긴 까다로운 요구에 부응하고 있습니다. 중동 및 아프리카는 아직 개발 도상이지만, 걸프 국가에서 스마트 시티의 테스트 운영으로 분산 대기 질 감지와 지능형 조명 등대에 대한 수요가 발생됩니다.

기타 혜택

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트 서포트

목차

제1장 서론

- 조사의 전제조건과 시장의 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 상황

- 시장 개요

- 시장 성장 촉진요인

- IoT와 엣지 디바이스의 도입 확대

- EV와 ADAS의 센서 컨텐츠 확대

- 5G의 보급이 RF MEMS 필터를 견인

- 300mm 웨이퍼 제조로의 시프트 MEMS

- 이종 집적과 칩렛 패키징

- PoC 진단을 위한 마이크로플루이딕스 MEMS의 급증

- 시장 성장 억제요인

- 복잡하고 자본 집약적인 제조

- 설계와 프로세스의 표준화의 갭

- 특수 소재에 공급 체인 의존도

- RF MEMS 특허가 라이선싱 코스트를 높임

- 가치/공급망 분석

- 기술의 전망

- 규제 상황

- Porter's Five Forces

- 신규 참가업체의 위협

- 공급기업의 협상력

- 구매자의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계

제5장 시장 규모와 성장 예측

- 디바이스 클래스별

- 센서

- 액추에이터

- 발진기와 타이밍

- 마이크로플루이딕스 칩

- 파워/모션 마이크로 제너레이터

- 센서/액추에이터 유형별

- 관성 센서

- 압력 센서

- RF MEMS

- 광학 MEMS

- 환경 센서

- MEMS 마이크

- 마이크로 볼로미터와 적외선 검출기

- 잉크젯 헤드

- 기타

- 용도별

- 소비자 가전

- 자동차

- 산업용 및 로봇

- 의료 및 의료기기

- 통신 인프라

- 항공우주 및 방위

- 기타

- 제조 공정별

- 벌크 마이크로 머시닝

- 표면 미세 가공

- HAR 실리콘 에칭/DRIE

- 실리콘 온 절연체(SOI) MEMS

- LIGA와 X선 리소그래피

- 첨단 3D 프린팅 MEMS

- 재료별

- 실리콘

- 폴리머

- 압전(AlN, PZT)

- 금속

- 화합물 반도체

- 석영 및 유리

- 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 동남아시아

- 호주, 뉴질랜드

- 기타 아시아태평양

- 중동 및 아프리카

- 중동

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 기타 중동

- 아프리카

- 남아프리카

- 나이지리아

- 기타 아프리카

- 북미

제6장 경쟁 구도

- 시장 집중도

- 전략적 동향

- 시장 점유율 분석

- 기업 프로파일

- Robert Bosch GmbH

- Broadcom Inc.

- STMicroelectronics NV

- Texas Instruments Inc.

- TDK Corporation(InvenSense)

- Qorvo Inc.

- Infineon Technologies AG

- NXP Semiconductors NV

- Knowles Electronics LLC

- Panasonic Corporation

- GoerTek Inc.

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.

- Analog Devices Inc.

- Alps Alpine Co., Ltd.

- Omron Corporation

- Sensata Technologies

- Silex Microsystems AB

- Teledyne MEMS

- Rogue Valley Microdevices Inc.

제7장 시장 기회와 미래 전망

CSM 25.11.20The global MEMS market size stands at USD 17.50 billion in 2025 and is projected to reach USD 24.81 billion by 2030, reflecting a steady 7.22% CAGR.

Momentum stems from rising sensor penetration in smartphones, electric vehicles, medical wearables, and industrial IoT nodes that demand durable, low-power, and miniaturized components. Automotive electrification multiplies pressure, temperature, and inertial sensor counts per vehicle, while point-of-care diagnostics pull microfluidic chips from pilot lines into mass production. Advancing 5G infrastructure further amplifies demand for RF MEMS filters that sustain low insertion loss across expanding frequency bands. Supply resilience improves as 300 mm wafer processing enters pilot runs in the United States, yet competition remains fragmented, letting niche specialists capture design wins in emerging use-cases such as edge AI sensor fusion.

Global MEMS Market Trends and Insights

Rising adoption of IoT & edge devices

The climb in connected endpoints obliges factories, buildings, and logistics hubs to embed dozens of sensors per asset, turning low-power accelerometers, gyroscopes, and environmental monitors into standard bill-of-materials components. Semiconductor companies increasingly package MEMS sensors with microcontrollers to deliver localized analytics that cut backhaul bandwidth and cloud latency. Edge AI chips that run decision trees or lightweight neural networks directly on sensor nodes push suppliers to rethink design rules for power budgets below 50 µW, prompting sustained redesign cycles that enlarge the MEMS market.

Expanding sensor content in EV & ADAS

Electric vehicles contain 2-3 X more pressure, inertial, and environmental sensors than internal-combustion cars. Murata's new domestic line for automotive-grade inertial sensors underlines how Japanese suppliers pivot to mobility revenue as legacy handset volumes plateau newswitch. Optical MEMS mirrors from TDK enable adaptive headlights and solid-state LiDAR, adding differentiated sockets per vehicle. LiDAR vendor RoboSense captured 33.5% global automotive LiDAR revenue in 2024, underscoring the intertwined growth of advanced driver assistance and high-precision sensing.

Complex & capital-intensive manufacturing

Transitioning to 300 mm wafers cuts die cost but demands new lithography, bonding, and metrology tools whose acquisition can exceed USD 500 million per line. SEMI projects 6% growth in 300 mm wafer shipments in Q1 2025, yet smaller MEMS fabs struggle to raise capital for the upgrade.U.S. CHIPS Act incentives ease financing for a handful of domestic projects, including Rogue Valley Microdevices' Florida fab slated for 2025 production. Suppliers without -300 mm capacity face widening cost gaps that compress margins.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of 5G driving RF MEMS filters

- Surge in microfluidic MEMS for PoC diagnostics

- RF MEMS patent thickets raising licensing costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sensors generated 57% of 2024 revenue as handset OEMs, automotive Tier-1 suppliers, and industrial automation houses all standardize inertial, pressure, and environmental packages. This dominant slice of the MEMS market underlines how mature manufacturing nodes deliver cost efficiency while maintaining reliability in harsh environments. The segment benefits from smartphones that embed up to six discrete motion and audio sensors, and vehicles that now integrate triple-redundant accelerometers for airbag, stability, and ADAS functions. In contrast, actuators deliver stable but slower growth tied to optical image-stabilization motors and micro-mirror arrays for LiDAR beam steering. Oscillators displace quartz timing in automotive powertrains, foreseeing rising attach rates as electrification accelerates.

Microfluidic chips, at 9.8% CAGR, represent the technology frontier. Lab-on-a-chip cartridges combine capillary flow control, electrochemical sensing, and on-board reagents, cutting diagnostic cycle time from days to minutes. Hospital procurement managers value simplified sample prep and minimal operator training, pushing device makers toward fully disposable units that rely on polymer-based MEMS flow channels. Pharmaceutical firms explore organ-on-chip platforms to model human tissue response, creating additional pull for high-precision microfluidic fabrication. This emerging basket supports sustained differentiation and positions suppliers that master surface chemistry as premium partners, expanding the MEMS market beyond traditional electromechanical spheres.

Inertial sensors secured 24.5% of 2024 revenue, underpinning smartphone orientation detection, automotive rollover protection, and industrial track-and-trace modules. Their proven reliability under vibration and temperature extremes cements the category's relevance within the MEMS market. Continuous performance improvements, such as bias drift under 1°/h, extend use-cases into precision agriculture and warehouse automation robotics. Meanwhile, RF MEMS components deliver 10.4% CAGR as 5G deployments request agile spectrum tuning unattainable with fixed ceramic filters. Foundries invest in hermetic wafer-level packaging to guard high-Q cavities against moisture ingress, safeguarding yield and elevating average selling prices.

MEMS microphones, pressure sensors, and environmental detectors sustain steady volume growth. STMicroelectronics' 2024 release of an autonomous industrial IMU that integrates finite-state-machine logic underscores the pivot toward edge intelligence where small code snippets filter events before transmission. Optical MEMS mirrors advance solid-state LiDAR, benefiting from minimal moving mass and mechanical fatigue resistance.

The MEMS Market is Segmented by Device Class (Sensors, Actuators, and More), Sensor/Actuator Type (Inertial Sensors, Pressure Sensors, and More), Application (Consumer Electronics, Automotive, and More), Fabrication Process (Bulk Micromachining, Surface Micromachining, and More), Material (Silicon, Polymers, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 45% revenue share in 2024 and is tracking a 10.7% CAGR through 2030. China's domestic vendors accelerate patent filings in RF front-ends, aiming to localize supply for 5G and satellite communications. Japanese champions TDK and Murata extend capacity for automotive-grade inertial sensors to capture global electrification demand. South Korea leverages advanced memory cleanrooms to diversify into MEMS timing devices, while Singapore and Malaysia expand test-and-assembly clusters that offer lower labor cost structures.

North America benefits from strong aerospace and defense programs as well as medical device innovation pipelines. The CHIPS Program Office awarded multi-billion-dollar grant negotiations to fabs that incorporate MEMS pilot lines, encouraging shorter domestic supply chains. Silicon wafer shipments rose 2.2% year-on-year in Q1 2025, with 300 mm category demand signalling readiness for high-volume production. Florida's new MEMS foundry will add regional resilience when it enters volume production in 2025.

Europe concentrates on automotive safety, industrial automation, and medical wearables. Regulatory frameworks mandating advanced driver assistance functions accelerate sensor penetration, boosting the region's contribution to the MEMS market. STMicroelectronics' autonomous industrial IMU caters to stringent long-lifecycle demands from German and Italian equipment makers. The Middle East and Africa remain nascent, yet smart-city pilots in Gulf states create lighthouse references for distributed air-quality sensing and intelligent lighting.

- Robert Bosch GmbH

- Broadcom Inc.

- STMicroelectronics N.V.

- Texas Instruments Inc.

- TDK Corporation (InvenSense)

- Qorvo Inc.

- Infineon Technologies AG

- NXP Semiconductors N.V.

- Knowles Electronics LLC

- Panasonic Corporation

- GoerTek Inc.

- Honeywell International Inc.

- Murata Manufacturing Co., Ltd.

- Analog Devices Inc.

- Alps Alpine Co., Ltd.

- Omron Corporation

- Sensata Technologies

- Silex Microsystems AB

- Teledyne MEMS

- Rogue Valley Microdevices Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of IoT and edge devices

- 4.2.2 Expanding sensor content in EV and ADAS

- 4.2.3 Proliferation of 5G driving RF MEMS filters

- 4.2.4 Shift to 300 mm MEMS wafer fabrication

- 4.2.5 Heterogeneous integration and chiplet packaging

- 4.2.6 Surge in microfluidic MEMS for PoC diagnostics

- 4.3 Market Restraints

- 4.3.1 Complex and capital-intensive manufacturing

- 4.3.2 Design and process standardization gaps

- 4.3.3 Supply-chain dependence on specialty materials

- 4.3.4 RF MEMS patent thickets raising licensing costs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device Class

- 5.1.1 Sensors

- 5.1.2 Actuators

- 5.1.3 Oscillators and Timing

- 5.1.4 Microfluidic Chips

- 5.1.5 Power/Motion Micro-generators

- 5.2 By Sensor / Actuator Type

- 5.2.1 Inertial Sensors

- 5.2.2 Pressure Sensors

- 5.2.3 RF MEMS

- 5.2.4 Optical MEMS

- 5.2.5 Environmental Sensors

- 5.2.6 MEMS Microphones

- 5.2.7 Microbolometers and IR Detectors

- 5.2.8 Ink-jet Heads

- 5.2.9 Others

- 5.3 By Application

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive

- 5.3.3 Industrial and Robotics

- 5.3.4 Healthcare and Medical Devices

- 5.3.5 Telecom Infrastructure

- 5.3.6 Aerospace and Defense

- 5.3.7 Others

- 5.4 By Fabrication Process

- 5.4.1 Bulk Micromachining

- 5.4.2 Surface Micromachining

- 5.4.3 HAR Silicon Etching / DRIE

- 5.4.4 Silicon-on-Insulator (SOI) MEMS

- 5.4.5 LIGA and X-ray Lithography

- 5.4.6 Advanced 3D-Printed MEMS

- 5.5 By Material

- 5.5.1 Silicon

- 5.5.2 Polymers

- 5.5.3 Piezoelectric (AlN, PZT)

- 5.5.4 Metals

- 5.5.5 Compound Semiconductors

- 5.5.6 Quartz and Glass

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 United Kingdom

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 APAC

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Southeast Asia

- 5.6.4.6 Australia and New Zealand

- 5.6.4.7 Rest of APAC

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 UAE

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Robert Bosch GmbH

- 6.4.2 Broadcom Inc.

- 6.4.3 STMicroelectronics N.V.

- 6.4.4 Texas Instruments Inc.

- 6.4.5 TDK Corporation (InvenSense)

- 6.4.6 Qorvo Inc.

- 6.4.7 Infineon Technologies AG

- 6.4.8 NXP Semiconductors N.V.

- 6.4.9 Knowles Electronics LLC

- 6.4.10 Panasonic Corporation

- 6.4.11 GoerTek Inc.

- 6.4.12 Honeywell International Inc.

- 6.4.13 Murata Manufacturing Co., Ltd.

- 6.4.14 Analog Devices Inc.

- 6.4.15 Alps Alpine Co., Ltd.

- 6.4.16 Omron Corporation

- 6.4.17 Sensata Technologies

- 6.4.18 Silex Microsystems AB

- 6.4.19 Teledyne MEMS

- 6.4.20 Rogue Valley Microdevices Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment