|

시장보고서

상품코드

1689774

부패 감지 기반 스마트 라벨 시장 : 점유율 분석, 산업 동향 및 통계, 성장 예측(2025-2030년)Spoil Detection-based Smart Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

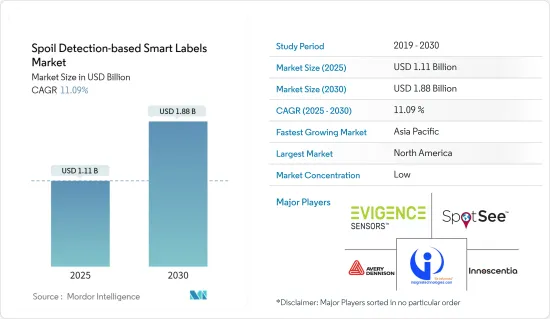

세계의 부패 감지 기반 스마트 라벨 시장 규모는 2025년 11억 1,000만 달러로 추정되며, 예측 기간 중(2025-2030년) CAGR 11.09%로 확대되어, 2030년에는 18억 8,000만 달러에 이를 것으로 예측됩니다.

스마트 라벨은 의약품, 식품 및 화장품 업계 전반에서 가장 인기있는 기술 중 하나가 되고 있습니다. 품목의 진정성과 추적성을 제공하면서 보다 높은 효율성과 수익성을 실현하는 이상적인 수단으로 주목받고 있습니다.

주요 하이라이트

- 스마트 라벨은 개별 자재에 대한 자세한 정보를 신속하게 제공하고 실시간 정보를 제공합니다. 또한 진정성과 공급망의 무결성을 보장하는 동시에 브랜드가 고객과 관련된 새로운 기회를 창출합니다. 위생 식품 재료에 대한 고객의 선호도 증가와 신선도의 정도를 신속하게 검출하는 능력은 예측 기간에 걸쳐 부패 검출 기반 스마트 라벨 시장 수요를 촉진할 것으로 예상됩니다.

- 최근 식품 및 의약품의 리콜 증가로 인해 특정 "콜드체인"상품의 제조, 취급 및 관리 중에 안전한 제품 온도 범위를 유지하는 진정한 과제에 대한 세계 인식이 높아지고 있습니다. 2020년 1월, AXIA Pharmaceutical 이름으로 사업 중인 FUSION IV Pharmaceuticals Inc.는 유효기간 내인 사용하지 않은 모든 멸균 의약품을 멸균 부족을 이유로 자발적으로 회수했습니다.

- 게다가 COVID-19 팬데믹의 출현은 전자상거래 플랫폼에서 안전하고 추적성이 있는 식품에 대한 경사가 증가함에 따라 눈에 보이는 행동의 변화를 증가시켜 일반적으로 건강과 안전에 대한 사람들의 의식을 높였습니다.

- IBM의 조사(2020년)에 따르면 소비자의 약 71%가 제품의 완전한 투명성과 추적성을 제공하는 기업에 대해 평균 약 37%의 추가 프리미엄을 지불하고자 합니다. 이러한 상황에서 공급망 내의 엔드 투 엔드 가시화는 소비자와의 신뢰 구축을 목표로 하는 기업에 있어서 최우선 사항 중 하나가 되고 있으며, 블록체인과 IoT가 큰 영향을 줄 것으로 기대되고 있습니다.

- 제약, 의료 및 식품 산업의 스마트 라벨은 이러한 산업에서 제품 추적 및 품질 유지에 대한 필요성이 높아지고 있습니다. 일부 스마트 라벨에는 특히 운송 중 부패를 감지하는 기능이 있습니다. 이 라벨에는 광학 센서, 초음파 센서, 액티브 센서 등 많은 유형의 센서가 내장되어 있습니다. 이 센서는 내구성이 우수하며 수분, 온도, 이동, 위치 및 기타 여러 요인에 대한 정보를 제공합니다.

- 이러한 센서를 도입한 기업은 제품의 상태를 확인하여 부패를 방지하고 신선도를 검증하는 데 사용할 수 있습니다. 또한 부패를 방지하기 위해 보관 시설의 온도를 확인할 수 있습니다.

부패 감지 기반 스마트 라벨 시장 동향

RFID 부문이 주요 시장 점유율을 차지할 전망

- RFID와 같은 센서를 부패 감지 스마트 라벨에 통합하는 동향은 향후 몇년안에 다양한 산업에 도입될 가능성이 높습니다. RFID는 비용이 제한적이며 유지 보수가 매우 적기 때문에 제조, 물류, 건강 관리, 농업, 식품 등 수많은 응용 장면에서 매력적입니다.

- 스마트 라벨 개발은 RFID의 혁신적인 응용입니다. 일반적인 RFID 시스템은 리더와 라벨이라는 두 가지 주요 구성 요소로 구성됩니다. 스마트 라벨은 RFID 시스템과 그래픽 사용자 인터페이스(GUI)로 구성됩니다.

- 기본적으로 RFID 시스템과 관련된 두 가지 주요 구성 요소는 트랜스폰더(안테나에 부착된 라벨)와 인터로게이터(RFID 리더)입니다. 부패 감지 스마트 라벨은 RFID 태그의 도움으로 식감과 색상을 변경하거나 시스템에 전달함으로써 식품 소재의 정확한 신선도를 전달합니다.

- FAO의 데이터에 따르면 세계 수준에서는 약 33%의 식품이 공급망에서 폐기됩니다. 유럽 위원회에 따르면, 이 숫자는 소매 시장에 도착하기 전 음식의 40% 이상에 해당합니다. 공급 체인에서 식품 폐기의 주된 이유는 생산지, 가공, 포장, 주로 미관상의 이유, HORECA의 구매 관리, 유통, 소매 등 다양합니다. 많은 유통 센터와 창고는 개선 프로그램의 일환으로 공정 효율성을 높이기 위해 투자를 하고 있습니다. 이러한 투자는 RFID 기반 스마트 라벨의 성장을 가속할 것으로 기대됩니다.

- RFID 기술은 라벨에 내장된 RF 태그를 읽고, 프로그래밍하고, 검증하는 것 외에도 라벨 표면에 텍스트, 바코드, 그래픽을 동시에 인쇄할 수 있는 프린터에 대한 수요를 창출합니다. 스마트 라벨 프린터는 그래픽, 바코드 및 사람이 읽을 수 있는 텍스트를 작성할 때 기존 프린터로 작동합니다. 또한 RFID 인코더와 리더도 내장되어 있습니다.

- RFID 시스템은 데이터를 읽을 때 직접 시선을 필요로 하지 않고 제품별로 고유한 추적성을 제공합니다. 이 독자적인 자동화는 공급망과 물류 프로세스를 시각화하여 재고 관리 및 구매 예측을 간소화하고 줄이는 동시에 오류, 알 수없는 손실 및 재고 부족을 최소화합니다.

북미가 가장 큰 점유율을 차지할 전망

- 북미는 부패 감지 기반 스마트 라벨의 세계 최대 시장 중 하나이며 미국이 큰 점유율을 차지하고 있습니다. 이 나라의 거대한 수요는 크고 작은 소매점의 광대한 존재로 인한 것입니다. 미국은 Walmart 등 소매 업체들이 활동의 활성화를 견인하고 있으며, 이 나라의 조사 대상 시장 성장에 크게 기여하고 있습니다.

- 미국 농무부에 따르면 미국에서는 연간 식량 공급의 30-40%가 식품 폐기물인 것으로 추정되고 있습니다. 식품 폐기는 이 나라에서 막대한 식량 불안으로 이어지고 있습니다. 이 나라에서는 2022년에만 5천만 명이 식량 불안에 시달릴 것으로 예상됩니다. 이 식량 안보의 엄청난 증가는 식품 부패를 줄이기 위해 대규모 노력을 촉진하고 시장 성장을 가속할 것으로 보입니다. 다양한 소매점의 선반에 늘어선 우려해야 할 식품 폐기에 대처하기 위해 벤더는 스마트 라벨을 기반으로 새로운 부패 감지를 도입하여 이러한 폐기를 최소화하려고 합니다.

- 조사된 시장에서 기술의 보급으로 스마트 라벨은 신선도를 예측하고 소비자와 유통업체가 부패한 것을 이해하는 데 도움이 됩니다. R&D는 과일의 품질을 변경하지 않고 과바의 신선도를 패키지에 표시할 수 있는 표시기 라벨을 개발하는 데 도움이 됩니다.

- 또한 USDA(미국농무부)와 FDA(식품의약부)은 2019년에 세포 기반 식육과 잠재적으로 다른 식품을 표시하는 프레임워크 합의를 발표했습니다. 이에 따라 이 나라 시장 규모는 더욱 확대될 것으로 예상됩니다. 이 나라의 공급업체는 공급망 전체의 추적성을 향상시키는 기술에 투자하고 있으며, 부패 감지 기반 스마트 라벨과 함께 블록체인의 사용이 증가하고 있습니다.

- 이 나라의 건강 관리 지출 증가와 더불어 RFID 기술은 의료 및 의료 분야에서 부패 감지 기반 스마트 라벨 시장을 촉진할 것으로 기대되고 있습니다. 지출 증가는 부패 감지 기반 스마트 라벨의 새로운 전개 수단을 생성할 것으로 예상됩니다. 전반적으로 시장은 예측 기간 동안 국내에서 크게 성숙할 것으로 예상됩니다.

부패 감지 기반 스마트 라벨 산업 개요

부패 감지 기반 스마트 라벨 시장의 경쟁 기업간 경쟁 관계는 Evigence Sensors, Insignia Technologies와 같은 주요 기업의 존재에 의해 높아지고 있습니다. 업계 기업들은 시장 성장을 가속하는 전략적 파트너십을 맺어 지속적인 R&D를 통해 제품 개발을 성공적으로 수행할 수 있었습니다.

- 2022년 3월 - Avery Dennison Corporation은 영국 요크셔에 본사를 둔 영국 기업 Catchpoint Ltd가 개발한 라이너리스 라벨 기술을 인수했습니다. 이 인수는 Catchpoint의 특허, 브랜드, 기업 비밀, 노하우를 다룹니다.

- 2022년 1월 - 생명 과학 제품을 손상으로부터 보호하고 공급망의 무결성을 보장하는 상태 표시 솔루션의 세계 리더인 SpotSee가 주로 적혈구의 중심 온도를 모니터링하는 의료기기 제조업체인 Biosynergy, Inc.를 인수했습니다.

- 2022년 1월 - 세계 기업, 정부 기관, 중소기업, 소비자를 위한 특수 라벨, 보안, 패키징 솔루션의 세계적인 리더인 CCL Industries Inc.는 미국에 본사를 두고 있는 2개의 소프트웨어 태그 카드 기업 International Master Products Corporation과 Lodging Access Systems, LLC를 인수했습니다.

기타 혜택:

- 엑셀 형식 시장 예측(ME) 시트

- 3개월간의 애널리스트·지원

목차

제1장 서론

- 조사의 전제조건과 시장 정의

- 조사 범위

제2장 조사 방법

제3장 주요 요약

제4장 시장 인사이트

- 시장 개요

- 업계의 매력도 - Porter's Five Forces 분석

- 신규 참가업체의 위협

- 구매자의 협상력

- 공급기업의 협상력

- 대체품의 위협

- 경쟁 기업간 경쟁 관계의 강도

- 산업 밸류체인 분석

- COVID-19 팬데믹의 업계에 대한 영향 평가

제5장 시장 역학

- 시장 성장 촉진요인

- 제품의 신선도 판정 요구 증가

- 위생적인 식품 소재에 대한 소비자 기호의 고조

- 보안 및 추적 솔루션에 대한 수요 증가

- 시장의 과제

- 유비쿼터스 규격의 부족과 안전성에 대한 우려

제6장 시장 세분화

- 기술(정성적 동향 분석)

- RFID

- 센싱 라벨

- NFC

- 최종 사용자 산업

- 의약품

- 식음료

- 물류

- 화장품

- 기타 최종 사용자 산업

- 지역

- 북미

- 미국

- 캐나다

- 유럽

- 독일

- 영국

- 프랑스

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 라틴아메리카

- 중동 및 아프리카

- 북미

제7장 경쟁 구도

- 기업 프로파일

- Evigence Sensors

- Insignia Technologies

- Avery Dennison Corporation

- Innoscentia

- SpotSee

- SATO Holding AG

- Scanbuy Inc.

- Zebra Technologies Corporation

- Ensurge Micropower ASA

- CCL Industries Inc.

제8장 투자 분석

제9장 시장의 미래

JHS 25.04.07The Spoil Detection-based Smart Labels Market size is estimated at USD 1.11 billion in 2025, and is expected to reach USD 1.88 billion by 2030, at a CAGR of 11.09% during the forecast period (2025-2030).

Smart labels are becoming one of the most popular technologies across the pharmaceutical, food, and cosmetics industries. They are viewed as an ideal means to achieve greater efficiencies and profitability while providing the authenticity of an item and its traceability.

Key Highlights

- Smart labels provide detailed information about individual items in less time and offer real-time information. They also ensure authenticity and supply chain integrity while creating new opportunities for brands to engage with customers. The rising customer preference for hygienic food materials and the ability to quickly detect the degree of freshness is expected to drive the demand in the spoil detection-based smart labels market over the forecast period.

- The increased food and pharmaceutical recalls in recent years have raised global awareness about the genuine challenges of maintaining safe product temperature ranges during the production, handling, and administration of specific 'cold chain' goods. In January 2020, FUSION IV Pharmaceuticals Inc. dba. AXIA Pharmaceutical voluntarily recalled all unused sterile drug products within expiry, to the user level, due to a lack of assurance of sterility.

- Further, the emergence of the COVID-19 pandemic has led to an increase in visible behavioral changes due to a higher inclination toward safe and traceable food on e-commerce platforms and raised public consciousness about health and safety in general.

- According to an IBM study (2020), approximately 71% of consumers were willing to pay an additional average premium of around 37% for companies providing full transparency and traceability of their products. Under such conditions, end-to-end visibility within the supply chain has become one of the top priorities for businesses seeking to build trust with their consumers, where blockchain and IoT are expected to make a significant impact.

- Smart labels in the pharmaceutical, healthcare, and food industries are buoyed by the increasing need to track and maintain the quality of the products in these industries. Some smart labels are also equipped to detect spoilage, especially during transit. Many kinds of sensors are integrated into these labels, such as optical, ultrasonic, and active sensors. They are durable and provide information about moisture, temperature, movement, location, and many other factors.

- Companies deploying such sensors can use them to check the products' condition to prevent spoilage and validate their freshness. Companies may also check the temperature of storage facilities to avoid spoilage.

Spoil Detection Based Smart Labels Market Trends

The RFID Segment is Expected to Hold a Major Market Share

- The trend of integrating sensors such as RFID with spoil detection-based smart labels is likely to be introduced across various industry verticals in the next few years. RFIDs have a limited cost and negligible maintenance, which make them appealing for numerous applicative scenarios such as manufacturing, logistics, healthcare, agriculture, and food.

- Smart label development is an innovative application of RFID. Typical RFID systems comprise two major components: the reader and the label. The smart label consists of an RFID system and a graphical user interface (GUI).

- Principally, the two main components involved in the RFID system are the transponder (the label attached to the antenna) and the interrogator (RFID reader). Spoil detection-based smart labels convey the exact degree of freshness of the food material by changing its texture and color or communicating to the system with the help of RFID tags.

- According to FAO data, on a global level, about 33% of food is wasted in the supply chain. As per the European Commission, this figure amounts to over 40% of food products before reaching the retail market. The key reasons for this food waste in the supply chain range from their production origin, transformation, and packaging, largely for their aesthetic reason, HORECA purchasing management, distribution, and retail. Many distribution centers and warehouses have been investing in improving process efficiency to increase the efficiency of the processes as a part of improvement programs. Such investments are expected to drive growth for RFID-based smart labels.

- RFID technology has generated demand for a printer capable of concurrently printing text, bar codes, and graphics on the label's surface in addition to reading, programming, and verifying the RF tag embedded in the label. Smart label printers function as traditional printers when creating graphics, bar codes, and human-readable text. They also have RFID encoders and readers embedded inside.

- An RFID system enables unique traceability per product without requiring a direct line of sight for data reading. This exclusive automation results in the visibility of supply chain and logistics processes, which reduces errors, unknown losses, and out-of-stock to a minimum while simplifying and lowering inventory management and purchasing forecasting.

North America is Expected to Hold the Largest Share

- North America is one of the largest markets for spoil detection-based smart labels globally, with the United States accounting for a significant share in the region. The country's huge demand can be attributed to the vast presence of small and big retail stores. The United States is led by retail giants, such as Walmart and others, driving the upsurge in activity, largely contributing to the country's growth of the studied market.

- According to the US Department of Agriculture, food waste is estimated at 30-40% of the food supply annually in the United States. Food waste has led to huge food insecurity in the country. The country is expected to witness 50 million people suffering from food insecurity in 2022 alone. This staggering increase in food security will likely fuel large-scale initiatives to reduce food spoilage, driving the market growth. To address the alarming food wastage on the shelves of various retail stores, vendors are introducing new spoil detection based on smart labels to minimize such wastage.

- Technology proliferation in the studied market has allowed smart labels to predict freshness and help consumers and distributors understand spoiled ones. Research studies have helped develop indicator labels that can indicate on-package freshness for guavas without altering the quality of the fruit.

- Also, USDA and FDA (Food and Drug Administration) announced a framework agreement to label cell-based meats and potentially other food products in 2019. This is expected to augment the market size in the country further. Vendors in the country invest in technologies that drive greater traceability throughout their supply chains, with blockchain increasingly used along with spoil detection-based smart labels.

- Besides the rise in healthcare expenditure in the country, RFID technology is expected to propel the spoil detection-based smart label market in the healthcare and medical sectors. The increased spending is anticipated to create new deployment avenues for spoil detection-based smart labels. Overall, the market is expected to mature significantly in the country over the forecast period.

Spoil Detection Based Smart Labels Industry Overview

The competitive rivalry in the spoil detection-based smart labels market is high due to the presence of some key players such as Evigence Sensors, Insignia Technologies, and many more. The players in the industry have been able to successfully come up with product developments through continuous research and development by entering strategic partnerships that have enabled them to boost the market growth.

- March 2022 - Avery Dennison Corporation acquired the linerless label technology developed by Catchpoint Ltd, a UK company based in Yorkshire, England. The purchase covers Catchpoint's patents, brand, trade secrets, and know-how.

- January 2022 - SpotSee, one of the global leaders in condition-indicating solutions that protect life sciences products against damage and ensure supply chain integrity, acquired Biosynergy, Inc., a manufacturer of medical devices primarily used to monitor the core temperature of red blood cells.

- January 2022 - CCL Industries Inc., one of the world leaders in specialty label, security, and packaging solutions for global corporations, government institutions, small businesses, and consumers, acquired two U.S. headquartered, software-powered tag and card businesses - International Master Products Corporation, and Lodging Access Systems, LLC for its Avery unit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of the COVID-19 Pandemic on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Need to Determine the Freshness of Products

- 5.1.2 Rising Consumer Preference for Hygienic Food Materials

- 5.1.3 Increasing Demand for Security and Tracking Solutions

- 5.2 Market Challenges

- 5.2.1 Lack of Ubiquitous Standards and Safety Concerns

6 MARKET SEGMENTATION

- 6.1 Technology (Qualitative Trend Analysis)

- 6.1.1 RFID

- 6.1.2 Sensing Label

- 6.1.3 NFC

- 6.2 End-user Industry

- 6.2.1 Pharmaceutical

- 6.2.2 Food and Beverage

- 6.2.3 Logistics

- 6.2.4 Cosmetics

- 6.2.5 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Evigence Sensors

- 7.1.2 Insignia Technologies

- 7.1.3 Avery Dennison Corporation

- 7.1.4 Innoscentia

- 7.1.5 SpotSee

- 7.1.6 SATO Holding AG

- 7.1.7 Scanbuy Inc.

- 7.1.8 Zebra Technologies Corporation

- 7.1.9 Ensurge Micropower ASA

- 7.1.10 CCL Industries Inc.