|

시장보고서

상품코드

1808959

근안 디스플레이 시장 동향과 기술 분석(2025년)2025 Near-Eye Display Market Trend and Technology Analysis |

||||||

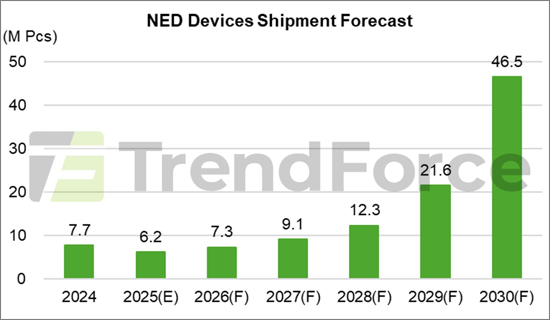

'근안 디스플레이 시장 동향과 기술 분석(2025년)'에서는 근안 디스플레이 디바이스 시장은 단기적으로 침체가 계속될 것으로 보고 있으며, 2025년 세계 출하량은 620만대로 예측되고 있습니다. Meta의 Quest 3s는 예상보다 낮으며 2025년 출하량은 560만대로 줄어들 것으로 예측됩니다. 대조적으로, AR 장치는 단기적으로 강한 기세를 보이고 있습니다. AI AR의 신제품과 OLEDoS의 비용저하에 견인되어 2025년 출하대수는 60 만대에 달할 것으로 예상됩니다. 중장기적으로는 Meta나 Apple 등의 대기업에 의한 VR/MR 제품의 개발이 진행되어 에코시스템의 강화로 이어질 것으로 보입니다. 한편, 통지형 AR 디바이스의 왕성한 수요와 하이 엔드의 풀 컬러 AR 제품의 상승이 장기적인 성장을 가속하고, NED 디바이스의 세계 출하 대수는 2030년까지 4,650만대로 급증할 것으로 전망됩니다.

AR 디스플레이 기술 전망

AR 디스플레이 기술의 선택은 브랜드 전략과 시장 동향을 반영합니다. TrendForce는 OLEDoS가 다른 디스플레이 기술과의 경쟁 격화에 직면하고 있다고 지적하고 있습니다. LCoS는 Meta의 채용에 의해 시장의 견인역이 될 것으로 예상되고, 단색 LEDoS를 사용한 통지형 AR 유리의 성장도 LEDoS의 보급을 뒷받침하고 있습니다.

장기적으로, AR 디바이스는 더 높은 컴퓨팅 능력, 더 긴 배터리 수명, 보다 향상된 디스플레이 성능을 요구할 것으로 보입니다. 세계 브랜드는 하이 스펙 풀 컬러 LEDoS 기술을 기울이고 있습니다. 비용 절감과 성능 향상에 따라 TrendForce는 풀 컬러 LEDoS를 탑재한 AR 디바이스의 출하 대수가 2030년까지 2,090만대에 달하고, 보급률 65%를 차지할 것으로 예측했습니다.

도파관 공정 및 SiC 얼라이언스 분석

AR 광학 엔진에서는 도파관 기술이 여전히 중요한 차별화 요인입니다. 현재의 주류는 회절 도파로이지만, 효율 개선은 여전히 필요합니다.

도파관 제조는 두 가지 주요 공정 기술에 지배됩니다.

- 나노 임프린트 리소그래피(NIL) - 모형 비용이 낮고 복잡한 나노구조 설계에 적응할 수 있기 때문에 초기 단계의 소량 개발에 적합합니다.

- 포토 리소그래피(PL) - 처리량이 높고 마스크 수명이 길고 고 굴절률 SiC 재료의 직접 가공이 가능하므로 대량 생산에 적합합니다.

TrendForce는 도파관 제조업체와 제휴를 연결하는 중국 SiC 공급업체 증가를 관찰합니다. SiC의 높은 굴절률은 매우 유망한 재료입니다. 현재 중국의 SiC 기판은 주로 4인치와 6인치이지만, 비용 효율성으로 인해 더 큰 크기로의 이동이 진행되고 있습니다. 2030년까지 8인치 SiC 웨이퍼 출하량은 20%를 초과할 것으로 예상되며, 12인치 개발도 시야에 들어갔습니다. 이로 인해 PL 기술의 채용이 더욱 가속화됩니다.

AR 브랜드 전략과 사양 동향

AR 광학 엔진 모듈의 소형화에 따라 사양이 수렴하고 차별화가 제한되고 있습니다. CMOS 기판의 크기와 설계는 비용 관리를 위해 표준화하는 경향이 있습니다. 현재 대부분의 LEDoS 및 LCoS 패널은 0.13-0.18인치이며 픽셀 밀도는 5,500 PPI를 초과합니다. LEDoS의 해상도는 일반적으로 640x480 - 720x720이며 LCoS 패널은 일반적으로 720x720입니다. 따라서 각 브랜드는 서로 다른 전략적 방향을 추구합니다.

Xreal은 FOV를 확대하고 컴퓨팅 성능을 향상시키는 디스플레이 기술과 알고리즘에 주력하고 있으며 RayNeo는 풀 컬러 LEDoS 도파로 AR 유리를 추진하면서 미디어 소비용 OLEDoS Birdbath 솔루션을 강화하고 있습니다. 한편 INMO는 올인원의 AI 구동형 AR 단말을 우선하고 있으며, Meta는 Apple의 미래 시장 진입에 대항하기 위해 풀라인업을 구축하고 AI 기능에 많은 투자를 할 계획입니다.

이 추세는 AR 시장이 하드웨어 전용 경쟁에서 보다 통합된 하드웨어 및 소프트웨어 에코시스템으로 옮겨가고 있음을 돋보이게 합니다.

목차

제1장 근안 디스플레이 디바이스 시장 분석

- NED 디바이스 출하 분석(2025-2030년)

- VR/MR 출하 분석(2025-2030년)

- 세계의 VR/MR 디바이스 시장 점유율(기술별)(2025-2030년)

- VR/MR 디바이스 시장 규모 분석 : LCD/OLEDoS(2025-2030년)

- AR 출하 분석(2025-2030년)

- AR 디바이스 시장 점유율(지역별)

- 세계의 AR 디바이스 시장 점유율(기술별)(2025-2030년)

- AR 디바이스 시장 규모 분석 : LCD/OLEDoS(2025-2030년)

제2장 근안 디스플레이 기술 개발 동향 분석

- 2.1. VR/MR 디스플레이 기술과 시장 동향 분석

- VST의 네이티브 문제 : 기하학적 왜곡

- Foveation은 데이터 전송과 전력 소비 절감

- 밝기의 지각은 중심와에도 초점을 맞춘다 - 주변 감광

- 편광과 팬케이크로 실현한 중심와형 VR 디스플레이

- LCD의 소비 전력을 삭감하는 솔루션

- 미니 LED 백라이트별 팬케이크 보상으로 인한 손실

- 직사광은 미니 LED 백라이트의 콘트라스트 게인 저하

- RGB 미니 LED 백라이트가 LCD VR의 가능성 확대

- 블루 라이트 미니 LED에서 RGB 미니 LED로 업그레이드

- 지향성 백라이트는 LCD VR의 이상적인 타겟

- 12인치 OLEDoS 진출기업의 용량 분석

- 풀 컬러 OLEDoS 기술의 횡방향 비교

- 트리플 노즐 증발 시스템으로 향상된 OLEDoS PPI 캡

- VR/MR 개발

- 2.2. AR 디스플레이 기술과 시장 동향 분석

- 광원의 사양과 가격의 스위트 스폿 분석

- 멀티존 마이크로/미니 LED 백라이트는 LCoS의 콘트라스트를 높여, 소비 전력을 삭감

- LCoS의 추가 소형화 : 평면광 기술의 지속적인 연구

- LCoS 기술 개발 동향

- LEDoS에서의 X-Cube에서 싱글 칩 풀 컬러로의 진화에 있어서의 과제

- LEDoS용 X-Cube에서 싱글 칩 풀 컬러 솔루션으로의 전환을 추진하는 요인

- 풀 컬러 LEDoS 기술의 측면 비교

- 풀 컬러 LEDoS 기술의 수직 스태킹의 횡방향 비교

- 수직 스태킹 LEDoS 주요 기술 분석 - 서울 바이오시스/JBD

- 풀 컬러 LEDoS 기술-InGaN의 횡방향 비교

- 마이크로 디스플레이의 CMOS 구동 백플레인이 12인치로

- 백플레인 설계에서 시스템 통합까지 LEDoS용 CMOS의 기술적 과제

- 칩 본딩 프로세스 분석

- 웨이퍼 접합 공정 분석

- 소니 세미컨덕터도 LEDoS용으로 D2W2W를 제안

- LEDoS 진출기업의 용량 분석

- LCoS와 LEDoS

- LEDoS와 LcoS의 소비 전력 비교

- LEDoS 및 LcoS 디스플레이의 사양 분석

- LEDoS 및 LCoS 풀 컬러 라이트 엔진의 사양 분석

- 2.3. AR 광학 기술과 시장 동향 분석

- 기하학적 도파관

- 회절 도파로

- 회절 도파로의 3개의 주요 사양에 있어서의 타협점

- 회절 도파로의 효율 과제

- 나노임프린트 리소그래피(NIL)와 포토리소그래피(PL)

- 열 NIL과 UV NIL

- 열 NIL의 과제

- 기하 광학 도파로에 레인 테크놀로지를 채용

- 편광 시스템

- Ant Reality Optics - 혼합 도파로

- 컴바이너 기술의 장단점

- 메타 도파관 특허 전략

- AUO와 BOE가 SRG 웨이브 가이드에 관여

- 2.4. SiC 광도파로 기술과 시장 동향 분석

- Meta Orion AR : SiC 광도파관 양면 그레이팅

- SiC 도파로 응용의 실현 가능성과 한계

- SiC 웨이퍼 사이즈별 AR 유리 출력

- SiC 웨이퍼 시장 분석

- SiC 산업 체인 제조업체

- 2.5. AR 시스템 기술과 시장 동향 분석

- 신기술 : 근안 디스플레이에서 시선 추적

- AR/VR - 아이트래킹의 이점 분석

- 시선 추적-PCCR vs. AI 이미지 분석

- 아이 추적 - 브랜드 전략과 밸류체인 분석

- SoC

제3장 세계의 AR 제품 개발 동향 분석

- 3.1. 중국의 AR 제품 개발 동향 분석

- AR 개발

- 중국 AR 브랜드 - Xreal

- 중국 AR 브랜드 - RayNeo

- 중국 AR 브랜드 - INMO

- 중국 AR 브랜드 - Rokid/MEIZU

- 중국 AR 유리 비교 : 중량/디스플레이 기술

- 중국 AR 유리 비교 : 가격/디스플레이 기술

- 3.2. AR 제품 개발 동향 분석 - 중국 이외

- AI/AR 유리의 로드맵

- 중국 이외의 AI/AR 유리의 비교

- AR 유리의 개발(2014-2024년)

- 중국제 이외의 AR 유리 풀 컬러 디스플레이 기술

제4장 진출기업의 동적 업데이트

- VR/MR Supply Chain

- Seeya

- Sidtek

- BOE Achieved Milestone of Double 5K for 0.9-inch OLEDoS

- AR Supply Chain

- EV Group

- Porotech

- Polar Light Technologies AB(PLT)

- Q Pixel

- Micledi Microdisplays

- VueReal

- JBD

- Hongshi

- Raysolve

- Giga-Image

- GIS/JorJin

- Himax

- Meta

- Snap

TrendForce, "2025 Near-Eye Display Market Trend and Technology Analysis" observes that the near-eye display device market is expected to remain subdued in the short term, with global shipments protected at 6.2 million units in 2025. Meta's Quest 3s has underperformed expectations, with shipments forecast to decline to 5.6 million units in 2025. In contrast, AR devices are showing stronger short-term momentum. Driven by new AI+AR products and falling OLEDoS costs, shipments are expected to reach 600,000 units in 2025. Over the medium to long term, ongoing VR/MR product development by major players such as Meta and Apple will help strengthen the ecosystem. On the other hand, strong demand in notification-type AR devices and the rise of high-end full-color AR products are set to fuel long-term growth, with global NED devices shipment forecast to surge to 46.5 million units by 2030.

Outlook on AR Display Technology

Choices regarding AR display technology reflect brand strategies and market trends. In the near term, OLEDoS will remain dominant in China due to cost advantages, though TrendForce notes it faces rising competition from other display technologies. LCoS is expected to gain market traction with adoption by Meta, while growth in notification-type AR glasses using single-color LEDoS is also driving LEDoS penetration.

Over the long term, AR devices will increasingly demand higher computing power, longer battery life, and enhanced display performance-particularly with the integration of AI. Global brands are leaning toward high-spec full-color LEDoS technology. As costs decline and performance improves, TrendForce forecasts shipments of AR devices equipped with full-color LEDoS to reach 20.9 million units by 2030, accounting for 65% penetration.

Waveguide Process and SiC Alliance Analysis

In AR optical engines, waveguide technology remains a critical differentiator. While diffractive waveguides are the current mainstream, efficiency improvements are still needed.

Two primary process technologies dominate waveguide manufacturing:

- Nanoimprint lithography (NIL): Suited for early-stage small-batch development due to lower mother mold costs and adaptability to complex nanostructure design.

- Photolithography (PL): Better for mass production, with higher throughput, longer mask lifetimes, and direct processing capability for high-refractive-index SiC materials.

TrendForce observes a growing number of Chinese SiC suppliers forming alliances with waveguide makers. SiC's high refractive index makes it a highly promising material. Currently, Chinese SiC substrates are mainly 4- and 6-inch, but cost efficiency is driving a shift to larger sizes. By 2030, shipments of 8-inch SiC wafers are expected to exceed 20%, with 12-inch development on the horizon. This will further accelerate the adoption of PL technology.

AR Brand Strategies and Specification Trends

As AR optical engine modules shrink, specifications are converging and limiting differentiation. CMOS substrate sizes and designs are trending toward standardization to manage costs. Currently, most LEDoS and LCoS panels range from 0.13-0.18 inches, with pixel densities exceeding 5,500 PPI. LEDoS resolutions typically range 640x480 to 720x720, while LCoS panels generally sit at 720x720. This has pushed brands to pursue distinct strategic directions.

Xreal is focused on display technology and algorithms to expand FOV and enhance computing performance, and RayNeo is strengthening its OLEDoS + Birdbath solution for media consumption while advancing full-color LEDoS + waveguide AR glasses. Meanwhile, INMO is prioritizing all-in-one AI-driven AR terminals and Meta plans to build a full product lineup and invest heavily in AI capabilities to counter Apple's future market entry.

This trend highlights a shift in the AR market from hardware-only competition to a more integrated hardware-software ecosystem.

Table of Contents

Chapter 1. Near-Eye Display Devices Market Analysis

- 2025-2030 NED Device Shipment Analysis

- 2025-2030 VR/MR Shipment Analysis

- 2025-2030 Global VR/MR Devices Market Share by Technology

- 2025-2030 VR/MR Devices Market Size Analysis: LCD/OLEDoS

- 2025-2030 AR Shipment Analysis

- AR Devices Market Share by Region

- 2025-2030 Global AR Devices Market Share by Technology

- 2025-2030 AR Devices Market Size Analysis: LCD/OLEDoS

Chapter 2. Near-Eye Display Technology Development Trend Analysis

- 2.1. VR/MR Display Technology and Market Trend Analysis

- Native Issue of VST : Geometric Distortion

- Foveation Reduces Data Transmission and Power Consumption

- Brightness Perception Also Focuses on Fovea - Peripheral Dimming

- Foveated VR Display Achieved through Polarization + Pancake

- Solutions in Reducing Power Consumption for LCD

- Losses Generated from Compensation on Pancake by Mini LED Backlight

- Straight Light Lowers Contrast Gain of Mini LED Backlight

- RGB Mini LED Backlight Enter Possible Realm of LCD VR

- Upgrading from Blue Light Mini LED to RGB Mini LED?

- Directional Backlight an Ideal Target of LCD VR

- 12-inch OLEDoS Player Capacity Analysis

- Lateral Comparison of Full-Color OLEDoS Technology

- OLEDoS PPI Cap Elevated by Triple-Nozzle Evaporation System

- Development of VR/MR

- 2.2. AR Display Technology and Market Trend Analysis

- Light Source Specification and Pricing Sweet Spot Analysis

- Multi-Zone Micro/Mini LED Backlight Increases Contrast and Reduces Power Consumption for LCoS

- LCoS Further Shrinking: Planar Optical Technology Ongoing Exploration

- Summarized Development Trends of LCoS Technology

- Challenges in Advancing from X-Cube to Single-Chip Full-Color for LEDoS

- Drivers Behind Transition from X-Cube to Single-Chip Full-Color Solution for LEDoS

- Lateral Comparison of Full-Color LEDoS Technology

- Lateral Comparison of Full-Color LEDoS Technology-Vertical Stacking

- Vertical Stacking LEDoS Key Technology Analysis- Seoul Viosys / JBD

- Lateral Comparison of Full-Color LEDoS Technology-InGaN

- CMOS Driving Backplanes of Microdisplays Marching to 12-inch

- Technical Challenges on CMOS for LEDoS from Backplane Designs to System Integration

- Chip Bonding Process Analysis

- Wafer Bonding Process Analysis

- Sony Semiconductor Also Proposed D2W2W for LEDoS

- LEDoS Player Capacity Analysis

- LCoS vs LEDoS

- Power consumption comparison between LEDoS and LCoS

- Analysis on Specifications of LEDoS and LCoS Displays

- Analysis on Specifications of LEDoS and LCoS Full-Color Light Engines

- 2.3. AR Optical Technology and Market Trend Analysis

- Geometric Waveguide

- Diffractive Waveguide

- Compromises of Diffraction Waveguides in the Three Major Specifications

- The Efficiency Challenges of Diffractive Waveguides

- Nano Imprint Lithography (NIL) vs. Photolithography (PL)

- Thermal NIL vs. UV NIL

- Thermal NIL Challenges

- Rain Technology Adopted with Geometric Optical Waveguide of

- the Polarization System

- Ant Reality Optics - Mixed Waveguide

- Pros and Cons of Combiner Technology

- Meta waveguide patent strategy

- AUO and BOE Both Involved in SRG Waveguide

- 2.4. SiC Optical Wavegudie Technology and Market Trend Analysis

- Meta Orion AR:SiC Optical Wavegudie + Dual-sided Grating

- Feasibility and limitation of SiC waveguide applications

- AR Glasses Output by SiC Wafer Size

- SiC Wafer Market Analysis

- SiC Industry Chain Manufacturers

- 2.5. AR System Technology and Market Trend Analysis

- Emerging Technology: Eye Tracking in Near-Eye Displays

- AR/VR - Analysis on Advantages of Eye Tracking

- Eye Tracking - PCCR vs. Al Image Analysis

- Eye Tracking - Analysis on Brand Strategies and Value Chain

- SoC

Chapter 3. Global AR Product Development Trend Analysis

- 3.1. AR Product Development Trend Analysis in China

- Development of AR

- China AR Brand-Xreal

- China AR Brand-RayNeo

- China AR Brand-INMO

- China AR Brand- Rokid / MEIZU

- China AR Glasses Comparison: Weight/Display Technology

- China AR Glasses Comparison: Price/Display Technology

- 3.2. AR Product Development Trend Analysis - Non China

- AI/AR Glasses Roadmap

- Non China AI/AR Glasses Comparison

- Development of AR glasses from 2014 to 2024

- Non China AR glasses Full-color Display Technology

Chapter 4. Player Dynamic Updates

- VR/MR Supply Chain

- Seeya

- Sidtek

- BOE Achieved Milestone of Double 5K for 0.9-inch OLEDoS

- AR Supply Chain

- EV Group

- Porotech

- Polar Light Technologies AB (PLT)

- Q Pixel

- Micledi Microdisplays

- VueReal

- JBD

- Hongshi

- Raysolve

- Giga-Image

- GIS /JorJin

- Himax

- Meta

- Snap