|

시장보고서

상품코드

1891249

외골격 시장 : 대상 부위별, 동작 모드별, 외골격 형태별, 이동성별, 주요 지역별 업계 동향과 예측Exoskeleton Market: Industry Trends and Global Forecasts, Till 2035 Distribution by Body Part Covered, Mode of Operation, Form of Exoskeleton, Mobility and Key Geographical Regions |

||||||

외골격 시장 : 개요

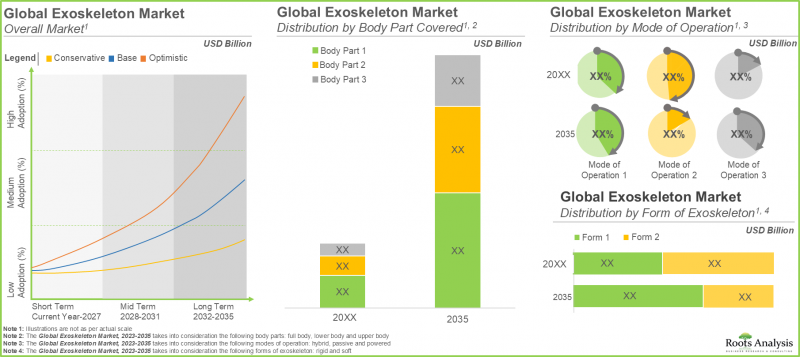

세계의 외골격 시장 규모는 2035년까지의 예측기간 동안 CAGR 22.4%로 성장하여 현재 29억 달러에서 2035년까지 203억 달러에 이를 것으로 추정되고 있습니다.

시장 규모 및 기회 분석은 다음 매개 변수별로 세분화됩니다.

대상 신체 부위

- 상반신

- 하반신

- 전신

작동 모드

- 전동식

- 수동식

- 하이브리드

형태

- 전동식

- 수동식

- 하이브리드

이동성

- 고정 및 지지

- 이동

최종 사용자

- 환자

- 의료 제공업체

주요 지역

- 북미

- 유럽

- 아시아태평양

- 기타 지역

의료용 외골격 시장 : 성장과 동향

최근 로봇 기술은 현저한 진보를 이루고 있으며 다양한 분야에서 인간의 보조나 지원을 목적으로 한 외골격의 유용성이 향상하고 있습니다. 특히 의료 분야에서는 환자와 의료 종사자 모두를 지원하는 큰 가능성을 나타내고 있습니다. 그러나 수십년에 걸친 연구와 수많은 응용 가능성에도 불구하고 임상 환경이나 가정 환경에서 자주 사용되는 다른 이동 지원 시스템과 의지 장비와의 경쟁으로 인해 외골격은 이해 관계자들 사이에서 주류로 선택받지 못하고 있습니다.

의료 분야의 외골격 장치는 주로 척수 손상(SCI), 뇌졸중, 신경 질환 또는 노화와 관련된 장애가 있는 사람들의 재활, 보행 훈련 및 이동 지원을 목적으로 합니다. 게다가 아시아태평양 등에서의 인구동태 변화는 이동능력 향상과 노인 의료에 대한 수요를 높이고 있으며, 미국의 특정 클리닉에서는 외골격 장치가 운동기능 회복에서의 재활 성과를 23% 향상시키는 것으로 보고되었습니다.

개발자는 외골격의 대중화를 위해 실제 수요에 부응하는 외골격 설계에 주력하고 있습니다. 비용 효율성과 사용 시 불쾌감과 같은 과제 해결을 위해 혁신적인 방법을 적극적으로 모색하여 번거로운 로봇 슈트가 아닌 보다 유기적이고 일체감 있는 "제2의 피부" 솔루션의 실현을 목표로 하고 있습니다. 또한 인공지능(AI)과 머신러닝을 통합하여 적절한 제어 알고리즘을 통해 장치가 사용자의 의도를 인식하고 인간과 로봇의 상호작용을 향상시키는 노력도 진행되고 있습니다. 또한 가상현실(VR), 증강현실(AR), 맞춤형 게임, 또는 이러한 기술을 결합한 혁신이 도입되어 환자의 참여를 촉진하고 할당된 운동을 지속하려는 의욕을 유지함으로써 로봇 요법의 개선을 도모하고 있습니다. 기술 진보와 이 분야에서의 지속적인 개발로 외골격 장치는 향후 수년간 큰 잠재력을 보유할 것으로 예측됩니다.

외골격 시장 : 주요 인사이트

이 보고서는 외골격 시장의 현재 상태를 상세하게 분석하고 업계 내 잠재적 성장 기회를 확인합니다. 주요 조사 결과는 다음과 같습니다.

- 현재 운동기능 장애가 있는 환자에 대한 지원이나 장애가 있는 환자를 다루는 간병인의 근골격계 손상 위험 저감을 목적으로 하는 200가지 유형 이상의 외골격이 판매 중이거나 개발 중입니다.

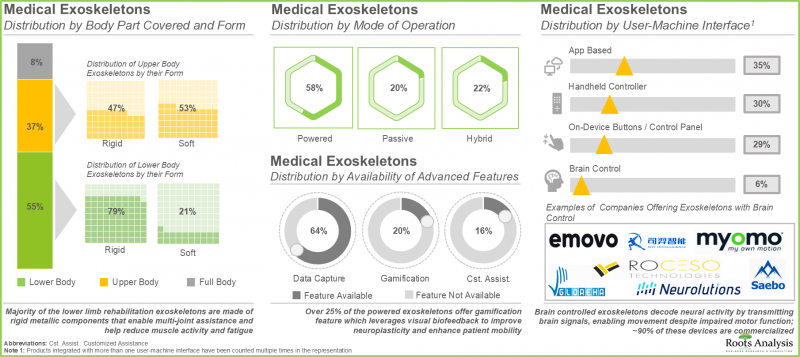

- 100가지 유형 이상의 의료용 외골격(경질 및 연질 포함)이 신체의 여러 부위를 커버하며 통상적으로 센서나 액추에이터를 구동하는 배터리로 동작합니다. 그 60% 이상이 환자의 행동 지표를 포착합니다.

- 의료용 외골격의 개발 기업은 세계적으로 사업을 전개하고 있으며, 그 40% 이상이 유럽의 주로 독일이나 스위스 등의 나라에 거점을 두고 있습니다.

- 환자의 의료용 외골격 수요 증가에 따라, 이 분야에서는 복수의 전략적 제휴가 체결되고 있습니다. 체결된 제휴의 대부분(26%)은 리셀러 계약입니다.

- 의료용 외골격 개발 기업은 도입률 향상과 사용자 투자 수익률(ROI) 극대화를 목표로 비용 절감을 도모하면서 선진 기능을 제품군에 통합하는 데 주력하고 있습니다.

- 2016년 이후 외골격과 관련된 특허가 약 3,800건 출원 및 승인되고 있으며, 이 분야에 종사하는 연구자들의 많은 노력을 볼 수 있습니다.

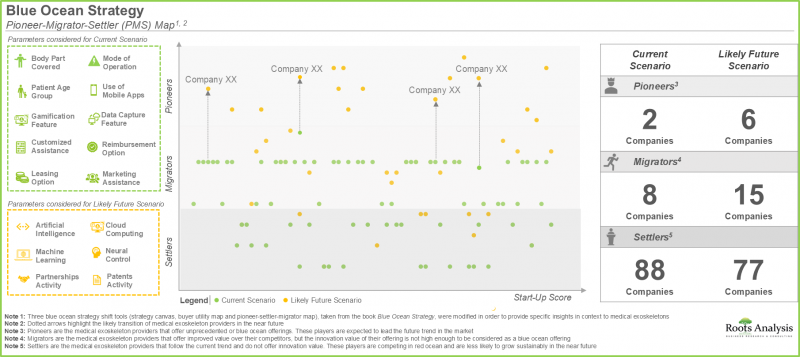

- 블루오션 전략 분석에서 개척자-이주자-안주자 지도를 통해 제품 기능 강화에 주력하고 있는 여러 의료용 외골격 개발 기업이 향후 수년간 개척자로 대두할 가능성이 높다는 것을 시사하고 있습니다.

- 2035년에는 근력 저하나 완전 또는 부분적인 마비가 있는 환자를 위해 주로 하반신을 지지하는 경성 외골격의 판매가 외골격 시장의 약 80%를 차지할 전망입니다.

의료용 외골격 시장 : 주요 부문

현재 하반신용 외골격 부문이 의료용 외골격 시장에서 가장 큰 점유율을 차지하고 있습니다.

대상 신체 부위에 따라 시장은 상반신용 외골격, 하반신용 외골격, 전신용 외골격으로 구분됩니다. 현재 하반신용 외골격 부문이 의료용 외골격 시장에서 가장 큰 점유율을 차지하고 있습니다. 이는 하반신용 외골격의 높은 가격과 하반신용 의료 외골격을 제공하는 기업의 증가 때문입니다. 덧붙여 전신용 의료외골격 시장은 보다 높은 CAGR로 성장할 것으로 예측되고 있습니다.

예측 기간 동안 수동형 외골격 부문은 외골격 시장에서 가장 빠르게 성장하는 부문으로 예상됩니다.

작동 모드별로 시장은 전동식 외골격, 수동식 외골격, 하이브리드 외골격으로 구분됩니다. 수동식 외골격 부문은 예측 기간 동안 비교적 빠른 성장률로 확대될 것으로 예측됩니다. 이는 액추에이터나 배터리를 필요로 하지 않고 필요한 인체공학적 지원을 제공하므로 초기 비용 절감과 사용자 유지비 절감으로 이어지기 때문입니다. 그러나 현재 전동식 의료용 외골격 부문은 의료용 외골격 시장에서 가장 큰 점유율을 차지하고 있습니다. 이 동향은 가까운 미래에 변화할 가능성은 낮을 전망입니다.

현재 경질 외골격 부문이 의료용 외골격 시장에서 가장 큰 점유율을 차지하고 있습니다.

형태별로, 시장 세분화는 경질 외골격과 연질 외골격으로 분류됩니다. 광범위한 이용 실적으로 경질 외골격이 의료용 외골격 시장을 독점하고 있습니다. 덧붙여 연질 외골격 부문도 비교적 높은 CAGR로 성장할 가능성이 높습니다.

현재 이동형 의료용 외골격이 의료용 외골격 시장에서 가장 큰 점유율을 차지하고 있습니다.

이동성별로 시장은 고정식 외골격과 이동식 외골격으로 세분화됩니다. 현재, 이동식 및 지상 보행용 의료용 외골격이 의료용 외골격 시장에서 보다 큰 점유율을 차지하고 있습니다. 이는 외골격이 환자의 기립, 계단 승강, 보행과 같은 기능적 자립 회복에 필수적인 활동에 참여할 수 있도록 하기 때문입니다. 또한 이동식 외골격은 외래 진료소, 주택, 공공장소 등 다양한 환경에서 이용 가능하며 환자가 기존의 의료 환경을 넘어 재활을 지속할 수 있도록 합니다.

현재 환자용 외골격이 의료용 외골격 시장에서 가장 큰 점유율을 차지할 것으로 예상됩니다

최종 사용자별로 시장 세분화는 시장을 환자와 의료 종사자로 구분합니다. 기존 의료용 외골격 시장의 대부분은 환자용 외골격이 차지하고 있다는 점에 유의해야 합니다.

북미가 시장에서 가장 큰 점유율을 차지할 전망입니다.

주요 지역별로는 북미, 유럽, 아시아태평양 및 기타 세계 지역으로 구분됩니다. 앞으로 수년간은 기타 세계 지역이 더 높은 CAGR로 성장할 것으로 예상됩니다.

외골격 시장의 대표 기업

- Bionic Yantra

- CYBERDYNE

- Ekso Bionics

- ExoAtlet

- Fourier Intelligence

- Gloreha

- Guangzhou Yikang Medical Equipment

- Hexar Humancare

- Hocoma

- MediTouch

- Milebot Robotics

- Myomo

- Neofect

- NextStep Robotics

- Panasonic

- ReWalk Robotics

- Rex Bionics

- Roam Robotics

- Trexo Robotics

- Tyromotion

- U&O Technologies

1차 조사 개요

본 조사에서 제시된 견해와 인사이트는 여러 이해관계자들과의 논의에 의해 작성되었습니다. 본 설문조사 보고서는 다음 업계 관계자에 대한 세부 인터뷰 기록을 게재합니다.

- A사 공동 창업자 겸 최고 경영 책임자

- B사 사업 기획 개발부장

- C사 영업 및 마케팅 담당 부사장

- D사 마케팅 및 디자인부장

- E사 창업자 겸 이사

의료용 외골격 시장 : 조사 범위

- 시장 규모와 기회 분석 : 본 보고서에서는 외골격 시장에 대해 (A)대상 신체 부위, (B)동작 모드, (C)이동성, (D)최종 사용자, (E)주요 지역 등 주요 시장 부문에 초점을 맞춘 상세한 분석을 제공합니다.

- 시장 상황 : 의료용 외골격 장치에 관한 종합적인 평가를 실시하고, (A)개발 상황, (B)대상 신체 부위, (C)동작 모드, (D)외골격의 형태, (E)장치의 가동성, (F)사용자-기계 인터페이스, (G)외골격의 고급 기능, (H)최종 사용자, (I)환자의 연령대, (J)환자를 위한 외골격 설정, (K)획기적인 의료기기 지정 여부를 바탕으로 평가를 실시하였습니다. 또한 (L)외골격 기술 및 소프트웨어, (M)외골격의 최대 중량, (N)최대 중량 운반 능력, (O)외골격의 치수에 대한 정보도 포함되어 있습니다. 또한 본 장에서는 의료용 외골격의 개발, 상업화에 종사하는 주요 기업의 리스트를 제시하고, 각사의 (P)설립연도, (Q)기업 규모, (R)본사 소재지, (S)기업 소유형태, (T)추가 제공 서비스, (U)의료용 외골격의 수에 근거한 가장 활발한 기업에 관한 정보를 기재하고 있습니다.

- 제품 경쟁력 : 의료용 외골격의 종합적인 경쟁 분석을 제공합니다. 구체적으로는 (A)공급자의 강점, (B)제품의 경쟁력, (C)최종 사용자 등의 요소를 검토합니다.

- 기업 프로파일(상세 프로파일) : 의료용 외골격을 제공하는 주요 기업의 상세 프로파일을 제공하며 (A)기업 개요, (B)재무 정보(공개된 경우), (C)제품 포트폴리오, (D)최근 동향, (E)미래 전망에 중점을 두고 있습니다.

- 기업 프로파일(표 형식) : 의료용 외골격을 제공하는 주요 기업의 간략한 개요이며 주로 (A)기업 개요 및 (B)제품 포트폴리오에 중점을 두고 있습니다.

- 제휴 및 협력 관계 : 2017년 이후에 본 분야에서 체결된 제휴 관계를 이하의 파라미터에 근거해 분석합니다. (A)제휴 연수, (B)제휴 형태(합병, 인수, 제품 개발, 상업화 계약, 라이선싱 계약, 서비스 계약, 제품 개발, 제조 계약, 합작 사업, 제조, 공급 계약, 제품 유통 계약), (C)파트너의 유형(업계 내 및 업계 외), (D)사업의 세계화, (E)가장 활발한 진출기업을 바탕으로 분석합니다. 이 장에서는 본 시장에서의 제휴 활동의 지역 분포에 대해서도 다룹니다.

- 특허 분석 : 출원 및 등록된 각종 특허의 상세 분석을 (A)특허의 유형, (B)특허출원연도, (C)특허공개연도, (D)지리적 소재지, (E)출원자 유형, (F)공개시기, (G)주요 CPC분류기호, (H)주요 기업(출원 및 등록 특허수 기반)에 따라 실시하였습니다.

- 블루 오션 전략 : 블루 오션 전략에 기반한 현재 및 미래 시장에 대한 종합적인 분석을 제공합니다. 신흥 의료용 외골격 기업을 위한 전략적 계획 및 가이드를 망라하고 경쟁이 없는 시장을 개척하는 지원을 실시합니다. 시장에서 경쟁 우위를 얻기 위해 블루 오션으로 전환하는 데 도움이 되는 13가지 전략 도구를 강조합니다.

- 시장 영향 분석 : 이 보고서는 시장 성장에 영향을 미치는 다양한 요인(추진 요인, 억제요인, 기회, 과제 등)을 분석합니다.

목차

제1장 서문

제2장 조사 방법

제3장 경제적 및 기타 프로젝트 특유의 고려 사항

- 개요

- 시장 역학

제4장 주요 요약

제5장 소개

- 개요

- 외골격의 개요

- 외골격의 역사

- 외골격의 분류

- 외골격의 특징

- 외골격의 한계

- 외골격의 응용

- 외골격의 전망

제6장 의료용 외골격 : 시장 상황

- 개요

- 의료용 외골격 : 시장 상황

- 의료용 외골격 : 개발 전망

제7장 비의료용 외골격 : 시장 상황

- 개요

- 비의료용 외골격 : 시장 상황

- 비의료용 외골격 : 개발 전망

제8장 의료용 외골격 : 제품 경쟁력 분석

- 개요

- 전제 및 주요 파라미터

- 조사 방법

- 의료용 외골격 : 제품 경쟁력 분석

제9장 외골격 개발자 : 상세한 기업 프로파일

- 개요

- CYBERDYNE

- Ekso Bionics

- ExoAtlet

- Fourier Intelligence

- Gloreha

- Guangzhou Yikang

- Hexar Humancare

- Hocoma

- Panasonic

- Tyromotion

제10장 외골격 개발자 : 기업 프로파일

- 개요

- Bionic Yantra

- MediTouch

- Milebot Robotics

- Myomo

- Neofect

- NextStep Robotics

- ReWalk Robotics

- Rex Bionics

- Roam Robotics

- Trexo Robotics

- U&O Technologies

제11장 의료용 외골격: 파트너십 및 협업

- 개요

- 파트너십 모델

- 의료용 외골격 : 파트너십과 콜라보레이션 목록

제12장 특허 분석

제13장 블루 오션 전략

- 블루 오션 전략 개요

제14장 시장 영향 분석 : 촉진요인, 억제요인, 기회, 과제

제15장 세계의 외골격 시장

제16장 외골격 시장(신체 부위별)

제17장 외골격 시장(동작 모드별)

제18장 외골격 시장(형태별)

제19장 외골격 시장(이동성별)

제20장 외골격 시장(최종사용자별)

제21장 외골격 시장(지역별)

제22장 결론

제23장 주요 인사이트

제24장 부록 I : 블루 오션 전략과 시프트 툴

- 개요

- 블루 오션 전략과 시프트 툴

- 블루 오션 전략의 순서

제25장 부록 II : 표 형식 데이터

제26장 부록 III : 기업 및 조직 목록

CSM 25.12.26Exoskeleton Market: Overview

As per Roots Analysis, the global exoskeleton market is estimated to grow from USD 2.9 billion in the current year to USD 20.3 billion by 2035, at a CAGR of 22.4% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Body Part Covered:

- Upper Extremity

- Lower Extremity

- Full Body

Mode of Operation:

- Powered

- Passive

- Hybrid

Form:

- Powered

- Passive

- Hybrid

Mobility

- Fixed / Supported

- Mobile

End Users

- Patients

- Healthcare Providers

Key Geographical Regions

- North America

- Europe

- Asia-Pacific

- Rest of the World

Medical Exoskeleton Market: Growth and Trends

Over the years, significant advancements have occurred in robotic technologies, leading to enhanced usability of exoskeletons across different sectors for aiding and supporting humans. Especially in healthcare, these devices have demonstrated significant potential in aiding both patients and medical professionals. It is important to mention that even after decades of study and numerous possible applications, exoskeletons have not become the favored choice for stakeholders because of competition from other mobility systems and prosthetic devices often used in clinical and domestic environments.

Exoskeletons in healthcare mainly support rehabilitation, gait training, and mobility for those with spinal cord injuries (SCI), strokes, neurological conditions, or age-related disabilities. Further, demographic changes, especially in areas such as Asia-Pacific, heighten the demand for mobility improvements and elder care, with exoskeletons boosting rehabilitation results by 23% in motor function recovery at certain US clinics.

To ensure widespread approval, developers are concentrating on meeting real needs with their exoskeleton designs. They are actively seeking innovations to address issues related to cost-efficiency and user discomfort, striving to turn exoskeletons into more organic and integrated second skin solutions instead of cumbersome robotic suits. Additionally, developers are incorporating artificial intelligence and machine learning to allow devices to recognize the user's intentions and enhance human-robot interactions via suitable control algorithms. Moreover, innovations such as virtual reality (VR), augmented reality (AR), tailored games, or a mix of these methods are being implemented to improve robotic therapy by boosting patient involvement and ensuring they stay dedicated to completing their assigned exercises. Due to technological progress and continual developments in this area, exoskeleton devices are expected to have significant potential in the years to come.

Exoskeleton Market: Key Insights

The report delves into the current state of the exoskeleton market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Presently, over 200 exoskeletons are available / under development to provide support to patients with mobility impairments or reduce the risk of musculoskeletal injuries among caregivers dealing with disabled patients.

- Over 100 medical exoskeletons, both rigid and soft, cover different parts of the body and are typically operated using batteries that power the sensors and actuators; over 60% of them capture the motion metrics of patients.

- Developers of medical exoskeletons have established a global presence; more than 40% of these players are based in Europe, primarily in countries, such as Germany and Switzerland.

- With the growing demand for medical exoskeletons amongst patients, several types of strategic deals have been inked in this domain; majority (26%) of partnerships signed were distribution agreements.

- In order to increase adoption rates and maximize return on investment (ROI) for the users, developers of medical exoskeletons are striving to reduce costs while incorporating advanced features into their portfolio of devices.

- Nearly 3,800 patents related to exoskeletons have been filed / granted since 2016, indicating the substantial efforts made by researchers engaged in this domain.

- The pioneer-migrator-settler map in blue ocean strategy analysis suggests that several medical exoskeleton developers focused on enhancing their product features are likely to emerge as pioneers in the coming years.

- In 2035, nearly 80% of the exoskeleton market is likely to be driven by the sales of rigid exoskeletons primarily supporting the lower body, in patients with muscle weaknesses or complete / partial paraplegia.

Medical Exoskeleton Market: Key Segments

Currently, Lower Body Exoskeleton Segment Occupies the Largest Share of the Medical Exoskeleton Market

In terms of the body part covered, the market is segmented into upper body exoskeletons, lower body exoskeletons and full body exoskeletons. At present, the lower body exoskeleton segment holds the maximum share of the medical exoskeleton market. This is due to the steep price of lower body exoskeletons and an increase in the number of companies providing lower body medical exoskeletons. It is worth highlighting that the exoskeleton market for full body medical exoskeletons is anticipated to grow at a higher CAGR.

Passive Exoskeletons Segment is the Fastest Growing Segment of the Exoskeleton Market During the Forecast Period

In terms of the mode of operation, the market is segmented into powered exoskeletons, passive exoskeletons and hybrid exoskeletons. The passive exoskeletons segment is expected to expand at a comparatively faster growth rate throughout the forecast period. This is due to the devices offering necessary ergonomic assistance without requiring actuators or batteries, resulting in decreased initial costs and lower maintenance expenses for the users. However, currently, the powered medical exoskeleton segment holds the maximum share of the medical exoskeleton market. This trend is unlikely to change in the near future.

Currently, Rigid Exoskeletons Segment Occupies the Largest Share of the Medical Exoskeleton Market

In terms of their form, the market is segmented into rigid exoskeletons and soft exoskeletons. Due to their extensive use, rigid exoskeletons dominate the medical exoskeleton market. It is worth noting that soft exoskeletons segment is likely to grow at a relatively higher CAGR.

Currently, Mobile Medical Exoskeletons Occupy the Largest Share of the Medical Exoskeleton Market

In terms of mobility, the market is segmented into stationary exoskeletons and mobile exoskeletons. It is worth highlighting that, at present, mobile / overground walking medical exoskeleton holds a larger share of the medical exoskeleton market. This is owing to the fact that exoskeletons enable patients to engage in activities such as standing, climbing stairs, or walking, which are vital for restoring functional independence. Moreover, mobile exoskeletons can be utilized in different settings, such as outpatient clinics, residential areas, and communal spaces, allowing patients to pursue their rehabilitation beyond conventional healthcare environments.

Currently, Patient-Focused Exoskeletons are Expected to Capture the Largest Share of the Medical Exoskeleton Market

In terms of the end-user, the market is segmented into patients and healthcare professionals. It is important to note that a significant share of the existing medical exoskeleton market is dominated by patient-oriented exoskeletons.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific and Rest of the world. It is worth highlighting that, over the years, the market in the rest of the world is expected to grow at a higher CAGR.

Example Players in the Exoskeleton Market

- Bionic Yantra

- CYBERDYNE

- Ekso Bionics

- ExoAtlet

- Fourier Intelligence

- Gloreha

- Guangzhou Yikang Medical Equipment

- Hexar Humancare

- Hocoma

- MediTouch

- Milebot Robotics

- Myomo

- Neofect

- NextStep Robotics

- Panasonic

- ReWalk Robotics

- Rex Bionics

- Roam Robotics

- Trexo Robotics

- Tyromotion

- U&O Technologies

Primary Research Overview

The opinions and insights presented in this study were influenced by discussions conducted with multiple stakeholders. The research report features detailed transcripts of interviews held with the following industry stakeholders:

- Co-Founder and Chief Executive Officer, Company A

- Director of Business Planning and Development, Company B

- Vice President of Sales and Marketing, Company C

- Marketing and Design Manager, Company D

- Founder and Director, Company E

Medical Exoskeleton Market: Research Coverage

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the exoskeleton market, focusing on key market segments, including [A] body part covered, [B] mode of operation, [C] mobility, [D] end users and [F] key geographical regions.

- Market Landscape: A comprehensive evaluation of medical exoskeletons, considering various parameters, such as [A] status of development, [B] body part covered, [C] mode of operation, [D] form of exoskeleton, [E] device mobility, [F] user-machine interface, [G] advanced features of exoskeleton, [H] end users, [I] patient age group, [J] exoskeleton setting for patients and [K] grant of breakthrough device designation. Additionally, it includes information on [L] exoskeleton technology / software, [M] maximum weight of exoskeleton, [N] maximum weight carrying capacity and [O] exoskeleton dimensions. Further, the chapter presents a list of players engaged in the development / commercialization of medical exoskeletons, along with information on their [P] year of establishment, [Q] company size, [R] location of headquarters, [S] company ownership, [T] additional services offered and [U] most active companies (in terms of number of medical exoskeleton offered).

- Product Competitiveness: A comprehensive competitive analysis of medical exoskeletons, examining factors, such as [A] supplier strength, [B] product competitiveness and [C] end users.

- Company Profiles (Detailed Profiles): In-depth profiles of key players offering medical exoskeletons, focusing on [A] company overviews, [B] financial information (if available), [C] product portfolio, [D] recent developments and [E] an informed future outlook.

- Company Profiles (Tabulated Profiles): Short profiles of key players offering medical exoskeletons, focusing on [A] company overviews and [B] product portfolio.

- Partnerships and Collaborations: An analysis of partnerships established in this sector, since 2017, based on several parameters, such as [A] year of partnership, [B] type of partnership (mergers and acquisitions, product development and commercialization agreements, licensing agreements, service agreements, product development and manufacturing agreements, joint ventures, manufacturing and supply agreements, and product distribution agreements), [C] type of partner (industry and non-industry), [D] business globalization and [E] most active players. This section also highlights the regional distribution of partnership activity in this market.

- Patent Analysis: Detailed analysis of various patents filed / granted based on [A] type of patent, [B] patent application year, [C] patent publication year, [D] geographical location, [E] type of applicant, [F] publication time, [G] top CPC symbols, [H] leading players (in terms of number of patents filed / granted), along with [I] a detailed patent benchmarking analysis.

- Blue Ocean Strategy: A comprehensive analysis of current and future market based on blue ocean strategy, covering a strategic plan / guide for emerging medical exoskeleton companies to help unlock an uncontested market, highlighting thirteen strategic tools that can help to shift towards blue ocean to gain a competitive edge in the market.

- Market Impact Analysis: The report analyzes various factors such as drivers, restraints, opportunities, and challenges affecting market growth.

Key Questions Answered in this Report

- How many companies are currently engaged in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

Reasons to Buy this Report

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

Additional Benefits

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Introduction

- 1.2. Key Market Insights

- 1.3. Scope of the Report

- 1.4. Research Methodology

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Project Methodology

- 2.4. Forecast Methodology

- 2.5. Robust Quality Control

- 2.6. Key Market Segmentations

- 2.7. Key Considerations

- 2.7.1. Demographics

- 2.7.2. Economic Factors

- 2.7.3. Government Regulations

- 2.7.4. Supply Chain

- 2.7.5. COVID Impact / Related Factors

- 2.7.6. Market Access

- 2.7.7. Healthcare Policies

- 2.7.8. Industry Consolidation

3. ECONOMIC AND OTHER PROJECT SPECIFIC CONSIDERATIONS

- 3.1. Chapter Overview

- 3.2. Market Dynamics

- 3.2.1. Time Period

- 3.2.1.1. Historical Trends

- 3.2.1.2. Current and Forecasted Estimates

- 3.2.2. Currency Coverage

- 3.2.2.1. Overview of Major Currencies Affecting the Market

- 3.2.2.2. Impact of Currency Fluctuations on the Industry

- 3.2.3. Foreign Exchange Impact

- 3.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 3.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 3.2.4. Recession

- 3.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 3.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 3.2.5. Inflation

- 3.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 3.2.5.2. Potential Impact of Inflation on the Market Evolution

- 3.2.1. Time Period

4. EXECUTIVE SUMMARY

5. INTRODUCTION

- 5.1. Chapter Overview

- 5.2. Overview of Exoskeletons

- 5.3. History of Exoskeletons

- 5.4. Classification of Exoskeletons

- 5.4.1. Based on Body Part Supported

- 5.4.2. Based on Form of Exoskeleton

- 5.4.3. Based on Mode of Operation

- 5.4.4 Based on Mobility

- 5.5. Features of Exoskeletons

- 5.6. Limitations of Exoskeletons

- 5.7. Applications of Exoskeletons

- 5.8. Future Aspects of Exoskeletons

6. MEDICAL EXOSKELETONS: MARKET LANDSCAPE

- 6.1. Chapter Overview

- 6.2. Medical Exoskeletons: Overall Market Landscape

- 6.2.1. Analysis by Status of Development

- 6.2.2. Analysis by Type of Body Part Covered

- 6.2.3. Analysis by Mode of Operation

- 6.2.4. Analysis by Type of Body Part Covered and Mode of Operation

- 6.2.5. Analysis by Form of Exoskeleton

- 6.2.6. Analysis by Mode of Operation and Form of Exoskeleton

- 6.2.7. Analysis by Type of Body Part Covered and Form of Exoskeleton

- 6.2.8. Analysis by Device Mobility

- 6.2.9. Analysis by Mode of Operation and Device Mobility

- 6.2.10. Analysis by Form of Exoskeleton and Device Mobility

- 6.2.11. Analysis by Type of Body Part Covered and Device Mobility

- 6.2.12. Analysis by User-Machine Interface

- 6.2.13. Analysis by Type of Body Part Covered and User-Machine Interface

- 6.2.14. Analysis by Mode of Operation and User-Machine Interface

- 6.2.15. Analysis by Availability of Advanced Features

- 6.2.16. Analysis by End User

- 6.2.17. Analysis by Patient Age Group

- 6.2.18. Analysis by Exoskeleton Setting for Patients

- 6.2.19. Analysis by Breakthrough Designation

- 6.3. Medical Exoskeletons: Developer: Landscape

- 6.3.1. Analysis by Year of Establishment

- 6.3.2. Analysis by Company Size

- 6.3.3. Analysis by Location of Headquarters

- 6.3.4. Analysis by Company Size and Location of Headquarters (Region)

- 6.3.5. Analysis by Company Ownership

- 6.3.6. Analysis by Location of Headquarters (Region) and Company Ownership

- 6.3.7. Analysis by Additional Services Offered

- 6.3.8. Most Active Players: Analysis by Number of Medical Exoskeletons

7. NON-MEDICAL EXOSKELETONS: MARKET LANDSCAPE

- 7.1. Chapter Overview

- 7.2. Non-Medical Exoskeletons: Overall Market Landscape

- 7.2.1. Analysis by Status of Development

- 7.2.2. Analysis by Type of Body Part Covered

- 7.2.3. Analysis by Body Part Supported

- 7.2.4. Analysis by Mode of Operation

- 7.2.5. Analysis by Form of Exoskeleton

- 7.2.6. Analysis by Type of Body Part Covered and Mode of Operation

- 7.2.7. Analysis by Type of Body Part Covered and Form of Exoskeleton

- 7.2.8. Analysis by Mode of Operation and Form of Exoskeleton

- 7.2.9. Analysis by Application Area

- 7.2.10. Analysis by Mode of Operation and Application Area

- 7.3. Non-Medical Exoskeletons: Developer Landscape

- 7.3.1. Analysis by Year of Establishment

- 7.3.2. Analysis by Company Size

- 7.3.3. Analysis by Company Size and Employee Count

- 7.3.4. Analysis by Location of Headquarters

- 7.3.5. Analysis by Company Size and Location of Headquarters (Region)

- 7.3.6. Analysis by Company Ownership

- 7.3.7. Analysis by Location of Headquarters (Region) and Company Ownership

- 7.3.8. Most Active Players: Analysis by Number of Non-Medical Exoskeletons

- 7.3.9. Most Active Players: Analysis by Number of Exoskeletons

8. MEDICAL EXOSKELETONS: PRODUCT COMPETITIVENESS ANALYSIS

- 8.1. Chapter Overview

- 8.2. Assumptions and Key Parameters

- 8.3. Methodology

- 8.4. Medical Exoskeletons: Product Competitiveness Analysis

- 8.4.1. Product Competitiveness Analysis: Upper Body Medical Exoskeletons

- 8.4.1.1. Product Competitiveness Analysis: Powered Upper Body Exoskeletons

- 8.4.1.2. Product Competitiveness Analysis: Passive Upper Body Exoskeletons

- 8.4.1.3. Product Competitiveness Analysis: Hybrid Upper Body Exoskeletons

- 8.4.2. Product Competitiveness Analysis: Lower Body Exoskeletons

- 8.4.2.1. Product Competitiveness Analysis: Powered Lower Body Exoskeletons

- 8.4.2.2. Product Competitiveness Analysis: Passive Lower Body Exoskeletons

- 8.4.2.3. Product Competitiveness Analysis: Hybrid Lower Body Exoskeletons

- 8.4.3. Product Competitiveness Analysis: Full Body Medical Exoskeletons

- 8.4.1. Product Competitiveness Analysis: Upper Body Medical Exoskeletons

9. EXOSKELETON DEVELOPERS: DETAILED COMPANY PROFILES

- 9.1. Chapter Overview

- 9.2. CYBERDYNE

- 9.2.1. Company Overview

- 9.2.2. Financial Information

- 9.2.3. Product Portfolio

- 9.2.4 Recent Developments and Future Outlook

- 9.3. Ekso Bionics

- 9.3.1. Company Overview

- 9.3.2. Financial Information

- 9.3.3. Product Portfolio

- 9.3.4 Recent Developments and Future Outlook

- 9.4. ExoAtlet

- 9.4.1. Company Overview

- 9.4.2. Product Portfolio

- 9.4.3. Recent Developments and Future Outlook

- 9.5. Fourier Intelligence

- 9.5.1. Company Overview

- 9.5.2. Product Portfolio

- 9.5.3. Recent Developments and Future Outlook

- 9.6. Gloreha

- 9.6.1. Company Overview

- 9.6.2. Product Portfolio

- 9.6.3. Recent Developments and Future Outlook

- 9.7. Guangzhou Yikang

- 9.7.1. Company Overview

- 9.7.2. Product Portfolio

- 9.7.3. Recent Developments and Future Outlook

- 9.8. Hexar Humancare

- 9.8.1. Company Overview

- 9.8.2. Product Portfolio

- 9.8.3. Recent Developments and Future Outlook

- 9.9. Hocoma

- 9.9.1. Company Overview

- 9.9.2. Product Portfolio

- 9.9.3. Recent Developments and Future Outlook

- 9.10. Panasonic

- 9.10.1. Company Overview

- 9.10.2. Financial Information

- 9.10.3. Product Portfolio

- 9.10.4. Recent Developments and Future Outlook

- 9.11. Tyromotion

- 9.11.1. Company Overview

- 9.11.2. Product Portfolio

- 9.11.3. Recent Developments and Future Outlook

10. EXOSKELETON DEVELOPERS: TABULATED COMPANY PROFILES

- 10.1. Chapter Overview

- 10.2. Bionic Yantra

- 10.2.1. Company Overview

- 10.2.2. Product Portfolio

- 10.3. MediTouch

- 10.3.1. Company Overview

- 10.3.2. Product Portfolio

- 10.4. Milebot Robotics

- 10.4.1. Company Overview

- 10.4.2. Product Portfolio

- 10.5. Myomo

- 10.5.1. Company Overview

- 10.5.2. Product Portfolio

- 10.6. Neofect

- 10.6.1. Company Overview

- 10.6.2. Product Portfolio

- 10.7. NextStep Robotics

- 10.7.1. Company Overview

- 10.7.2. Product Portfolio

- 10.8. ReWalk Robotics

- 10.8.1. Company Overview

- 10.8.2. Product Portfolio

- 10.9. Rex Bionics

- 10.9.1. Company Overview

- 10.9.2. Product Portfolio

- 10.10. Roam Robotics

- 10.10.1. Company Overview

- 10.10.2. Product Portfolio

- 10.11. Trexo Robotics

- 10.11.1. Company Overview

- 10.11.2. Product Portfolio

- 10.12. U&O Technologies

- 10.12.1. Company Overview

- 10.12.2. Product Portfolio

11. MEDICAL EXOSKELETONS: PARTNERSHIPS AND COLLABORATIONS

- 11.1. Chapter Overview

- 11.2. Partnership Models

- 11.3. Medical Exoskeletons: List of Partnerships and Collaborations

- 11.3.1. Analysis by Year of Partnership

- 11.3.2. Analysis by Type of Partnership

- 11.3.3. Analysis by Year and Type of Partnership

- 11.3.4. Analysis by Purpose of Partnership

- 11.3.5. Analysis by Type and Purpose of Partnership

- 11.3.6. Analysis by Type of Partner

- 11.3.7. Analysis by Year of Partnership and Type of Partner

- 11.3.8. Analysis by Type of Non-Industry Players

- 11.3.9. Most Active Players: Distribution by Number of Partnerships

- 11.3.10. Analysis by Geography

- 11.3.10.1. Local and International Agreements

- 11.3.10.2. Intracontinental and Intercontinental Agreements

12. PATENT ANALYSIS

- 12.1. Chapter Overview

- 12.2. Scope and Methodology

- 12.3. Exoskeletons: Patent Analysis

- 12.3.1. Analysis by Patent Application Year

- 12.3.2. Analysis by Patent Publication Year

- 12.3.3. Analysis by Type of Patent and Patent Publication Year

- 12.3.4. Analysis by Publication Time

- 12.3.5. Analysis by Patent Jurisdiction

- 12.3.6. Analysis by CPC symbols

- 12.3.7. Analysis by Type of Applicant

- 12.3.8. Leading Industry Players: Analysis by Number of Patents

- 12.3.9. Leading Non-Industry Players: Analysis by Number of Patents

- 12.3.10. Leading Patent Assignees: Analysis by Number of Patents

- 12.4. Exoskeletons: Patent Benchmarking

- 12.4.1. Analysis by Patent Characteristics

- 12.4.2. Exoskeleton: Patent Valuation

- 12.5. Leading Players by Number of Citations

13. BLUE OCEAN STRATEGY

- 13.1. Overview of Blue Ocean Strategy

- 13.1.1. Red Oceans

- 13.1.2. Blue Oceans

- 13.1.3. Comparison of Red Ocean Strategy and Blue Ocean Strategy

- 13.1.4. Medical Exoskeletons: Blue Ocean Strategy and Shift Tools

- 13.1.4.1. Strategy Canvas

- 13.1.4.2. Pioneer-Migrator-Settler (PMS) Map

- 13.1.4.3. Buyer Utility Map

14. MARKET IMPACT ANALYSIS: DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES

- 14.1. Chapter Overview

- 14.2. Market Drivers

- 14.3. Market Restraints

- 14.4. Market Opportunities

- 14.5. Market Challenges

- 14.6. Conclusion

15. GLOBAL EXOSKELETONS MARKET

- 15.1. Chapter Overview

- 15.2. Forecast Methodology and Key Assumptions

- 15.3. Global Exoskeletons Market, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 15.3.1. Scenario Analysis

- 15.3.1.1. Conservative Scenario

- 15.3.1.2. Optimistic Scenario

- 15.3.1. Scenario Analysis

- 15.4. Key Market Segmentations

16. EXOSKELETONS MARKET, BY BODY PART COVERED

- 16.1. Chapter Overview

- 16.2. Forecast Methodology and Key Assumptions

- 16.3. Overall Exoskeletons Market: Distribution by Body Part Covered

- 16.3.1. Overall Upper Body Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.3.2. Overall Lower Body Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.3.3. Overall Full Body Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.4. Medical Exoskeletons Market: Distribution by Body Part Covered

- 16.4.1 Medical Upper Body Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.4.2. Medical Lower Body Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.4.3. Medical Full Body Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.5. Non-Medical Exoskeletons Market: Distribution by Body Part Covered

- 16.5.1. Non-Medical Upper Body Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.5.2. Non-Medical Lower Body Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.5.3. Non-Medical Full Body Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 16.6. Data Triangulation and Validation

17. EXOSKELETONS MARKET, BY MODE OF OPERATION

- 17.1. Chapter Overview

- 17.2. Forecast Methodology and Key Assumptions

- 17.3. Overall Exoskeletons Market: Distribution by Mode of Operation

- 17.3.1. Overall Powered Exoskeletons Market: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.3.2. Overall Passive Exoskeletons Market: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.3.3. Overall Hybrid Exoskeletons Market: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.4. Medical Exoskeletons Market: Distribution by Mode of Operation

- 17.4.1. Medical Powered Exoskeletons Market: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.4.2. Medical Passive Exoskeletons Market: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.4.3. Medical Hybrid Exoskeletons Market: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.5. Non-Medical Exoskeletons Market: Distribution by Mode of Operation

- 17.5.1. Non-Medical Powered Exoskeletons Market: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.5.2. Non-Medical Passive Exoskeletons Market: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.5.3. Non-Medical Hybrid Exoskeletons Market: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 17.6. Data Triangulation and Validation

18. EXOSKELETON MARKETS, BY THEIR FORM

- 18.1. Chapter Overview

- 18.2. Forecast Methodology and Key Assumptions

- 18.3. Overall Exoskeletons Market: Distribution by Form

- 18.3.1. Overall Rigid Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.3.2. Overall Soft Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.4. Medical Exoskeletons Market: Distribution by Form

- 18.4.1. Medical Rigid Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.4.2. Medical Soft Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.5. Non-Medical Exoskeletons Market: Distribution by Form

- 18.5.1. Non-Medical Rigid Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.5.2. Non-Medical Soft Exoskeletons: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 18.6. Data Triangulation and Validation

19. EXOSKELETON MARKETS, BY THEIR MOBILITY

- 19.1. Chapter Overview

- 19.2. Forecast Methodology and Key Assumptions

- 19.3. Medical Exoskeletons Market: Distribution by Mobility

- 19.3.1. Medical Fixed/ Supported Exoskeleton: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.3.2. Medical Mobile / Overground Walking Exoskeleton: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 19.4. Data Triangulation and Validation

20. EXOSKELETONS MARKET, BY END USERS

- 20.1. Chapter Overview

- 20.2. Forecast Methodology and Key Assumptions

- 20.3. Overall Exoskeletons Market: Distribution by End Users

- 20.4. Exoskeletons Market for Patients: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.5. Exoskeletons Market for Healthcare Providers: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.6. Exoskeletons Market for Industry Workers: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.7. Exoskeletons Market for Military Personnel: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.8. Exoskeletons Market for Other End Users: Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 20.9. Data Triangulation and Validation

21. EXOSKELETONS MARKET, BY GEOGRAPHY

- 21.1. Chapter Overview

- 21.2. Forecast Methodology and Key Assumptions

- 21.3. Overall Exoskeletons Market: Distribution by Geography

- 21.3.1. North America, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 21.3.2 Europe, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 21.3.3. Asia-Pacific, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 21.3.4. Rest of the World, Historical Trends (since 2018) and Forecasted Estimates (till 2035)

- 21.4. Data Triangulation and Validation

22. CONCLUSION

23. EXECUTIVE INSIGHTS

- 23.1. Chapter Overview

- 23.2. Company A

- 23.2.1. Company Snapshot

- 23.2.2. Interview Transcript: Co-Founder and Chief Executive Officer

- 23.3. Company B

- 23.3.1. Company Snapshot

- 23.3.2. Interview Transcript: Director of Business Planning and Development

- 23.4. Company C

- 23.4.1. Company Snapshot

- 23.4.2. Interview Transcript: Vice President of Sales and Marketing

- 23.5. Company D

- 23.5.1. Company Snapshot

- 23.5.2. Interview Transcript: Founder and Director

- 23.6. Company E

- 23.6.1. Company Snapshot

- 23.6.2. Interview Transcript: Marketing and Design Manager

24. APPENDIX I: BLUE OCEAN STRATEGY AND SHIFT TOOLS

- 24.1. Chapter Overview

- 24.2. Blue Ocean Strategy and Shift Tools

- 24.2.1. Value Innovation

- 24.2.2. Four Action Framework

- 24.2.3. Eliminate-Raise-Reduce-Create (ERRC) Grid

- 24.2.4. Six Path Framework

- 24.2.5. Three Tiers of Non-customers

- 24.3 Sequence of Blue Ocean Strategy

- 24.3.1. The Price Corridor of the Mass

- 24.3.2. Four Hurdles to Strategy Execution

- 24.3.3. Tipping Point Leadership

- 24.3.4. Fair Process